FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2023

Commission File Number: 001-34985

Globus Maritime Limited

(Translation of registrant’s name into English)

128 Vouliagmenis

Avenue, 3rd Floor, Glyfada, Attica, Greece, 166 74

(Address of principal executive office)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F

x Form 40-F ¨

INFORMATION CONTAINED IN THIS FORM 6-K REPORT

This Form 6-K is furnished by Globus Maritime

Limited (the “Company” or “our” or “us” or “we”). Attached to this report(this “Report”)

on Form 6-K as Exhibit 99.1 is a copy of the press release of the Company dated August 2023 titled “GlobusMaritime

Limited Announces Amendment to Term Loan Facility and Agreements to Sell Two Vessels.

On August 10, 2023,

we entered into an amended and restated term loan facility with First-Citizens Bank & Trust Company (formerly known as CIT

Bank N.A.). We had originally borrowed $34.25 million in May 2021, which we increased to $52.25 million in August 2022. This

amended and restated facility, which we refer to as the First-Citizens Bank & Trust Company Loan Facility, relates to the financing

of our ships, the Diamond Globe, Power Globe, Orion Globe, River Globe, Sky Globe, Star

Globe, Moon Globe, and Galaxy Globe. The borrowers under the First- Citizens Bank & Trust Company

are Devocean Maritime Ltd., Domina Maritime Ltd, Dulac Maritime S.A., Artful Shipholding S.A., Serena Maritime Limited, Salaminia Maritime

Limited, Argo Maritime Limited and Talisman Maritime Limited and the First Citizens Bank & Trust Company Loan Facility is guaranteed

by Globus Maritime Limited.

This amended and restated

loan agreement is for an aggregate of $77.25 million (i.e., an additional $25 million from the previous facility as it had been amended).

We also entered into a swap agreement with respect to LIBOR. We paid First-Citizens Bank & Trust Company (formerly known as CIT

Bank N.A.) an upfront fee in the amount of 1.25% of the total commitment of the loan.

The First-Citizens Bank & Trust Company

Loan Facility currently bears interest at Term SOFR together with an adjustment of 0.1% per annum plus a margin of 2.70% (or 4.70% default

interest) per annum. The First-Citizens Bank & Trust Company Loan Facility, as amended, consists of eight tranches, which

shall be repaid in consecutive quarterly installments with the final installment due on the first six tranches in May 2026 and on

the final two tranches in August 2027. Through May 2026, each installment is an aggregate amount of $1,935,606.06 as well

as a balloon payment in an aggregate amount of $20,223,485 due in May 2026. Thereafter, the installments are $500,000 and balloon

payment in an aggregate amount of $17,000,000 due in August 2027.

The First-Citizens Bank &

Trust Company Loan Facility may be prepaid. If the prepayment of the tranche financing Orion Globe occurs on or before August 2023,

the prepayment fee is 2% of the amount prepaid and thereafter until August 10, 2024, the prepayment fee is 1% of the amount prepaid,

subject to certain exceptions. If the prepayment of the tranche financing either Diamon Globe or Power Globe occurs on or before August 2024,

the prepayment fee is 2% of the amount prepaid and thereafter until August 2025, the prepayment fee is 1% of the amount prepaid,

subject to certain exceptions. The prepayment fee for a prepayment of any other tranche is 1% of the amount prepaid, subject to certain

exceptions. We cannot reborrow any amount of the First-Citizens Bank & Trust Company Loan that is prepaid or repaid.

The First-Citizens Bank &

Trust Company Loan Facility is secured by:

| · | First preferred mortgage over m/v River Globe, m/v Sky Globe, m/v Star

Globe, m/v Moon Globe, m/v Diamond Globe, m/v Power Globe, m/v Galaxy Globe and m/v

Orion Globe. |

| · | Guarantee from Globus Maritime Limited and joint liability of the eight vessel owning companies (each

of which is a borrower under the First-Citizens Bank & Trust Company Loan Facility). |

| · | Shares pledges respecting each borrower. |

| · | Pledges of bank accounts, a pledge of each borrower’s rights under any interest rate hedging agreement

in respect of the First-Citizens Bank & Trust Company Loan Facility, a general assignment over each ship's earnings, insurances

and any requisition compensation in relation to that ship, and an assignment of the rights of Globus Maritime with respect to any indebtedness

owed to it by the borrowers. |

We are not permitted,

without the written consent of First-Citizens Bank & Trust Company, to enter into a charter the duration of which exceeds or

is capable of exceeding, by virtue of any optional extensions, 12 months.

The First-Citizens Bank &

Trust Company Loan Facility contains various covenants requiring the vessels owning companies and/or Globus Maritime Limited to, among

other things, ensure that:

| |

· |

The borrowers, must maintain a minimum liquidity at all times of not less than $500,000 for each mortgaged ship. |

| |

· |

A minimum loan (including any exposure under a related hedging agreement) to value ratio of 70% until May 2024, and thereafter 65%. |

| |

· |

Each borrower must maintain in its earnings account $150,000 in respect of each ship then subject to a mortgage. |

| |

· |

Globus Maritime Limited must maintain cash in an amount of not less than $150,000 for each ship that it owns that is not subject to a mortgage as part of the First-Citizens Bank and Trust Company Loan Facility. |

| |

· |

Globus Maritime Limited must have a maximum leverage ratio of 0.75:1.00. |

| |

· |

If Globus Maritime Limited pays a dividend, subject to certain exceptions, then the debt service coverage ratio (i.e., aggregate EBITDA of Globus Maritime Limited for any period to the debt service for such period) after such dividend and for the remain of the First-Citizen Loan Facility shall be at least 1.15:1.00. |

Each borrower must create

a reserve fund in the reserve account to meet the anticipated dry docking and special survey fees and expenses for the relevant ship owned

by it and (for certain ships) the installation of ballast water treatment system on the ship owned by it by maintaining in the reserve

account a minimum credit balance that may not be withdrawn (other than for the purpose of covering the documented and incurred costs and

expenses for the next special survey of that ship). Amounts must be paid into this reserve account quarterly, such that $1,200,000 is

set aside by each borrower for its ship’s special survey, except for Serena Maritime Limited and Salaminia Maritime Limited, each

of which is required to set aside quarterly payments that aggregate to $900,000, Argo Maritime Limited, which is required to set aside

quarterly payments that aggregate to $675,000, and Talisman Maritime Limited, which is required to set aside quarterly payments that aggregate

to $315,000.

No borrower shall incur

or permit to be outstanding any financial indebtedness except “Permitted Financial Indebtedness.”

“Permitted Financial

Indebtedness” means:

(a) any

financial indebtedness incurred under the finance documents;

(b) any

financial indebtedness (including permitted inter-company loans) that is subordinated to all financial indebtedness incurred under the

finance documents pursuant to a subordination agreement or, in the case of any permitted inter-company loans pursuant to the First-Citizen

Bank & Trust Company Loan Facility or otherwise and which is, in the case of any such financial indebtedness of a borrower (other

than financial indebtedness arising out of any permitted inter-company loan), the subject of subordinated debt security; and

(c) in

relation to a ship, any trade debt on arm's length commercial terms reasonably incurred in the ordinary course of owning, operating, trading,

chartering, maintaining and repairing that ship, which, (i) until 90 days from the relevant utilization date, does not exceed $500,000

(or the equivalent in any other currency) in aggregate in respect of that ship and remains unpaid; and (b) on and from the date falling

after 90 days from the relevant utilization date, is (x) up to $50,000 (or the equivalent in any other currency) in aggregate in

respect of that ship and does not remain unpaid for more than 90 days of (A) its due date or (B) in the case where the borrower

owning that ship has not received the relevant invoice, the date on which that borrower becomes aware that the invoice is due and remains

outstanding; and (y) is more than $50,000 and does not exceed $500,000 (or the equivalent in any other currency) in aggregate in

respect of that ship and does not remain unpaid for more than 30 days of (A) its due date or (B) in the case where the borrower

owning that ship has not received the relevant invoice, the date on which that borrower becomes aware that the invoice is due and remains

outstanding.

Globus Maritime Limited

is prohibited from making dividends (other than up to $1,000,000 annually on or in respect of its preferred shares) in cash or redeem

or repurchase its shares unless there is no event of default under the First-Citizens Bank & Trust Company Loan Facility, the

net loan (including any exposure under a related hedging agreement) to value ratio is less than 60% before the making of the dividend

and Globus Maritime Limited is in compliance with the debt service coverage ratio, and Globus Maritime Limited must prepay the First-Citizens

Bank & Trust Company Loan Facility in an equal amount of the dividend.

The First-Citizens Bank &

Trust Company Loan Facility also prohibits certain changes of control, including, among other things, the delisting of Globus from the

Nasdaq or another internationally recognized stock exchange, or the acquisition by any person or group of persons (acting in concert)

of a majority of the shareholder voting rights or the ability to appoint a majority of board members or to give directions with respect

to the operating and financial policies of Globus Maritime Limited with which the directors are obliged to comply, other than those persons

disclosed to First-Citizens Bank & Trust Company (formerly known as CIT Bank N.A.) on or around the date of the First-Citizen

Bank & Trust Company Loan Facility and their affiliates and immediate family members.

THIS

REPORT ON FORM 6-K (INCLUDING THE EXHIBIT HERETO) IS HEREBY INCORPORATED BY REFERENCE INTO THE COMPANY’S REGISTRATION

STATEMENTS: (A) ON FORM F-3 (FILE NO. 333-240042), FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON JULY

23, 2020 AND DECLARED EFFECTIVE AUGUST 6, 2020 (B) ON FORM F-3 (FILE NO. 333-239250), FILED WITH THE SECURITIES AND

EXCHANGE COMMISSION ON JULY 31, 2020 AND DECLARED EFFECTIVE AUGUST 6, 2020, AND (C) ON FORM F-3 (FILE NO. 333-273249),

FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON JULY 14, 2023 AND DECLARED EFFECTIVE ON JULY 26, 2023.

SIGNATURES

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

| |

GLOBUS MARITIME LIMITED |

| |

|

|

| |

By: |

/s/ Athanasios Feidakis |

| |

Name: |

Athanasios Feidakis |

| |

Title: |

President, Chief Executive Officer and Chief Financial Officer |

Date:

August 18, 2023

Exhibit 99.1

Globus

Maritime Limited Announces Amendment to Term Loan Facility and Signs Agreements to Sell Two Vessels

August

18, 2023 - Glyfada, Greece - Globus Maritime Limited (the “Company” or “Globus”) (NASDAQ: GLBS) announced

today that it has entered into, amended and restated a term loan facility with First Citizens Bank & Trust Company (formerly known

as CIT Bank N.A.) for an additional borrowing of $25 million, increasing the loan facility to $77.25 million. As part of the amendment,

the Diamond Globe and Power Globe, previously unencumbered ships, became part of the security package for this loan facility.

The interest rate on the loan facility was also lowered to Term SOFR together with an adjustment of 0.1% per annum, plus a margin of

2.70%.

In

addition, on August 11, 2023, the Company, through a wholly owned subsidiary, entered into a binding agreement to sell the 2009-built

m/v/ Sky Globe for a gross price of $10.7 million, before commissions and expenses, to an unaffiliated third party, which sale is subject

to standard closing conditions and requirements. The vessel is expected to be delivered to its new owner between September 1st,

2023 and September 30th, 2023.

Furthermore,

on August 16th, 2023, the Company, through a wholly owned subsidiary, entered into a binding agreement to sell the 2010-built

m/v/ Star Globe for a gross price of $11.2 million, before commissions and expenses, to an unaffiliated third party, which sale is subject

to standard closing conditions and requirements. The vessel is expected to be delivered to its new owner between September 1st,

2023 and September 30th, 2023.

About

Globus Maritime Limited

Globus

is an integrated dry bulk shipping company that provides marine transportation services worldwide and presently owns, operates and manages

a fleet of six dry bulk vessels that transport iron ore, coal, grain, steel products, cement, alumina and other dry bulk cargoes internationally.

Globus’ subsidiaries own and operate eight vessels (prior to the sale of the vessels m/v Sky Globe & m/v Star Globe) with a

total carrying capacity of 567,467 DWT and a weighted average age of 11.2 years as of June 30, 2023.

Safe

Harbor Statement

This

communication contains “forward-looking statements” as defined under U.S. federal securities laws. Forward-looking

statements provide the Company’s current expectations or forecasts of future events. Forward-looking statements include

statements about the Company’s expectations, beliefs, plans, objectives, intentions, assumptions and other statements that are

not historical facts or that are not present facts or conditions. Words or phrases such as “anticipate,”

“believe,” “continue,” “estimate,” “expect,” “intend,”

“may,” “ongoing,” “plan,” “potential,” “predict,” “project,”

“will” or similar words or phrases, or the negatives of those words or phrases, may identify forward-looking statements,

but the absence of these words does not necessarily mean that a statement is not forward-looking. Forward-looking statements are

subject to known and unknown risks and uncertainties and are based on potentially inaccurate assumptions that could cause actual

results to differ materially from those expected or implied by the forward-looking statements. The Company’s actual results

could differ materially from those anticipated in forward-looking statements for many reasons specifically as described in

the Company’s filings with the Securities and Exchange Commission. Accordingly, you should not unduly rely on these

forward-looking statements, which speak only as of the date of this communication. Globus undertakes no obligation to publicly

revise any forward-looking statement to reflect circumstances or events after the date of this communication or to reflect the

occurrence of unanticipated events. You should, however, review the factors and risks Globus describes in the reports it files from

time to time with the Securities and Exchange Commission.

For

further information please contact:

| Globus

Maritime Limited +30 210 960 8300 |

Capital

Link – New York +1 212 661 7566 |

| Athanasios

Feidakis, CEO |

Nicolas

Bornozis globus@capitallink.com |

| a.g.feidakis@globusmaritime.gr |

|

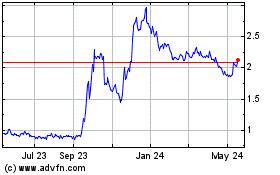

Globus Maritime (NASDAQ:GLBS)

Historical Stock Chart

From Jan 2025 to Feb 2025

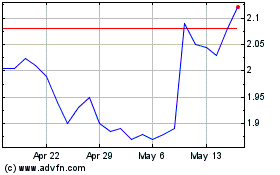

Globus Maritime (NASDAQ:GLBS)

Historical Stock Chart

From Feb 2024 to Feb 2025