El Pollo Loco Holdings, Inc. (Nasdaq: LOCO) today announced

financial results for the 13-week period ended

March 27, 2024.

Highlights for the first quarter ended

March 27, 2024 compared to the first quarter ended

March 29, 2023 were as follows:

- Total revenue was

$116.2 million compared to $114.5 million.

- System-wide comparable

restaurant sales(1)

increased by 5.1%.

- Income from

operations was $9.7 million compared to $7.8 million.

- Restaurant

contribution(1) was

$17.1 million, or 17.6% of company-operated restaurant revenue,

compared to $14.7 million, or 15.0% of company-operated restaurant

revenue.

- Net income was

$5.9 million, or $0.19 per diluted share, compared to net

income of $4.9 million, or $0.13 per diluted share.

- Adjusted net

income(1) was

$6.8 million, or $0.22 per diluted share, compared to

$4.9 million, or $0.14 per diluted share.

- Adjusted

EBITDA(1) was $15.7

million, compared to $12.2 million.

|

(1) |

System-wide

comparable restaurant sales, restaurant contribution, adjusted net

income and adjusted EBITDA are not presented in accordance with

accounting principles generally accepted in the United States of

America (“GAAP”) and are defined below under “Definitions of

Non-GAAP and other Key Financial Measures” below. A reconciliation

of these non-GAAP financial measures to the most directly

comparable GAAP financial measure is included in the accompanying

financial data. See also “Non-GAAP Financial Measures” below. |

Liz Williams, Chief Executive Officer of El

Pollo Loco Holdings, Inc., stated, “The strength of the El

Pollo Loco brand centers around our signature product –

fire-grilled, citrus-marinated chicken that is prepared fresh daily

for our customers. Since starting as CEO almost two months ago, I

have been impressed with the brand’s beloved status among customers

and our long-term potential for growth. With our unique positioning

at the intersection of the Chicken and Mexican categories, I

believe that we can take El Pollo Loco to another level. To that

end, I have focused our organization around five strategic pillars:

Brand that Wins, Hospitality Mindset, Digital First, Winning Unit

Economics, and New Unit Growth, all of which are designed with one

goal in mind – to get the right building blocks in place for future

success. El Pollo Loco should be and will be a national brand, and

I believe we have the right strategy in place to achieve our

immense potential.”

First Quarter 2024 Financial Results

Company-operated restaurant revenue in the first

quarter of 2024 decreased to $97.2 million, compared to $97.9

million in the first quarter of 2023, mainly due to a $5.0 million

decrease in revenue primarily from

the 18 company-operated restaurants sold by the Company

to existing franchisees and a $0.1 million decrease in revenue

recognized for our loyalty points program. This company-operated

restaurant revenue decrease was partially offset by $0.8 million of

additional sales from restaurants opened during or after the first

quarter of 2023 as well as an increase in company-operated

comparable restaurant revenue of $3.5 million, or 3.8%. The

company-operated comparable restaurant sales increase consisted of

a 2.5% increase in average check size due to increases in menu

prices and an approximately 1.2% increase in transactions.

Franchise revenue in the first quarter of 2024

increased 17.3% to $11.3 million. This increase was primarily due

to revenue generated from 18 company-operated restaurants

sold by the Company to existing franchisees and the opening of

three restaurants, in each case, during or subsequent to the first

quarter of 2023. In addition, this increase was due to a

franchise comparable restaurant sales increase of 5.9%.

Income from operations in the first quarter of

2024 was $9.7 million, compared to $7.8 million in the first

quarter of 2023. Restaurant contribution was $17.1 million, or

17.6% of company-operated restaurant revenue, compared to $14.7

million, or 15.0% of company-operated restaurant revenue in the

first quarter of 2023. The increase in restaurant contribution as a

percentage of company-operated restaurant revenue was largely due

to higher menu prices combined with better operating

efficiencies.

General and administrative expenses in the first

quarter of 2024 was $11.9 million, compared to $11.2 million in the

first quarter of 2023. The increase was due primarily to a

$0.5 million increase in restructuring costs related to

certain positions in the organization and a $0.6 million

increase in executive transition costs. The increase in general and

administrative expenses for quarter was offset by a $0.3 million

decrease in legal fees.

Net income for the first quarter of 2024

was $5.9 million, or $0.19 per diluted share,

compared to net income of $4.9 million, or $0.13 per

diluted share, in the first quarter of 2023. Adjusted net income

was $6.8 million, or $0.22 per diluted share, during the

first quarter of 2023, compared to $4.9 million,

or $0.14 per diluted share, during the first quarter of

2023.

As of March 27, 2024, after pay downs

of $4.0 million on its five-year senior-secured revolving credit

facility during the first quarter, the Company’s outstanding debt

balance was $80.0 million with $9.1 million in cash and cash

equivalents. Additionally, during the first quarter, the Company

repurchased 136,400 shares of common stock under its 2023

Share Repurchase Program, using open market purchases, for total

consideration of approximately $1.2 million. Following

completion of these repurchases, approximately $6.2 million of the

Company’s common stock remained available for repurchase under the

Share Repurchase Program at March 27, 2024.

Subsequent Events

Further, the Company paid down $5.0 million

on its 2022 Revolver resulting in outstanding borrowings as of May

2, 2024 of $75.0 million.

2024 Outlook

The Company is providing the following expectations for the

remainder of 2024:

- The opening of two new company-owned

restaurants and five to seven new franchised restaurants.

- Capital spend of $25.0 - $28.0 million.

- G&A expense between $45.0 and $47.0 million excluding

one-time charges.

- Adjusted income tax rate of 27.0 –

28.0%.

Definitions of Non-GAAP and other Key Financial

Measures

System-Wide Sales are neither

required by, nor presented in accordance with, GAAP. System-wide

sales are the sum of company-operated restaurant revenue and sales

from franchised restaurants. The Company’s total revenue in the

consolidated statements of income is limited to company-operated

restaurant revenue and franchise revenue from the Company’s

franchisees. Accordingly, system-wide sales should not be

considered in isolation or as a substitute for our results as

reported under GAAP. Management believes that the presentation of

system-wide sales provides useful information to investors because

it is a measure that is widely used in the restaurant industry,

including by our management, to evaluate brand scale and market

penetration.

Company-Operated Restaurant

Revenue consists of sales of food and beverages in

company-operated restaurants net of promotional allowances,

employee meals, and other discounts. Company-operated restaurant

revenue in any period is directly influenced by the number of

operating weeks in such period, the number of open restaurants, and

comparable restaurant sales. Seasonal factors and the timing of

holidays cause our revenue to fluctuate from quarter to quarter.

Our revenue per restaurant is typically lower in the first and

fourth quarters due to reduced January and December transactions

and higher in the second and third quarters. As a result of

seasonality, our quarterly and annual results of operations and key

performance indicators such as company-operated restaurant revenue

and comparable restaurant sales may fluctuate.

Comparable Restaurant Sales

reflect year-over-year sales changes for comparable

company-operated, franchised and system-wide restaurants. A

restaurant enters our comparable restaurant base the first full

week after it has operated for 15 months. Comparable restaurant

sales exclude restaurants closed during the applicable period. At

March 27, 2024, there were 478 comparable restaurants,

168 company-operated and 310 franchised. Comparable restaurant

sales indicate the performance of existing restaurants, since new

restaurants are excluded. Comparable restaurant sales growth can be

generated by an increase in the number of meals sold and/or by

increases in the average check size, resulting from a shift in menu

mix and/or higher prices resulting from new products or price

increases. Because other companies may calculate this measure

differently than we do, comparable restaurant sales as presented

herein may not be comparable to similarly titled measures reported

by other companies. Management believes that comparable restaurant

sales is a valuable metric for investors to evaluate the

performance of our store base, excluding the impact of new stores

and closed stores.

Restaurant Contribution and

Restaurant Contribution Margin are neither

required by, nor presented in accordance with, GAAP. Restaurant

contribution is defined as company-operated restaurant revenue less

company restaurant expenses, which includes food and paper cost,

labor and related expenses, and occupancy and other operating

expenses, where applicable. Restaurant contribution therefore

excludes franchise revenue, franchise advertising fee revenue and

franchise expenses as well as certain other costs, such as general

and administrative expenses, franchise expenses, depreciation and

amortization, impairment and closed-store reserve, loss on disposal

of assets and other costs that are considered corporate-level

expenses and are not considered normal operating costs of our

restaurants. Accordingly, restaurant contribution is not indicative

of overall Company results and does not accrue directly to the

benefit of stockholders because of the exclusion of certain

corporate-level expenses. Restaurant contribution margin is defined

as restaurant contribution as a percentage of net

company-operated restaurant revenue. Restaurant contribution and

restaurant contribution margin are supplemental measures of

operating performance of our restaurants, and our calculations

thereof may not be comparable to those reported by other companies.

Restaurant contribution and restaurant contribution margin have

limitations as analytical tools, and you should not consider them

in isolation, or superior to, or as substitutes for the analysis of

our results as reported under GAAP. Management uses restaurant

contribution and restaurant contribution margin as key metrics to

evaluate the profitability of incremental sales at our restaurants,

to evaluate our restaurant performance across periods, and to

evaluate our restaurant financial performance compared with our

competitors. Management believes that restaurant contribution and

restaurant contribution margin are important tools for investors,

because they are widely-used metrics within the restaurant industry

to evaluate restaurant-level productivity, efficiency, and

performance. Management further believes restaurant level operating

margin is useful to investors to highlight trends in our core

business that may not otherwise be apparent to investors when

relying solely on GAAP financial measures.

EBITDA and Adjusted

EBITDA are neither required by, nor presented in

accordance with, GAAP. EBITDA represents net income (loss) before

interest expense, provision (benefit) for income taxes,

depreciation, and amortization, and adjusted EBITDA represents net

income (loss) before interest expense, provision (benefit) for

income taxes, depreciation, amortization, and items that we do not

consider representative of our ongoing operating performance, as

identified in the reconciliation table included under “Unaudited

Reconciliation of Net Income to EBITDA and Adjusted EBITDA” in the

accompanying financial tables at the end of this release. EBITDA

and adjusted EBITDA as presented in this release are supplemental

measures of our performance that are neither required by, nor

presented in accordance with, GAAP. EBITDA and adjusted EBITDA are

not measurements of our financial performance under GAAP and should

not be considered as alternatives to net income, operating income,

or any other performance measures derived in accordance with GAAP,

or as alternatives to cash flow from operating activities as a

measure of our liquidity. In addition, in evaluating EBITDA and

adjusted EBITDA, you should be aware that in the future we will

incur expenses or charges such as those added back to calculate

EBITDA and adjusted EBITDA. Our presentation of EBITDA and adjusted

EBITDA should not be construed as an inference that our future

results will be unaffected by unusual or nonrecurring items.

EBITDA and adjusted EBITDA have limitations as

analytical tools, and you should not consider them in isolation, or

as substitutes for analysis of our results as reported under GAAP.

Some of these limitations are (i) they do not reflect our cash

expenditures, or future requirements for capital expenditures or

contractual commitments, (ii) they do not reflect changes in, or

cash requirements for, our working capital needs, (iii) they do not

reflect interest expense, or the cash requirements necessary to

service interest or principal payments, on our debt, (iv) although

depreciation and amortization are non-cash charges, the assets

being depreciated and amortized will often have to be replaced in

the future, and EBITDA and adjusted EBITDA do not reflect any cash

requirements for such replacements, (v) they do not adjust for all

non-cash income or expense items that are reflected in our

statements of cash flows, (vi) they do not reflect the impact of

earnings or charges resulting from matters we consider not to be

indicative of our on-going operations, and (vii) other companies in

our industry may calculate these measures differently than we do,

limiting their usefulness as comparative measures. We compensate

for these limitations by providing specific information regarding

the GAAP amounts excluded from such non-GAAP financial measures. We

further compensate for the limitations in our use of non-GAAP

financial measures by presenting comparable GAAP measures more

prominently.

Management believes that EBITDA and adjusted

EBITDA facilitate operating performance comparisons from period to

period by isolating the effects of some items that vary from period

to period without any correlation to core operating performance or

that vary widely among similar companies. These potential

differences may be caused by variations in capital structures

(affecting interest expense), tax positions (such as the impact on

periods or companies of changes in effective tax rates or NOLs) and

the age and book depreciation of facilities and equipment

(affecting relative depreciation expense). We also present EBITDA

and adjusted EBITDA because (i) management believes that these

measures are frequently used by securities analysts, investors and

other interested parties to evaluate companies in our industry,

(ii) management believes that investors will find these measures

useful in assessing our ability to service or incur indebtedness,

and (iii) we use EBITDA and adjusted EBITDA internally as benchmark

to compare our performance to that of our competitors.

Adjusted Net Income is

neither required by, nor presented in accordance with, GAAP.

Adjusted net income represents net income adjusted for

(i) costs (or gains) related to loss (or gains) on disposal of

assets or assets held for sale and asset impairment and closed

store costs reserves, (ii) amortization expense and other

estimate adjustments (whether expense or income) incurred on the

Tax Receivable Agreement (“TRA”) completed at the time of our IPO,

(iii) legal costs associated with securities class action

litigation, (iv) extraordinary legal settlement costs,

(v) insurance proceeds received related to securities class

action legal expenses and (vi) provision for income taxes at a

normalized tax rate of 27.1% for the thirteen weeks ended

March 27, 2024 and 26.9% for the thirteen weeks ended

March 29, 2023, which reflects our estimated long-term

effective tax rate, including both federal and state income taxes

(excluding the impact of the income tax receivable agreement,

valuation allowance and other discrete items) and applied after

giving effect to the foregoing adjustments. Because other companies

may calculate these measures differently than we do, adjusted net

income as presented herein may not be comparable to similarly

titled measures reported by other companies. Management believes

adjusted net income is an important supplement to GAAP measures

that enhances the overall understanding of our operating

performance and long-term profitability, and enables investors to

more effectively compare the Company’s performance to prior and

future periods.

Conference Call

The Company will host a conference call to

discuss financial results for the first quarter of 2024 today at

4:30 PM Eastern Time. Liz Williams, Chief Executive Officer, and

Ira Fils, Chief Financial Officer, will host the call.

The conference call can be accessed live over

the phone by dialing 201-493-6780. A replay will be available after

the call and can be accessed by dialing 412-317-6671; the passcode

is 13745688. The replay will be available until Thursday, May 16,

2024. The conference call will also be webcast live from the

Company’s corporate website at investor.elpolloloco.com under the

“Events & Presentations” page. An archive of the webcast

will be available at the same location on the corporate website

shortly after the call has concluded.

About El Pollo Loco

El Pollo Loco (Nasdaq:LOCO) is the nation’s

leading fire-grilled chicken restaurant chain renowned for its

masterfully citrus-marinated, fire-grilled chicken and handcrafted

entrees using fresh ingredients inspired by Mexican recipes. With

more than 490 company-owned and franchised restaurants in Arizona,

California, Nevada, Colorado, Texas, Utah, and Louisiana, El Pollo

Loco is expanding its presence in key markets through a combination

of company and existing and new franchisee development. Visit us on

our website at www.ElPolloLoco.com.

Forward-Looking Statements

This press release contains forward-looking

statements that are subject to risks and uncertainties. All

statements other than statements of historical fact included in

this press release are forward-looking statements. Forward-looking

statements discuss our current expectations and projections

relating to our financial condition, results of operations, plans,

objectives, future performance and business. You can identify

forward-looking statements because they do not relate strictly to

historical or current facts. These statements may include words

such as “aim,” “anticipate,” “believe,” “estimate,” “expect,”

“forecast,” “outlook,” “potential,” “project,” “projection,”

“plan,” “intend,” “seek,” “may,” “could,” “would,” “will,”

“should,” “can,” “can have,” “likely,” the negatives thereof and

other words and terms of similar meaning in connection with any

discussion of the timing or nature of future operating or financial

performance or other events. They appear in a number of places

throughout this press release and include our 2024 outlook and

statements regarding the expected results of our initiatives and

our ability to capture opportunities and attract franchisees, as

well as our ongoing business intentions, beliefs or current

expectations concerning, among other things, our results of

operations, financial condition, sales levels, liquidity,

prospects, growth, strategies and the industry in which we operate.

All forward-looking statements are subject to risks and

uncertainties that could cause actual results to differ materially

from those that we expected.

While we believe that our assumptions are

reasonable, we caution that it is very difficult to predict the

impact of known factors, and it is impossible for us to anticipate

all factors that could affect our actual results. All

forward-looking statements are expressly qualified in their

entirety by these cautionary statements. You should evaluate all

forward-looking statements made in this press release in the

context of the risks and uncertainties that could cause outcomes to

differ materially from our expectations. These factors include, but

are not limited to: global economic or other business conditions

that may affect the desire or ability of our customers to purchase

our products such as inflationary pressures, high unemployment

levels, increases in gas prices, and declines in median income

growth, consumer confidence and consumer discretionary spending;

our ability to open new restaurants or establish new markets,

including difficulty in finding sites and in negotiating acceptable

leases; our ability to compete successfully, including with other

quick-service and fast casual restaurants; our vulnerability to

changes in political and economic conditions and consumer

preferences; our ability to attract, develop, assimilate, and

retain employees; our vulnerability to adverse changes in regions

where we are geographically concentrated; the possibility that we

may continue to incur significant impairment of certain of our

assets, in particular in our new markets; changes in food and

supply costs, especially for chicken, labor, construction and

utilities; social media and negative publicity, whether or not

valid, and our ability to respond to and effectively manage the

accelerated impact of social media; our ability to continue to

expand our digital business, delivery orders and catering; concerns

about food safety and quality and about food-borne illness;

dependence on frequent and timely deliveries of food and supplies;

our ability to service our level of indebtedness; the uncertainty

related to the success of our marketing programs, new menu items,

advertising campaigns and restaurant designs and remodels; adverse

changes in the economic environment, including inflation and

increased labor and supply costs, which may affect our franchisees,

with adverse consequences to us; the impacts of the uncertainty

around public health crises on our company, our employees, our

customers, our partners, our industry and the economy as a whole,

as well as our franchisees’ ability to operate their individual

restaurants without disruption; our limited control over our

franchisees and potential deterioration of our relations with

existing or potential franchisees; potential exposure to unexpected

costs and losses from our self-insurance programs; potential

obligations under long-term and non-cancelable leases, and our

ability to renew leases at the end of their terms; the possibility

that Delaware law, our organizational documents, our shareholder

rights agreement, and our existing and future debt agreements may

impede or discourage a takeover; the impact of shareholder activism

on our expenses, business and stock price; the impact of any

failure of our information technology system or any breach of our

network security; the impact of any security breaches on our

ability to protect our customers’ payment method data or personal

information; our ability to enforce and maintain our trademarks and

protect our other proprietary intellectual property; risks related

to government regulation and litigation, including employment and

labor laws and other risks set forth in our filings with the

Securities and Exchange Commission from time to time, including

under Item 1A, Risk Factors in our annual report on

Form 10-K for the year ended December 27, 2023,

as such risk factors may be amended, supplemented or superseded

from time to time by other reports we file with the Securities and

Exchange Commission, all of which are or will be available online

at www.sec.gov.

We caution you that the important factors

referenced above may not contain all of the factors that are

important to you. In addition, we cannot assure you that we will

realize the results or developments we expect or anticipate or,

even if substantially realized, that they will result in the

consequences we anticipate or affect us or our operations in the

ways that we expect. The forward-looking statements included in

this press release are made only as of the date hereof. We

undertake no obligation to publicly update or revise any

forward-looking statement as a result of new information, future

events or otherwise, except as required by law. If we do update one

or more forward-looking statements, no inference should be made

that we will make additional updates with respect to those or other

forward-looking statements. We qualify all of our forward-looking

statements by these cautionary statements.

Non-GAAP Financial Measures

To supplement our consolidated financial

statements, which are prepared and presented in accordance with

GAAP, we use the following non-GAAP financial measures that are

supplemental measures of the operating performance of our business

and restaurants: System-wide sales, Restaurant contribution and

restaurant contribution margin, EBITDA and adjusted EBITDA, and

Adjusted net income. Our calculations of these non-GAAP financial

measures may not be comparable to those reported by other

companies. These measures have limitations as analytical tools, and

are not intended to be considered in isolation or as substitutes

for, or superior to, financial measures prepared and presented in

accordance with GAAP. We use non-GAAP financial measures for

financial and operational decision-making and as a means to

evaluate period-to-period comparisons and to evaluate our

restaurants’ financial performance against our competitors’

performance. We believe these measures they provide useful

information about our operating results, enhance understanding of

past performance and future prospects, and allow for greater

transparency with respect to key metrics used by management in its

financial and operational decision making. These non-GAAP financial

measures may also assist investors in evaluating our business and

performance relative to industry peers and provide greater

transparency with respect to the Company’s financial condition and

results of operation.

Additional information about these non-GAAP

financial measures (System-wide sales, Restaurant contribution and

restaurant contribution margin, EBITDA and adjusted EBITDA, and

Adjusted net income) is provided under “Definitions of Non-GAAP and

other Key Financial Measures” above. For a reconciliations of each

of these non-GAAP financial measures to the most directly

comparable GAAP financial measure, see “Unaudited Reconciliation of

System-Wide Sales to Company-Operated Restaurant Revenue and Total

Revenue,” “Unaudited Reconciliation of Net Income to EBITDA and

Adjusted EBITDA,” “Unaudited Reconciliation of Net Income to

Adjusted Net Income” and “Unaudited Reconciliation of Income from

Operations to Restaurant Contribution” in the accompanying

financial tables at the end of this press release.

Investor Contact:Jeff

PriesterICRInvestors@elpolloloco.com

Media Contact:Glenda VaqueranoThe ID

AgencyEPLmedia@theidagency.com

EL POLLO LOCO

HOLDINGS, INC.UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF INCOME(in thousands,

except share data)

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Thirteen Weeks Ended |

| |

|

March 27, 2024 |

|

March 29, 2023 |

| |

|

$ |

|

% |

|

$ |

|

% |

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

Company-operated restaurant revenue |

|

$ |

97,153 |

|

|

83.6 |

|

|

$ |

97,873 |

|

|

85.5 |

|

|

Franchise revenue |

|

|

11,348 |

|

|

9.8 |

|

|

|

9,672 |

|

|

8.4 |

|

|

Franchise advertising fee revenue |

|

|

7,652 |

|

|

6.6 |

|

|

|

6,981 |

|

|

6.1 |

|

|

Total revenue |

|

|

116,153 |

|

|

100.0 |

|

|

|

114,526 |

|

|

100.0 |

|

|

Cost of operations: |

|

|

|

|

|

|

|

|

|

|

|

Food and paper cost (1) |

|

|

25,619 |

|

|

26.4 |

|

|

|

26,902 |

|

|

27.5 |

|

|

Labor and related expenses (1) |

|

|

30,580 |

|

|

31.5 |

|

|

|

31,541 |

|

|

32.2 |

|

|

Occupancy and other operating expenses (1) |

|

|

23,865 |

|

|

24.6 |

|

|

|

24,886 |

|

|

25.4 |

|

|

Gain on recovery of insurance proceeds, lost profits, net (1) |

|

|

— |

|

|

— |

|

|

|

(151 |

) |

|

(0.2 |

) |

|

Company restaurant expenses (1) |

|

|

80,064 |

|

|

82.5 |

|

|

|

83,178 |

|

|

84.9 |

|

| General

and administrative expenses |

|

|

11,925 |

|

|

10.3 |

|

|

|

11,199 |

|

|

9.8 |

|

|

Franchise expenses |

|

|

10,602 |

|

|

9.1 |

|

|

|

9,032 |

|

|

7.9 |

|

|

Depreciation and amortization |

|

|

3,851 |

|

|

3.3 |

|

|

|

3,637 |

|

|

3.2 |

|

| Loss on

disposal of assets |

|

|

41 |

|

|

0.0 |

|

|

|

30 |

|

|

0.0 |

|

| Gain on

recovery of insurance proceeds, property, equipment and

expenses |

|

|

(41 |

) |

|

(0.0 |

) |

|

|

(242 |

) |

|

(0.2 |

) |

| Gain on

disposition of restaurants |

|

|

— |

|

|

— |

|

|

|

(136 |

) |

|

(0.1 |

) |

|

Impairment and closed-store reserves |

|

|

32 |

|

|

0.0 |

|

|

|

77 |

|

|

0.1 |

|

|

Total expenses |

|

|

106,474 |

|

|

91.7 |

|

|

|

106,775 |

|

|

93.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from operations |

|

|

9,679 |

|

|

8.3 |

|

|

|

7,751 |

|

|

6.8 |

|

| Interest

expense, net |

|

|

1,564 |

|

|

1.3 |

|

|

|

1,004 |

|

|

0.9 |

|

| Income

tax receivable agreement income |

|

|

— |

|

|

— |

|

|

|

(122 |

) |

|

(0.1 |

) |

|

Income before provision for income taxes |

|

|

8,115 |

|

|

7.0 |

|

|

|

6,869 |

|

|

6.0 |

|

|

Provision for income taxes |

|

|

2,203 |

|

|

1.9 |

|

|

|

1,951 |

|

|

1.7 |

|

|

Net income |

|

$ |

5,912 |

|

|

5.1 |

|

|

$ |

4,918 |

|

|

4.3 |

|

|

Net income per share: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.19 |

|

|

|

|

$ |

0.14 |

|

|

|

|

Diluted |

|

$ |

0.19 |

|

|

|

|

$ |

0.13 |

|

|

|

|

Weighted average shares used in computing net income per

share: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

30,777,769 |

|

|

|

|

|

36,234,105 |

|

|

|

|

Diluted |

|

|

30,937,226 |

|

|

|

|

|

36,478,158 |

|

|

|

|

(1) |

Percentages

for line items relating to cost of operations and company

restaurant expenses are calculated with company-operated restaurant

revenue as the denominator. All other percentages use total

revenue. |

EL POLLO LOCO

HOLDINGS, INC.UNAUDITED SELECTED CONDENSED

CONSOLIDATED BALANCE SHEETS AND SELECTED OPERATING

DATA(dollar amounts in thousands)

|

|

|

|

|

|

|

|

| |

|

As of |

| |

|

March 27, 2024 |

|

December 27, 2023 |

|

Selected Balance Sheet Data: |

|

|

|

|

|

|

| Cash and

cash equivalents |

|

$ |

9,121 |

|

$ |

7,288 |

| Total

assets |

|

|

598,023 |

|

|

592,301 |

| Total

debt |

|

|

80,000 |

|

|

84,000 |

| Total

liabilities |

|

|

341,734 |

|

|

341,605 |

| Total

stockholders’ equity |

|

|

256,289 |

|

|

250,696 |

|

|

|

|

|

|

|

|

| |

|

Thirteen Weeks Ended |

| |

|

March 27, 2024 |

|

March 29, 2023 |

|

Selected Operating Data: |

|

|

|

|

|

|

|

Company-operated restaurants at end of period |

|

|

172 |

|

|

187 |

|

Franchised restaurants at end of period |

|

|

323 |

|

|

303 |

|

Company-operated: |

|

|

|

|

|

|

|

Comparable restaurant sales growth |

|

|

3.8% |

|

|

3.8% |

|

Restaurants in the comparable base |

|

|

168 |

|

|

181 |

EL POLLO LOCO

HOLDINGS, INC.UNAUDITED RECONCILIATION OF

SYSTEM-WIDE SALES TO COMPANY-OPERATED RESTAURANT REVENUE AND TOTAL

REVENUE(in thousands)

| |

|

|

|

|

|

|

| |

|

Thirteen Weeks Ended |

|

(Dollar amounts in thousands) |

|

March 27, 2024 |

|

March 29, 2023 |

|

Company-operated restaurant revenue |

|

$ |

97,153 |

|

|

$ |

97,873 |

|

| Franchise revenue |

|

|

11,348 |

|

|

|

9,672 |

|

| Franchise advertising fee

revenue |

|

|

7,652 |

|

|

|

6,981 |

|

| Total

Revenue |

|

|

116,153 |

|

|

|

114,526 |

|

| Franchise revenue |

|

|

(11,348 |

) |

|

|

(9,672 |

) |

| Franchise advertising fee

revenue |

|

|

(7,652 |

) |

|

|

(6,981 |

) |

| Sales from franchised

restaurants |

|

|

170,737 |

|

|

|

155,614 |

|

| System-wide

sales |

|

$ |

267,890 |

|

|

$ |

253,487 |

|

EL POLLO LOCO

HOLDINGS, INC.UNAUDITED RECONCILIATION OF NET

INCOME TO EBITDA AND ADJUSTED EBITDA(in

thousands)

|

|

|

|

|

|

|

|

| |

|

Thirteen Weeks Ended |

| |

|

March 27, 2024 |

|

March 29, 2023 |

|

Adjusted EBITDA: |

|

|

|

|

|

|

|

Net income, as reported |

|

$ |

5,912 |

|

|

$ |

4,918 |

|

|

Non-GAAP adjustments: |

|

|

|

|

|

|

|

Provision for income taxes |

|

|

2,203 |

|

|

|

1,951 |

|

|

Interest expense, net of interest income |

|

|

1,564 |

|

|

|

1,004 |

|

|

Depreciation and amortization |

|

|

3,851 |

|

|

|

3,637 |

|

|

EBITDA |

|

$ |

13,530 |

|

|

$ |

11,510 |

|

|

Stock-based compensation expense (a) |

|

|

920 |

|

|

|

771 |

|

|

Loss on disposal of assets (b) |

|

|

41 |

|

|

|

30 |

|

|

Impairment and closed-store reserves (c) |

|

|

32 |

|

|

|

77 |

|

|

Gain on disposition of restaurants (d) |

|

|

— |

|

|

|

(136 |

) |

|

Income tax receivable agreement income (e) |

|

|

— |

|

|

|

(122 |

) |

|

Special dividend (f) |

|

|

— |

|

|

|

129 |

|

|

Special legal expenses (g) |

|

|

— |

|

|

|

298 |

|

|

Gain on recovery of insurance proceeds (h) |

|

|

(41 |

) |

|

|

(394 |

) |

|

Executive transition costs (i) |

|

|

643 |

|

|

|

— |

|

|

Restructuring charges (j) |

|

|

551 |

|

|

|

— |

|

|

Pre-opening costs (k) |

|

|

23 |

|

|

|

5 |

|

| Adjusted

EBITDA |

|

$ |

15,699 |

|

|

$ |

12,168 |

|

|

(a) |

Includes non-cash, stock-based compensation. |

| (b) |

Loss on disposal of assets

includes the loss on disposal of assets related to retirements and

replacement or write-off of leasehold improvements or

equipment. |

| (c) |

Includes costs related to

impairment of property and equipment and ROU assets and closing

restaurants. During the thirteen weeks ended

March 27, 2024, we did not record any non-cash impairment

charges. During the thirteen weeks ended March 29, 2023,

we recorded non-cash impairment charges of less than $0.1 million,

primarily related to the carrying value of the ROU assets of one

restaurant in California.During both the thirteen weeks ended

March 27, 2024 and March 29, 2023, we recognized less

than $0.1 million of closed-store reserve expense related to the

amortization of ROU assets, property taxes and CAM payments for our

closed locations. |

| (d) |

During the thirteen weeks ended

March 29, 2023, we completed the sale of one restaurant within

California to an existing franchisee. This sale resulted in

cash proceeds of $0.2 million during the thirteen weeks

ended March 29, 2023 and a net gain on sale of restaurant

of $0.1 million for the thirteen weeks ended March 29, 2023. |

| (e) |

On July 30, 2014, we entered

into the TRA. This agreement calls for us to pay to our pre-IPO

stockholders 85% of the savings in cash that we realize in our

taxes as a result of utilizing our NOLs and other tax attributes

attributable to preceding periods. For the thirteen weeks ended

March 27, 2024, we did not record any income tax receivable

agreement income or expense. For the thirteen weeks ended

March 29, 2023, income tax receivable agreement income

consisted of the amortization of interest expense and changes in

estimates for actual tax returns filed, related to our total

expected TRA payments. |

| (f) |

During the thirteen weeks ended

March 29, 2023, we encountered costs related to a special dividend

declaration. On October 11, 2022, the Board of Directors declared a

special dividend of $1.50 per share on the common stock of the

Company. The special dividend was paid on November 9, 2022, to

stockholders of record, including holders of restricted stock, at

the close of business on October 24, 2022. |

| (g) |

Consists of legal costs related

to the share distribution by Trimaran Group of substantially all of

the Company’s common stock held by Trimaran Group to its investors,

members and limited partners, which occurred on March 28,

2023. |

| (h) |

During the prior quarters, one of

our restaurants incurred damage resulting from a fire. In fiscal

2023, we incurred costs directly related to the fire of less than

$0.1 million. We recognized gains of $0.2 million, related to the

reimbursement of property and equipment and expenses incurred and

$0.2 million related to the reimbursement of lost profits. The gain

on recovery of insurance proceeds and reimbursement of lost

profits, net of the related costs is included in the accompanying

condensed consolidated statements of income, for fiscal 2023, as a

reduction of company restaurant expenses. We received from the

insurance company cash of $0.4 million, net of the insurance

deductible, during fiscal 2023. |

| (i) |

Includes costs associated with

the transition of our former CEO, such as severance, executive

recruiting costs and stock-based compensation costs. |

| (j) |

On March 8, 2024, the Company

made the decision to eliminate and restructure certain positions in

the organization, which resulted in one-time costs of approximately

$0.5 million. |

| (k) |

Pre-opening costs are a component

of general and administrative expenses, and consist of costs

directly associated with the opening of new restaurants and

incurred prior to opening, including management labor costs, staff

labor costs during training, food and supplies used during

training, marketing costs, and other related pre-opening costs.

These are generally incurred over the three to five months

prior to opening. Pre-opening costs also include occupancy costs

incurred between the date of possession and the opening date for a

restaurant. |

EL POLLO LOCO

HOLDINGS, INC.UNAUDITED RECONCILIATION OF NET

INCOME TO ADJUSTED NET INCOME(dollar amounts in

thousands, except share data)

|

|

|

|

|

|

|

|

| |

|

Thirteen Weeks Ended |

| |

|

March 27, 2024 |

|

March 29, 2023 |

|

Adjusted net income: |

|

|

|

|

|

|

|

Net income, as reported |

|

$ |

5,912 |

|

|

$ |

4,918 |

|

|

Provision for taxes, as reported |

|

|

2,203 |

|

|

|

1,951 |

|

|

Income tax receivable agreement income |

|

|

— |

|

|

|

(122 |

) |

|

Loss on disposal of assets |

|

|

41 |

|

|

|

30 |

|

|

Gain on disposition of restaurants |

|

|

— |

|

|

|

(136 |

) |

|

Impairment and closed-store reserves |

|

|

32 |

|

|

|

77 |

|

|

Special dividend |

|

|

— |

|

|

|

129 |

|

|

Special legal expenses |

|

|

— |

|

|

|

298 |

|

|

Restructuring charges |

|

|

551 |

|

|

|

— |

|

|

Gain on recovery of insurance proceeds |

|

|

(41 |

) |

|

|

(394 |

) |

|

Executive transition costs |

|

|

643 |

|

|

|

— |

|

|

Provision for income taxes |

|

|

(2,536 |

) |

|

|

(1,816 |

) |

|

Adjusted net income |

|

$ |

6,805 |

|

|

$ |

4,935 |

|

|

Adjusted weighted-average share and per share

data: |

|

|

|

|

|

|

| Adjusted

net income per share |

|

|

|

|

|

|

|

Basic |

|

$ |

0.22 |

|

|

$ |

0.14 |

|

|

Diluted |

|

$ |

0.22 |

|

|

$ |

0.14 |

|

|

Weighted-average shares used in computing adjusted net income per

share |

|

|

|

|

|

|

|

Basic |

|

|

30,777,769 |

|

|

|

36,234,105 |

|

|

Diluted |

|

|

30,937,226 |

|

|

|

36,478,158 |

|

EL POLLO LOCO

HOLDINGS, INC.UNAUDITED RECONCILIATION OF

INCOME FROM OPERATIONS TO RESTAURANT

CONTRIBUTION(dollar amounts in

thousands)

|

|

|

|

|

|

|

|

|

| |

|

Thirteen Weeks Ended |

|

| |

|

March 27, 2024 |

|

March 29, 2023 |

|

|

Restaurant contribution: |

|

|

|

|

|

|

|

|

Income from operations |

|

$ |

9,679 |

|

|

$ |

7,751 |

|

|

|

Add (less): |

|

|

|

|

|

|

|

|

General and administrative expenses |

|

|

11,925 |

|

|

|

11,199 |

|

|

|

Franchise expenses |

|

|

10,602 |

|

|

|

9,032 |

|

|

|

Depreciation and amortization |

|

|

3,851 |

|

|

|

3,637 |

|

|

|

Loss on disposal of assets |

|

|

41 |

|

|

|

30 |

|

|

|

Gain on recovery of insurance proceeds, property, equipment and

expenses |

|

|

(41 |

) |

|

|

(242 |

) |

|

|

Franchise revenue |

|

|

(11,348 |

) |

|

|

(9,672 |

) |

|

|

Franchise advertising fee revenue |

|

|

(7,652 |

) |

|

|

(6,981 |

) |

|

|

Impairment and closed-store reserves |

|

|

32 |

|

|

|

77 |

|

|

|

Gain on disposition of restaurants |

|

|

— |

|

|

|

(136 |

) |

|

|

Restaurant contribution |

|

$ |

17,089 |

|

|

$ |

14,695 |

|

|

|

|

|

|

|

|

|

|

|

|

Company-operated restaurant revenue: |

|

|

|

|

|

|

|

|

Total revenue |

|

$ |

116,153 |

|

|

$ |

114,526 |

|

|

|

Less: |

|

|

|

|

|

|

|

|

Franchise revenue |

|

|

(11,348 |

) |

|

|

(9,672 |

) |

|

|

Franchise advertising fee revenue |

|

|

(7,652 |

) |

|

|

(6,981 |

) |

|

|

Company-operated restaurant revenue |

|

$ |

97,153 |

|

|

$ |

97,873 |

|

|

|

|

|

|

|

|

|

|

|

|

Restaurant contribution margin (%) |

|

|

17.6 |

|

% |

|

15.0 |

|

% |

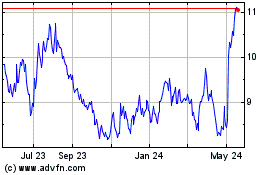

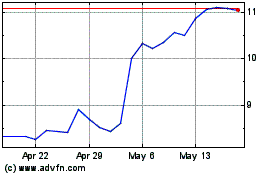

El Pollo Loco (NASDAQ:LOCO)

Historical Stock Chart

From Jan 2025 to Feb 2025

El Pollo Loco (NASDAQ:LOCO)

Historical Stock Chart

From Feb 2024 to Feb 2025