Euronet Amends and Extends its Unsecured Revolving Credit Facility

December 17 2024 - 3:01PM

Euronet Worldwide, Inc. (NASDAQ: EEFT), a leading global electronic

payments provider and distributor, today announced the Company has

amended its unsecured revolving credit facility to increase the

facility from $1.25 billion to $1.90 billion. The Company also

extended the maturity date by five years from December 17, 2024, to

December 17, 2029, with a syndicate of domestic and international

financial institutions.

The amended credit facility includes a

multi-currency borrowing tranche totaling $1.685 billion and a USD

borrowing tranche totaling $215 million. The amended facility also

removes the credit spread adjustment on SOFR and SONIA borrowings.

All other terms remain substantially the same as the existing

credit facility.

“We are pleased that all our banking partners

continued to support our business, most at increased commitment

levels. We are equally pleased to have several new banking partners

join the facility, which will provide capital flexibility in

banking services in areas that are important to our expansion,”

stated Rick Weller, Executive Vice President and Chief Financial

Officer of Euronet Worldwide, Inc. “The increased capacity will

allow us the flexibility to grow the business to continue to

deliver year-over-year double-digit growth rates and ultimately

deliver additional value to our shareholders.”

About Euronet Worldwide,

Inc.Starting in Central Europe in 1994 and growing to a

global real-time digital and cash payments network with millions of

touchpoints today, Euronet now moves money in all the ways

consumers and businesses depend upon. This includes money

transfers, credit/debit card processing, ATMs, POS services,

branded payments, foreign currency exchange and more. With products

and services in more than 200 countries and territories provided

through its own brand and branded business segments,

Euronet and its financial technologies and networks make

participation in the global economy easier, faster and more secure

for everyone.

A leading global financial technology solutions

and payments provider, Euronet has developed an extensive global

payments network that includes 55,292 installed ATMs, approximately

949,000 EFT POS terminals and a growing portfolio of outsourced

debit and credit card services which are under management in 113

countries; card software solutions; a prepaid processing network of

approximately 766,000 POS terminals at approximately 348,000

retailer locations in 64 countries; and a global money transfer

network of approximately 595,000 locations serving 198 countries

and territories. Euronet serves clients from its corporate

headquarters in Leawood, Kansas, USA, and 67 worldwide offices. For

more information, please visit the Company's website at

www.euronetworldwide.com.

Forward-Looking Statements

Statements contained in this news release that

concern Euronet's or its management's intentions, expectations, or

predictions of future performance, are forward-looking statements.

Euronet's actual results may vary materially from those anticipated

in such forward-looking statements as a result of a number of

factors, including: conditions in world financial markets and

general economic conditions, including impacts from the

COVID-19 or other pandemics; inflation; the war in the Ukraine

and the related economic sanctions; military conflicts in the

Middle East; our ability to successfully integrate any acquired

operations; economic conditions in specific countries and regions;

technological developments affecting the market for our products

and services; our ability to successfully introduce new products

and services; foreign currency exchange rate fluctuations; the

effects of any breach of our computer systems or those of our

customers or vendors, including our financial processing networks

or those of other third parties; interruptions in any of our

systems or those of our vendors or other third parties; our ability

to renew existing contracts at profitable rates; changes in fees

payable for transactions performed for cards bearing international

logos or over switching networks such as card transactions on ATMs;

our ability to comply with increasingly stringent regulatory

requirements, including anti-money laundering, anti-terrorism,

anti-bribery, consumer and data protection and privacy; changes in

laws and regulations affecting our business, including tax and

immigration laws and any laws regulating payments, including

dynamic currency conversion transactions; changes in our

relationships with, or in fees charged by, our business partners;

competition; the outcome of claims and other loss contingencies

affecting Euronet; the cost of borrowing (including fluctuations in

interest rates), availability of credit and terms of and compliance

with debt covenants; and renewal of sources of funding as they

expire and the availability of replacement funding. These risks and

other risks are described in the Company's filings with the

Securities and Exchange Commission, including our Annual Report on

Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on

Form 8-K. Copies of these filings may be obtained via the SEC's

Edgar website or by contacting the Company. Any forward-looking

statements made in this release speak only as of the date of this

release. Except as may be required by law, Euronet does

not intend to update these forward-looking statements and

undertakes no duty to any person to provide any such update under

any circumstances. The Company regularly posts important

information to the investor relations section of its website.

For further information regarding this release, please contact:

Euronet Worldwide, Inc.

Stephanie Taylor

staylor@euronetworldwide.com

(913) 327-4200

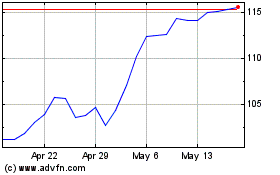

Euronet Worldwide (NASDAQ:EEFT)

Historical Stock Chart

From Feb 2025 to Mar 2025

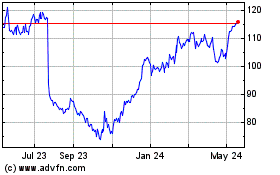

Euronet Worldwide (NASDAQ:EEFT)

Historical Stock Chart

From Mar 2024 to Mar 2025