Form 8-K - Current report

November 12 2024 - 8:00AM

Edgar (US Regulatory)

false

0001007019

0001007019

2024-11-11

2024-11-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): November 11, 2024

COFFEE

HOLDING CO., INC.

(Exact

Name of Registrant as Specified in its Charter)

| Nevada |

|

001-32491 |

|

11-2238111 |

| (State

or Other Jurisdiction

|

|

(Commission |

|

(IRS

Employer |

| of Incorporation) |

|

File

Number) |

|

Identification

No.) |

| 3475

Victory Boulevard, Staten Island, New York |

|

10314 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code (718) 832-0800

Not

Applicable

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange where registered |

| Common

Stock, par value $0.001 per share |

|

JVA |

|

Nasdaq

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

| Item

7.01 | Regulation

FD Disclosure. |

On

November 11, 2024, Coffee Holding Co., Inc. (the “Company”) issued a press release announcing the completion of the

purchase of certain assets. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

On

November 11, 2024, the Company announced that it purchased all of the assets of Empire Coffee Company (“Empire”) based in

Port Chester, NY. The purchase was made under Article 9 of the UCC and consists of Empire’s inventory, equipment, accounts

receivable, customer list and all intellectual property. The purchase price of $800,000 was negotiated between Coffee Holding and Empire’s

former lender and was paid on November 7, 2024. Coffee also entered into a new lease for Empire’s property on

the same day.

| Item

9.01 | Financial

Statements and Exhibits. |

(d)

Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

COFFEE

HOLDING CO., INC. |

| |

|

|

| |

By: |

/s/

Andrew Gordon |

| |

Name: |

Andrew

Gordon |

| |

Title: |

President

and Chief Executive Officer |

| |

|

|

| Date:

November 12, 2024 |

|

|

Exhibit 99.1

Coffee

Holding Co., Inc. Announces the Purchase of Assets of Empire Coffee Company

Staten

Island, NY, November 11, 2024 — Coffee Holding Co., Inc. (NASDAQ: JVA) (“Coffee Holding”), a publicly traded integrated

wholesale coffee roaster and dealer located in the United States announced today that it purchased all of the assets of Empire Coffee

Company (“Empire”) based in Port Chester, NY. The purchase was made under Article 9 of the UCC and consists of Empire’s

inventory, equipment, accounts receivable, customer list and all intellectual property. To facilitate the purchase, Coffee Holding

created a new wholly owned subsidiary named Second Empire. Operations will be conducted by Second Empire. The purchase price of $800,000

was negotiated between Coffee Holding and Empire’s former lender and was paid on November 7, 2024. Coffee Holding also entered

into a new lease for Empire’s property on the same day.

“We

have known the principals at Empire for over forty years,” said Andrew Gordon, President and CEO of Coffee Holding. “Unfortunately,

Empire never fully recovered from the Covid-19 shutdowns and the changes in consumer buying patterns that accompanied these shutdowns.

The fact that we were able to complete a transaction allowing us to operate a first-class turnkey manufacturing facility where we are

currently servicing some of our customers is a big win for us. We believe the purchase price represents about $0.60 on the dollar for

the assets’ true value and we believe given our proven ability as an operator, we can quickly improve upon Empire’s recent

performance and ramp up operations and return them to pre-Covid levels of annual revenue. Unlike our past Steep/Generations

acquisition, we plan on controlling the day to day decision making and operations of Second Empire to ensure the success of the venture.

In addition, we believe the ownership of this entity will result in both manufacturing and other cost savings almost immediately,

as well as giving us the flexibility in the near term to explore greater future savings in our other existing facilities,”

continued Andrew Gordon.

About

Coffee Holding

Founded

in 1971, Coffee Holding Co., Inc. (NASDAQ: JVA) is a leading integrated wholesale coffee roaster and dealer in the United States and

one of the few coffee companies that offers a broad array of coffee products across the entire spectrum of consumer tastes, preferences

and price points. Coffee Holding’s product offerings consist of eight proprietary brands, each targeting a different segment of

the consumer coffee market as well as roasting and blending coffees for major wholesalers and retailers throughout the United States

who want to have products under their own names to compete with national brands. In addition to selling roasted coffee, Coffee Holding

Co., Inc. also imports green coffee beans from around the world which it resells to smaller regional roasters and coffee shops around

the United States and Canada.

Forward-Looking

Statements

Any

statements that are not historical facts contained in this release are “forward-looking statements” within the meaning of

the Private Securities Litigation Reform Act of 1995, including the Company’s outlook on the revenue growth. Forward-looking statements

include statements with respect to our beliefs, plans, objectives, goals, expectations, anticipations, assumptions, estimates, intentions,

and future performance, and involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which

may cause our actual results, performance or achievements to be materially different from future results, performance or achievements

expressed or implied by such forward-looking statements. All statements other than statements of historical fact are statements that

could be forward-looking statements. We have based these forward-looking statements upon information available to management as of the

date of this release and management’s expectations and projections about certain future events. It is possible that the assumptions

made by management for purposes of such statements may not materialize. Such statements may involve risks and uncertainties, including

but not limited to those relating to product demand, pricing, market acceptance, hedging activities, the effect of economic conditions,

intellectual property rights, the outcome of competitive products, risks in product development, the results of financing efforts, the

ability to complete transactions and other factors discussed from time to time in the Company’s Securities and Exchange Commission

filings. The Company undertakes no obligation to update or revise any forward-looking statement for events or circumstances after the

date on which such statement is made.

For

further information, contact:

Coffee

Holding Co., Inc.

Andrew

Gordon

President

& CEO

(718)

832-0800

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

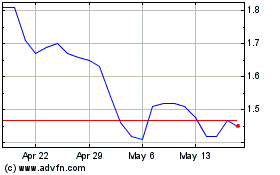

Coffee (NASDAQ:JVA)

Historical Stock Chart

From Jan 2025 to Feb 2025

Coffee (NASDAQ:JVA)

Historical Stock Chart

From Feb 2024 to Feb 2025