Kaival Brands Innovations Group, Inc. (NASDAQ:

KAVL) ("Kaival Brands" or the "Company,"), the exclusive U.S.

distributor of all products manufactured by Bidi Vapor, LLC ("Bidi

Vapor"), on Monday announced its financial results for the fiscal

2024 first quarter ended January 31, 2024 and provided a business

update.

Recent Business Highlights

- Reduced net

inventories to $2.1 million as of January 31, 2024, down 49.5% from

$4.1 million as of October 31, 2023.

- Terminated

service agreement with QuikFillRx (d/b/a Kaival Marketing

Services), the third-party service provider responsible for

increasing sales of Bidi Sticks, effective February 22, 2024. This

action is expected to save the Company more than $1.5 million in

expenses annually.

- Appointed

Nirajkumar Patel, the Company’s Chief Science and Regulatory

Officer, as the Company’s Chief Executive Officer.

- Appointed Eric

Morris as the Company’s Interim Chief Financial Officer.

Management Comments

Nirajkumar Patel, Chief Executive Officer and

Chief Science and Regulatory Officer of Kaival Brands, stated,

“After serving as an employee and non-committee Board member for

the last two years, I have stepped into the role of CEO to redirect

the Company’s efforts and focus our energy and resources on

initiatives that will enable us to move forward. First, let me

assure you, the team at Kaival remains focused on preserving and

improving shareholder value. We have experienced a number of

stalled starts related to the FDA’s denial of Bidi Vapor’s

premarket tobacco product application (PMTA) for Bidi Vapor’s

“Classic” tobacco-flavored BIDI® Stick ENDS device, and (which

denial Bidi is appealing), we are navigating a number of

transitions. However, we continue to believe there is tremendous

value related to our international business as well as new,

potential opportunities to monetize the extensive and valuable

inhalation patent portfolio that we acquired from GoFire, Inc. in

May of last year. The purchase of the portfolio marked the

beginning of our diversification efforts and move away from sole

reliance on revenues from the sales of Bidi Sticks. Our efforts to

explore profitability of this portfolio are underway, and we are

incredibly energized by the interest and revenue opportunities we

believe could be available to us through this portfolio.”

Patel continued, “We have engaged an outside

firm to assist us in exploring strategic alternatives. Kaival

Brands International, LLC (‘KBI’), is not included within the scope

of consideration. We remain committed to our multi-national

licensing partner and our shared interest in delivering a portfolio

of smoke-free products. We are optimistic that refining our

strategic focus will enable us to diversify, reduce business risk

and better optimize our financial results as we move forward.”

Engaged Maxim Group LLC to explore strategic

alternatives of the parent company, excluding Kaival Brands

International, the Company’s subsidiary that is party to its

international licensing agreement.

Financial Results for Fiscal First

Quarter 2024

Revenues: Revenues for the

first quarter of fiscal year 2024 were $3.2 million, compared to

$2.5 million in the same period of the prior fiscal year. Revenues

increased in the first quarter of 2024, primarily due to a decrease

in credits being issued to customers.

Cost of Revenue, Net, and Gross

Profit: Gross profit in the first quarter of fiscal year

2024 was approximately $1.2 million, or approximately 37.3% of

revenues, net, compared to approximately $0.5 million gross profit

or approximately 21.4%, of revenues, net, for the first quarter of

fiscal year 2023. Total cost of revenue, net was approximately $2.0

million, or approximately 62.7% of revenue, net for the first

quarter of fiscal year 2024, compared to approximately $2.0

million, or approximately 78.6% of revenue, net for the first

quarter of fiscal year 2023. The increase in gross profit is due to

fewer credits granted in current year

Operating Expenses: Total

operating expenses were approximately $2.9 million for the first

quarter of fiscal year 2024, compared to approximately $3.5 million

for the first quarter of fiscal year 2023. For the first quarter of

fiscal year 2024, operating expenses consisted primarily of

advertising and promotion fees of approximately $0.4 million, stock

option expense of approximately $0.3 million, professional fees of

approximately $0.8 million, and all other general and

administrative expenses of approximately $1.4 million. General and

administrative expenses in the first quarter of fiscal year 2024

consisted primarily of salaries and wages, insurance, lease

expense, project expenses, banking fees, business fees and state

and franchise taxes. For the first quarter of fiscal year 2023,

operating expenses consisted primarily of advertising and promotion

fees of approximately $0.6 million, stock option expense of

approximately $1.4 million, professional fees of approximately $0.6

million, and all other general and administrative expenses of

approximately $0.9 million. General and administrative expenses in

the first quarter of fiscal year 2023 consisted primarily of

salaries and wages, insurance, lease expense, project expenses,

banking fees, business fees and state and franchise taxes. We

expect future operating expenses to increase while we increase the

footprint of our business and generate increased sales

growth.

Net Loss: As a result of the

items noted above, the net loss for the first quarter of fiscal

year 2024 was approximately $2.2 million, or $0.76 basic and

diluted net loss per share, compared to a net loss of approximately

$3.0 million, or $1.12 basic and diluted net loss per share, for

the first quarter of fiscal year 2023. The decrease in the net loss

for the first quarter of fiscal year 2024, as compared to the first

quarter of fiscal year 2023, is primarily attributable to the

increase in revenues and decrease in operating expenses as noted

above.

Cash Position: As of January

31, 2024, the Company had working capital of $0.3 million and total

cash of $0.6 million compared to working capital of [*] and a total

cash of [*] as of January 31, 2023. .

Additional information regarding the Company’s

results of operations for the first quarter ended January 31, 2024,

is available in the Company’s Quarterly Report on Form 10-Q for

such reporting period, which has been filed with the Securities and

Exchange Commission.

ABOUT KAIVAL BRANDS

Based in Grant-Valkaria, Florida, Kaival Brands

is a company focused on incubating and commercializing innovative

products into mature and dominant brands, with a current focus on

the distribution of electronic nicotine delivery systems (ENDS)

also known as “e-cigarettes” for use by customers 21 years and

older. Our business plan is to seek to diversify into distributing

other nicotine and non-nicotine delivery system products (including

those related to hemp-derived cannabidiol (known as CBD) products).

Kaival Brands and Philip Morris Products S.A. (via sublicense from

Kaival Brands) are the exclusive global distributors of all

products manufactured by Bidi Vapor LLC. Based in Melbourne,

Florida, Bidi Vapor maintains a commitment to responsible,

adult-focused marketing, supporting age-verification standards and

sustainability through its BIDI® Cares recycling program. Bidi

Vapor's premier device, the BIDI® Stick, which is distributed

exclusively by Kaival Brands, is a premium product made with

high-quality components, a UL-certified battery and technology

designed to deliver a consistent vaping experience for adult

smokers 21 and over. Nirajkumar Patel, the Company’s Chief

Executive Officer and director, owns and controls Bidi Vapor. As a

result, Bidi Vapor is considered a related party of the

Company.

Learn more about Kaival Brands at

https://ir.kaivalbrands.com/overview/default.aspx.

ABOUT KAIVAL LABS

Based in Grant-Valkaria, Florida, Kaival Labs is

a wholly-owned subsidiary of Kaival Brands focused on developing

new branded and white-label products and services in the vaporizer

and inhalation technology sectors. Kaival Labs’ current patent

portfolio consists of 19 existing and 47 pending with novel

technologies across extrusion dose control, product preservation,

tracking and tracing usage, multiple modalities and child safety.

The patents and patent applications cover territories including the

United States, Australia, Canada, China, the European Patent

Organisation, Israel, Japan, Mexico, New Zealand and South Korea.

The portfolio also includes a fully-functional proprietary mobile

device software application that is used in conjunction with

certain patents in the portfolio.

Learn more about Kaival Labs at

https://kaivallabs.com.

Cautionary Note Regarding

Forward-Looking Statements

This press release and the statements of the

Company’s management and partners included herein and related to

the subject matter herein includes statements that constitute

“forward-looking statements” (as defined in Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended), which are statements

other than historical facts. You can identify forward-looking

statements by words such as “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,”

“position,” “should,” “strategy,” “target,” “will,” and similar

words. All forward-looking statements speak only as of the date of

this press release. Although we believe that the plans, intentions,

and expectations reflected in or suggested by the forward-looking

statements are reasonable, there is no assurance that these plans,

intentions, or expectations will be achieved. Therefore, actual

outcomes and results could materially and adversely differ from

what is expressed, implied, or forecasted in such statements. Our

business may be influenced by many factors that are difficult to

predict, involve uncertainties that may materially affect results,

and are often beyond our control. Factors that could cause or

contribute to such differences include, but are not limited to: (i)

actions taken by Bidi Vapor and the courts in response to the FDA’s

January 2024 MDO on its Classic Bidi Stick, (ii) future actions by

the FDA relating to the PMTAs for Bidi Vapor’s 10 other flavors

that could adversely impact our business and prospects, including

the outcome of FDA’s scientific review of Bidi Vapor’s pending

PMTAs, (iii) the results of international marketing and sales

efforts by Philip Morris International, the Company’s international

distribution partner, (iv) how quickly domestic and international

markets adopt our products, (v) the scope of future FDA enforcement

of regulations in the ENDS industry, (vi) the FDA’s approach to the

regulation of synthetic nicotine and its impact on our business,

(vii) potential federal and state flavor bans and other

restrictions on ENDS products, (viii) general economic uncertainty

in key global markets and a worsening of geopolitical and economic

conditions, including low levels of economic growth, (ix) the

effects of steps that we are taking to raise capital, reduce

operating costs and diversity our product offerings, (x) our

inability to generate and sustain profitable sales growth,

including sales growth in U.S. and international markets, (xi)

circumstances or developments that may make us unable to implement

or realize anticipated benefits, or that may increase the costs, of

our current and planned business initiatives, (xii) significant

changes in our relationships with our distributors or

sub-distributors and (xiii) other factors detailed by us in our

public filings with the Securities and Exchange Commission,

including the disclosures under the heading “Risk Factors” in our

Annual Report on Form 10-K for the fiscal year ended October 31,

2023, filed with the Securities and Exchange Commission on February

14, 2024 and our subsequent Quarterly Reports on Form 10-Q and

accessible at www.sec.gov. All forward-looking statements included

in this press release are expressly qualified in their entirety by

such cautionary statements. Except as required under the federal

securities laws and the Securities and Exchange Commission’s rules

and regulations, we do not have any intention or obligation to

update any forward-looking statements publicly, whether as a result

of new information, future events, or otherwise.

Contact:Brett Maas, Managing

PartnerHayden IR(646) 536-7331brett@haydenir.com

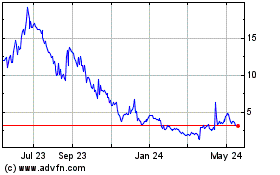

Kaival Brands Innovations (NASDAQ:KAVL)

Historical Stock Chart

From Dec 2024 to Jan 2025

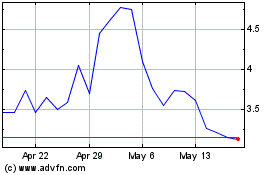

Kaival Brands Innovations (NASDAQ:KAVL)

Historical Stock Chart

From Jan 2024 to Jan 2025