false

0001659617

0001659617

2023-11-20

2023-11-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED): November 20, 2023

MOLECULIN BIOTECH, INC.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

|

001-37758

|

47-4671997

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

(Commission File No.)

|

(I.R.S. Employer Identification

No.)

|

5300 Memorial Drive, Suite 950, Houston, TX 77007

(Address of principal executive offices and zip code)

(713) 300-5160

(Registrant’s telephone number, including area code)

(Former name or former address, if changed from last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-14(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol (s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $.001 per share

|

MBRX

|

The NASDAQ Stock Market LLC

|

|

Item 7.01

|

Regulation FD Disclosure

|

On November 20, 2023, Moleculin Biotech, Inc. (the “Company”), held a virtual investor call with the Company’s Chairman and Chief Executive Officer, Walter Klemp.

A copy of the script is attached to this report as Exhibit 99.1 and is incorporated by reference herein.

The information contained in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, is being furnished and shall not be “filed” for the purpose of the Securities Exchange Act of 1934, as amended (“Exchange Act”), nor shall it be incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as amended (“Securities Act”), unless specifically identified therein as being incorporated by reference.

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

104

|

Cover page Interactive Data File (formatted as Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

MOLECULIN BIOTECH, INC.

|

|

| |

|

|

|

| |

|

|

|

| |

Date:

|

November 20, 2023

|

|

| |

|

|

|

| |

By:

|

/s/ Jonathan P. Foster

|

|

| |

|

Jonathan P. Foster

|

|

Exhibit 99.1

Virtual Investor: What this Means – Next Generation Anthracycline

November 20, 2023

Participants:

| |

●

|

Wally Klemp, Chairman and Chief Executive Officer

|

Moleculin Bio (Nasdaq: MBRX)

Jenene Introduction:

| |

●

|

Hello and thank you for joining us today for another Virtual Investor – What This Means Segment. My name is Jenene Thomas, CEO of JTC IR, and I will be the moderator for the event.

|

Today we are featuring Moleculin Biotech and I am pleased to be joined by Walter Klemp, Chairman and Chief Executive Officer of the Company.

Before we get started, I just want to inform our audience that Moleculin Bio is listed on the Nasdaq and trades under the ticker M B R X. During today’s discussion, the Company will be making forward-looking statements and actual results could differ materially from these forward-looking statements. Some of the factors that could cause actual results to differ materially from these contemplated by such forward-looking statements are discussed in the periodic reports Moleculin files with the Securities and Exchange Commission. These documents are available in the Investors section of the Company's website and on the Securities and Exchange Commission's website. We encourage you to review these documents carefully.

Moderated questions

Jenene: Wally, you recently announced an important Clinical Trial Update for your Annamycin programs and so we are here today to discuss the details and break down the significance of this update for investors.

Let’s take a step back and set the stage for those that are new to the Moleculin opportunity.

|

1)

|

Jenene Question: Could you please provide us with a brief [three sentences] history on anthracyclines?

|

Wally Response: Sure, Jenene. Well, Jenene, today’s anthracyclines represent 40-year-old technology that no one has improved on. Annamycin represents a radical improvement that will change the way we think about anthracyclines forever.

For background, anthracyclines have been and continue to be the most important drugs available for patients with AML or advanced soft tissue sarcoma, and for that matter a lot of other cancers, but they represent 40-year-old technology that hasn’t been improved in decades, and they have some serious limitations.

The most important of those limitations is that they are significantly cardiotoxic. So much so that the FDA has placed a lifetime maximum limit on cumulative anthracycline exposure and if you go over that limit there’s a 65% chance that you’ll have impaired heart function.

And, what this means is that most AML and STS patients just don’t get to benefit from anthracyclines.

|

2)

|

Jenene Question: Wally, could you please explain what a ‘next generation’ anthracycline means?

|

Wally Response: We describe Annamycin as a next generation anthracycline because we believe it’s going to change the way clinicians think about anthracyclines and it’s going to radically increase the number of patients they can treat with them. Essentially, we are intent upon democratizing anthracyclines so that a majority of patients can enjoy their benefits.

First and foremost, Annamycin is completely noncardiotoxic. We’ve now treated 66 patients and we’ve taken 50 of them above the lifetime maximum dose, with some as much as 2 to 6 times the lifetime limit, without any evidence of cardiotoxicity.

And, Annamycin is easier on patients than current anthracyclines, so many patients who couldn’t qualify for intensive therapy now will. No longer do patients have to be excluded because of age or heart condition. And, we should never have to damage a child’s heart in order to treat their cancer.

This means, for the first time ever, we can not only treat almost all patients with an anthracycline, but we can even start to use anthracyclines in a maintenance setting. We’re not just making a better anthracycline, but we are on a path to greatly expand the market.

|

3)

|

Jenene Question: Why is management so excited about Annamycin STS data, especially OS?

|

The problem in advanced soft tissue sarcoma has been that the standard of care is doxorubicin, the most commonly used anthracycline. And, once you reach the lifetime maximum limit, you have to move on to what can best be called salvage therapies.

One of the other things that makes Annamycin a next generation drug is that, in animal models, it is 30 times better than doxorubicin at accumulating in the lungs, which is where most sarcomas eventually metastasize.

When you look at the data we just announced from our ongoing Phase 2 trial, several things emerge. The far right column of the table shows that, when you optimize for the best performing dose level in patients with 2 or fewer prior therapies, we see a 78% response rate and 56% of patients are getting a progression free survival of 3.6 months.

What may be more important, though is overall survival. It’s too early to calculate this in the Phase 2 group, but in the Phase 1 we are at 11 months and climbing. Importantly, though, patients who withdraw from the study count against your OS, so if you exclude the one withdrawal we had, we are at 13.4 months and climbing. OS in first line patients doesn’t get better than 12-15 months and we’re doing this in later stage patients.

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5728024/

The study link shown on screen here is a meta-analysis of prior second line therapy trials for Advanced STS – and it concludes (quote) “Although the results of this meta‐analysis on ORR, OS, and PFS of salvage therapy in metastatic STS were positive, the prognosis of these patients remains unsatisfactory, with a median survival of 8–12 months. “ (end quote)

The fact is that no one has been able to move the needle in OS for this class of patients, yet Annamycin is doing this in patients with up to 9 prior therapies in our Phase 1B study.

The additional Phase 2 data we come out with in early ’24 should tell the rest of this story, so we are really looking forward to this next data milestone.

|

4)

|

Jenene Question: Lastly, why are you so excited about the Annamycin AML data?

|

Wally Response: Well, the problems with current anthracyclines are even more exaggerated in AML. If you’re diagnosed with AML, your best chance for survival (and actually beating the disease) is intensive induction therapy with an anthracycline and then a curative bone marrow transplant.

But only about a third of patients can even qualify for standard induction therapy. If you’re too old (which is true for most AML patients) or have co-morbidities (especially heart issues) then you are deemed “unfit” for intensive therapy. At that point, your best option is Venetoclax and azacytidine, but this Ven-aza combination is super hard on patients and is unsuccessful in most cases.

Right out of the blocks, our early phase 2 data on 8 patients generated 3 complete responses, which is as good as Ven-aza only we’re doing this in later stage patients than Ven-aza and with way better tolerability.

And when you look at the individual details, the story gets more compelling. We had a 78-year-old who stopped responding to Ven-Aza after 17 months and generated a complete response with a single treatment. This patient has been in complete remission now for 8 months and the treating physician felt comfortable giving a second course for good measure because the treatment was so well tolerated.

The 64-year-old on the other hand, tried Ven-Aza but didn’t respond, yet had a CR with one course of Annamycin and 3 months following had a curative bone marrow transplant.

The latest CR just isn’t old enough to comment on durability but notice that all of these patients were taken well above the lifetime maximum limit of 550 mg/m2. Also, we disclosed in our Q that a 9th patient was just evaluated and appears to have met the bone marrow criteria for a CR but we need an opportunity to review the data before including that patient in our preliminary statistics.

Look, the reason for shareholders to be excited is this: venetoclax is a half-a-billion-dollar drug for AbbVie. And although our n is small and the data are preliminary, we appear to be outperforming in this indication. Finally, in AML, the trial sizes and criteria for success are such that we think our approval pathway will be clear by second quarter of next year. So, frankly, this is probably our fastest pathway to approval and to establishing a partnering relationship with big pharma.

Jenene, we are now at the point where the very next piece of data could be the one that lights up our valuation and we think that’s a pretty good reason to be excited!

Jenene Closing:

| |

●

|

With that, this concludes the Virtual Investor What this Means segment with Moleculin. I would like to thank Wally Klemp, Chairman and CEO of Moleculin for joining us today.

|

| |

●

|

I would also like to thank our viewers for your time and attention. As a reminder, you can access the webcast replay from today’s event at: www.virtualinvestorco.com.

|

https://www.virtualinvestorco.com/wtm-mbrx-next-generation-anthracycline

Video will be available approx. 60 days

v3.23.3

Document And Entity Information

|

Nov. 20, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

MOLECULIN BIOTECH, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Nov. 20, 2023

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-37758

|

| Entity, Tax Identification Number |

47-4671997

|

| Entity, Address, Address Line One |

5300 Memorial Drive, Suite 950

|

| Entity, Address, City or Town |

Houston

|

| Entity, Address, State or Province |

TX

|

| Entity, Address, Postal Zip Code |

77007

|

| City Area Code |

713

|

| Local Phone Number |

300-5160

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

MBRX

|

| Security Exchange Name |

NASDAQ

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001659617

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

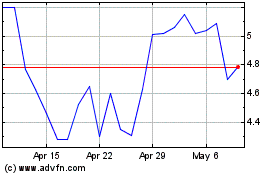

Moleculin Biotech (NASDAQ:MBRX)

Historical Stock Chart

From Apr 2024 to May 2024

Moleculin Biotech (NASDAQ:MBRX)

Historical Stock Chart

From May 2023 to May 2024