false

--12-31

0001289636

0001289636

2025-01-02

2025-01-02

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 2,

2025

PROFIRE ENERGY, INC.

(Exact name of registrant as specified in its charter)

| Nevada |

|

001-36378 |

|

20-0019425 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

321 South 1250 West Suite 1

Lindon, UT |

84042 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including

area code: (801) 796-5127

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 |

|

PFIE |

|

NASDAQ |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

Introductory Note.

As

previously disclosed in the Current Report on Form 8-K filed by Profire Energy, Inc., a Delaware corporation (the

“Company” or “we”), with the Securities and Exchange

Commission (the “SEC”) on October 29, 2024, the Company entered into an Agreement and Plan of Merger,

dated October 28, 2024 (the “Merger Agreement”), with CECO Environmental Corp., a Delaware corporation

(“Parent”), and Combustion Merger Sub, Inc., a Delaware corporation and a direct, wholly owned subsidiary

of Parent (“Purchaser”). The Merger Agreement provides

for the acquisition of the Company by Parent in a two-step, all cash transaction, consisting of a tender offer by Purchaser,

followed by a subsequent merger of Purchaser with and into the Company (the “Merger”), with the Company continuing

as the surviving corporation.

| Item 1.02 | Termination of a Material Definitive Agreement |

Effective as of consummation of the Merger, the Company terminated

the Company’s 2014 Equity Incentive Plan and 2023 Executive Incentive Plan.

Item 2.01 Completion of Acquisition or Disposition of Assets

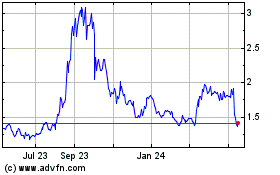

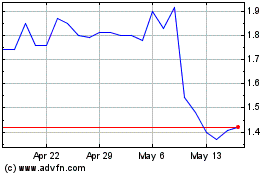

Pursuant

to the Merger Agreement, and upon the terms and subject to the conditions provided for therein, and pursuant to the Offer to Purchase,

dated December 3, 2024, as amended or supplemented from time to time, of Parent and Purchaser and the related Letter of Transmittal

and Notice of Guaranteed Delivery (collectively, the “Offer”), on December 3, 2024, Purchaser commenced

the Offer for all of the Company’s issued and outstanding shares of common stock, par value $0.001 per

share (the “Shares”), other than any Cancelled Shares (as defined below), at a purchase price of $2.55 per Share

(the “Offer Price”), net to the seller thereof in cash, without interest, and subject to any required

withholding tax.

The Offer

expired at one minute after 11:59 p.m. Eastern Time on December 31, 2024 (the “Expiration Time”) and

was not extended. According to Colonial Stock Transfer Company, Inc., the depositary and paying agent for the Offer, as of the Expiration

Time, 39,688,706 Shares were validly tendered and not validly withdrawn pursuant to the Offer, and 337,815 commitments to tender under

the guaranteed delivery procedures described in the Offer were received, representing in the aggregate approximately 86.31% of the outstanding

Shares. The number of Shares validly tendered and not validly withdrawn satisfied the condition to the Offer that there be a number of

Shares validly tendered and not validly withdrawn that, considered together with all other Shares (if any) beneficially owned by Parent,

Purchaser or any other subsidiary of Parent, equals at least a majority of the voting power of the Shares outstanding at the Expiration

Time. Each condition to the Offer was satisfied or waived, and, on January 2, 2025 (the “Offer Acceptance Time”),

Purchaser irrevocably accepted for payment all Shares that were validly tendered and not validly withdrawn pursuant to the Offer.

Following

the Offer Acceptance Time and the consummation of the Offer, each condition to the Merger (as defined below) set forth in the Merger Agreement

was satisfied or waived, and on January 3, 2025, Purchaser merged with and into the Company (the “Merger”

and, together with the Offer and the other transactions contemplated by the Merger Agreement, the “Transactions”)

pursuant to Section 92A.133 of the Nevada Revised Statues (the “NRS”) and Section 252 of the

General Corporation Law of the State of Delaware (the “DGCL”), without a meeting

or vote of the Company’s stockholders, with the Company continuing as the surviving corporation. At the effective time of the Merger

(the “Effective Time”), each issued and outstanding Share, other than any Shares owned by Parent, Purchaser

or the Company (as treasury stock or otherwise) or any of their respective direct or indirect wholly owned subsidiaries (the “Cancelled

Shares”), was converted into the right to receive, in cash, an amount equal to the Offer Price (the “Merger

Consideration”) in cash, without interest, and subject to any required withholding tax.

At the Effective Time,

each award of restricted stock units relating to a Share (“Company RSU”) that was outstanding under the Company’s

2014 Equity Incentive Plan or 2023 Equity Incentive Plan as of immediately prior to the Effective Time, whether or not then vested, fully

vested and was canceled and converted into the right to receive, as promptly as reasonably practicable after the Effective Time, an amount

in cash, without interest, equal to the product of: (a) the aggregate number of Shares of restricted stock, assuming that for Company

RSUs with vesting requirements subject to performance goals, such performance goals have been met at the maximum level of performance,

and (b) the Merger Consideration, less any taxes required to be withheld.

The

aggregate consideration paid by Parent and Purchaser to acquire the Shares in the Offer and the Merger was approximately $118 million.

The foregoing

description of the Merger Agreement and the Transactions is not complete and is qualified in its entirety by reference to the Merger Agreement,

a copy of which was filed as Exhibit 2.1 to the Current Report on Form 8-K filed by the Company with the

SEC on October 29, 2024, and is incorporated herein by reference.

Item 3.01. Notice

of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

The information

set forth in the Introductory Note and Item 2.01 of this Current Report on Form 8-K is incorporated by reference into this Item 3.01.

On January 3,

2025, in connection with the consummation of the Transactions, the Company notified the Nasdaq Stock Market LLC (“NASDAQ”)

of the consummation of the Merger and requested that NASDAQ suspend trading of the Shares and file with the SEC a Form 25 Notification

of Removal from Listing and/or Registration to delist the Shares and deregister the Shares under Section 12(b) of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”). NASDAQ halted trading of the Shares prior to the open

of trading on the morning of January 3, 2025. The Company also intends to file with the SEC a Certification and Notice of Termination

of Registration on Form 15 under the Exchange Act, requesting the termination of registration of the Shares under Section 12(g) of

the Exchange Act and the suspension of the Company’s reporting obligations under Sections 13 and 15(d) of the Exchange Act

with respect to the Shares.

Item 3.03. Material

Modification to Rights of Security Holders.

The information

set forth in the Introductory Note, Item 1.02, Item 2.01, Item 3.01 and Item 5.03 of this Current Report on Form 8-K is

incorporated by reference into this Item 3.03.

In connection

with the completion of the Merger, at the Effective Time, holders of Shares and Company RSUs ceased to have any rights in connection with

their holding of such securities (other than their right to receive the Merger consideration described in Item 2.01 above).

Item 5.01.

Changes in Control of Registrant.

The information

set forth in the Introductory Note, Item 2.01, Item 5.02 and Item 5.03 of this Current Report on Form 8-K is incorporated

by reference into this Item 5.01.

As a

result of the consummation of the Offer, a change in control of the Company occurred. At the Effective Time, the Company became a wholly

owned subsidiary of Parent.

Parent

provided Purchaser with the funds necessary to complete the Transactions in accordance with the Merger Agreement from borrowings under

its revolving credit facility.

Item 5.02.

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain

Officers.

The information

set forth in the Introductory Note and Item 2.01 of this Current Report on Form 8-K is incorporated by reference into this Item 5.02.

In connection

with the consummation of the Transactions, Brenton W. Hatch, Colleen Larkin Bell, Ryan W. Oviatt, Daren J. Shaw and Ronald R. Spoehel,

being all of the directors of the Company, immediately prior to the Effective Time, resigned from the board of directors and ceased to

be directors of the Company as of the Effective Time. These resignations were solely

in connection with the Merger and not a result of any disagreement regarding the Company’s operations, policies or practices.

Item 5.03.

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

The information

set forth in the Introductory Note and Item 2.01 of this Current Report on Form 8-K is incorporated by reference into this Item 5.03.

Pursuant

to the terms of the Merger Agreement, at the Effective Time, the Company’s articles of incorporation and bylaws were each amended

and restated in their entirety. Copies of the amended and restated articles of incorporation and amended and restated bylaws are attached

as Exhibit 3.1 and Exhibit 3.2, respectively, to this Current Report on Form 8-K, and

are incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d)

Exhibits. The following exhibits are furnished as part of this Current Report on Form 8-K:

* Certain exhibits and schedules to this exhibit have been omitted

pursuant to Item 601(a)(5) of Regulation S-K. The registrant agrees to furnish a copy of the omitted exhibits and schedules to the

SEC on a supplemental basis upon its request.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

PROFIRE ENERGY, INC. |

| |

|

| |

|

| January 3, 2025 |

By: /s/ Ryan W. Oviatt |

| |

Name: Ryan W. Oviatt |

| |

Title: Co-Chief Executive Officer & President |

| |

|

| |

|

| |

By: /s/ Cameron M. Tidball |

| |

Name: Cameron M. Tidball |

| |

Title: Co-Chief Executive Officer & President |

Exhibit 3.1

AMENDED AND RESTATED

ARTICLES OF INCORPORATION

OF

PROFIRE ENERGY, INC.

ARTICLE I

NAME

The name of the corporation

is Profire Energy, Inc. (the “Corporation”).

ARTICLE II

purpose

The Corporation is formed

for the purpose of engaging in any lawful activity for which corporations may be organized under the laws of the State of Nevada.

ARTICLE III

AUTHORIZED CAPITAL STOCK

The total authorized capital

stock of the Corporation shall consist of One Thousand (1,000) shares of common stock, par value $0.001 per share.

ARTICLE IV

DIRECTORS

The members of the governing

board of the Corporation are styled as directors. The Board of Directors shall be elected in such manner as shall be provided

in the bylaws of the Corporation. The number of directors may be changed from time to time in such manner as provided in the

bylaws of the Corporation.

ARTICLE V

INDEMNIFICATION;

EXCULPATION

A. No director or officer

of the Corporation shall be personally liable to the Corporation or any of its stockholders for damages for breach of fiduciary duty as

a director or officer; provided, however, that the foregoing provision shall not eliminate or limit the liability of a director or officer

(i) for acts or omissions which involve intentional misconduct, fraud or knowing violation of law, or (ii) the payment of dividends

in violation of Section 78.300 of the Nevada Revised Statutes (“NRS”).

B. In addition to any other

rights of indemnification permitted by the laws of the State of Nevada or as may be provided for by the Corporation in its bylaws or by

agreement, the expenses of directors and officers incurred in defending a civil or criminal action, suit or proceeding, involving alleged

acts or omissions of such directors or officers in their respective capacities as directors or officers of the Corporation must be paid

by the Corporation or through insurance purchased and maintained by the Corporation or through other financial arrangements made by the

Corporation, as they are incurred and in advance of the final disposition of the action, suit or proceeding, upon receipt of an undertaking

by or on behalf of the director or officer to repay the amount if it is ultimately determined by a court of competent jurisdiction that

he or she is not entitled to be indemnified by the Corporation.

C. Any repeal or modification

of this Article V approved by the stockholders of the Corporation shall be prospective only, and shall not adversely

affect any limitation on the liability of a director or officer of the Corporation existing as of the time of such repeal or modification. In

the event of any conflict between this Article V and any other article of the Corporation’s articles of incorporation,

the terms and provisions of this Article V shall control.

ARTICLE VI

SPECIAL PROVISIONS REGARDING DISTRIBUTIONS

Notwithstanding anything to

the contrary in the articles of incorporation or the bylaws of the Corporation, the Corporation is hereby specifically allowed to make

any distribution that otherwise would be prohibited by NRS 78.288(2)(b).

Exhibit 3.2

AMENDED

AND RESTATED BYLAWS

OF

PROFIRE ENERGY, INC.

January 3, 2025

ARTICLE I

MEETINGS

OF STOCKHOLDERS

Section 1.

Place of Meetings.

All meetings of stockholders

shall be held at the registered office of Profire Energy, Inc., a Nevada corporation (the “Corporation”), in the

State of Nevada or at such other place or places within or without the State of Nevada as may be specified in the notices of such meetings.

Notwithstanding the foregoing, the Board of Directors of the Corporation (the “Board”) may, in its sole discretion,

determine that the meeting shall not be held at any place, but shall be held solely by means of remote communications, subject to such

guidelines and procedures as the Board may adopt, as permitted by applicable law.

Section 2.

Annual Meeting.

An annual meeting of stockholders

for the election of directors and the transaction of such other business as may be properly brought before such meeting shall be held

on such date or dates as the Board may from time to time determine. Any annual meeting of stockholders may be adjourned in accordance

with Section 5(c) of this Article from time to time until the business to be transacted at such meeting is completed.

Section 3.

Special Meetings.

Special meetings of the stockholders

may be called at any time by the Chairman of the Board, or, in the absence or disability of the Chairman of the Board (including an absence

because no Chairman of the Board shall have been designated), the President (or, in the event of his absence or disability, by any Vice

President) or by the Board. A special meeting shall be called by the Chairman of the Board (if any), the President (or, in the event of

his absence or disability, by any Vice President) or by the Secretary, immediately upon receipt of a written request therefor by a stockholder

or stockholders holding in the aggregate at least sixty percent (60%) of the outstanding shares of the Corporation at the time entitled

to vote at any meeting of the stockholders. If such officers or the Board shall fail to call such meeting within twenty (20) days after

receipt of such request, any stockholder executing such request may call such meeting. Any such special meeting of the stockholders shall

be held at such place or places, within or without the State of Nevada, as shall be specified in the notice or waiver of notice thereof.

Section 4.

Record Date.

(a) In

order to determine the stockholders entitled to notice of or to vote at any meeting of stockholders or any adjournment thereof, the Board

may fix a record date, which record date shall not precede the date upon which the resolution fixing such record date is adopted by the

Board and which record date shall not be more than sixty (60) nor less than ten (10) days before the date of such meeting. If no

record date is fixed by the Board, the record date for determining stockholders entitled to notice of or to vote at a meeting of stockholders

shall be the close of business on the day next preceding the day on which notice of such meeting is given or, if such notice is waived

by all of the stockholders, the close of business on the day next preceding the day on which such meeting is held. A determination of

stockholders of record entitled to notice of or to vote at a meeting of stockholders shall apply to any adjournment of the meeting; provided,

however, that the Board may fix a new record date for such adjourned meeting.

(b) In

order to determine the stockholders entitled to consent to action in writing without a meeting, the Board may fix a record date, which

record date shall not precede the date upon which the resolution fixing such record date is adopted by the Board and which record date

shall not be more than ten (10) days after the date upon which the resolution fixing such record date is adopted by the Board. If

no record date is fixed by the Board, the record date for determining stockholders entitled to consent to action in writing without a

meeting, when no prior action by the Board is required by Nevada Revised Statutes, as then in effect (the “Law”), shall

be the first date on which a signed written consent setting forth the action taken or proposed to be taken is delivered to the Corporation

at its registered office in the State of Nevada, its principal place of business or an officer or agent of the Corporation having custody

of the books in which proceedings of meetings of stockholders are recorded. Delivery made to the Corporation at its registered office

shall be made by personal delivery or by certified or registered mail, return receipt requested. If no record date has been fixed by the

Board and prior action by the Board is required by the Law, the record date for determining stockholders entitled to consent to action

in writing without a meeting shall be the close of business on the day on which the Board adopts the resolution taking such prior action.

Section 5.

Notice of Meetings; Waiver.

(a) Each

notice of each meeting of stockholders shall state the place, date and hour of such meeting, the means of remote communications, if any,

by which stockholders and proxy holders may be deemed to be present in person and vote at such meeting and, unless it is for an annual

meeting of stockholders, shall indicate that it is being sent by or at the direction of the person(s) calling such meeting and state

the purpose(s) for which such meeting is being called. If, at any meeting of stockholders, action is proposed to be taken which would,

if taken, give stockholders fulfilling the requirements of the Law the right to receive payment for their shares of capital stock of the

Corporation, the notice of such meeting shall include a statement of such proposed action and such right. Not less than ten (10) nor

more than sixty (60) days before the date of such meeting, the Secretary (or, in the event of his absence or disability, any Assistant

Secretary) shall give or cause to be given a copy of the notice of such meeting, either by personal delivery, by mail or by electronic

transmission (if made in accordance with this Section 5(a)) to each person entitled to notice of such meeting. If mailed, such notice

shall be deemed to have been given to a stockholder when it is deposited in the United States mail, postage prepaid, directed to the stockholder

at his address as it appears on the stock records of the Corporation or, if he shall have filed with the Secretary a written request providing

that notices to him be mailed to some other address, then directed to him at such other address.

Without limiting the manner

in which notice otherwise may be given effectively to stockholders, any notice to stockholders given by the Corporation under any provision

of the Law, the Certificate of Incorporation or these Bylaws, shall be effective if given by a single written notice to stockholders who

share an address if consented to by the stockholders at that address to whom such notice is given. Any stockholder who fails to object

in writing to the Corporation, within sixty (60) days of having been given written notice by the Corporation of its intention to send

the single notice permitted by the Law and this paragraph, shall be deemed to have consented to receiving such single written notice.

Any such consent shall be revocable by the stockholder by written notice to the Corporation.

Without limiting the foregoing,

any notice to stockholders given by the Corporation pursuant to this Section 5 shall be effective if given by a form of electronic

transmission consented to by the stockholder to whom the notice is given. Any such consent shall be revocable by the stockholder by written

notice to the Corporation and shall also be deemed revoked if (1) the Corporation is unable to deliver by electronic transmission

two consecutive notices given by the Corporation in accordance with such consent and (2) such inability becomes known to the Secretary

or an Assistant Secretary of the Corporation, the transfer agent or other person responsible for the giving of notice; provided,

however, the inadvertent failure to treat such inability as a revocation shall not invalidate any meeting or other action. Notice

given by a form of electronic transmission in accordance with these Bylaws shall be deemed given: (i) if by facsimile telecommunication,

when directed to a number at which the stockholder has consented to receive notice; (ii) if by electronic mail, when directed to

an electronic mail address at which the stockholder has consented to receive notice; (iii) if by a posting on an electronic network,

together with separate notice to the stockholder of such specific posting, upon the later of such posting and the giving of such separate

notice; and (iv) if by another form of electronic transmission, when directed to the stockholder.

For purposes of these Bylaws,

“electronic transmission” means any form of communication not directly involving the physical transmission of paper that creates

a record that may be retained, retrieved and reviewed by a recipient thereof, and that may be directly reproduced in paper form by such

a recipient through an automated process.

(b) A

written waiver of notice of a meeting of stockholders signed by a stockholder entitled to notice of such meeting, before or after such

meeting, shall be deemed to be equivalent to the giving of proper notice to such stockholder of such meeting. Attendance of a stockholder

at a meeting of stockholders shall constitute a waiver of notice of such meeting, except when such stockholder attends such meeting for

the express purpose of objecting, at the commencement of such meeting, to the transaction of any business at such meeting because such

meeting was not lawfully called or convened. Neither the business to be transacted at nor the purpose of any meeting of stockholders is

required to be specified in any written waiver of notice of such meeting.

(c) When

a meeting of stockholders is adjourned to another time or place, it shall not be necessary to give any notice of the adjourned meeting

if the time and place to which such meeting is adjourned are announced at such meeting. Any business may be transacted at such adjourned

meeting which might have been transacted at the original meeting. If the adjournment is for more than thirty (30) days or if, after such

adjournment, the Board fixes a new record date for such adjourned meeting, a notice of such adjourned meeting shall be given to each person

entitled to notice of such adjourned meeting.

Section 6.

List of Stockholders.

The Secretary shall prepare,

at least ten (10) days prior to each meeting of stockholders, a complete list of the stockholders entitled to vote at such meeting,

arranged in alphabetical order and showing the address of each such stockholder and the number of shares held of record by each such stockholder.

Such list shall be open for inspection by any stockholder, for purposes germane to such meeting, during ordinary business hours, for the

ten (10) days prior to such meeting, either (i) on a reasonably accessible electronic network, provided that the information

required to gain access to such list is provided with the notice of the meeting, or (ii) during ordinary business hours, at the principal

place of business of the Corporation. If the meeting is to be held at a place, the list shall also be produced and kept at the time and

place of the meeting during the whole time thereof and may be inspected by any stockholder who is present. If the meeting is to be held

solely by means of remote communication, the list shall also be open to the examination of any stockholder during the whole time thereof

on a reasonably accessible electronic network and the information required to access such list shall be provided with the notice of the

meeting. The stock records of the Corporation shall be conclusive evidence as to who is entitled to examine such stock records, the list

described in this Section 6 or the books of the Corporation or to vote at any meeting of stockholders.

Section 7.

Quorum; Manner of Acting.

(a) Except

as otherwise required by the Law or the Certificate of Incorporation, the presence, at the commencement of such meeting, in person or

by proxy of a holder or holders of at least sixty percent (60%) of the issued and outstanding shares of capital stock of the Corporation

entitled to vote at a meeting of stockholders shall be required in order to constitute a quorum for the transaction of business thereat.

(b) If

a quorum shall not be present at the commencement of any meeting of stockholders, the holder or holders of a majority of the issued and

outstanding shares of capital stock of the Corporation present in person or by proxy and entitled to vote at such meeting may adjourn

such meeting to another time and place.

(c) Except

as otherwise required by the Law or the Certificate of Incorporation, a matter submitted to a vote at a meeting of stockholders shall

have been approved only if a quorum was present at the commencement of such meeting and the holder or holders of at least sixty percent

(60%) of the issued and outstanding shares of the capital stock of the Corporation entitled to vote on such matter and present in person

or by proxy at such meeting shall have voted to approve such matter.

(d) At

all meetings of stockholders, a stockholder may vote by proxy (i) executed in writing by the stockholder or such stockholder’s

duly authorized attorney-in-fact or (ii) transmitted by the stockholder or such stockholder’s duly authorized attorney-in-fact

by telegram, cablegram or other means of electronic transmission to the proxyholder or to a proxy solicitation firm, proxy support system

or like agent duly authorized by the proxyholder to receive such transmission, provided that such telegram, cablegram or other means of

electronic transmission sets forth or is submitted with information from which it can be determined that the telegram, cablegram or other

electronic transmission was authorized by the stockholder. Such proxy must be filed with the Secretary of the Corporation at or before

the time of the meeting. No such proxy shall be voted or acted upon after three (3) years from its date, unless the proxy provides

for a longer period. A duly executed proxy shall be irrevocable if it states that it is irrevocable and if, and only as long as, it is

coupled with an interest sufficient under the Law to support an irrevocable power. A stockholder may revoke any proxy which is not irrevocable

by attending the meeting and voting in person or by filing with the Secretary an instrument in writing revoking the proxy or another duly

executed proxy bearing a later date.

(e) If

authorized by the Board in accordance with these Bylaws and the Law, stockholders and proxyholders not physically present at a meeting

of stockholders may, by means of remote communication, (i) participate in a meeting of stockholders and (ii) be deemed present

in person and vote at a meeting of stockholders, whether such meeting is to be held at a designated place or solely by means of remote

communication, provided that (x) the Corporation shall implement reasonable measures to verify that each person deemed present and

permitted to vote at a meeting by means of remote communication is a stockholder or proxyholder, (y) the Corporation shall implement

reasonable measures to provide such stockholders and proxyholders a reasonable opportunity to participate in the meeting and to vote on

matters submitted to the stockholders, including an opportunity to read or hear the proceedings of the meeting substantially concurrently

with such proceedings, and (z) if any stockholder or proxyholder votes or takes other action at the meeting by means of remote communication,

a record of such vote or other action shall be maintained by the Corporation.

Section 8.

Order of Business; Voting.

(a) The

Chairman of the Board, or, in the absence or disability of the Chairman of the Board (including an absence because no Chairman of the

Board shall have been designated), the President, or, in their absence, a person designated by the Board, or in the absence of all of

them, a person designated by the holders of a majority of the outstanding shares of capital stock of the Corporation present in person

or by proxy and entitled to vote at such meeting shall act as the chairman of such meeting. The chairman of each meeting of stockholders

shall call such meeting to order, determine the order of business at such meeting and otherwise preside over such meeting. The chairman

of the meeting shall announce at the meeting the date and time of the opening and closing of the polls for each matter upon which the

stockholders will vote at the meeting.

(b) The

Secretary shall act as secretary for each meeting of stockholders and keep the minutes thereof, but, in the absence of the Secretary,

the chairman of such meeting shall appoint some other person to act as secretary of such meeting.

(c) Unless

required by the Law, requested by any stockholder (present in person or by proxy and entitled to vote at such meeting) or directed by

the chairman of such meeting, neither the vote for the election of directors nor any other business at a meeting of stockholders is required

to be conducted by written ballot.

(d) Any

action required or permitted to be taken at a meeting of stockholders may be taken without a meeting, without any prior notice and without

a vote thereon, if stockholders having not less than the minimum number of votes that would be necessary to take such action at a meeting

at which all stockholders entitled to vote thereon were present and voting, consent in writing to such action and such writing(s) are

filed with the minutes of proceedings of the stockholders. Prompt written notice of the taking of such action shall be given by the Secretary

to all stockholders who have not consented in writing to such action.

Section 9.

Inspectors.

(a) The

Board in advance of any meeting of stockholders may (and shall, if required by the Law) appoint one or more inspectors to act at such

meeting or any adjournment thereof. If inspectors are not so appointed, the chairman of such meeting may, and on request of any stockholder

present in person or by proxy and entitled to vote at such meeting shall, appoint one or more such inspectors. No director, nominee for

director, officer or employee of the Corporation shall be appointed as an inspector. Inspectors need not be stockholders. In case any

person so appointed fails to appear or act, the vacancy may be filled by appointment of another person by the Board in advance of such

meeting or at such meeting by the chairman of such meeting.

(b) Each

inspector appointed to act at any meeting of stockholders shall, before entering upon the discharge of his duties, take and sign an oath

to execute faithfully the duties of inspector at such meeting with strict impartiality and according to the best of his ability. Such

inspectors shall (i) determine the number of shares outstanding and the voting power of each such share, the number of shares represented

at such meeting, the existence of a quorum and the validity and effect of proxies, (ii) receive votes or ballots, (iii) hear

and determine all challenges and questions arising in connection with the right to vote, (iv) count and tabulate all votes or ballots,

(v) determine the result and (vi) do all acts which may be proper in connection with conducting a vote at such meeting, with

fairness to all stockholders. On the request of the chairman of such meeting or any stockholder present in person or by proxy and entitled

to vote at such meeting, the inspector(s) shall make a report in writing of any challenge, question or matter determined by them

and execute a certificate of any fact found by them. Any such report or certificate shall be prima facie evidence of the facts so stated

and of the vote so certified.

ARTICLE II

BOARD

OF DIRECTORS

Section 1.

Powers; Qualifications; Number; Election.

(a) The

business and affairs of the Corporation shall be managed by or under the direction of the Board. Except as otherwise provided in the Certificate

of Incorporation, the Board may exercise all of the authority and powers of the Corporation and do all of the lawful acts and things which

are not by the Law, the Certificate of Incorporation or these Bylaws directed or required to be exercised or done by the stockholders.

The directors shall act only in their capacity as members of the Board and the individual directors shall have no power as such. Each

director shall be at least twenty-one (21) years of age. A director is not required to be a resident of the State of Nevada or a stockholder.

The Board shall consist of that number of directors (but not less than two (2) or more than seven (7)) as shall be fixed in accordance

with the Certificate of Incorporation. If the Certificate of Incorporation does not fix the number of directors, then the Board may fix

the number of directors within the range specified above. The initial number of directors shall be fixed at four (4).

(b) At

all elections of directors by stockholders entitled to vote thereon, the individuals receiving the vote of at least sixty percent (60%)

of the shares then outstanding and entitled to vote at an election of directors shall be deemed to have been elected as directors.

Section 2.

Term of Office of a Director.

The term of office of each

director shall commence at the time of his election and qualification and shall expire upon the due election and qualification of his

successor or upon his earlier death, resignation or removal.

Section 3.

Resignations; Removals; Filling of Vacancies.

(a) Any

director may resign at any time by giving written notice of his resignation to the Board or the Secretary. Such resignation shall take

effect at the time of receipt of such notice by the Board or the Secretary, as the case may be, or at any later time specified therein

and, unless otherwise specified therein, the acceptance of such resignation shall not be necessary to make it effective.

(b) Any

director or the entire Board may be removed, with or without cause, by the vote of the holder or holders of more than sixty percent (60%)

of the shares then outstanding and entitled to vote at an election of directors.

(c) If

any vacancies shall occur on the Board, by reason of death, resignation, removal or otherwise, or if the authorized number of directors

shall be increased, the directors then in office shall continue to act, and such vacancies and newly created directorships may be filled

by a majority of the directors then in office, although less than a quorum. A director elected to fill a vacancy or a newly created directorship

shall hold office until his successor has been elected and qualified or until his earlier death, resignation or removal. Any such vacancy

or newly created directorship may also be filled at any time by vote of the stockholders.

Section 4.

Meetings of the Board; Notice; Waiver.

(a) All

regular meetings of the Board shall be held at such places within or without the State of Nevada as may be fixed by the Board. All special

meetings of the Board shall be held at such place or places within or without the State of Nevada as may be specified in the notices of

such meetings.

(b) Regular

meetings of the Board for the transaction of such business as may be properly brought before such meetings shall be held on such dates

and at such times as may be fixed by the Board. Notices of such regular meetings are not required to be given.

(c) Special

meetings of the Board may be called at any time by the Chairman of the Board (if any), the President or any director. Each such meeting

shall be called by giving notice to that effect to the Secretary at least forty-eight (48) hours before such meeting. Such notice shall

state the place, date, hour and purpose(s) of such meeting. Promptly after receipt of such notice and, in any event, not less than

the minimum amount of time specified below before such meeting, the Secretary shall give notice of such meeting to all directors. Such

notice shall state the place, date, hour and purpose(s) of such meeting and shall indicate that such notices are being sent at the

request of the person or persons calling such meetings. Except as otherwise required by the Law, each notice of each special meeting of

the Board shall be given by (i) mail addressed to a director at his residence or usual place of business at least seven (7) days

before the date of such meeting or (ii) personal delivery or telex, telephone, telegram, cablegram, telecopier or other electronic

means addressed to a director at his usual place of business at least twenty-four (24) hours before such meeting. If mailed, such notice

shall be deemed to have been given to a director five (5) days after it is deposited in the United States mail, postage prepaid,

directed to such director at his residence or usual place of business.

(d) A

written waiver of notice of a meeting of the Board signed by a director, before or after such meeting, shall be deemed to be equivalent

to the giving of proper notice to such director of such meeting. Attendance of a director at a meeting of the Board shall constitute a

waiver of notice of such meeting, except when such director attends such meeting for the express purpose of objecting, at the commencement

of such meeting, to the transaction of any business at such meeting because such meeting was not lawfully called or convened. Neither

the business to be transacted at nor the purpose of any regular or special meeting of the Board is required to be specified in any written

waiver of notice of such meeting.

Section 5.

Quorum; Adjournment.

The presence of a majority

of the entire Board at any meeting of the Board shall be required in order to constitute a quorum for the transaction of business thereat.

Any meeting of the Board may be adjourned from time to time until the business to be transacted at such meeting is completed. If a quorum

shall not be present at any such meeting, a majority of the directors present may adjourn such meeting to another time and place. When

a meeting of the Board is adjourned to another time and place, it shall not be necessary to give any notice of the adjourned meeting if

the time and place to which such meeting is adjourned are announced at such meeting. Any business may be transacted at such adjourned

meeting which might have been transacted at the original meeting.

Section 6.

Manner of Acting.

(a) The

Board may designate a Chairman of the Board. If so designated, the Chairman of the Board shall preside at all meetings of stockholders

and of the Board. He shall perform such other duties as the Board may from time to time assign to him. In the absence or disability of

the Chairman of the Board (including an absence because no Chairman of the Board shall have been designated), a chairman of the meeting

shall be designated as provided in Section 8(a) of Article I hereof. The chairman of each meeting of the Board shall call

such meeting to order, determine the order of business at such meeting and otherwise preside over such meeting.

(b) The

Secretary shall act as secretary of each meeting of the Board and keep the minutes thereof, but, in the absence of the Secretary, the

chairman of such meeting shall appoint some other person to act as secretary of such meeting.

(c) At

each meeting of the Board each director shall be entitled to one (1) vote. Except as otherwise provided in the Certificate of Incorporation

or these Bylaws, a matter submitted to a vote at a meeting of the Board shall have been approved only if a quorum was present at the time

of the vote thereon and a majority of the directors present at that time shall have voted to approve such matter.

(d) Any

action required or permitted to be taken at any meeting of the Board may be taken without a meeting if all of the directors consent in

writing or by signed electronic transmission (either of which may be in counterparts) to such action and such writing(s) or electronic

transmission(s) are filed with the minutes of proceedings of the Board.

Section 7.

Participation in Meeting by Telephone.

One or more directors may

participate in a meeting of the Board by means of conference telephone or similar communications equipment by means of which all persons

participating in such meeting can hear each other at the same time. Participation in a meeting of the Board by such means shall constitute

presence in person at such meeting.

Section 8.

Compensation and Expenses of Directors.

Directors may be compensated

for rendering services as such as determined from time to time by the Board. Directors shall be reimbursed for reasonable out-of-pocket

expenses incurred by them in connection with rendering services as such.

ARTICLE III

COMMITTEES

OF THE BOARD

Section 1.

Regular Committees.

The Board may, pursuant to

a resolution or resolutions adopted by an affirmative vote of a majority of the entire Board, designate one or more committees of the

Board (including an Executive Committee). The members of each such committee shall consist of such directors (but only such directors)

designated by the Board, pursuant to a resolution or resolutions adopted by an affirmative vote of a majority of the entire Board. The

Board may, pursuant to a resolution or resolutions adopted by an affirmative vote of a majority of the entire Board, designate one or

more directors as alternate members of any committee who may replace any absent or disqualified member of such committee at any meeting

of such committee. Any vacancy on any committee resulting from death, resignation, removal or otherwise, which is not filled by an alternate

member, shall be filled by the Board, pursuant to a resolution or resolutions adopted by an affirmative vote of a majority of the entire

Board. Directors elected to fill such vacancies shall hold office for the balance of the term(s) of the members whose vacancies are

so filled. Each committee will report its actions in the interim between meetings of the Board at the next meeting of the Board or as

otherwise directed by the Board.

Section 2.

Regular Committee Powers.

Any committee of the Board,

to the extent (but only to the extent) provided in a resolution or resolutions adopted by an affirmative vote of a majority of the entire

Board, (i) shall have and may exercise all of the powers and authority of the Board and do all of the lawful acts and things which

may be done by the Board in the management of the business and affairs of the Corporation and (ii) may authorize the seal of the

Corporation to be affixed to all papers which may require it; provided, however, that no such committee shall have the power

or authority to do the following: amend the Certificate of Incorporation; adopt an agreement of merger or consolidation; recommend to

the stockholders the sale, lease or exchange of all or substantially all of the Corporation’s property and assets; recommend to

the stockholders a dissolution of the Corporation or a revocation of a dissolution of the Corporation; except as otherwise provided in

the Certificate of Incorporation, call a meeting of stockholders; amend or repeal these Bylaws or adopt new Bylaws; or, unless the Certificate

of Incorporation, these Bylaws or resolutions adopted by an affirmative vote of a majority of the entire Board shall expressly so provide,

declare a dividend, authorize the issuance of shares of capital stock of the Corporation or adopt a certificate of ownership and merger.

Section 3.

Advisory Committees.

The Board or a committee of

the Board may designate one or more advisory committees to report to the Board or a committee of the Board. Each such advisory committee

shall consist of one or more individuals designated by the Board or the committee of the Board which designated such advisory committee.

Such individuals are not required to be directors. The Board may designate one or more individuals as alternate members of any advisory

committee who may replace any absent or disqualified member of such advisory committee at any meeting of such committee. Any absence of

any member of any advisory committee or vacancy on any advisory committee resulting from death, resignation, removal or otherwise, which

is not filled by an alternate member, shall be filled only by the Board or the committee of the Board which designated such advisory committee.

Individuals elected to fill such vacancies shall hold office for the balance of the term(s) of the members whose vacancies are so

filled. Each advisory committee will report its actions in the interim between meetings of the Board or the committee of the Board which

designated such advisory committee at the next meeting of the Board or the committee of the Board which designated such advisory committee

or as otherwise directed by the Board or the committee of the Board which designated such advisory committee. An advisory committee shall

have none of the powers or authority of the Board or any committee of the Board.

Section 4.

Procedures.

Unless otherwise expressly

authorized by the Board in the resolution(s) designating such committee or advisory committee, the members of committees or advisory

committees shall act only as a committee and the individual members shall have no power as such. Any member of any committee or advisory

committee may be removed as such at any time as (but only as) provided in the resolution(s) designating such committee or advisory

committee. The presence, at any meeting thereof, of a majority of the total number of members which a committee or advisory committee

would have if there were no vacancies thereon shall be required in order to constitute a quorum for the transaction of business at such

meeting. The term of office of each member of any committee or advisory committee shall commence at the time of his election and qualification

and shall continue until his successor shall have been duly elected or until his earlier death, resignation or removal. Except as otherwise

provided in this Article III or in the resolution(s) designating such committee or advisory committee and except for the reference

to presiding at meetings of stockholders in Section 6(a) of Article II hereof, Sections 4, 5, 6, 7 and 8 of Article II

hereof shall apply to committees and advisory committees and members thereof as if references therein to the Board and directors were

references to such committees and members, respectively.

ARTICLE IV

OFFICERS

Section 1.

Officers.

The officers of the Corporation

may include the following: a President, one or more Vice Presidents (one or more of whom may be designated as an Executive Vice President

or a Senior Vice President), a Secretary or a Treasurer. The officers shall be elected at any time and from time to time by the Board.

The Board may also elect or appoint, in accordance with Section 6 of this Article IV, such other officers as it may at any time

and from time to time determine. Any of such offices may be held by the same person.

Section 2.

President.

The President shall be the

chief executive officer of the Corporation and shall, subject to the control of the Board, have general supervision over and general charge

for the business of the Corporation. The President shall see that all orders of the Board are carried into effect. The President shall

generally perform such duties as may from time to time be assigned to him by these Bylaws or by the Board and is authorized to enter into

contracts and execute and deliver instruments on behalf of the Corporation in the ordinary course of its business without specific approval

of the Board.

Section 3.

Vice Presidents.

Each Vice President shall,

subject to the control of the Board and the President, perform all duties as may from time to time be assigned to him by the Board, the

President or these Bylaws. In case of the absence of the President, any Vice President designated by the Board shall perform the duties

of the President with all of the powers of, and subject to all of the restrictions upon, the President. In addition, if the Board designates

one or more Vice Presidents, each such officer shall be authorized to enter into contracts and execute and deliver instruments on behalf

of the Corporation in the ordinary course of its business without specific approval of the Board.

Section 4.

Treasurer.

The Treasurer shall, subject

to the control of the Board and the President, have charge and custody of and be responsible for all of the funds and securities of the

Corporation, keep or have kept full and accurate accounts of assets, liabilities, receipts, disbursements and other transactions of the

Corporation in books belonging to the Corporation, cause or have caused regular audits of such books to be made and all moneys and other

valuable effects to be deposited in the name of and to the credit of the Corporation in such banks or other depositories as may be designated

by the Board. The Treasurer shall, subject to the control of the Board and the President, disburse the funds of the Corporation as ordered

by the Board or the other officers of the Corporation in accordance with these Bylaws, taking proper vouchers for such disbursements,

and shall render to the President and to the Board at its meetings or whenever he or it may require a statement of all his transactions

as treasurer and an account of the financial condition of the Corporation. In general, the Treasurer shall, subject to the control of

the Board and the President, perform all of the duties incident to the office of treasurer and such other duties as may from time to time

be assigned to him by the Board, the President or these Bylaws.

Section 5.

Secretary.

The Secretary shall, subject

to the control of the Board and the President, act as secretary of, and keep the minutes of, the proceedings of the Board and the stockholders

in books belonging to the Corporation, give or cause to be given notice of all meetings of stockholders and directors as required by these

Bylaws, be custodian of the seal of the Corporation, affix the seal, or cause it to be affixed, to all certificates for shares of capital

stock of the Corporation and to all documents the execution of which on behalf of the Corporation under its seal shall have been specifically

or generally authorized by the Board, have charge of the stock records of the Corporation and of the other books, records and papers of

the Corporation relating to its organization as a corporation and see that the reports, statements and other documents required by law

relating to the maintenance of the existence, qualifications and franchises of the Corporation as a corporation are properly kept or filed.

The Secretary shall, subject to the control of the Board and the President, generally perform all of the duties incident to the office

of secretary and such other duties as may from time to time be assigned to him by the Board, the President or these Bylaws.

Section 6.

Additional Officers.

The Board may from time to

time elect or appoint such other officers (including, without limitation, one or more Assistant Treasurers, one or more Assistant Secretaries

and other assistant officers) of the Corporation as the Board may deem proper, each of whom shall hold office for such period, have such

authority and perform such duties as the Board or the President pursuant to authority delegated to him by the Board may from time to time

determine.

Section 7.

Removal.

Any officer of the Corporation

may be removed at any time by the Board or by the President pursuant to authority delegated to him by the Board.

Section 8.

Resignations.

Any officer may resign from

his office at any time by giving written notice of his resignation to the Board, the President or the Secretary. The resignation of any

officer shall take effect at the time of receipt of such notice by the Board, the President or the Secretary, as the case may be, or at

any later time specified therein and, unless otherwise specified therein, the acceptance of such resignation shall not be necessary to

make it effective. No such resignation shall affect any rights which the Corporation may have under any agreement with such officer.

Section 9.

Giving of Bond by Officers.

All officers of the Corporation,

if required to do so by the Board, shall furnish bonds to the Corporation for the faithful performance of their duties subject to such

penalties and with such conditions and security as the Board may from time to time require. All expenses of any such bond shall be paid

by the Corporation.

Section 10.

Compensation of Officers.

Compensation of officers of

the Corporation may be fixed from time to time by the Board or, in the case of officers other than the President, by the President pursuant

to authority delegated to him by the Board.

Section 11.

Term of Office.

Subject to Section 7

of this Article IV, the term of office of each officer shall commence at the time of his election and qualification and shall continue

until his successor shall have been duly elected and qualified or his earlier death, resignation or removal.

Section 12.

Voting Stock Held by Corporation.

Except as otherwise determined

from time to time by the Board, the President shall have full power and authority in the name and on behalf of the Corporation to attend

any meeting of stockholders, partners or owners of any corporation, limited liability company, partnership or other entity in which the

Corporation may hold stock, a partnership interest or other ownership interest and at any such meeting shall possess and may exercise

any and all rights and powers incident to the ownership of such stock or interest which, as the owner thereof, the Corporation might have

possessed and exercised. The Board may from time to time confer like powers upon any other person(s) and the President may delegate

his powers hereunder to any other officer of the Corporation. Notwithstanding the foregoing, no officer of the Corporation, including

the President, shall vote any such interest or securities, execute any consent with respect to any such interest or securities, transfer

any such interest or securities or make any commitment to do any of the foregoing, except as specifically authorized by the affirmative

vote of the holder or holders of at least sixty percent (60%) or more of the shares then outstanding and entitled to vote for the election

of directors.

ARTICLE V

INDEMNIFICATION

Section 1.

Indemnification.

(a) Each

person who is or was made a party to or is threatened to be made a party to, or is or was involved in, any action, suit or proceeding,

whether civil, criminal, administrative or investigative (a “Proceeding”), by reason of the fact that he, or a person

of whom he is the legal representative, is or was a director, officer or employee of the Corporation or a subsidiary of the Corporation

or is or was serving at the request of the Corporation as a director, officer, partner, member, employee, agent or trustee of another

corporation (other than a subsidiary of the Corporation) or of a partnership, joint venture, trust or other enterprise, including an employee

benefit plan, whether the basis of such proceeding is alleged action in an official capacity as an officer, director or employee or in

any other capacity while so serving, shall be indemnified by the Corporation for and held harmless by the Corporation from and against,

to the fullest extent authorized by the Law, as the same exists or may hereafter be amended (but, in the case of any such amendment, only

to the extent that such amendment permits the Corporation to provide broader or greater rights to indemnification than the Law prior to

such amendment permitted the Corporation to provide), all expenses, liabilities and losses (including attorneys’ fees, judgments,

fines, excise taxes, penalties and amounts paid or to be paid in settlement) reasonably and actually incurred or suffered by such person

in connection therewith; provided, however, that except as provided herein with respect to proceedings seeking to enforce

rights to indemnification, the Corporation shall indemnify any such person seeking indemnification in connection with a Proceeding (or

part thereof) initiated by such person, directly or indirectly, only if such Proceeding (or part thereof) was authorized by the Board.

(b) The

right to indemnification set forth in this Article V is a contract right and shall include the right of the person receiving indemnification

to be paid the expenses (including costs and attorneys’ fees and disbursements) reasonably and actually incurred in defending a

proceeding in advance of its final disposition to the fullest extent authorized by the Law, as the same exists or may hereafter be amended

(but, in the case of any such amendment, only to the extent that such amendment permits the Corporation to provide broader or greater

rights to advancement of expenses than the Law prior to such amendment permitted the Corporation to provide); provided, however,

that, if the Law requires, the advancement of such expenses incurred by a person in advance of the final disposition of a proceeding,

shall be made only upon delivery to the Corporation of a written undertaking, by or on behalf of such person, to repay all amounts so

advanced if it shall ultimately be determined that such person is not entitled to be indemnified under this Article V or otherwise.

No person receiving an advance shall be required to provide security for the undertaking. Such right to indemnification and to the advancement

of expenses may be granted to any other agent of the Corporation or its subsidiaries if, and to the extent, authorized pursuant to a resolution

or resolutions adopted by the Board.

(c) If

a claim under this Article V is not paid in full by the Corporation within thirty (30) days after a written demand therefor has been

received by the Corporation from the claimant, the claimant may at any time thereafter bring suit against the Corporation to recover the

unpaid amount of the claim and, if successful in whole or in part, the claimant shall also be entitled to be paid the expense of prosecuting

such suit and interest at the prevailing statutory rate on the unjust amount of the claim. It shall be a defense to any such suit (other

than a suit brought to enforce a claim for expenses incurred in defending a proceeding in advance of its final disposition where the required

undertaking, if any is required, has been tendered to the Corporation) that the claimant has not met the standards of conduct which make

it permissible under the Law for the Corporation to indemnify the claimant for the amount claimed, but the burden of proving such defense

shall be on the Corporation. Neither the failure of the Corporation (including the Board, independent legal counsel to the Corporation

or the stockholders) to have made a determination prior to the commencement of such suit that indemnification of the claimant is proper

in the circumstances because he or she has met the applicable standard of conduct set forth in the Law nor an actual determination by

the Corporation (including the Board, independent legal counsel to the Corporation or the stockholders) that the claimant has not met

such applicable standard of conduct shall be a defense to the action or create a presumption that the claimant has not met the applicable

standard of conduct.

Section 2.

Indemnification Not Exclusive.

The indemnification of or

the advancement of expenses for any person under this Article V, or the right of any person to indemnification or advancement of

expenses under this Article V, shall not limit or restrict in any way the power of the Corporation to indemnify or advance expenses

for such person in any other manner permitted by the Law or be deemed exclusive of, or invalidate, any other right which such person may

have or acquire under any law, agreement, vote of stockholders or disinterested directors, or otherwise.

Section 3.

Successors.

The right of any person to

indemnification and advancement of expenses under this Article V shall continue as to a person after such person shall have ceased

to be such an officer, director, partner, member, employee, agent or trustee, shall inure to the benefit of the heirs, distributees, executors,

administrators and other legal representatives of such person, shall survive and not be adversely affected by any modification or repeal

of this Article V with respect to any claim or proceeding which arose, or transaction, matter, event or condition which occurred

or existed, before such modification or repeal, and shall be binding upon all successors of the Corporation.

Section 4.

Insurance.

The Corporation may purchase

and maintain insurance on behalf of any person who is or was such an officer, director, partner, member, employee, agent or trustee against

any liability asserted against such person as such an officer, director, partner, member, employee, agent or trustee or arising out of

such person’s status as such an officer, director, partner, member, employee, agent or trustee, whether or not the Corporation would

have the power to indemnify such person against such liability under the provisions of this Article V or the Law.

Section 5.

Definition of Certain Terms.

(a) For

purposes of this Article V, references to “fines” shall include any excise taxes assessed against a person with respect

to an employee benefit plan; and references to “serving at the request of the Corporation” shall include any service as a

director, officer, fiduciary, employee or agent of the Corporation which imposes duties on, or involves services by, such director, officer,

fiduciary, employee or agent with respect to an employee benefit plan, its participants or its beneficiaries.

(b) For

purposes of this Article V and the Law, a person who acted in good faith and in a manner such person reasonably believed to be in

the interest of the participants and beneficiaries of an employee benefit plan shall be deemed to have acted in a manner “not opposed

to the best interest of the Corporation.”

(c) For

purposes of this Article V, the term “Corporation” shall include any predecessor of the Corporation and any constituent

corporation (including any constituent of a constituent) absorbed by the Corporation in a consolidation or merger; and the term “other

enterprise” shall include any corporation, partnership, joint venture or trust.

ARTICLE VI

CONTRACTS;

BANK ACCOUNTS

Section 1.

Execution of Contracts.

Except as otherwise provided

in these Bylaws, the Board may from time to time authorize any officer, employee, agent or representative of the Corporation, in the name

and on behalf of the Corporation, to enter into any contract or engagement or execute and deliver any instrument. Such authorization may

be general or confined to specific instances. Unless so authorized by the Board or these Bylaws, no officer, employee, agent or representative

shall have any power or authority to bind the Corporation by any contract or engagement, to pledge its credit or to render it pecuniarily

liable for any purpose or to any amount.

Section 2.

Checks; Drafts; Notes.

All checks, drafts and other

orders for the payment of moneys out of the funds of the Corporation and all notes or other evidences of indebtedness of the Corporation

shall be signed in the name and on behalf of the Corporation in the manner authorized from time to time by the Board.

Section 3.

Deposits.

All funds of the Corporation

not otherwise employed shall be deposited from time to time to the credit of the Corporation in the banks, trust companies or other depositories

selected from time to time by the Board or by an officer, employee, agent or representative of the Corporation to whom such authority

may from time to time be delegated by the Board. For the purpose of making such a deposit, any officer, employee, agent or representative

to whom authority to make such a deposit is delegated by the Board may endorse, assign and deliver checks, drafts and other orders for

the payment of moneys which are payable to the order of the Corporation.

ARTICLE VII

SHARES;

DIVIDENDS

Section 1.

Uncertificated Shares.

The shares of capital stock

of the Corporation shall be uncertificated and evidenced by a book-entry system maintained by the registrar of such stock; provided that

the Board may provide by resolution or resolutions that some or all of any class or series shall be certificated shares. If shares are

represented by certificates, such certificates shall be in the form, other than bearer form, approved by the Board. The certificates representing

shares of capital stock of the Corporation shall be signed by, on in the name of, the Corporation by any two (2) authorized officers

of the Corporation. Any or all such signatures may be electronic. In case any officer, transfer agent or registrar who has signed or whose

facsimile signature has been placed upon any certificate shall have ceased to be such an officer, transfer agent or registrar before such

certificate is issued, such certificate may be issued with the same effect as if he were such officer, transfer agent or registrar on

the date of issuance of such certificate.

Section 2.

Authorization to Issue.

The capital stock of the Corporation

shall be issued for such consideration as shall be fixed, from time to time, by the Board.

Section 3.

Transfers.

Transfers of shares of capital

stock of the Corporation shall be made on the records of the Corporation only upon authorization by the record holder of such shares,

in person or by his duly authorized attorney or legal representative, upon surrender and cancellation of certificates therefor duly endorsed

or accompanied by duly executed stock powers (with such proof of authenticity of signature, if any, as the Corporation or its agent may

require) for a like number of shares, upon payment of all applicable taxes thereon, if any, and upon compliance with any restrictions

on transfer thereof, if any. The person in whose name shares of capital stock of the Corporation stand on the records of the Corporation

shall be deemed the owner of such shares for all purposes regarding the Corporation. The Board may make such additional rules and

regulations and take such actions as it may deem expedient, not inconsistent with the Certificate of Incorporation and these Bylaws, concerning

the issue, transfer and registration of certificates or the issue of certificates in lieu of certificates claimed to have been lost, destroyed,

stolen or mutilated.

Section 4.

Lost, Stolen or Destroyed Certificates.

The Corporation may direct

a new certificate or uncertificated shares to be issued in order to replace any certificate theretofore issued by it alleged to have been

lost, stolen or destroyed upon the making of an affidavit of that fact by the owner of the allegedly lost, stolen or destroyed certificate.

When authorizing such issue of a new certificate or uncertificated shares, the Board may, in its discretion and as a condition precedent

to the issue thereof, require the owner of the lost, stolen or destroyed certificate, or his legal representative, to give to the Corporation

a bond or other security to indemnify it against all losses, liabilities and expenses (including attorneys’ fees and expenses) incurred

in connection with investigating, defending and settling any claim that may be made against it on account of the alleged loss, theft or

destruction of such certificate or the issuance of such new certificate or uncertificated shares.

Section 5.

Fractions of a Share.

Subject to the provisions

of the Certificate of Incorporation, the Corporation shall have the authority to issue (but shall not be obligated, under these Bylaws,

to issue) fractions of a share of any class or series of capital stock of the Corporation. In lieu of issuing a fraction of a share of

any class or series of capital stock of the Corporation, the Corporation may (i) make such payments as may be determined using such

equitable method as the Board or an officer of the Corporation may select and/or (ii) issue that number of whole shares of such class

or series of capital stock of the Corporation as may be determined using such equitable method for rounding fractions to integers as the

officers of the Corporation may select, as the Board may determine or the Certificate of Incorporation may require.

Section 6.

Dividends.

Subject to the provisions

of the Certificate of Incorporation and to the extent permitted by the Law, the Board may declare and pay dividends on shares of any class

or series of capital stock of the Corporation at such times and in such amounts as, in its opinion, the conditions of the business of

the Corporation render advisable. Before payment of any dividend, the Board may set aside out of the surplus or net profits of the Corporation

such sum or sums as the Board may from time to time, in its absolute discretion, deem proper as a reserve fund to meet contingencies or

for equalizing dividends, for repairing or maintaining any property of the Corporation or for such other purposes as the Board may from

time to time deem to be in the best interests of the Corporation.

ARTICLE VIII

CORPORATE

SEAL

The Board may adopt a corporate

seal of the Corporation which shall be in such form as the Board may from time to time determine. When authorized by these Bylaws or by

the Board, a facsimile of the corporate seal may be affixed in lieu of the corporate seal.

ARTICLE IX

FISCAL

YEAR

The fiscal year of the Corporation

shall be fixed from time to time by the Board and, in the absence thereof, shall be the calendar year.

ARTICLE X

AMENDMENTS

These Bylaws may be amended

or repealed, and new Bylaws adopted, by the Board.

ARTICLE XI

CONSTRUCTION

Section 1.

Pronouns.

Unless otherwise expressly

specified in these Bylaws, the masculine, feminine or neuter form of a word includes the other forms of such word and the singular form

of a word includes the plural of such word.

Section 2.

Entire Board.

The term “entire Board”

as used herein shall mean the total number of members that the Board would have if there were no vacancies on the Board.

* * *

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |