GYRODYNE ANNOUNCES COMMENCEMENT OF RIGHTS OFFERING

February 06 2024 - 8:25AM

Gyrodyne, LLC (“Gyrodyne” or the “Company”) (NASDAQ: GYRO), an

owner and manager of a diversified portfolio of real estate

properties, today announced the commencement of the subscription

period of its rights offering.

As previously announced, the Company intends to raise up to $5

million in aggregate gross proceeds by way of a rights offering in

which its existing shareholders as of the record date of January

29, 2024 will be granted rights to purchase shares of the Company’s

common stock (the “Rights Offering”).

The Company filed a registration statement (File No. 333-276312)

(the “Registration Statement”) with respect to the proposed Rights

Offering with the Securities and Exchange Commission (the “SEC”) on

December 29, 2023. In the Rights Offering, the Company

will distribute to holders of Gyrodyne’s common shares

non-transferable subscription rights to purchase up to an aggregate

of 625,000 shares of common stock at a subscription price of $8.00

per share. Each right consists of a basic subscription privilege

and an oversubscription privilege. The rights under the basic

subscription privilege will be distributed in proportion to

shareholders’ holdings on the Record Date. Shareholders will

receive one subscription right for each five shares held. Each

whole subscription right gives the shareholders the opportunity to

purchase two of the Company’s common shares for $8.00 per share. If

a shareholder exercises his or her basic subscription right in

full, and other shareholders do not, such shareholder will be

entitled to an oversubscription privilege to purchase a portion of

the unsubscribed shares at the subscription price, subject to

proration and certain limitations.

The Company expects to use the net proceeds received from the

rights offering to complete the pursuit of entitlements on the

Company’s Flowerfield and Cortlandt Manor properties, for

litigation fees and expenses in the Article 78 proceeding against

the Company, for property purchase agreement negotiation and

enforcement, for necessary capital improvements in the Company’s

real estate portfolio, and for general working capital.

The subscription rights are exercisable until 5:00 p.m., New

York City time, on March 7, 2024. Gyrodyne may extend the rights

offering period for additional periods ending no later than April

6, 2024 or cancel the rights offering at any time for any

reason.

A registration statement relating to these securities was

declared effective by the Securities and Exchange Commission on

February 2, 2024.

About Gyrodyne

Gyrodyne, LLC owns and manages a diversified portfolio of real

estate properties comprising office, industrial and

service-oriented properties in the New York metropolitan area. The

Company owns a 63-acre site approximately 50 miles east of New York

City on the north shore of Long Island, which includes industrial

and office buildings and undeveloped property, and a medical office

park in Cortlandt Manor, New York, both of which are the subject of

plans to seek value-enhancing entitlements. The Company's common

shares are traded on the NASDAQ Capital Market under the symbol

GYRO. Additional information about the Company may be found on its

web site at www.gyrodyne.com.

Cautionary Statement Regarding Forward-Looking Statements

The statements made in this press release and other materials

the Company has filed or may file with the SEC, in each case that

are not historical facts, contain "forward-looking information"

within the meaning of the Private Securities Litigation Reform Act

of 1995, and Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934, both as amended, which

can be identified by the use of forward-looking terminology such as

"may," "will," "anticipates," "expects," "projects," "estimates,"

"believes," "seeks," "could," "should," or "continue," the negative

thereof, and other variations or comparable terminology as well as

statements regarding the evaluation of strategic alternatives and

liquidation contingencies. These forward-looking statements are

based on the current plans and expectations of management and are

subject to a number of risks and uncertainties that could cause

actual results to differ materially from those reflected in such

forward-looking statements. Such risks and uncertainties include,

but are not limited to, risks and uncertainties relating to our

efforts to enhance the values of our remaining properties and seek

the orderly, strategic sale of such properties as soon as

reasonably practicable, risks associated with the Article 78

proceeding against the Company and any other litigation that may

develop in connection with our efforts to enhance the value of and

sell our properties, ongoing community activism, risks associated

with proxy contests and other actions of activist shareholders,

risks related to the recent banking crisis and closure of two major

banks (including one with whom we indirectly have a mortgage loan),

regulatory enforcement, risks inherent in the real estate markets

of Suffolk and Westchester Counties in New York, the ability to

obtain additional capital in order to enhance the value of the

Flowerfield and Cortlandt Manor properties and negotiate sales

contracts and defend the Article 78 proceeding from a position of

strength, the continuing effects of the COVID-19 pandemic, the

ongoing risk of inflation, elevated interest rates, recession and

supply chain constraints or disruptions and other risks detailed

from time to time in the Company's SEC reports. These and other

matters the Company discusses in this press release may cause

actual results to differ from those the Company describes.

Additional Information and Where to Find It

The Company has filed the Registration Statement (including a

prospectus) with the SEC for the offering to which this press

release relates. Before you invest, you should read the prospectus

in that registration statement and other documents the Company has

filed with the SEC for more complete information about the Company

and this offering. You may get these documents for free by visiting

EDGAR on the SEC website at www.sec.gov.

No Offer or Solicitation

This press release shall not constitute an offer, nor a

solicitation of an offer, of the sale or purchase of securities,

nor shall any securities of the Company be offered or sold in any

jurisdiction in which such an offer, solicitation or sale would be

unlawful. It is an outline of matters for discussion only.

Neither the SEC nor any state securities commission has approved or

disapproved of the transactions contemplated hereby or determined

if this document is truthful or complete. Any representation to the

contrary is a criminal offense. In connection with the Rights

Offering transaction discussed herein, the Registration Statement

was filed with the SEC on December 29, 2023. Shareholders of

the Company are urged to read the Registration Statement and the

documents incorporated by reference therein before making any

investment decision with respect to the Rights Offering because

they will contain important information regarding the proposed

Rights Offering transaction. You should not construe the

contents of this press release as legal, tax, accounting or

investment advice or a recommendation. You should consult

your own counsel and tax and financial advisors as to legal and

related matters concerning the matters described herein.

Alternatively, you may obtain copies of the prospectus, by contacting Mackenzie Partners, Inc., the information agent for the offering, at:

Mackenzie Partners, Inc.

1407 Broadway, 27th Floor

New York, NY 10018

Call toll-free: (800) 322-2885

E-mail: proxy@mackenziepartners.com

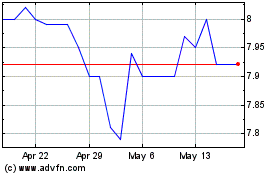

Gyrodyne (NASDAQ:GYRO)

Historical Stock Chart

From Oct 2024 to Nov 2024

Gyrodyne (NASDAQ:GYRO)

Historical Stock Chart

From Nov 2023 to Nov 2024