0000937556false00009375562025-01-172025-01-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________________________________

FORM 8-K

________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 17, 2025

MASIMO CORPORATION

(Exact name of registrant as specified in its charter)

________________________________________________

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| DE | | 001-33642 | | 33-0368882 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| 52 Discovery | | Irvine, | | CA | | | | | 92618 |

| (Address of Principal Executive Offices) | | | | | (Zip Code) |

| | | | | | (949) | 297-7000 | | | |

Registrant’s telephone number, including area code: |

Not Applicable |

(Former name or former address, if changed since last report) |

| | | | | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2 (b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | | | | |

| Securities Registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.001 par value | | MASI | | The Nasdaq Stock Market LLC |

| | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| Emerging growth company | ☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

| | | | | |

Item 5.02.....Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Appointment of Catherine Szyman as Chief Executive Officer and Transition of Michelle Brennan to Chairman of the Board

On January 21, 2025, Masimo Corporation (the “Company”) announced that the Board of Directors of the Company (the “Board”) has appointed Catherine Szyman, 58, as Chief Executive Officer of the Company, effective as of February 12, 2025 (the “Effective Date”). As of the Effective Date, Michelle Brennan will cease to serve as Interim Chief Executive Officer of the Company, a role that she has held since September 24, 2024. Ms. Brennan will continue to serve as member of the Board, and has been appointed to the role of Chairman of the Board while Quentin Koffey will serve in the role of Vice-Chairman of the Board. Upon her cessation of service as Interim Chief Executive Officer, Ms. Brennan will be entitled to certain payments and benefits in accordance with the terms of her Employment Agreement with the Company, previously disclosed as Exhibit 10.1 to the Form 8-K filed by the Company on November 18, 2024.

Ms. Szyman’s appointment follows an extensive search process overseen by the Board with the assistance of a leading external search firm. During this process, the Board evaluated numerous high quality candidates.

In connection with Ms. Szyman’s appointment as Chief Executive Officer, the Board increased the authorized number of directors on the Board to nine and appointed Ms. Szyman to fill such vacancy created by the increase in directors, in each case effective as of the Effective Date. Ms. Szyman will serve as a Class II director until the annual meeting of stockholders of the Company at which the Class II directors are elected, until her successor is duly elected and has qualified, or until her earlier death, resignation or removal.

Ms. Szyman led the Critical Care business at Edwards Lifesciences for over a decade – including through the acquisition by BD (Becton, Dickinson and Company) in September of 2024. While at Edwards, Ms. Szyman accelerated the revenue growth of the business by shifting to AI-driven solutions that aid clinicians in decision making and help patients return home to their families faster. Previously, Ms. Szyman spent more than 20 years at Medtronic, where she held positions with increasing levels of responsibility inside and outside the U.S., including leadership roles in corporate strategy, business development and finance, and as the worldwide president of both the Endovascular and Diabetes business units. Ms. Szyman currently serves on the board of Inari Medical (NASDAQ: NARI). She previously served on the boards of Outset Medical (NASDAQ: OM), the Edwards Lifesciences Foundation, and the Opus School of Business at the University of St. Thomas. Ms. Szyman received a B.A. from the University of St. Thomas and an M.B.A. from Harvard Business School.

There are no arrangements or understandings between Ms. Szyman and any person pursuant to which Ms. Szyman was selected as an officer or director, and no family relationships exist between Ms. Szyman and any director or executive officer of the Company. Ms. Szyman is not a party to any transaction to which the Company is or was a participant and in which Ms. Szyman has a direct or indirect material interest subject to disclosure under Item 404(a) of Regulation S-K.

Offer Letter with Ms. Szyman

On January 17, 2025, the Company and Ms. Szyman entered into an offer letter (the “Offer Letter”) in respect of her service as Chief Executive Officer. Under the Offer Letter, Ms. Szyman’s will receive an initial annual base salary of $1,000,000, a target annual bonus opportunity of 100% of base salary and a maximum annual bonus opportunity equal to 200% of such target, and an annual target long-term incentive award opportunity of $7,000,000. To the extent that the Company determines after the Effective Date to adopt a policy for the vesting of performance stock units upon retirement, any such retirement policy that applies to Ms. Szyman will be no worse than the attainment of 60 years of age and at least five years of continuous employment with the Company. Ms. Szyman will also be eligible to participate in the Company’s employee benefit plans and programs applicable to senior executives of the Company generally, as may be in effect from time to time.

In consideration of certain unvested equity awards forfeited from her previous employer, Ms. Szyman will receive a one-time award of (i) restricted stock units with a target grant date value of approximately $6,000,000 (the “Buy-Out RSUs”), which will vest in three equal installments on each of the first, second and third anniversaries of the Effective Date, and (ii) performance stock units with a target grant date value of approximately $4,000,000 (the “Buy-Out PSUs”), which will vest in accordance with the Company’s vesting terms for annual long-term incentive awards granted in 2025 to other executives of the Company.

Upon a termination of Ms. Szyman’s employment without cause or by Ms. Szyman with good reason other than on or within two years following a change in control, Ms. Szyman will be entitled to receive: (i) an amount equal to one and one-half times the sum of her base salary and target annual bonus opportunity, paid in equal installments over the 18 months following termination in accordance with the Company’s payroll practices; (ii) a prorated annual bonus for the year of termination based on actual performance (the “Prorated Actual Bonus”); (iii) a monthly cash payment in respect of continued coverage under the Consolidated Omnibus Budget Reconciliation Act of 1985 for up to 18 months following termination (the “COBRA Benefit”);

(iv) a period of 90 days following termination to exercise any vested stock options (the “Options Exercisability”); and (v) acceleration and vesting of the Buy-Out RSUs and the Buy-Out PSUs (based on the target level of performance). All other unvested equity awards will be forfeited.

Upon a termination of Ms. Szyman’s employment without cause or by Ms. Szyman with good reason, in each case on or within two years following a change in control, Ms. Szyman will be entitled to receive: (i) a lump sum amount equal to three times the sum of her base salary and target annual bonus opportunity; (ii) a prorated target annual bonus for the year of termination; (iii) the COBRA Benefit; (iv) the Options Exercisability; and (v) acceleration and vesting of all unvested equity awards, with the treatment of any PSUs determined in accordance with the applicable award agreements.

Upon a termination of Ms. Szyman’s employment due to death or disability, Ms. Szyman or Ms. Szyman’s estate (as applicable) will be entitled to receive (i) the Prorated Actual Bonus, (ii) the Options Exercisability and (iii) acceleration and vesting of the Buy-Out RSUs.

Severance benefits are subject to Ms. Szyman’s execution and non-revocation of a separation and general release and continued compliance with certain obligations to the Company. Ms. Szyman will also be bound by the terms of a Masimo Confidentiality Agreement, which contains perpetual confidentiality and a non-solicitation covenant that will extend for two years following the termination of employment with the Company.

The above description of the Offer Letter is qualified in its entirety by reference to the terms of the Offer Letter, a copy of which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

| | | | | |

| Item 7.01. | Regulation FD Disclosure. |

A copy of the Company’s press release relating to the announcement described in Item 5.02, dated January 21, 2025, is furnished as Exhibit 99.1 to this Form 8-K.

In accordance with General Instructions B.2 of Form 8-K, the information in Item 7.01 of this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

| | | | | |

| Item 9.01. | Financial Statements and Exhibits. |

(d) The following items are filed as exhibits to the Current Report on Form 8-K.

| | | | | |

Exhibit No. | Description |

| 10.1 | |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, Masimo Corporation has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | MASIMO CORPORATION |

| | | | | |

| Date: January 21, 2025 | | | | By: | | /s/ MICAH YOUNG |

| | | | | | Micah Young |

| | | | | | Executive Vice President & Chief Financial Officer |

| | | | | | (Principal Financial Officer) |

January 17, 2025

Catherine Szyman

Via electronic mail

Dear Katie:

It is with great pleasure that we offer you the position of Chief Executive Officer (“CEO”) of Masimo Corporation (the “Company”), effective February 12, 2025 (the “Start Date”). This letter (this “Offer Letter”) sets forth the principal terms and conditions of your employment with Masimo.

| | | | | | | | | | | | | | |

| Duties and Responsibilities: | During your employment with the Company, you will serve as CEO, reporting to the Board of Directors of the Company (the “Board”), with duties and obligations commensurate with such position. Additionally, you will be appointed to the Board and, during your employment with the Company as CEO, the Company will use its best efforts to cause you to be nominated for re-election to the Board at each subsequent annual meeting of the Company’s stockholders. You will devote all of your attention and time during working hours to the affairs and business of the Company. You may not serve on the board of directors, trustees or any similar governing body of any outside entity without the prior written consent of the Board; except as a member of the board of directors of any entity listed on Exhibit A to this Offer Letter. |

| | | | |

| Location: | Your principal location of employment will be our Irvine office located at 52 Discovery, Irvine, CA 92618, subject to such reasonable business travel as will be required in the course of your duties from time to time. |

| | | | |

| Annual Salary: | Your base salary will be $1,000,000 per year (the “Base Salary”), paid in approximately equal installments in accordance with the Company’s customary payroll practices. If your Base Salary is adjusted, such adjusted Base Salary will then constitute the Base Salary for all purposes of this Offer Letter. The Base Salary shall be subject to annual review, but may not be decreased without your express written consent. |

| | | | |

| Annual Bonus: | You will be eligible for an annual target bonus opportunity equal to 100% of your Base Salary (the “Target Bonus”), with a maximum bonus opportunity equal to 200% of the Target Bonus, in each case subject to and in accordance with the terms of the Company’s Executive Bonus Incentive Plan (or any successor arrangement thereto). The actual amount of your annual bonus, if any, will be determined by the Compensation Committee of the Board (the “Committee”) in its sole discretion, and will be payable (other than pursuant to the sections below entitled “Termination by the Company without Cause or by You for Good Reason Outside of a Change in Control”, “Termination by the Company without Cause or by You for Good Reason in Connection with a Change in Control”, and “Termination Upon Death or Disability”) subject to your continued employment with the Company through the date of payment. |

| | | | |

| | | | | | | | | | | | | | |

| Annual LTI Awards: | You will be eligible to receive annual long-term equity incentive awards (the “Annual LTI Opportunity”) with a target grant date fair value of $7,000,000. The Annual LTI Opportunity will be granted in accordance with the terms of the Company’s 2017 Equity Incentive Plan (as amended or replaced from time to time, the “Equity Plan”) and in the same form as, and with the same terms and conditions (including vesting conditions) established by the Committee in its sole discretion for, other annual long-term equity incentive awards to other similarly-situated executives of the Company, as set forth in the applicable award agreement(s). The Annual LTI Opportunity will be reviewed annually by the Committee based on performance, market data and other factors deemed relevant by the Committee. To the extent that the Company determines after the Start Date to adopt a policy for the vesting of PSUs (as defined below) upon retirement, any such retirement policy that applies to you will be no worse than the attainment of 60 years of age and at least five years of continuous employment with the Company. |

| | | | |

| Buy-Out LTI Awards: | In consideration of existing unvested equity awards forfeited by you from your current employer and subject to you providing the Company with reasonable documentation establishing such forfeiture, you will receive the following long-term incentive awards (the “Buy-Out LTI Awards”): |

| | | | |

| | (i) Restricted Stock Units with a grant date value of approximately $6,000,000 as of the Start Date (the “Buy-Out RSUs”), which will vest ratably over three years, with one-third of the award vesting on each of the first, second and third anniversaries of the Start Date, subject to your continued employment with the Company through the applicable vesting (other than pursuant to the sections below entitled “Termination by the Company without Cause or by You for Good Reason Outside of a Change in Control”, “Termination by the Company without Cause or by You for Good Reason in Connection with a Change in Control”, and “Termination Upon Death or Disability”); and |

| | | | |

| | (ii) Performance Stock Units (“PSUs”) with a grant date value of approximately $4,000,000 that vest in accordance with the Company’s vesting terms for the 2025 annual long-term incentive awards for other executives of the Company (the “Buy-Out PSUs”). |

| | | | |

| The Buy-Out RSUs will be granted to you as soon as administratively practicable following the Start Date. The Buy-Out PSUs will be granted to you as part of your 2025 annual long-term equity incentive awards and at the same time as such grants are made to similarly-situated executives of the Company (in addition to and not in lieu of the Annual LTI Opportunity for 2025). The Buy-Out LTI Awards will be subject to the terms and conditions of the Equity Plan and award agreements thereunder that are consistent with the terms of this Offer Letter and otherwise with respect to the long-term incentive awards to similarly-situated executives. |

| | | | |

| Other Employee Benefits: | You will be eligible to participate on the same basis as other executives of the Company in the employee benefits plans and programs of the Company as in effect from time to time and subject to the terms, conditions and limitations contained in the applicable plans. The Company shall reimburse you, in an amount not to exceed $25,000, for reasonable, documented attorneys’ fees incurred by you in connection with negotiating this Offer Letter. |

| | | | |

| Vacation: | You will be entitled to vacation in accordance with the Company’s policies and procedures now in force or as such policies and procedures may be modified with respect to all senior executives of the Company. |

| | | | |

| | | | | | | | | | | | | | |

| Termination: | Your employment with the Company is “at will”, meaning that (i) the Company may terminate the employment relationship with you at any time, with or without notice and with or without Cause (as defined below) and (ii) you may terminate the employment relationship with the Company at any time with or without Good Reason (as defined below), subject only to the requirement that, to terminate your employment without Good Reason, you provide sixty (60) days prior written notice to the Company. Upon termination of your employment with the Company for any reason, you will be deemed to resign from (i) the board of directors (or similar body) of any subsidiary of the Company and/or any other board to which you have been appointed or nominated by or on behalf of the Company (including the Board); and (ii) any position with the Company or any subsidiary of the Company, including, but not limited to, as an officer and director of the Company and any of its subsidiaries and affiliates. You agree to execute such confirmatory agreements as reasonably requested by the Company. |

| |

| As used in this Offer Letter, “Cause” means your: (i) willful and continued failure to perform your duties to the Company, other than any such failure resulting from your incapacity due to physical or mental illness; provided, that the performance of the Company, in of itself, shall not be considered evidence of your failure to perform your duties with the Company, so long as you are exerting your reasonable best efforts in good faith; (ii) willful misconduct that is or may reasonably be expected to be materially injurious to the Company or any of its affiliates; (iii) breach of the Company’s code of conduct or any other policy of the Company that is applicable to you; (iv) engagement in fraud, embezzlement or illegal or unethical conduct which is, in each case, materially injurious to the Company or any of its affiliates; (v) conviction of, or a plea of guilty or no contest to, any (A) felony or comparable crime under foreign law or (B) criminal offense involving fraud, dishonesty or moral turpitude; or (vi) breach of this Offer Letter or the Confidentiality Agreement (as defined below). For purposes of the foregoing definition, no act, or failure to act, by you will be considered “willful” if taken or omitted in the good faith belief that the act or omission was in, or not opposed to, the best interests of the Company and its affiliates. The termination of your employment shall not be effective as for Cause unless and until (y) the Company provides you with written notice setting forth in reasonable detail the facts and circumstances claimed by the Company to constitute Cause, and (z) with respect to clauses (i), (ii), (iii) and (vi), in the event that it is possible for you to cure or remedy the events giving rise to Cause (as determined by the Board in good faith), you fail to cure or remedy such acts or omissions within 15 days following your receipt of such notice (and during such 15-day period you have had the opportunity with the assistance of your own legal counsel to appear before the Board to address such matter).

As used in this Offer Letter, “Good Reason” means the occurrence of any of the following events without your consent: (i) a material reduction in Base Salary or Target Bonus opportunity; (ii) the requirement that you change your principal location of employment to any location that is more than 40 miles from Irvine, California; or (iii) a material reduction or material adverse alternation of your duties, responsibilities, authority and/or title as set forth in the section of this Offer Letter entitled “Duties and Responsibilities”; provided, however, that Good Reason will not exist unless (x) the Company has received written notice of Good Reason from you setting forth in reasonable detail the basis of the event giving rise to Good Reason within 30 days of the initial occurrence of such event; (y) the Company does not cure such event within 30 days of receipt of such written notice; and (z) you terminate employment, if at all, within 30 days following the end of the cure period. |

| | | | |

| Compensation upon Termination: | You will not be eligible to participate in the Company’s Amended and Restated 2007 Severance Protection Plan (as amended from time to time) or any successor thereto. Instead, any severance payments or benefits will be determined in accordance with this Offer Letter. |

| | | | | | | | | | | | | | |

| Termination in General. Upon any termination of your employment, you will be entitled to receive: (i) any earned but unpaid Base Salary; (ii) any earned but unpaid annual bonus for the year prior to the year in which termination of your employment occurs; (iii) payment for accrued and unused vacation time; (iv) reimbursement of any business expenses incurred in accordance with the Company’s policies as in effect from time to time but not paid; and (iv) any compensation and/or benefits as may be due or payable to you (or your beneficiary, legal representative or estate, as the case may be, in the event of your death) in accordance with the terms and provisions of any employee benefit plan or program of the Company, to be paid in accordance with such terms (collectively, “Accrued Obligations”). Except as otherwise provided in this Offer Letter (including, without limitation, in the sections entitled “Termination by the Company without Cause or by You for Good Reason Outside of a Change in Control”, “Termination by the Company without Cause or by You for Good Reason in Connection with a Change in Control”, and “Termination Upon Death or Disability”), all unvested equity-based awards will be forfeited immediately upon termination of your employment. |

| | | | |

| Termination by the Company without Cause or by You for Good Reason Outside of a Change in Control. Upon a termination of your employment by the Company without Cause or by you for Good Reason (as defined below), in each case other than on or within two years following a Change in Control (as defined in the Equity Plan), subject to the section below entitled “Severance Conditions,” you will be entitled to receive: |

| | | | |

| | (i) The Accrued Obligations; |

| | | | |

| | (ii) An amount equal to one and one-half times the sum of (x) Base Salary and (y) Target Bonus, paid in equal installments over the 18 months following termination in accordance with the Company’s payroll practices, with such payments commencing on the payroll date immediately following the 60th day following termination and the first such payment to include, as applicable, any such amounts that would otherwise have been paid through such payroll date; |

| | | | |

| | (iii) A prorated annual bonus for the year in which you are terminated based on actual performance and paid in a lump sum at the same time as the Company pays other executives their annual bonus (but in any event no later than March 15 of the year following the year in which termination of your employment occurs) (the “Prorated Actual Bonus”); |

| | | | |

| | (iv) If you timely elect and maintain continuation coverage pursuant to the Consolidated Omnibus Budget Reconciliation Act of 1985 (“COBRA”) for you and your eligible dependents, as applicable, a monthly cash payment equal to the amount the Company contributes from time to time to group medical, dental and/or vision insurance premiums (as applicable) for you and your eligible dependents (as applicable) until the earlier of (A) 18 months following the date on which your employment terminates or (B) the date upon which you begin other employment that provides for health coverage benefits; provided, however, that if the Company determines in its sole discretion exercised in reasonable good faith that it cannot provide the COBRA benefits without potentially violating applicable law (including, without limitation, Section 2716 of the Public Health Service Act), you and the Company will coordinate in good faith to restructure such benefit (the “COBRA Benefit”); |

| | | | |

| | (v) A period of 90 days following termination to exercise any vested stock options, after which date any such unexercised options will be forfeited (the “Post-Termination Options Exercisability”); |

| | | | |

| | (vi) Acceleration and vesting in full of the Buy-Out RSUs (the “Buy-Out RSUs Benefit”); and |

| | | | |

| | (vii) Acceleration and vesting of the Buy-Out PSUs (based on the target level of performance in the case of the Buy-Out PSUs). All other unvested equity-based awards will be forfeited immediately upon termination of your employment. |

| | | | |

| Termination by the Company without Cause or by You for Good Reason in Connection with a Change in Control. Upon termination of your employment by the Company without Cause or by you for Good Reason, in each case on or within two years following a Change in Control, subject to the section below entitled “Severance Conditions,” you will be entitled to receive: |

| | | | | | | | | | | | | | |

| | (i) The Accrued Obligations; |

| | | | |

| | (ii) An amount equal to three times the sum of (x) Base Salary and (y) Target Bonus, paid in a lump sum on or before the 60th day following termination of your employment; |

| | | | |

| | (iii) A prorated Target Bonus, paid in a lump sum on or before the 60th day following termination of your employment; |

| | | | |

| | (iv) The COBRA Benefit; |

| | | | |

| | (v) The Post-Termination Options Exercisability; and |

| | | | |

| | (vi) Acceleration and vesting of all unvested equity awards, with the treatment of any PSUs determined in accordance with the applicable award agreements pursuant to which such PSUs were granted. |

| | | | |

| | Notwithstanding the foregoing, in the event that the Change in Control does not qualify as a “change in control event” within the meaning of Section 409A (as defined below), then the payment due under sub-section (ii) of the paragraph of this section entitled “Termination by the Company without Cause or by You for Good Reason in Connection with a Change in Control” will instead be paid at the time and in the form as set forth in sub-section (ii) of the paragraph of this section entitled “Termination by the Company without Cause or by You for Good Reason Outside of a Change in Control.” |

| | | | |

| | Termination Upon Death or Disability. Your employment hereunder shall terminate upon your death or Disability. Upon termination of your employment hereunder for either Disability or death, you or your estate (as the case may be) shall be entitled to receive the Accrued Obligations, the Prorated Actual Bonus, the Post-Termination Options Exercisability and the Buy-Out RSUs Benefit. As used in this Offer Letter, “Disability” means you (A) are unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment which can be expected to result in death or can be expected to last for a continuous period of not less than 12 months, or (B) are, by reason of any medically determinable physical or mental impairment which can be expected to result in death or can be expected to last for a continuous period of not less than 12 months, receiving income replacement benefits for a period of not less than three months under an accident and health plan, or disability plan, covering employees of the Company or an affiliate of the Company. Any question as to the existence of your Disability as to which you and the Company cannot agree shall be determined in writing by a qualified independent physician selected by the Company. |

| | | | |

| Severance Conditions: | As a condition to the payments and other benefits set forth in the section entitled “Compensation upon Termination” other than the Accrued Obligations, you must (i) execute and not revoke a separation and general release agreement in substantially the form used by the Company for similarly-situated executives of the Company (the “Release”), which must become effective in accordance with its terms no later than 55 days following the termination of your employment and (ii) continue to comply with the Masimo Employee Confidentiality Agreement attached hereto as Exhibit B (the “Confidentiality Agreement”) and any other agreement or policy of the Company received in advance in writing by you. Failure to comply with the restrictive covenants or policies or to execute, permit to become effective or adhere to the Release will result in forfeiture in full of any of the payments and other benefits set forth in the section entitled “Compensation upon Termination” other than the Accrued Obligations. |

| | | | |

| | | | | | | | | | | | | | |

| Section 280G: | In the event that any payments or benefits provided for in this Offer Letter or otherwise payable to you (collectively, the “Payments”) (i) constitute “parachute payments” within the meaning of Section 280G of the Internal Revenue Code of 1986, as amended (the “Code”), and (ii) but for this provision, would be subject to the excise tax imposed by Section 4999 of the Code, then the Payments will be either (x) delivered in full or (y) delivered as to such lesser extent that would result in no portion of the Payments being subject to excise tax under Section 4999 of the Code, whichever of the foregoing amounts, taking into account the applicable federal, state and local income and employment taxes and the excise tax imposed by Section 4999 of the Code (and any equivalent state or local excise taxes), results in the receipt by you, on an after-tax basis, of the greatest amount of Payments, notwithstanding that all or some portion of such Payments may be taxable under Section 4999 of the Code. |

| | | | |

| Unless the Company and you otherwise agree in writing, any determination required under this Section will be made in writing by a nationally-recognized accounting or consulting firm selected by the Company (the “Determination Firm”), whose determination will be conclusive and binding upon you and the Company for all purposes. For purposes of making the calculations required by this Section, the Determination Firm may make reasonable assumptions and approximations concerning applicable taxes and may rely on reasonable, good faith interpretations concerning the application of Sections 280G and 4999 of the Code. The Company and you agree to furnish to the Determination Firm such information and documents as the Determination Firm may reasonably request in order to make a determination under this provision. The Company will bear all costs the Determination Firm may reasonably incur in connection with any calculations contemplated by this provision. Any reduction in the Payments required by this provision will occur in the following order, as applicable: (i) reduction of any cash severance payments otherwise payable to you; (ii) reduction of any other cash payments otherwise payable to you; (iii) reduction of any payments attributable to any acceleration of vesting or payments with respect to any equity award; and (iv) reduction of any other benefits otherwise payable to you on a pro-rated basis or such other manner that complies with Section 409A. With respect to each category of the foregoing, such reduction will occur first with respect to amounts that are not “deferred compensation” within the meaning of Section 409A and next with respect to payments that are deferred compensation, in each case beginning with payments that would otherwise be made last in time. In the event that acceleration of vesting of equity awards is to be reduced, such acceleration of vesting will be cancelled in the reverse order of the date of grant for equity awards. If two or more equity awards are granted on the same date, each award will be reduced on a pro-rata basis. |

| | | | |

Other Policies: | You will also be subject to applicable policies of the Company and its affiliates as in effect from time to time, including without limitation any stock ownership guidelines and any clawback or recoupment policies. Without limiting the generality of the foregoing, you acknowledge and agree that you will be bound by and subject to the terms of the Masimo Corporation Clawback Policy, as amended from time to time. |

| | | | |

| Section 409A: | This Offer Letter is intended to comply with the requirements of Section 409A of the Code (together with the applicable regulations thereunder, “Section 409A”) or an exemption therefrom and will be interpreted, administered and construed in accordance with such intent. Any payment or benefit due upon a termination of your employment that represents a “deferral of compensation” within the meaning of Section 409A will be paid or provided to you only upon a “separation from service” as defined in Treasury Regulation Section 1.409A-1(h) to the extent required to comply with Section 409A. In addition, notwithstanding any provision of this Offer Letter to the contrary, if necessary to comply with the restriction in Section 409A(a)(2)(B) of the Code concerning payments to “specified employees” (as defined in Section 409A), any payment on account of your separation from service that would otherwise be due under this Offer Letter within six months after such separation will be delayed until the first business day of the seventh month following your date of termination (or, if earlier, the date of your death) and the first such payment will include the cumulative amount of any payments that would have been paid prior to such date if not for such restriction. For purposes of Section 409A, each payment made under this Offer Letter will be treated as a separate payment. In no event may you, directly or indirectly, designate the calendar year of payment. |

| | | | | | | | | | | | | | |

| | | | |

| All reimbursements provided under this Offer Letter will be made or provided in accordance with the requirements of Section 409A, including, where applicable, the requirement that (i) any reimbursement is for expenses incurred during your lifetime (or during a shorter period of time specified in this Offer Letter); (ii) the amount of expenses eligible for reimbursement during a calendar year may not affect the expenses eligible for reimbursement in any other calendar year; (iii) the reimbursement of an eligible expense will be made on or before the last day of the calendar year following the year in which the expense is incurred; and (iv) the right to reimbursement is not subject to liquidation or exchange for another benefit. |

| | | | |

| Withholding Taxes: | The Company may withhold from any amounts or benefits payable under this Offer Letter (including, without limitation, any Buy-Out LTI Awards) income taxes and payroll taxes that are required to be withheld pursuant to any applicable law or regulation. |

| | | | |

Representations: | You represent and warrant to the Company that (i) your employment with the Company will not conflict with or result in your breach of any agreement to which you are a party or otherwise may be bound; (ii) you have not violated, and in connection with your employment with the Company will not violate, any non-solicitation, non-competition or other restrictive covenant or agreement of a prior employer by which you are or may be bound; and (iii) in connection with your employment with the Company, you will not use any confidential or proprietary information that you may have obtained in connection with employment with any prior employer. |

| | | | |

| Notice: | All notices, consents, waivers, and other communications under this Offer Letter must be in writing and will be deemed to have been given (i) on the day sent, if delivered by hand, or (ii) on the business day after the day sent if delivered by a recognized overnight courier, return receipt requested, addressed as follows: |

| | | | |

| If to you: |

| At the address on file in the Company’s personnel records |

| If to the Company: |

| Masimo Corporation |

| 52 Discovery |

| Irvine, CA 92618 |

| Attn: Chief Legal Officer |

| | | | |

| Governing Law; Dispute Resolution: | The validity, interpretation, construction and performance of this Offer Letter will be governed by the laws of the State of California without regard to its conflicts of laws principles. Any suit, action or proceeding arising out of or relating to this Offer Letter will be brought in the Superior Court of California for the County of Orange, and the parties hereby irrevocably accept the exclusive personal jurisdiction of such court for the purpose of any suit, action or proceeding. In addition, the parties each hereby irrevocably waive, to the fullest extent permitted by law, any objection which they may now or hereafter have to the laying of venue of any suit, action or proceeding arising out of or relating to this Offer Letter in the Superior Court of California for the County of Orange, and hereby further irrevocably waive any claim that any suit, action or proceeding brought in such court has been brought in an inconvenient forum. |

This Offer Letter, together with the Confidentiality Agreement, sets forth the entire agreement with respect to your employment with the Company and supersedes all prior offers, agreements, term sheets, discussions and other communications by any employee, officer, director or other representative of the Company, whether written or oral. Any modification or amendment to this Offer Letter must be in writing signed by both you and an officer of the Company.

Please confirm your acceptance and agreement to the terms of this Offer Letter by signing below and returning the signed original to me. Any signature to this Offer Letter delivered by photographic, facsimile or PDF copy will be deemed to be an original signature hereto. If we have not received your signed acceptance by January 17, 2025, this Offer Letter will be null and void.

[Remainder of page intentionally blank]

We look forward to you joining our Team.

Sincerely,

/s/ Quentin Koffey

Quentin Koffey

Lead Independent Director, Masimo Corporation

Accepted and agreed:

| | | | | | | | | | | | | | |

/s/ CATHERINE SZYMAN | | | January 17, 2025 | |

| Catherine Szyman | | | Date | |

[Signature Page to Szyman Offer Letter]

Exhibit A

Outside Entity Board Membership

1.Member of the Board of Directors (including the compensation committee) of Inari Medical

2.Member of the Board of Directors of JSerra Catholic High School.

Exhibit B

MASIMO EMPLOYEE CONFIDENTIALITY AGREEMENT

As an employee of Masimo Corporation or its subsidiaries (“Masimo”) and in consideration of the compensation and benefits from my employment, I enter into this Masimo Employee Confidentiality Agreement (the “Agreement”) with Masimo and agree as follows:

1.Masimo has and will develop, compile and own certain proprietary and confidential information that has great value in its business (“Confidential Information”). Confidential Information includes information and physical material not generally known or available outside Masimo and information and physical material entrusted to Masimo in confidence by third parties. Confidential Information includes, without limitation: (i) Masimo Inventions (as defined below); (ii) technical data, trade secrets, know-how, including negative know-how, research, product or service ideas or plans, software codes and designs, developments, inventions, laboratory notebooks, processes, formulas, techniques, mask works, engineering designs and drawings, hardware configuration information, lists of, or information relating to, employees and consultants of Masimo (including, but not limited to, the names, contact information, jobs, compensation, and expertise of such employees and consultants), lists of, or information relating to, suppliers and customers (including, but not limited to, customers of Masimo on whom I called or with whom I became acquainted during employment with Masimo), price lists, pricing methodologies, cost data, market share data, marketing plans, licenses, contract information, business plans, financial forecasts, historical financial data, budgets or other business information disclosed to me by Masimo either directly or indirectly, whether in writing, electronically, orally, or by observation, or developed or created by me, either alone or jointly with others, while employed by Masimo. I acknowledge that such information is secret, valuable and owned by Masimo, and that Masimo has exercised substantial efforts to preserve the information’s secrecy.

2.During and after my employment by Masimo, I agree to keep confidential, and not disclose or make use of any Confidential Information except as authorized by Masimo and as necessary for the performance of my duties as a Masimo employee. I also agree not to remove or otherwise transmit Confidential Information or Inventions (as defined below) from the premises or possession of Masimo without the express prior written consent of an authorized representative of Masimo. I acknowledge that the unauthorized disclosure of Confidential Information may be highly prejudicial to Masimo’s interests, an invasion of privacy, and an improper disclosure of trade secrets.

3.During my employment with Masimo, I will not disclose to Masimo or make use of any confidential, proprietary or trade secret information or material belonging to a former employer or other third party. I represent and warrant that I have returned all property and confidential information belonging to all prior employers.

4.I represent that I am not subject to any agreement(s) with any third party that conflict with my obligations to Masimo or would prevent me from performing all of my assigned duties as a Masimo employee.

5.Prior to my employment with Masimo, I did not create any inventions, works of authorship, or trade secrets that relate in any way to the business of Masimo, except for those, if any, identified on the list attached to this Agreement as Appendix I.

6.I agree that I will promptly disclose in writing to Masimo all discoveries, developments, designs, ideas, improvements, inventions, formulas, processes, techniques, know-how, and data works of authorship, (whether or not patentable or registrable under copyright or similar statutes) made, conceived, reduced to practice, or learned by me (either alone or jointly with others) during my employment with Masimo, that are related to or useful in the business of Masimo, or which result from or relate to tasks assigned to me by Masimo, or result from the use of equipment, property, or premises owned, leased, or otherwise acquired by Masimo. For the purposes of this Agreement, all of the foregoing are referred to as Inventions.

7.I acknowledge and agree that all Inventions other than those listed in Appendix I belong to and shall be the sole property of Masimo and shall be Inventions of Masimo subject to the provisions of this Agreement. I agree to assign and hereby assign to Masimo all rights that I may have to such Inventions, except for inventions I am allowed to retain under California Labor Code section 2870, a copy of which is attached to this Agreement as Appendix II.

8.I agree that all works of authorship to which I contribute during my employment shall be considered “works made for hire” and shall be the sole property of Masimo.

9.I will keep adequate records of all Inventions to which I contribute during my employment, and will make such records available to Masimo on request.

10.I will cooperate with Masimo and do whatever is necessary or appropriate to obtain patents, copyrights, or other legal protection on projects to which I contribute, and, if I am incapacitated for any reason from doing so, I hereby authorize Masimo to act as my agent and attorney-in-fact and to take whatever action is needed on my part to carry out this Agreement.

11.Upon termination of my employment for any reason, I will immediately assemble all property of Masimo in my possession or under my control and return it unconditionally to Masimo. In the event of a termination (voluntary or otherwise) of my employment with Masimo, I agree that I will protect the value of the Confidential Information and Inventions of Masimo and will prevent their misappropriation or disclosure.

12.During my employment with Masimo, I will not do anything to compete with Masimo’s present or contemplated business, nor will I plan or organize any competitive business activity or help any other party or entity compete with Masimo. I will not enter into any agreement that conflicts with my duties or obligations to Masimo, and I will devote all of my working time and energy to the business of Masimo. I represent that I am not under any previous or current contractual or employment obligation that may conflict with or impair my ability to perform my duties at Masimo.

13.Except where prohibited by law, I agree that during my employment and for a period of two (2) years immediately following termination of my employment with Masimo, I will not, without express written authorization from Masimo, solicit, induce, or influence any employee or consultant of Masimo to quit their employment or cease working with or doing business with Masimo. Notwithstanding the foregoing, an advertisement seeking candidates for employment in a publication of general or industry circulation or an online job posting not targeted to any Masimo employee or Masimo employees generally shall not violate this Agreement.

14.I agree that the provisions of paragraph 13 above are necessary and appropriate to protect the Confidential Information and legitimate business interests of Masimo. I understand and agree that if any court or arbitrator of competent jurisdiction finds that any or all of the restrictions in paragraph 13 are unreasonable in length or scope under the applicable law, such court or arbitrator shall enforce them only to the extent such court or arbitrator finds reasonable and consistent with the law.

15.I agree that a violation of this Agreement will cause irreparable harm to Masimo for which an award of money damages would be inadequate. I therefore agree that Masimo shall be entitled to injunctive relief, in addition to any claims for money damages or other relief.

16.Notwithstanding the confidentiality obligations set forth in this agreement, I understand that, pursuant to the Defend Trade Secrets Act of 2016 (“DTSA”), 18 U.S. Code § 1833(b), I will not be held criminally or civilly liable under any federal or state trade secret law for the disclosure of a trade secret that: (A) is made (i) in confidence to a federal, state, or local government official, either directly or indirectly, or to an attorney; and (ii) solely for the purpose of reporting or investigating a suspected violation of law; or (B) is made in a complaint or other document filed in a lawsuit or other proceeding, if such filing is made under seal. I also understand that if I file a lawsuit for retaliation by Masimo for reporting a suspected violation of law, I may disclose the trade secret to my attorney and use the trade secret information in the court proceeding, if I (A) file any document containing the trade secret under seal; and (B) do not disclose the trade secret, except pursuant to court order. I further understand that if a court of law determines that I misappropriated Masimo trade secrets willfully or maliciously, including by making permitted disclosures without following the requirements of the DTSA as detailed in this paragraph, then Masimo may be entitled to an award of exemplary damages and attorneys’ fees. Nothing in this Agreement or any exhibit or attachment hereto: (A) limits or affects my right to disclose or discuss sexual harassment or sexual assault disputes; (B) prevents me from communicating with, filing a charge or complaint with, providing documents or information voluntarily or in response to a subpoena or other information request to, or from participating in an investigation or proceeding conducted by, the Equal Employment Opportunity Commission, National Labor Relations Board, the

Securities and Exchange Commission, law enforcement, or any other federal, state or local agency charged with the enforcement of any laws, or from testifying, providing evidence, or responding to a subpoena or discovery request in court litigation or arbitration; or (C) prevents a non-management, non-supervisory employees from engaging in protected concerted activity under Section 7 of the National Labor Relations Act or similar state law such as joining, assisting, or forming a union, bargaining, picketing, striking, or participating in other activity for mutual aid or protection, or refusing to do so; this includes using or disclosing information acquired through lawful means regarding wages, hours, benefits, or other terms and conditions of employment, unless the information was entrusted to the employee in confidence by the Company as part of the employee’s job duties.

17.For purposes of enforcing the injunctive relief provisions of this Agreement, Masimo and I hereby consent to jurisdiction and venue in the state and federal courts of Orange County, California. All other claims will be subject to arbitration if I am a party to a Mutual Agreement to Arbitrate Claims with Masimo.

18.This Agreement shall be governed by the law of the state in which I reside, or Delaware if I reside outside the United States.

19.I understand that my obligations under this Agreement remain in effect even after my employment with Masimo terminates.

20.This Agreement does not guarantee me any term of employment or limit my or Masimo’s right to terminate my employment at any time, with or without cause and with or without notice.

21.I understand that, by the act of presenting this Agreement to me, Masimo has agreed to bind itself to (and is entitled to invoke) this Agreement upon my executing of it, without need for a signature on its part.

22.If a court or arbitrator finds any provision of this Agreement invalid or unenforceable as applied to any circumstance, the remainder of this Agreement and the application of such provision to other persons or circumstances shall be interpreted so as best to effect the intent of the parties.

23.This Agreement is binding on my successors and assigns, and will benefit the successors and assigns of Masimo, including any subsidiaries and affiliates thereof.

24.This Agreement represents my entire agreement with Masimo with respect to the subject matter herein, superseding any previous oral or written understandings or agreements with Masimo or any of its officers. This Agreement may be amended or modified only in writing signed by both of the parties hereto.

[Remainder of page intentionally blank]

| | | | | | | | | | | | | | |

/s QUENTIN KOFFEY | | /s/ CATHERINE SZYMAN |

| Name: | Quentin Koffey | | Catherine Szyman |

| Title: | Lead Independent Director | | Date: | January 17, 2025 |

| Date: | January 17, 2025 | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

[Signature Page to Confidentiality Agreement]

APPENDIX I

LIST OF PRIOR INVENTIONS AND ORIGINAL WORKS OF AUTHORSHIP

| | | | | | | | | | | | | | |

| Title | | Date | | Identifying Number or Brief Description |

APPENDIX II

CALIFORNIA LABOR CODE SECTION 2870

EMPLOYMENT AGREEMENTS; ASSIGNMENT OF RIGHTS

“(a) Any provision in an employment agreement which provides that an employee shall assign or offer to assign any of his or her rights in an invention to his or her employer shall not apply to an invention that the employee developed entirely on his or her own time without using the employer’s equipment, supplies, facilities, or trade secret information except for those inventions that either:

(1) Relate at the time of conception or reduction to practice of the invention to the employer’s business, or actual or demonstrably anticipated research or development of the employer.

(2) Result from any work performed by the employee for the employer.

(b) To the extent a provision in an employment agreement purports to require an employee to assign an invention otherwise excluded from being required to be assigned under subdivision (a), the provision is against the public policy of this state and is unenforceable.”

Masimo Announces Leadership Transition

Katie Szyman Appointed Chief Executive Officer and to Board of Directors

Interim CEO Michelle Brennan Named Chairman of Masimo’s Board

IRVINE, Calif. – January 21, 2025 – Today the Board of Directors (the “Board”) of Masimo (NASDAQ: MASI), a leading global medical innovator, announced that Katie Szyman has been appointed the next Chief Executive Officer (“CEO”) of the Company. Interim CEO Michelle Brennan has been appointed Chairman of Masimo’s Board and Lead Independent Director Quentin Koffey has been appointed Vice Chairman. All of these changes are effective as of February 12, 2025.

Ms. Szyman is currently worldwide president of Advanced Patient Monitoring at BD (Becton, Dickinson and Company). Previously, Ms. Szyman led the Critical Care product group at Edwards Lifesciences (“Edwards”), which was acquired by BD in a transaction that closed in September of 2024. Her appointment follows an extensive search process overseen by the Board with the assistance of executive recruitment firm Korn Ferry. During this process, the Board evaluated numerous internal and external candidates. The Board concluded that Ms. Szyman was the right choice given her successful track record of accelerating revenue growth by bringing new patient monitoring products to market, extensive experience leading and retaining top industry talent, and deep existing relationships within the sector.

While at Edwards, Ms. Szyman significantly accelerated revenue growth in the Critical Care product group through numerous successful initiatives, including entering adjacent markets through internal and external innovation and introducing the first AI technology cleared by the Food and Drug Administration in the patient monitoring space. She possesses significant operational and financial leadership experience that will aid Masimo as it continues to address its cost structure and improve gross margin performance. Ms. Szyman also brings public company board experience, including serving as a director of Inari Medical since 2019.

Mr. Koffey stated:

“Katie’s more than 35 years of relevant experience and her unique mix of expertise set her apart during our search and make her an ideal fit to lead the next innovation-focused stage of Masimo’s evolution. We also want to thank Michelle for her exemplary performance in the interim CEO role, particularly in leading a seamless transition for customers, employees and shareholders from day one. We look forward to continuing to benefit from her experience and judgement as she moves into her new position as Chairman of the Board.”

Ms. Brennan added:

“We wanted our next CEO to be someone who is passionate about the role and inspiring as well as engaging the team at Masimo – and Katie made clear that she is that person. Her advanced patient monitoring category knowledge and deep existing relationships within the industry position her to make an immediate impact as she works with the Board on prioritizing our pipeline to focus on large opportunities, while developing a clear strategy for bringing our next generation patient monitoring platform to market.”

Ms. Szyman commented:

“I have long admired Masimo as an innovation leader, and I could not be more excited about the opportunity to grow the business and deliver improved outcomes for millions more patients around the world. I believe Masimo’s leadership team and bench of talent is top tier, and I am thrilled by the chance to work with and learn from this group.”

The Board remains committed to the previously announced review of alternatives for both the consumer audio and consumer healthcare businesses and has engaged Centerview Partners and Morgan Stanley as financial advisors and Sullivan & Cromwell as a legal advisor. The Board looks forward to providing updates in the near-term regarding value-creation initiatives, including this strategic review.

More About Katie Szyman

Ms. Szyman led the Critical Care business at Edwards Lifesciences for over a decade – including through the acquisition by BD (Becton, Dickinson and Company) in September of 2024. While at Edwards, Ms. Szyman accelerated the revenue growth of the business by shifting to AI-driven solutions that aid clinicians in decision making and help patients return home to their families faster. Previously, Ms. Szyman spent more than 20 years at Medtronic, where she held positions with increasing levels of responsibility inside and outside the U.S., including leadership roles in corporate strategy, business development and finance, and as the worldwide president of both the Endovascular and Diabetes business units. Ms. Szyman currently serves on the board of Inari Medical (NASDAQ: NARI). She previously served on the boards of Outset Medical (NASDAQ: OM), the Edwards Lifesciences Foundation, and the Opus School of Business at the University of St. Thomas. Ms. Szyman received a B.A. from the University of St. Thomas and an M.B.A. from Harvard Business School.

@Masimo | #Masimo

About Masimo

Masimo (NASDAQ: MASI) is a global medical technology company that develops and produces a wide array of industry-leading monitoring technologies, including innovative measurements, sensors, patient monitors, and automation and connectivity solutions. In addition, Masimo Consumer Audio is home to eight legendary audio brands, including Bowers & Wilkins, Denon, Marantz, and Polk Audio. Our mission is to improve life, improve patient outcomes, and reduce the cost of care.

Forward-Looking Statements

This press release includes forward-looking statements as defined in Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, in connection with the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, among others, statements regarding the review of alternatives for both the consumer audio and healthcare businesses. These forward-looking statements are based on current expectations about future events affecting us and are subject to risks and uncertainties, all of which are difficult to predict and many of which are beyond our control and could cause our actual results to differ materially and adversely from those expressed in our forward-looking statements as a result of various risk factors, including, but not limited to: risks related to our leadership appointments, our assumptions regarding the consumer audio and healthcare business review; as well as other factors discussed in the “Risk Factors” section of our most recent reports filed with the Securities and Exchange Commission (“SEC”), which may be obtained for free at the SEC's website at www.sec.gov. Although we believe that the expectations reflected in our forward-looking statements are reasonable, we do not know whether our expectations will prove correct. All forward-looking statements included in this press release are expressly qualified in their entirety by the foregoing cautionary statements. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of today's date. We do not undertake any obligation to update, amend or clarify these statements or the “Risk Factors” contained in our most recent reports filed with the SEC, whether as a result of new information, future events or otherwise, except as may be required under the applicable securities laws.

# # #

| | | | | | | | |

| Investor Contact: Eli Kammerman | | Media Contact: Evan Lamb |

| (949) 297-7077 | | (949) 396-3376 |

| ekammerman@masimo.com | | elamb@masimo.com |

| | or |

| | Longacre Square Partners |

| | masimo@longacresquare.com |

Masimo, SET, Signal Extraction Technology, Improving Patient Outcome and Reducing Cost of Care... by Taking Noninvasive Monitoring to New Sites and Applications, rainbow, SpHb, SpOC, SpCO, SpMet, PVI and ORI are trademarks or registered trademarks of Masimo Corporation

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

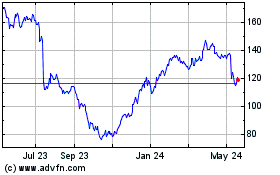

Masimo (NASDAQ:MASI)

Historical Stock Chart

From Jan 2025 to Feb 2025

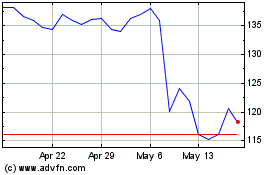

Masimo (NASDAQ:MASI)

Historical Stock Chart

From Feb 2024 to Feb 2025