Interchange derived from the Expensify Card

grew to $4.6 million, an increase of 48% as compared to the same

period last year

Expensify, Inc. (Nasdaq: EXFY), a payments superapp that helps

individuals and businesses around the world simplify the way they

manage money across expenses, corporate cards and bills, today

released a letter to shareholders from Founder and CEO David

Barrett alongside results for its quarter ended September 30,

2024.

A Message From Our

Founder

I'm happy to report that Q3'24 has extended and expanded upon

the strong results of the previous two quarters:

- Our core business has remained stable. Though we're

still catching up to last year's paid users and revenue (slightly

down 5% and 3% y/y, respectively), our paid users have been stable

for the past two quarters, and revenue is up 6% q/q. Even more

exciting, total card spend is up 8% q/q, with a majority of that

spend occurring on our new card program. Our strategy of using

Expensify Classic as a stable foundation on which to launch New

Expensify for our next generation of growth is working great.

- We are raising our 2024 free cash flow guidance, again.

We initially announced FY'24 FCF guidance in Q1'24 in the range of

$10.0 - $12.0 million. In Q2 we raised this to $11.0 - $13.0

million, and then again to $15.0 - $16.0 million in Q3 as the full

extent of our cost cutting measures came online. I'm happy to share

that we've found even more efficiencies, and are increasing FY'24

FCF guidance by another 27% to $19.0 - $20.0 million.

- The new Expensify Card program is almost fully deployed.

As of the end of Q3, 94% of Expensify Card spend has transitioned

to the new program, which in addition to earning more interchange

per swipe, also treats all that interchange as revenue. We are

increasingly confident in our ability to reduce interchange from

the old program down to immaterial amounts or even $0 by EOY,

making the confusing interchange contra-expense a distant

memory.

- New Expensify is driving more interest and new leads.

Market reception has been fantastic: we generated 61% more leads at

Suiteworld 2024 by focusing on New Expensify than we did at the

same conference in 2023 with Classic. We are currently sending a

slice of our smallest leads from the Expensify homepage to New

Expensify, and our sales and account management organizations are

gradually perfecting their New Expensify pitch for maximum effect,

the current iteration sounding something like:

- The best expense tools (including Expensify) can automate about

80% of your expense workflow based on the information on the

transaction alone. But the last 20% requires information not

available on the receipt or card swipe: the client you're meeting,

the conference you're attending, etc. That part requires emailing a

question to the employee… and then waiting. Even if your question

only takes a second to answer, they might take a month to respond,

blowing up your accounting timeline. New Expensify's mobile-first,

chat-first design streamlines that 20% by helping your question get

answered at "the speed of chat", taking precedence over their email

inbox. But additionally, by capturing the general chat leading up

to the expense (and after it's made), we expect that our AI will

soon be able to automate that 20% without needing to ask the

employee anything. We believe that New Expensify will be the only

expense management tool to achieve 100% end-to-end automation.

- Expensify Travel is generating new revenue. Beta

customers continued booking travel in Q3, which resulted in

Expensify Travel driving new revenue for the first time. Our

initial travel beta has been completed, and we've expanded the beta

to a targeted group of mid-market customers.

Expensify Classic is proving to be an excellent foundation on

which to launch New Expensify and Expensify Travel, and the entire

company has shifted its focus toward supporting the growth of these

two products in the market. I can't wait to share more progress

soon!

-david Founder and CEO of Expensify

Third Quarter 2024 Highlights

Financial:

- Revenue was $35.4 million, a decrease of 3% compared to the

same period last year.

- Generated $3.7 million of cash from operating activities.

- Free cash flow was $6.7 million.

- Net loss was $2.2 million, compared to $17.0 million for the

same period last year.

- Non-GAAP net income was $5.4 million.

- Adjusted EBITDA was $9.7 million.

- Interchange derived from the Expensify Card grew to $4.6

million, an increase of 48% compared to the same period last

year.

- See Financial Outlook section for Free Cash Flow guidance for

fiscal year ending December 31, 2024.

Business:

- Paid members - Paid members were 684,000, a

decrease of 5% from the same period last year.

- New Expensify Card program - The majority of active

Expensify Card customers began transitioning to the new program,

with 94% of spend migrated by end of Q3.

- Expensify Travel - Expensify Travel has completed its

initial beta and has expanded its beta to a targeted group of

mid-market customers.

Financial Outlook

Expensify's outlook statements are based on current estimates,

expectations and assumptions and are not a guarantee of future

performance. The following statements are forward-looking and

actual results could differ materially depending on market

conditions and the factors set forth under “Forward-Looking

Statements” below. There can be no assurance that the Company will

achieve the results expressed by this guidance.

Free Cash Flow

Expensify estimates Free Cash Flow of $19.0 million to $20.0

million for the fiscal year ending December 31, 2024.

The Company does not provide a reconciliation for free cash flow

estimates on a forward-looking basis because it is unable, without

making unreasonable efforts, to provide a meaningful or reasonably

accurate calculation or estimation of net cash provided by

operating activities and certain reconciling items on a

forward-looking basis, which could be significant to the Company's

results.

Stock Based Compensation

An estimate of expected stock-based compensation for the next

four fiscal quarters is as follows, which is driven primarily by

the pre-IPO grant of RSUs issued to all employees (which vest

quarterly over eight years with approximately five years

remaining).

Est. stock-based compensation (millions)

Q4 2024

Q1 2025

Q2 2025

Q3 2025

Low

High

Low

High

Low

High

Low

High

Cost of revenue, net

$ 2.7

$ 3.4

$ 2.5

$ 3.2

$ 2.2

$ 2.9

$ 2.0

$ 2.7

Research and development

2.3

3.0

2.2

2.9

1.9

2.6

1.8

2.5

General and administrative

1.4

1.8

1.4

1.8

1.2

1.6

1.1

1.5

Sales and marketing

0.6

0.8

0.6

0.8

0.5

0.7

0.5

0.7

Total

$ 7.0

$ 9.0

$ 6.7

$ 8.7

$ 5.8

$ 7.8

$ 5.4

$ 7.4

Availability of Information on

Expensify’s Website

Investors and others should note that Expensify routinely

announces material information to investors and the marketplace

using SEC filings, press releases, public conference calls,

webcasts and the Expensify Investor Relations website at

https://ir.expensify.com. While not all of the information that the

Company posts to its Investor Relations website is of a material

nature, some information could be deemed to be material.

Accordingly, the Company encourages investors, the media and others

interested in Expensify to review the information that it shares on

its Investor Relations website.

Conference Call

Expensify will host a video call to discuss the financial

results and business highlights at 2:00 p.m. Pacific Time today. An

investor presentation and the video call information is available

on Expensify’s Investor Relations website at

https://ir.expensify.com. A replay of the call will be available on

the site for three months.

Non-GAAP Financial

Measures

In addition to financial measures prepared in accordance with

U.S. generally accepted accounting principles (“GAAP”), we provide

certain non-GAAP financial measures, including adjusted EBITDA,

non-GAAP net loss, and free cash flow.

We believe our non-GAAP financial measures are useful in

evaluating our business, measuring our performance, identifying

trends affecting our business, formulating business plans and

making strategic decisions. Accordingly, we believe that these

non-GAAP financial measures provide useful information to investors

and others in understanding and evaluating our results of

operations in the same manner as our management team. These

non-GAAP financial measures are presented for supplemental

informational purposes only, should not be considered a substitute

for financial information presented in accordance with GAAP, and

may be different from similarly titled metrics or measures

presented by other companies. Non-GAAP financial measures have

limitations as analytical tools and should not be considered in

isolation or as substitutes for financial information presented

under GAAP. There are a number of limitations related to the use of

non-GAAP financial measures versus comparable financial measures

determined under GAAP. For example, other companies in our industry

may calculate these non-GAAP financial measures differently or may

use other measures to evaluate their performance. All of these

limitations could reduce the usefulness of these non-GAAP financial

measures as analytical tools. Investors are encouraged to review

the related GAAP financial measures and the reconciliations of

these non-GAAP financial measures to their most directly comparable

GAAP financial measures and to not rely on any single financial

measure to evaluate our business. A reconciliation of each non-GAAP

financial measure to the most directly comparable financial measure

stated in accordance with GAAP is at the end of this press

release.

Adjusted EBITDA. We define adjusted EBITDA as net loss

from operations excluding provision for income taxes, interest and

other expenses, net, depreciation and amortization, and stock-based

compensation.

Non-GAAP net income. We define non-GAAP net income as net

loss from operations excluding stock-based compensation.

Free cash flow. We define Free cash flow as net cash

provided by operating activities excluding changes in settlement

assets and settlement liabilities, which represent funds held for

customers and customer funds in transit, respectively, reduced by

the purchases of property and equipment and software development

costs.

The tables at the end of the Condensed Consolidated Financial

Statements provide reconciliations to the most directly comparable

GAAP financial measure to each of these non-GAAP financial

measures.

Forward-Looking

Statements

Forward-looking statements in this press release, or made during

the earnings call, which are not historical facts, are

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1955. These statements include

statements regarding our strategy, future financial condition,

future operations, future cash flow, projected costs, prospects,

plans, objectives of management and expected market growth, product

developments and their potential impact and our stock-based

compensation estimates and involve known and unknown risks that are

difficult to predict. As a result, our actual results, performance

or achievements may differ materially from those expressed or

implied by these forward-looking statements. In some cases, you can

identify forward-looking statements because they contain words such

as “may,” “will,” “shall,” “should,” “expects,” “plans,”

“anticipates,” “could,” “intends,” “target,” “projects,”

“contemplates,” “believes,” “estimates,” “predicts,” “potential,”

“goal,” “ambition,” “objective,” “seeks,” “outlook,” or “continue”

or the negative of these words or other similar terms or

expressions that concern our expectations, strategy, plans, or

intentions. Such forward-looking statements are necessarily based

upon estimates and assumptions that, while considered reasonable by

us and our management, are inherently uncertain. Factors that may

cause actual results to differ materially from current expectations

include, but are not limited to: the impact on inflation on us and

our members; our borrowing costs have and may continue to increase

as a result of increases in interest rates; our expectations

regarding our financial performance and future operating

performance; our ability to attract and retain members, expand

usage of our platform, sell subscriptions to our platform and

convert individuals and organizations into paying customers; the

timing and success of new features, integrations, capabilities and

enhancements by us, or by competitors to their products, or any

other changes in the competitive landscape of our market; the

amount and timing of operating expenses and capital expenditures

that we may incur to maintain and expand our business and

operations to remain competitive; the sufficiency of our cash, cash

equivalents and investments to meet our liquidity needs; our

ability to make required payments under and to comply with the

various requirements of our current and future indebtedness; our

cash flows, the prevailing stock prices, general economic and

market conditions and other considerations that could affect the

specific timing, price and size of repurchases under our stock

repurchase program or our ability to fund any stock repurchases;

geopolitical tensions, including the war in Ukraine and the

escalating conflict in Israel, Gaza and surrounding areas; our

ability to effectively manage our exposure to fluctuations in

foreign currency exchange rates; the expenses associated with being

a public company; the size of our addressable markets, market share

and market trends; anticipated trends, developments and challenges

in our industry, business and the highly competitive markets in

which we operate; any adverse impact on our business operations as

a result of using artificial intelligence or other machine learning

technologies in our services; our expectations regarding our income

tax liabilities and the adequacy of our reserves; our ability to

effectively manage our growth and expand our infrastructure and

maintain our corporate culture; our ability to identify, recruit

and retain skilled personnel, including key members of senior

management; the safety, affordability and convenience of our

platform and our offerings; our ability to successfully defend

litigation brought against us; our ability to successfully

identify, manage and integrate any existing and potential

acquisitions of businesses, talent, technologies or intellectual

property; general economic conditions in either domestic or

international markets, and geopolitical uncertainty and

instability, including as a result of the 2024 United States

presidential election; our protections against security breaches,

technical difficulties, or interruptions to our platform; our

ability to maintain, protect and enhance our intellectual property;

and other risks discussed in our filings with the SEC. All

forward-looking statements attributable to us or persons acting on

our behalf are expressly qualified in their entirety by the

cautionary statements set forth above. We caution you not to place

undue reliance on any forward-looking statements, which are made

only as of the date of this press release. We do not undertake or

assume any obligation to update publicly any of these

forward-looking statements to reflect actual results, new

information or future events, changes in assumptions or changes in

other factors affecting forward-looking statements, except to the

extent required by applicable law. If we update one or more

forward-looking statements, no inference should be drawn that we

will make additional updates with respect to those or other

forward-looking statements.

About Expensify

Expensify is a payments superapp that helps individuals and

businesses around the world simplify the way they manage money.

More than 12 million people use Expensify's free features, which

include corporate cards, expense tracking, next-day reimbursement,

invoicing, bill pay, and travel booking in one app. All free.

Whether you own a small business, manage a team, or close the books

for your clients, Expensify makes it easy so you have more time to

focus on what really matters.

Expensify, Inc.

Condensed Consolidated Balance

Sheets

(unaudited, in thousands, except

share data)

As of September 30,

As of December 31,

2024

2023

Assets

Cash and cash equivalents

$

39,172

$

47,510

Accounts receivable, net

12,650

13,834

Settlement assets, net

53,391

39,261

Prepaid expenses

9,002

5,649

Other current assets

24,321

30,978

Total current assets

138,536

137,232

Capitalized software, net

16,859

12,494

Property and equipment, net

13,763

14,372

Lease right-of-use assets

5,611

6,435

Deferred tax assets, net

489

457

Other assets

988

5,794

Total assets

$

176,246

$

176,784

Liabilities and stockholders'

equity

Accounts payable

$

1,035

$

1,425

Accrued expenses and other liabilities

7,294

9,390

Borrowings under line of credit

—

15,000

Current portion of long-term debt, net of

original issue discount and debt issuance costs

—

7,655

Lease liabilities, current

631

432

Settlement liabilities

39,379

33,990

Total current liabilities

48,339

67,892

Lease liabilities, non-current

5,928

6,467

Other liabilities

2,045

1,681

Total liabilities

56,312

76,040

Commitments and contingencies

Stockholders' equity:

Preferred stock, par value $0.0001;

10,000,000 shares of preferred stock authorized as of September 30,

2024 and December 31, 2023; no shares of preferred stock issued and

outstanding as of September 30, 2024 and December 31, 2023

—

—

Common stock, par value $0.0001;

1,000,000,000 shares of Class A common stock authorized as of

September 30, 2024 and December 31, 2023; 77,119,750 and 70,569,815

shares of Class A common stock issued and outstanding as of

September 30, 2024 and December 31, 2023, respectively; 21,871,197

and 24,994,989 shares of LT10 common stock authorized as of

September 30, 2024 and December 31, 2023, respectively; 4,209,827

and 7,333,619 shares of LT10 common stock issued and outstanding as

of September 30, 2024 and December 31, 2023, respectively;

24,969,634 and 24,998,941 shares of LT50 common stock authorized as

of September 30, 2024 and December 31, 2023, respectively;

7,597,099 and 7,321,894 shares of LT50 common stock issued and

outstanding as of September 30, 2024 and December 31, 2023,

respectively

9

8

Additional paid-in capital

269,441

241,509

Accumulated deficit

(149,516

)

(140,773

)

Total stockholders' equity

119,934

100,744

Total liabilities and stockholders'

equity

$

176,246

$

176,784

Expensify, Inc.

Condensed Consolidated

Statements of Operations

(unaudited, in thousands, except

share and per share data)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Revenue

$

35,409

$

36,494

$

102,232

$

115,479

Cost of revenue, net (1)

17,145

17,680

46,091

50,380

Gross margin

18,264

18,814

56,141

65,099

Operating expenses:

Research and development (1)

5,618

6,607

17,936

17,119

General and administrative (1)

9,084

14,245

29,760

38,386

Sales and marketing (1)

3,274

12,860

9,730

36,757

Total operating expenses

17,976

33,712

57,426

92,262

Income (loss) from operations

288

(14,898

)

(1,285

)

(27,163

)

Other income (expenses), net

181

(2,375

)

(1,033

)

(5,158

)

Income (loss) before income taxes

469

(17,273

)

(2,318

)

(32,321

)

(Provision for) benefit from income

taxes

(2,667

)

270

(6,425

)

(1,931

)

Net loss

$

(2,198

)

$

(17,003

)

$

(8,743

)

$

(34,252

)

Net loss per share:

Basic and diluted

$

(0.02

)

$

(0.21

)

$

(0.10

)

$

(0.42

)

Weighted average shares of common stock

used to compute net loss per share:

Basic and diluted

88,177,739

82,469,190

86,643,209

82,085,508

(1)

Includes stock-based compensation expense

as follows:

Three Months Ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Cost of revenue, net

$

2,843

$

3,312

$

8,661

$

10,218

Research and development

2,530

2,901

8,424

7,562

General and administrative

1,560

2,532

4,965

7,552

Sales and marketing

697

1,522

1,485

5,280

Total stock-based compensation expense

$

7,630

$

10,267

$

23,535

$

30,612

Expensify, Inc.

Condensed Consolidated

Statements of Cash Flows

(unaudited, in thousands)

Nine Months Ended September

30,

2024

2023

Cash flows from operating activities:

Net loss

$

(8,743

)

$

(34,252

)

Adjustments to reconcile net loss to net

cash provided by operating activities:

Depreciation and amortization

4,851

3,871

Reduction of operating lease right-of-use

assets

411

476

Loss on impairment, receivables and sale

or disposal of equipment

637

585

Stock-based compensation expense

23,535

30,612

Amortization of original issue discount

and debt issuance costs

43

139

Deferred tax assets

(32

)

(86

)

Changes in assets and liabilities:

Accounts receivable, net

845

1,671

Settlement assets, net

(13,202

)

(9,381

)

Prepaid expenses

1,597

3,672

Other current assets

2,707

(1,861

)

Other assets

(144

)

(125

)

Accounts payable

(349

)

229

Accrued expenses and other liabilities

(1,501

)

4,259

Operating lease liabilities

67

(236

)

Settlement liabilities

5,389

2,451

Other liabilities

364

78

Net cash provided by operating

activities

16,475

2,102

Cash flows from investing activities:

Purchases of property and equipment

—

(1,103

)

Software development costs

(6,699

)

(3,730

)

Net cash used in investing activities

(6,699

)

(4,833

)

Cash flows from financing activities:

Principal payments of finance leases

(96

)

(482

)

Principal payments of outstanding debt

(22,671

)

(8,450

)

Payments for debt issuance costs

(71

)

—

Repurchases of early exercised stock

options

(35

)

(21

)

Proceeds from common stock purchased under

Matching Plan

2,900

3,132

Proceeds from issuance of common stock on

exercise of stock options

303

216

Payments for employee taxes withheld from

stock-based awards

—

(1,766

)

Repurchase and retirement of common

stock

(1,510

)

(3,000

)

Net cash used in financing activities

(21,180

)

(10,371

)

Net decrease in cash and cash equivalents

and restricted cash

(11,404

)

(13,102

)

Cash and cash equivalents and restricted

cash, beginning of period

96,658

147,710

Cash and cash equivalents and restricted

cash, end of period

$

85,254

$

134,608

Supplemental disclosure of cash flow

information:

Cash paid for interest

$

1,326

$

4,396

Cash paid for income taxes

$

3,735

$

3,104

Noncash investing and financing items:

Stock-based compensation capitalized as

software development costs

$

2,315

$

2,219

Purchases of property and equipment and

capitalized software in accounts payable and accrued expenses

$

178

$

—

Right-of-use assets acquired through

operating leases

$

—

$

6,402

Right-of-use assets acquired through

finance leases

$

—

$

409

Reconciliation of cash and cash

equivalents and restricted cash to the Condensed Consolidated

Balance Sheets

Cash and cash equivalents

$

39,172

$

89,118

Restricted cash included in other current

assets

23,748

23,398

Restricted cash included in settlement

assets, net

22,334

22,092

Total cash, cash equivalents and

restricted cash

$

85,254

$

134,608

Expensify,

Inc.

Reconciliation of GAAP to

Non-GAAP Financial Measures

(unaudited, in thousands, except

percentages)

Adjusted EBITDA and Adjusted EBITDA

Margin

Three Months Ended September

30,

2024

2023

Net loss

$

(2,198

)

$

(17,003

)

Net loss margin

(6

)%

(47

)%

Add:

Provision for (benefit from) income

taxes

2,667

(270

)

Other (income) expenses, net

(181

)

2,375

Depreciation and amortization

1,758

1,082

Stock-based compensation expense

7,630

10,267

Adjusted EBITDA

$

9,676

$

(3,549

)

Adjusted EBITDA margin

27

%

(10

)%

Non-GAAP Net Income and Non-GAAP Net

Income Margin

Three Months Ended September

30,

2024

2023

Net loss

$

(2,198

)

$

(17,003

)

Net loss margin

(6

)%

(47

)%

Add:

Stock-based compensation expense

7,630

10,267

Non-GAAP net income (loss)

$

5,432

$

(6,736

)

Non-GAAP net income (loss) margin

15

%

(18

)%

Adjusted Operating Cash Flow and Free Cash

Flow

Three Months Ended September

30,

2024

2023

Net cash provided by (used in) operating

activities

$

3,687

$

(5,106

)

Operating cash flow margin

10

%

(14

)%

(Increase) decrease in changes in assets

and liabilities:

Settlement assets

5,326

4,137

Settlement liabilities

(502

)

(3,833

)

Adjusted operating cash flow

8,511

(4,802

)

Less: .

Purchases of property and equipment

—

(624

)

Software development costs

(1,832

)

(1,687

)

Free cash flow

$

6,679

$

(7,113

)

Free cash flow margin

19

%

(19

)%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107527256/en/

Investor Relations Contact Nick Tooker

investors@expensify.com

Press Contact James Dean press@expensify.com

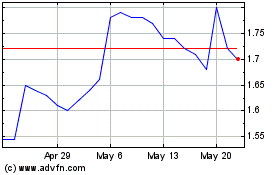

Expensify (NASDAQ:EXFY)

Historical Stock Chart

From Jan 2025 to Feb 2025

Expensify (NASDAQ:EXFY)

Historical Stock Chart

From Feb 2024 to Feb 2025