Filed Pursuant to Rule 424(b)(5)

Registration No. 333-261638

PROSPECTUS SUPPLEMENT

(To Prospectus dated December 23, 2021)

Up to $10,000,000

Common Stock

We have entered into an open

market sales agreement (the “Sales Agreement”) with Leerink Partners LLC (“Leerink Partners”), dated as of December 14,

2021, relating to the sale of shares of our common stock, $0.0001 par value per share, offered by this prospectus supplement and the accompanying

prospectus. In accordance with the terms of the Sales Agreement, pursuant to this prospectus supplement and the accompanying prospectus,

we may offer and sell shares of our common stock having an aggregate offering price of up to $10,000,000 from time to time through or

to Leerink Partners, acting as our agent.

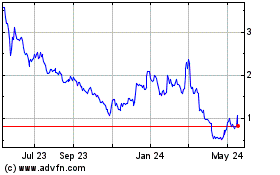

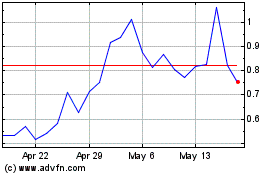

Our common stock is listed

on The Nasdaq Capital Market under the symbol “EYEN”. On May 15, 2024, the last reported sale price of our common stock

on The Nasdaq Capital Market was $1.06 per share.

Sales of the common stock,

if any, under this prospectus supplement may be made in sales deemed to be an “at the market offering” as defined in Rule 415(a)(4) promulgated

under the Securities Act of 1933, as amended (the “Securities Act”). Leerink Partners is not required to sell any specific

amount of securities, but will act as our sales agent using commercially reasonable efforts consistent with its normal trading and sales

practices, on mutually agreed terms between Leerink Partners and us. There is no arrangement for funds to be received in any escrow, trust

or similar arrangement.

The compensation to Leerink

Partners for sales of our common stock will be 3.0% of the gross sales price per share sold. See “Plan of Distribution” beginning

on page S-10 of this prospectus supplement for additional information regarding the compensation to be paid to Leerink Partners.

In connection with the sale of the common stock on our behalf, Leerink Partners will be deemed to be an “underwriter” within

the meaning of the Securities Act and the compensation of Leerink Partners will be deemed to be underwriting commissions. We have also

agreed to provide indemnification and contribution to Leerink Partners with respect to certain liabilities, including liabilities under

the Securities Act.

We are a “smaller reporting company”

under applicable Securities and Exchange Commission rules and are subject to reduced public company reporting requirements for this

prospectus supplement and future filings.

INVESTING IN OUR COMMON

STOCK INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD REVIEW CAREFULLY THE RISKS AND UNCERTAINTIES DESCRIBED UNDER THE HEADING “RISK

FACTORS” ON PAGE S-5 OF THIS PROSPECTUS SUPPLEMENT, AND UNDER SIMILAR HEADINGS IN THE DOCUMENTS THAT ARE INCORPORATED BY

REFERENCE INTO THIS PROSPECTUS SUPPLEMENT.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

supplement or the accompanying prospectus are truthful or complete. Any representation to the contrary is a criminal offense.

Leerink Partners

The date of this prospectus supplement is May 16,

2024

TABLE OF CONTENTS

PROSPECTUS

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts.

The first part is this prospectus supplement, which describes the terms of this offering of common stock from time to time and also adds

to and updates information contained in the accompanying prospectus and the documents incorporated by reference into this prospectus supplement

and the accompanying prospectus. The second part, the accompanying prospectus dated December 23, 2021, including the documents incorporated

by reference therein, provides more general information that may not relate to this offering. Generally, when we refer to this prospectus,

we are referring to both parts of this document combined. To the extent there is a conflict between the information contained in this

prospectus supplement, on the one hand, and the information contained in the accompanying prospectus or in any document incorporated by

reference that was filed with the Securities and Exchange Commission (the “SEC”), before the date of this prospectus supplement,

on the other hand, you should rely on the information in this prospectus supplement. If any statement in one of these documents is inconsistent

with a statement in another document having a later date (for example, a document incorporated by reference in the accompanying prospectus),

the statement in the document having the later date modifies or supersedes the earlier statement.

Before buying any of the common

stock that we are offering, we urge you to carefully read this prospectus supplement, the accompanying prospectus and all of the information

incorporated by reference herein and therein, as well as the additional information described under the heading “Incorporation of

Certain Documents by Reference.” These documents contain important information that you should consider when making your investment

decision.

We have not, and Leerink Partners

has not, authorized anyone to provide you with information that is different from or in addition to the information contained in this

prospectus supplement and the accompanying prospectus and in any related free writing prospectus filed by us with the SEC. Accordingly,

neither we nor Leerink Partners takes any responsibility for, or can provide any assurance as to the reliability of, any information that

others may give. Neither we nor Leerink Partners is making offers to sell or seeking offers to buy shares of our common stock in any jurisdiction

where the offer or sale is not permitted. You should assume that the information appearing in this prospectus supplement, the accompanying

prospectus, the documents incorporated by reference herein and therein and any related free writing prospectus is accurate only as of

the respective dates of such documents, regardless of the time of delivery of this prospectus supplement or any sale of the common stock

offered hereby. Our business, financial condition, results of operations and prospects may have changed materially since those dates.

We further note that the representations,

warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in

this prospectus supplement or the accompanying prospectus were made solely for the benefit of the parties to such agreement, including,

in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation,

warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly,

such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

Unless the context otherwise

requires, “Eyenovia,” “the Company,” “we,” “us,” “our” and similar terms refer

to Eyenovia, Inc. and our subsidiaries.

INDUSTRY AND MARKET DATA

We obtained the industry,

statistical and market data in this prospectus supplement and the accompanying prospectus from our own internal estimates and research,

as well as from industry and general publications and research, surveys and studies conducted by third parties. In presenting this information,

we have made assumptions based on such data and other similar sources, and on our knowledge of, and our experience to date in, the potential

markets for our product candidates. Although we believe the data from these third-party sources is reliable and are responsible for the

accuracy of such data, we have not independently verified any third-party information. The industry in which we operate is subject to

a high degree of uncertainty and risk due to a variety of factors, including those described in the section entitled “Risk Factors”.

These and other factors could cause results to differ materially from those expressed in the estimates made by third parties and by us.

PROSPECTUS SUPPLEMENT SUMMARY

The following is a summary

of what we believe to be the most important aspects of our business and the offering of our common stock under this prospectus supplement

and the accompanying prospectus. We urge you to read this entire prospectus supplement and the accompanying prospectus, including the

more detailed consolidated financial statements, notes to the consolidated financial statements and other information incorporated by

reference from our other filings with the SEC. Investing in our securities involves risks. Therefore, carefully consider the risk factors

set forth in our most recent annual and quarterly filings with the SEC, as well as other information in this prospectus supplement, the

accompanying prospectus and the documents incorporated by reference herein or therein, before purchasing our common stock. Each of the risk

factors could adversely affect our business, operating results and financial condition, as well as adversely affect the value of an investment

in our common stock.

Overview

We are an ophthalmic technology

company focused on the late-stage development of MicroPine in the multi-billion dollar pediatric progressive myopia market while commercializing

Mydcombi™ (tropicamide and phenylephrine HCL ophthalmic spray) for inducing mydriasis for routine diagnostic procedures and in conditions

where short term pupil dilation is desired, and clobetasol propionate ophthalmic suspension, for the treatment of post-operative pain

and inflammation following ocular surgery. We are also developing the Optejet® delivery system both for use in combination with our

own drug-device therapeutic programs and for out-licensing for use in combination with therapeutics for additional indications. Our aim

is to improve the delivery of topical ophthalmic medication through the ergonomic design of the Optejet which facilitates ease-of-use

and delivery of more physiologically appropriate medication volume, with the goal to reduce side effects and improve tolerability, and

introduce digital health technology to improve therapy compliance and ultimately medical outcomes.

The ergonomic and functional

design of the Optejet allows for horizontal drug delivery and eliminates the need to tilt the head back or the manual dexterity to squeeze

a bottle, to administer medications. Drug is delivered in a microscopic array of droplets faster than the blink reflex to help ensure

instillation success. The precise delivery of a low-volume columnar spray by the Optejet device minimizes contamination risk with a non-protruding

nozzle and self-closing shutter. In clinical trials, the Optejet has demonstrated that its targeted delivery achieves a high rate of successful

administration, with 98% of sprays being accurately delivered upon first attempt compared to the established rate reported with traditional

eye drops of ~ 50%.

A more physiologically appropriate

volume of medication in the range of seven to nine microliters is delivered by the Optejet, which is approximately one-fifth of the 35

to 50 microliter dose typically delivered in a single eye drop. Lower volume of medication exposes the ocular surface to less active ingredient

and preservatives, potentially reducing ocular stress and surface damage and improving tolerability. The lower volume also minimizes the

potential for drug to enter systemic circulation, with the goal of avoiding some common side effects that are related to overdosing of

the eye.

We are developing versions

of the Optejet with on-board digital technology that records the date and time of each use. These data may be used to provide reminders

via Bluetooth to smart devices and to allow healthcare practitioners to monitor usage. This information can then be used by practitioners

and health care systems to measure treatment compliance and improve medical decision making. In this way, the Optejet could serve as an

extension of the physician’s office by providing information that is not currently possible to collect except through the use of

diaries.

Our drug-device product line

includes Mydcombi (tropicamide and phenylephrine HCL ophthalmic spray) and therapeutic programs MicroPine (atropine ophthalmic spray)

and MicroLine (pilocarpine ophthalmic spray). MicroPine is our first-in-class topical therapy for the treatment of progressive myopia,

a disease associated with pathologic axial elongation of the eye and sclero-retinal stretching. In the United States, myopia is estimated

to affect approximately 25 million children, with up to five million considered to be at high risk for progressive myopia. In February

2019, the U.S. Food and Drug Administration (“FDA”) accepted our Investigational New Drug application (“IND”) to initiate the CHAPERONE study to reduce the progression of myopia in children. The first patient was

enrolled in the CHAPERONE study in June 2019.

On October 9, 2020, we

entered into a license agreement with Bausch + Lomb (“B+L”), pursuant to which B+L had the rights to develop and

commercialize MicroPine in the United States and Canada (the “Bausch License Agreement”). Under the terms of the Bausch License Agreement, we received an upfront

payment of $10.0 million and were eligible to receive up to a total of $35.0 million in additional payments, based on the

achievement of certain regulatory and launch-based milestones. B+L also agreed to pay royalties to Eyenovia on a tiered basis

(ranging from mid-single digit to mid-teen percentages) on gross profits from sales of MicroPine in the United States and Canada,

subject to certain adjustments. Under the terms of the Bausch License Agreement, B+L assumed sponsorship of the IND as well as

ownership and the costs related to the ongoing CHAPERONE study.

On January 12, 2024, we entered

into an agreement with B+L to repatriate our rights to MicroPine and take control of the CHAPERONE study. In this agreement, we agreed

to pay B+L $2.0 million in cash up front. In addition, we have issued $3.0 million in common stock upon successful transfer of the regulatory

documents and study elements to us, which occurred in April 2024. We also agreed to pay B+L a 2% royalty on net sales once MicroPine is

commercialized in the United States, assuming receipt of regulatory approvals. We believe that this arrangement is in our and our shareholders’

best interests, as it may substantially increase the value of the asset through potential improvements in the conduct of the study, including

a planned interim analysis of the data in late 2024.

We have also

successfully expanded our manufacturing capabilities through a partnership with Coastline International, Inc. located in Tijuana,

Mexico, as well as the construction of our new manufacturing facility in Reno, Nevada and the construction of our own fill and

finish facility in Redwood City, California. We have received FDA clearance for using both Coastline International, Inc. and our

Redwood City facility for the production of Mydcombi cartridges, and FDA clearance for using our Reno facility for the production of

technical elements such as the base unit for the Optejet device.

MicroLine is our investigational

pharmacologic treatment for presbyopia, a non-preventable, age-related hardening of the lens, which causes the gradual loss of the eye’s

ability to focus on near objects and impairs near visual acuity. There are two FDA-approved treatments for presbyopia which use pilocarpine,

the same drug used in our investigational product. We have completed two Phase III studies using our Optejet® device. In these studies,

patients reported high satisfaction with using the device and a strong preference over using an eye dropper bottle. We released positive

top-line results from VISION-2 in the fourth quarter of 2022. We are planning to meet with the FDA in mid-2024 to discuss a transition

of the product into our new Gen-2 Optejet device, which has a significantly lower cost to manufacture than the first generation device.

Mydcombi is the only FDA-approved

fixed combination of the two leading mydriatic agents, tropicamide and phenylephrine in the United States and our first FDA-approved product.

As an ophthalmic spray delivered with Optejet technology, Mydcombi may present a number of benefits for ophthalmic surgical centers, optometric

and ophthalmic offices and patients. Those benefits may include improved cost-effectiveness in centers that employ single-use bottles

for mydriasis, more efficient use of office time and resources, and an overall improved doctor-patient experience. We have begun the commercialization

of Mydcombi, with the first commercial sale of the product occurring on August 3, 2023 as part of a targeted launch, and are planning

to expand our launch with the onboarding of ten sales representatives in early 2024. We received FDA approval for our primary Mydcombi

manufacturing facility in February 2024, which we believe will allow us to expand and continue to build our manufacturing operations.

On August 10, 2020, we

entered into a license agreement with Arctic Vision pursuant to which Arctic Vision may develop and commercialize MicroPine,

MicroLine and Mydcombi in Greater China (mainland China, Hong Kong, Macau and Taiwan) and South Korea (the “Arctic Vision License Agreement”). Under the terms of the

Arctic Vision License Agreement, as amended, we received an upfront payment of $4.25 million before any payments to Senju. In

addition, we may receive up to a total of $37.7 million in additional payments, based on various development and regulatory

milestones, including the initiation of clinical research and approvals in Greater China and South Korea, and development costs.

Arctic Vision also will purchase its supply of MicroPine, MicroLine and Mydcombi from Eyenovia or, for such products not supplied by

Eyenovia, pay a mid-single digit percentage royalty on net sales of such products, subject to certain adjustments. We will pay

between 30 and 40 percent of such payments, royalties, or net proceeds of such supply to Senju pursuant to the Senju License

Agreement.

We are in active discussions

with manufacturers of existing and late-stage ophthalmic medications to explore whether development with the Optejet technology can solve

unmet medical and business needs. Some of those business needs could include extension of exclusivity under the Optejet patents, improvement

in a drug’s tolerability profile, or potential improvement in treatment compliance.

On August 15, 2023, we

entered into a license agreement (the “Formosa License”) with Formosa Pharmaceuticals, Inc. (“Formosa”),

whereby we acquired the exclusive U.S. rights to commercialize any product related to a novel formulation of clobetasol propionate

ophthalmic suspension 0.05% (the “Licensed Product”), which was approved by the FDA, for post-operative inflammation and

pain after ocular surgery, on March 4, 2024. The Formosa License will remain in effect for ten years from the date of the first

commercial sale of a Licensed Product, unless earlier terminated.

We paid Formosa an

upfront payment in an aggregate amount of $2.0 million which consisted of (a) cash in the amount of $1.0 million and (b) 487,805

shares of common stock valued at $1.0 million. We also capitalized $122,945 of transaction costs in connection with the Formosa

License. In addition, we must pay Formosa up to $4.0 million upon the achievement of certain development milestones and up to $80

million upon the achievement of certain sales milestones. The trigger for the initial $2.0 million development milestone payments

was FDA approval of the Licensed Product and the effective date of the acceptance by the Company of the transfer and assignment of

the FDA approval occurred on March 11, 2024. Based on the achievement of this milestone, we paid Formosa the aggregate amount of

$2.0 million, consisting of (a) cash in the amount of $1.0 million on April 26, 2024 and (b) 613,496 shares of common stock valued

at $1.0 million on May 2, 2024. The remaining $2.0 million development milestone will be triggered on the earlier of twelve months

after FDA approval of the Licensed Product or six months following the first commercial sale of the Licensed Product.

Corporate Information

We were organized as a corporation

under the laws of the State of Florida on March 12, 2014 under the name “PGP Holdings V, Inc.” On May 5, 2014, we changed

our name to Eyenovia, Inc. On October 6, 2014, we reincorporated in the State of Delaware by merging into Eyenovia, Inc., a Delaware corporation.

Our principal executive office is located at 295 Madison Avenue, Suite 2400, New York, NY 10017, and our telephone number is (833) 393-6684.

We maintain a website at http://www.eyenovia.com, to which we regularly post copies of our press releases as well as additional information

about us. The information contained on, or that can be accessed through, our website is not a part of this prospectus supplement or the

accompanying prospectus. We have included our website address in this prospectus supplement solely as an inactive textual reference.

All brand names or trademarks

appearing in this prospectus supplement and the accompanying prospectus are the property of their respective holders. Use or display

by us of other parties’ trademarks, trade dress, or products in this prospectus supplement and the accompanying prospectus is not

intended to, and does not, imply a relationship with, or endorsements or sponsorship of, us by the trademark or trade dress owners.

THE OFFERING

| Shares of common stock offered by us: |

Shares of our common stock having an aggregate offering price of up to $10,000,000. |

| |

|

| Shares of common stock to be outstanding immediately after this offering: |

Up to 63,304,724 shares, assuming sales of 9,433,962 shares of common

stock are made in this offering at an offering price of $1.06 per share, the

last reported sale price of shares of our common stock on The Nasdaq Capital Market on May

15, 2024. The actual number of shares that may be issued will vary depending

on the sales price under this offering. |

| |

|

| Manner of offering: |

“At the market offering” that may be made from time to time on The Nasdaq Capital Market or other existing trading market for shares of our common stock through or to, Leerink Partners. See the section entitled “Plan of Distribution” on page S-10 of this prospectus supplement. |

| |

|

| Use of proceeds: |

We intend to use the net proceeds of this offering for working capital

and general corporate purposes. Proceeds may also be used to repay amounts outstanding under the Loan and Security Agreement with

Avenue Capital Management II, L.P. and related entities (together, “Avenue”). See the section titled “Use of Proceeds”

on page S-8 of this prospectus supplement. |

| |

|

| Risk factors: |

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page S-5 of this prospectus supplement and the other information included in, or incorporated by reference into, this prospectus supplement and the accompanying prospectus for a discussion of certain factors you should carefully consider before deciding to invest in shares of our common stock. |

| |

|

| The Nasdaq Capital Market symbol: |

EYEN |

The number of shares of common

stock outstanding immediately after this offering is based on 53,870,762 shares of common stock outstanding as of March 31, 2024 on a pro forma

basis, which includes 47,386,349 shares outstanding as of March 31, 2024 (actual); 347,794 shares of common stock issued since March 31, 2024

pursuant to our at-the-market offering facility; 3,223,726 shares of common stock issued in a registered direct offering in April 2024 (the “Registered Direct Offering”); 613,496 shares

issued to Formosa in April 2024 pursuant to the Formosa License; and 2,299,397 shares issued to B+L in May 2024 pursuant to our agreement

with B+L.

This number excludes:

| |

· |

6,022,877 shares of our common stock underlying outstanding options to purchase common stock under

our 2014 Equity Incentive Plan, as amended (the “2014 Plan”) and our Amended and Restated 2018 Omnibus Stock Incentive

Plan (the “2018 Plan”) with a weighted average exercise price of $3.19 per share; |

| |

· |

241,764 shares of our common stock issuable in connection with restricted

stock units under the 2014 Plan and the 2018 Plan; |

| |

· |

1,337,909 shares of our common stock reserved for future issuance under the 2014 Plan and the 2018

Plan; |

| |

|

|

| |

· |

2,327,747 shares of our common stock issuable upon conversion of outstanding

convertible notes; and |

| |

· |

warrants to purchase 10,926,554 shares of our common stock, with a weighted average exercise price of $2.28 per share. |

Unless otherwise noted, the

information in this prospectus supplement reflects and assumes no exercise of outstanding options and warrants.

RISK FACTORS

Investing in our securities

involves a high degree of risk. You should consider carefully the risks and uncertainties, as well as other information, in this prospectus

supplement and the accompanying prospectus and the documents incorporated by reference herein and therein, including the risks described

under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023, as amended by Amendment No. 1

thereto, and as updated by any other document that we subsequently file with the SEC and that is incorporated by reference into this prospectus

supplement, and any free writing prospectus that we have authorized for use in connection with this offering. The risks set forth in this

prospectus supplement and the accompanying prospectus and incorporated by reference herein and therein are those which we believe are

the material risks that we face. These risks are not the only ones facing us and there may be additional matters that we are unaware of

or that we currently consider immaterial. The occurrence of any of such risks may materially and adversely affect our business, financial

condition, results of operations and future prospects. In such an event, the market price of our common stock could decline, and you could

lose part or all of your investment.

Risks Related to this Offering

You may experience immediate and substantial

dilution.

The offering price per share

being offered may exceed the net tangible book value per share of our common stock outstanding prior to this offering. Assuming that an

aggregate of 9,433,962 shares of our common stock are sold under this prospectus supplement at a price of $1.06

per share, the last reported sale price of our common stock on The Nasdaq Capital Market on May 15, 2024, the aggregate gross proceeds

will be approximately $10.0 million. After deducting commissions and estimated aggregate offering expenses payable by us, you will

experience immediate dilution of $0.94 per share, representing the difference between our pro forma as adjusted net tangible book value

per share as of March 31, 2024, after giving effect to the pro forma adjustments further described in “Dilution” and the sale

of shares in this offering at the assumed offering price. Shares issuable pursuant to the exercise of outstanding stock options and warrants, restricted stock units, new awards pursuant to the 2014 Plan or 2018 Plan, or upon the conversion of convertible notes payable, may result in further

dilution of your investment. See the section entitled “Dilution” below for a more detailed illustration of the dilution you

would incur if you participate in this offering.

You may experience future dilution as a

result of future equity offerings.

In order to raise additional

capital, we may in the future offer additional shares of our common stock or other securities convertible into or exchangeable for our

common stock at prices that may not be the same as the price per share paid by any investor in this offering. We may sell shares or other

securities in any other offering at a price per share that is less than the price per share paid by an investor in this offering, and

investors purchasing shares or other securities in the future could have rights superior to existing stockholders. The price per share

at which we sell additional shares of our common stock, or securities convertible or exchangeable into common stock, in future transactions

may be higher or lower than the price per share paid by investors in this offering.

We may be required to raise additional capital

by issuing new securities with terms or rights superior to those of our existing securityholders, which could adversely affect your investment

in our company, the market price of shares of our common stock and our business.

We might require additional

financing to fund future operations, including our research and development, manufacturing and any possible sales and marketing activities.

We may not be able to obtain financing on favorable terms, if at all. If we raise additional funds by issuing equity securities, the percentage

ownership of our then current stockholders will be reduced, and the holders of the new equity securities may have rights superior to those

of our then existing securityholders, which could adversely affect the market price of our common stock and the voting power of shares

of our common stock. If we raise additional funds by issuing debt securities, the holders of these debt securities would similarly have

some rights senior to those of our then existing securityholders, and the terms of these debt securities could impose restrictions on

operations and create a significant interest expense for us which could have a materially adverse effect on our business.

Sales of our common stock in this offering,

or the perception that such sales may occur, could cause the market price of our common stock to fall.

We may issue and sell shares

of our common stock for aggregate gross proceeds of up to $10,000,000 from time to time in connection with this offering. The actual number

of shares of common stock that may be issued and sold in this offering, as well as the timing of any such sales, will depend on a number

of factors, including, among others, the prices at which any shares are actually sold in this offering (which may be influenced by market

conditions, the trading price of our common stock and other factors) and our determinations as to the appropriate timing, sources and

amounts of funding we need. The issuance and sale from time to time of these new shares of common stock, or the mere fact that we are

able to issue and sell these shares in this offering, could cause the market price of our common stock to decline.

It is not possible to predict the actual

number of shares of common stock we will sell under the Sales Agreement, or the gross proceeds resulting from those sales.

Subject to certain limitations

in the Sales Agreement and compliance with applicable law, we have the discretion to deliver a placement notice to Leerink Partners at

any time throughout the term of the Sales Agreement. The number of shares that are sold through Leerink Partners after the delivery of

a placement notice will fluctuate based on a number of factors, including the market price of our common stock during the sales period,

the limits we set with Leerink Partners in any applicable placement notice, and the demand for our common stock during the sales period.

Because the price per share will fluctuate during this offering, it is not currently possible to predict the number of shares that will

be sold or the gross proceeds to be raised in connection with those sales.

The common stock offered hereby will be

sold in “at-the-market offerings” and investors who buy shares at different times will likely pay different prices.

Investors who purchase shares

in this offering at different times will likely pay different prices, and accordingly may experience different levels of dilution and

different outcomes in their investment results. We will have discretion, subject to market demand, to vary the timing, prices and number

of shares sold in this offering. Investors may experience a decline in the value of the shares they purchase in this offering as a result

of sales made at prices lower than the prices they paid.

We have broad discretion in the use of the

net proceeds from this offering and may not use them effectively.

Our management will have

broad discretion in the application of the net proceeds from this offering and could spend the proceeds in ways that do not improve our

business, financial condition or results of operations or enhance the value of our common stock. See “Use of Proceeds” on

page S-8 of this prospectus supplement for a description of our proposed use of proceeds from this offering.

The failure by our management

to apply these funds effectively could result in financial losses that could harm our business, cause the price of our common stock to

decline and delay the development of our product candidates. Pending their use, we may invest the net proceeds from this offering in a

manner that does not produce income or that loses value.

If securities or industry analysts do not

publish research or reports about our business, or publish negative reports about our business, our stock price and trading volume could

decline.

The trading market for our

common stock will be influenced by the research and reports that securities or industry analysts publish about us or our business. We

do not have any control over these analysts. If one or more of the analysts who cover us downgrade our stock or change their opinion of

our stock in a negative manner, our stock price would likely decline. If one or more of these analysts cease coverage of our company or

fail to regularly publish reports on us, we could lose visibility in the financial markets, which could cause our stock price or trading

volume to decline.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement,

the accompanying prospectus, the documents we have filed with the SEC that are incorporated by reference herein and therein and any free

writing prospectus that we have authorized for use in connection with this offering contain “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”). These statements relate to future events or to our future operating

or financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance

or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking

statements. Forward-looking statements may include, but are not limited to, statements about:

| · | our need to raise additional money to fund our operations for the next twelve months as a going concern; |

| · | our estimates regarding expenses, future revenue, timing of any future revenue, capital requirements and needs for additional financing; |

| · | our expectations related to the use of proceeds from our financings; |

| · | risks of our and our licensees’ clinical trials including, but not limited to, the costs, design, initiation and enrollment,

timing, progress and results of such trials; |

| · | the timing and our or our licensees’ ability to submit applications for, obtain and maintain regulatory approval for Mydcombi,

clobetasol propionate and our product candidates; |

| · | the production and commercialization of Mydcombi and clobetasol propionate; |

| · | reliance on third parties to develop and commercialize Mydcombi, clobetasol propionate and certain of our product candidates; |

| · | our and our partners’ ability to timely develop, implement and maintain manufacturing, commercialization and marketing capabilities

and strategies for Mydcombi, clobetasol propionate and certain of our product candidates; |

| · | our estimates regarding the potential market opportunities for Mydcombi, clobetasol propionate and our product candidates; |

| · | the potential advantages of Mydcombi, clobetasol propionate and our product candidates and platform technology and potential revenues

from licensing transactions; |

| · | the rate and degree of market acceptance and clinical utility of Mydcombi, clobetasol propionate and our product candidates; |

| · | our intellectual property position; |

| · | our ability to identify additional products, product candidates or technologies with significant commercial potential that are consistent

with our commercial objectives; |

| · | our ability to attract and retain key personnel; |

| · | the impact of government laws and regulations; |

| · | our competitive position; |

| · | developments relating to our competitors and our industry; |

| · | our ability to maintain and establish collaborations; |

| · | general or regional economic conditions; |

| · | changes in U.S. GAAP; and |

| · | changes in the legal, regulatory and legislative environments in the markets in which we operate, and the impact of these changes

on our ability to obtain regulatory approval for our products. |

In some cases, you can identify

forward-looking statements by terms such as “anticipate,” “believe,” “can,” “continue,”

“could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,”

“potential,” “project,” “seek,” “should,” “target,” “will,” “would”

and similar expressions or variations intended to identify forward- looking statements. These statements reflect our current views with

respect to future events, are based on assumptions and are subject to risks and uncertainties. Given these uncertainties, you should not

place undue reliance on these forward-looking statements. We discuss in greater detail, and incorporate by reference into this prospectus

supplement and the accompanying prospectus in their entirety, many of these risks under the headings “Risk Factors” on page

S-5 of this prospectus supplement, and in our Annual Report on Form 10-K for the year ended December 31, 2023, as amended by Amendment No. 1 thereto and as updated by our subsequent filings under the Exchange Act, which are incorporated herein by reference, as may be updated

or superseded by the risks and uncertainties described under similar headings in the other documents that are filed after the date hereof

and incorporated by reference into this prospectus supplement. Also, these forward-looking statements represent our estimates and assumptions

only as of the date of the document containing the applicable statement.

You should read this prospectus

supplement, the accompanying prospectus, the documents we have filed with the SEC that are incorporated by reference herein and therein

and any free writing prospectus that we have authorized for use in connection with this offering completely and with the understanding

that our actual future results may be materially different from what we expect. We qualify all of the forward-looking statements in the

foregoing documents by these cautionary statements.

Unless required by law, we

undertake no obligation to update or revise any forward-looking statements to reflect new information or future events or developments.

Thus, you should not assume that our silence over time means that actual events are bearing out as expressed or implied in such forward-looking

statements.

USE OF PROCEEDS

We may issue and sell up to

$10,000,000 of our common stock from time to time. Because there is no minimum offering amount required as a condition to close this offering,

the actual total public offering amount, commissions and proceeds to us, if any, are not determinable at this time. There can be no assurance

that we will sell any shares under or fully utilize the Sales Agreement with Leerink Partners as a source of financing.

We intend to use the net proceeds

from this offering, if any, for working capital and general corporate purposes. Proceeds may also be used to repay amounts outstanding under the Loan and Security Agreement with Avenue. The Avenue loan bears interest

at an annual rate equal to the greater of (a) 7.0% and (b) the prime rate as reported in The Wall Street Journal plus 4.45%. The maturity

date is November 1, 2025.

As of the date of this prospectus

supplement, we cannot specify with certainty any of the particular uses of the proceeds, if any, from this offering. Accordingly, we will

retain broad discretion over the use of any such proceeds. Pending the use of the net proceeds, if any, from this offering as described

above, we intend to invest the net proceeds in investment-grade, interest-bearing instruments.

DILUTION

If you invest in our common

stock in this offering, your ownership interest will be diluted to the extent of the difference between the offering price per share paid

by the purchasers in this offering and our pro forma as adjusted net tangible book value per share immediately after this offering.

Our historical net tangible

book deficit as of March 31, 2024 was approximately $(4.3) million, or $(0.09) per share of common stock. We calculate tangible book value

per share by dividing our total tangible assets, less total liabilities, by the number of shares of our common stock outstanding as of

March 31, 2024.

Our pro forma net

tangible book deficit as of March 31, 2024 was approximately

$(2.1) million, or

$(0.04) per share of common stock. We calculate pro forma net tangible

book deficit per share by dividing (a) the total of our historical net tangible book value, the net proceeds received after March 31,

2024 from our at-the-market offering and the net proceeds received in the Registered Direct Offering, by (b) the sum of (i) the

total number of shares of our common stock outstanding as of March 31, 2024, (ii) the number of shares of our common stock issued

after March 31, 2024 in our at-the-market offering, (iii) the number of shares issued in the Registered Direct Offering, (iv) the

number of shares issued to Formosa in April 2024 pursuant to the Formosa License and (v) the number of shares issued to B+L in April

2024 pursuant to our agreement with B+L.

We present dilution on a

pro forma as adjusted basis to give effect to the sale by us of shares of our common stock in this offering in the aggregate amount

of $10,000,000, at an assumed public offering price of $1.06 per share of common stock, the last reported sale price of our common

stock on The Nasdaq Capital Market on May 15, 2024, after deducting commissions and estimated offering expenses payable by us. This

offering represents an immediate increase in net tangible book value to existing stockholders of $0.16 per share of common stock and

immediate dilution in net tangible book value to purchasers of shares of common stock in this offering of $0.94 per share of common

stock. The following table illustrates this dilution per share of common stock:

| Assumed public offering price per share | |

| | | |

$ | 1.06 | |

| Historical net tangible book deficit per share as of March 31, 2024 | |

$ | (0.09 | ) | |

| | |

| Pro forma increase in net tangible book value per share as of March 31, 2024 | |

| 0.05 | | |

| | |

| Pro forma net tangible book deficit per share | |

| (0.04 | ) | |

| | |

| Increase in pro forma net tangible book value per share attributable to this offering | |

| 0.16 | | |

| | |

| Pro forma as adjusted tangible book value per share, after giving effect to this offering | |

| | | |

| 0.12 | |

| Dilution per share to investors in this offering | |

| | | |

$ | 0.94 | |

The number of shares of common

stock outstanding immediately after this offering is based on 53,870,762 shares of common stock outstanding as of March 31, 2024 on a pro forma

basis, which includes 47,386,349 shares outstanding as of March 31, 2024 (actual); 347,794 shares of common stock issued since March 31, 2024

pursuant to our at-the-market offering facility; 3,223,726 shares of common stock issued in the Registered Direct Offering; 613,496 shares

issued to Formosa in April 2024 pursuant to the Formosa License; and 2,299,397 shares issued to B+L in April 2024 pursuant to our agreement

with B+L.

This number excludes:

| |

· |

6,022,877 shares of our common stock underlying outstanding options to purchase common Stock under

the 2014 Plan and the 2018 Plan with a weighted average exercise price of $3.19 per share; |

| |

· |

241,764 shares of our common stock issuable in connection with restricted

stock units under the 2014 Plan and the 2018 Plan; |

| |

· |

1,337,909 shares of our common stock reserved for future issuance under the 2014 Plan and the 2018

Plan; |

| |

|

|

| |

· |

2,327,747 shares of our common stock issuable upon conversion of outstanding

convertible notes; and |

| |

· |

warrants to purchase 10,926,554 shares of our common stock, with a weighted average exercise price of $2.28 per share. |

Unless otherwise noted, the information in this prospectus supplement

reflects and assumes no exercise of outstanding options and warrants.

To the extent that any

of these options or warrants are exercised, new options are issued under our 2014 Plan or 2018 Plan, shares are issued in satisfaction of the restricted stock units, or convertible notes payable are converted, or we issue additional shares of

common stock, warrants or other equity securities in the future, there may be further dilution to investors participating in this

offering.

In addition, we may choose

to raise additional capital due to market conditions or strategic considerations even if we believe we have sufficient funds for our current

or future operating plans. To the extent that additional capital is raised through the sale of equity or convertible debt securities,

the issuance of these securities may result in further dilution to our shareholders.

PLAN OF DISTRIBUTION

We have entered into a Sales

Agreement with Leerink Partners under which we may issue and sell shares of common stock having an aggregate offering price of up to $50,000,000

from time to time through Leerink Partners as our sales agent. As of the date of this prospectus, an aggregate of $14,450,163 of shares

of common stock have been sold pursuant to the Sales Agreement, and up to $10,000,000 of shares of common stock may be sold pursuant to

this prospectus supplement and the accompanying prospectus. Sales of shares of common stock, if any, under this prospectus supplement

will be made at market prices by any method that is deemed to be an “at-the-market” offering, as defined in Rule 415

under the Securities Act, including sales made directly on the Nasdaq Capital Market or any other trading market for our common stock.

If authorized by us in writing, Leerink Partners may purchase shares of our common stock as principal.

Leerink Partners will offer

shares of our common stock subject to the terms and conditions of the Sales Agreement on a daily basis or as otherwise agreed upon by

us and Leerink Partners. We will designate the maximum amount of common stock to be sold through Leerink Partners on a daily basis or

otherwise determine such maximum amount together with Leerink Partners. Subject to the terms and conditions of the Sales Agreement, Leerink

Partners will use its commercially reasonable efforts consistent with its normal trading and sales practices to sell on our behalf all

of the shares of common stock requested to be sold by us. We may instruct Leerink Partners not to sell shares of common stock if the sales

cannot be effected at or above the price designated by us in any such instruction. Leerink Partners or we may suspend the offering of

shares of our common stock being made through Leerink Partners under the Sales Agreement upon proper notice to the other party. Leerink

Partners and we each have the right, by giving written notice as specified in the Sales Agreement, to terminate the Sales Agreement in

each party’s sole discretion at any time. The offering of shares of our common stock pursuant to the Sales Agreement will otherwise

terminate upon the termination of the Sales Agreement as provided therein.

The aggregate compensation

payable to Leerink Partners as sales agent will be an amount equal to 3.0% of the gross proceeds of any shares sold through it pursuant

to the Sales Agreement. We previously reimbursed Leerink Partners $75,000 of Leerink Partners’ actual outside legal expenses incurred

by Leerink Partners in connection with this offering. We have also agreed to reimburse Leerink Partners for certain ongoing fees of its

legal counsel. We estimate that the total expenses of the offering payable by us, excluding commissions payable to Leerink Partners under

the Sales Agreement, will be approximately $75,000.

Leerink Partners will provide

written confirmation to us following the close of trading on the Nasdaq Capital Market on each day in which shares of common stock are

sold through it as sales agent under the Sales Agreement. Each confirmation will include the number of shares of common stock sold through

it as sales agent on that day, the volume weighted average price of the shares of common stock sold, the percentage of the daily

trading volume and the net proceeds to us.

Settlement for sales of shares

of common stock will occur, unless the parties agree otherwise, on the second business day that is also a trading day following the date

on which any sales were made in return for payment of the net proceeds to us. Pursuant to recent amendments to Rule 15c6-1 of the Exchange

Act, settlement for any securities offered under this prospectus on or after May 28, 2024, may occur on the first business day that is

also a trading day following the date on which any sales were made in return for payment of the net proceeds to us. There is no arrangement

for funds to be received in an escrow, trust or similar arrangement. There is no arrangement for funds to be received in an escrow, trust

or similar arrangement.

We will report at least quarterly

the number of shares of common stock sold through Leerink Partners under the Sales Agreement, the net proceeds to us and the compensation

paid by us to Leerink Partners in connection with the sales of shares of common stock during the relevant period.

In connection with the sales

of shares of common stock on our behalf, Leerink Partners may be deemed to be an “underwriter” within the meaning of the Securities

Act, and the compensation paid to Leerink Partners may be deemed to be underwriting commissions or discounts. We have agreed in the Sales

Agreement to provide indemnification and contribution to Leerink Partners against certain liabilities, including liabilities under the

Securities Act. As sales agent, Leerink Partners will not engage in any transactions that stabilize our common stock.

LEGAL MATTERS

The validity of the common

stock offered by this prospectus supplement will be passed upon by Covington & Burling LLP, Boston, Massachusetts. Paul Hastings LLP,

New York, New York, is representing Leerink Partners in connection with the offering.

EXPERTS

The financial statements

of Eyenovia, Inc. as of December 31, 2023 and 2022 and for each of the two years in the period ended December 31, 2023, have been audited

by Marcum LLP, independent registered public accounting firm, as stated in their report, which includes an explanatory paragraph as to

the Company’s ability to continue as a going concern, which is incorporated herein by reference. Such financial statements of Eyenovia,

Inc. are incorporated in this prospectus by reference in reliance on the report of such firm given upon their authority as experts in

accounting and auditing.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The SEC allows us to “incorporate

by reference” information from other documents that we file with it, which means that we can disclose important information to you

by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus supplement.

Information in this prospectus supplement supersedes information incorporated by reference that we filed with the SEC prior to the date

of this prospectus supplement, while information that we file later with the SEC will automatically update and supersede the information

in this prospectus supplement. We incorporate by reference into this prospectus supplement and the accompanying prospectus the information

or documents listed below that we have filed with the SEC (Commission File No. 001-38365):

The SEC file number for each

of the documents listed above is 001-38365.

In addition, any future filings

(other than current reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed on such form that are related to such

items unless such Form 8-K expressly provides to the contrary) made with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the

Exchange Act, prior to the termination of this offering, will be deemed incorporated by reference into this prospectus supplement.

Any statement contained in

this prospectus supplement or in a document incorporated or deemed to be incorporated by reference into this prospectus supplement will

be deemed to be modified or superseded for purposes of this prospectus supplement to the extent that a statement contained in this prospectus

supplement or other subsequently filed document that also is or is deemed to be incorporated by reference into this prospectus supplement

modifies or supersedes the statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded,

to constitute a part of this prospectus supplement.

We will furnish without charge

to you, on written or oral request, a copy of any filing or report incorporated by reference, including exhibits to the document. You

should direct any requests for documents to Eyenovia, Inc., 295 Madison Avenue, Suite 2400, New York, NY 10017, (833) 393-6684,

Attention: Corporate Secretary.

PROSPECTUS

$100,000,000

COMMON

STOCK

PREFERRED STOCK

DEBT SECURITIES

WARRANTS

RIGHTS

UNITS

This prospectus

will allow us to issue, from time to time at prices and on terms to be determined at or prior to the time of the offering, up to $100,000,000

of any combination of the securities described in this prospectus, either individually or in units. We may also offer common stock, or

preferred stock upon conversion of or exchange for the debt securities; common stock upon conversion of or exchange for preferred stock;

common stock, preferred stock or debt securities upon the exercise of warrants or rights.

This prospectus

describes the general terms of these securities and the general manner in which these securities will be offered. We will provide you

with the specific terms of any offering in one or more supplements to this prospectus. The prospectus supplements will also describe the

specific manner in which these securities will be offered and may also supplement, update or amend information contained in this document.

You should read this prospectus and any prospectus supplement, as well as any documents incorporated by reference into this prospectus

or any prospectus supplement, carefully before you invest.

Our securities

may be sold directly by us to you, through agents designated from time to time or to or through underwriters or dealers. For additional

information on the methods of sale, you should refer to the section entitled “Plan of Distribution” in this prospectus and

in the applicable prospectus supplement. If any underwriters or agents are involved in the sale of our securities with respect to which

this prospectus is being delivered, the names of such underwriters or agents and any applicable fees, commissions or discounts and over-

allotment options will be set forth in a prospectus supplement. The price to the public of such securities and the net proceeds that we

expect to receive from such sale will also be set forth in a prospectus supplement.

Our common stock

is listed on The Nasdaq Capital Market under the symbol “EYEN.” On December 10, 2021, the last reported sale price of our

common stock was $3.76 per share. The applicable prospectus supplement will contain information, where applicable, as to any other listing,

if any, on The Nasdaq Capital Market or any securities market or other securities exchange of the securities covered by the prospectus

supplement. Prospective purchasers of our securities are urged to obtain current information as to the market prices of our securities,

where applicable.

We

are an “emerging growth company” and a “smaller reporting company” under applicable Securities and Exchange Commission

rules and are subject to reduced public company reporting requirements for this prospectus and future filings.

Investing

in our securities involves a high degree of risk. See “Risk Factors” included in any accompanying prospectus supplement and

in the documents incorporated by reference in this prospectus for a discussion of the factors you should carefully consider before deciding

to purchase these securities.

Neither the

Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if

this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus

is December 23, 2021.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus

is part of a registration statement that we filed with the U.S. Securities and Exchange Commission (the “SEC”), utilizing

a “shelf” registration process. Under this shelf registration process, we may offer shares of our common stock, various series

of debt securities or preferred stock, and warrants or rights to purchase any such securities, either individually or in units, in one

or more offerings, with a total value of up to $100,000,000. This prospectus provides you with a general description of the securities

we may offer. Each time we offer a type or series of securities under this prospectus, we will provide a prospectus supplement that will

contain specific information about the terms of that offering.

This

prospectus does not contain all of the information included in the registration statement. For a more complete understanding of the

offering of the securities, you should refer to the registration statement, including its exhibits. The prospectus supplement may

also add, update or change information contained or incorporated by reference in this prospectus. However, no prospectus supplement

will offer a security that is not registered and described in this prospectus at the time of its effectiveness. This prospectus,

together with the applicable prospectus supplements and the documents incorporated by reference into this prospectus, includes all

material information relating to the offering of securities under this prospectus. You should carefully read this prospectus, the

applicable prospectus supplement, the information and documents incorporated herein by reference and the additional information

under the heading “Where You Can Find More Information” before making an investment decision.

You should rely

only on the information we have provided or incorporated by reference in this prospectus or any prospectus supplement. We have not authorized

anyone to provide you with information different from that contained or incorporated by reference in this prospectus. No dealer, salesperson

or other person is authorized to give any information or to represent anything not contained or incorporated by reference in this prospectus.

You must not rely on any unauthorized information or representation. This prospectus is an offer to sell only the securities offered hereby,

but only under circumstances and in jurisdictions where it is lawful to do so. You should assume that the information in this prospectus

or any prospectus supplement is accurate only as of the date on the front of the document and that any information we have incorporated

herein by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this

prospectus or any sale of a security.

We

further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any

document that is incorporated by reference in the prospectus were made solely for the benefit of the parties to such agreement,

including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a

representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the

date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the

current state of our affairs.

This prospectus

may not be used to consummate sales of our securities, unless it is accompanied by a prospectus supplement. To the extent there are inconsistencies

between any prospectus supplement, this prospectus and any documents incorporated by reference, the document with the most recent date

will control.

Unless the context

otherwise requires, “Eyenovia,” “EYEN,” “the Company,” “we,” “us,” “our”

and similar terms refer to Eyenovia, Inc. and our subsidiaries.

PROSPECTUS SUMMARY

The following

is a summary of what we believe to be the most important aspects of our business and the offering of our securities under this prospectus.

We urge you to read this entire prospectus, including the more detailed consolidated financial statements, notes to the consolidated financial

statements and other information incorporated by reference from our other filings with the SEC or included in any applicable prospectus

supplement. Investing in our securities involves risks. Therefore, carefully consider the risk factors set forth in any prospectus supplements

and in our most recent annual and quarterly filings with the SEC, as well as other information in this prospectus and any prospectus supplements

and the documents incorporated by reference herein or therein, before purchasing our securities. Each of the risk factors could adversely

affect our business, operating results and financial condition, as well as adversely affect the value of an investment in our securities.

About Eyenovia, Inc.

We are a clinical

stage ophthalmic biopharmaceutical company developing a pipeline of advanced therapeutics based on our proprietary microdose array print

(MAP™) therapeutics. We aim to achieve clinical microdosing of next-generation formulations of well-established ophthalmic pharmaceutical

agents using our high-precision targeted ocular delivery system, branded the Optejet® which has the potential to replace conventional

eye dropper delivery and improve safety, tolerability, patient compliance and topical delivery success for ophthalmic eye treatments.

In the clinic, the Optejet has demonstrated the ability to horizontally deliver ophthalmic medication with a success rate significantly

higher than that of traditional eye drops (~ 90% vs. ~ 50%). Our technology is designed to achieve single-digit μl-volume physiologic

drug delivery with up to a 75% reduction in ocular drug and preservative topical dosing and has demonstrated significant improvement in

the therapeutic index in drugs used for mydriasis and IOP lowering through three Phase II and Phase III trials. Conventional eye formulations

lack high-precision micro-volume delivery and expose the ocular surface to approximately 300% more medication and preservatives than are

physiologically indicated leading to clinically recognized ocular and non-ocular side effects. Using the Optejet, we are developing the

next generation of smart ophthalmic therapeutics which target new indications or new combinations where there are currently no comparable

drug therapies approved by the U.S. Food and Drug Administration, (the “FDA”). Our microdose therapeutics follow the FDA-designated

pharmaceutical registration and regulatory process. Consistent with the recent FDA reclassification of MydCombi, we believe that most

of our product candidates are, or will be, classified by the FDA as drug- led combination products.

Our pipeline is

currently focused on the late-stage development of novel, potential first-in-class therapeutic indications for over an estimated five

million potential patients with progressive myopia in the United States and over an estimated one hundred million potential patients with

age-related near vision impairment, or presbyopia — indications where there is tremendous unmet need and no known existing FDA-approved

therapies. We are also developing the first microdose fixed combination ophthalmic pharmaceutical for mydriasis to address the estimated

over 100 million annual comprehensive eye exams with pupil dilation.

MicroPine

is our investigational first-in-class topical therapy for the treatment of progressive myopia, a back-of-the-eye ocular disease

associated with pathologic axial elongation and sclero-retinal stretching. In the United States, myopia is estimated to affect

approximately 25 million children, with up to five million considered to be at risk for high myopia. In February 2019, the FDA

accepted our investigational new drug application, or IND, to initiate a Phase III registration trial of MicroPine (the CHAPERONE

study) to reduce the progression of myopia in children. We enrolled the first patient in the CHAPERONE study in June 2019. Due to

the COVID-19 pandemic, we experienced delays in trial enrollment and initiation as a result of reduced clinical trial activities and

operations at investigator sites during the first half of 2020. However, we have since been able to resume enrollment in the

CHAPERONE study at a slower pace than initially planned.

On

October 9, 2020, we entered into a License Agreement (the “Bausch License Agreement”) with a subsidiary of Bausch Health

Companies Inc. (“Bausch Health”) pursuant to which Bausch Health may develop and commercialize MicroPine in the United States

and Canada. Under the terms of the Bausch License Agreement, we received an upfront payment of $10.0 million and we may receive up to

a total of $35.0 million in additional payments, based on the achievement of certain regulatory and launch-based milestones. Bausch Health

also will pay us royalties on a tiered basis (ranging from mid-single digit to mid-teen percentages) on gross profits from sales of MicroPine

in the United States and Canada, subject to certain adjustments. Under the terms of the Bausch License Agreement, Bausch Health is in

the process of assuming oversight for, and has assumed the costs related to the ongoing CHAPERONE study.

MicroLine

is our investigational pharmacologic treatment for presbyopia. Presbyopia is a non- preventable, age-related hardening of the lens,

which causes the gradual loss of the eye’s ability to focus at near and impairs near visual acuity. There currently are no

known FDA-approved drugs for the improvement of near vision in patients with presbyopia, although other companies have related

therapies in their pipeline. We have two planned Phase III VISION trials for MicroLine, and initiated the first of these trials in

December 2020. On May 25, 2021, we announced positive topline data from the Phase III VISION-1 study evaluating MicroLine for the

temporary improvement of near vision in adults with presbyopia. The study achieved its primary endpoint and the Company recently

initiated VISION -2, a second Phase III registration study. VISION-2, is a double-masked, placebo-controlled, cross-over superiority

trial designed to enroll 120 patients randomized between 2% pilocarpine and placebo cohorts. Topline data from VISION-2 is

anticipated in mid-2022. These studies will serve as the basis for a planned New Drug Application (NDA) submission to FDA. VISION-1

results will be presented at a future ophthalmic-focused medical meeting.

On

August 10, 2020, we entered into a License Agreement (the “Arctic Vision License Agreement”) with Arctic Vision (Hong

Kong) Limited (“Arctic Vision”), pursuant to which Arctic Vision may develop and commercialize MicroPine and MicroLine

in Greater China (mainland China, Hong Kong, Macau and Taiwan) and South Korea. Under the terms of the Arctic Vision License

Agreement, we received an upfront payment of $4.0 million before any payments to Senju Pharmaceutical Co., Ltd.

(“Senju”). In addition, we may receive up to a total of $43.75 million in additional payments, based on various

development and regulatory milestones, including the initiation of clinical research and approvals in Greater China and South Korea,

and development costs. Milestone revenue includes $2.0 million related to the MicroStat product resulting from Amendment 1 to the

Arctic Vision License Agreement between the Company and Arctic Vision which was executed on September 14, 2021. Arctic Vision also

will purchase its supply of MicroPine, MicroLine and MicroStat from us or, for such products not supplied by us, pay us a mid-single

digit percentage royalty on net sales of such products, subject to certain adjustments. We will pay a mid- double digit percentage

of such payments, royalties, or net proceeds of such supply to Senju pursuant to the Exclusive License Agreement with Senju dated

March 8, 2015, as amended by the License Amendment dated April 8, 2020, and a Letter Agreement dated August 10, 2020 (the

“Senju License Agreement”).

The

Senju License Agreement was amended further by the License Amendment 2, effective September 14, 2021 (the “Amendment

2”). The Amendment 2 excludes Greater China and South Korea from the territory in which Senju was granted an exclusive

royalty-bearing license from the Company. In consideration for this exclusion, and upon and after the execution of Amendment 1 with

Arctic Vision, the Company must make payments to Senju based on non-royalty license revenue and sales revenue, including a one-time

upfront payment of $250,000 which represented an inducement to Senju to approve Amendment 1 of the Arctic Vision License Agreement

related to the MicroStat Product. This upfront payment to Senju was in addition to and separate from the previously established 40%

payment on milestone revenue.

MydCombi™

(or MicroStat) is our fixed combination formulation of phenylephrine-tropicamide for mydriasis, designed to be a novel approach for the

estimated over one hundred million office-based comprehensive and diabetic eye exams performed every year in the United States. We have

completed two Phase III trials for MydCombi and announced positive results from these studies, known as MIST-1 and MIST-2. In March 2021,

the FDA accepted our NDA, for MydCombi for use to achieve mydriasis in routine diagnostic procedures and in conditions where short-term

pupil dilation is desired. On October 25, 2021, the Company announced the reclassification of the Company’s proprietary, first-in-class

combination microdose formulation of tropicamide and phenylephrine for in-office pupil dilation, MydCombi, as a drug- device combination

product by the FDA in a Complete Response Letter (“CRL”) received on October 22, 2021, following a change in the agency’s

legal interpretation of its authorities imposed by a recent court ruling. The Company is preparing the necessary documents for expedited

resubmission of the new drug application for MydCombi in response to the CRL.

We have not received

U.S. marketing approval for any product candidate and we have therefore not generated any revenues from product sales.

Additional Information

For additional

information related to our business and operations, please refer to the reports incorporated herein by reference, including our Annual Report on Form 10-K for the year ended December 31, 2020, as described under the caption “Incorporation of Documents by Reference”

on page 27 of this prospectus.

Impact of COVID-19

In March 2020,

the World Health Organization declared COVID-19 a global pandemic and recommended containment and mitigation measures worldwide. The COVID-19

pandemic has been evolving, and to date has led to the implementation of various responses, including government-imposed quarantines,

travel restrictions and other public health safety measures.

Management continues

to closely monitor the impact of the COVID-19 pandemic on all aspects of the business, including how it will impact operations and the

operations of customers, vendors, and business partners. Due to the COVID-19 pandemic, we have experienced delays in trial enrollment

and initiation as a result of reduced clinical trial activities and operations at investigator sites. However, we have since been able

to resume operations largely as they were prior to the pandemic. The extent to which COVID-19 impacts the future business, results of

operation and financial condition will depend on future developments, which are highly uncertain and cannot be predicted with confidence

at this time, such as the continued duration of the outbreak, new information that may emerge concerning the severity or other strains

of COVID-19 or the effectiveness of actions to contain COVID-19 or treat its impact, among others. If we or any of the third parties with

which we engage, however, were to experience shutdowns or other business disruptions, the ability to conduct our business in the manner

and on the timelines presently planned could be materially and negatively affected, which could have a material adverse impact on business,

results of operation and financial condition. The estimates of the impact on the Company’s business may change based on new information

that may emerge concerning COVID-19 and the actions to contain it or treat its impact and the economic impact on local, regional, national,

and international markets.

Our Corporate Information

We

were organized as a corporation under the laws of the State of Florida on March 12, 2014 under the name “PGP Holdings V,

Inc.” On May 5, 2014, we changed our name to Eyenovia, Inc. On October 6, 2014, we reincorporated in the State of Delaware by

merging into Eyenovia, Inc., a Delaware corporation. Our principal executive office is located at 295 Madison Avenue, Suite 2400,

New York, NY 10017, and our telephone number is 917-289-1117. We maintain a website at http://www.eyenovia.com, to which we

regularly post copies of our press releases as well as additional information about us. The information contained on, or that can be

accessed through, our website is not a part of this prospectus. We have included our website address in this prospectus solely as an

inactive textual reference.

All brand names

or trademarks appearing in this prospectus are the property of their respective holders. Use or display by us of other parties’

trademarks, trade dress, or products in this prospectus is not intended to, and does not, imply a relationship with, or endorsements or

sponsorship of, us by the trademark or trade dress owners.

Implications of Being an Emerging

Growth Company

As