Hooker Furnishings Corporation (NASDAQ-GS: HOFT) (the “Company” or

“HFC”), a global leader in the design, production, and marketing of

home furnishings for 100 years, today reported its fiscal 2025

third quarter operating results for the period beginning July 29

and ending October 27, 2024.

Fiscal 2025 Third Quarter

Overview

- Results for the

third quarter were driven by continued macro-economic and

industry-wide headwinds which resulted in low demand and $7.5

million in charges ($4.4 million net of tax based on the effective

tax rate in the third quarter), including restructuring costs

related to the Company’s previously announced cost savings plan

($3.1 million of mostly severance), the bankruptcy of a significant

customer ($2.4 million of bad debt expense) and non-cash trade-name

impairment charges ($2.0 million related to Home Meridian (HMI)

segment trade names.) These factors led to an operating loss of

$7.3 million and a consolidated net loss of $4.1 million or ($0.39)

per diluted share for the third quarter.

- Consolidated net

sales were $104.4 million, a decrease of $12.5 million, or 10.7%,

compared to the same quarter of the previous year, primarily due to

ongoing macro-economic and related challenges in the home

furnishings industry, loss of sales due to a customer bankruptcy

and higher discounting to adjust inventory mix and levels.

- The Company is

starting to see improved efficiencies from the cost reductions and

expects to realize and exceed its goal of 10% or $10 million in

annualized cost savings in fiscal 2026.

- The restructuring

efforts at HMI in recent years are showing meaningful results and

continued progress as HMI reinforce the Company’s belief that the

segment is now on a sustainable path of profitability which will

gain momentum as demand normalizes in the industry. In the third

quarter, Home Meridian achieved a gross margin of 20.5%, its

highest level since the business was acquired in 2016.

- For the

nine-month period of fiscal 2025, consolidated net sales were

$293.0 million, a decrease of $43.4 million or 12.9% compared to

the same period of the previous year. This decrease was also due to

persistent low demand affecting the home furnishings industry, and

the absence of $11 million in liquidation sales from the

unprofitable ACH product line which the Company exited last year.

For the nine-month period, the Company reported a consolidated

operating loss of $15.4 million and a net loss of $10.2 million, or

($0.97) per diluted share, attributed to lower overall sales,

higher ocean freight costs at Hooker Branded, under-absorbed

indirect costs at Domestic Upholstery, as well as the $7.5

million in charges mentioned earlier.

Management Commentary

“Despite the charges recorded in Q3 and the

sustained macro-economic and furniture retail challenges, we’re

encouraged by the sequential quarterly improvement in our core

business profitability and by the progress of our cost reduction

efforts, which will be more fully realized beginning in the 4th

quarter,” said Jeremy Hoff, Chief Executive Officer at Hooker

Furnishings. “This progress is a reflection of our team’s focus on

managing our controllables and reducing non-strategic costs in a

very challenging environment, while investing in impactful

initiatives, including our recently announced global licensing

agreement with Margaritaville, all of which we expect will benefit

us when demand normalizes,” Hoff said.

“There are positive developments in the

macro-economic environment, such as cooling inflation and recent

interest rate cuts in September and November, which should begin to

increase demand for furnishings as lower mortgage rates boost the

housing market,” Hoff said.

“While early in our new merchandising strategy,

our October High Point Market introductions were positively

received with significant placements across the board at Hooker

Legacy and HMI,” Hoff said. “In addition, we had the best retail

placement market to date at outdoor furniture specialist Sunset

West.”

“Early customer feedback of three major

casegoods collections for Hooker Branded gave us the confidence to

place initial cuttings early before these groups were officially

introduced in October. As a result, the collections will ship this

month with a second cutting in January, increasing our

speed-to-market by six months,” Hoff said. “This puts us in a

strong position for the coming fiscal year on our available product

assortment.”

“In anticipation of increased demand and the

typically strong fall selling season, Hooker Branded’s inventories

increased nearly $11 million or 40% during the quarter compared to

the previous quarter-end,” Hoff said. In addition, “We are

aggressively producing our top collections to ensure we will be in

stock during the first quarter of fiscal 2026,” Hoff said, adding

that, “these inventories are high-quality assortments, centered on

our best-selling and most-profitable SKUs.”

Segment Reporting: Hooker

Branded

The Hooker Branded segment net sales decreased

by $4.2 million, or 10.7%, in the third quarter of fiscal 2025

versus the prior year period due primarily to lower average selling

prices. While the gross revenue in this segment decreased by 6.7%

compared to the previous year’s third quarter, discounts increased

by 390 bps, primarily due to higher discounting on excess

inventories to re-balance inventory mix and levels. Unit volume

decreased by a modest 2.1% compared to the prior year’s third

quarter but exceeded the first and second quarters of this fiscal

year.

For the quarter, the segment reported an

operating loss of $1.7 million, on historically low third quarter

net sales. The result included approximately $1.0 million in

severance charges related to the Company’s previously announced

cost reduction plan.

Incoming orders decreased by 13.3%

year-over-year. The quarter-end order backlog was 30% lower than at

the end of the prior year’s third quarter but remained 18% higher

than pre-pandemic levels at the end of the fiscal 2020 third

quarter.

For the nine-month period, net sales decreased

by $13.9 million, or 11.7%, also due to 5.9% lower average selling

prices resulting from the price reductions implemented in the

previous year in response to reduced ocean freight costs. Unit

volume was essentially flat, decreasing by about 1% compared to the

prior year nine-month period.

Segment Reporting: Home Meridian

(HMI)

The Home Meridian segment’s net sales decreased

by $5.1 million, or 11.8%, in the third quarter of fiscal 2025

versus the prior year period due to reduced unit volume. Over 40%

of the sales decrease was attributable to the loss of a major

customer following its bankruptcy. Sales through major furniture

chains and independent furniture stores decreased, though these

decreases were partially offset by an 8% increase in sales within

the hospitality business, marking two consecutive quarters of

higher revenues. Incoming orders increased by 8.1% compared to the

previous year’s third quarter, while decreasing modestly by 2.9%

for the nine-month period, despite the absence of orders from the

discontinued ACH product line and the loss of the same

customer. The quarter-end backlog was 32.2% higher than the prior

year’s third quarter end.

“Our strategic focus to support sustained

profitability through restructuring Home Meridian’s business is

yielding meaningful results, including significantly reduced

allowances, improved product margins, and lower fixed costs across

nearly all areas of this segment. We are encouraged that Home

Meridian achieved a gross margin of 20.5% in the fiscal 2025 third

quarter despite decreased net sales, its highest level since the

acquisition in 2016.”

For the quarter, the segment reported an

operating loss of $3.7 million, driven by a total of $4.6 million

in charges, including the $2.4 million in bad debt charges due to

the previously mentioned customer bankruptcy, $2.0 million in

non-cash intangible asset impairment charges, and $233,000 in

severance charges related to the Company’s previously announced

cost reduction plan.

For the nine-month period, net sales decreased

by $19 million, or 16.6%, largely due to the absence of $11 million

in ACH liquidation sales, which accounted for approximately 60% of

the sales decrease and 75% of the unit volume decrease. Sales

decreased in nearly all channels during the period, except for

hospitality business, which experienced a 23% increase.

Segment Reporting: Domestic

Upholstery

Domestic Upholstery segment net sales decreased

by $3.2 million, or 9.9%, compared to the prior year third quarter,

due to decreased sales at Shenandoah, Bradington-Young and HF

Custom, attributed to persistent low demand. This decrease was

partially offset by a 9.1% increase in sales at Sunset West, which

has delivered year-over-year quarterly sales growth for three

consecutive quarters this fiscal year. Gross profit decreased due

to lower net sales, but the gross margin remained stable. For the

quarter, the segment reported an operating loss of $281,000, a

sequential improvement versus $1.3 million in operating losses

recorded in each of the fiscal 2025 first and second quarters. The

current quarter’s operating loss included approximately $560,000 in

severance charges related to the Company’s previously announced

cost reduction plan.

Incoming orders decreased by 4.8% during the

quarter, and the quarter-end backlog was 29.9% lower than at the

end of the prior year’s third quarter. Excluding Sunset West, the

order backlog remained consistent with pre-pandemic levels at the

end of the fiscal 2020 third quarter.

For the nine-month period, net sales decreased

by $10.6 million, or 10.8%, also due to decreased sales at

Bradington-Young, Shenandoah, and HF Custom, partially offset by a

10.1% increase in Sunset West net sales.

Cash, Debt, and Inventory

Cash and cash equivalents were $20.4 million at

the end of the third quarter, a decrease of $22.7 million for the

year-end in January. Inventory levels increased by $4.7 million

from year-end, primarily driven by a $6.2 million increase in

Hooker Branded inventories.

During the nine-month period, we used cash and

cash equivalents on hand to fund $7.4 million in cash dividends to

our shareholders, $2.8 million for further development of our

cloud-based ERP system, and $2.7 million in capital expenditures.

In addition to our cash balance, we had an aggregate of $28.3

million available under our existing revolver at quarter-end to

fund working capital needs, as well as $29.0 million cash surrender

value of company-owned life insurance. “With strategic inventory

management, reasonable capital expenditures, and prudent expense

management, we believe we have sufficient financial resources to

support our business operations for the foreseeable future,” said

Paul A. Huckfeldt, Senior Vice President and Chief Financial

Officer.

Capital Allocation

“As Jeremy mentioned, we are aggressively

building inventory to support three new major casegoods collections

and our best-selling and most profitable SKUs to accelerate speed

to market and product availability for both the current and next

fiscal year,” said Huckfeldt. “The inventory build is also driven

by what is expected to be a longer than typical lunar new year

holiday in Vietnam, an expected longer post-holiday ramp up period

there driven by both the extended holiday and by lower production

demand in Vietnam, and a possible US port strike in January 2025,”

he said.

“We expect to finalize the refinancing of our

credit facility and plan to pay off our term debt in the

coming days. In addition, we announced the payment of our regular

quarterly dividend in December demonstrating our confidence in the

Company’s future success,” Huckfeldt continued.

Outlook

“Over the last few months, the key economic

indicators that impact furniture sales have been trending

positively,” said Hoff.

Namely:

-

Interest rates, which drive home mortgage rates, were cut by the

Federal Reserve in September and November.

-

Since summer, inflation has been cooling to levels closer to the

Federal Reserve’s 2% target: at 2.9% in July, 2.5% in August, 2.4%

in September and 2.6% in October.

-

In November, a leading real estate industry group stated its belief

that the worst of the housing inventory shortage is ending and

forecast an approximate 10% increase in home sales for 2025, with

mortgage rates stabilizing around 6%.

-

Consumer sentiment rose in November to 71.8, its highest level

since April, and the stock market continues near all-time

highs.

“While the macro-economic outlook is improving,

our team will continue to focus on the controllables and

improvements already underway at Hooker Furnishings,” Hoff said.

“Our balance sheet, financial condition and seasoned management

team should well equip us to navigate any remaining challenges as

we focus on maximizing efficiencies with the cost reductions while

simultaneously investing in expansion strategies that will position

us for revenue and profitability growth when demand fully returns,”

he said.

Conference Call Details

Hooker Furnishings will present its fiscal 2025

third quarter financial results via teleconference and live

internet webcast on Thursday morning, December 5th, 2024 at 9:00 AM

Eastern Time. A live webcast of the call will be available on the

Investor Relations page of the Company’s website at

https://investors.hookerfurnishings.com/events and archived for

replay. To access the call by phone, participants should go to this

link (registration link) and you will be provided with dial in

details. To avoid delays, participants are encouraged to dial into

the conference call fifteen minutes ahead of the scheduled start

time.

Hooker Furnishings Corporation, in its 100th

year of business, is a designer, marketer and importer of casegoods

(wooden and metal furniture), leather furniture, fabric-upholstered

furniture, lighting, accessories, and home décor for the

residential, hospitality and contract markets. The Company also

domestically manufactures premium residential custom leather and

custom fabric-upholstered furniture and outdoor furniture. Major

casegoods product categories include home entertainment, home

office, accent, dining, and bedroom furniture in the upper-medium

price points sold under the Hooker Furniture brand. Hooker’s

residential upholstered seating product lines include

Bradington-Young, a specialist in upscale motion and stationary

leather furniture, HF Custom (formerly Sam Moore), a specialist in

fashion forward custom upholstery offering a selection of chairs,

sofas, sectionals, recliners and a variety of accent upholstery

pieces, Hooker Upholstery, imported upholstered furniture targeted

at the upper-medium price-range and Shenandoah Furniture, an

upscale upholstered furniture company specializing in private label

sectionals, modulars, sofas, chairs, ottomans, benches, beds and

dining chairs in the upper-medium price points for lifestyle

specialty retailers. The H Contract product line supplies

upholstered seating and casegoods to upscale senior living

facilities. The Home Meridian division addresses more moderate

price points and channels of distribution not currently served by

other Hooker Furnishings divisions or brands. Home Meridian’s

brands include Pulaski Furniture, casegoods covering the complete

design spectrum in a wide range of bedroom, dining room, accent and

display cabinets at medium price points, Samuel Lawrence Furniture,

value-conscious offerings in bedroom, dining room, home office and

youth furnishings, Prime Resources International, value-conscious

imported leather upholstered furniture, and Samuel Lawrence

Hospitality, a designer and supplier of hotel furnishings. The

Sunset West division is a designer and manufacturer of comfortable,

stylish and high-quality outdoor furniture. Hooker Furnishings

Corporation’s corporate offices and upholstery manufacturing

facilities are located in Virginia, North Carolina and California,

with showrooms in High Point, N.C., Las Vegas, N.V., Atlanta, G.A.

and Ho Chi Minh City, Vietnam. The company operates distribution

centers in Virginia, Georgia, and Vietnam. Please visit our

websites hookerfurnishings.com, hookerfurniture.com,

bradington-young.com, hfcustomfurniture.com,

hcontractfurniture.com, homemeridian.com, pulaskifurniture.com,

slh-co.com, and sunsetwestusa.com.

Certain statements made in this release, other

than those based on historical facts, may be forward-looking

statements. Forward-looking statements reflect our reasonable

judgment with respect to future events and typically can be

identified by the use of forward-looking terminology such as

“believes,” “expects,” “projects,” “intends,” “plans,” “may,”

“will,” “should,” “would,” “could” or “anticipates,” or the

negative thereof, or other variations thereon, or comparable

terminology, or by discussions of strategy. Forward-looking

statements are subject to risks and uncertainties that could cause

actual results to differ materially from those in the

forward-looking statements. Those risks and uncertainties include

but are not limited to: (1) general economic or business

conditions, both domestically and internationally, including the

current macro-economic uncertainties and challenges to the retail

environment for home furnishings along with instability in the

financial and credit markets, in part due to inflation and high

interest rates, including their potential impact on (i) our sales

and operating costs and access to financing, (ii) customers, and

(iii) suppliers and their ability to obtain financing or generate

the cash necessary to conduct their respective businesses; (2) the

cyclical nature of the furniture industry, which is particularly

sensitive to changes in consumer confidence, the amount of

consumers’ income available for discretionary purchases, and the

availability and terms of consumer credit; (3) risks associated

with the ultimate outcome of our planned cost reduction plans,

including the amounts and timing of savings realized; (4) risks

associated with the outcome of the HMI segment restructuring which

we expect to complete in fiscal 2025, including whether we can

return the segment to consistent profitability; (5) risks

associated with our reliance on offshore sourcing and the cost of

imported goods, including fluctuation in the prices of purchased

finished goods, customs issues, freight costs, including the price

and availability of shipping containers, ocean vessels, domestic

trucking, and warehousing costs and the risk that a disruption in

our offshore suppliers or the transportation and handling

industries, including labor stoppages, strikes, or slowdowns, could

adversely affect our ability to timely fill customer orders; (6)

the impairment of our long-lived assets, which can result in

reduced earnings and net worth; (7) difficulties in forecasting

demand for our imported products and raw materials used in our

domestic operations; (8) adverse political acts or developments in,

or affecting, the international markets from which we import

products, including duties or tariffs imposed on those products by

foreign governments or the U.S. government; (9) our inability to

collect amounts owed to us or significant delays in collecting such

amounts; (10) the interruption, inadequacy, security breaches or

integration failure of our information systems or information

technology infrastructure, related service providers or the

internet or other related issues including unauthorized disclosures

of confidential information, hacking or other cyber-security

threats or inadequate levels of cyber-insurance or risks not

covered by cyber-insurance; (11) risks associated with domestic

manufacturing operations, including fluctuations in capacity

utilization and the prices and availability of key raw materials,

as well as changes in transportation, warehousing and domestic

labor costs, availability of skilled labor, and environmental

compliance and remediation costs; (12) disruptions and damage

(including those due to weather) affecting our Virginia or Georgia

warehouses, our Virginia, North Carolina or California

administrative facilities, our High Point, Las Vegas, and Atlanta

showrooms or our representative offices or warehouses in Vietnam

and China; (13) changes in U.S. and foreign government regulations

and in the political, social and economic climates of the countries

from which we source our products; (14) risks associated with

product defects, including higher than expected costs associated

with product quality and safety, regulatory compliance costs (such

as the costs associated with the US Consumer Product Safety

Commission’s new mandatory furniture tip-over standard, STURDY)

related to the sale of consumer products and costs related to

defective or non-compliant products, product liability claims and

costs to recall defective products and the adverse effects of

negative media coverage; (15) the risks specifically related to the

concentrations of a material part of our sales and accounts

receivable in only a few customers, including the loss of several

large customers through business consolidations, failures or other

reasons, or the loss of significant sales programs with major

customers; (16) the direct and indirect costs and time spent by our

associates associated with the implementation of our Enterprise

Resource Planning system (“ERP”), including costs resulting from

unanticipated disruptions to our business; (17) achieving and

managing growth and change, and the risks associated with new

business lines, acquisitions, including the selection of suitable

acquisition targets, restructurings, strategic alliances and

international operations; (18) risks associated with securing a

suitable credit facility, which may include restrictive covenants

that could limit our ability to pursue our business strategies;

(19) risks associated with distribution through third-party

retailers, such as non-binding dealership arrangements; (20) the

cost and difficulty of marketing and selling our products in

foreign markets; (21) changes in domestic and international

monetary policies and fluctuations in foreign currency exchange

rates affecting the price of our imported products and raw

materials; (22) price competition in the furniture industry; (23)

changes in consumer preferences, including increased demand for

lower-priced furniture. and (24) other risks and uncertainties

described under Part I, Item 1A. "Risk Factors" in the Company’s

Annual Report on Form 10-K for the fiscal year ended January 28,

2024. Any forward-looking statement that we make speaks only as of

the date of that statement, and we undertake no obligation, except

as required by law, to update any forward-looking statements

whether as a result of new information, future events or otherwise

and you should not expect us to do so.

|

Table I |

|

HOOKER FURNISHINGS CORPORATION AND

SUBSIDIARIES |

|

CONSOLIDATED STATEMENTS OF OPERATIONS |

|

(In thousands, except per share data) |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

For the |

|

|

|

Thirteen Weeks Ended |

|

Thirty-Nine Weeks Ended |

|

|

|

October 27, |

October 29, |

|

October 27, |

October 29, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

104,352 |

|

|

$ |

116,831 |

|

|

$ |

293,005 |

|

|

$ |

336,452 |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales |

|

|

80,327 |

|

|

|

83,121 |

|

|

|

228,687 |

|

|

|

251,495 |

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

|

24,025 |

|

|

|

33,710 |

|

|

|

64,318 |

|

|

|

84,957 |

|

|

|

|

|

|

|

|

|

|

|

|

Selling and administrative expenses |

|

|

28,416 |

|

|

|

24,016 |

|

|

|

75,030 |

|

|

|

70,207 |

|

|

Trade name impairment charges |

|

|

1,953 |

|

|

|

- |

|

|

|

1,953 |

|

|

|

- |

|

|

Intangible asset amortization |

|

|

916 |

|

|

|

924 |

|

|

|

2,765 |

|

|

|

2,732 |

|

|

|

|

|

|

|

|

|

|

|

|

Operating (loss) / income |

|

|

(7,260 |

) |

|

|

8,770 |

|

|

|

(15,430 |

) |

|

|

12,018 |

|

|

|

|

|

|

|

|

|

|

|

|

Other income, net |

|

|

612 |

|

|

|

659 |

|

|

|

2,575 |

|

|

|

1,071 |

|

|

Interest expense, net |

|

|

319 |

|

|

|

364 |

|

|

|

886 |

|

|

|

1,197 |

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) / Income before income taxes |

|

|

(6,967 |

) |

|

|

9,065 |

|

|

|

(13,741 |

) |

|

|

11,892 |

|

|

|

|

|

|

|

|

|

|

|

|

Income tax (benefit) / expense |

|

|

(2,836 |

) |

|

|

2,027 |

|

|

|

(3,567 |

) |

|

|

2,620 |

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) / income |

|

$ |

(4,131 |

) |

|

$ |

7,038 |

|

|

$ |

(10,174 |

) |

|

$ |

9,272 |

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) / Earnings per share |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.39 |

) |

|

$ |

0.66 |

|

|

$ |

(0.97 |

) |

|

$ |

0.85 |

|

|

Diluted |

|

$ |

(0.39 |

) |

|

$ |

0.65 |

|

|

$ |

(0.97 |

) |

|

$ |

0.85 |

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

|

10,541 |

|

|

|

10,536 |

|

|

|

10,519 |

|

|

|

10,748 |

|

|

Diluted |

|

|

10,541 |

|

|

|

10,676 |

|

|

|

10,519 |

|

|

|

10,878 |

|

|

|

|

|

|

|

|

|

|

|

|

Cash dividends declared per share |

|

$ |

0.23 |

|

|

$ |

0.22 |

|

|

$ |

0.69 |

|

|

$ |

0.66 |

|

|

|

|

|

|

|

|

|

|

|

|

Table II |

|

HOOKER FURNISHINGS CORPORATION AND

SUBSIDIARIES |

|

CONSOLIDATED STATEMENTS OF COMPREHENSIVE (LOSS) / INCOME |

|

(In thousands) |

|

(Unaudited) |

| |

|

|

|

|

|

|

|

|

| |

|

For the |

| |

|

Thirteen Weeks Ended |

|

Thirty-Nine Weeks Ended |

| |

|

October 27, |

|

October 29, |

|

October 27, |

October 29, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

|

|

|

|

|

|

|

|

Net (loss) / income |

|

$ |

(4,131 |

) |

|

$ |

7,038 |

|

|

$ |

(10,174 |

) |

|

$ |

9,272 |

|

|

Other comprehensive income: |

|

|

|

|

|

|

|

|

|

Actuarial adjustments |

|

|

(59 |

) |

|

|

(70 |

) |

|

|

(177 |

) |

|

|

(209 |

) |

|

Income tax effect on adjustments |

|

|

14 |

|

|

|

17 |

|

|

|

42 |

|

|

|

50 |

|

|

Adjustments to net periodic benefit cost |

|

|

(45 |

) |

|

|

(53 |

) |

|

|

(135 |

) |

|

|

(159 |

) |

| |

|

|

|

|

|

|

|

|

|

Total comprehensive (loss) / income |

|

$ |

(4,176 |

) |

|

$ |

6,985 |

|

|

$ |

(10,309 |

) |

|

$ |

9,113 |

|

| |

|

|

|

|

|

|

|

|

|

Table III |

|

HOOKER FURNISHINGS CORPORATION AND

SUBSIDIARIES |

|

CONSOLIDATED BALANCE SHEETS |

|

(In thousands) |

|

As of |

|

October 27, |

|

January 28, |

|

|

|

|

2024 |

|

|

|

2024 |

|

| |

|

(Unaudited) |

|

|

|

Assets |

|

|

|

|

|

Current assets |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

20,410 |

|

|

$ |

43,159 |

|

|

Trade accounts receivable, net |

|

|

51,773 |

|

|

|

51,280 |

|

|

Inventories |

|

|

66,493 |

|

|

|

61,815 |

|

|

Income tax recoverable |

|

|

3,005 |

|

|

|

3,014 |

|

|

Prepaid expenses and other current assets |

|

|

9,038 |

|

|

|

5,530 |

|

|

Total current assets |

|

|

150,719 |

|

|

|

164,798 |

|

|

Property, plant and equipment, net |

|

|

28,524 |

|

|

|

29,142 |

|

|

Cash surrender value of life insurance policies |

|

|

28,984 |

|

|

|

28,528 |

|

|

Deferred taxes |

|

|

15,575 |

|

|

|

12,005 |

|

|

Operating leases right-of-use assets |

|

|

47,435 |

|

|

|

50,801 |

|

|

Intangible assets, net |

|

|

23,904 |

|

|

|

28,622 |

|

|

Goodwill |

|

|

15,036 |

|

|

|

15,036 |

|

|

Other assets |

|

|

16,687 |

|

|

|

14,654 |

|

|

Total non-current assets |

|

|

176,145 |

|

|

|

178,788 |

|

|

Total assets |

|

$ |

326,864 |

|

|

$ |

343,586 |

|

|

|

|

|

|

|

|

Liabilities and Shareholders′ Equity |

|

|

|

|

|

Current liabilities |

|

|

|

|

|

Current portion of long-term debt |

|

$ |

21,946 |

|

|

$ |

1,393 |

|

|

Trade accounts payable |

|

|

23,240 |

|

|

|

16,470 |

|

|

Accrued salaries, wages and benefits |

|

|

6,937 |

|

|

|

7,400 |

|

|

Customer deposits |

|

|

5,799 |

|

|

|

5,920 |

|

|

Current portion of operating lease liabilities |

|

|

7,612 |

|

|

|

6,964 |

|

|

Other accrued expenses |

|

|

2,785 |

|

|

|

3,262 |

|

|

Total current liabilities |

|

|

68,319 |

|

|

|

41,409 |

|

|

Long term debt |

|

|

- |

|

|

|

21,481 |

|

|

Deferred compensation |

|

|

6,989 |

|

|

|

7,418 |

|

|

Operating lease liabilities |

|

|

42,785 |

|

|

|

46,414 |

|

|

Other long-term liabilities |

|

|

- |

|

|

|

889 |

|

|

Total long-term liabilities |

|

|

49,774 |

|

|

|

76,202 |

|

|

Total liabilities |

|

|

118,093 |

|

|

|

117,611 |

|

|

|

|

|

|

|

|

Shareholders′ equity |

|

|

|

|

|

Common stock, no par value, 20,000 shares

authorized, 10,710 and 10,672 shares issued and

outstanding on each date |

|

50,026 |

|

|

|

49,524 |

|

|

Retained earnings |

|

|

158,146 |

|

|

|

175,717 |

|

|

Accumulated other comprehensive income |

|

|

599 |

|

|

|

734 |

|

|

Total shareholders′ equity |

|

|

208,771 |

|

|

|

225,975 |

|

|

Total liabilities and shareholders′ equity |

|

$ |

326,864 |

|

|

$ |

343,586 |

|

|

|

|

|

|

|

| |

|

|

|

|

|

Table IV |

|

HOOKER FURNISHINGS CORPORATION AND

SUBSIDIARIES |

|

CONSOLIDATED STATEMENTS OF CASH FLOWS |

|

(In thousands) |

|

(Unaudited) |

|

|

|

For the |

|

|

|

Thirty-Nine Weeks Ended |

|

|

|

October 27, |

|

October 29, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

Operating Activities: |

|

|

|

|

|

Net (loss) / income |

|

$ |

(10,174 |

) |

|

$ |

9,272 |

|

|

Adjustments to reconcile net (loss) / income to net cash

(used in) / provided by operating activities: |

|

|

|

|

|

Depreciation and amortization |

|

|

6,930 |

|

|

|

6,626 |

|

|

Deferred income tax (benefit) / expense |

|

|

(3,532 |

) |

|

|

2,575 |

|

|

Trade name impairment |

|

|

1,953 |

|

|

|

- |

|

|

Noncash restricted stock and performance awards |

|

|

502 |

|

|

|

1,685 |

|

|

Provision for doubtful accounts and sales allowances |

|

|

272 |

|

|

|

(270 |

) |

|

Gain on life insurance policies |

|

|

(1,060 |

) |

|

|

(784 |

) |

|

(Gain) / loss on disposal of assets |

|

|

(2 |

) |

|

|

29 |

|

|

Changes in assets and liabilities: |

|

|

|

|

|

Trade accounts receivable |

|

|

(765 |

) |

|

|

3,334 |

|

|

Inventories |

|

|

(4,678 |

) |

|

|

33,264 |

|

|

Income tax recoverable |

|

|

9 |

|

|

|

5 |

|

|

Prepaid expenses and other assets |

|

|

(6,361 |

) |

|

|

(3,400 |

) |

|

Trade accounts payable |

|

|

6,757 |

|

|

|

7,169 |

|

|

Accrued salaries, wages, and benefits |

|

|

(463 |

) |

|

|

(2,574 |

) |

|

Customer deposits |

|

|

(122 |

) |

|

|

(3,477 |

) |

|

Operating lease assets and liabilities |

|

|

385 |

|

|

|

366 |

|

|

Other accrued expenses |

|

|

(1,384 |

) |

|

|

(4,400 |

) |

|

Deferred compensation |

|

|

(601 |

) |

|

|

(650 |

) |

|

Net cash (used in) / provided by operating activities |

|

$ |

(12,334 |

) |

|

$ |

48,770 |

|

|

|

|

|

|

|

|

Investing Activities: |

|

|

|

|

|

Purchases of property and equipment |

|

|

(2,656 |

) |

|

|

(5,718 |

) |

|

Premiums paid on life insurance policies |

|

|

(387 |

) |

|

|

(378 |

) |

|

Proceeds received on life insurance policies |

|

|

936 |

|

|

|

444 |

|

|

Proceeds from sales of assets |

|

|

3 |

|

|

|

- |

|

|

Acquisitions |

|

|

- |

|

|

|

(2,373 |

) |

|

Net cash used in investing activities |

|

$ |

(2,104 |

) |

|

$ |

(8,025 |

) |

|

|

|

|

|

|

|

Financing Activities: |

|

|

|

|

|

Purchase and retirement of common stock |

|

|

- |

|

|

|

(11,674 |

) |

|

Cash dividends paid |

|

|

(7,378 |

) |

|

|

(7,228 |

) |

|

Payments for long-term loans |

|

|

(933 |

) |

|

|

(1,050 |

) |

|

Net cash used in financing activities |

|

$ |

(8,311 |

) |

|

$ |

(19,952 |

) |

|

|

|

|

|

|

|

Net (decrease) / increase in cash and cash equivalents |

|

|

(22,749 |

) |

|

|

20,793 |

|

|

Cash and cash equivalents - beginning of year |

|

|

43,159 |

|

|

|

19,002 |

|

|

Cash and cash equivalents - end of quarter |

|

$ |

20,410 |

|

|

$ |

39,795 |

|

|

|

|

|

|

|

|

Supplemental disclosure of cash flow information: |

|

|

|

|

|

Cash paid for income taxes, net of refund |

|

$ |

82 |

|

|

$ |

74 |

|

|

Cash paid for interest, net |

|

|

970 |

|

|

|

1,375 |

|

|

|

|

|

|

|

|

Non-cash transactions: |

|

|

|

|

|

Increase / (decrease) in lease liabilities arising from changes in

right-of-use assets |

|

$ |

2,263 |

|

|

$ |

(8,987 |

) |

|

Increase in property and equipment through accrued purchases |

|

|

13 |

|

|

|

35 |

|

|

|

|

|

|

|

|

Table V |

|

HOOKER FURNISHINGS CORPORATION AND

SUBSIDIARIES |

|

NET SALES AND OPERATING (LOSS) / INCOME BY SEGMENT |

|

(In thousands) |

|

(Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Thirteen Weeks Ended |

|

Thirty-Nine Weeks Ended |

|

|

|

October 27, 2024 |

|

|

October 29, 2023 |

|

|

October 27, 2024 |

|

|

October 29, 2023 |

|

|

|

|

|

% Net |

|

|

% Net |

|

|

% Net |

|

|

% Net |

|

Net sales |

|

|

Sales |

|

|

Sales |

|

|

Sales |

|

|

Sales |

|

Hooker Branded |

|

$ |

34,940 |

|

33.5% |

|

$ |

39,122 |

|

33.5% |

|

$ |

105,049 |

|

35.9% |

|

$ |

118,936 |

|

35.4% |

|

Home Meridian |

|

|

38,553 |

|

36.9% |

|

|

43,692 |

|

37.4% |

|

|

95,493 |

|

32.6% |

|

|

114,524 |

|

34.0% |

|

Domestic Upholstery |

|

|

29,327 |

|

28.1% |

|

|

32,559 |

|

27.9% |

|

|

87,910 |

|

30.0% |

|

|

98,555 |

|

29.3% |

|

All Other |

|

|

1,532 |

|

1.5% |

|

|

1,458 |

|

1.2% |

|

|

4,553 |

|

1.6% |

|

|

4,437 |

|

1.3% |

|

Consolidated |

|

$ |

104,352 |

|

100% |

|

$ |

116,831 |

|

100% |

|

$ |

293,005 |

|

100% |

|

$ |

336,452 |

|

100% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating (loss) / income |

|

|

|

|

|

|

|

|

|

|

|

|

Hooker Branded |

|

$ |

(1,694 |

) |

-4.9% |

|

$ |

7,399 |

|

18.9% |

|

$ |

(2,094 |

) |

-2.0% |

|

$ |

14,014 |

|

11.8% |

|

Home Meridian |

|

|

(3,681 |

) |

-9.5% |

|

|

923 |

|

2.1% |

|

|

(7,850 |

) |

-8.2% |

|

|

(4,532 |

) |

-4.0% |

|

Domestic Upholstery |

|

|

(281 |

) |

-1.0% |

|

|

688 |

|

2.1% |

|

|

(2,875 |

) |

-3.3% |

|

|

2,739 |

|

2.8% |

|

All Other |

|

|

(1,604 |

) |

-104.7% |

|

|

(240 |

) |

-16.5% |

|

|

(2,611 |

) |

-57.4% |

|

|

(203 |

) |

-4.6% |

|

Consolidated |

|

$ |

(7,260 |

) |

-7.0% |

|

$ |

8,770 |

|

7.5% |

|

$ |

(15,430 |

) |

-5.3% |

|

$ |

12,018 |

|

3.6% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Table VI |

|

HOOKER FURNISHINGS CORPORATION AND

SUBSIDIARIES |

|

Order Backlog |

|

(In thousands) |

|

(Unaudited) |

| As of |

|

|

|

|

|

|

|

|

|

|

Reporting Segment |

October 27, 2024 |

|

January 28, 2024 |

|

October 29, 2023 |

|

|

November 3, 2019 |

| |

|

|

|

|

|

|

|

|

|

|

Hooker Branded |

|

$ |

13,049 |

|

|

$ |

15,416 |

|

|

$ |

18,646 |

|

|

|

$ |

11,058 |

|

|

Home Meridian |

|

|

36,506 |

|

|

|

36,013 |

|

|

|

27,611 |

|

|

|

|

103,467 |

|

|

Domestic Upholstery |

|

15,018 |

|

|

|

18,920 |

|

|

|

21,418 |

|

|

|

|

12,206 |

|

|

All Other |

|

|

1,194 |

|

|

|

1,475 |

|

|

|

1,760 |

|

|

|

|

2,250 |

|

| |

|

|

|

|

|

|

|

|

|

|

Consolidated |

|

$ |

65,767 |

|

|

$ |

71,824 |

|

|

$ |

69,435 |

|

|

|

$ |

128,981 |

|

| |

|

|

|

|

|

|

|

|

|

For more information, contact: Paul A. Huckfeldt, Senior Vice

President & Chief Financial Officer, Phone: (276) 666-3949

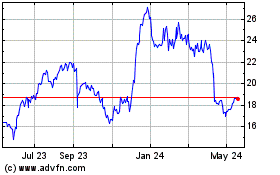

Hooker Furnishings (NASDAQ:HOFT)

Historical Stock Chart

From Jan 2025 to Feb 2025

Hooker Furnishings (NASDAQ:HOFT)

Historical Stock Chart

From Feb 2024 to Feb 2025