false

--12-31

0000855654

0000855654

2024-02-12

2024-02-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES

EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

February 12, 2024

ImmunoGen, Inc.†

(Exact name of registrant as specified in its

charter)

| Massachusetts |

0-17999 |

04-2726691 |

(State or other jurisdiction

of incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

830 Winter Street, Waltham, MA 02451

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including

area code: (781) 895-0600

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Trading Symbol |

Name

of Each Exchange on Which Registered |

| Common Stock, $.01 par value |

IMGN |

Nasdaq Global Select Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

† In connection with the completion of the transactions to which

this Current Report on Form 8-K relates, the registrant’s stock ceased trading on the Nasdaq Global Select Market.

Introductory Note.

As previously disclosed, on November 30, 2023, ImmunoGen, Inc.,

a Massachusetts corporation (the “Company” or “ImmunoGen”), entered into an Agreement and Plan of Merger (the

“Merger Agreement”) with AbbVie Inc., a Delaware corporation (“AbbVie”), Athene Subsidiary LLC, a Delaware limited

liability company and wholly owned subsidiary of AbbVie (“Intermediate Sub”), and Athene Merger Sub Inc., a Massachusetts

corporation and wholly owned subsidiary of Intermediate Sub (“Purchaser”). On February 12, 2024, Purchaser merged

with and into the Company (the “Merger”) on the terms and conditions set forth in the Merger Agreement, with the Company surviving

the Merger as a wholly owned subsidiary of Intermediate Sub (the “Surviving Corporation”).

Item 1.02 Termination of a Material Definitive

Agreement.

In connection with the consummation of the Merger, on February 12,

2024, ImmunoGen repaid in full the obligations then owed under the Loan Agreement (the “Loan Agreement”), dated as of

April 6, 2023, by and among the Company, as the borrower, certain subsidiaries of the Company party thereto from time to time, as

guarantors, BPCR Limited Partnership, as a lender, BioPharma Credit Investments V (Master) LP, as a lender, and BioPharma Credit PLC,

as collateral agent for the lenders, and upon the receipt of such payment by BPCR Limited Partnership and BioPharma Credit Investment

V (Master) LP, as applicable, all obligations under the Loan Agreement and related collateral documents, other than certain continuing

indemnity obligations and other obligations which, by the express terms of the Loan Agreement and related ancillary documents, survive

the termination of the Loan Agreement, were terminated and all security interests in the collateral securing the loans were released.

Item 2.01 Completion of Acquisition or Disposition

of Assets.

Pursuant to the Merger Agreement, at the effective time of the

Merger (the “Effective Time”), each share of common stock, par value $.01 per share, of the Company (“Company

Common Shares”) that was issued and outstanding immediately prior to the Effective Time (other than certain excluded Company

Common Shares as set forth in the Merger Agreement (such shares, the “Excluded Shares”)) was converted into the right to

receive an amount in cash equal to $31.26, without interest (the “Merger Consideration”).

Each

option to purchase Company Common Shares (a “Company Stock Option”), each restricted stock unit award in respect of Company

Common Shares and each deferred stock unit award measured by the value of Company Common Shares (or pursuant to which Company Common Shares

may be delivered) (collectively, “Company Equity Awards”), granted prior to the date of the Merger Agreement and that were

outstanding and unvested as of immediately prior to the Effective Time, vested in full upon the Effective Time. As of the Effective Time,

each Company Stock Option that was outstanding immediately prior to the Effective Time was cancelled and in exchange therefor the holder

became entitled to receive an amount in cash, without interest and less applicable tax withholdings, equal to (i) the total number

of Company Common Shares subject to such Company Stock Option immediately prior to the Effective Time, multiplied by (ii) the excess,

if any, of the Merger Consideration over the applicable exercise price per Company Common Share under such Company Stock Option. As of

the Effective Time, each Company Equity Award (other than a Company Stock Option), subject to certain exceptions with respect to restricted

stock unit awards granted after the date of the Merger Agreement, that was outstanding immediately prior to the Effective Time was cancelled

and in exchange therefor the holder became entitled to receive in cash, without interest and less applicable tax withholdings, an amount

equal to the product of (x) the total number of Company Common Shares subject to (or deliverable under) such Company Equity Award

immediately prior to the Effective Time multiplied by (y) the Merger Consideration. With respect to restricted stock unit

awards in respect of Company Common Shares granted on or after the date of the Merger Agreement, as of the Effective Time, each such award

will be exchanged for restricted stock units with respect to shares of AbbVie common stock (adjusted in accordance with the Merger

Agreement) and will continue to vest on its original vesting schedule and in accordance with the terms and conditions applicable prior

to the Effective Time.

The information set forth in the Introductory Note of this Current

Report on Form 8-K is incorporated herein by reference. The description of the Merger and the Merger Agreement contained in this

Item 2.01 does not purport to be complete and is subject to and qualified in its entirety by reference to the full text of the Merger

Agreement, which was included as Exhibit 2.1 to the Current Report on Form 8-K filed with the U.S. Securities and Exchange Commission

(the “SEC”) by the Company on November 30, 2023 and is incorporated herein by reference.

Item 3.01 Notice of Delisting or Failure to

Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

In connection with the consummation of the Merger, the Company notified

representatives of the Nasdaq Global Select Market (“Nasdaq”) that the Merger had been completed and requested that Nasdaq

delist the Company Common Shares. As a result, shares of Company Common Shares ceased to trade prior to market open on February 12,

2024, and became eligible for delisting from Nasdaq and termination of registration under the Securities Exchange Act of 1934, as amended

(the “Exchange Act”). The Company has requested that Nasdaq file with the SEC a Notification of Removal From Listing and Registration

on Form 25 to delist the Company Common Shares from Nasdaq under Section 12(b) of the Exchange Act on February 12,

2024. After the Form 25 becomes effective, the Surviving Corporation intends to file a Form 15 with the SEC to terminate the

registration of the Company Stock under Section 12(g) of the Exchange Act and suspend its reporting obligations with the SEC

under Sections 13 and 15(d) of the Exchange Act.

The disclosure set forth in the Introductory Note of this Current Report

on Form 8-K and the disclosure set forth in Item 2.01 of this Current Report on Form 8-K are incorporated herein by reference.

Item 3.03 Material Modification to Rights of

Security Holders.

In connection with the consummation of the Merger, at the Effective

Time, holders of shares of Company Common Shares (other than Excluded Shares) and Company Equity Awards ceased to have any rights in connection

with their holding of such securities (other than their right to receive (a) with respect to Company Common Shares, the Merger Consideration,

as described in Item 2.01, and (b) with respect to Company Equity Awards, the consideration described in Item 2.01).

The disclosure set forth in the Introductory Note of this Current Report

on Form 8-K and the disclosure set forth in Items 2.01, 3.01 and 5.03 of this Current Report on Form 8-K are incorporated herein

by reference.

Item 5.01 Changes in Control of Registrant.

As a result of the consummation of the Merger, a change in control

of the Company occurred, and the Company became a wholly owned subsidiary of Intermediate Sub. The total equity value of the transaction

was approximately $10.1 billion. AbbVie funded the Merger with a combination of cash on hand and debt.

The information set forth in the Introductory Note and the information set forth under Items 2.01, 3.03 and 5.02 of this Current Report

on Form 8-K is incorporated herein by reference.

Item 5.02 Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

In connection with the Merger, effective as of the Effective Time,

Stephen C. McCluski, Stuart A. Arbuckle, Mark J. Enyedy, Mark A. Goldberg, Tracey L. McCain, Dean J. Mitchell, Kristine Peterson, Helen

Thackray, and Richard J. Wallace ceased to be members of the Company’s board of directors (the “Board of Directors”)

or any committee thereof.

The disclosure set forth in the Introductory Note of this Current Report

on Form 8-K and the disclosure set forth in Item 2.01 of this Current Report on Form 8-K are incorporated herein by reference.

Item 5.03 Amendments to Articles of Incorporation

or Bylaws; Change in Fiscal Year.

Pursuant to the Merger Agreement, effective as of the Effective Time,

the amended and restated articles of organization of the Company and the amended and restated by-laws of the Company, each as in effect

immediately prior to the Effective Time were each amended and restated in their entirety, as set forth in Exhibits 3.1 and 3.2, respectively,

to this Current Report on Form 8-K, which are incorporated herein by reference.

The disclosure set forth in the Introductory Note of this Current Report

on Form 8-K and the disclosure set forth in Item 2.01 of this Current Report on Form 8-K are incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit

No. |

|

Description |

| 2.1† |

|

Agreement and Plan of Merger, dated as of November 30, 2023, among ImmunoGen, Inc., AbbVie Inc., Athene Subsidiary LLC, and Athene Merger Sub Inc. (incorporated by reference to Exhibit 2.1 to the Current Report on Form 8-K filed by ImmunoGen, Inc. with the Securities and Exchange Commission on November 30, 2023). |

| 3.1 |

|

Restated Articles of Organization of ImmunoGen, Inc. |

| 3.2 |

|

Amended and Restated By-Laws of ImmunoGen, Inc. |

| 104 |

|

Cover Page Interactive Data File, formatted in Inline XBRL. |

† Certain of the exhibits

and schedules to this exhibit have been omitted in accordance with Regulation S-K Item 601(b)(2). The Registrant agrees to furnish supplementally

a copy of all omitted exhibits and schedules to the SEC upon its request.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: February 12, 2024

| |

ImmunoGen, Inc. |

| |

|

| |

By: |

/s/ Daniel S. Char |

| |

Name: |

Daniel S. Char |

| |

Title: |

Senior Vice President, Chief Legal Officer |

Exhibit 3.1

| ____________________________________________________________________

FORM MUST BE TYPED FORM MUST BE TYPED

5IF$PNNPOXFBMUIPG.BTTBDIVTFUUT

William Francis Galvin

Secretary of the Commonwealth

One Ashburton Place, Boston, Massachusetts 02108-1512

P.C. c156ds1007950c11335 01/13/05

* Changes to Article VIII must be made by filing a statement of change of supplemental information form.

** Professional corporations governed by G.L. Chapter 156A and must specify the professional activities of the corporation.

D

PC

Restated Articles of Organization

(General Laws Chapter 156D, Section 10.07; 950 CMR 113.35)

(1) Exact name of corporation: ___________________________________________________________________________

(2)

(number, street, city or town, state, zip code)

(3) Date adopted: _____________________________________________________________________________________

(month, day, year)

(4) Approved by:

(check appropriate box)

® the directors without shareholder approval and shareholder approval was not required;

OR

® the board of directors and the shareholders in the manner required by G.L. Chapter 156D and the corporation’s articles

of organization.

(5) The following information is required to be included in the articles of organization pursuant to G.L. Chapter 156D, Section

2.02 except that the supplemental information provided for in Article VIII is not required:*

ARTICLE I

The exact name of the corporation is:

ARTICLE II

Unless the articles of organization otherwise provide, all corporations formed pursuant to G.L. Chapter 156D have the purpose of

engaging in any lawful business. Please specify if you want a more limited purpose:**

ImmunoGen, Inc.

Registered office address:

✔

ImmunoGen, Inc.

The purpose of the corporation is to engage in any lawful business for which a corporation may be

organized under Chapter 156D of the General Laws of Massachusetts.

CT Corporation System, 155 Federal Street, Suite 700, Boston, Massachusetts 02110 |

| ARTICLE III

State the total number of shares and par value, * if any, of each class of stock that the corporation is authorized to issue. All corpo-rations must authorize stock. If only one class or series is authorized, it is not necessary to specify any particular designation.

WITHOUT PAR VALUE WITH PAR VALUE

TYPE NUMBER OF SHARES TYPE NUMBER OF SHARES PAR VALUE

ARTICLE IV

Prior to the issuance of shares of any class or series, the articles of organization must set forth the preferences, limitations and rela-tive rights of that class or series. The articles may also limit the type or specify the minimum amount of consideration for which

shares of any class or series may be issued. Please set forth the preferences, limitations and relative rights of each class or series and,

if desired, the required type and minimum amount of consideration to be received.

ARTICLE V

The restrictions, if any, imposed by the articles or organization upon the transfer of shares of any class or

series of stock are:

ARTICLE VI

Other lawful provisions, and if there are no such provisions, this article may be left blank.

Note: The preceding six (6) articles are considered to be permanent and may be changed only by filing appropriate articles of amendment.

*G.L. Chapter 156D eliminates the concept of par value, however a corporation may specify par value in Article III. See G.L. Chapter 156D,

Section 6.21, and the comments relative thereto.

Common 100 $0.01

(a) Voting Rights. The holders of shares of common stock shall be entitled to one vote for each share so held

with respect to all matters to be voted on by shareholders of the corporation.

(b) Rights Upon Dissolution. Upon any voluntary or involuntary liquidation, dissolution or winding up of the affairs

of the corporation, the net assets of the corporation shall be distributed pro rata to the holders of the common

stock.

None.

See Article VI attached hereto and made a part hereof. |

| ARTICLE VII

The effective date of organization of the corporation is the date and time the articles were received for filing if the articles are not

rejected within the time prescribed by law. If a later effective date is desired, specify such date, which may not be later than the

90th day after the articles are received for filing:

It is hereby certified that these restated articles of organization consolidate all amendments into a single document. If a new

amendment authorizes an exchange, or effects a reclassification or cancellation, of issued shares, provisions for implementing that

action are set forth in these restated articles unless contained in the text of the amendment.

Specify the number(s) of the article(s) being amended: __________________________________________________________

Signed by: ___________________________________________________________________________________________ ,

(signature of authorized individual)

on this _________________________day of_________________________________________ , _____________________ .

II, III, IV, V, VI

® Chairman of the board of directors,

® President,

® Other officer,

® Court-appointed fiduciary,

twelfth February 2024

X

/s/ Emily Weith |

| Examiner

Name approval

C

M

COMMONWEALTH OF MASSACHUSETTS

William Francis Galvin

Secretary of the Commonwealth

One Ashburton Place, Boston, Massachusetts 02108-1512

Restated Articles of Organization

(General Laws Chapter 156D, Section 10.07; 950 CMR 113.35)

I hereby certify that upon examination of these restated articles of organiza-tion, duly submitted to me, it appears that the provisions of the General Laws

relative to the organization of corporations have been complied with, and

I hereby approve said articles; and the filing fee in the amount of $______

having been paid, said articles are deemed to have been filed with me this

_____________ day of _____________, 20______ , at _______a.m./p.m.

time

Effective date: _________________________________________________

(must be within 90 days of date submitted)

WILLIAM FRANCIS GALVIN

Secretary of the Commonwealth

Filing fee: Minimum filing fee $200, plus $100 per article amended, stock in-creases $100 per 100,000 shares, plus $100 for each additional 100,000 shares or

any fraction thereof.

TO BE FILLED IN BY CORPORATION

Contact Information:

Telephone: ____________________________________

Email: ______________________________________________________

Upon filing, a copy of this filing will be available at www.sec.state.ma.us/cor.

If the document is rejected, a copy of the rejection sheet and rejected document will

be available in the rejected queue.

CT Corporation System

155 Federal Street, Suite 700

Boston, Massachusetts 02110

(617) _______________ 757-6400

[Intentionally omitted] |

| ARTICLE VI

(a) The board of directors may make, amend or repeal the bylaws in whole or in part, except with respect to

any provision thereof which by law or the bylaws requires action by the shareholders.

(b) Notwithstanding anything in these articles of organization or the corporation’s bylaws to the contrary,

(i) shareholders may act without a meeting by unanimous written consent, and (ii) where written consents are

solicited by or at the direction of the board of directors, shareholders may act without a meeting if the action is taken

by shareholders having not less than the minimum number of votes necessary to take that action at a meeting at

which all shareholders entitled to vote on the action are present and voting. Any action by written consent must be a

proper subject for shareholder action by written consent.

(c) The board of directors may consist of one or more individuals, notwithstanding the number of

shareholders.

(d) To the maximum extent permitted by Chapter 156D of the Massachusetts General Laws, as the same

exists or may hereafter be amended, no director of the corporation shall be personally liable to the corporation for

monetary damages for breach of fiduciary duty as a director, notwithstanding any provision of law imposing such

liability. No amendment to or repeal of the provisions of this paragraph shall apply to or have any effect on the

liability or alleged liability of any director of the corporation for or with respect to any act or failure to act of such

director occurring prior to such amendment or repeal. |

Exhibit 3.2

IMMUNOGEN, INC.

AMENDED AND RESTATED

BYLAWS

AMENDED AND RESTATED BYLAWS

FOR THE REGULATION

OF

IMMUNOGEN, INC.

A MASSACHUSETTS CORPORATION

TABLE OF CONTENTS

Page

| ARTICLE I NAME,

OFFICES AND SEAL |

1 |

| |

|

| Section 1.1. | |

Name |

1 |

| Section 1.2. | |

Registered Office |

1 |

| Section 1.3. | |

Other Offices |

1 |

| Section 1.4. | |

Seal |

1 |

| | |

|

|

| ARTICLE II SHAREHOLDERS |

1 |

| |

|

| Section 2.1. | |

Place of a Meeting |

1 |

| Section 2.2. | |

Annual Meetings |

1 |

| Section 2.3. | |

Special Meetings |

1 |

| Section 2.4. | |

Notice of Meetings |

1 |

| Section 2.5. | |

Quorum |

2 |

| Section 2.6. | |

Voting |

2 |

| Section 2.7. | |

Actions without a Meeting |

2 |

| Section 2.8. | |

Record Date |

3 |

| Section 2.9. | |

Meetings by Remote Communication |

3 |

| Section 2.10. | |

Permissible Forms of Shareholder

Action |

3 |

| | |

|

|

| ARTICLE III DIRECTORS |

4 |

| |

|

| Section 3.1. | |

Powers of Directors |

4 |

| Section 3.2. | |

Number, Election and Term of

Directors |

4 |

| Section 3.3. | |

Vacancies |

4 |

| Section 3.4. | |

Removals |

4 |

| Section 3.5. | |

Meetings |

4 |

| Section 3.6. | |

Quorum; Voting |

4 |

| Section 3.7. | |

Informal Action |

5 |

| Section 3.8. | |

Committees |

5 |

| Section 3.9. | |

Fees and Compensation |

5 |

| Section 3.10. | |

Loans to Directors |

5 |

| | |

|

|

| ARTICLE IV OFFICERS |

5 |

| |

|

| Section 4.1. | |

Enumeration |

5 |

| Section 4.2. | |

Term and Compensation |

5 |

| Section 4.3. | |

Vacancies |

5 |

| Section 4.4. | |

Removals |

6 |

| Section 4.5. | |

President |

6 |

| Section 4.6. | |

Treasurer |

6 |

| Section 4.7. | |

Secretary |

6 |

| | |

|

|

| ARTICLE V INDEMNIFICATION |

6 |

| |

|

| Section 5.1. | |

Indemnification |

6 |

| ARTICLE VI STOCK |

7 |

| |

|

| Section 6.1. | |

Issuance of Stock |

7 |

| Section 6.2. | |

Stock Certificates |

7 |

| Section 6.3. | |

Transfer of Stock |

7 |

| Section 6.4. | |

Lost, Stolen, Destroyed, or

Mutilated Certificates |

7 |

| Section 6.5. | |

Regulations |

7 |

| Section 6.6. | |

Holders of Record |

7 |

| Section 6.7. | |

Restriction on Transfer |

7 |

| | |

|

|

| ARTICLE VII CORPORATE

RECORDS |

8 |

| |

|

| Section 7.1. | |

Records To Be Kept |

8 |

| Section 7.2. | |

Records in the Commonwealth |

8 |

| | |

|

|

| ARTICLE VIII MISCELLANEOUS |

8 |

| |

|

| Section 8.1. | |

Amendments |

8 |

| Section 8.2. | |

Emergency Bylaws |

8 |

| Section 8.3. | |

Fiscal Year |

8 |

AMENDED AND RESTATED BYLAWS

ARTICLE I

NAME, OFFICES AND SEAL

Section 1.1. Name. The

name of the corporation shall be ImmunoGen, Inc. (the “Corporation”).

Section 1.2. Registered

Office. The Corporation shall have a Registered Office in the Commonwealth of Massachusetts. The Directors may at any time and from

time to time change the location of the Registered Office of the Corporation in the Commonwealth.

Section 1.3. Other

Offices. The Corporation may also have a Principal Office and any other office or offices at such other location or locations, within

or without the Commonwealth of Massachusetts, as the Directors may from time to time designate.

Section 1.4. Seal.

If the Board of Directors elects to have an official seal of the Corporation, then such seal shall bear the Corporation’s name,

the year of its incorporation, and the word “Massachusetts,” and shall otherwise be in such form as the Directors may from

time to time determine.

ARTICLE II

SHAREHOLDERS

Section 2.1. Place

of a Meeting. All meetings of shareholders shall be held at a place specified in the notice of the meeting or solely by means of remote

communication in accordance with Section 2.9.

Section 2.2. Annual

Meetings. The annual meeting of the shareholders of the Corporation for the election of Directors and for the transaction of such

other business as properly may come before such meeting shall be held at such place, either within or without the Commonwealth of Massachusetts,

or, within the sole discretion of the Board of Directors, by remote communication, on such date and hour as may be fixed from time to

time by resolution of the Board of Directors and set forth in the notice or waiver of notice of the meeting. If no annual meeting is held,

then a special meeting in lieu of an annual meeting may be held on a date determined by the Board of Directors and any action taken at

such meeting shall have the same effect as though it were taken at an annual meeting.

Section 2.3. Special

Meetings. Special meetings of the shareholders may be called at any time by the President (or, in the event of his or her absence

or disability, by any Vice President), or by the Board of Directors. A special meeting shall be called by the President (or, in the event

of his or her absence or disability, by any Vice President), or by the Secretary, immediately upon receipt of a written request therefor

by shareholders holding in the aggregate not less than ten percent of the outstanding shares of the Corporation at the time entitled to

vote at any meeting of the shareholders. Special meetings of the shareholders shall be held at such places, within or without the Commonwealth

of Massachusetts, or, within the sole discretion of the Board of Directors, by remote communication, as shall be specified in the respective

notices or waivers of notice thereof.

Section 2.4. Notice

of Meetings. Except as otherwise permitted by law, written notice of the date, time and place of all meetings of shareholders

stating the purposes of the meeting shall be given by the Secretary or an Assistant Secretary (if any) or other authorized person to

each shareholder entitled to vote thereat. Notice may be electronic to the extent permitted by law, or may be given in person, by

telephone, by voicemail or by messenger, or by posting it, postage prepaid addressed to him or her at his or her address as it

appears in the records of the Corporation, or by any other means permitted by law, and in any case at least seven (7), but not more

than sixty (60) days before the meeting.

No notice of any meeting or

of the purposes thereof need be given to a shareholder if a written waiver of notice, executed before or after the meeting by such shareholder

or his or her attorney, is filed with records of the meeting.

Section 2.5. Quorum.

At a meeting of the shareholders, a majority of votes entitled to be cast on a matter shall constitute a quorum, except when a larger

quorum is required by law, by the Articles of Organization or by these Bylaws. If there is less than a quorum at a meeting, a majority

of the shares represented may vote to adjourn indefinitely, or may vote to adjourn from time to time and without giving further notice

of the adjournment other than the announcement at the meeting at which the vote for adjournment is taken; provided, however, that if a

new record date is set for the adjourned meeting, notice shall be given to anyone holding shares as of the new record date to the extent

required by law. Any business may be transacted at such adjourned meeting that might have been transacted at the meeting originally called.

Section 2.6. Voting.

Unless the Articles of Organization provide otherwise, each shareholder is entitled to one vote for each share held by such shareholder,

regardless of class, on each matter voted on at a shareholders’ meeting. A shareholder may vote his or her shares in person or may

appoint a proxy to vote or otherwise act for him or her by signing an appointment form, either personally or by his or her attorney-in-fact.

An appointment of a proxy is effective when received by the Secretary or other officer or agent authorized to tabulate votes. Unless otherwise

provided in the appointment form, an appointment is valid for a period of 11 months from the date the shareholder signed the form or,

if it is undated, from the date of its receipt by the officer or agent. An appointment of a proxy is revocable by the shareholder unless

the appointment form conspicuously states that it is irrevocable and the appointment is coupled with an interest, as defined in the Massachusetts

Business Corporation Act (the “Act”). Subject to the provisions of Section 7.24 of the Act and to any express

limitation on the proxy’s authority appearing on the face of the appointment form, the Corporation is entitled to accept the proxy’s

vote or other action as that of the shareholder making the appointment.

Section 2.7. Actions

without a Meeting.

(a) Action

to be taken at an annual or special shareholders’ meeting may be taken without a meeting if the action is taken either: (1) by

all shareholders entitled to vote on the action; or (2) to the extent permitted by the Articles of Organization, by shareholders

having not less than the minimum number of votes necessary to take the action at a meeting at which all shareholders entitled to vote

on the action are present and voting. The action shall be evidenced by one or more written consents that describe the action taken, are

signed by shareholders having the requisite votes, bear the date of the signatures of such shareholders, and are delivered to the Corporation

for inclusion with the records of meetings within 60 days of the earliest dated consent delivered to the Corporation as required by this

Section 2.7. A consent signed under this Section has the effect of a vote at a meeting.

(b) If

action is to be taken pursuant to the consent of voting shareholders without a meeting, the Corporation, at least seven days before the

action authorized by such consent is taken, shall give notice, which complies in form with the requirements of Section 2.4,

of the action (1) to nonvoting shareholders in any case where such notice would be required by law if the action were taken at a

meeting, and (2) if the action is to be taken pursuant to the consent of less than all the shareholders entitled to vote on the matter,

to all shareholders entitled to vote who did not consent to the action. The notice shall contain, or be accompanied by, the same material

that would have been required by law to be sent to shareholders in or with the notice of a meeting at which the action would have been

submitted to the shareholders for approval.

Section 2.8. Record

Date. The Directors may fix the record date in order to determine the shareholders entitled to notice of a shareholders’ meeting,

to demand a special meeting, to vote, or to take any other action. If a record date for a specific action is not fixed by the Board of

Directors, and is not supplied by law, the record date shall be the close of business either on the day before the first notice is sent

to shareholders, or, if no notice is sent, on the day before the meeting or, in the case of action without a meeting by written consent,

the date the first shareholder signs the consent. A record date fixed under this Section may not be more than 70 days before the

meeting or action requiring a determination of shareholders. A determination of shareholders entitled to notice of or to vote at a shareholders’

meeting is effective for any adjournment of the meeting unless the Board of Directors fixes a new record date, which it shall do if the

meeting is adjourned to a date more than 120 days after the date fixed for the original meeting.

Section 2.9. Meetings

by Remote Communication. Unless otherwise provided in the Articles of Organization, if authorized by the Directors: any annual or

special meeting of shareholders need not be held at any place but may instead be held solely by means of remote communication. Subject

to such guidelines and procedures as the Board of Directors may adopt, shareholders and proxyholders not physically present at a meeting

of shareholders may, by means of remote communications: (a) participate in a meeting of shareholders; and (b) be deemed present

in person and vote at a meeting of shareholders whether such meeting is to be held at a designated place or solely by means of remote

communication, provided that: (i) the Corporation shall implement reasonable measures to verify that each person deemed present and

permitted to vote at the meeting by means of remote communication is a shareholder or proxyholder; (ii) the Corporation shall implement

reasonable measures to provide such shareholders and proxyholders a reasonable opportunity to participate in the meeting and to vote on

matters submitted to the shareholders, including an opportunity to read or hear the proceedings of the meeting substantially concurrently

with such proceedings; and (iii) if any shareholder or proxyholder votes or takes other action at the meeting by means of remote

communication, a record of such vote or other action shall be maintained by the Corporation.

Section 2.10. Permissible

Forms of Shareholder Action.

(a) Any

vote, consent, waiver, proxy appointment or other action by a shareholder or by the proxy or other agent of any shareholder shall be considered

given in writing, dated and signed, if, in lieu of any other means permitted by law, it consists of an electronic transmission that sets

forth or is delivered with information from which the Corporation can determine (i) that the electronic transmission was transmitted

by the shareholder, proxy or agent or by a person authorized to act for the shareholder, proxy or agent; and (ii) the date on which

such shareholder, proxy, agent or authorized person transmitted the electronic transmission. The date on which the electronic transmission

is transmitted shall be considered to be the date on which it was signed. The electronic transmission shall be considered received by

the Corporation if it has been sent to any address specified by the Corporation for the purpose or, if no address has been specified,

to the principal office of the Corporation, addressed to the Secretary or other officer or agent having custody of the records of proceedings

of shareholders.

(b) Any

copy, facsimile or other reliable reproduction of a vote, consent, waiver, proxy appointment or other action by a shareholder or by the

proxy or other agent of any shareholder may be substituted or used in lieu of the original writing for any purpose for which the original

writing could be used, but the copy, facsimile or other reproduction shall be a complete reproduction of the entire original writing.

ARTICLE III

DIRECTORS

Section 3.1. Powers

of Directors. The business and affairs of the Corporation shall be managed by or under the direction of the Board of Directors, which

shall exercise all powers that may be exercised or performed by the Corporation subject to any limitations set forth by statute, the Articles

of Organization or these Bylaws.

Section 3.2. Number,

Election and Term of Directors. The authorized number of Directors of the Corporation shall be two; provided, however, that the Board

of Directors shall have the authority to increase or decrease the number of the Directors of the Corporation (but not to fewer than the

number of Directors then in office); provided, further, that the number of Directors shall be fixed at not less than two whenever the

Corporation shall have only two shareholders and not less than one whenever the Corporation shall have only one shareholder. Director(s) need

not be shareholders unless so required by the Articles of Organization. The Director(s) shall be elected by the shareholders at the

annual meeting or any special meeting called for such purpose. If for any cause, the Director(s) shall not have been elected at an

annual meeting, they may be elected as soon thereafter as convenient. Each Director shall hold office until his or her successor shall

be duly elected and qualified or until his or her earlier resignation or removal. A Director may resign at any time upon written notice

to the Board of Directors, its chairperson or the Corporation.

Section 3.3. Vacancies.

If a vacancy occurs on the Board of Directors, including a vacancy resulting from an increase in the number of Directors: (a) the

shareholders may fill the vacancy; (b) the Board of Directors may fill the vacancy; or (c) if the Directors remaining in office

constitute fewer than a quorum of the Board, they may fill the vacancy by the affirmative vote of a majority of all the Directors remaining

in office. A vacancy that will occur at a specific later date may be filled before the vacancy occurs, but the new Director may not take

office until the vacancy occurs.

Section 3.4. Removals.

A Director (including persons elected by Directors to fill vacancies in the Board of Directors) may be removed from office (a) with

or without cause by the vote of the holders of a majority of the shares issued and outstanding and entitled to vote in the election of

such Director or (b) with cause by the vote of a majority of the Directors then in office.

Section 3.5. Meetings.

Meetings of the Board of Directors shall be held at such place within or outside the Commonwealth of Massachusetts as may from time to

time be fixed by vote of the Board of Directors, or as may be specified in the notice of the meeting. A regular meeting of the Board of

Directors shall be held immediately following the annual meeting of the shareholders, and other regular meetings shall be held at such

times and places as may from time to time be fixed by vote of the Board of Directors. Special meetings of the Board of Directors may be

held at any time upon the call of the President by any form of notice permitted by the Act duly served on or sent or mailed to each Director

not less than two days before such meeting. No notice of any regular meeting of the Board of Directors shall be required. Notice of a

special meeting need not be given to any Director if a written waiver of notice, executed by him or her before or after the meeting, is

filed with the records of the meeting, or to any Director who attends the meeting without protesting, prior thereto or at its commencement,

the lack of notice to him or her.

Section 3.6. Quorum;

Voting. Except as otherwise provided by law, the Articles of Organization or these Bylaws, a majority of the total number of Directors

shall constitute a quorum for the transaction of business, and the vote of a majority of the Directors present at any meeting at which

a quorum is present shall be the act of the Board of Directors. A Director may be removed for cause only after reasonable notice and opportunity

to be heard before the body proposing removal.

Section 3.7. Informal

Action. Any action required or permitted to be taken at any meeting of the Board of Directors, or of any committee thereof, may be

taken without a meeting if all members of the Board or committee, as the case may be, consent thereto in writing, and the writing or writings

are filed with the minutes of proceedings of the Board or committee.

Section 3.8. Committees.

The Board of Directors may create one or more committees and appoint members of the Board of Directors to serve on them. Each committee

may have one or more members, who serve at the pleasure of the Board of Directors. The creation of a committee and appointment of members

to it must be approved by a majority of all the Directors in office when the action is taken. Section 3.5 through Section 3.7

shall apply to committees and their members. To the extent specified by the Board of Directors, each committee may exercise the authority

of the Board of Directors. A committee may not, however: (a) authorize distributions; (b) approve or propose to shareholders

actions that the Act requires be approved by shareholders; (c) change the number of the Board of Directors, remove Directors from

office or fill vacancies on the Board of Directors; (d) amend the Articles of Organization; (e) adopt, amend or repeal Bylaws;

or (f) authorize or approve reacquisition of shares, except according to a formula or method prescribed by the Board of Directors.

The creation of, delegation of authority to, or action by a committee does not alone constitute compliance by a Director with the applicable

standards of conduct prescribed by the Articles of Organization, these Bylaws, or otherwise by law.

Section 3.9. Fees

and Compensation. Directors and members of committees may receive compensation for their services and reimbursements for expenses,

as may be fixed or determined by resolution of the Board of Directors.

Section 3.10. Loans

to Directors. The Corporation may not lend money to, or guarantee the obligation of a Director of, the Corporation unless: (a) the

specific loan or guarantee is approved by a majority of the votes represented by the outstanding voting shares of all classes, voting

as a single voting group, except the votes of shares owned by or voted under the control of the benefited Director; or (b) the Corporation’s

Board of Directors determines that the loan or guarantee benefits the Corporation and either approves the specific loan or guarantee or

a general plan authorizing loans and guarantees. The fact that a loan or guarantee is made in violation of this Section shall not

affect the borrower’s liability on the loan.

ARTICLE IV

OFFICERS

Section 4.1. Enumeration.

The officers of the Corporation shall be elected by the Board of Directors and shall consist of a President, a Treasurer, a Secretary,

and such other officers (if any), including Vice-Presidents and Assistant Treasurers and Assistant Secretaries, as the Board of Directors

shall from time to time elect. The Board of Directors may at any time elect one of its members as Chairman of the Board of the Corporation,

who shall preside at meetings of the Board of Directors and shall have such powers and perform such duties as shall from time to time

be prescribed by the Board of Directors. Any two or more offices may be held by the same person.

Section 4.2. Term

and Compensation. Officers shall be elected by the Board of Directors from time to time, to serve at the pleasure of the Board. Each

officer shall hold office until his or her successor is elected and qualified, or until his or her earlier resignation or removal. An

officer may resign at any time by delivering notice to the Corporation. The compensation of all officers shall be fixed by, or pursuant

to authority delegated by, the Board of Directors from time to time.

Section 4.3. Vacancies.

A vacancy in any office because of death, resignation, removal, disqualification, or any other cause shall be filled in the manner prescribed

in these Bylaws for regular appointment to that office.

Section 4.4. Removals.

The Directors may remove any officer elected by them with or without cause by the vote of a majority of the Directors then in office.

An officer may be removed for cause only after reasonable notice and opportunity to be heard before the body proposing removal.

Section 4.5. President.

The President when present shall preside at all meetings of the shareholders and, if there is no Chairman of the Board of Directors, of

the Directors. He or she shall be the chief executive officer of the Corporation except as the Board of Directors may otherwise provide.

The President shall perform such duties and have such powers additional to the foregoing as the Directors shall designate.

Section 4.6. Treasurer.

The Treasurer shall, subject to the direction of the Directors, have general charge of the financial affairs of the Corporation and shall

cause to be kept accurate books of accounts. He or she shall have custody of all funds, securities, and valuable documents of the Corporation,

except as the Directors may otherwise provide. The Treasurer shall perform such duties and have such powers additional to the foregoing

as the Directors may designate.

Section 4.7. Secretary.

The Secretary shall have responsibility for preparing minutes of the Directors’ and shareholders’ meetings and for authenticating

records of the Corporation. The Secretary shall perform such duties and have such powers additional to the foregoing as the Directors

shall designate.

ARTICLE V

INDEMNIFICATION

Section 5.1. Indemnification.

The Corporation shall indemnify and hold harmless each person, now or hereafter an executive officer (within the meaning of the

Securities Exchange Act of 1934, as amended) or Director of the Corporation, from and against any and all claims and liabilities to

which he or she may be or become subject by reason of his or her being or having been an executive officer or Director of the

Corporation or by reason of his or her alleged acts or omissions as an executive officer or Director of the Corporation, and shall

indemnify and reimburse each such executive officer and Director against and for any and all legal and other expenses reasonably

incurred by him or her in connection with any such claim and liabilities, actual or threatened, whenever arising, including, without

limitation, after he or she has ceased to be an executive officer or Director of the Corporation, except with respect to any matter

as to which such executive officer or Director of the Corporation shall have not acted in good faith and in the reasonable belief

that his or her action was in the best interest of the Corporation; provided, however, that prior to such determination, the

Corporation may compromise and settle any such claims and liabilities and pay such expenses. Such indemnification shall include

payment by the Corporation of expenses incurred in defending a civil or criminal action or proceeding in advance of the final

disposition of such action or proceeding, upon receipt of an undertaking by the person indemnified to repay such payment if he or

she shall be adjudicated not to be entitled to indemnification under this section. The Corporation shall similarly indemnify and

hold harmless persons who serve at its express written request as directors or executive officers of another organization in which

the Corporation owns shares or of which it is a creditor, if such entity fails, pursuant to an indemnity or advancement obligation

or insurance, to cover such costs and expenses; notwithstanding the foregoing, if such person may be entitled to be indemnified by

such other organization or is insured by an insurer providing insurance coverage under an insurance policy issued to such other

organization for any liabilities, expenses or other losses as to which such person also would be entitled to be indemnified by the

Corporation pursuant to the foregoing provisions of this Article V then it is intended, as between the Corporation and

such other organization and/or its insurer, that such other organization and its insurer will be the full indemnitor or insurer of

first resort for any such liabilities, expenses or other losses, and that only thereafter may the Corporation be required to pay

indemnification or advancement of any such liabilities, expenses, or other losses. The right of indemnification herein provided

shall be in addition to and not exclusive of any other rights to which any executive officer or Director of the Corporation, or any

such persons who serve at its request as aforesaid, may otherwise be lawfully entitled. As used in this Article V, the

terms “executive officer” and “Director” include their respective heirs, executors and administrators.

ARTICLE VI

STOCK

Section 6.1. Issuance

of Stock. Shares of capital stock of any class now or hereafter authorized, securities convertible into or exchangeable for such stock,

or options or other rights to purchase such stock or securities may be issued or granted in accordance with authority granted by resolution

of the Board of Directors.

Section 6.2. Stock

Certificates. Shares of the capital stock of the Corporation need not be represented by certificates but may be recorded in book entry

form. If certificates for shares of capital stock of the Corporation are issued, such certificates shall be in the form adopted by the

Board of Directors, shall be signed, either manually or by facsimile, by the President or a Vice President (if any) and by the Secretary

or Treasurer, or by any two officers designated by the Board of Directors, and shall bear the Corporation’s seal (if there is one)

or its facsimile. All such certificates shall be numbered consecutively, and the name of the person owning the shares represented thereby,

with the number of such shares and the date of issue, shall be entered on the books of the Corporation.

Section 6.3. Transfer

of Stock. Shares of capital stock of the Corporation shall be transferred only on the books of the Corporation, by the holder of record

in person or by the holder’s duly authorized representative, upon surrender to the Corporation of the certificate for such shares

duly endorsed for transfer, together with such other documents (if any) as may be required to effect such transfer.

Section 6.4. Lost,

Stolen, Destroyed, or Mutilated Certificates. New stock certificates may be issued to replace certificates alleged to have been lost,

stolen, destroyed, or mutilated, upon such terms and conditions, including proof of loss or destruction, and the giving of a satisfactory

bond of indemnity, as the Board of Directors from time to time may determine pursuant to Massachusetts law.

Section 6.5. Regulations.

The Board of Directors shall have power and authority to make all such rules and regulations not inconsistent with these Bylaws,

the Articles of Organization or Massachusetts’ law as it may deem expedient concerning the issue, transfer, and registration of

shares of capital stock of the Corporation.

Section 6.6. Holders

of Record. The Corporation shall be entitled to treat as the shareholder the person in whose name shares are registered in the records

of the Corporation or, if the Board of Directors has established a procedure by which the beneficial owner of shares that are registered

in the name of a nominee will be recognized by the Corporation as a shareholder, the beneficial owner of shares to the extent of the rights

granted by a nominee certificate on file with the Corporation.

Section 6.7. Restriction

on Transfer. A restriction on the hypothecation, transfer or registration of transfer of shares of the Corporation may be imposed

by the Articles of Organization, these Bylaws or by an agreement among any number of shareholders or such holders and the Corporation.

No restriction so imposed shall be binding with respect to those securities issued prior to the adoption of the restriction unless the

holders of such securities are parties to an agreement or voted in favor of the restriction. Restrictions shall be noted on the front

or back of share certificates.

ARTICLE VII

CORPORATE RECORDS

Section 7.1. Records

To Be Kept. The Corporation shall keep as permanent records minutes of all meetings of its shareholders and Board of Directors, a

record of all actions taken by the shareholders or Board of Directors without a meeting, and a record of all actions taken by a committee

of the Board of Directors in place of the Board of Directors on behalf of the Corporation. The Corporation shall maintain appropriate

accounting records. The Corporation or its agent shall maintain a record of its shareholders, in a form that permits preparation of a

list of the names and addresses of all shareholders, in alphabetical order by class of shares showing the number and class of shares held

by each. The Corporation shall maintain its records in written form or in another form capable of conversion into written form within

a reasonable time.

Section 7.2. Records

in the Commonwealth. The Corporation shall keep within The Commonwealth of Massachusetts a copy of the following records at its principal

office or an office of its transfer agent or of its Secretary or Assistant Secretary (if any) or of its registered agent:

(a) its

Articles or Restated Articles of Organization and all amendments to them currently in effect;

(b) its Bylaws or restated Bylaws and all amendments to them currently in effect;

(c) resolutions

adopted by its Board of Directors creating one or more classes or series of shares, and fixing their relative rights, preferences, and

limitations, if shares issued pursuant to those resolutions are outstanding;

(d) the

minutes of all shareholders’ meetings, and records of all action taken by shareholders without a meeting, for the past three years;

(e) all

written communications to shareholders generally within the past three years, including the financial statements furnished under Section 16.20

of the Act for the past three years;

(f) a list of the names and business addresses of its current Directors and officers; and

(g) its most recent annual report delivered to the Massachusetts Secretary of State.

ARTICLE VIII

MISCELLANEOUS

Section 8.1. Amendments.

(a) The

power to make, amend or repeal these Bylaws shall be in the shareholders. If authorized by the Articles of Organization, the Board of

Directors may also make, amend or repeal these Bylaws in whole or in part, except with respect to any provision thereof which by virtue

of an express provision in the Act, the Articles of Organization, or these Bylaws, requires action by the shareholders.

(b) Not

later than the time of giving notice of the meeting of shareholders next following the making, amending or repealing by the Board of Directors

of any By-Law, notice stating the substance of the action taken by the Board of Directors shall be given to all shareholders entitled

to vote on amending the Bylaws. Any action taken by the Board of Directors with respect to the Bylaws may be amended or repealed by the

shareholders.

Section 8.2. Emergency

Bylaws. The Board of Directors may adopt emergency bylaws, as permitted by the Act.

Section 8.3. Fiscal

Year. The fiscal year end of the Corporation shall be December 31st of each year.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

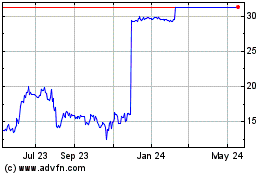

ImmunoGen (NASDAQ:IMGN)

Historical Stock Chart

From Feb 2025 to Mar 2025

ImmunoGen (NASDAQ:IMGN)

Historical Stock Chart

From Mar 2024 to Mar 2025