Registration

No. 333-

As

filed with the Securities and Exchange Commission on October 18, 2024

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Newmark

Group, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

81-4467492 |

|

(State or other jurisdiction of

incorporation or organization) |

|

(IRS Employer

Identification No.) |

125 Park Avenue

New York, New York 10017

(Address of Principal Executive Offices) (Zip

Code)

Amended and Restated Newmark Group, Inc. Long

Term Incentive Plan

(Full title of the plan)

Stephen M. Merkel

Executive Vice President and Chief Legal Officer

Newmark Group, Inc.

125 Park Avenue

New York, New York 10017

(Name and address of agent for service)

(212) 372-2000

(Telephone number, including area code, of

agent for service)

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of

“large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth

company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☒ |

|

Accelerated filer |

☐ |

| |

|

|

|

|

| Non-accelerated filer |

☐ |

|

Smaller reporting company |

☐ |

| |

|

|

|

|

| |

|

|

Emerging growth company |

☐ |

If an emerging growth company, include by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY NOTE

This Registration Statement on

Form S-8 (this “Registration Statement”) is filed by Newmark Group, Inc. (“we,” “us,” “our”

or the “Registrant”) for the purpose of registering 100,000,000 additional shares of

our Class A Common Stock, par value $0.01 per share (the “Class A Common Stock”), and additional Restricted Stock Units and

Other Stock-Based Awards under the Securities Act of 1933, as amended, pursuant to the Amended and Restated Newmark Group, Inc. Long Term

Incentive Plan (the “Plan”). Such shares of Class A Common Stock may be issued over time in accordance with then-current compensatory

arrangements. Additionally, we may acquire shares of Class A Common Stock and limited partnership units of Newmark Holdings, L.P. under

our share repurchase and unit redemption programs in effect from time to time to mitigate share issuance growth. The shares of the Class

A Common Stock, Restricted Stock Units and Other Stock-Based Awards registered herein to

be offered and sold pursuant to the Plan are of the same classes of securities as the shares of the Class A Common Stock, Restricted Stock

Units and Other Stock-Based Awards registered under our currently effective Registration

Statements on Form S-8 filed with the Securities and Exchange Commission (the “Commission”) on December 20, 2017 (File No.

333-222201), November 20, 2019 (File No. 333-234785), September 2, 2021 (File No. 333-259262), April 4, 2023 (File No. 333-271119), and

August 25, 2023 (File No. 333-274235) (collectively, the “Prior Registration Statements”). Pursuant to General Instruction

E to Form S-8, the contents of the Prior Registration Statements are incorporated herein by reference except to the extent supplemented,

amended or superseded by the information set forth herein. Only those items containing new information not contained in the Prior Registration

Statements are presented herein.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents previously filed by us with the Commission

are incorporated by reference into this Registration Statement:

| (a) | Our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the Commission

on February 29, 2024. |

| (b) | Our Amendment No. 1 to our Annual Report on Form 10-K/A for the fiscal year ended December

31, 2023, filed with the Commission on April 26, 2024. |

| (d) | Our Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2024, filed with the

Commission on May 10, 2024. |

| (e) | Our Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2024, filed with the

Commission on August 8, 2024. |

| (f) | Our Current Reports on Form 8-K, filed with the Commission on January

5, 2024, January 12, 2024, February

22, 2024 (other than as indicated therein), April

30, 2024, May 3, 2024 (other

than as indicated therein), June 10,

2024, August 2, 2024 (other

than as indicated therein), August

12, 2024, and October 18, 2024. |

| (g) | The description of the Class A Common Stock contained in our Registration Statement on Form 8-A (Registration No. 001-38329), filed with the Commission on December 14, 2017, as updated by Exhibit 4.1 to our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 filed with the Commission on February 29, 2024, including any amendment or report filed

for the purpose of updating such description. |

All documents subsequently filed by us pursuant to Sections 13(a),

13(c), 14 and 15(d) of the Securities Exchange Act of 1934, as amended, prior to the filing of a post-effective amendment which indicates

that all securities offered hereby have been sold or which deregisters all securities then remaining unsold shall be deemed to be incorporated

by reference into this Registration Statement and to be a part hereof from the date of the filing of such documents.

Any statement contained herein or in a document, all or a portion of

which is incorporated or deemed to be incorporated by reference herein, shall be deemed to be modified or superseded for purposes of this

Registration Statement to the extent that a statement contained herein or in any other subsequently filed document that also is or is

deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall

not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Item 6. Indemnification of Directors and Officers

Section 145 of the Delaware General Corporation Law (the “DGCL”)

provides that a corporation may indemnify directors and officers as well as other employees and individuals against expenses (including

attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by such person in connection

with any threatened, pending or completed actions, suits or proceedings in which such person is made a party by reason of such person

being or having been a director, officer, employee or agent of the Registrant. The DGCL provides that Section 145 is not exclusive of

other rights to which those seeking indemnification may be entitled under any bylaws, agreement, vote of stockholders or disinterested

directors or otherwise. The Registrant’s Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws provide

for indemnification by the Registrant of its directors and officers to the fullest extent permitted by the DGCL.

Section 102(b)(7) of the DGCL permits a corporation to provide in its

certificate of incorporation that a director or officer of the corporation shall not be personally liable to the corporation or its stockholders

for monetary damages for breach of fiduciary duty as a director or officer, except for liability of (1) a director or officer for any

breach of the director’s or officer’s duty of loyalty to the corporation or its stockholders, (2) a director or officer for

acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (3) a director under Section

174 of the DGCL, (4) a director or officer for any transaction from which the director or officer derived an improper personal benefit

or (5) an officer in any action by or in the right of the corporation. The Registrant’s Amended and Restated Certificate of Incorporation

provides for such limitation of liability to the fullest extent permitted by the DGCL.

The Registrant maintains standard policies of insurance under which

coverage is provided (1) to its directors and officers against loss arising from claims made by reason of breach of duty or other wrongful

act, while acting in their capacity as directors and officers of the Registrant, and (2) to the Registrant with respect to payments which

may be made by the Registrant to such directors and officers pursuant to any indemnification provision contained in the Registrant’s

Amended and Restated Certificate of Incorporation or Amended and Restated Bylaws or otherwise as a matter of law.

Item 8. Exhibits.

The Exhibit Index set forth below

is incorporated by reference in response to this Item 8.

EXHIBIT

INDEX

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant

certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this

Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of New York, State of New

York, on October 18, 2024.

| |

Newmark Group, Inc. |

| |

|

|

|

| |

By: |

/s/ Howard W. Lutnick |

| |

|

Name: |

Howard W. Lutnick |

| |

|

Title: |

Executive Chairman |

[Signature Page to Registration Statement on Form

S-8 re: Amended and Restated Newmark Group, Inc. Long Term Incentive Plan]

POWERS OF ATTORNEY

Each of the undersigned, whose signature appears below, hereby constitutes

and appoints Howard W. Lutnick and Stephen M. Merkel, and each of them, as his or her true and lawful attorneys-in-facts and agents, with

full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities, to sign

any or all amendments to this Registration Statement, and to file the same, with all exhibits thereto and other documents in connection

therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, or his or her substitute or substitutes,

and each of them, full power and authority to do and perform each and every act and thing necessary or appropriate to be done with respect

to this Registration Statement or any amendments hereto in the premises, as fully to all intents and purposes as he or she might or could

do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents, or his or her substitute or substitutes, may

lawfully do or cause to be done by virtue thereof.

Pursuant to the requirements of the Securities Act of 1933, this Registration

Statement has been signed below by the following persons, in the capacities and on the date indicated:

| Signature |

|

Capacity in Which Signed |

|

Date |

| |

|

|

|

|

| /s/ Howard W. Lutnick |

|

Executive Chairman and Director |

|

October 18, 2024 |

| Howard W. Lutnick |

|

(Principal Executive Officer) |

|

|

| |

|

|

|

|

| /s/ Barry M. Gosin |

|

Chief Executive Officer |

|

October 18, 2024 |

| Barry M. Gosin |

|

|

|

|

| |

|

|

|

|

| /s/ Michael J. Rispoli |

|

Chief Financial Officer |

|

October 18, 2024 |

| Michael J. Rispoli |

|

(Principal Financial and Accounting Officer) |

|

|

| |

|

|

|

|

| /s/ Virginia S. Bauer |

|

Director |

|

October 18, 2024 |

| Virginia S. Bauer |

|

|

|

|

| |

|

|

|

|

| /s/ Kenneth A. McIntyre |

|

Director |

|

October 18, 2024 |

| Kenneth A. McIntyre |

|

|

|

|

| |

|

|

|

|

| /s/ Jay Itzkowitz |

|

Director |

|

October 18, 2024 |

| Jay Itzkowitz |

|

|

|

|

[Signature Page to Registration Statement on Form

S-8 re: Amended and Restated Newmark Group, Inc. Long Term Incentive Plan]

Exhibit 5.1

NEWMARK GROUP, INC.

October 18, 2024

Newmark Group, Inc.

125 Park Avenue

New York, New York 10017

Ladies and Gentlemen:

I am the Executive Vice President

and Chief Legal Officer of Newmark Group, Inc., a Delaware corporation (the “Company”). In connection with the

Registration Statement on Form S-8 (the “Registration Statement”) filed by the Company with the U.S. Securities and

Exchange Commission (the “Commission”) on the date hereof, relating to the registration under the Securities Act of

1933, as amended (the “Securities Act”), of the offer and sale of up to 100,000,000 shares (the “Shares”)

of Class A common stock, par value $0.01 per share (the “Class A Common Stock”), and Restricted Stock Units, with or

without dividend equivalents, and Other Stock-Based Awards, representing rights to acquire some or all of the Shares, pursuant to the

Company’s Amended and Restated Long Term Incentive Plan (the “Plan”), you have requested my opinion with respect

to the matters set forth below.

For the purposes of this opinion letter, I, or attorneys working under

my direction (collectively, “we”), have examined the Registration Statement and the originals, or duplicates or certified

or conformed copies, of such corporate records, agreements, documents and other instruments, including the Second Amended and Restated

Certificate of Incorporation of the Company (the “Certificate of Incorporation”), the Amended and Restated Bylaws of

the Company (the “Bylaws”) and the Plan, and have made such other investigations as we have deemed relevant and necessary

in connection with the opinions set forth below. As to questions of fact material to this opinion letter, we have relied upon oral and

written representations and certificates of officers and other representatives of the Company and certificates or comparable documents

of public officials.

In making such examination and rendering the opinions set forth below,

we have assumed without verification the genuineness of all signatures, the authenticity of all documents submitted to us as originals,

that all documents submitted to us as certified copies are true and correct copies of such originals, the authenticity of the originals

of such documents submitted to us as certified copies, and the legal capacity of all individuals executing any of the foregoing documents.

We have also assumed that any Shares to be offered and sold from time

to time will be duly authorized and issued in accordance with the Certificate of Incorporation and the Bylaws, the authorizing resolutions

of the Board of Directors of the Company or a committee thereof and applicable law, and that any certificates evidencing such Shares will

be duly executed and delivered, against receipt of the consideration approved by the Company, which will be no less than the par value

of the Class A Common Stock on a per share basis.

Based upon the foregoing, and subject to the qualifications, assumptions

and limitations stated herein, I am of the opinion that, when the Shares and any Restricted Stock Units and Other Stock-Based Awards sold

have been issued, delivered and paid for in the manner contemplated by and upon the terms and conditions set forth in the Plan, the Shares

will be validly issued, fully paid and nonassessable, and the Restricted Stock Units and Other Stock-Based Awards will constitute valid

and legally binding obligations of the Company.

I am a member of the bar of the State of New York, and I do not express

any opinion herein concerning any law other than the laws of the State of New York and the Delaware General Corporation Law (including

the statutory provisions, all applicable provisions of the Delaware Constitution and reported judicial decisions interpreting the foregoing).

I hereby consent to the filing of this opinion letter as Exhibit 5.1

to the Registration Statement. In giving such consent, I do not thereby admit that I am in the category of persons whose consent is required

under Section 7 of the Securities Act, and the rules and regulations of the Commission promulgated thereunder.

| |

Very truly yours, |

| |

|

| |

/s/ Stephen M. Merkel |

| |

Stephen M. Merkel

Executive Vice President and

Chief Legal Officer |

[Signature Page to Exhibit 5.1 Legal Opinion on

Form S-8 re: Amended and Restated Newmark Group, Inc. Long Term Incentive Plan]

Exhibit 23.1

Consent of Independent Registered Public Accounting

Firm

We consent to the incorporation by reference in the Registration Statement

(Form S-8) pertaining to the Amended and Restated Newmark Group, Inc. Long Term Incentive Plan of our reports dated February 29, 2024,

with respect to the consolidated financial statements of Newmark Group, Inc. and the effectiveness

of internal control over financial reporting of Newmark Group, Inc. included in its Annual Report (Form 10-K) for the year ended

December 31, 2023, filed with the Securities and Exchange Commission.

/s/ Ernst & Young LLP

New York, New York

October 18, 2024

S-8

EX-FILING FEES

0001690680

0001690680

1

2024-10-18

2024-10-18

0001690680

2

2024-10-18

2024-10-18

0001690680

3

2024-10-18

2024-10-18

0001690680

2024-10-18

2024-10-18

iso4217:USD

xbrli:pure

xbrli:shares

Ex-Filing Fees

CALCULATION OF FILING FEE TABLE

S-8

NEWMARK GROUP, INC.

Table 1: Newly Registered Securities

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Line Item Type |

|

Security Type |

|

Security Class Title |

|

Notes |

|

Fee Calculation

Rule |

|

Amount Registered |

|

Proposed Maximum Offering

Price Per Unit |

|

Maximum Aggregate Offering Price |

|

Fee Rate |

|

Amount of Registration Fee |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fees to be Paid |

|

Equity |

|

Class A Common Stock, par value $0.01 per share |

|

(1) |

|

Other |

|

100,000,000 |

|

$ |

14.4875 |

|

$ |

1,448,750,000.00 |

|

0.0001531 |

|

$ |

221,803.63 |

| Fees to be Paid |

|

Equity |

|

Restricted Stock Units |

|

(2) |

|

Other |

|

|

|

|

|

|

|

|

|

0.0001531 |

|

|

0.00 |

| Fees to be Paid |

|

Equity |

|

Other Stock-Based Awards |

|

(3) |

|

Other |

|

|

|

|

|

|

|

|

|

0.0001531 |

|

|

0.00 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Offering Amounts: |

|

$ |

1,448,750,000.00 |

|

|

|

$ |

221,803.63 |

| Total Fee Offsets: |

|

|

|

|

|

|

|

0.00 |

| Net Fee Due: |

|

|

|

|

|

|

$ |

221,803.63 |

__________________________________________

Offering Notes

| (1) | |

Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), the number of shares of Class A Common Stock, par value $0.01 per share (the “Class A Common

Stock”), of Newmark Group, Inc. being registered shall include an indeterminate number of additional shares which may become issuable as a result of stock splits, stock dividends, or similar

transactions in accordance with the anti-dilution provisions of the Amended and Restated Newmark Group, Inc. Long Term Incentive Plan (the “Plan”). The proposed maximum offering price per

unit herein is calculated pursuant to Rules 457(c) and 457(h) under the Securities Act, and is based upon the average of the high and low sale prices of the Class A Common Stock reported on

the Nasdaq Global Select Market on October 11, 2024. |

| (2) | |

Restricted Stock Units represent rights, with or without dividend equivalents, to acquire shares of the Class A Common Stock pursuant to the Plan upon the vesting thereof for no additional

consideration. Each Restricted Stock Unit shall represent a right to acquire one share of the Class A Common Stock, subject to adjustment for stock splits, stock dividends, or similar

transactions in accordance with the anti-dilution provisions of the Plan. The aggregate number of Restricted Stock Units and Other Stock-Based Awards (as described in footnote (3)) sold

pursuant to the Plan shall not exceed the number of shares of the Class A Common Stock being registered herein, as adjusted pursuant to Rule 416(a) under the Securities Act. The Restricted

Stock Units registered herein are included in the offering price and fee calculations for the shares of the Class A Common Stock being registered herein. Any value attributable to the Restricted

Stock Units is reflected in the market price of the Class A Common Stock, and any Restricted Stock Units sold will be sold for consideration not to exceed the value of the underlying shares of

the Class A Common Stock represented by the Restricted Stock Units on the date of sale. Accordingly, there is no additional offering price or registration fee with respect to the Restricted Stock

Units being registered herein. |

| (3) | |

Other Stock-Based Awards represent rights to acquire shares of the Class A Common Stock for no additional consideration pursuant to the Plan, upon the exchange of exchangeable REUs,

PSUs, LPUs or certain other limited partnership units issued by Newmark Holdings, L.P. (“Newmark Holdings”) pursuant to the Newmark Holdings Participation Plan, and upon the exchange of

compensatory exchangeable Founding Partner Units issued by Newmark Holdings. Each Other Stock-Based Award shall represent a right to acquire one share of the Class A Common Stock,

subject to adjustment as described in the Amended and Restated Agreement of Limited Partnership of Newmark Holdings, as amended, and for stock splits, stock dividends, or similar

transactions in accordance with the anti-dilution provisions of the Plan. The aggregate number of Restricted Stock Units (as described in footnote (2)) and Other Stock-Based Awards sold

pursuant to the Plan shall not exceed the number of shares of the Class A Common Stock being registered herein, as adjusted pursuant to Rule 416(a) under the Securities Act. The Other

Stock-Based Awards registered herein are included in the offering price and fee calculations for the shares of the Class A Common Stock being registered herein. Any value attributable to the

Other Stock-Based Awards is reflected in the market price of the Class A Common Stock, and any Other Stock-Based Awards sold will be sold for consideration not to exceed the value of the

underlying shares of the Class A Common Stock represented by the Other Stock-Based Awards on the date of sale. Accordingly, there is no additional offering price or registration fee with

respect to the Other Stock-Based Awards being registered herein. |

v3.24.3

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_FeeExhibitTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:feeExhibitTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissionLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissnTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.24.3

Offerings

|

Oct. 18, 2024

USD ($)

shares

|

| Offering: 1 |

|

| Offering: |

|

| Fee Previously Paid |

false

|

| Other Rule |

true

|

| Security Type |

Equity

|

| Security Class Title |

Class A Common Stock, par value $0.01 per share

|

| Amount Registered | shares |

100,000,000

|

| Proposed Maximum Offering Price per Unit |

14.4875

|

| Maximum Aggregate Offering Price |

$ 1,448,750,000.00

|

| Fee Rate |

0.01531%

|

| Amount of Registration Fee |

$ 221,803.63

|

| Offering Note |

Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), the number of shares of Class A Common Stock, par value $0.01 per share (the “Class A Common

Stock”), of Newmark Group, Inc. being registered shall include an indeterminate number of additional shares which may become issuable as a result of stock splits, stock dividends, or similar

transactions in accordance with the anti-dilution provisions of the Amended and Restated Newmark Group, Inc. Long Term Incentive Plan (the “Plan”). The proposed maximum offering price per

unit herein is calculated pursuant to Rules 457(c) and 457(h) under the Securities Act, and is based upon the average of the high and low sale prices of the Class A Common Stock reported on

the Nasdaq Global Select Market on October 11, 2024.

|

| Offering: 2 |

|

| Offering: |

|

| Fee Previously Paid |

false

|

| Other Rule |

true

|

| Security Type |

Equity

|

| Security Class Title |

Restricted Stock Units

|

| Fee Rate |

0.01531%

|

| Amount of Registration Fee |

$ 0.00

|

| Offering Note |

Restricted Stock Units represent rights, with or without dividend equivalents, to acquire shares of the Class A Common Stock pursuant to the Plan upon the vesting thereof for no additional

consideration. Each Restricted Stock Unit shall represent a right to acquire one share of the Class A Common Stock, subject to adjustment for stock splits, stock dividends, or similar

transactions in accordance with the anti-dilution provisions of the Plan. The aggregate number of Restricted Stock Units and Other Stock-Based Awards (as described in footnote (3)) sold

pursuant to the Plan shall not exceed the number of shares of the Class A Common Stock being registered herein, as adjusted pursuant to Rule 416(a) under the Securities Act. The Restricted

Stock Units registered herein are included in the offering price and fee calculations for the shares of the Class A Common Stock being registered herein. Any value attributable to the Restricted

Stock Units is reflected in the market price of the Class A Common Stock, and any Restricted Stock Units sold will be sold for consideration not to exceed the value of the underlying shares of

the Class A Common Stock represented by the Restricted Stock Units on the date of sale. Accordingly, there is no additional offering price or registration fee with respect to the Restricted Stock

Units being registered herein.

|

| Offering: 3 |

|

| Offering: |

|

| Fee Previously Paid |

false

|

| Other Rule |

true

|

| Security Type |

Equity

|

| Security Class Title |

Other Stock-Based Awards

|

| Fee Rate |

0.01531%

|

| Amount of Registration Fee |

$ 0.00

|

| Offering Note |

Other Stock-Based Awards represent rights to acquire shares of the Class A Common Stock for no additional consideration pursuant to the Plan, upon the exchange of exchangeable REUs,

PSUs, LPUs or certain other limited partnership units issued by Newmark Holdings, L.P. (“Newmark Holdings”) pursuant to the Newmark Holdings Participation Plan, and upon the exchange of

compensatory exchangeable Founding Partner Units issued by Newmark Holdings. Each Other Stock-Based Award shall represent a right to acquire one share of the Class A Common Stock,

subject to adjustment as described in the Amended and Restated Agreement of Limited Partnership of Newmark Holdings, as amended, and for stock splits, stock dividends, or similar

transactions in accordance with the anti-dilution provisions of the Plan. The aggregate number of Restricted Stock Units (as described in footnote (2)) and Other Stock-Based Awards sold

pursuant to the Plan shall not exceed the number of shares of the Class A Common Stock being registered herein, as adjusted pursuant to Rule 416(a) under the Securities Act. The Other

Stock-Based Awards registered herein are included in the offering price and fee calculations for the shares of the Class A Common Stock being registered herein. Any value attributable to the

Other Stock-Based Awards is reflected in the market price of the Class A Common Stock, and any Other Stock-Based Awards sold will be sold for consideration not to exceed the value of the

underlying shares of the Class A Common Stock represented by the Other Stock-Based Awards on the date of sale. Accordingly, there is no additional offering price or registration fee with

respect to the Other Stock-Based Awards being registered herein.

|

| X |

- DefinitionThe amount of securities being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_AmtSctiesRegd |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTotal amount of registration fee (amount due after offsets). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe rate per dollar of fees that public companies and other issuers pay to register their securities with the Commission. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeRate |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:percentItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCheckbox indicating whether filer is using a rule other than 457(a), 457(o), or 457(f) to calculate the registration fee due. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesOthrRuleFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum aggregate offering price for the offering that is being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxAggtOfferingPric |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative100TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum offering price per share/unit being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxOfferingPricPerScty |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal4lItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingNote |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:textBlockItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe title of the class of securities being registered (for each class being registered). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTitl |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionType of securities: "Asset-backed Securities", "ADRs/ADSs", "Debt", "Debt Convertible into Equity", "Equity", "Face Amount Certificates", "Limited Partnership Interests", "Mortgage Backed Securities", "Non-Convertible Debt", "Unallocated (Universal) Shelf", "Exchange Traded Vehicle Securities", "Other" Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:securityTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_OfferingTable |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_PrevslyPdFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

ffd_OfferingAxis=1 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

ffd_OfferingAxis=2 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

ffd_OfferingAxis=3 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

v3.24.3

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesSummaryLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_NetFeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlFeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlOfferingAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlOffsetAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

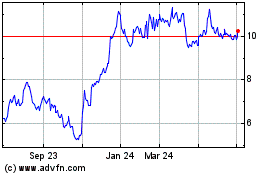

Newmark (NASDAQ:NMRK)

Historical Stock Chart

From Dec 2024 to Jan 2025

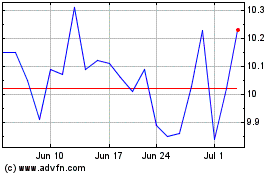

Newmark (NASDAQ:NMRK)

Historical Stock Chart

From Jan 2024 to Jan 2025