The energy sector has been performing remarkably well this year,

especially following the geopolitical tensions in Russia, and is

clearly outpacing the broad market indices. Further, the current

demand/supply dynamics suggest higher oil prices, and in turn

soaring prices for energy stocks and the related ETFs.

Russia Threatens Oil Supply

The situation in Russia is getting worse as the Ukrainian regime

calls for military buildup against Russia on one hand, and the U.S.

and European Union are looking for more tough sanctions against the

country on the other if the crisis escalates further. This is

especially true given that at least three pro-Russian militants

were killed in the gun battle near the volatile eastern Ukrainian

town of Slavyansk on Sunday (read: 3 Commodity ETFs Surging on

Russia Sanctions).

Since Russia is a huge supplier of both natural gas and oil,

Western Europe and other markets are heavily dependent on Russian

production to fuel their economies. If the crisis escalates or

European Union hits Russia with more sanctions then the latter

could keep European markets away from its vast oil and natural gas

supplies. This will result in higher oil prices, pushing Western

Europe in search of other markets to meet their energy needs.

Encouraging Demand/Supply Trends

Though oil production in the U.S., the largest oil consumer,

reached its highest levels in 24 years thanks to new hydraulic

fracturing (fracking) methods and a boom in unconventional oil

production, output in other countries is showing signs of waning.

The civil unrest and operational issues in Libya and Iraq, reduced

supplies in Saudi Arabia, and repairs and maintenance in Kazakhstan

oil fields would take a toll on total oil supply going forward in

addition to Russia’s reduced output.

As a result, non-OPEC supply is expected to fall by 0.25 million

barrels per day this year to 29.8 million barrels per day, as per

the International Energy Agency (IEA). The agency also expects

global demand to rise a modest 1.5% to 92.7 million barrels per day

this year. Most of the demand is expected to come from volatile

emerging markets.

Moreover, the oil and energy industry currently has a Zacks

Industry Rank in the top 38%, suggesting a bullish outlook for the

broad sector. So the overall sector is looking quite promising at

present, especially given some of the weakness in many of the

high-flying names in other key sectors such as biotech and

technology (read: The Momentum Stock Crash Puts These ETFs in

Focus).

Fortunately, there are a few top ranked picks in this corner of the

market, and we have described some below. Any of these could enjoy

smooth trading and lead the market higher in Q2:

Top Energy ETFs

iShares U.S. Oil & Gas Exploration & Production ETF

(IEO)

This ETF tracks the Dow Jones U.S. Select Oil Exploration &

Production Index and holds 77 securities in its basket. The fund

has $468.6 million in its AUM and trades in good volume of nearly

111,000 shares per day. It charges 46 bps in annual fees and

expenses (read: Energy Exploration ETFs: A Bright Spot in The

Choppy Market).

The product is heavily concentrated on the top firm –

ConocoPhillips (COP) – at 12.9% while EOG Resources (EOG), Anadarko

Petroleum (APC) and Phillips 66 (PSX) round off to the next three

spots with combined 21.5% of assets. In terms of industrial

exposure, exploration and production takes the top position at

70.60% while integrated oil & gas takes the remainder.

The fund added about 10% so far this year and has a Zacks ETF Rank

of 1 or ‘Strong Buy’ rating with a ‘High’ risk outlook.

PowerShares DWA Energy Momentum Portfolio

(PXI)

This fund provides exposure to 34 energy stocks having positive

relative strength (momentum) characteristics by tracking the DWA

Energy Technical Leaders Index. It has accumulated $203 million in

its asset base and trades in small volume of about 24,000 shares

per day. Expense ratio came in at 0.66%.

The ETF is somewhat concentrated on the top 10 holdings at over 44%

with the largest allocation going to Cheniere Energy (LNG) and

Continental Resources (CLR). From a sector look, three-fourths of

the portfolio is tilted toward oil, gas & consumable fuels

while energy, equipment and services make up for the remainder.

PXI is up 8.6% in the year-to-date time frame and has a Zacks ETF

Rank of 2 or ‘Buy’ rating with a ‘High’ risk outlook (see: all the

energy ETFs here).

Top Energy Stocks:

Sprague Resources LP (SRLP)

Investors looking for a concentrated play on a particular company

in the energy industry could consider SRLP. This company is one of

the largest independent suppliers of energy and materials handling

services in the Northeast. Its products include home heating oil,

diesel fuels, residual fuels, gasoline and natural gas.

SRLP has seen solid earnings estimate revisions for both the

current quarter and the current year over the past month as about

more than 50% of the analysts revised their estimates upward. In

fact, over the past one month, the consensus estimate for the

current quarter has risen from 4 cents per share to 6 cents per

share while the current year estimates climbed from $1.47 per share

to $1.61 per share. This suggests that a bright future is ahead for

this company.

Sprague currently has a Zacks Rank #2 (Buy), meaning it could be

primed for more growth in the months ahead.

Targa Resources Corp. (TRGP)

For a slightly different play on the energy segment, investors

should consider TRGP. This company primarily supplies midstream

natural gas and natural gas liquid services in the United

States.

TRGP has also seen rising earnings estimates with about 40% of the

analysts increasing earnings estimate for the current quarter and

the current year over the past 30 days. The consensus estimate for

the current quarter and current year stood at 61 cents and $2.71

per share, respectively (read: 3 Oil ETFs Stand Out on Russian

Tensions).

This is up from 56 cents for the current quarter and $2.25 per

share for the current year over the last 30 days. Further, the

estimates represent a whopping year-over-year growth of 69.4% and

74.7% for this quarter and the year, respectively. This suggests

the company’s incredible potential to grow in the coming months.

Further, Targa currently has a Zacks Rank #2 (Buy), underscoring

the company’s solid position.

Bottom Line

Markets have been choppy of late as soft global economic

fundamentals, stretched valuations and earnings warnings dampened

investor mood. In light of this, it might be time to focus on a

sector that is seeing rising earnings estimates, and is well

positioned to benefit from the current geopolitical pressures

(read: 3 Low Risk ETFs for Market Turmoil).

Energy companies certainly poised to benefit from this scenario and

any of the aforementioned picks could be solid choices to play this

trend given the uncertain market environment.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHARS-US O&G (IEO): ETF Research Reports

PWRSH-DW EGY MO (PXI): ETF Research Reports

SPRAGUE RESRCS (SRLP): Free Stock Analysis Report

TARGA RESOURCES (TRGP): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

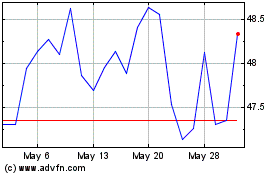

Invesco ETF Trust Invesc... (NASDAQ:PXI)

Historical Stock Chart

From Nov 2024 to Dec 2024

Invesco ETF Trust Invesc... (NASDAQ:PXI)

Historical Stock Chart

From Dec 2023 to Dec 2024