Ingles Markets, Incorporated (NASDAQ: IMKTA) today reported

results for the three and twelve months ended September 28,

2024.

Robert P. Ingle II, Chairman of the Board, stated, “After

Hurricane Helene impacted our communities, I am proud of how not

only our associates came together, but our entire region. We are

truly thankful for all the volunteers and the outpouring of support

for our region.”

Impact of Hurricane

Helene

On September 27, 2024, Hurricane Helene severely impacted

western North Carolina, including the area where the Company’s

headquarters are located, resulting in catastrophic flooding which

caused power, communication and water outages, and major road

closures. For the quarter and year ended September 28, 2024, the

Company recognized an impairment loss of $30.4 million related to

inventory damaged or destroyed by Hurricane Helene. Additionally,

the Company also recognized a property and equipment impairment

loss of $4.5 million for the quarter and year ended September 28,

2024.

Fourth Quarter Results

Net sales totaled $1.40 billion for the quarter ended September

28, 2024, compared with $1.58 billion for the quarter ended

September 30, 2023. Fourth quarter results of fiscal 2024 had 13

weeks compared to 14 weeks for the fourth quarter of fiscal

2023.

Gross profit for the fourth quarter of fiscal 2024 totaled

$299.4 million, or 21.4% of sales. Gross profit for the fourth

quarter of fiscal 2023 was $369.7 million, or 23.3% of sales.

Operating and administrative expenses for the fourth quarter of

fiscal 2024 totaled $301.0 million compared with $299.4 million for

the fourth quarter of fiscal 2023.

Interest expense totaled $5.2 million for the fourth quarter of

fiscal 2024 compared with $5.9 million for the fourth quarter of

fiscal 2023. Total debt at the end of fiscal 2024 was $532.6

million compared with $550.2 million at the end of fiscal 2023.

Net loss totaled $1.5 million for the fourth quarter of fiscal

2024 quarter compared with net income of $52.6 million for the

fourth quarter of fiscal 2023. Basic and diluted losses per share

for Class A Common Stock were $0.08, for the quarter ended

September 28, 2024, compared with basic and diluted earnings per

share of $2.83 and $2.77, respectively, for the quarter ended

September 30, 2023. Basic and diluted losses per share for Class B

Common Stock were each $0.07 for the quarter ended September 28,

2024, compared with basic and diluted income per share of $2.57 for

the quarter ended September 30, 2023.

Annual Results

Net sales totaled $5.64 billion for the fiscal year ended

September 28, 2024, compared with $5.89 billion for the fiscal year

ended September 30, 2023. The fiscal year ended September 28, 2024,

had 52 weeks, and the fiscal year ended September 30, 2023, had 53

weeks.

Gross profit for the fiscal year ended September 28, 2024,

totaled $1.3 billion, or 23.1% of sales. Gross profit for the

fiscal year ended September 30, 2023, totaled $1.4 billion, or

23.8% of sales.

Operating and administrative expenses totaled $1.2 billion for

the fiscal year ended September 28, 2024, and $1.1 billion for the

fiscal year ended September 30, 2023.

Interest expense was $21.9 million for the fiscal year ended

September 28, 2024, compared with $22.1 million for the fiscal year

ended September 30, 2023.

Net income totaled $105.5 million for the fiscal year ended

September 28, 2024, compared with $210.8 million for the fiscal

year ended September 30, 2023. Basic and diluted earnings per share

for Class A Common Stock were $5.68 and $5.56, respectively, for

the fiscal year ended September 28, 2024, compared with $11.35 and

$11.10, respectively, for the fiscal year ended September 30, 2023.

Basic and diluted earnings per share for Class B Common Stock were

each $5.16 for the fiscal year ended September 28, 2024, compared

with basic and diluted earnings per share of $10.32 for the fiscal

year ended September 30, 2023.

Capital expenditures for the 2024 fiscal year totaled $210.9

million compared with $173.6 million for the 2023 fiscal year.

The Company currently has the full amount available under its

$150.0 million line of credit. The Company believes its financial

resources, including the line of credit and other internal and

anticipated external sources of funds, will be sufficient to meet

planned capital expenditures, debt service and working capital

requirements for the foreseeable future.

About Ingles Markets,

Incorporated

Ingles Markets, Incorporated is a leading grocer with operations

in six southeastern states. Headquartered in Asheville, North

Carolina, the Company operates 198 supermarkets. In conjunction

with its supermarket operations, the Company operates neighborhood

shopping centers, most of which contain an Ingles supermarket. The

Company also owns a fluid dairy facility that supplies Ingles

supermarkets and unaffiliated customers. To learn more about Ingles

Markets visit ingles-markets.com.

Cautionary Note Regarding

Forward-Looking Statements

This press release includes certain “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995. These forward-looking statements may address, among other

things, our expected financial and operational results and the

related assumptions underlying our expected results. These

forward-looking statements are distinguished by use of words such

as “anticipate,” “aim,” “believe,” “continue,” “could,” “estimate,”

“expect,” “intends,” “may,” “might,” “plan,” “possible,”

“potential,” “predict,” “project,” “should,” “will,” “would” and

the negative of these terms, and similar references to future

periods. These statements are based on management’s current

expectations and are subject to uncertainty and changes in

circumstances. Actual results may differ materially from these

expectations due to, among other things: business and economic

conditions generally in the Company’s operating area, including

inflation or deflation; shortages of labor, distribution capacity,

and some product shortages; inflation in food, labor and gasoline

prices; the Company’s ability to successfully implement our

expansion and operating strategies; pricing pressures and other

competitive factors, including online-based procurement of products

the Company sells; sudden or significant changes in the

availability of gasoline and retail gasoline prices; the maturation

of new and expanded stores; general concerns about food safety; the

Company’s ability to manage technology and data security; the

availability and terms of financing; and increases in costs,

including food, utilities, labor and other goods and services

significant to the Company’s operations. Detailed information about

these factors and additional important factors can be found in the

documents that the Company files with the Securities and Exchange

Commission, such as Form 10-K, Form 10-Q and Form 8-K.

Forward-looking statements speak only as of the date the statements

were made. The Company does not undertake an obligation to update

forward-looking information, except to the extent required by

applicable law.

INGLES MARKETS,

INCORPORATED

(Amounts in thousands except per

share data)

Unaudited Financial

Highlights

Consolidated Statements of

Income

Quarter Ended

Year Ended

Sept. 28,

Sept. 30,

Sept. 28,

Sept. 30,

2024

2023

2024

2023

Net sales

$

1,397,529

$

1,584,995

$

5,639,609

$

5,892,782

Gross profit

299,391

369,720

1,299,835

1,404,915

Operating and administrative expenses

300,958

299,400

1,161,797

1,115,381

Gain from sale or disposal of assets

124

1,276

9,106

2,770

(Loss) income from operations

(1,443

)

71,596

147,144

292,304

Other income, net

3,675

2,978

14,217

8,269

Interest expense

5,207

5,935

21,860

22,068

Income tax (benefit) expense

(1,502

)

15,998

33,960

67,693

Net (loss) income

$

(1,473

)

$

52,641

$

105,541

$

210,812

Basic (loss) earnings per common share –

Class A

$

(0.08

)

$

2.83

$

5.68

$

11.35

Diluted (loss) earnings per common share –

Class A

$

(0.08

)

$

2.77

$

5.56

$

11.10

Basic (loss) earnings per common share –

Class B

$

(0.07

)

$

2.57

$

5.16

$

10.32

Diluted (loss) earnings per common share –

Class B

$

(0.07

)

$

2.57

$

5.16

$

10.32

Additional selected information:

Depreciation and amortization expense

$

34,091

$

29,162

$

121,623

$

115,979

Rent expense

$

2,111

$

2,731

$

9,703

$

10,592

Consolidated Balance

Sheets

Sept. 28,

Sept. 30,

2024

2023

ASSETS

Cash and cash equivalents

$

353,688

$

328,540

Receivables-net

78,266

107,571

Inventories

462,085

493,860

Other current assets

31,509

22,586

Property and equipment-net

1,526,708

1,431,872

Other assets

75,627

89,417

TOTAL ASSETS

$

2,527,883

$

2,473,846

LIABILITIES AND STOCKHOLDERS' EQUITY

Current maturities of long-term debt

$

17,521

$

17,527

Accounts payable, accrued expenses and current portion of other

long-term liabilities

303,101

313,007

Deferred income taxes

63,767

67,187

Long-term debt

515,102

532,632

Other long-term liabilities

82,643

84,521

Total Liabilities

982,134

1,014,874

Stockholders' equity

1,545,749

1,458,972

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY

$

2,527,883

$

2,473,846

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241227781704/en/

Ingles Markets, Inc. Contact: Pat Jackson, Chief Financial

Officer pjackson@ingles-markets.com (828) 669-2941 (Ext. 223)

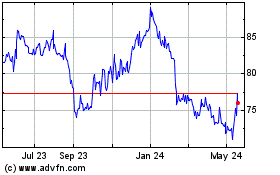

Ingles Markets (NASDAQ:IMKTA)

Historical Stock Chart

From Dec 2024 to Jan 2025

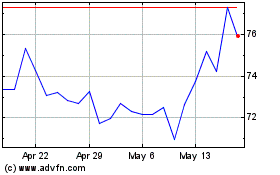

Ingles Markets (NASDAQ:IMKTA)

Historical Stock Chart

From Jan 2024 to Jan 2025