As filed with the Securities and Exchange Commission

on August 8, 2024.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

INNODATA

INC.

(Exact name of registrant as specified in its charter)

| Delaware |

13-347594 |

(State or other jurisdiction of

incorporation or organization) |

(I.R.S. Employer

Identification Number) |

55 Challenger Road

Ridgefield Park, New Jersey 07660

(201) 371-8000

(Address, including zip code, and telephone number, including area code,

of registrant’s principal executive offices)

Jack S. Abuhoff

Chief Executive Officer and President

Innodata Inc.

55 Challenger Road

Ridgefield Park, New Jersey 07660

(201) 371-8000

(Name, address, including zip code, and telephone number, including area code,

of agent for service)

Copies to:

David C. Schwartz, Esq.

Thurston J. Hamlette, Esq.

Morgan Lewis & Bockius LLP

502 Carnegie Center, Suite 201

Princeton, New Jersey 08540

(609) 919-6600

(Approximate date of commencement of proposed

sale to the public: From time to time after the effective date of this Registration Statement, as determined by market conditions.)

If the only securities being registered on this

Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities being registered on

this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than

securities offered only in connection with dividend or interest reinvestment plans, check the following box. x

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment

filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. ¨

If this Form is a registration statement

pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission

pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If this Form is a post-effective amendment

to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes

of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ |

Accelerated filer ¨ |

| Non-accelerated filer x |

Smaller reporting company x |

| |

Emerging growth company ¨ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

The registrant hereby amends this registration

statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which

specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the

Securities Act or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a),

may determine.

The information in this prospectus

is not complete and may be changed or supplemented. No securities described in this prospectus can be sold until the registration statement

that we filed to cover the securities has become effective under the rules of the Securities and Exchange Commission. This prospectus

is not an offer to sell the securities, nor is it a solicitation of an offer to buy the securities in any state where an offer or sale

of the securities is not permitted.

Subject

to Completion, dated august 8, 2024

PROSPECTUS

$50,000,000

Common Stock

Preferred Stock

Debt Securities

Warrants

Units

We may offer from time to

time in one or more offerings up to an aggregate of $50,000,000 of the common stock, preferred stock, debt securities, warrants or units

described in this prospectus, separately or together in one or more combinations. The preferred stock, debt securities, and warrants

may be convertible into or exercisable or exchangeable for common stock or preferred stock or other securities, as identified in the

applicable prospectus supplement.

This prospectus provides

a general description of the securities we may offer. This prospectus will allow us to offer for sale securities over time. Each time

we sell securities, we will provide specific terms of the securities offered in the applicable prospectus supplement. We may also authorize

one or more free writing prospectuses to be provided to you in connection with these offerings. The prospectus supplement and any related

free writing prospectus may add, update or change information contained in this prospectus. You should carefully read this prospectus,

the applicable prospectus supplement and any related free writing prospectus, as well as the documents incorporated by reference herein

and therein, before you invest in any of our securities. This prospectus may not be used to sell the securities unless accompanied by

a prospectus supplement.

We may offer and sell the

securities through underwriters, dealers or agents, or directly to purchasers, or through a combination of these methods. See “Plan

of Distribution” beginning on page 14 of this prospectus.

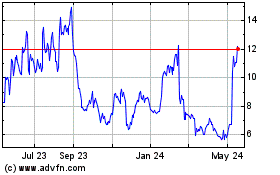

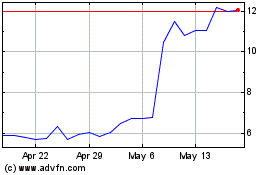

Our common stock is listed

on the Nasdaq Global Market under the symbol “INOD.” On August 7, 2024, the last reported sale price of our common

stock was $15.46 per share.

Investing in our securities

involves risk. See “Risk Factors” beginning on page 4 of this prospectus. You should carefully read this prospectus,

any applicable prospectus supplement and any related free writing prospectus, as well as the documents incorporated by reference herein

and therein, before you invest in any of our securities.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2024

TABLE OF CONTENTS

About

This Prospectus

This prospectus is part of

a registration statement that we have filed with the Securities and Exchange Commission (the “SEC” or the “Commission”)

using a “shelf” registration process under the Securities Act of 1933, as amended (the “Securities Act”). Under

this shelf registration process, we may offer and sell, from time to time, any combination of the securities described in this prospectus

in one or more offerings up to a total dollar amount of $50,000,000.

This prospectus provides

a general description of the securities we may offer. Each time we sell the securities, we will, to the extent required by law, provide

a prospectus supplement that will contain specific information about the terms of the offering. We may also authorize one or more free

writing prospectuses to be provided to you in connection with the offering. The prospectus supplement and any related free writing prospectus

may add, update or change information contained in this prospectus. This prospectus does not contain all of the information included

in the registration statement. For a more complete understanding of the offering of the securities, you should refer to the registration

statement, including its exhibits. You should carefully read this prospectus, the applicable prospectus supplement, and any applicable

free writing prospectus, as well as the information and documents incorporated herein and therein by reference and the additional information

under the heading “Where You Can Find More Information,” before making an investment decision.

We have not authorized any

dealer, salesman or other person to give any information or to make any representation other than those contained in, or incorporated

by reference into, this prospectus and the applicable prospectus supplement, and any free writing prospectus we have authorized for use

in connection with a specific offering.

This prospectus and any accompanying

prospectus supplement to this prospectus do not constitute an offer to sell or the solicitation of an offer to buy any securities other

than the registered securities to which they relate, nor do this prospectus or any accompanying prospectus supplement to this prospectus

constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful

to make such offer or solicitation in such jurisdiction. You should not assume that the information contained in this prospectus, any

accompanying prospectus supplement and any applicable free writing prospectus is accurate on any date subsequent to the date set forth

on the front of the document or that any information we have incorporated by reference is correct on any date subsequent to the date

of the document incorporated by reference, even though this prospectus, any accompanying prospectus supplement or any applicable free

writing prospectus is delivered, or securities sold, on a later date.

This prospectus may not be

used by us to consummate sales of our securities unless it is accompanied by a prospectus supplement. To the extent there are inconsistencies

between any prospectus supplement, this prospectus and any documents incorporated by reference, the document with the most recent date

will control.

This prospectus and the information

incorporated herein by reference include our trademarks, trade names and service marks, which are protected under applicable intellectual

property laws and are the property of Innodata Inc., or its subsidiaries. Solely for convenience, trademarks, trade names and service

marks referred to in this prospectus may appear without the ®, TM or SM symbols, but such references are not intended to indicate,

in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to

these trademarks, trade names and service marks. We do not intend our use or display of other parties’ trademarks, trade names

or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship

of us by, these other parties.

Unless the context otherwise

requires, references in this prospectus to “we,” “us,” “our,” the “Company,” and “Innodata”

refer to Innodata Inc., a Delaware corporation, and its subsidiaries.

The

Company

Our Business

We are a leading data engineering

company. Our mission is to help the world’s most prestigious companies deliver the promise of ethical, high-performing artificial

intelligence (“AI”), which we believe will contribute to a safer and more prosperous world.

Innodata was founded on a

simple idea: engineer the highest quality data so organizations across broad industry segments could make smarter decisions. Today, we

believe we are delivering the highest quality data for some of the world’s most innovative technology companies to use to train

the AI models of the future.

AI holds the promise that

computers can perceive and understand the world, enabling products and services that would have been previously unimaginable and impossible

with traditional coding. AI learns from data, and the highest-performing AI will have learned from the highest-quality data. We believe

that we can contribute meaningfully by harnessing our capabilities, honed over 30+ years, in collecting and annotating data at scale

with consistency and high accuracy.

We are also helping companies

deploy and integrate AI into their operations and products and providing innovative AI-enabled industry platforms, helping ensure that

our customers’ businesses are prepared for a world in which machines augment human activity in ways previously unimaginable.

We developed our capabilities

and honed our approaches progressively over the last 30+ years creating high-quality data for many of the world’s most demanding

information companies. Approximately eight years ago, we formed Innodata Labs, a research and development center, to research, develop

and apply machine learning and emerging AI to our large-scale, human-intensive data operations. In 2019, we began packaging the capabilities

that emerged from our R&D efforts in order to align with several fast-growing new markets and help companies use AI/ML to drive performance

benefits and business insights.

Our historical core competency

in high-quality data, combined with these R&D efforts in applied AI, created the foundation for the evolution of our offerings, which

include AI Data Preparation, AI Model Deployment and Integration, and AI-Enabled Industry Platforms.

Corporate Information

Innodata Inc. was founded

in 1988 as a Delaware corporation. Our principal executive offices are located at 55 Challenger Road, Ridgefield Park, New Jersey 07660,

just outside New York City, and our telephone number is (201) 371-8000.

Our website is www.innodata.com;

information contained on our website is not included as a part of, or incorporated by reference into, this prospectus. There we make

available, free of charge, our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K,

and any amendments to those reports, as soon as reasonably practicable after we electronically file that material with, or furnish it

to, the SEC. Our SEC reports can be obtained through the Investor Relations section of our website or from the Securities and Exchange

Commission at www.sec.gov.

Risk

Factors

Investing in our securities

involves risks. Before making an investment decision, you should carefully consider these risks as well as other information we include

or incorporate by reference in this prospectus. In particular, you should carefully consider the information under the heading “Risk

Factors,” as well as the factors listed under the heading “Cautionary Note Regarding Forward-Looking Statements,” in

each case contained in our Annual Report on Form 10-K for our most recent fiscal year, as supplemented and updated by subsequent

Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that we have filed or will file with the SEC, and in other documents

incorporated by reference into this prospectus, as well as the risk factors and other information contained in or incorporated by reference

into any accompanying prospectus supplement before investing in any of our securities. New risks may emerge in the future at any time,

and we cannot predict such risks or estimate the extent to which they may affect our financial condition or performance. Any such risks

could result in a decrease in the value of the securities and your investment therein.

CAUTIONARY

Note Regarding Forward-Looking Statements

This prospectus and the documents

incorporated by reference into this prospectus and any prospectus supplement or free writing prospectus may contain “forward-looking

statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of

1934, as amended (the “Exchange Act”). These forward-looking statements include, without limitation, statements concerning

our operations, economic performance, and financial condition. Words such as “project,” “believe,” “expect,”

“can,” “continue,” “could,” “intend,” “may,” “should,” “will,”

“anticipate,” “indicate,” “predict,” “likely,” “estimate,” “plan,”

“potential,” “possible,” or the negatives thereof, and other similar expressions generally identify forward-looking

statements.

These forward-looking statements

are based on management’s current expectations, assumptions and estimates and are subject to a number of risks and uncertainties,

including, without limitation:

| · | impacts resulting from ongoing geopolitical

conflicts, including between Russia and the Ukraine, Hamas’ attack against Israel and

the ensuing conflict and increased hostilities between Iran and Israel; |

| · | investments in large language models; |

| · | that contracts may be terminated

by customers; |

| · | projected or committed volumes of

work may not materialize; |

| · | pipeline opportunities and customer

discussions which may not materialize into work or expected volumes of work; |

| · | the likelihood of continued development

of the markets, particularly new and emerging markets, that our services support; |

| · | the ability and willingness of our

customers and prospective customers to execute business plans that give rise to requirements

for our services; |

| · | continuing reliance on project-based

work in the Digital Data Solutions (DDS) segment and the primarily at-will nature of such

contracts and the ability of these customers to reduce, delay or cancel projects; |

| · | potential inability to replace projects

that are completed, canceled or reduced; continuing DDS segment revenue concentration in

a limited number of customers; |

| · | our dependency on content providers

in our Agility segment; |

| · | the Company’s ability to achieve

revenue and growth targets; |

| · | difficulty in integrating and deriving

synergies from acquisitions, joint ventures and strategic investments; |

| · | potential undiscovered liabilities

of companies and businesses that we may acquire; |

| · | potential impairment of the carrying

value of goodwill and other acquired intangible assets of companies and businesses that we

acquire; |

| · | a continued downturn in or depressed

market conditions; |

| · | changes in external market factors;

changes in our business or growth strategy; |

| · | the emergence of new, or growth in

existing competitors; |

| · | various other competitive and technological

factors; |

| · | our use of and reliance on information

technology systems, including potential security breaches, cyber-attacks, privacy breaches

or data breaches that result in the unauthorized disclosure of consumer, customer, employee

or Company information, or service interruptions; and |

| · | other risks and uncertainties indicated

from time to time on our filings with the SEC. |

Our actual results could

differ materially from the results referred to in forward-looking statements. Factors that could cause or contribute to such differences

include, but are not limited to, the risks discussed in Part I, Item 1A. “Risk Factors,” “Part II, Item

7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and other parts of our

Annual Report on Form 10-K, filed with the SEC on March 4, 2024 and in our other filings that we may make with the SEC.

Any forward-looking statements

that we make in this prospectus speak only as of the date of such statements and we undertake no obligation to publicly update any forward-looking

statements or to publicly announce revisions to any of the forward-looking statements, whether as a result of new information, future

events or otherwise, except as may otherwise be required by the federal securities laws.

Use

of Proceeds

Except as described in any

applicable prospectus supplement or in any related free writing prospectuses we may authorize for use in connection with a specific offering,

we anticipate that the net proceeds from our sale of any securities will be used for general corporate purposes. General corporate purposes

may include additions to working capital, capital expenditures, investments in our subsidiaries, possible acquisitions, and the repurchase,

redemption or retirement of securities, including our common stock. We believe it is prudent to have an effective shelf registration

statement on file with the SEC to preserve the flexibility to raise capital from time to time, if and when needed. Although we have no

specific plans to raise money as of the time of filing this registration statement, we believe it’s good corporate governance to

ensure future flexibility to enable us to take advantage of opportunities we may identify in the market.

As of the date of this prospectus,

we cannot specify with certainty all of the particular uses for the net proceeds to us from the sale of the securities offered by us

hereunder. We will set forth in the applicable prospectus supplement or free writing prospectus our intended use for the net proceeds

received from the sale of any securities sold pursuant to the prospectus supplement or free writing prospectus.

Description

of the Securities We May Offer

The descriptions of the securities

contained in this prospectus summarize the material terms and provisions of the various types of securities that we may offer. We will

describe in the applicable prospectus supplement relating to any securities the particular terms of the securities offered by that prospectus

supplement. If we so indicate in the applicable prospectus supplement, the terms of the securities may differ from the terms we have

summarized below. We will also include in the prospectus supplement information, where applicable, about material U.S. federal income

tax considerations relating to the securities, and the securities exchange, if any, on which the securities will be listed.

We may offer and sell from

time to time, in one or more primary offerings, our common stock, preferred stock, debt securities, warrants or units, or any combination

of the foregoing.

In this prospectus, we refer

to the common stock, preferred stock, debt securities, warrants or units, or any combination of the foregoing securities to be sold by

us in a primary offering collectively as “securities.” The total dollar amount of all securities that we may issue under

this prospectus will not exceed $50,000,000.

This prospectus may not be

used by us to consummate a sale of securities unless it is accompanied by a prospectus supplement.

Description

of Capital Stock

The following description

of our common stock and preferred stock, together with the additional information we include in the applicable prospectus supplement,

summarizes the material terms and provisions of the common stock and preferred stock that we may offer under this prospectus. It may

not contain all the information that is important to you. For the complete terms of our common stock and preferred stock, please refer

to our Restated Certificate of Incorporation, dated April 27, 1993, as amended February 28, 2001, and as further amended November 14,

2003 and June 5, 2012 (the “Certificate of Incorporation”) and our Amended and Restated By-Laws (the “By-Laws”).

General

The total number of shares

of capital stock that the Company has authority to issue is 79,998,000, divided into two classes consisting of (i) 75,000,000 shares

of common stock, $0.01 par value per share and (ii) 4,998,000 shares of preferred stock, $0.01 par value per share.

As of August 1, 2024,

28,988,841 shares of common stock were issued and outstanding and no shares of preferred stock were issued and outstanding.

Common Stock

Dividends

Subject to the preferential

rights of any other class or series of capital stock, including preferred stock, holders of our common stock are entitled to receive

dividends when and as declared by our Board of Directors out of funds legally available for the payment of dividends.

Ranking

The common stock ranks junior

with respect to dividend rights and rights upon liquidation, dissolution or winding-up of the Company to all other securities and indebtedness

of the Company.

Conversion Rights

The shares of common stock

are not convertible into other securities.

Voting Rights

Holders of shares of our

common stock are entitled to one vote per share on all matters voted on by our stockholders. A majority of the shares entitled to vote

at any meeting of stockholders shall constitute a quorum for the transaction of any business thereat. In all matters other than the election

of directors, the affirmative vote of the majority of shares present in person or represented by proxy at the meeting and entitled to

vote on the subject matter shall be the act of the stockholders. Directors shall be elected by a plurality of the votes of the shares

present in person or represented by proxy at the meeting and entitled to vote on the election of directors. There are no cumulative voting

rights for the election of directors.

Liquidation

In the event of a liquidation,

dissolution or winding up of the Company, after payments to creditors and the holders of any senior securities, the holders of common

stock will be entitled to receive pro rata all of the remaining assets of the Company available for distribution to our stockholders.

Redemption

We have no obligation or

right to redeem our common stock.

Preferred Stock

The issuance of shares of

preferred stock, or the issuance of rights to purchase preferred stock, could be used to discourage an unsolicited acquisition proposal.

For example, a business combination could be impeded by the issuance of a series of preferred stock containing class voting rights that

would enable the holder or holders of such series to block any such transaction. Alternatively, a business combination could be facilitated

by the issuance of a series of preferred stock having sufficient voting rights to provide a required percentage vote of the Company’s

stockholders. In addition, under some circumstances, the issuance of preferred stock could adversely affect the voting power and other

rights of the holders of common stock. Although prior to issuing any series of preferred stock the Board is required to make a determination

as to whether the issuance is in the best interests of the Company’s stockholders, the Board could act in a manner that would discourage

an acquisition attempt or other transaction that some, or a majority, of the stockholders might believe to be in their best interests

or in which the stockholders might receive a premium for their stock over prevailing market prices of such stock. The Board does not

presently intend to seek stockholder approval prior to any issuance of currently authorized preferred stock, unless otherwise required

by law or applicable stock exchange requirements.

Indemnification of Directors and Officers

The Company’s directors

and officers are indemnified as provided by the DGCL, the Company’s Certificate of Incorporation, and the Company’s By-Laws.

The Company has been advised that, in the opinion of the SEC, indemnification for liabilities arising under the Securities Act is against

public policy as expressed in the Securities Act, and is, therefore, unenforceable. In the event that a claim for indemnification against

such liabilities is asserted by one of the Company’s directors, officers, or controlling persons in connection with the securities

being registered, the Company will, unless in the opinion of its legal counsel the matter has been settled by controlling precedent,

submit the question of whether such indemnification is against public policy to a court of appropriate jurisdiction. The Company will

then be governed by the court’s decision.

We are party to indemnification

agreements with each of our directors and officers. These agreements require us to, among other things, indemnify our directors and officers

against certain liabilities that may arise by reason of their status or service as directors or officers to the fullest extent permitted

by applicable laws. These indemnification provisions and the indemnification agreements are sufficiently broad to permit indemnification

of our officers and directors for liabilities, including reimbursement of expenses incurred, arising under the Securities Act. The Company

also maintains director and officer liability insurance.

Delaware Anti-Takeover Law

The Company is subject to

the provisions of Section 203 of the DGCL. Section 203 prohibits publicly held Delaware corporations from engaging in a “business

combination” with an “interested stockholder” for a period of three years after the date of the transaction in which

the person became an interested stockholder, unless the business combination is approved in a prescribed manner. A “business combination”

includes mergers, asset sales and other transactions resulting in a financial benefit to the interested stockholder. Subject to certain

exceptions, an “interested stockholder” is a person who, together with affiliates and associates, owns, or within three years

did own, 15% or more of the corporation’s voting stock. These provisions could have the effect of delaying, deferring or preventing

a change of control of the Company or reducing the price that certain investors might be willing to pay in the future for shares of the

Company’s stock.

Transfer Agent

Equiniti Trust Company, LLC

serves as the transfer agent and registrar for the Company’s common stock.

Description

of Debt Securities

We may issue from time to

time, in one or more offerings, senior or subordinated debt securities covered by this prospectus. When we offer to sell a particular

series of debt securities, we will describe the specific terms of the series in the applicable prospectus supplement.

Description

of Warrants

We may issue warrants to

purchase our debt or equity securities or other rights, including rights to receive payment in cash or securities based on the value,

rate or price of one or more specified commodities, currencies, securities or indices, or any combination of the foregoing. Warrants

may be issued independently or together with any other securities and may be attached to, or separate from, such securities. Each series

of warrants will be issued under a separate warrant agreement to be entered into between us and a warrant agent. The terms of any warrants

to be issued and a description of the material provisions of the applicable warrant agreement will be set forth in the applicable prospectus

supplement.

Description

of Units

As specified in the applicable

prospectus supplement, we may issue units consisting of warrants, debt securities, shares of preferred stock, shares of common stock

or any combination of such securities.

Legal

Ownership of Securities

We can issue securities in

registered form or in the form of one or more global securities. We describe global securities in greater detail below. We refer to those

persons who have securities registered in their own names on the books that we or any applicable trustee maintain for this purpose as

the “holders” of those securities. These persons are the legal holders of the securities. We refer to those persons who,

indirectly through others, own beneficial interests in securities that are not registered in their own names, as “indirect holders”

of those securities. As we discuss below, indirect holders are not legal holders, and investors in securities issued in book-entry form

or in street name will be indirect holders.

Book-Entry Holders

We may issue securities in

book-entry form only, as we will specify in the applicable prospectus supplement. This means securities may be represented by one or

more global securities registered in the name of a financial institution that holds them as depositary on behalf of other financial institutions

that participate in the depositary’s book-entry system. These participating institutions, which are referred to as participants,

in turn, hold beneficial interests in the securities on behalf of themselves or their customers.

Only the person in whose

name a security is registered is recognized as the holder of that security. Securities issued in global form will be registered in the

name of the depositary or its nominee. Consequently, for securities issued in global form, we will recognize only the depositary as the

holder of the securities, and we will make all payments on the securities to the depositary. The depositary passes along the payments

it receives to its participants, which in turn pass the payments along to their customers who are the beneficial owners. The depositary

and its participants do so under agreements they have made with one another or with their customers; they are not obligated to do so

under the terms of the securities.

As a result, investors in

a book-entry security will not own securities directly. Instead, they will own beneficial interests in a global security, through a bank,

broker or other financial institution that participates in the depositary’s book-entry system or holds an interest through a participant.

As long as the securities are issued in global form, investors will be indirect holders, and not holders, of the securities.

Street Name Holders

We may terminate a global

security or issue securities in non-global form. In these cases, investors may choose to hold their securities in their own names or

in “street name.” Securities held by an investor in street name would be registered in the name of a bank, broker or other

financial institution that the investor chooses, and the investor would hold only a beneficial interest in those securities through an

account he or she maintains at that institution.

For securities held in street

name, we will recognize only the intermediary banks, brokers and other financial institutions in whose names the securities are registered

as the holders of those securities, and we will make all payments on those securities to them. These institutions pass along the payments

they receive to their customers who are the beneficial owners, but only because they agree to do so in their customer agreements or because

they are legally required to do so. Investors who hold securities in street name will be indirect holders, not holders, of those securities.

Legal Holders

Our obligations, as well

as the obligations of any applicable trustee and of any third parties employed by us or a trustee, run only to the legal holders of the

securities. We do not have obligations to investors who hold beneficial interests in global securities, in street name or by any other

indirect means. This will be the case whether an investor chooses to be an indirect holder of a security or has no choice because we

are issuing the securities only in global form.

For example, once we make

a payment or give a notice to the holder, we have no further responsibility for the payment or notice even if that holder is required,

under agreements with depositary participants or customers or by law, to pass it along to the indirect holders but does not do so. Similarly,

we may want to obtain the approval of the holders to amend an indenture, to relieve us of the consequences of a default or of our obligation

to comply with a particular provision of the indenture or for other purposes. In such an event, we would seek approval only from the

holders, and not the indirect holders, of the securities. Whether and how the holders contact the indirect holders is up to the holders.

Special Considerations for Indirect Holders

If you hold securities through

a bank, broker or other financial institution, either in book-entry form or in street name, you should check with your own institution

to find out:

| · | how it handles securities payments

and notices; |

| · | whether it imposes fees or charges; |

| · | how it would handle a request for

the holders’ consent, if ever required; |

| · | whether and how you can instruct

it to send you securities registered in your own name so you can be a holder, if that is

permitted in the future; |

| · | how it would exercise rights under

the securities if there were a default or other event triggering the need for holders to

act to protect their interests; and |

| · | if the securities are in book entry

form, how the depositary’s rules and procedures will affect these matters. |

Global Securities

A global security is a security

held by a depositary that represents one or any other number of individual securities. Generally, all securities represented by the same

global securities will have the same terms.

Each security issued in book-entry

form will be represented by a global security that we deposit with and register in the name of a financial institution or its nominee

that we select. The financial institution that we select for this purpose is called the depositary. Unless we specify otherwise in the

applicable prospectus supplement, The Depository Trust Company (DTC) will be the depositary for all securities issued in book-entry form.

A global security may not

be transferred to or registered in the name of anyone other than the depositary, its nominee or a successor depositary, unless special

termination situations arise. We describe those situations below under “—Special Situations When a Global Security Will Be

Terminated.” As a result of these arrangements, the depositary, or its nominee, will be the sole registered owner and holder of

all securities represented by a global security, and investors will be permitted to own only beneficial interests in a global security.

Beneficial interests must be held by means of an account with a broker, bank or other financial institution that in turn has an account

with the depositary or with another institution that does. Thus, an investor whose security is represented by a global security will

not be a holder of the security, but only an indirect holder of a beneficial interest in the global security.

If the prospectus supplement

for a particular security indicates that the security will be issued in global form only, then the security will be represented by a

global security at all times unless and until the global security is terminated. If termination occurs, we may issue the securities through

another book-entry clearing system or decide that the securities may no longer be held through any book-entry clearing system.

Special Considerations for Global Securities

As an indirect holder, an

investor’s rights relating to a global security will be governed by the account rules of the investor’s financial institution

and of the depositary, as well as general laws relating to securities transfers. We do not recognize an indirect holder as a holder of

securities and instead deal only with the depositary that holds the global security.

If securities are issued

only in the form of a global security, an investor should be aware of the following:

| · | an investor cannot cause the securities

to be registered in his or her name, and cannot obtain non global certificates for his or

her interest in the securities, except in the special situations we describe below; |

| · | an investor will be an indirect holder

and must look to his or her own bank or broker for payments on the securities and protection

of his or her legal rights relating to the securities, as we describe under “—Legal

Holders” above; |

| · | an investor may not be able to sell

interests in the securities to some insurance companies and to other institutions that are

required by law to own their securities in non-book entry form; |

| · | an investor may not be able to pledge

his or her interest in a global security in circumstances where certificates representing

the securities must be delivered to the lender or other beneficiary of the pledge in order

for the pledge to be effective; |

| · | the depositary’s policies,

which may change from time to time, will govern payments, transfers, exchanges and other

matters relating to an investor’s interest in a global security. We and any applicable

trustee have no responsibility for any aspect of the depositary’s actions or for its

records of ownership interests in a global security. We and the trustee also do not supervise

the depositary in any way; |

| · | the depositary may, and we understand

that DTC will, require that those who purchase and sell interests in a global security within

its book entry system use immediately available funds, and your broker or bank may require

you to do so as well; and |

| · | financial institutions that participate

in the depositary’s book entry system, and through which an investor holds its interest

in a global security, may also have their own policies affecting payments, notices and other

matters relating to the securities. There may be more than one financial intermediary in

the chain of ownership for an investor. We do not monitor and are not responsible for the

actions of any of those intermediaries. |

Special Situations When a Global Security Will Be Terminated

In a few special situations

described below, the global security will terminate and interests in it will be exchanged for physical certificates representing those

interests. After that exchange, the choice of whether to hold securities directly or in street name will be up to the investor. Investors

must consult their own banks or brokers to find out how to have their interests in securities transferred to their own name, so that

they will be direct holders. We have described the rights of holders and street name investors above.

The global security will

terminate when the following special situations occur:

| · | if the depositary notifies us that

it is unwilling, unable or no longer qualified to continue as depositary for that global

security and we do not appoint another institution to act as depositary within 90 days; |

| · | if we notify any applicable trustee

that we wish to terminate that global security; or |

| · | if an event of default has occurred

with regard to securities represented by that global security and has not been cured or waived. |

The prospectus supplement

may also list additional situations for terminating a global security that would apply only to the particular series of securities covered

by the prospectus supplement. When a global security terminates, the depositary, and not we or any applicable trustee, is responsible

for deciding the names of the institutions that will be the initial direct holders.

Plan

of Distribution

We may offer securities under

this prospectus from time to time pursuant to underwritten public offerings, negotiated transactions, block trades or a combination of

these methods or through underwriters or dealers, through agents and/or directly to one or more purchasers. The securities may be distributed

from time to time in one or more transactions:

| · | at a fixed price or prices, which

may be changed; |

| · | at market prices prevailing at the

time of sale; |

| · | at prices related to such prevailing

market prices; or |

Each time that securities

covered by this prospectus are sold, we will provide a prospectus supplement or supplements that will describe the method of distribution

and set forth the terms and conditions of the offering of such securities, including the offering price of the securities and the proceeds

to us.

Offers to purchase the securities

being offered by this prospectus may be solicited directly. Agents may also be designated to solicit offers to purchase the securities

from time to time. Any agent involved in the offer or sale of our securities will be identified in a prospectus supplement.

If a dealer is utilized in

the sale of the securities being offered by this prospectus, the securities will be sold to the dealer, as principal. The dealer may

then resell the securities to the public at varying prices to be determined by the dealer at the time of resale.

If an underwriter is utilized

in the sale of the securities being offered by this prospectus, an underwriting agreement will be executed with the underwriter at the

time of sale and the name of any underwriter will be provided in the prospectus supplement that the underwriter will use to make resales

of the securities to the public. In connection with the sale of the securities, we, or the purchasers of securities for whom the underwriter

may act as agent, may compensate the underwriter in the form of underwriting discounts or commissions. The underwriter may sell the securities

to or through dealers, and those dealers may receive compensation in the form of discounts, concessions or commissions from the underwriters

and/or commissions from the purchasers for which they may act as agent. Unless otherwise indicated in a prospectus supplement, an agent

will be acting on a best efforts basis and a dealer will purchase securities as a principal, and may then resell the securities at varying

prices to be determined by the dealer.

Any compensation paid to

underwriters, dealers or agents in connection with the offering of the securities, and any discounts, concessions or commissions allowed

by underwriters to participating dealers will be provided in the applicable prospectus supplement. Underwriters, dealers and agents participating

in the distribution of the securities may be deemed to be underwriters within the meaning of the Securities Act, and any discounts and

commissions received by them and any profit realized by them on resale of the securities may be deemed to be underwriting discounts and

commissions. We may enter into agreements to indemnify underwriters, dealers and agents against civil liabilities, including liabilities

under the Securities Act, or to contribute to payments they may be required to make in respect thereof and to reimburse those persons

for certain expenses.

The securities may or may

not be listed on a national securities exchange. To facilitate the offering of securities, certain persons participating in the offering

may engage in transactions that stabilize, maintain or otherwise affect the price of the securities. This may include over-allotments

or short sales of the securities, which involve the sale by persons participating in the offering of more securities than were sold to

them. In these circumstances, these persons would cover such over-allotments or short positions by making purchases in the open market

or by exercising their over-allotment option, if any. In addition, these persons may stabilize or maintain the price of the securities

by bidding for or purchasing securities in the open market or by imposing penalty bids, whereby selling concessions allowed to dealers

participating in the offering may be reclaimed if securities sold by them are repurchased in connection with stabilization transactions.

The effect of these transactions may be to stabilize or maintain the market price of the securities at a level above that which might

otherwise prevail in the open market. These transactions may be discontinued at any time.

If indicated in the applicable

prospectus supplement, underwriters or other persons acting as agents may be authorized to solicit offers by institutions or other suitable

purchasers to purchase the securities at the public offering price set forth in the prospectus supplement, pursuant to delayed delivery

contracts providing for payment and delivery on the date or dates stated in the prospectus supplement. These purchasers may include,

among others, commercial and savings banks, insurance companies, pension funds, investment companies and educational and charitable institutions.

Delayed delivery contracts will be subject to the condition that the purchase of the securities covered by the delayed delivery contracts

will not at the time of delivery be prohibited under the laws of any jurisdiction in the United States to which the purchaser is subject.

The underwriters and agents will not have any responsibility with respect to the validity or performance of these contracts.

We may engage in at the market

offerings into an existing trading market in accordance with Rule 415(a)(4) under the Securities Act. The terms of such “at

the market offerings” will be set forth in the applicable prospectus supplement. We may engage an agent to act as a sales agent

in such “at the market offerings” on a best efforts basis using commercially reasonable efforts consistent with normal trading

and sales practices, on mutually agreed terms between such agent and us. We will name any agent involved in such “at the market

offerings” of securities and will list commissions payable by us to these agents in the applicable prospectus supplement.

In addition, we may enter

into derivative transactions with third parties, or sell securities not covered by this prospectus to third parties in privately negotiated

transactions. If the applicable prospectus supplement so indicates, in connection with those derivatives, the third parties may sell

securities covered by this prospectus and the applicable prospectus supplement, including in short sale transactions. If so, the third

party may use securities pledged by us or borrowed from us or others to settle those sales or to close out any related open borrowings

of stock, and may use securities received from us in settlement of those derivatives to close out any related open borrowings of stock.

The third party in such sale transactions will be an underwriter and, if not identified in this prospectus, will be named in the applicable

prospectus supplement (or a post-effective amendment). In addition, we may otherwise loan or pledge securities to a financial institution

or other third party that in turn may sell the securities short using this prospectus and an applicable prospectus supplement. Such financial

institution or other third party may transfer its economic short position to investors in our securities or in connection with a concurrent

offering of other securities.

The specific terms of any

lock-up provisions in respect of any given offering will be described in the applicable prospectus supplement.

The underwriters, dealers

and agents may engage in transactions with us, or perform services for us, in the ordinary course of business for which they receive

compensation.

General Information

Underwriters, dealers and

agents that participate in the distribution of our securities may be underwriters as defined in the Securities Act, and any discounts

or commissions they receive and any profit they make on the resale of the offered securities may be treated as underwriting discounts

and commissions under the Securities Act. Any underwriters or agents will be identified and their compensation described in a prospectus

supplement. We may indemnify agents, underwriters, and dealers against certain civil liabilities, including liabilities under the Securities

Act, or make contributions to payments they may be required to make relating to those liabilities. Our agents, underwriters, and dealers,

or their affiliates, may be customers of, engage in transactions with, or perform services for us in the ordinary course of business.

Each series of securities

offered by this prospectus may be a new issue of securities with no established trading market. Any underwriters to whom securities offered

by this prospectus are sold by us for public offering and sale may make a market in the securities offered by this prospectus, but the

underwriters will not be obligated to do so and may discontinue any market making at any time without notice. No assurance can be given

as to the liquidity of the trading market for any securities offered by this prospectus.

Representatives of the underwriters

through whom our securities are sold for public offering and sale may engage in over-allotment, stabilizing transactions, syndicate short

covering transactions and penalty bids in accordance with Regulation M under the Exchange Act. Over-allotment involves syndicate sales

in excess of the offering size, which creates a syndicate short position. Stabilizing transactions permit bids to purchase the offered

securities so long as the stabilizing bids do not exceed a specified maximum.

Syndicate covering transactions

involve purchases of the offered securities in the open market after the distribution has been completed in order to cover syndicate

short positions. Penalty bids permit the representative of the underwriters to reclaim a selling concession from a syndicate member when

the offered securities originally sold by such syndicate member are purchased in a syndicate covering transaction to cover syndicate

short positions. Such stabilizing transactions, syndicate covering transactions and penalty bids may cause the price of the offered securities

to be higher than it would otherwise be in the absence of such transactions. These transactions may be effected on a national securities

exchange and, if commenced, may be discontinued at any time.

Underwriters, dealers and

agents may be customers of, engage in transactions with or perform services for, us and our subsidiaries in the ordinary course of business.

We will bear all costs, expenses

and fees in connection with the registration of the securities as well as the expense of all commissions and discounts, if any, attributable

to the sales of any of our securities by us.

Where

You Can Find More Information

We file annual, quarterly

and periodic reports, proxy statements and other information with the SEC. Many of our SEC filings are available to the public from the

SEC’s website: www.sec.gov. We make available free of charge our annual, quarterly and current reports, proxy statements and other

information upon request or such reports are available on the Company’s website at www.innodata.com. To access or request such

materials, please visit www.innodata.com or contact us at the following address or telephone number: Innodata Inc., 55 Challenger Road,

Ridgefield Park, New Jersey 07660, Attention: Investor Relations, at (201)-371-8000. Exhibits to the documents will not be sent unless

those exhibits have specifically been incorporated by reference in this prospectus.

You may also obtain reports,

statements or other information that we file with the SEC by accessing our website at www.innodata.com, under the Investor Relations

tab, SEC Filings. Information contained in, or accessible through, our website does not constitute a part of this prospectus or any accompanying

prospectus supplement.

Incorporation

of Certain Documents by Reference

The SEC allows us to “incorporate

by reference” the information we file with it, which means that we can disclose important information to you by referring you to

those documents. The information that is incorporated by reference is considered to be part of this prospectus, and the information that

we file later with the SEC will automatically update and supersede this information. We incorporate by reference into this prospectus

the following documents:

| · | our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on March

4, 2024; |

| · | our definitive Proxy Statement on Schedule 14A for our 2024 Annual Meeting of Stockholders, filed April

25, 2024 (solely to the extent incorporated by reference into Part III of our Annual Report on Form 10-K for the fiscal year ended

December 31, 2023); |

| · | our Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, filed with the SEC on May

8, 2024; |

| · | our Current Report on Form 8-K filed with the SEC on June

6, 2024; and |

| · | the description of common stock set forth in Exhibit

4.2 to our Annual Report on Form 10-K for the year ended December 31, 2021, filed with the SEC on March 24, 2022, as supplemented

by the “Description of Capital Stock” found on page 8 of this prospectus and including any amendments or reports filed for

the purpose of updating such description. |

All documents subsequently

filed with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the termination of this offering shall

be deemed to be incorporated by reference into the prospectus. Any statement contained in any document incorporated by reference herein

will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus

or any additional prospectus supplements modifies or supersedes such statement. Any statement so modified or superseded will not be deemed,

except as so modified or superseded, to constitute a part of this prospectus.

Legal

Matters

The validity of the securities

offered hereby will be passed upon for us by Morgan, Lewis & Bockius LLP, Princeton, New Jersey. Any underwriters will be advised

about other issues relating to any offering by their own legal counsel.

Experts

The consolidated financial

statements of Innodata Inc. as of December 31, 2023 and 2022 and for each of the two years in the period ended December 31,

2023 incorporated by reference in this Prospectus and in the Registration Statement have been so incorporated in reliance on the report

of BDO India LLP an independent registered public accounting firm, given on the authority of said firm as experts in auditing and accounting.

$50,000,000

Common Stock

Preferred Stock

Debt Securities

Warrants

Units

Prospectus

,

2024

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

| Item 14. | Other Expenses of Issuance and Distribution. |

The following table sets

forth an estimate of the costs and expenses payable by us in connection with the offering described in this registration statement. All

of the amounts shown are estimates except the Securities and Exchange Commission registration fee:

| Securities and Exchange Commission registration fee |

|

$ |

7,380.00 |

|

| Printing expenses |

|

$ |

|

(1) |

| Legal fees and expenses |

|

$ |

|

(1) |

| Accounting fees and expenses |

|

$ |

|

(1) |

| Transfer Agent and Registrar fees and expenses |

|

$ |

|

(1) |

| Miscellaneous |

|

$ |

|

(1) |

| Total |

|

$ |

|

(1) |

(1) These fees are calculated based on the securities offered

and the number of issuances and accordingly cannot be estimated at this time.

| Item 15. | Indemnification of Directors and Officers. |

Our directors and officers

are indemnified as provided by the Delaware General Corporation Law, our Certificate of Incorporation, and our By-Laws. We have been

advised that, in the opinion of the Securities and Exchange Commission, indemnification for liabilities arising under the Securities

Act is against public policy as expressed in the Securities Act, and is, therefore, unenforceable. In the event that a claim for indemnification

against such liabilities is asserted by one of our directors, officers, or controlling persons in connection with the securities being

registered, we will, unless in the opinion of our legal counsel the matter has been settled by controlling precedent, submit the question

of whether such indemnification is against public policy to a court of appropriate jurisdiction. We will then be governed by the court’s

decision.

We are party to indemnification

agreements with each of our directors and officers. These agreements require us to, among other things, indemnify our directors and officers

against certain liabilities which may arise by reason of their status or service as directors or officers to the fullest extent permitted

by applicable laws. These indemnification provisions and the indemnification agreements are sufficiently broad to permit indemnification

of our officers and directors for liabilities, including reimbursement of expenses incurred, arising under the Securities Act. The Company

also maintains director and officer liability insurance.

Exhibit No. |

Description |

| |

|

| 1.1** |

Form of Underwriting Agreement. |

| |

|

| 3.1(a) |

Restated Certificate of Incorporation dated April 27, 1993 (incorporated

herein by reference to Exhibit 3.1(a) to the Company’s Annual Report on Form 10-K for the year ended December 31,

2003, filed with the SEC on March 26, 2004). |

| |

|

| 3.1(b) |

Certificate of Amendment of Certificate of Incorporation of Innodata Corporation

dated February 28, 2001 (incorporated herein by reference to Exhibit 3.1(b) to the Company’s Annual Report on

Form 10-K for the year ended December 31, 2003, filed with the SEC on March 26, 2004). |

| |

|

| 3.1(c) |

Certificate of Amendment of Certificate of Incorporation of Innodata Corporation

dated November 14, 2003 (incorporated herein by reference to Exhibit 3.1(c) to the Company’s Annual Report on

Form 10-K for the year ended December 31, 2003, filed with the SEC on March 26, 2024). |

| |

|

| 3.1(d) |

Certificate of Amendment of Certificate of Incorporation of Innodata Isogen, Inc.

dated June 5, 2012 (incorporated herein by reference to Exhibit 3.1 to the Company’s Quarterly Report on Form 10-Q

for the quarter ended June 30, 2012, filed with the SEC on August 7, 2012). |

| |

|

| 3.2 |

Amended and Restated By-laws of Innodata Corporation (incorporated herein

by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K, filed with the SEC on December 20,

2002). |

| |

|

| 4.1 |

Specimen Common Stock Certificate (incorporated herein by reference to Exhibit 4.1

to the Company’s Quarterly Report on Form 10-Q, filed with the SEC on August 7, 2015). |

| |

|

| 4.2** |

Form of Senior Note. |

| |

|

| 4.3** |

Form of Subordinated Note. |

| |

|

| 4.4** |

Form of Warrant Agreement. |

| |

|

| 4.5** |

Form of Warrant Certificate. |

| |

|

| 4.6** |

Form of Certificate of Designations. |

| |

|

| 4.7** |

Form of Preferred Stock Certificate. |

| |

|

| 4.8** |

Form of Unit Agreement. |

| |

|

| 5.1* |

Legal Opinion of Morgan, Lewis & Bockius LLP (relating to the base

prospectus). |

| |

|

| 23.1* |

Consent of BDO India LLP. |

| |

|

| 23.2* |

Consent of Morgan, Lewis & Bockius LLP (included in Exhibit 5.1). |

| |

|

| 24.1* |

Power of Attorney (included on signature page). |

| |

|

| 25.1*** |

Statement of Eligibility of Trustee on Form T-1 for Senior Indenture

under Trust Indenture Act of 1939. |

| |

|

| 25.2*** |

Statement of Eligibility of Trustee on Form T-1 for Subordinated Indenture

under Trust Indenture Act of 1939. |

| |

|

| 107.1* |

Filing fee table. |

| ** | To be filed by amendment or as an exhibit

to a document filed under the Securities Exchange Act of 1934, as amended, and incorporated

by reference herein. |

| *** | To be filed separately pursuant to Section 305(b)(2) of

the Trust Indenture Act of 1939, as amended, and the appropriate rules and regulations

thereunder. |

The undersigned registrant

hereby undertakes:

| 1) | To file, during any period in which offers

or sales are being made, a post-effective amendment to this registration statement: (i) to

include any prospectus required by Section 10(a)(3) of the Securities Act; (ii) to

reflect in the prospectus any facts or events arising after the effective date of the registration

statement (or the most recent post-effective amendment thereof) which, individually or in

the aggregate, represent a fundamental change in the information set forth in the registration

statement. Notwithstanding the foregoing, any increase or decrease in volume of securities

offered (if the total dollar value of securities offered would not exceed that which was

registered) and any deviation from the low or high end of the estimated maximum offering

range may be reflected in the form of prospectus filed with the Commission, pursuant to Rule 424(b) if,

in the aggregate, the changes in volume and price represent no more than 20 percent change

in the maximum aggregate offering price set forth in the “Calculation of Filing Fee

Tables” or “Calculation of the Registration Fee” table, as applicable,

in the effective registration statement; and (iii) to include any material information

with respect to the plan of distribution not previously disclosed in the registration statement

or any material change to such information in the registration statement; |

Provided, however, that paragraphs

(1)(i), (1)(ii) and (1)(iii) do not apply if the information required to be included in a post-effective amendment by those

paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or Section 15(d) of

the Exchange Act, that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant

to Rule 424(b) that is part of the registration statement

| 2) | That, for the purpose of determining

any liability under the Securities Act, each such post-effective amendment shall be deemed

to be a new registration statement relating to the securities offered therein, and the offering

of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

| 3) | To remove from registration by means

of a post-effective amendment any of the securities being registered which remain unsold

at the termination of the offering. |

| 4) | That, for the purpose of determining

liability under the Securities Act to any purchaser: |

| i. | Each prospectus filed by the registrant

pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement

as of the date the filed prospectus was deemed part of and included in the registration statement;

and |

| ii. | Each prospectus required to be filed pursuant

to Rule 424(b)(2), (b)(5) or (b)(7) as part of a registration statement in

reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i),

(vii) or (x) for the purpose of providing the information required by Section 10(a) of

the Securities Act shall be deemed to be part of and included in the registration statement

as of the earlier of the date such form of prospectus is first used after effectiveness or

the date of the first contract of sale of securities in the offering described in prospectus.

As provided in Rule 430B, for liability purposes of the issuer and any person that is

at that date an underwriter, such date shall be deemed to be a new effective date of the

registration statement relating to the securities in the registration statement to which

the prospectus relates, and the offering of such securities at that time shall be deemed

to be the initial bona fide offering thereof. Provided, however , that no statement made

in a registration statement or prospectus that is part of the registration statement or made

in a document incorporated or deemed incorporated by reference into the registration statement

or prospectus that is part of the registration statement will, as to a purchaser with a time

of contract of sale prior to such effective date, supersede or modify any statement that

was made in the registration statement or prospectus that was part of the registration statement

or made in any such document immediately prior to such effective date. |

| 5) | That, for the purpose of determining

liability of the registrant under the Securities Act to any purchaser in the initial distribution

of the securities, the undersigned registrant undertakes that in a primary offering of securities

of the undersigned registrant pursuant to this registration statement, regardless of the

underwriting method used to sell the securities to the purchaser, if the securities are offered

or sold to such purchaser by means of any of the following communications, the undersigned

registrant will be a seller to the purchaser and will be considered to offer or sell such

securities to such purchaser: |

| i. | Any preliminary prospectus or prospectus

of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424; |

| ii. | Any free writing prospectus relating to

the offering prepared by or on behalf of the undersigned registrant or used or referred to

by the undersigned registrant; |

| iii. | The portion of any other free writing

prospectus relating to the offering containing material information about the undersigned

registrant or its securities provided by or on behalf of an undersigned registrant; and |

| iv. | Any other communication that is an offer

in the offering made by the undersigned registrant to the purchaser. |

| 6) | The undersigned registrant hereby undertakes

that, for purposes of determining any liability under the Securities Act, each filing of

the registrant’s annual report pursuant to section 13(a) or section 15(d) of

the Exchange Act (and, where applicable, each filing of an employee benefit plan’s

annual report pursuant to section 15(d) of the Exchange Act) that is incorporated by

reference in the registration statement shall be deemed to be a new registration statement

relating to the securities offered therein, and the offering of such securities at that time

shall be deemed to be the initial bona fide offering thereof. |

| 7) | Insofar as indemnification for liabilities

arising under the Securities Act may be permitted to directors, officers and controlling

persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant

has been advised that in the opinion of the Securities and Exchange Commission such indemnification

is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

In the event that a claim for indemnification against such liabilities (other than the payment

by the registrant of expenses incurred or paid by a director, officer or controlling person

of the registrant in the successful defense of any action, suit or proceeding) is asserted

by such director, officer or controlling person in connection with the securities being registered,

the registrant will, unless in the opinion of its counsel the matter has been settled by

controlling precedent, submit to a court of appropriate jurisdiction the question whether

such indemnification by it is against public policy as expressed in the Act and will be governed

by the final adjudication of such issue. |

| 8) | The undersigned registrant hereby undertakes

to file an application for the purpose of determining the eligibility of the trustee to act

under subsection (a) of Section 310 of the Trust Indenture Act in accordance with

the rules and regulations prescribed by the Commission under Section 305(b)(2) of

the Trust Indenture Act. |

SIGNATURES

Pursuant to the requirements

of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements

for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto

duly authorized in the City of Ridgefield Park, State of New Jersey, on August 8, 2024.

| |

INNODATA INC. |

| |

|

| |

By: |

/s/ Jack S. Abuhoff |

| |

|

Jack S. Abuhoff |

| |

|

Chief Executive Officer and President |

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE

PRESENTS, that each person whose signature appears below constitutes and appoints Jack S. Abuhoff and Marissa B. Espineli, and each of

them, the undersigned’s true and lawful attorneys-in-fact and agents, with full power of substitution and revocation, for and in

the undersigned’s name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments)

to this registration statement and any registration statement filed pursuant to Rule 462(b) under the Securities Act, and to

file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission, granting

unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite

and necessary to be done, as fully to all intents and purposes as the undersigned might or could do in person, hereby ratify and confirming

all that said attorneys-in-fact and agents or any of them, or their or his substitutes, may lawfully do or cause to be done by virtue

thereof.

Pursuant to the requirements

of the Securities Exchange Act, as amended, this registration statement has been signed below by the following persons on behalf of the

registrant and in the capacities indicated on the date listed below.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/ Jack S. Abuhoff |

|

Chief Executive Officer and President (Principal Executive Officer) |

|

August 8, 2024 |

| Jack S. Abuhoff |

|

|

|

|

| |

|

|

|

|

| /s/ Marissa B. Espineli |

|

Interim Chief Financial Officer

|

|

August 8, 2024 |

| Marissa B. Espineli |

|

(Principal Financial Officer and Principal Accounting Officer) |

|

|

| |

|

|

|

|

| /s/ Louise C. Forlenza |

|

Director |

|

August 8, 2024 |

| Louise C. Forlenza |

|

|

|

|

| |

|

|

|

|

| /s/ Stewart R. Massey |

|

Director |

|

August 8, 2024 |

| Stewart R. Massey |

|

|

|

|

| |

|

|

|

|

| /s/ Nauman (Nick) Toor |

|

Director (Chairman) |

|

August 8, 2024 |

| Nauman (Nick) Toor |

|

|

|

|

Exhibit 5.1

August 8, 2024

Innodata Inc.

55 Challenger Road

Ridgefield Park, New Jersey 07660

Re: Registration Statement on Form S-3

of Innodata Inc.

Ladies and Gentlemen:

We have acted as counsel to Innodata Inc., a Delaware corporation

(the “Company”), in connection with a Registration Statement on Form S-3 filed by the Company on August 8,

2024 (as may be amended, the “Registration Statement”) with the Securities and Exchange Commission under the Securities

Act of 1933, as amended (the “Act”).