Form 424B3 - Prospectus [Rule 424(b)(3)]

October 22 2024 - 3:05PM

Edgar (US Regulatory)

Filed pursuant to Rule 424(b)(3)

Registration No. 333-278468

PROSPECTUS SUPPLEMENT

(To Prospectus Dated April 30, 2024)

Up to 5,497,506 Common Shares

Offered by the Selling Stockholders

This prospectus supplement supplements

the information contained in the prospectus dated April 30, 2024 (the “Prospectus”), which forms a part of our Registration

Statement on Form S-3 (Registration No. 333-278468) (the “Registration Statement”), relating to the offer and resale,

from time to time, by the selling stockholders (the “Selling Stockholders”) named in the Prospectus of our common shares,

no par value per share (our “common shares”).

This prospectus supplement should

be read in conjunction with the Prospectus. If there is any inconsistency between the information in the Prospectus and this prospectus

supplement, you should rely on the information in this prospectus supplement. This prospectus supplement is not complete without, and

may not be delivered or utilized except in connection with, the Prospectus, including any amendments or supplements thereto. Capitalized

terms used in this prospectus supplement and not otherwise defined herein have the meanings set forth in the Prospectus.

We are filing this

prospectus supplement pursuant to that certain exchange agreement, dated October 17, 2024, by and among us and certain of the Selling

Stockholders (the “Share Exchange”) to reflect the cancellation of certain of the common shares registered for resale under

the Registration Statement, as well as to update the information contained in the section of the Prospectus entitled “Selling

Stockholders” to reflect the Share Exchange. For more information regarding the Share Exchange,

please see the Current Report on Form 8-K filed by us on October 17, 2024.

The following table has also been revised to update

the holdings of the Selling Stockholders as of the date of this prospectus supplement. The table, including the footnotes, set forth under

the caption “Selling Stockholders” in the Prospectus is hereby replaced in its entirety by the below table.

The number of common shares beneficially

owned by each Selling Stockholder in the table below is based on information supplied to us by each such Selling Stockholder, with beneficial

ownership determined in accordance with the rules and regulations of the SEC and includes voting or investment power with respect

to the common shares. This information does not necessarily indicate beneficial ownership for any other purpose. The percentage of beneficial

ownership is based on 73,331,690 common shares outstanding as of October 21, 2024.

| | |

Common

Shares Beneficially

Owned

Prior to Offering | | |

| | |

Common

Shares Beneficially

Owned

After Offering | |

| Selling Stockholder | |

Number of

Common

Shares | | |

Percentage of

Outstanding

Common

Shares | | |

Number of

Common Shares

Registered for

Sale Hereby | | |

Number of

Common

Shares | | |

Percentage of

Outstanding

Common

Shares | |

| Deep Track Biotechnology Master Fund, LTD(1) | |

| 7,065,099 | | |

| 9.14 | % | |

| 2,666,667 | | |

| 4,398,432 | | |

| 5.69 | % |

| Commodore Capital Master LP(2) | |

| 7,694,963 | | |

| 9.99 | % | |

| 1,833,333 | | |

| 7,595,442 | | |

| 9.64 | % |

| K2 HealthVentures Equity Trust LLC(3) | |

| 997,506 | | |

| 1.34 | % | |

| 997,506 | | |

| — | | |

| — | |

| (1) | The number of shares beneficially owned prior to and after this offering includes 4,000,000 common shares underlying a warrant for

common shares owned by this Selling Stockholder. Under the terms of such warrant, the holder may not exercise the warrant to the extent

such exercise would cause such holder, together with its affiliates, to beneficially own a number of common shares which would exceed

9.99% of the number of common shares outstanding following such exercise (the “Ownership Cap”). Upon 61 days’ advance

written notice to us, the holder of such warrant may from time to time increase or decrease the Ownership Cap percentage up to 19.99%.

Deep Track Capital, LP (the “Deep Track Investment Manager”) serves as the investment manager to Deep Track Biotechnology

Master Fund Ltd. (the “Deep Track Master Fund”) and may be deemed to beneficially own such shares. Deep Track Capital

GP, LLC (the “Deep Track General Partner”) is the General Partner of the Deep Track Investment Manager. David Kroin is the

Chief Investment Officer of the Deep Track Investment Manager and managing member of the Deep Track General Partner and may be deemed

to beneficially own such shares. The business address of the Deep Track Master Fund, the Deep Track Investment Manager, the Deep Track

General Partner and Mr. Kroin is 200 Greenwich Avenue, 3rd Floor, Greenwich, CT 06830. |

| (2) | The number of shares beneficially owned prior to this offering includes 3,694,963 common shares underlying warrants for common shares

owned by this Selling Stockholder. Under the terms of such warrants, the holder may not exercise the warrants to the extent such exercise

would cause such holder, together with its affiliates, to beneficially own a number of common shares which would exceed the Ownership

Cap. Upon 61 days’ advance written notice to us, the holder of such warrants may from time to time increase or decrease the

Ownership Cap percentage up to 19.99%. The number of shares beneficially owned prior to this offering does not include 1,733,812

common shares underlying such warrants as a result of the Ownership Cap and the 61 days’ advance notice provision. The number

of shares beneficially owned after this offering includes 5,428,775 common shares underlying such warrants for common shares owned by

this Selling Stockholder. Commodore Capital LP is the investment manager to Commodore Capital Master LP and may be deemed to beneficially

own the shares held by Commodore Capital Master LP. Michael Kramarz and Robert Egen Atkinson are the managing partners of Commodore Capital

LP and exercise investment discretion with respect to these shares. Commodore Capital LP and Commodore Capital Master LP have shared voting

and dispositive power with respect to these shares. The address of Commodore Capital LP and Commodore Capital Master LP is 444 Madison

Avenue, 35th Floor, New York, NY 10022. |

| (3) | Consists of up to 997,506 common shares issuable upon the conversion by the Lenders of any portion of the principal amount of the

Term Loan up to an aggregate principal amount of $4.0 million, then outstanding under the Loan Agreement. Parag Shah and Anup Arora serve

as the managing members of K2 HealthVentures LLC, the sole member of K2 HealthVentures Equity Trust LLC, and in such capacities may be

deemed to indirectly beneficially own the shares beneficially owned by K2 HealthVentures Equity Trust LLC. The address of K2 HealthVentures

LLC and K2 HealthVentures Equity Trust LLC is 855 Boylston Street, Suite 1000, Boston, MA 02116. |

Investing in our common shares

involves a high degree of risk. See “Risk Factors” on page 9 of the Prospectus and in the documents incorporated by reference

into the Prospectus.

Neither the Securities and Exchange

Commission nor any state or other securities commission has approved or disapproved of the common shares offered in the Prospectus or

determined if the Prospectus or this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement

is October 22, 2024.

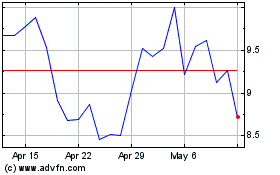

Mind Medicine MindMed (NASDAQ:MNMD)

Historical Stock Chart

From Oct 2024 to Nov 2024

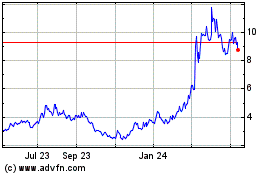

Mind Medicine MindMed (NASDAQ:MNMD)

Historical Stock Chart

From Nov 2023 to Nov 2024