00018687262023Q3false--12-3100018687262023-01-012023-09-3000018687262023-11-03xbrli:shares00018687262023-09-30iso4217:USD00018687262022-12-31iso4217:USDxbrli:shares00018687262023-07-012023-09-3000018687262022-07-012022-09-3000018687262022-01-012022-09-300001868726us-gaap:CommonStockMember2022-12-310001868726us-gaap:AdditionalPaidInCapitalMember2022-12-310001868726us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001868726us-gaap:RetainedEarningsMember2022-12-310001868726us-gaap:RetainedEarningsMember2023-01-012023-03-3100018687262023-01-012023-03-310001868726us-gaap:CommonStockMember2023-01-012023-03-310001868726us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001868726us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001868726us-gaap:CommonStockMember2023-03-310001868726us-gaap:AdditionalPaidInCapitalMember2023-03-310001868726us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001868726us-gaap:RetainedEarningsMember2023-03-3100018687262023-03-310001868726us-gaap:RetainedEarningsMember2023-04-012023-06-3000018687262023-04-012023-06-300001868726us-gaap:CommonStockMember2023-04-012023-06-300001868726us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001868726us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001868726us-gaap:CommonStockMember2023-06-300001868726us-gaap:AdditionalPaidInCapitalMember2023-06-300001868726us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001868726us-gaap:RetainedEarningsMember2023-06-3000018687262023-06-300001868726us-gaap:RetainedEarningsMember2023-07-012023-09-300001868726us-gaap:CommonStockMember2023-07-012023-09-300001868726us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300001868726us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-300001868726us-gaap:CommonStockMember2023-09-300001868726us-gaap:AdditionalPaidInCapitalMember2023-09-300001868726us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300001868726us-gaap:RetainedEarningsMember2023-09-300001868726us-gaap:CommonStockMember2021-12-310001868726us-gaap:AdditionalPaidInCapitalMember2021-12-310001868726us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001868726us-gaap:RetainedEarningsMember2021-12-3100018687262021-12-310001868726us-gaap:RetainedEarningsMember2022-01-012022-03-3100018687262022-01-012022-03-310001868726us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-310001868726us-gaap:CommonStockMember2022-01-012022-03-310001868726us-gaap:CommonStockMember2022-03-310001868726us-gaap:AdditionalPaidInCapitalMember2022-03-310001868726us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-310001868726us-gaap:RetainedEarningsMember2022-03-3100018687262022-03-310001868726us-gaap:RetainedEarningsMember2022-04-012022-06-3000018687262022-04-012022-06-300001868726us-gaap:CommonStockMember2022-04-012022-06-300001868726us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-300001868726us-gaap:CommonStockMember2022-06-300001868726us-gaap:AdditionalPaidInCapitalMember2022-06-300001868726us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-300001868726us-gaap:RetainedEarningsMember2022-06-3000018687262022-06-300001868726us-gaap:RetainedEarningsMember2022-07-012022-09-300001868726us-gaap:CommonStockMember2022-07-012022-09-300001868726us-gaap:AdditionalPaidInCapitalMember2022-07-012022-09-300001868726us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-012022-09-300001868726us-gaap:CommonStockMember2022-09-300001868726us-gaap:AdditionalPaidInCapitalMember2022-09-300001868726us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-300001868726us-gaap:RetainedEarningsMember2022-09-3000018687262022-09-30olpx:business_channel0001868726olpx:SalesChannelThroughIntermediaryProfessionalMember2023-07-012023-09-300001868726olpx:SalesChannelThroughIntermediaryProfessionalMember2022-07-012022-09-300001868726olpx:SalesChannelThroughIntermediaryProfessionalMember2023-01-012023-09-300001868726olpx:SalesChannelThroughIntermediaryProfessionalMember2022-01-012022-09-300001868726olpx:SalesChannelThroughIntermediarySpecialtyRetailMember2023-07-012023-09-300001868726olpx:SalesChannelThroughIntermediarySpecialtyRetailMember2022-07-012022-09-300001868726olpx:SalesChannelThroughIntermediarySpecialtyRetailMember2023-01-012023-09-300001868726olpx:SalesChannelThroughIntermediarySpecialtyRetailMember2022-01-012022-09-300001868726us-gaap:SalesChannelDirectlyToConsumerMember2023-07-012023-09-300001868726us-gaap:SalesChannelDirectlyToConsumerMember2022-07-012022-09-300001868726us-gaap:SalesChannelDirectlyToConsumerMember2023-01-012023-09-300001868726us-gaap:SalesChannelDirectlyToConsumerMember2022-01-012022-09-300001868726country:US2023-07-012023-09-300001868726country:US2022-07-012022-09-300001868726country:US2023-01-012023-09-300001868726country:US2022-01-012022-09-300001868726us-gaap:NonUsMember2023-07-012023-09-300001868726us-gaap:NonUsMember2022-07-012022-09-300001868726us-gaap:NonUsMember2023-01-012023-09-300001868726us-gaap:NonUsMember2022-01-012022-09-300001868726us-gaap:SalesRevenueNetMembercountry:GBus-gaap:GeographicConcentrationRiskMember2023-07-012023-09-30xbrli:pure0001868726us-gaap:SalesRevenueNetMembercountry:GBus-gaap:GeographicConcentrationRiskMember2023-01-012023-09-300001868726us-gaap:SalesRevenueNetMembercountry:GBus-gaap:GeographicConcentrationRiskMember2022-07-012022-09-300001868726us-gaap:SalesRevenueNetMembercountry:GBus-gaap:GeographicConcentrationRiskMember2022-01-012022-09-300001868726us-gaap:TradeNamesMember2023-09-300001868726us-gaap:PatentedTechnologyMember2023-09-300001868726us-gaap:CustomerRelationshipsMember2023-09-300001868726us-gaap:ComputerSoftwareIntangibleAssetMember2023-09-300001868726us-gaap:TradeNamesMember2022-12-310001868726us-gaap:PatentedTechnologyMember2022-12-310001868726us-gaap:CustomerRelationshipsMember2022-12-310001868726us-gaap:ComputerSoftwareIntangibleAssetMember2022-12-310001868726us-gaap:PatentedTechnologyMember2023-07-012023-09-300001868726us-gaap:PatentedTechnologyMember2022-07-012022-09-300001868726us-gaap:PatentedTechnologyMember2023-01-012023-09-300001868726us-gaap:PatentedTechnologyMember2022-01-012022-09-300001868726olpx:BrandNameAndCustomerRelationshipsMember2023-07-012023-09-300001868726olpx:BrandNameAndCustomerRelationshipsMember2022-07-012022-09-300001868726olpx:BrandNameAndCustomerRelationshipsMember2023-01-012023-09-300001868726olpx:BrandNameAndCustomerRelationshipsMember2022-01-012022-09-300001868726us-gaap:ComputerSoftwareIntangibleAssetMember2023-07-012023-09-300001868726us-gaap:ComputerSoftwareIntangibleAssetMember2022-07-012022-09-300001868726us-gaap:ComputerSoftwareIntangibleAssetMember2023-01-012023-09-300001868726us-gaap:ComputerSoftwareIntangibleAssetMember2022-01-012022-09-300001868726us-gaap:OtherIntangibleAssetsMember2023-07-012023-09-300001868726us-gaap:OtherIntangibleAssetsMember2022-07-012022-09-300001868726us-gaap:OtherIntangibleAssetsMember2023-01-012023-09-300001868726us-gaap:OtherIntangibleAssetsMember2022-01-012022-09-300001868726olpx:February2022CreditFacilityMemberus-gaap:SecuredDebtMemberus-gaap:LineOfCreditMember2022-02-230001868726olpx:February2022CreditFacilityMemberus-gaap:SecuredDebtMemberus-gaap:LineOfCreditMember2023-09-300001868726olpx:February2022CreditFacilityMemberus-gaap:SecuredDebtMemberus-gaap:LineOfCreditMember2022-12-310001868726olpx:February2022CreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2022-02-230001868726olpx:February2022CreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2023-09-300001868726olpx:February2022CreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2022-12-310001868726us-gaap:InterestRateCapMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-08-110001868726us-gaap:FairValueInputsLevel3Memberus-gaap:InterestRateCapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherAssetsMember2023-09-300001868726us-gaap:FairValueInputsLevel3Memberus-gaap:InterestRateCapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherAssetsMember2022-12-310001868726us-gaap:FairValueInputsLevel3Memberus-gaap:InterestRateCapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-300001868726us-gaap:FairValueInputsLevel3Memberus-gaap:InterestRateCapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-09-300001868726us-gaap:FairValueInputsLevel3Memberus-gaap:InterestRateCapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-09-300001868726us-gaap:FairValueInputsLevel3Memberus-gaap:InterestRateCapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-012022-09-300001868726us-gaap:StockAppreciationRightsSARSMember2022-01-012022-09-300001868726olpx:ServicesRelatedToTheDevelopmentMaintenanceAndEnhancementOfTheCompanysProfessionalApplicationMember2023-07-012023-09-300001868726olpx:ServicesRelatedToTheDevelopmentMaintenanceAndEnhancementOfTheCompanysProfessionalApplicationMember2023-01-012023-09-300001868726olpx:ServicesRelatedToTheDevelopmentMaintenanceAndEnhancementOfTheCompanysProfessionalApplicationMember2022-07-012022-09-300001868726olpx:ServicesRelatedToTheDevelopmentMaintenanceAndEnhancementOfTheCompanysProfessionalApplicationMember2022-01-012022-09-3000018687262023-02-092023-02-09olpx:plaintiff00018687262023-03-022023-03-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________

FORM 10-Q

________________________

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2023

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

Commission File Number 001-40860

________________________

Olaplex Holdings, Inc.

(Exact name of registrant as specified in its charter)

________________________

| | | | | | | | |

| Delaware | | 87-1242679 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

Address not applicable1

(Address of principal executive offices and zip code)

(310) 691-0776

(Registrant’s telephone number, including area code)

________________________

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of Each Class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.001 per share | | OLPX | | Nasdaq Global Select Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large Accelerated Filer | ☒ | Accelerated Filer | ☐ |

| | | |

| Non-accelerated Filer | ☐ | Smaller reporting company | ☐ |

| | | |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of November 3, 2023, registrant had 654,733,052 shares of common stock, par value $0.001 per share, outstanding.

1 Olaplex Holdings, Inc. is a fully remote company. Accordingly, it does not maintain a principal executive office.

OLAPLEX HOLDINGS, INC.

TABLE OF CONTENTS

| | | | | | | | |

| | Page |

| | |

| Item 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 1A. | | |

| | |

| Item 3. | | |

| Item 4. | | |

| | |

| | |

| |

GLOSSARY

As used in this Quarterly Report on Form 10-Q (“Quarterly Report”), the terms identified below have the meanings specified below unless otherwise noted or the context indicates otherwise. Except where the context otherwise requires or where otherwise indicated, the terms “OLAPLEX” “we,” “us,” “our,” “the Company,” and “our business” refer to Olaplex Holdings, Inc. and its consolidated subsidiaries.

•“2020 Credit Agreement” refers to the Credit Agreement, dated as of January 8, 2020, by and among Olaplex, Inc., Penelope Intermediate Corp., MidCap Financial Trust, as administrative agent, collateral agent and swingline lender, and each lender and issuing bank from time to time party thereto, as amended by the First Incremental Amendment to the 2020 Credit Agreement, dated as of December 18, 2020. The 2020 Credit Agreement was refinanced and replaced by the 2022 Credit Agreement.

•“2022 Credit Agreement” refers to the Credit Agreement, dated as of February 23, 2022, by and among Olaplex, Inc., Penelope Intermediate Corp, Goldman Sachs Bank USA, as administrative agent, collateral agent and swingline lender, and each lender and issuing bank from time to time party thereto. The 2022 Credit Agreement refinanced and replaced the 2020 Credit Agreement, and includes, among other things, a $675 million seven-year senior-secured term loan facility (the “2022 Term Loan Facility”) and a $150 million five-year senior-secured revolving credit facility (the “2022 Revolver”).

•“IPO” refers to the initial public offering of shares of common stock of Olaplex Holdings, Inc., completed on October 4, 2021.

•“Penelope” refers to Penelope Holdings Corp., which is an indirect parent of Olaplex, Inc., the Company’s primary operating subsidiary.

•“Penelope Group Holdings” refers to Penelope Group Holdings L.P., which prior to the IPO was the direct parent of Penelope.

•“Pre-IPO Stockholders” refers to, collectively, (i) the former limited partners of Penelope Group Holdings prior to the Reorganization Transactions and (ii) holders of options to purchase shares of common stock of Penelope that were vested as of the consummation of the Reorganization Transactions.

•“Pre-IPO Tax Assets” refers to, collectively, certain tax attributes existing prior to the IPO, including tax basis in intangible assets and capitalized transaction costs relating to taxable years ending on or before the date of the IPO (calculated by assuming the taxable year of the relevant entity closes on the date of the IPO), that are amortizable over a fixed period of time (including in tax periods beginning after the IPO) and which are available to us and our wholly-owned subsidiaries.

•“Reorganization Transactions” refers to the internal reorganization completed in connection with our IPO, pursuant to which Olaplex Holdings, Inc. became an indirect parent of Olaplex, Inc. For further information, see “Reorganization Transactions” in “Note 1 - Nature of Operations and Basis of Presentation” to our Consolidated Financial Statements included in Part II, Item 8 of our Annual Report on Form 10-K for the year ended December 31, 2022.

•“Tax Receivable Agreement” refers to the income tax receivable agreement entered into by the Company in connection with the Reorganization Transactions under which the Company is required to pay the Pre-IPO Stockholders 85% of the cash savings, if any, in United States (“U.S.”) federal, state or local tax that the Company actually realizes on its taxable income following the IPO, as specified in the Tax Receivable Agreement.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q (the “Quarterly Report”) contains certain forward-looking statements and information relating to us that are based on the beliefs of our management as well as assumptions made by, and information currently available to, us. These statements include, but are not limited to, statements about our strategies, plans, objectives, expectations, intentions, expenditures and assumptions and other statements contained in or incorporated by reference in this Quarterly Report that are not historical or current facts. When used in this document, words such as “may,” “will,” “could,” “should,” “intend,” “potential,” “continue,” “anticipate,” “believe,” “estimate,” “expect,” “plan,” “target,” “predict,” “project,” “forecast,” “seek” and similar expressions as they relate to us are intended to identify forward-looking statements.

The forward-looking statements in this Quarterly Report reflect our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operation. Examples of forward-looking statements include, among others, statements we make regarding: our financial position and operating results; our business plans, strategies and objectives, including sales and marketing investments; general economic and industry trends; our business prospects; our reputation and brand; our product technology; future product development and introduction, including entry into adjacent and other categories; growth and expansion opportunities, including expansion in existing markets and into new markets; our sales channels and omnichannel strategy; legal proceedings; future payments under our Tax Receivable Agreement; our customer base; our supply chain and global distribution network; our information technology; our employees and culture; our operational capabilities; interest rate derivatives; and our expenses, inventory levels, other working capital and liquidity. Forward-looking statements are predictions based upon assumptions that may not prove to be accurate, and they are not guarantees of future performance. As such, you should not place significant reliance on our forward-looking statements. Neither we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements, including any such statements taken from third party industry and market reports.

Forward-looking statements involve known and unknown risks, inherent uncertainties and other factors that are difficult to predict which may cause our actual results, performance, time frames or achievements to be materially different from any future results, performance, time frames or achievements expressed or implied by the forward-looking statements, including, without limitation, the following:

•our ability to anticipate and respond to market trends and changes in consumer preferences and execute on our growth strategies and expansion opportunities, including with respect to new product introductions;

•our ability to develop, manufacture and effectively and profitably market and sell future products;

•our ability to accurately forecast customer and consumer demand for our products;

•competition in the beauty industry;

•our ability to effectively maintain and promote a positive brand image and expand our brand awareness;

•our dependence on a limited number of customers for a large portion of our net sales;

•our ability to attract new customers and consumers and encourage consumer spending across our product portfolio;

•our ability to successfully implement new or additional marketing efforts;

•our relationships with and the performance of our suppliers, manufacturers, distributors and retailers and our ability to manage our supply chain;

•impacts on our business from political, regulatory, economic, trade and other risks associated with operating internationally;

•our ability to manage our executive leadership change and to attract and retain senior management and other qualified personnel;

•our reliance on our and our third-party service providers’ information technology;

•our ability to maintain the security of confidential information;

•our ability to establish and maintain intellectual property protection for our products, as well as our ability to operate our business without infringing, misappropriating or otherwise violating the intellectual property rights of others;

•the outcome of litigation and regulatory proceedings;

•the impact of changes in federal, state and international laws, regulations and administrative policy;

•our existing and any future indebtedness, including our ability to comply with affirmative and negative covenants under the 2022 Credit Agreement;

•our ability to service our existing indebtedness and obtain additional capital to finance operations and our growth opportunities;

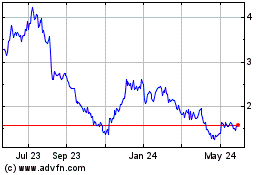

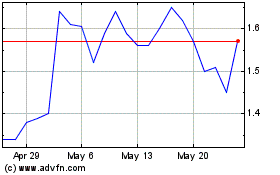

•volatility of our stock price;

•our “controlled company” status and the influence of investment funds affiliated with Advent International L.P. over us;

•the impact of an economic downturn and inflationary pressures on our business;

•fluctuations in our quarterly results of operations;

•changes in our tax rates and our exposure to tax liability; and

•the other factors identified in the “Risk Factors” section of our Annual Report on Form 10-K for the year ended December 31, 2022 (the “2022 Form 10-K”) and in other documents that we file with the U.S. Securities and Exchange Commission from time to time.

Many of these factors are macroeconomic in nature and are, therefore, beyond our control. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, our actual results, performance or achievements may vary materially from those described in this Quarterly Report as anticipated, believed, estimated, expected, intended, planned or projected. We discuss many of these risks in greater detail in the “Risk Factors” section of our 2022 Form 10-K. The forward-looking statements included in this Quarterly Report are made only as of the date hereof. Unless required by law, we neither intend nor assume any obligation to update these forward-looking statements for any reason after the date of this Quarterly Report to conform these statements to actual results or to changes in our expectations or otherwise.

PART I - FINANCIAL INFORMATION

ITEM 1. Financial Statements

OLAPLEX HOLDINGS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(amounts in thousands, except per share and share data)

(Unaudited)

| | | | | | | | | | | |

| September 30,

2023 | | December 31,

2022 |

| Assets | | | |

| Current Assets: | | | |

| Cash and cash equivalents | $ | 429,586 | | | $ | 322,808 | |

Accounts receivable, net of allowances of $23,978 and $19,198 | 51,876 | | | 46,220 | |

| Inventory | 112,762 | | | 144,425 | |

| Other current assets | 6,418 | | | 8,771 | |

| Total current assets | 600,642 | | | 522,224 | |

| Property and equipment, net | 929 | | | 1,034 | |

| Intangible assets, net | 959,855 | | | 995,028 | |

| Goodwill | 168,300 | | | 168,300 | |

| | | |

| Other assets | 12,441 | | | 11,089 | |

| Total assets | $ | 1,742,167 | | | $ | 1,697,675 | |

| | | |

| Liabilities and stockholders’ equity | | | |

| Current Liabilities: | | | |

| Accounts payable | $ | 13,349 | | | $ | 9,748 | |

| Sales and income taxes payable, net | 2,503 | | | 3,415 | |

| Accrued expenses and other current liabilities | 17,409 | | | 17,107 | |

| Current portion of long-term debt | 6,750 | | | 8,438 | |

| Current portion of Related Party payable pursuant to Tax Receivable Agreement | 16,184 | | | 16,380 | |

| Total current liabilities | 56,195 | | | 55,088 | |

| Long-term debt | 650,350 | | | 654,333 | |

| Deferred tax liabilities | 4,068 | | | 1,622 | |

| Related Party payable pursuant to Tax Receivable Agreement | 189,391 | | | 205,675 | |

| Other liabilities | 1,768 | | | — | |

| Total liabilities | 901,772 | | | 916,718 | |

| | | |

Contingencies (Note 10) | | | |

| | | |

Stockholders’ equity (Notes 1 and 8): | | | |

Common stock, $0.001 par value per share; 2,000,000,000 shares authorized, 654,724,366 and 650,091,380 shares issued and outstanding as of September 30, 2023 and December 31, 2022, respectively | 654 | | | 649 | |

Preferred stock, $0.001 par value per share; 25,000,000 shares authorized and no shares issued and outstanding | — | | | — | |

Additional paid-in capital | 324,593 | | | 312,875 | |

| Accumulated other comprehensive income | 2,806 | | | 2,577 | |

Retained earnings | 512,342 | | | 464,856 | |

| Total stockholders’ equity | 840,395 | | | 780,957 | |

| Total liabilities and stockholders’ equity | $ | 1,742,167 | | | $ | 1,697,675 | |

The accompanying notes are an integral part of these Condensed Consolidated Financial Statements

OLAPLEX HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

(amounts in thousands, except per share and share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net sales | $ | 123,555 | | | $ | 176,454 | | | $ | 346,583 | | | $ | 573,553 | |

| Cost of sales: | | | | | | | |

| Cost of product (excluding amortization) | 37,415 | | | 45,484 | | | 98,431 | | | 140,999 | |

| Amortization of patented formulations | 2,592 | | | 1,142 | | | 6,298 | | | 5,091 | |

| Total cost of sales | 40,007 | | | 46,626 | | | 104,729 | | | 146,090 | |

| Gross profit | 83,548 | | | 129,828 | | | 241,854 | | | 427,463 | |

| Operating expenses: | | | | | | | |

| Selling, general, and administrative | 36,433 | | | 30,807 | | | 119,770 | | | 79,232 | |

| Amortization of other intangible assets | 10,378 | | | 10,329 | | | 31,025 | | | 30,890 | |

| | | | | | | |

| Total operating expenses | 46,811 | | | 41,136 | | | 150,795 | | | 110,122 | |

| Operating income | 36,737 | | | 88,692 | | | 91,059 | | | 317,341 | |

| Interest expense, net | (9,510) | | | (10,499) | | | (30,259) | | | (30,653) | |

| Other expense, net | | | | | | | |

| Loss on extinguishment of debt | — | | | — | | | — | | | (18,803) | |

| Other expense, net | (970) | | | (2,251) | | | (1,328) | | | (3,852) | |

| Total other expense, net | (970) | | | (2,251) | | | (1,328) | | | (22,655) | |

Income before provision for income taxes | 26,257 | | | 75,942 | | | 59,472 | | | 264,033 | |

| Income tax provision | 5,891 | | | 15,179 | | | 11,986 | | | 53,594 | |

| Net income | $ | 20,366 | | | $ | 60,763 | | | $ | 47,486 | | | $ | 210,439 | |

| | | | | | | |

| Net income per share: | | | | | | | |

| Basic | $ | 0.03 | | | $ | 0.09 | | | $ | 0.07 | | | $ | 0.32 | |

| Diluted | $ | 0.03 | | | $ | 0.09 | | | $ | 0.07 | | | $ | 0.30 | |

| Weighted average common shares outstanding: | | | | | | | |

| Basic | 654,702,392 | | | 649,099,780 | | | 653,603,665 | | | 648,963,625 | |

| Diluted | 678,758,020 | | | 691,257,654 | | | 681,089,543 | | | 691,585,787 | |

| | | | | | | |

| Other comprehensive (loss) income: | | | | | | | |

| Unrealized (loss) gain on derivatives, net of income tax effect | $ | (861) | | | $ | 1,931 | | | $ | 229 | | | $ | 1,931 | |

| Total other comprehensive (loss) income: | (861) | | | 1,931 | | | 229 | | | 1,931 | |

| Comprehensive income: | $ | 19,505 | | | $ | 62,694 | | | $ | 47,715 | | | $ | 212,370 | |

The accompanying notes are an integral part of these Condensed Consolidated Financial Statements

OLAPLEX HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

(amounts in thousands, except number of shares)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shares

(Note 1) | | Amount | | Additional Paid

in Capital | | Accumulated Other Comprehensive Income | | Retained

Earnings | | Total Equity |

| Balance - December 31, 2022 | 650,091,380 | | | $ | 649 | | | $ | 312,875 | | | $ | 2,577 | | | $ | 464,856 | | | $ | 780,957 | |

| Net income | — | | | — | | | — | | | — | | | 20,964 | | | 20,964 | |

| Exercise of stock-settled stock appreciation rights | 109,620 | | | — | | | 326 | | | — | | | — | | | 326 | |

| Shares withheld and retired for taxes on exercise of stock-settled stock appreciation rights | (83,501) | | | — | | | (390) | | | — | | | — | | | (390) | |

| Exercise of stock options | 3,659,267 | | | 4 | | | 3,295 | | | — | | | — | | | 3,299 | |

| Share-based compensation expense | — | | | — | | | 2,018 | | | — | | | — | | | 2,018 | |

| Unrealized loss on derivatives (net of taxes) | — | | | — | | | — | | | (557) | | | — | | | (557) | |

| Balance – March 31, 2023 | 653,776,766 | | | $ | 653 | | | $ | 318,124 | | | $ | 2,020 | | | $ | 485,820 | | | $ | 806,617 | |

| Net income | — | | | — | | | — | | | — | | | 6,156 | | | 6,156 | |

| Exercise of stock options | 754,062 | | | 1 | | | 797 | | | — | | | — | | | 798 | |

| Share-based compensation expense | — | | | — | | | 2,634 | | | — | | | — | | | 2,634 | |

| Unrealized gain on derivatives (net of taxes) | — | | | — | | | — | | | 1,647 | | | — | | | 1,647 | |

| Balance – June 30, 2023 | 654,530,828 | | | $ | 654 | | | $ | 321,555 | | | $ | 3,667 | | | $ | 491,976 | | | $ | 817,852 | |

| Net income | — | | | — | | | — | | | — | | | 20,366 | | | 20,366 | |

| Exercise of stock options | 193,538 | | | — | | | 352 | | | — | | | — | | | 352 | |

| Share-based compensation expense | — | | | — | | | 2,686 | | | — | | | — | | | 2,686 | |

| Unrealized loss on derivatives (net of taxes) | — | | | — | | | — | | | (861) | | | — | | | (861) | |

Balance – September 30, 2023 | 654,724,366 | | | $ | 654 | | | $ | 324,593 | | | $ | 2,806 | | | $ | 512,342 | | | $ | 840,395 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shares

(Note 1) | | Amount | | Additional Paid

in Capital | | Accumulated Other Comprehensive Income | | Retained

Earnings | | Total Equity |

| Balance - December 31, 2021 | 648,794,041 | | | $ | 648 | | | $ | 302,866 | | | $ | — | | | $ | 220,784 | | | $ | 524,298 | |

| Net income | — | | | — | | | — | | | — | | | 61,961 | | | 61,961 | |

| Conversion of cash settled units to stock appreciation rights | — | | | — | | | 1,632 | | | — | | | — | | | 1,632 | |

| Exercise of stock-settled stock appreciation rights | 117,180 | | | — | | | 348 | | | — | | | — | | | 348 | |

| Shares withheld and retired for taxes on exercise of stock-settled stock appreciation rights | (55,244) | | | — | | | (920) | | | — | | | — | | | (920) | |

| Share-based compensation expense | — | | | — | | | 1,696 | | | — | | | — | | | 1,696 | |

| Balance – March 31, 2022 | 648,855,977 | | | $ | 648 | | | $ | 305,622 | | | $ | — | | | $ | 282,745 | | | $ | 589,015 | |

| Net income | — | | | — | | | — | | | | | 87,715 | | | 87,715 | |

| Exercise of stock options | 231,846 | | | 1 | | | 739 | | | — | | | — | | | 740 | |

| Share-based compensation expense | — | | | — | | | 1,727 | | | | | — | | | 1,727 | |

| Balance – June 30, 2022 | 649,087,823 | | | $ | 649 | | | $ | 308,088 | | | $ | — | | | $ | 370,460 | | | $ | 679,197 | |

| Net income | — | | | — | | | — | | | — | | | 60,763 | | | 60,763 | |

| Exercise of stock options | 25,000 | | | — | | | 74 | | | — | | | — | | | 74 | |

| Share-based compensation expense | — | | | — | | | 2,031 | | | — | | | — | | | 2,031 | |

| Unrealized gain on derivatives (net of taxes) | — | | | — | | | — | | | 1,931 | | | — | | | 1,931 | |

Balance – September 30, 2022 | 649,112,823 | | PY | $ | 649 | | PY | $ | 310,193 | | | $ | 1,931 | | | $ | 431,223 | | | $ | 743,996 | |

The accompanying notes are an integral part of these Condensed Consolidated Financial Statements

OLAPLEX HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(amounts in thousands)

(Unaudited)

| | | | | | | | | | | |

| Nine Months Ended

September 30, |

| 2023 | | 2022 |

Cash flows from operating activities: | | | |

| Net income | $ | 47,486 | | | $ | 210,439 | |

| Adjustments to reconcile net income to net cash from operations provided by operating activities: | | | |

Amortization of patent formulations | 6,298 | | | 5,091 | |

Amortization of other intangibles | 31,025 | | | 30,890 | |

Inventory write-off and disposal | 9,801 | | | 5,958 | |

| | | |

Depreciation of fixed assets | 344 | | | 233 | |

| | | |

Amortization of debt issuance costs | 1,359 | | | 2,955 | |

Deferred taxes | 2,377 | | | (4,532) | |

Share-based compensation expense | 7,338 | | | 5,454 | |

Loss on extinguishment of debt | — | | | 18,803 | |

| Other operating | 795 | | | 147 | |

| Changes in operating assets and liabilities, net of effects of acquisition (as applicable): | | | |

Accounts receivable, net | (5,656) | | | (52,507) | |

Inventory | 23,260 | | | (57,132) | |

Other current assets | 2,170 | | | 6,344 | |

Accounts payable | 3,601 | | | 3,959 | |

Accrued expenses and other current liabilities | (1,311) | | | 14,283 | |

| Other assets and liabilities | (390) | | | (8,578) | |

| Net cash provided by operating activities | 128,497 | | | 181,807 | |

| | | |

| Cash flows from investing activities: | | | |

Purchase of property and equipment | (239) | | | (100) | |

| Purchase of intangible assets | (500) | | | — | |

Purchase of software | (2,163) | | | (1,612) | |

| | | |

| | | |

| Net cash used in investing activities | (2,902) | | | (1,712) | |

| | | |

| Cash flows from financing activities: | | | |

| | | |

Proceeds from exercise of stock options | 4,449 | | | 814 | |

Payments for shares withheld and retired for taxes and exercise price for stock-settled share appreciation rights | (64) | | | (572) | |

| Payment to pre-IPO stockholders pursuant to Tax Receivable Agreement | (16,452) | | | — | |

Principal payments for 2022 Term Loan Facility, and principal payments and prepayment fees for 2020 Term Loan Facility | (6,750) | | | (780,382) | |

| | | |

Proceeds from the issuance of 2022 Term Loan Facility | — | | | 675,000 | |

Payments of debt issuance costs | — | | | (11,944) | |

| Net cash used in financing activities | (18,817) | | | (117,084) | |

| | | |

| Net increase in cash and cash equivalents | 106,778 | | | 63,011 | |

| Cash and cash equivalents - beginning of period | 322,808 | | | 186,388 | |

| Cash and cash equivalents - end of period | $ | 429,586 | | | $ | 249,399 | |

| | | |

| Supplemental disclosure of cash flow information: | | | |

Cash paid for income taxes | $ | 9,531 | | | $ | 54,904 | |

Cash paid during the year for interest | $ | 44,421 | | | $ | 21,716 | |

| | | |

| Supplemental disclosure of noncash activities: | | | |

| | | |

| | | |

Cash-settled units liability reclassification to additional paid in capital | $ | — | | | $ | 1,632 | |

| Assets acquired under operating lease | $ | 2,128 | | | $ | — | |

The accompanying notes are an integral part of these Condensed Consolidated Financial Statements

OLAPLEX HOLDINGS, INC.

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except share and per share amounts, percentages and as otherwise indicated)

(Unaudited)

NOTE 1- NATURE OF OPERATIONS AND BASIS OF PRESENTATION

Olaplex Holdings, Inc. (“Olaplex Holdings” and, together with its subsidiaries, the “Company”) is a Delaware corporation that was incorporated on June 8, 2021. Olaplex Holdings is organized as a holding company and operates indirectly through its wholly owned subsidiaries, Penelope and Olaplex, Inc., which conducts business under the name “Olaplex”. Olaplex is an innovative, science-enabled, technology-driven beauty company that is focused on delivering its patent-protected prestige hair care products to professional hair salons, retailers and everyday consumers. Olaplex develops, manufactures and distributes a line of hair care products developed to address three key uses: treatment, maintenance and protection.

Basis of Presentation

The accompanying unaudited interim Condensed Consolidated Financial Statements have been prepared in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”) for interim financial information and with the instructions to Form 10-Q and Rule 10-01 of Regulation S-X promulgated by the U.S. Securities and Exchange Commission (the “SEC”). Accordingly, they do not include all of the information and footnotes required by U.S. GAAP for complete financial statements. The unaudited interim Condensed Consolidated Financial Statements furnished reflect all adjustments which are, in the opinion of management, necessary for a fair statement of the results for the interim periods presented. The results of operations of any interim period are not necessarily indicative of the results of operations to be expected for the full fiscal year. The unaudited interim Condensed Consolidated Financial Statements should be read in conjunction with the Consolidated Financial Statements and accompanying footnotes included in the Company’s 2022 Form 10-K.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Estimates and Assumptions

Preparing financial statements requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue, and expenses. Examples of estimates and assumptions include: for revenue recognition, determining the nature and timing of satisfaction of performance obligations, variable consideration, and other obligations such as product returns, allowance for promotions, and refunds; loss contingencies; the fair value of share-based options and stock settled stock appreciation rights (“SARs”); the fair value of and/or potential impairment of goodwill and intangible assets for the Company’s reporting unit; the fair value of the Company’s interest rate cap; useful lives of the Company’s tangible and intangible assets; estimated income tax and tax receivable payments; the net realizable value of, and demand for the Company’s inventory. Actual results and outcomes may differ from management’s estimates and assumptions due to risks and uncertainties.

Fair Value of Financial Instruments

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The authoritative guidance for fair value measurements established a framework for measuring fair value and established a three-level valuation hierarchy for disclosure of fair value measurements as follows:

Level 1—Observable inputs that reflect quoted prices (unadjusted) for identical assets or liabilities in active markets. The Company’s Level 1 assets consist of its marketable securities.

Level 2—Observable quoted prices for similar assets or liabilities in active markets and observable quoted prices for identical assets or liabilities in markets that are not active.

Level 3—Unobservable inputs that are not corroborated by market data.

Cash and cash equivalents, accounts receivable, accounts payable and accrued expenses are reflected at carrying value, which approximates fair value due to the short-term maturity. The Company’s long-term debt is recorded at its carrying value in the Condensed Consolidated Balance Sheets, which may differ from fair value. The Company’s interest rate cap is recorded at its Level 3 fair value in the Condensed Consolidated Balance Sheets.

Accounting Policies

There have been no material changes in significant accounting policies as described in the Company’s Consolidated Financial Statements for the year ended December 31, 2022.

Constructive Retirement of Common Stock Repurchases

When the Company's common stock is retired or purchased for constructive retirement for net share settlement of stock options, any excess purchase price over par value is allocated between additional paid-in-capital, to the extent that previous net gains from sales or retirements are included therein, and the remainder to retained earnings.

Tax Receivable Agreement

As part of the IPO, the Company entered into the Tax Receivable Agreement under which the Company will be required to pay to the Pre-IPO Stockholders 85% of the federal, state or local tax cash savings that the Company actually realizes on its taxable income following the IPO, as a result of the amortization of intangible assets and capitalized transaction costs that existed as of the date of the IPO. Under the Tax Receivable Agreement, generally the Company will retain the benefit of the remaining 15% of the applicable tax savings.

The Tax Receivable Agreement liability is calculated based on current tax laws and the assumption that the Company and its subsidiaries will earn sufficient taxable income to realize the full tax benefits subject to the Tax Receivable Agreement. Updates to the Company’s blended state tax rate and allocation of U.S. versus foreign sourced income may impact the established liability and changes to that established liability would be recorded to other income (expense) in the period the Company made the determination regarding the applicable change. The Company expects that future payments under the Tax Receivable Agreement relating to the Pre-IPO Tax Assets could aggregate to $205.6 million over the 13-year remaining period under the Tax Receivable Agreement. Payments under the Tax Receivable Agreement, which began in the year ended December 31, 2022, are not conditioned upon the parties’ continued ownership of equity in the Company.

Reclassifications

Certain amounts presented have been reclassified within “Note 6 - Accrued Expenses and Other Current Liabilities” as of December 31, 2022 to conform with the current period presentation, including a prior year reclassification from Other accrued expenses and current liabilities to Accrued advertising and Accrued inventory purchases. The reclassifications had no effect on the Company’s Total current liabilities.

NOTE 3 – NET SALES

The Company distributes products in the U.S. and internationally through professional distributors in the salon channel, directly to retailers for sale in their physical stores and e-commerce sites, and direct-to-consumer (“DTC”) through sales to third-party e-commerce customers and through its own Olaplex.com website. As such, the Company’s three business channels consist of professional, specialty retail and DTC as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended | | For the Nine Months Ended |

| September 30, 2023 | | September 30, 2022 | | September 30, 2023 | | September 30, 2022 |

| Net sales by Channel: | | | | | | | |

| Professional | $ | 48,289 | | | $ | 62,991 | | | $ | 137,626 | | | $ | 245,539 | |

| Specialty retail | 43,159 | | | 74,191 | | | 107,785 | | | 202,692 | |

| DTC | 32,107 | | | 39,272 | | | 101,172 | | | 125,322 | |

| Total net sales | $ | 123,555 | | | $ | 176,454 | | | $ | 346,583 | | | $ | 573,553 | |

Revenue by major geographic region is based upon the geographic location of customers who purchase the Company’s products. The majority of net sales are transacted in U.S. Dollars, the Company’s functional and reporting currency. During the three and nine months ended September 30, 2023 and September 30, 2022, the Company’s net sales to consumers in the United States and International regions were as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended | | For the Nine Months Ended |

| September 30, 2023 | | September 30, 2022 | | September 30, 2023 | | September 30, 2022 |

| Net sales by Geography: | | | | | | | |

| United States | $ | 61,880 | | | $ | 89,543 | | | $ | 159,641 | | | $ | 330,973 | |

| International | 61,675 | | | 86,911 | | | 186,942 | | | 242,580 | |

| Total net sales | $ | 123,555 | | | $ | 176,454 | | | $ | 346,583 | | | $ | 573,553 | |

United Kingdom (“U.K.”) net sales for the three and nine months ended September 30, 2023 were 7% and 8% of total net sales, respectively, and for the three and nine months ended September 30, 2022 were 13% and 10% of total net sales, respectively. No other international country exceeded 10% of total net sales for the three and nine months ended September 30, 2023 and September 30, 2022.

NOTE 4 - INVENTORY

Inventory as of September 30, 2023 and December 31, 2022 consisted of the following:

| | | | | | | | | | | |

| September 30, 2023 | | December 31, 2022 |

| Raw materials and packaging components | $ | 35,619 | | | $ | 36,194 | |

| Finished goods | 77,143 | | | 108,231 | |

| Inventory | $ | 112,762 | | | $ | 144,425 | |

During the three and nine months ended September 30, 2023, the Company recorded inventory write-offs of $3.6 million and $9.8 million, respectively, due to reserves for product obsolescence. The Company did not record material write-offs for product obsolescence during the same periods ended September 30, 2022.

NOTE 5 – GOODWILL AND INTANGIBLE ASSETS

Goodwill and intangible assets are comprised of the following:

| | | | | | | | | | | | | | | | | | | | | | | |

| September 30, 2023 |

| Estimated

Useful Life | | Gross Carrying

Amount | | Accumulated

Amortization | | Net Carrying Amount |

| Brand name | 25 years | | $ | 952,000 | | | $ | (141,954) | | | $ | 810,046 | |

| Product formulations | 15 years | | 136,500 | | | (33,809) | | | 102,691 | |

| Customer relationships | 20 years | | 53,000 | | | (9,879) | | | 43,121 | |

| Software | 3 years | | 5,085 | | | (1,088) | | | 3,997 | |

Total finite-lived intangibles | | | 1,146,585 | | | (186,730) | | | 959,855 | |

| Goodwill | Indefinite | | 168,300 | | | — | | | 168,300 | |

Total goodwill and other intangibles | | | $ | 1,314,885 | | | $ | (186,730) | | | $ | 1,128,155 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| December 31, 2022 |

| Estimated

Useful Life | | Gross

Carrying Amount | | Accumulated

Amortization | | Net Carrying Amount |

| Brand name | 25 years | | $ | 952,000 | | | $ | (113,394) | | | $ | 838,606 | |

| Product formulations | 15 years | | 136,000 | | | (26,998) | | | 109,002 | |

| Customer relationships | 20 years | | 53,000 | | | (7,892) | | | 45,108 | |

| Software | 3 years | | 2,922 | | | (610) | | | 2,312 | |

Total finite-lived intangibles | | | 1,143,922 | | | (148,894) | | | 995,028 | |

| Goodwill | Indefinite | | 168,300 | | | — | | | 168,300 | |

Total goodwill and other intangibles | | | $ | 1,312,222 | | | $ | (148,894) | | | $ | 1,163,328 | |

The amortization of the Company’s brand name, customer relationships and software is recorded to Amortization of other intangible assets in the Condensed Consolidated Statements of Operations and Comprehensive Income. A portion of Amortization of patented formulations is capitalized to Inventory in the Condensed Consolidated Balance Sheets, and the remainder is recorded to Amortization of patented formulations in the Condensed Consolidated Statements of Operations and Comprehensive Income. Amortization of the Company’s definite-lived intangible assets for the three and nine months ended September 30, 2023 and 2022 was as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended | | For the Nine Months Ended |

| September 30, 2023 | | September 30, 2022 | | September 30, 2023 | | September 30, 2022 |

| | | | | | | |

| Amortization of patented formulations | $ | 2,592 | | | $ | 1,142 | | | $ | 6,298 | | | $ | 5,091 | |

| | | | | | | |

| Amortization expense, brand name and customer relationships | 10,179 | | | 10,182 | | | 30,547 | | | 30,547 | |

| Amortization expense, software | 199 | | | 147 | | | 478 | | | 343 | |

| Amortization of other intangible assets | 10,378 | | | 10,329 | | | 31,025 | | | 30,890 | |

| | | | | | | |

| Amortization of patented formulations capitalized to inventory | $ | (315) | | | $ | 1,125 | | | $ | 513 | | | $ | 1,709 | |

NOTE 6 - ACCRUED EXPENSES AND OTHER CURRENT LIABILITIES

Accrued expenses as of September 30, 2023 and December 31, 2022 consisted of the following:

| | | | | | | | | | | |

| September 30, 2023 | | December 31, 2022 |

| Accrued professional fees | $ | 4,242 | | | $ | 3,187 | |

| Payroll liabilities | 3,598 | | | 4,092 | |

| Accrued freight | 2,707 | | | 3,283 | |

| Accrued inventory purchases | 2,191 | | | 1,140 | |

| Accrued advertising | 2,056 | | | 1,356 | |

| Deferred revenue | 1,235 | | | 2,015 | |

| Other accrued expenses and current liabilities | 1,129 | | | 1,220 | |

| | | |

| Accrued interest | 251 | | | 814 | |

| Accrued expenses and other current liabilities | $ | 17,409 | | | $ | 17,107 | |

NOTE 7 - LONG-TERM DEBT

The Company’s Long-Term Debt as of September 30, 2023 and December 31, 2022 consisted of the following:

| | | | | | | | | | | |

| September 30, 2023 | | December 31, 2022 |

| Long-term debt | | | |

| Credit Agreement, dated as of February 23, 2022 (the “2022 Credit Agreement”) | | | |

$675 Million 7-Year Senior Secured Term Loan Facility (the “2022 Term Loan Facility”) | $ | 664,875 | | | $ | 671,625 | |

$150 Million 5-Year Senior Secured Revolving Credit Facility (the “2022 Revolver”)(1) | — | | | — | |

| | | |

| | | |

| | | |

| Debt issuance costs | (7,775) | | | (8,854) | |

Total term loan debt | 657,100 | | | 662,771 | |

| Less: Current portion | (6,750) | | | (8,438) | |

Long-term debt, net of debt issuance costs and current portion | $ | 650,350 | | | $ | 654,333 | |

(1) As of September 30, 2023 and December 31, 2022, the Company did not have outstanding amounts drawn on the 2022 Revolver, including letters of credit and swingline loan sub-facilities. As of September 30, 2023, the Company had $150 million of available borrowing capacity under the 2022 Revolver.

The interest rate on outstanding debt under the 2022 Term Loan Facility was 8.9% per annum as of September 30, 2023. The interest rates for all facilities under the 2022 Credit Agreement are calculated based upon the Company’s election among (a) adjusted term SOFR plus an additional interest rate spread, (b) with respect to a borrowing in Euros under the 2022 Revolver, a euro interbank offered rate plus an additional interest rate spread, or (c) an “Alternate Base Rate” (as defined in the 2022 Credit Agreement) plus an additional interest rate spread.

Interest expense, net, inclusive of debt amortization, for the three months ended September 30, 2023 and September 30, 2022 was $9.5 million and $10.5 million respectively, and for the nine months ended September 30, 2023 and September 30, 2022 was $30.3 million and $30.7 million, respectively.

The fair value of the Company’s long-term debt is based on the market value of its long-term debt instrument. Based on the inputs used to value the long-term debt, the Company’s long-term debt is categorized within Level 2 in the fair value hierarchy. As of September 30, 2023, the carrying amount of the Company’s long-term debt under the 2022 Credit Agreement was $657.1 million, and the fair value of the Company’s long-term debt was $555.2 million. As of December 31, 2022, the carrying amount of the Company’s long-term debt under the 2022 Credit Agreement was $662.8 million, and the fair value of the Company’s long-term debt was $624.6 million.

The 2022 Credit Agreement includes, among other things, customary negative and affirmative covenants (including reporting, financial and maintenance covenants) and events of default (including a change of control) for facilities of this type. In addition, the 2022 Credit Agreement includes a springing first lien leverage ratio financial covenant, which is applicable only to the lenders under the 2022 Revolver. The Company was in compliance with its financial covenants on September 30, 2023 and December 31, 2022. The 2022 Term Loan Facility and the 2022 Revolver are secured by substantially all of the assets of Olaplex, Inc. and the other guarantors, subject to certain exceptions and thresholds.

Interest Rate Cap Transaction

The Company’s results are subject to risk from interest rate fluctuations on borrowings under the 2022 Credit Agreement, including the 2022 Term Loan Facility. The Company may, from time to time, utilize interest rate derivatives in an effort to add stability to interest expense and to manage its exposure to interest rate movements. On August 11, 2022, the Company entered into an interest rate cap transaction (the “interest rate cap”) in connection with the 2022 Term Loan Facility, with a notional amount of $400 million. Interest rate caps designated as cash flow hedges involve the receipt of variable amounts from a counterparty if interest rates rise above the strike rate applicable to the transaction, in exchange for an up-front premium paid by the Company. The Company has designated the interest rate cap as a cash-flow hedge for accounting purposes.

For derivatives designated, and that qualify, as cash flow hedges of interest rate risk, the gain or loss on the derivative is recorded in Accumulated other comprehensive income and subsequently reclassified into Interest expense, net in the same period(s) during which the hedged transaction affects earnings, as documented at hedge inception in accordance with the Company’s accounting policy election.

The table below presents the fair value of the Company’s derivative financial instruments, which are classified within Other assets on the Company’s Condensed Consolidated Balance Sheets as of September 30, 2023 and December 31, 2022.

| | | | | | | | | | | |

| |

| September 30, 2023 | | December 31, 2022 |

| Fair value, interest rate cap asset | $ | 4,545 | | | $ | 5,042 | |

During the three and nine months ended September 30, 2023, the Company’s interest rate cap generated an unrecognized pre-tax loss of $0.7 million and a gain of $0.3 million, respectively, recorded in Accumulated other comprehensive income on the Company’s Condensed Consolidated Balance Sheets. During the same periods, the Company also recognized a $1.3 million and $2.8 million reduction, respectively, in interest expense related to the Company’s receipt of funds as a result of an interest rate cap settlement with the Company’s counterparty, partially offset by $0.3 million and $0.8 million, respectively, of interest expense related to amortization of the interest rate cap premium paid by the Company in connection with the interest rate cap.

During each of the three and nine months ended September 30, 2022, the Company’s interest rate cap generated an unrecognized pre-tax gain of $2.4 million, recorded in Accumulated other comprehensive income on the Company’s Condensed Consolidated Balance Sheets. During the same periods, the Company also recognized $0.1 million of interest expense related to amortization of the interest rate cap premium paid by the Company in connection with the interest rate cap.

The Company performed an initial effectiveness assessment on the interest rate cap and determined it to be an effective hedge of the cash flows related to the interest rate payments on the 2022 Term Loan Facility. The hedge is evaluated qualitatively on a quarterly basis for effectiveness. Changes in fair value are recorded in Accumulated other comprehensive income and periodic settlements of the interest rate cap will be recorded in Interest expense, net along with the interest on amounts outstanding under the 2022 Term Loan Facility. Payment of the up-front premium of the interest rate cap is included within Other assets and liabilities within cash flows from operating activities on the Company’s Condensed Consolidated Statements of Cash Flows.

The Company does not hold or issue derivative financial instruments for trading purposes, nor does it hold or issue leveraged derivative instruments. By using derivative financial instruments to hedge exposures to interest rate fluctuations, the Company exposes itself to counterparty credit risk. The Company manages exposure to counterparty credit risk by entering into derivative financial instruments with highly rated institutions that can be expected to fully perform under the terms of the applicable contracts.

NOTE 8 - EQUITY

During the nine months ended September 30, 2023, the Company issued 109,620 shares of its common stock upon vesting and settlement of net stock-settled SARs. The Company repurchased 83,501 of outstanding shares of its common stock for the net settlement of SARs for payment of taxes related to such SARs, which were accounted for as a share retirement.

Additionally, during the nine months ended September 30, 2023, the Company issued 4,606,867 shares of its common stock as a result of stock options exercised.

On August 2, 2023, the Company adopted the Amended and Restated 2020 Omnibus Equity Incentive Plan, effective September 27, 2021, which amended and restated the Penelope Holdings Corp. 2020 Omnibus Equity Incentive Plan (the "Original Plan") solely to reflect the Reorganization Transactions and the assumption by the Company of the Original Plan.

During the nine months ended September 30, 2022, the Company converted 886,950 cash-settled units into SARs, with a fair value liability of $1,632 reclassified from Accrued expenses and other current liabilities to Additional paid-in capital. The Company issued 117,180 shares of its common stock upon vesting and settlement of net stock-settled SARs. The Company repurchased 55,244 of outstanding shares of its common stock for the net settlement of SARs for payment of taxes related to such SARs, which were accounted for as a share retirement.

Additionally, during the nine months ended September 30, 2022, the Company issued 256,846 shares of its common stock as a result of stock options exercised.

NOTE 9 - RELATED PARTY TRANSACTIONS

In July 2020, the Company entered into an agreement with CI&T, an information technology and software company, in which certain investment funds affiliated with Advent International L.P., the holder of a majority of the Company’s common stock (collectively the “Advent Funds”), hold a greater than 10% equity interest. During the three months ended September 30, 2023, the Company did not make any payments to CI&T. During the nine months ended September 30, 2023, the Company paid CI&T $12. During the three and nine months ended September 30, 2022, the Company paid CI&T $153 and $179, respectively. The Company engaged CI&T for services related to the development, maintenance and

enhancement of the Olaplex professional application, as well as other digital marketing services, all of which were negotiated on an arm’s length basis and on market terms.

Tax Receivable Agreement

In connection with the Reorganization Transactions, the Company entered into the Tax Receivable Agreement with the Pre-IPO Stockholders. See further discussion in “Note 2 – Summary of Significant Accounting Policies – Tax Receivable Agreement”. During the three months ended September 30, 2023, the Company did not make a payment to the Pre-IPO Stockholders. During the nine months ended September 30, 2023, the Company made a payment to the Pre-IPO Stockholders of $16.6 million as required pursuant to the terms of the Tax Receivable Agreement. During the three and nine months ended September 30, 2022, the Company made a payment to the Pre-IPO Stockholders of $4.2 million as required pursuant to the terms of the Tax Receivable Agreement.

NOTE 10 - CONTINGENCIES

From time to time, the Company is subject to various legal actions arising in the ordinary course of business. The Company cannot predict with reasonable assurance the outcome of these legal actions brought against the Company as they are subject to uncertainties. Accordingly, any settlement or resolution in these legal actions may occur and affect the Company’s net income in such period as the settlement or resolution.

Pending Legal Proceedings:

On November 17, 2022, a putative securities class action was filed against the Company and certain of its current and former officers and directors in the United States District Court for the Central District of California, captioned Lilien v. Olaplex Holdings, Inc. et al., No. 2:22-cv-08395. A consolidated complaint was filed on April 28, 2023, which names as additional defendants the underwriters for the Company’s IPO and various stockholders that sold shares of common stock of the Company in the IPO. The action is brought on behalf of a putative class of purchasers of the Company’s common stock in or traceable to the Company’s IPO and asserts claims under Sections 11, 12, and 15 of the Securities Act of 1933. The action seeks certification of the putative class, compensatory damages, attorneys’ fees and costs, and any other relief that the court determines is appropriate. The defendants moved to dismiss the consolidated complaint on July 19, 2023. The court held a hearing on the defendants’ motions to dismiss on October 16, 2023, and a decision has yet to issue. The underwriter defendants have notified the Company of their intent to seek indemnification from the Company pursuant to the IPO underwriting agreement regarding the claims asserted in this action. The Company intends to vigorously defend the pending lawsuit.

On February 9, 2023, twenty-eight plaintiffs filed Albahae, et al. v. Olaplex Holdings, Inc., et al., No. 2:23-cv-00982, a complaint alleging personal and economic injury and asserting claims for breach of warranty, negligence/gross negligence, products liability, unjust enrichment, and violations of California False Advertising Law and Unfair Competition Law, against the Company and Cosway Company, Inc., the Company’s primary contract manufacturer, in the United States District Court for the Central District of California. On March 2, 2023, the plaintiffs amended the complaint to include seventy-three additional plaintiffs. The plaintiffs allege that certain ingredients used in some Company products have purportedly caused irritation or posed a hazard to consumers, and that the Company engaged in misrepresentation with respect to those products. The plaintiffs seek actual and consequential damages, punitive damages, restitution in the form of disgorgement of profits, attorneys’ fees and costs, and any other relief that the court determines is appropriate. On April 17, 2023, the Company moved to dismiss and to sever the plaintiffs’ claims. On July 11, 2023, the Court granted the Company’s motion to sever and dismissed all but the first named plaintiff. The Court also dismissed the operative complaint with leave to re-file on the grounds that it now contained allegations that were not relevant to the claims of the one, remaining plaintiff. On July 24, 2023, the remaining plaintiff filed a notice, voluntarily dismissing her claims without prejudice.

Any potential loss associated with these pending legal proceedings is not probable or reasonably estimable at this time.

As of September 30, 2023 and December 31, 2022, the Company was not subject to any other currently pending legal matters or claims that could have a material adverse effect on its financial position, results of operations, or cash flows should such litigation be resolved unfavorably.

NOTE 11 – NET INCOME PER SHARE

The following is a reconciliation of the numerator and denominator in the basic and diluted net income per common share computations:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30,

2023 | | September 30,

2022 | | September 30,

2023 | | September 30,

2022 |

| Numerator: | | | | | | | |

| Net income | $ | 20,366 | | | $ | 60,763 | | | $ | 47,486 | | | $ | 210,439 | |

| | | | | | | |

| Denominator: | | | | | | | |

Weighted average common shares outstanding – basic | 654,702,392 | | | 649,099,780 | | | 653,603,665 | | | 648,963,625 | |

| Dilutive common equivalent shares from equity options | 24,055,628 | | | 42,157,874 | | | 27,485,878 | | | 42,622,162 | |

Weighted average common shares outstanding – diluted | 678,758,020 | | | 691,257,654 | | | 681,089,543 | | | 691,585,787 | |

| | | | | | | |

| Net income per share: | | | | | | | |

| Basic | $ | 0.03 | | | $ | 0.09 | | | $ | 0.07 | | | $ | 0.32 | |

| Diluted | $ | 0.03 | | | $ | 0.09 | | | $ | 0.07 | | | $ | 0.30 | |

Options to purchase 4,473,909 and 2,887,141 shares of the Company’s common stock for the three and nine months ended September 30, 2023, respectively, and options to purchase 1,275,337 and 1,170,756 shares of the Company’s common stock for the three and nine months ended September 30, 2022, respectively, were not included in the computation of diluted net income per share because the exercise prices of these options were greater than the average market price per share of the Company’s common stock for the applicable period, and therefore would have been anti-dilutive.

ITEM 2 - MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our unaudited interim Condensed Consolidated Financial Statements and related notes included elsewhere in this Quarterly Report and with our audited Consolidated Financial Statements included in the 2022 Form 10-K.

Some of the information contained in this discussion and analysis, including information with respect to our plans and strategy for our business, includes forward-looking statements that involve risks and uncertainties. Our actual results may differ materially from management’s expectations as a result of various factors. Factors that could cause or contribute to these differences include, but are not limited to, those identified below and those discussed in the section “Special Note Regarding Forward-Looking Statements” in this Quarterly Report and in “Item 1A. – Risk Factors” in the 2022 Form 10-K.

Company Overview

OLAPLEX is an innovative, science-enabled, technology-driven beauty company. Since our inception in 2014, we have focused on delivering effective, patent-protected and proven product performance in the prestige hair care category. Our mission is to blaze new paths to well-being that ignite confidence from the inside out.

OLAPLEX disrupted and revolutionized the prestige hair care category by creating the bond-building space in 2014. We have grown from an initial assortment of three products sold exclusively through the professional channel to a broader suite of products offered through the professional, specialty retail and DTC channels that have been developed to address three key uses: treatment, maintenance and protection. Our patent-protected bond-building technology relinks disulfide bonds in human hair that are destroyed via chemical, thermal, mechanical, environmental and aging processes. Our current product portfolio comprises eighteen unique, complementary products specifically developed to provide a holistic regimen for hair health.

The strength of our business model and ability to scale have created a compelling financial profile historically characterized by revenue growth and very strong profitability. We have developed a mutually reinforcing, synergistic, omnichannel model that leverages the strength of each of our channels and our strong digital capabilities that we apply across our sales platforms. Our professional channel serves as the foundation for our brand. Through this channel, professional hairstylists introduce consumers to our products and, we believe, influence consumer purchasing decisions. Our specialty retail channel works to increase awareness of, and education for, our products and expand consumer penetration. Our DTC channel, comprised of Olaplex.com and sales through third-party e-commerce platforms, also provides us with the opportunity to engage directly with our consumers to provide powerful feedback that drives decisions we make around new product development.

Four Strategic Pillars

We are focused on executing against four key strategic pillars that we believe will support our long-term growth. These include igniting our global brand, disrupting with innovation, amplifying channel coverage and charting new geographies. These key strategic pillars are supported by our efforts to build capabilities and infrastructure that we believe will enable our aspirations.

Igniting our Global Brand

We believe we have built one of the most powerful brands in the prestige hair care category. We plan to continue growing awareness of our global brand, in an effort to deepen connections with existing customers as well as reach new audiences. We will also continue to invest in enhancing our brand equity. Our marketing model remains focused on implementing high return on investment, performance marketing activities aimed at fueling growth. Key levers of our marketing include creative campaigns, organic social media activations, strategic paid media, education and training regarding our brand, community engagement with our professional hairstylists, influencer partnerships, and retailer activations such as sampling and in-store events.

Disrupting with Innovation

We believe we have a strong pipeline of disruptive innovation that leverages our science-based technology and patented Bis-amino ingredient. We plan to launch two-to-four products annually over the next five years. To support this pipeline, we intend to continue to invest in research and development to strengthen our internal innovation capabilities. We remain excited about the opportunity to enter additional hair care adjacent categories and also other categories where our patents can serve as a foundation for entry that we believe is supported by consumer trust in our brand.

Amplifying Channel Coverage

In our professional channel, we have undertaken efforts to support strong relationships with the hairstylist community and maintain brand awareness by increasing our field support efforts, deepening partnerships with distributors and customers, and refreshing educational content. We are pursuing opportunities to further penetrate premium and prestige salons. In specialty retail, we are enhancing visual merchandising in stores and deploying targeted communications intended to enable new customer acquisition. For our DTC business, we are evolving the digital experiences on Olaplex.com and third party e-commerce websites. On Olaplex.com, we expect to continue to invest in site enhancements and more advanced personalization efforts.

Charting New Geographies

We believe there is substantial opportunity to grow globally. Our priority international regions are currently key markets in Europe and Asia. Across Europe and other regions, we aim to implement our business model by first establishing a strong professional channel and then complementing that channel through entry into specialty retail and DTC. In Asia, we intend to partner with distributors in the region that will support the omni-channel distribution and sales for our brand.

Supporting our Four Strategic Pillars

To enable these four key growth pillars, we intend to continue to build our capabilities and infrastructure. These efforts extend across our organization, including focusing on cultivating top talent and building a strong corporate culture, evolving our operational capabilities as we scale, and ensuring that we have financial structure, technology and data to support our growth.

Business Environment & Trends

We continue to monitor the effects of the global macroeconomic environment, including the risk of recession, inflationary pressures, competitive products and discounting, currency volatility, rising interest rates, higher costs of raw materials, social and political issues, geopolitical tensions and regulatory matters. We also are mindful of inflationary pressures on our consumers, and are monitoring the impact that these inflationary pressures may have on consumer spending and preferences and inventory rebalancing at our customers in an increasingly competitive industry.

Competition in the beauty industry is based on a variety of factors, including innovation, product efficacy, accessible pricing, brand recognition and loyalty, service to the consumer, promotional activities, advertising, special events, new product introductions, e-commerce initiatives and other activities. We have seen increased competitive activity including discounting in the prestige hair care category, which may continue in a heightened inflationary environment. We believe we have a well-recognized and strong reputation in our core markets and that the quality and performance of our products, our emphasis on innovation, and our engagement with our professional and consumer communities position us to compete effectively.

Overview of Third Quarter 2023 Financial Results

•Net sales decreased 30.0% from $176.5 million in the three months ended September 30, 2022 to $123.6 million in the three months ended September 30, 2023. For the three months ended September 30, 2023, net sales in our professional channel decreased 23.3%, our specialty retail channel decreased 41.8% and our DTC channel decreased 18.2%, in each case as compared to the three months ended September 30, 2022.

•Gross profit margin decreased from 73.6% in the three months ended September 30, 2022 to 67.6% in the three months ended September 30, 2023, primarily as a result of increased promotional allowance, an increased reserve for product obsolescence, and higher input costs for raw materials.

•Operating expenses for the three months ended September 30, 2023 increased by 13.8%, as compared to the three months ended September 30, 2022, primarily as a result of increased investments in sales and marketing, higher payroll due to workforce expansion, and higher employee benefit costs, partially offset by lower distribution and fulfillment costs incurred in the three months ended September 30, 2023.

•Operating income decreased from $88.7 million for the three months ended September 30, 2022 to $36.7 million for the three months ended September 30, 2023.

•Net income decreased from $60.8 million for the three months ended September 30, 2022 to $20.4 million for the three months ended September 30, 2023.

Overview of Year to Date 2023 Financial Results

•Net sales decreased 39.6% from $573.6 million in the nine months ended September 30, 2022 to $346.6 million in the nine months ended September 30, 2023. For the nine months ended September 30, 2023, net sales in our professional channel decreased 43.9%, our specialty retail channel decreased 46.8%, and our DTC channel decreased 19.3%, in each case as compared to the nine months ended September 30, 2022.

•Gross profit margin decreased from 74.5% in the nine months ended September 30, 2022 to 69.8% in the nine months ended September 30, 2023, primarily as a result of an increased reserve for product obsolescence, increased promotional allowance, and higher input costs for raw materials and warehousing.

•Operating expenses for the nine months ended September 30, 2023 increased by 36.9%, as compared to the nine months ended September 30, 2022, primarily as a result of increased investments in sales and marketing, higher professional fees, legal settlement costs, a one-time former distributor payment, payroll due to workforce expansion, and employee benefit costs, partially offset by lower distribution and fulfillment costs incurred in the nine months ended September 30, 2023.

•Operating income decreased from $317.3 million for the nine months ended September 30, 2022 to $91.1 million for the nine months ended September 30, 2023.

•Net income decreased from $210.4 million for the nine months ended September 30, 2022 to $47.5 million for the nine months ended September 30, 2023.

Results of operations

Comparison of the Three Months Ended September 30, 2023 to the Three Months Ended September 30, 2022

The following table sets forth our Condensed Consolidated Statements of Operations and Comprehensive Income data for each of the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, |

| 2023 | | 2022 |

| (in thousands) | | % of Net sales | | (in thousands) | | % of Net sales |

| Net sales | $ | 123,555 | | | 100.0 | % | | $ | 176,454 | | | 100.0 | % |

| Cost of sales: | | | | | | | |

| Cost of product (excluding amortization) | 37,415 | | | 30.3 | | | 45,484 | | | 25.8 | |

| Amortization of patented formulations | 2,592 | | | 2.1 | | | 1,142 | | | 0.6 | |

| Total cost of sales | 40,007 | | | 32.4 | | | 46,626 | | | 26.4 | |

| Gross profit | 83,548 | | | 67.6 | | | 129,828 | | | 73.6 | |

| Operating expenses: | | | | | | | |

| Selling, general, and administrative | 36,433 | | | 29.5 | | | 30,807 | | | 17.5 | |