Form SC 13D/A - General Statement of Acquisition of Beneficial Ownership: [Amend]

November 06 2024 - 3:31PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13D

(Amendment No. 2)

(Rule 13d-101)

Under the Securities Exchange Act of 1934

EVOKE PHARMA, INC.

(Name of Issuer)

Common

Stock,

par

value $0.0001 per share

(Title of Class of Securities)

30049G203

(CUSIP NUMBER)

Taki Vasilakis

130 Main St. 2nd Floor

New Canaan, CT 06840

(203) 308-4440

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

November 6,

2024

(Date of event which requires filing of this statement)

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition which is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e),

13d-1(f) or 13d-1(g) check the following box ¨.

The information required in the remainder of this

cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended

(the “Act”), or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions

of the Act.

| 1 |

NAME OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Nantahala Capital Management, LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a) ¨

(b) ¨ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS*

AF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEM 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Massachusetts |

|

NUMBER OF

SHARES

BENEFICIALLY |

7 |

SOLE VOTING POWER

0 |

|

OWNED BY

EACH

REPORTING

PERSON WITH |

8 |

SHARED VOTING POWER

254,632 |

| |

9 |

SOLE DISPOSITIVE POWER

0 |

| |

10 |

SHARED DISPOSITIVE POWER

254,632 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

254,632 |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES

CERTAIN SHARES* |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

15.99% |

| 14 |

TYPE OF REPORTING PERSON*

IA, OO |

| 1 |

NAME OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Wilmot B. Harkey |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a) ¨

(b) ¨ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS*

AF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEM 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States |

|

NUMBER OF

SHARES

BENEFICIALLY |

7 |

SOLE VOTING POWER

0 |

|

OWNED BY

EACH

REPORTING

PERSON WITH |

8 |

SHARED VOTING POWER

254,632 |

| |

9 |

SOLE DISPOSITIVE POWER

0 |

| |

10 |

SHARED DISPOSITIVE POWER

254,632 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

254,632 |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES

CERTAIN SHARES* |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

15.99% |

| 14 |

TYPE OF REPORTING PERSON*

HC, IN |

| 1 |

NAME OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Daniel Mack |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a) ¨

(b) ¨ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS*

AF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEM 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States |

|

NUMBER OF

SHARES

BENEFICIALLY |

7 |

SOLE VOTING POWER

0 |

|

OWNED BY

EACH

REPORTING

PERSON WITH |

8 |

SHARED VOTING POWER

254,632 |

| |

9 |

SOLE DISPOSITIVE POWER

0 |

| |

10 |

SHARED DISPOSITIVE POWER

254,632 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

254,632 |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES

CERTAIN SHARES* |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

15.99% |

| 14 |

TYPE OF REPORTING PERSON*

HC, IN |

EXPLANATORY NOTE

This Amendment No. 2 (“Amendment No. 2”)

amends and supplements the Schedule 13D filed with the Securities and Exchange Commission on behalf of Nantahala Capital Management, LLC,

a Massachusetts limited liability company (“Nantahala”), Mr. Wilmot B. Harkey and Mr. Daniel Mack, the principals of Nantahala

(collectively, the “Reporting Persons”) on September 20, 2024 (the “Original Schedule 13D”), as previously amended

on October 1, 2024, relating to Common Stock, par value $0.0001 per share (the “Common Stock”), of Evoke Pharma, Inc., a Delaware

corporation (the “Issuer”). Capitalized terms used but not defined in this Amendment No. 2 have the meanings set forth in

the Original Schedule 13D as previously amended. Except as specifically provided herein, this Amendment No. 2 does not modify any of the

information reported in the Original Schedule 13D as previously amended.

| Item 4. |

Purpose of the Transaction |

Item 4 is hereby supplemented by the addition

of the following disclosure:

On November 6, 2024, Nantahala

delivered notice to the Issuer increasing the Beneficial Ownership Limitation in respect of Warrants that Nantahala holds on behalf of

certain Nantahala Investors to 15.99% of the outstanding shares of Common Stock. Pursuant to the terms of the Warrants, such increase

in the Beneficial Ownership Limitation shall not be effective until the 61st day after delivery of such notice.

In connection with such increase

in the Beneficial Ownership Limitation, Nantahala became the beneficial owner of approximately 15.99% of the outstanding shares of Common

Stock and eligible to designate a second member of the Issuer’s board of directors pursuant to the September 2024 Letter Agreement,

subject to compliance with applicable Nasdaq rules. The Reporting Persons have not identified a person for designation to the Issuer’s

board of directors pursuant to that right.

| Item 5. |

Interest in Securities of the Issuer |

Item 5 is hereby amended and restated as follows:

(a) The

aggregate percentage of Common Stock beneficially owned by the Reporting Persons is based upon 1,592,447 shares of Common Stock outstanding

as of November 6, 2024, which includes 1,394,064 shares of Common Stock outstanding (as disclosed to Nantahala in connection with the

Warrant exercise described below in Item 5(c)) and the issuance of 91,945 shares of Common Stock in that Warrant exercise, together with

106,438 shares of Common Stock for which the Warrants may be exercised as of the date hereof (giving effect to the Beneficial Ownership

Limit described above in Item 4), which are deemed outstanding pursuant to Rule 13d-3(d)(1)(i).

Nantahala, as the investment

adviser of the Nantahala Investors, may be deemed to beneficially own 254,632 shares of Common Stock, which includes 148,194 shares of

Common Stock held by the Nantahala Investors and a further 106,438 shares of Common Stock issuable upon exercise of the Warrants (giving

effect to the Beneficial Ownership Limitation), or approximately 15.99% of the outstanding shares of Common Stock. Each of Mr. Harkey

and Mr. Mack, as principals of Nantahala, may also be deemed to beneficially own the same shares of Common Stock.

(b)

Nantahala, Mr. Harkey and Mr. Mack have the shared power to vote and dispose of the Common Stock reported in this Schedule 13D.

(c)

Since Amendment No. 1 was filed, neither the Reporting Persons nor the Other Officers have made any transactions in the shares of Common

Stock, except that on October 29, 2024, Nantahala caused one of the Nantahala Investors to make a cashless exercise of Warrants representing

the right to purchase 92,096 shares of Common Stock, surrendering 151 of such shares of Common Stock in satisfaction of the exercise price

then payable for such exercise.

(d)

The Nantahala Investors hold the shares of Common Stock reported herein or have the right to acquire the shares of Common Stock reported

herein based on holding the Warrants. No person other than the Nantahala Investors is known to have the right to receive, or the power

to direct the receipt of dividends from, or proceeds from the sale of, the Common Stock reported herein, which, in the case of Blackwell

Partners LLC - Series A, relates to more than 5% of the outstanding shares of Common Stock.

(e)

Not applicable.

| Item 6. |

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer |

Item 6 is hereby supplemented by the addition

of the following disclosure:

The disclosure set forth in

Item 4 affects the Warrants previously disclosed in this Item 6 and is incorporated herein in respect thereof.

Signatures

After reasonable inquiry and

to the best of their knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true,

complete and correct.

Dated: November 6,

2024

| NANTAHALA CAPITAL MANAGEMENT, LLC |

|

| |

|

|

| |

|

|

| By: |

/s/ Taki Vasilakis |

|

| |

Taki Vasilakis |

|

| |

Chief Compliance Officer |

|

| |

|

|

| |

|

|

| |

|

|

| /s/ Wilmot B. Harkey |

|

| Wilmot B. Harkey |

|

| |

|

|

| |

|

|

| /s/ Daniel Mack |

|

| Daniel Mack |

|

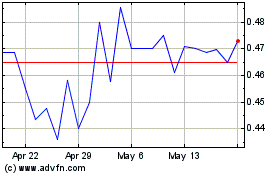

Evoke Pharma (NASDAQ:EVOK)

Historical Stock Chart

From Oct 2024 to Nov 2024

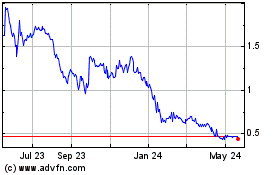

Evoke Pharma (NASDAQ:EVOK)

Historical Stock Chart

From Nov 2023 to Nov 2024