UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16 UNDER

THE

SECURITIES EXCHANGE ACT OF 1934

For

the month of December 2024

Commission

File Number 001-36896

MERCURITY

FINTECH HOLDING INC.

(Registrant’s

name)

1330

Avenue of the Americas, Fl 33,

New

York, NY 10019

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

On

December 16, 2024, Mercurity Fintech Holding Inc. (the “Company”) published an announcement (the “Press Release”),

a copy of which is attached herein as Exhibit 99.1.

This

report on Form 6-K (including the exhibit hereto) shall not be deemed to be “filed” for purposes of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”) and shall not be incorporated by reference into any filing under the Securities

Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

EXHIBIT

INDEX

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| Mercurity

Fintech Holding Inc. |

|

| |

|

|

| By: |

/s/

Shi Qiu |

|

| Name: |

Shi

Qiu |

|

| Title: |

Chief

Executive Officer |

|

Date:

December 16, 2024

Exhibit

99.1

Mercurity

Fintech Announces Strategic Joint Venture to Expand into AI Hardware Intelligent Manufacturing and Support Liquid Cooling Solutions for

World Leading AI Servers

New

York, — Mercurity Fintech Holding Inc. (“Mercurity Fintech,” “the Company,” “we,” “us,”

“our company,” or “MFH”) (Nasdaq: MFH), a digital fintech group, today announced the signing of a term sheet

with a high-tech enterprise specialized in the manufacturing and sale of precision fasteners, structural parts and other precision metal

parts products for new energy vehicles and smart electronic devices. This collaboration aims to establish a strategic joint venture (the

“JV”) in Hong Kong, focused on expanding into AI hardware intelligent manufacturing and supporting advanced cooling solutions

for AI servers.

The

term sheet sets forth the indicative material terms and conditions for the formation of the JV and is subject to the definitive agreements

to be entered into by the parties. These terms are non-binding unless specifically stated otherwise, and the definitive agreements will

include customary representations, warranties, and indemnifications for transactions of a similar nature and scale.

Key

Highlights of the Joint Venture:

Expansion

into AI Hardware Intelligent Manufacturing: The JV will focus on producing precision components and accessories tailored to the needs

of global leaders in artificial intelligence, smart driving, and wearable technology, including leading AI server companies and technology

companies. The JV’s establishment aligns with Mercurity Fintech’s strategic vision to diversify its business and enter the

fast-growing AI hardware manufacturing sector.

Strategic

Position with Cooling Systems: The JV aims to explore opportunities in advanced cooling solutions, which are critical for next-generation

AI servers. Our JV partner has collaboration with the world leading AI server company, including recent requests to produce samples for

liquid cooling projects, which highlights its proven capabilities in delivering advanced solutions.

Capital

Contributions and Structure: The initial investment amounts to USD $9.8 million, with Mercurity Fintech holding a 51% stake. This

financial commitment underscores both parties’ confidence in the potential of the partnership.

Global

Reach and Manufacturing Excellence: The JV envisions establishing a manufacturing hub to streamline operations and ensure the delivery

of high-quality products to clients worldwide.

Enhanced

Product Offering: In addition to liquid cooling systems, the JV will explore opportunities to manufacture sub-assemblies and precision

parts for next-generation AI, automotive, and wearable technologies, diversifying its product portfolio and solidifying its market presence.

The

joint venture will leverage the collaboration with the world leading AI server company to align with the increasing demand for efficient

cooling technologies essential for advanced AI servers. Harnessing MFH’s capabilities in international marketing and technological

innovation, the JV is positioned to capitalize on growth opportunities across AI, automotive, and wearable technology markets. Its commitment

to research and development ensures that the JV will deliver innovative, high-quality solutions tailored to meet evolving industry needs.

Shi

Qiu, CEO of Mercurity Fintech, commented:

“This

partnership represents a pivotal moment for Mercurity Fintech as we expand our business scope into the thriving AI hardware intelligent

manufacturing sector. By combining our partner’s unparalleled expertise in precision engineering with Mercurity Fintech’s

technological and operational acumen, we are poised to create a unique value proposition for global technology companies. Our JV partner’s

collaboration with the world leading AI server company underscores the immense potential of this venture and our shared commitment to

innovation.”

About

Mercurity Fintech Holding Inc.

Mercurity

Fintech Holding Inc. is a digital fintech company with subsidiaries specializing in distributed computing and digital consultation across

North America and the Asia-Pacific region. Our focus is on delivering innovative financial solutions while adhering to principles of

compliance, professionalism, and operational efficiency. Our aim is to contribute to the evolution of digital finance by providing secure

and innovative financial services to individuals and businesses. And our dedication to compliance, professionalism, and operational excellence

ensures that we remain a trusted partner in the rapidly transforming financial landscape. For more information, please visit the Company’s

website at https://mercurityfintech.com.

Forward-Looking

Statements

This

announcement contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995. All statements other than statements of historical fact in this announcement are forward-looking statements. These

forward-looking statements involve known and unknown risks and uncertainties and are based on current expectations and projections about

future events and financial trends that the Company believes may affect its financial condition, results of operations, business strategy

and financial needs. Investors can identify these forward-looking statements by words or phrases such as “may,” “will,”

“expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,”

“believe,” “potential,” “continue,” “is/are likely to” or other similar expressions.

The Company undertakes no obligation to update forward-looking statements to reflect subsequent occurring events or circumstances, or

changes in its expectations, except as may be required by law. Although the Company believes that the expectations expressed in these

forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions

investors that actual results may differ materially from the anticipated results.

For

more information, please contact:

International Elite Capital Inc.

Vicky

Chueng

Tel:

+1(646) 866-7928

Email:

mfhfintech@iecapitalusa.com

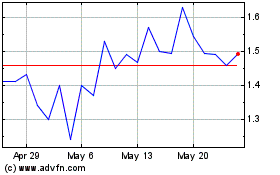

Mercurity Fintech (NASDAQ:MFH)

Historical Stock Chart

From Nov 2024 to Dec 2024

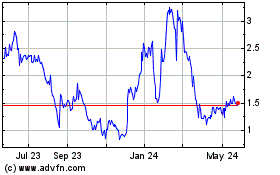

Mercurity Fintech (NASDAQ:MFH)

Historical Stock Chart

From Dec 2023 to Dec 2024