As filed with the Securities

and Exchange Commission on May 9, 2024

Registration No. 333-276253

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2 to

FORM F-10

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

QUIPT HOME MEDICAL CORP.

(Exact name of registrant as specified in its

charter)

| British

Columbia, Canada |

|

8090 |

|

Not

Applicable |

(Province

or Other Jurisdiction

of

Incorporation or Organization) |

|

(Primary

Standard Industrial

Classification Code Number (if

applicable)) |

|

(I.R.S.

Employer

Identification Number (if

applicable)) |

1019 Town Drive

Wilder, KY

Tel: (859) 878-2220

(Address and telephone number of Registrant’s

principal executive offices)

C T Corporation System

1015

15th Street N.W., Suite 1000

Washington, DC 20005

Tel: (202) 572-3133

(Name, address (including zip code) and telephone

number (including area code) of agent for service in the United States)

Copies to:

| |

|

Larry

W. Nishnick

DLA Piper LLP (US)

4365 Executive Drive, Suite 1100

San Diego, CA 92121

(858) 677-1414 |

|

|

Approximate date of commencement of proposed

sale of the securities to the public: From time to time after this Registration Statement becomes effective.

British Columbia, Canada

(Principal jurisdiction regulating this offering

(if applicable))

It is proposed that this filing shall become effective (check appropriate

box)

| A. |

¨ |

upon

filing with the Commission, pursuant to Rule 467(a) (if in connection with an offering being made contemporaneously in the United

States and Canada). |

| B. |

x |

At

some future date (check the appropriate box below) |

| |

1. |

¨ |

pursuant

to Rule 467(b) on (date) at (time) (designate a time not sooner than 7 calendar days after filing). |

| |

2. |

x |

pursuant

to Rule 467(b) on May 13, 2024 at 4:15 p.m. (Eastern) (designate a time 7 calendar days or sooner after filing) because the securities

regulatory authority in the review jurisdiction has issued a receipt or notification of clearance on May 9, 2024. |

| |

3. |

¨ |

pursuant

to Rule 467(b) as soon as practicable after notification of the Commission by the Registrant or the Canadian securities regulatory

authority of the review jurisdiction that a receipt or notification of clearance has been issued with respect hereto. |

| |

4. |

¨ |

after

the filing of the next amendment to this Form (if preliminary material is being filed). |

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to the home jurisdiction’s

shelf prospectus offering procedures, check the following box. x

The Registrant hereby amends this Registration

Statement on such date or dates as may be necessary to delay its effective date until the Registration Statement shall become effective

as provided in Rule 467 under the Securities Act of 1933 or on such date as the Commission, acting pursuant to Section 8(a) of

the Act, may determine.

PART I

INFORMATION REQUIRED TO BE DELIVERED TO

OFFEREES OR PURCHASERS

This offering is made by a foreign issuer

that is permitted, under a multijurisdictional disclosure system adopted by the United States, to prepare this prospectus in accordance

with the disclosure requirements of its home country. Prospective investors should be aware that such requirements are different from

those of the United States. Financial statements included or incorporated herein, if any, have been prepared in accordance with foreign

generally accepted accounting principles, and may be subject to foreign auditing and auditor independence standards, and thus may not

be comparable to financial statements of United States companies.

Prospective investors should be aware that

the acquisition of the securities described herein may have tax consequences both in the United States and in the home country of the

Registrant. Such consequences for investors who are resident in, or citizens of, the United States may not be described fully herein.

The enforcement by investors of civil liabilities

under the federal securities laws may be affected adversely by the fact that the Registrant is incorporated or organized under the laws

of a foreign country, that some or all of its officers and directors may be residents of a foreign country, that some or all of the underwriters

or experts named in the registration statement may be residents of a foreign country, and that all or a substantial portion of the assets

of the Registrant and said persons may be located outside the United States.

THESE SECURITIES HAVE NOT BEEN APPROVED OR

DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION NOR HAS THE COMMISSION PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS.

ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

This short form prospectus is

a base shelf prospectus. This short form prospectus has been filed under legislation in each of the provinces and territories of Canada

that permits certain information about these securities to be determined after this prospectus has become final and that permits the

omission from this prospectus of that information. The legislation requires the delivery to purchasers of a prospectus supplement containing

the omitted information within a specified period of time after agreeing to purchase any of these securities.

Information contained herein is

subject to completion or amendment. A registration statement relating to these securities has been filed with the United States Securities

and Exchange Commission. These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement

becomes effective. This prospectus shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any

sale of securities in any state in which such offer, solicitation or sale would be unlawful prior to registration or qualification under

the securities laws of any such state.

No securities regulatory authority has expressed

an opinion about these securities and it is an offence to claim otherwise. This short form base shelf prospectus constitutes a public

offering of these securities only in those jurisdictions where they may be lawfully offered for sale and therein only by persons permitted

to sell such securities. The securities offered hereby have not been and will not be registered under the United States Securities Act

of 1933, as amended (the “U.S. Securities Act”), or the securities laws of any state of the United States, and may

not be offered, sold or delivered, directly or indirectly, in the United States of America, its territories and, possessions, any state

of the United States or the District of Columbia (the “United States”), or to a “U.S. person” (as such

term is defined in Regulation S under the U.S. Securities Act) (a “U.S. Person”) unless exemptions from the registration

requirements of the U.S. Securities Act and any applicable state securities laws are available. This short form base shelf prospectus

does not constitute an offer to sell or a solicitation of an offer to buy any of these securities within the United States or to, or

for the account or benefit of, any U.S. Person. See “Plan of Distribution”.

Information

has been incorporated by reference in this short form prospectus from documents filed with securities commissions or similar authorities

in Canada. Copies of the documents incorporated herein by reference may be obtained on request without charge from the secretary of Quipt

Home Medical Corp. at 1019 Town Drive Wilder, Kentucky, USA 41076, telephone: (859) 878-2220, and are also available electronically at

www.sedarplus.ca.

SHORT FORM BASE SHELF PROSPECTUS

| New Issue and/or Secondary

Offering |

May

8, 2024 |

QUIPT HOME MEDICAL CORP.

$300,000,000

Common Shares

Preferred Shares

Debt Securities

Warrants

Subscription Receipts

Units

This

short form base shelf prospectus (the “Prospectus”) relates to the offering for sale by Quipt Home Medical Corp. (the

“Company” or “Quipt”) from time to time, during the 25-month period that this Prospectus, including

any amendments thereto, remains effective, of up to $300,000,000 (or the equivalent in other currencies based on the applicable

exchange rate at the time of the offering) in the aggregate of: (i) common shares (“Common Shares”); (ii) preferred

shares (“Preferred Shares”); (iii) debt securities (“Debt Securities”); (iv) warrants

(“Warrants”) to acquire any of the securities that are described in this Prospectus; (v) subscription receipts

(“Subscription Receipts”); and (vi) units (“Units”) comprised of one or more of any of the

other securities that are described in this Prospectus, or any combination of such securities (all of the foregoing collectively, the

“Securities” and individually, a “Security”). One or more securityholders of the Company may also

offer and sell Securities under this Prospectus. See “The Selling Securityholders”. The Securities may be offered

in amounts, at prices and on terms to be determined based on market conditions at the time of sale and set forth in an accompanying prospectus

supplement (each, a “Prospectus Supplement”).

In

addition, the Securities may be offered and issued in consideration for the acquisition of other businesses, assets or securities by

the Company or any of its direct or indirect subsidiaries (each, a “Subsidiary” and collectively the “Subsidiaries”).

The consideration for any such acquisition may consist of the Securities separately, a combination of Securities or any combination of,

among other things, Securities, cash and an assumption of liabilities.

Prospective investors should be aware that the

purchase of any Securities may have tax consequences that may not be fully described in this Prospectus or in any Prospectus Supplement,

and should carefully review the tax discussion, if any, in the applicable Prospectus Supplement and in any event consult with a tax adviser.

All shelf information permitted under applicable

laws to be omitted from this Prospectus will be contained in one or more Prospectus Supplements that will be delivered to purchasers

together with this Prospectus, except in cases where an exemption from such delivery has been obtained. Each Prospectus Supplement will

be incorporated by reference into this Prospectus for the purposes of securities legislation as of the date of the Prospectus Supplement

and only for the purposes of the distribution of the Securities to which the Prospectus Supplement pertains.

The

specific terms of any Securities offered will be described in the applicable Prospectus Supplement including, where applicable: (i) in

the case of Common Shares, the number of Common Shares offered, the offering price, whether the Common Shares are being offered for cash,

and any other terms specific to the Common Shares offered; (ii) in the case of Preferred Shares, the class and number of Preferred

Shares offered, the offering price, whether the Preferred Shares are being offered for cash, and any other terms specific to the Preferred

Shares offered; (iii) in the case of Debt Securities, the specific designation of the Debt Securities, the price at which

the Debt Securities will be offered, the maturity date of the Debt Securities, the rate at which such Debt Securities will bear interest,

the terms and conditions upon which the Debt Securities may be redeemed, repaid or purchased and the terms and conditions for any conversion

or exchange of the Debt Securities for any other securities; (iv) in the case of Warrants, the number of Warrants being offered,

the offering price, the designation, number and terms of the other Securities purchasable upon exercise of the Warrants, and any procedures

that will result in the adjustment of those numbers, the exercise price, the dates and periods of exercise, whether the Warrants are

being offered for cash, and any other terms specific to the Warrants offered; (v) in the case of Subscription Receipts, the number

of Subscription Receipts being offered, the offering price, the terms, conditions and procedures for the conversion of the Subscription

Receipts into other Securities, the designation, number and terms of such other Securities, whether the Subscription Receipts are being

offered for cash, and any other terms specific to the Subscription Receipts offered; and (vi) in the case of Units, the number of

Units being offered, the offering price, the number and terms of the Securities comprising the Units, whether the Units are being offered

for cash, and any other terms specific to the Units offered. Where required by statute, regulation or policy, and where the Securities

are offered in currencies other than Canadian dollars, appropriate disclosure of foreign exchange rates applicable to the Securities

will be included in the Prospectus Supplement describing the Securities.

No underwriter or agent has been involved

in the preparation of this Prospectus or performed any review of the contents of this Prospectus.

The Company or any selling securityholder may

offer and sell the Securities to or through underwriters or dealers purchasing as principals, and may also sell directly to one or more

purchasers or through agents. See “Plan of Distribution”. The Prospectus Supplement relating to a particular offering

of Securities will identify each underwriter, dealer or agent, as the case may be, engaged by the Company or any selling securityholder

in connection with the offering and sale of the Securities and the identity of any selling securityholder, and will set forth the terms

of the offering of such Securities, including, to the extent applicable, any fees, discounts or any other compensation payable to underwriters,

dealers or agents in connection with the offering, the method of distribution of the Securities, the initial issue price (in the event

that the offering is a fixed price distribution), the proceeds that the Company or any selling securityholder will, or expects to receive

and any other material terms of the plan of distribution. This Prospectus may qualify an “at-the-market distribution” (as

such term is defined in National Instrument 44-102 – Shelf Distributions (“NI 44-102”)).

The Securities may be sold from time to time

in one or more transactions at a fixed price or prices or at non-fixed prices. If offered on a non-fixed price basis, the Securities

may be offered at market prices prevailing at the time of sale, at prices determined by reference to the prevailing price of a specified

security in a specified market or at prices to be negotiated with purchasers, in which case the compensation payable to an underwriter,

dealer or agent in connection with any such sale will be decreased by the amount, if any, by which the aggregate price paid for Securities

by the purchasers is less than the gross proceeds paid by the underwriter, dealer or agent to the Company or any selling securityholder.

The price at which the Securities will be offered and sold may vary from purchaser to purchaser and during the period of distribution.

In connection with any offering of Securities,

other than an “at-the-market distribution”, unless otherwise specified in a Prospectus Supplement, the underwriters, dealers

or agents, as the case may be, may over-allot or effect transactions which stabilize, maintain or otherwise affect the market price of

the Securities at a level other than those which otherwise might prevail on the open market. Such transactions may be commenced, interrupted

or discontinued at any time. A purchaser who acquires Securities forming part of the underwriters’, dealers’ or agents’

over-allocation position acquires those securities under this Prospectus and the Prospectus Supplement relating to the particular offering

of Securities, regardless of whether the over-allocation position is ultimately filled through the exercise of the over-allotment option

or secondary market purchases. See “Plan of Distribution”. No underwriter or dealer involved in an “at-the-market

distribution” under this Prospectus, no affiliate of such an underwriter or dealer and no person or company acting jointly or in

concert with such underwriter or dealer will over-allot Securities in connection with such distribution or effect any other transactions

that are intended to stabilize or maintain the market price of the Securities.

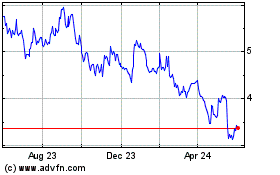

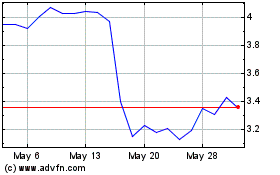

The

issued and outstanding Common Shares are listed on the Toronto Stock Exchange (the “TSX”) under the symbol “QIPT”

and on The Nasdaq Capital Market (“Nasdaq”), under the trading ticker symbol “QIPT”. On May 7, 2024, the

last trading day prior to the date of this Prospectus, the closing price of the Common Shares on the TSX was $5.48, and on Nasdaq was

US$4.01. Unless otherwise specified in the applicable Prospectus Supplement, each series or issue of Securities (other than Common Shares)

will not be listed on any securities exchange. Accordingly, there is currently no market through which the Securities (other than Common

Shares) may be sold and purchasers may not be able to resell such Securities purchased under this Prospectus. This may affect the pricing

of such Securities in the secondary market, the transparency and availability of trading prices, the liquidity of such Securities and

the extent of issuer regulation. See “Risk Factors”.

The

Company has three classes of issued and outstanding shares: the Common Shares, first preferred shares (each, a “First

Preferred Share”) without par value, and second preferred shares (each, a “Second Preferred Share”) without

par value (together with the First Preferred Shares, constitute the “Preferred Shares”, and collectively with the

Common Shares, the “Company Shares”). See “Description of the Share Capital of the Company”.

Note to U.S. Holders

Prospective investors should be aware that the

acquisition of the securities described herein may have tax consequences both in the United States and in Canada. Such consequences for

investors who are resident in, or citizens of, the United States may not be described fully herein. The enforcement by investors of civil

liabilities under U.S. federal securities laws may be affected adversely by the fact that the Company is incorporated or organized under

the laws of a foreign country, that some of its officers and directors may be residents of a foreign country and that some or all of

the underwriters or experts named in the registration statement may be residents of a foreign country. These securities have not been

approved or disapproved by the Securities and Exchange Commission nor has the commission passed upon the accuracy or adequacy of this

prospectus. Any representation to the contrary is a criminal offense.

Quipt has prepared its financial statements,

incorporated herein by reference, in accordance with International Financial Reporting Standards as issued by the International Accounting

Standards Board which is incorporated within Part 1 of the CPA Canada Handbook – Accounting, and its consolidated financial

statements are subject to Canadian generally accepted auditing standards and auditor independence standards.

Certain

of the Company’s directors and officers reside outside of Canada. Each of the following persons has appointed DLA Piper (Canada)

LLP, Suite 2700, 1133 Melville Street, Vancouver, British Columbia V6E 4E5 as agent for service of process:

| Directors

and Officers |

Gregory Crawford, Chief Executive Officer and Director

Mark Greenberg, Director

Brian Wessel, Director

Dr. Kevin A. Carter, Director

Hardik Mehta, Chief Financial Officer |

Purchasers are advised that it may not be possible

for investors to enforce judgments obtained in Canada against any person that resides outside of Canada, even if the party has appointed

an agent for service of process. See “Agent for Service of Process”.

Unless otherwise indicated, all references to

“$”, “C$” or “dollars” in this Prospectus refer to Canadian dollars and all references to “US$”

in this Prospectus refer to United States dollars. See “Currency and Exchange Rate Information”.

Investing in the Securities is speculative

and involves significant risks. Readers should carefully review and evaluate the risk factors contained in this Prospectus, the applicable

Prospectus Supplement and in the documents incorporated by reference herein before purchasing any Securities. See “Cautionary

Note Regarding Forward-Looking Statements” and “Risk Factors”.

The Company is not making an offer of the

Securities in any jurisdiction where such offer is not permitted.

Unless otherwise specified in a Prospectus Supplement

relating to any Securities offered, certain legal matters in connection with the offering of Securities will be passed upon on behalf

of the Company by DLA Piper (Canada) LLP.

The

Company’s head office is located at 1019 Town Drive Wilder, Kentucky 41076, telephone (859) 878-2220, and its registered

office is located at Suite 2700, 1133 Melville Street, Vancouver, British Columbia V6E 4E5.

TABLE OF CONTENTS

GENERAL

MATTERS

No

person is authorized by the Company to provide any information or to make any representation other than as contained in this Prospectus

or any Prospectus Supplement in connection with the issue and sale of the Securities offered hereunder. Prospective investors

should rely only on the information contained or incorporated by reference in this Prospectus and any applicable Prospectus Supplement

in connection with an investment in the Securities. Prospective investors should assume that the information appearing in this Prospectus

or any Prospectus Supplement is accurate only as of the date on the front of such documents and that information contained in any document

incorporated by reference is accurate only as of the date of that document unless specified otherwise. The Company’s business,

financial condition, financial performance and prospects may have changed since those dates.

This

Prospectus is part of a “shelf” registration statement on Form F-10 that the Company has filed with the United

States Securities and Exchange Commission (the “SEC”).

Information contained on the Company’s

website does not form part of this Prospectus nor is it incorporated by reference herein. Investors should rely only on information contained

or incorporated by reference in this Prospectus.

Unless otherwise noted or the context indicates

otherwise, the “Company”, “Quipt”, “we”, “us” and “our”

refer to Quipt Home Medical Corp., and its direct and indirect Subsidiaries.

Unless otherwise indicated, information contained

or incorporated by reference in this Prospectus or any Prospectus Supplement concerning the Company’s industry and the markets

in which it operates or seeks to operate is based on information from third party sources, industry reports and publications, websites

and other publicly available information, and management studies and estimates. Unless otherwise indicated, the Company’s estimates

are derived from publicly available information released by third party sources as well as data from the Company’s own internal

research, and include assumptions which the Company believes to be reasonable based on management’s knowledge of the Company’s

industry and markets. The Company’s internal research and assumptions have not been verified by any independent source, and the

Company has not independently verified any third-party information. While the Company believes that such third-party information to be

generally reliable, such information and estimates are inherently imprecise. In addition, projections, assumptions and estimates of the

Company’s future performance or the future performance of the industry and markets in which the Company operates are necessarily

subject to a high degree of uncertainty and risk due to a variety of factors, including those described in this Prospectus or any Prospectus

Supplement, as applicable, and the documents incorporated by reference herein or therein.

This Prospectus, any applicable Prospectus Supplement

and the documents incorporated herein by reference include references to the Company’s trademarks, including, without limitation,

the “Quipt” trademark on the face page of this Prospectus, which are protected under applicable intellectual property

laws and are the Company’s property. The Company’s trademarks and trade names referred to in this Prospectus, any applicable

Prospectus Supplement and the documents incorporated herein by reference may appear without the ® or ™ symbol, but

references to the Company’s trademarks and trade names in the absence of such symbols are not intended to indicate, in any way,

that the Company will not assert, to the fullest extent under applicable law, its rights to these trademarks and trade names. All other

trademarks and trade names used in this Prospectus, any applicable Prospectus Supplement or in documents incorporated herein by reference

are the property of their respective owners.

The financial statements of the Company incorporated

by reference in this Prospectus and any applicable Prospectus Supplement, as applicable, are reported in United States dollars and have

been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board.

Certain calculations included in tables and other figures in this Prospectus, any Prospectus Supplement and the documents incorporated

by reference therein may have been rounded for clarity of presentation.

FINANCIAL

AND EXCHANGE RATE INFORMATION

Unless otherwise indicated, all references to

“$”, “C$” or “dollars” mean references to the lawful money of Canada. All references to “US$”

refer to United States dollars.

The following table sets forth (a) the average

and ending rate of exchange for the Canadian dollar, expressed in U.S. dollars, in effect for the periods indicated; and (b) the

high and low exchange rates for the Canadian dollar, expressed in U.S. dollars, during the periods indicated, each based on the indicative

rate of exchange as reported by the Bank of Canada for conversion of Canadian dollars into U.S. dollars.

Year Ended

September 30

C$ to US$ | |

Three Months

Ended

C$ to US$ | |

| | |

2023 | | |

2022 | | |

2021 | | |

March

31, 2024 | |

| High | |

| 0.7617 | | |

| 0.8111 | | |

| 0.8306 | | |

| 0.7510 | |

| Low | |

| 0.7217 | | |

| 0.7285 | | |

| 0.7491 | | |

| 0.7357 | |

| Average | |

| 0.7416 | | |

| 0.7832 | | |

| 0.7915 | | |

| 0.7414 | |

| Closing | |

| 0.7396 | | |

| 0.7296 | | |

| 0.7849 | | |

| 0.7380 | |

On

May 7, 2024, the daily exchange rate for the Canadian dollar in terms of United States dollars, as quoted by the Bank of Canada, was

$1.00 = US$0.7297.

NON-IFRS

MEASURES

The annual consolidated financial statements

of the Company are prepared in accordance with International Financial Reporting Standards (“IFRS”). Additionally,

the Company utilizes certain non-IFRS measures which are believed to be meaningful in the assessment of the Company’s performance.

These metrics are non-standard measures under IFRS and may not be identical to similar measures reported by other companies. The Company

believes that these measures, together with measures determined in accordance with IFRS, provide investors with an improved ability to

evaluate the underlying performance of the Company. Non-IFRS measures do not have any standardized meaning prescribed under IFRS, and

therefore they may not be comparable to similar measures employed by other companies. The data is intended to provide additional information

and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Prospectus and the documents incorporated

by reference herein contain certain “forward-looking information” within the meaning of Canadian securities legislation and

“forward-looking statements” within the meaning of applicable securities legislation, including the United States Private

Securities Litigation Reform Act of 1995 (collectively, “forward-looking statements”). Forward-looking statements

are neither historical facts nor assurances of future performance. Instead, they are based upon the Company’s current beliefs,

expectations, and assumptions regarding the future of its business, future plans and strategies, and other future conditions. Forward-looking

statements can be identified by the words such as “expect”, “likely”, “may”, “will”,

“would”, “could”, “should”, “continue”, “contemplate”, “intend”,

or “anticipate”, “believe”, “envision”, “estimate”, “expect”, “plan”,

“predict”, “project”, “target”, “potential”, “proposed”, “estimate”

and other similar words, including negative and grammatical variations thereof, or statements that certain events or conditions “may”

or “will” happen, or by discussions of strategy. Forward-looking statements include estimates, plans, expectations, opinions,

forecasts, projections, targets, guidance, or other statements that are not statements of fact. Such forward-looking statements are made

as of the date of this Prospectus, or in the case of documents incorporated by reference herein, as of the date of each such document.

Forward-looking

statements in this Prospectus, any Prospectus Supplement or the documents incorporated by reference herein and therein include,

but are not limited to, statements with respect to:

| · | financial

condition and resources; |

| · | anticipated

needs for working capital; |

| · | information

with respect to future growth and growth strategies; |

| · | anticipated

trends in the industry in which the Company operates; |

| · | the

Company’s future financing plans; |

| · | commercial

disputes or claims; |

| · | limitations

on insurance coverage; |

| · | availability

and expectations regarding of cash flow to fund capital requirements; |

| · | the

product offerings of the Company; |

| · | the

competitive conditions of the industry; |

| · | the

competitive and business strategies of the Company; |

| · | applicable

laws, regulations and any amendments thereof; |

| · | on-going

implications of the novel coronavirus (“COVID-19”); |

| · | statements

relating to the business and future activities of, and developments related to, the Company,

including such things as future business strategy, competitive strengths, goals, expansion

and growth of the Company’s business, operations and plans; |

| · | the

anticipated use of proceeds of any offering of securities; and |

| · | other

events or conditions that may occur in the future. |

Forward-looking

statements are based on the reasonable assumptions, estimates, analysis and opinions of the Company’s management made in light

of its experience and its perception of trends, current conditions and expected developments, as well as other factors that management

believes to be relevant and reasonable in the circumstances at the date that such statements are made, but which may prove to be incorrect.

The Company believes that the assumptions and expectations reflected in such forward-looking statements are reasonable. The material

factors and assumptions used to develop the forward-looking statements contained in this Prospectus or any documents that are

incorporated by reference into this Prospectus and any Prospectus Supplement include, without limitation:

| · | the

Company’s ability to successfully execute its growth strategies and business plan; |

| · | the

ability to successfully identify strategic acquisitions; |

| · | the

Company’s ability to realize anticipated benefits, synergies or generate revenue, profits

or value from its recent acquisitions into existing operations; |

| · | management’s

perceptions of historical trends, current conditions and expected future developments; |

| · | the

ability of the Company to take market share from competitors; |

| · | the

Company’s ability to attract and retain skilled staff; |

| · | market

conditions and competition; |

| · | the

products, services and technology offered by the Company’s competitors; |

| · | the

Company’s ability to generate cash flow from operations |

| · | the

Company’s ability to keep pace with changing regulatory requirements; |

| · | the

ongoing ability to conduct business in the regulatory environments in which the Company operates

and may operate in the future; |

| · | that

the Company’s ability to maintain strong business relationships with its suppliers,

service provides and other third parties will be maintained; |

| · | COVID-19

and recall related supply chain issues will be resolved within the near future; |

| · | the

Company’s ability to fulfill prescriptions for services and products; |

| · | the

anticipated growth of the niche market of home equipment and monitoring; |

| · | the

anticipated increase in demand for various medical products and equipment; |

| · | demand

and interest in the Company’s products and services; |

| · | the

ability to deploy up front capital to purchase monitoring and treatment equipment; |

| · | anticipated

and unanticipated costs; |

| · | the

timely receipt of any required regulatory authorizations, approvals, consents, permits and/or

licenses; |

| · | the

general economic, financial market, regulatory and political conditions in which the Company

operates and the absence of material adverse changes in the Company’s industry, regulatory

environmental or the global economy; and |

| · | other

considerations that management believes to be appropriate in the circumstances. |

Forward-looking

statements speak only as at the date they are made and are based on information currently available and on the then current expectations.

A number of factors could cause actual events, performance or results to differ materially from what is projected in the forward-looking

statements. Potential purchasers of the Securities are cautioned that forward-looking statements are not based on historical facts but

instead are based on reasonable assumptions and estimates of management of the Company at the time they were provided or made and involve

known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company,

as applicable, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking

statements, including, but not limited to, known and unknown risks, uncertainties, assumptions and other factors, including those listed

under “Risk Factors” in this Prospectus, any Prospectus Supplement and the AIF (as defined herein), which include: credit

risks, market risks (including those related to equity, commodity, foreign exchange and interest rate markets), liquidity risks, operational

risks (including those related to technology and infrastructure), and risks relating to reputation, insurance, strategy, regulatory matters,

legal matters, environmental matters and capital adequacy. Examples of such risk factors include: the Company may be subject to significant

capital requirements and operating risks; changes in law, the ability to implement business strategies, growth strategies and pursue

business opportunities; state of the capital markets; the availability of funds and resources to pursue operations; decline of reimbursement

rates; dependence on few payors; possible new drug discoveries; a novel business model; dependence on key suppliers; granting of permits

and licenses in a highly regulated business; competition; difficulty integrating newly acquired businesses; low profit market segments;

disruptions in or attacks (including cyber-attacks) on information technology, internet, network access or other voice or data communications

systems or services; the evolution of various types of fraud or other criminal behaviour; the failure of third parties to comply with

their obligations; the impact of new and changes to, or application of, current laws and regulations; risk of litigation and governmental

proceedings; the overall litigation environment, including in the United States; risks related to infectious diseases, including the

impacts of COVID-19; increased competition; changes in foreign currency rates; the potential loss of foreign private issuer status; risks

relating to the deterioration of global economic conditions; increased funding costs and market volatility due to market illiquidity

and competition for funding; critical accounting estimates and changes to accounting standards, policies, and methods; and the occurrence

of natural and unnatural catastrophic events and claims resulting from such events, as well as other general economic, market and business

conditions, amongst others, as well as those risk factors described under the heading “Risk Factors” and elsewhere

in this Prospectus, any Prospectus Supplement and the documents incorporated by reference herein and therein and as described from time

to time in documents filed by the Company with Canadian securities regulatory authorities. Although the Company has attempted

to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking

statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. The Company

provides no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially

from those anticipated in such statements.

Readers are cautioned that the cautionary statements

and list of risk factors set out in this Prospectus, any Prospectus Supplement and the AIF are not exhaustive. A number of factors could

cause actual events, performance or results to differ materially from what is projected in forward-looking statements. The purpose of

forward-looking statements is to provide the reader with a description of management’s expectations, and such forward-looking statements

may not be appropriate for any other purpose. You should not place undue reliance on forward-looking statements contained in this Prospectus,

any Prospectus Supplement or in any document incorporated by reference herein or therein. Although the Company believes that the expectations

reflected in such forward-looking statements are reasonable, it can give no assurance that such expectations will prove to have been

correct. Forward-looking statements are provided and made as of the date of this Prospectus, any Prospectus Supplement or the applicable

documents incorporated herein and therein by reference, as applicable, and the Company does not undertake any obligation to revise or

update any forward-looking statements or information, other than as expressly required by applicable law. The forward-looking statements

contained in this Prospectus, any Prospectus Supplement and the documents incorporated by reference herein and therein are expressly

qualified in their entirety by this cautionary statement. Potential purchasers of the Securities should read this entire Prospectus,

each applicable Prospectus Supplement and the documents incorporated by reference herein and therein, and consult their own professional

advisors to ascertain and assess the income tax and legal risks and other aspects associated with holding Securities.

FINANCIAL

INFORMATION

The Company’s financial statements that

are incorporated by reference into this Prospectus have been prepared in accordance with International Financial Reporting Standards,

as issued by the International Accounting Standards Board, and are presented in United States dollars. As a result, certain financial

information included in or incorporated by reference in this Prospectus may not be comparable to financial information prepared by companies

in the United States reporting under U.S. generally accepted accounting principles.

DOCUMENTS

INCORPORATED BY REFERENCE

Information

has been incorporated by reference in this Prospectus from documents filed with the securities commissions or similar regulatory authorities

in Canada. As of the date of this Prospectus, the following documents, each of which has been filed with the securities regulatory

authorities in each province and territory of Canada, as applicable, are specifically incorporated by reference and form an integral

part of this Prospectus:

Any documents of the type required to be incorporated

by reference herein pursuant to National Instrument 44-101 – Short Form Prospectus Distributions, including any annual

information forms, all material change reports (excluding confidential reports, if any), all annual and interim financial statements

and management’s discussion and analysis relating thereto, or information circular or amendments thereto that the Company files

with any securities commission or similar regulatory authority in Canada after the date of this Prospectus and prior to the expiry of

this Prospectus will be deemed to be incorporated by reference in this Prospectus. The documents incorporated or deemed to be incorporated

herein by reference contain meaningful and material information relating to the Company and readers should review all information contained

in this Prospectus, any Prospectus Supplement and the documents incorporated or deemed to be incorporated by reference herein or therein.

Upon a new annual information form and new annual

consolidated financial statements being filed by the Company with the applicable Canadian securities commissions or similar regulatory

authorities in Canada during the period that this Prospectus is effective, the previous annual information form, the previous annual

consolidated financial statements and all interim consolidated financial statements and in each case the accompanying management’s

discussion and analysis and material change reports, filed prior to the commencement of the financial year of the Company in which the

new annual information form is filed shall be deemed to no longer be incorporated into this Prospectus for purpose of future offers and

sales of Securities under this Prospectus. Upon interim consolidated financial statements and the accompanying management’s discussion

and analysis being filed by the Company with the applicable Canadian securities commissions or similar regulatory authorities during

the period that this Prospectus is effective, all interim consolidated financial statements and the accompanying management’s discussion

and analysis filed prior to such new interim consolidated financial statements and management’s discussion and analysis shall be

deemed to no longer be incorporated into this Prospectus for purposes of future offers and sales of Securities under this Prospectus.

In addition, upon a new management information circular for an annual general meeting of shareholders being filed by the Company with

the applicable Canadian securities commissions or similar regulatory authorities during the period that this Prospectus is effective,

the previous management information circular filed in respect of the prior annual general meeting of shareholders shall no longer be

deemed to be incorporated into this Prospectus for purposes of future offers and sales of Securities under this Prospectus.

References to the Company’s website in

this Prospectus, any Prospectus Supplement or any documents that are incorporated by reference into this Prospectus and any Prospectus

Supplement do not incorporate by reference the information on such website into this Prospectus or any Prospectus Supplement, and the

Company disclaims any such incorporation by reference.

A Prospectus Supplement containing the specific

terms of any offering of the Securities will be delivered to purchasers of the Securities together with this Prospectus and will be deemed

to be incorporated by reference in this Prospectus as of the date of the Prospectus Supplement and only for the purposes of the offering

of the Securities to which that Prospectus Supplement pertains.

In addition, certain marketing materials (as

that term is defined in applicable Canadian securities legislation) may be used in connection with a distribution of Securities under

this Prospectus and the applicable Prospectus Supplement(s). Any “template version” of “marketing materials”

(as those terms are defined in applicable Canadian securities legislation) pertaining to a distribution of Securities, and filed by the

Company after the date of the Prospectus Supplement for the distribution and before termination of the distribution of such Securities,

will be deemed to be incorporated by reference in that Prospectus Supplement for the purposes of the distribution of Securities to which

the Prospectus Supplement pertains.

Copies

of the documents incorporated herein by reference may be obtained on request without charge from Quipt Home Medical Corp. at 1019 Town

Drive Wilder, Kentucky, USA 41076, telephone: (859) 878-2220, and are also available electronically through SEDAR+ on the Company’s

profile at www.sedarplus.ca.

Any statement contained in this Prospectus

or in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes

of this Prospectus to the extent that a statement contained herein, in any Prospectus Supplement or in any other subsequently filed document

which also is, or is deemed to be, incorporated by reference herein, modifies or supersedes that statement. Any statement so modified

or superseded shall not constitute a part of this Prospectus, except as so modified or superseded. The modifying or superseding statement

need not state that it has modified or superseded a prior statement or include any other information set forth in the document or statement

that it modifies or supersedes. The making of a modifying or superseding statement shall not be deemed an admission for any purposes

that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission

to state a material fact that is required to be stated or that is necessary to prevent a statement that is made from being false or misleading

in the circumstances in which it was made. Any statement so modified or superseded shall not be deemed, except as so modified or superseded,

to constitute part of this Prospectus.

The Company has not provided or otherwise authorized

any other person to provide investors with information other than as contained or incorporated by reference in this Prospectus or any

Prospectus Supplement. If an investor is provided with different or inconsistent information, such investor should not rely on it.

DESCRIPTION

OF THE BUSINESS

The following description of the Company does

not contain all of the information about the Company and its assets and business that you should consider before investing in any Securities.

You should carefully read the entire Prospectus and the applicable Prospectus Supplement, including the sections titled “Risk Factors”

herein and therein, and the AIF, as well as the documents incorporated by reference herein and therein before making an investment decision.

Corporate Structure

The Company was incorporated under the Business

Corporations Act (Alberta) on March 5, 1997. Pursuant to a reverse take-over transaction completed on June 1, 2010 by way

of a three cornered amalgamation, the Company acquired all of the issued and outstanding shares in the capital of PHM DME Healthcare

Inc. and changed its name to “Patient Home Monitoring Corp.” On December 30, 2013, pursuant to a Certificate of Continuance,

the Company changed its jurisdiction of governance by continuing from Alberta into British Columbia.

On

December 21, 2017, pursuant to an arrangement under the provisions of Division 5 of Part 9 of the Business Corporations

Act (British Columbia) (the “BCBCA”) involving the Company, Viemed Healthcare, Inc. and the securityholders

of the Company, the Company completed a spin-out of Viemed Healthcare, Inc. and its operating businesses. In addition, on December 21,

2017, the Company completed an amalgamation, by way of vertical short-form amalgamation under the BCBCA, with its wholly owned subsidiary

and the amalgamating company continuing as “Patient Home Monitoring Corp.” On May 4, 2018, the Company changed its name

to “Protech Home Medical Corp”, and on December 31, 2018, the Company effected a consolidation of its Common

Shares on the basis of one (1) post-consolidation Common Share for every five (5) pre-consolidation Common Shares.

On May 13, 2021, the Company changed its

name from “Protech Home Medical Corp.” to “Quipt Home Medical Corp.” and effected a consolidation (the “Consolidation”)

of its Common Shares on the basis of one (1) post-Consolidation Common Share for every four (4) pre-Consolidation Common Shares.

The

Company’s head office is located at 1019 Town Drive, Wilder, Kentucky 41076, and its registered office is located at Suite 2700,

1133 Melville Street, Vancouver, British Columbia V6E 4E5.

The Company’s Common Shares are listed

for trading on the TSX under the symbol “QIPT”, and on Nasdaq under the symbol “QIPT”.

Business of the Company

The Company is a U.S. based home medical equipment

provider, focused on end-to-end respiratory care. The Company, through its subsidiaries, is a provider of DME/home medical equipment

(“HME”). The Company seeks to continue to expand its offerings to include the management of several chronic disease

states focusing on patients with heart or pulmonary disease, sleep apnea, reduced mobility and other chronic health conditions requiring

home-based services in the United States. The primary business objective of the Company is to create shareholder value by focusing on

organic growth of its core business and strategically expanding its geographical footprint by acquiring other DME/HME providers. The

Company’s growth strategy is to aggregate patients in existing or complimentary markets, through both acquisitions and organically

by taking market share directly from competitors. The Company leverages technology to increase patient compliance by making ongoing training

and patient follow up easier on the patient and improving the speed and ease of equipment and device delivery and set-up.

The Company’s main revenue sources are

providing in-home medical equipment and supplies and providing respiratory and DME to patients in the United States.

The Company is an acquisitive company that follows

a disciplined and accretive capital allocation strategy. The Company’s mergers and acquisitions (“M&A”)

strategy is based on acquiring additional DME/HME providers that are accretive and synergistic to the Company. The Company generally

seeks to acquire cash generating companies which lead to increased cash flows that are then re-invested to make additional new cash generating

acquisitions. The Company generally operates under a shared services model which results in obtaining cost efficiencies, technology improvements

and synergies across the acquisitions and the various business units where possible. The Company is focused on the implementation of

digital technology solutions for the acquired subsidiaries.

The Company’s revenue lines are based on

fulfilling prescriptions for services and products for patients that suffer from chronic illness. The growing niche market of home equipment

and monitoring provides significant opportunity to garner market share and may require the ongoing deployment of up-front capital to

purchase monitoring and treatment equipment. The Company believes that it is well positioned to acquire the equipment necessary to grow

its annuity stream businesses.

Among

other things, the Company, through its subsidiaries, offers an array of durable medical equipment focused on pulmonary disease

services, home-based sleep apnea and chronic obstructive pulmonary disease treatments, the treatment of chronic power mobility conditions

and mobility solutions, as well as home-based healthcare logistics and services, including: traditional and non-traditional durable medical

respiratory equipment and services, bariatric equipment, bathroom safety products, Bi-level PAP (bilevel positive airway pressure) equipment,

non-invasive ventilation equipment, supplies and services, including continuous positive airway pressure (CPAP) and bilevel positive

airway pressure (BiPAP) units, canes/crutches, masks, sleep apnea equipment and accessories, hospital beds, humidifiers, nebulizer and

compressors, oxygen concentrator, mobility equipment and power mobility services, patient lifts, walkers, wheelchairs, products for wound

care, nebulizers, oxygen concentrators and other related equipment and medical supplies, as well as sleep testing. The demand for these

items is expected to grow as the United States population continues to age and chronic diseases among those aged 65 and over continue

to increase.

Recent Developments

From time to time, the Company is involved in

various legal proceedings arising from the ordinary course of business, including governmental investigations or other actions or lawsuits

alleging potential failures to comply with laws or regulations. As disclosed in the Company’s news release dated February 14,

2024, it received a civil investigative demand from the Department of Justice (“DOJ”) through the U.S. Attorney’s

Office for the Northern District of Georgia pursuant to the False Claims Act regarding an investigation concerning whether the Company

may have caused the submission of false claims to government healthcare programs for CPAP equipment. The Company is cooperating with

the investigation. The DOJ has not indicated to the Company whether it believes the Company engaged in any wrongdoing. In April 2024,

the Company received a subpoena from the U.S. Securities and Exchange Commission (the “SEC”) to provide certain documents

related to the Company and the DOJ investigation, CID and financial reporting and disclosure matters (“SEC Subpoena”).

According to the SEC, the investigation pursuant to which the SEC Subpoena was issued does not mean that the SEC has concluded that anyone

has violated the law, nor does the investigation mean that the SEC has a negative opinion of any person, entity or security. The Company,

through its external legal counsel, has been in contact with the SEC and is cooperating with the SEC as it relates to the SEC Subpoena.

Additional governmental agencies could conduct independent investigations relating to this investigation or separate unrelated matters. No assurance can be given as to the timing or outcome of the DOJ’s

or SEC’s investigations. See “Risk Factors”.

For

certain other details about the Company’s business, please refer to the AIF and other documents incorporated by reference in this

Prospectus and any Prospectus Supplement, which are available on SEDAR+ at www.sedarplus.ca.

THE

SELLING SECURITYHOLDERS

Securities may be sold under this Prospectus

by way of secondary offering by or for the account of certain of the Company’s securityholders. The Prospectus Supplement that

will be filed in connection with any offering of Securities by any selling securityholder will include the following information:

| · | the

name of each selling securityholder; |

| · | if

the selling securityholder is incorporated, continued or otherwise organized under the laws

of a foreign jurisdiction or resides outside Canada, the name and address of the person or

company the selling securityholder has appointed as agent for service of process; |

| · | the

number or amount of Securities owned, controlled or directed of the class being distributed

by each selling securityholder; |

| · | the

number or amount of Securities of the class being distributed for the account of each selling

securityholder; |

| · | the

number or amount of Securities of any class to be owned, controlled or directed by the selling

securityholders after the distribution and the percentage that number or amount represents

of the total number of the Company’s outstanding Securities; |

| · | whether

the Securities are owned by the selling securityholders both of record and beneficially,

of record only, or beneficially only; |

| · | if

a selling securityholder is not an individual, disclosure regarding the principal securityholders

thereof, as applicable; and |

| · | all

other information that is required to be included in the applicable Prospectus Supplement. |

USE

OF PROCEEDS

The net proceeds to the Company from any offering

of Securities and the proposed use of those proceeds will be set forth in the applicable Prospectus Supplement relating to that offering

of Securities. Among other potential uses, the Company may use the net proceeds from the sale of Securities for general corporate purposes,

including funding ongoing operations and/or working capital requirements, to repay indebtedness outstanding from time to time, and to

fund capital projects and potential future acquisitions and mergers. The Company will not receive any proceeds from any sale of any Securities

by any selling securityholder(s).

As at the date of this Prospectus, the Company

anticipates using the net proceeds to the Company from any offering of Securities primarily to fund general corporate purposes, including

funding ongoing operations and/or working capital requirements, to repay indebtedness outstanding from time to time, and to fund capital

projects and potential future acquisitions and mergers. The Company’s acquisition approach generally targets companies that are

either: (i) heavily respiratory weighted companies with gross revenue in the range of US$5 to $80 million, and consistent annual

EBITDA (earnings before interest, taxes, depreciation, and amortization) margins between 10% and 20% or more; (ii) sub US$5 million

revenue targets with the strategic goal of expanding the Company’s payer mix and expanding our geographical footprint across new

states to be become a national DME provider; or (iii) targeting substantially larger opportunities that would be more meaningful

in terms of revenue, EBITDA, active patient base and geographical operating footprint. The Company believes that the maximum size that

the Company can raise under this Prospectus of $300,000,000 (or the equivalent in other currencies based on the applicable exchange rate

at the time of the offering) will provide sufficient room to draw upon in order to complete strategic acquisitions in the future if,

as and when any such opportunities arise, and is expected to position the Company to aggressively pursue its corporate strategy to grow

the business. The Company has spent the last several years building and solidifying its platform and within the last year has pivoted

into a strategy more focused on growth, both internal and by acquisition and other strategic transactions. For any specific acquisition

for which the Company raises funds for under the Prospectus, the Company intends to include details of the acquisition in any Prospectus

Supplement and any other additional disclosure as required by applicable securities laws.

Notwithstanding

the foregoing, management of the Company will retain broad discretion in allocating the net proceeds of any offering of Securities by

the Company under this Prospectus and the Company’s actual use of the net proceeds will vary depending on the availability and

suitability of investment opportunities and its operating and capital needs from time to time. All expenses relating to an offering of

Securities and any compensation paid to underwriting dealers or agents as the case may be, will be paid out of the proceeds from the

sale of Securities, unless otherwise stated in the applicable Prospectus Supplement. See

“Risk Factors - Discretion in the Use of Proceeds”.

The Company may, from time to time, issue securities

(including Securities) other than pursuant to this Prospectus.

DESCRIPTION OF SHARE CAPITAL

The

Company is authorized to issue an unlimited number of Common Shares, an unlimited number of First Preferred Shares, and an unlimited

number of Second Preferred Shares. As of May 7, 2024, there were 42,571,523 Common Shares issued and outstanding as fully

paid and non-assessable and no First Preferred Shares and no Second Preferred Shares (the “Preferred Shares”)

issued and outstanding.

The

following is a summary of the rights, privileges, restrictions and conditions attached to the Common Shares and the Preferred

Shares, but does not purport to be complete. Reference should be made to the Articles of the Company and the full text of their provisions

for a complete description thereof, which are available on the Company’s profile on SEDAR+ at www.sedarplus.ca.

Common Shares

All of the Common Shares are of the same class

and, once issued, rank equally as to dividends, voting powers and participation in assets and in all other respects, on liquidation,

dissolution or winding up of the Company, whether voluntary or involuntary, or any other distribution of the assets of the Company among

its shareholders for the purpose of winding up its affairs after the Company has paid out its liabilities. The issued Common Shares are

not subject to call or assessment by the Company nor are there any pre-emptive, conversion, exchange, redemption or retraction rights

attaching to the Common Shares.

All registered holders of Common Shares are entitled

to receive notice of any general or special meeting to be convened by the Company. At any general or special meeting, subject to the

restrictions on joint registered owners of Common Shares, each holder of Common Shares is entitled to one vote per share of which it

is the registered owner and may exercise such votes either in person or by proxy. Otherwise, on a show of hands every Shareholder who

is present in person and entitled to vote will have one vote, and on a poll every Shareholder has one vote for each Common Share of which

it is the registered owner. The Company’s articles provide that the rights and provisions attached to any class of shares, in which

shares are issued, may not be modified, amended or varied unless consented to by special resolution passed by a majority of not less

than two-thirds of the votes cast in person or by proxy by holders of shares of that class.

Preferred Shares

The First Preferred Shares of each series shall,

with respect to the payment of dividends and the distribution of assets in the event of the liquidation, dissolution or winding-up of

the Company or for the purpose of winding–up its affairs, rank on parity with the First Preferred Shares of every other series

and be entitled to preference over the Second Preferred Shares of every other series and the Common Shares of the Company. The Second

Preferred Shares of each series shall, with respect to the payment of dividends and the distribution of assets in the event of the liquidation,

dissolution or winding-up of the Company or for the purpose of winding–up its affairs, rank on parity with the Second Preferred

Shares of every other series and be entitled to preference over the Common Shares of the Company.

CONSOLIDATED

CAPITALIZATION

From

December 31, 2023, the date of the Company’s most recently filed condensed consolidated interim financial statements,

to the date of this Prospectus, there have been no material changes to the Company’s share capitalization on a consolidated basis.

The applicable Prospectus Supplement will describe

any material change, and the effect of such material change, on the share and loan capitalization of the Company that will result from

the issuance of Securities pursuant to such Prospectus Supplement.

DESCRIPTION

OF SECURITIES BEING DISTRIBUTED

The following is a brief summary of certain general

terms and provisions of the Securities as at the date of this Prospectus. The summary does not purport to be complete and is indicative

only. The specific terms of any Securities to be offered under this Prospectus, and the extent to which the general terms described in

this Prospectus apply to such Securities, will be set forth in the applicable Prospectus Supplement.

Common Shares

For

a brief summary of the material attributes of the Common Shares, see “Description of Share Capital - Common Shares”.

Common Shares may be sold separately or together with other Securities, as the case may be.

Preferred Shares

For

a brief summary of the material attributes of the Preferred Shares, see “Description of Share Capital - Preferred Shares”.

Preferred Shares may be sold separately or together with other Securities, as the case may be.

Debt Securities

The Company may issue Debt Securities, separately

or together, with Common Shares, Preferred Shares, Warrants, Subscription Receipts or Units or any combination thereof, as the case may

be. The Debt Securities will be issued in one or more series under an indenture (the “Indenture”) to be entered into

between the Company and one or more trustees (the “Trustee”) that will be named in a Prospectus Supplement for a series

of Debt Securities. A copy of the form of the Indenture to be entered into has been or will be filed with the securities commissions

or similar authorities in Canada when it is entered into. The description of certain provisions of the Indenture in this section do not

purport to be complete and are subject to, and are qualified in their entirety by reference to, the provisions of the Indenture. Terms

used in this summary that are not otherwise defined herein have the meaning ascribed to them in the Indenture. The particular terms relating

to Debt Securities offered by a Prospectus Supplement will be described in the related Prospectus Supplement. This description may include,

but may not be limited to, any of the following, if applicable:

| · | the

specific designation of the Debt Securities; any limit on the aggregate principal amount

of the Debt Securities; the date or dates, if any, on which the Debt Securities will mature

and the portion (if less than all of the principal amount) of the Debt Securities to be payable

upon declaration of acceleration of maturity; |

| · | the

rate or rates (whether fixed or variable) at which the Debt Securities will bear interest,

if any, the date or dates from which any such interest will accrue and on which any such

interest will be payable and the record dates for any interest payable on the Debt Securities

that are in registered form; |

| · | the

terms and conditions under which the Company may be obligated to redeem, repay or purchase

the Debt Securities pursuant to any sinking fund or analogous provisions or otherwise; |

| · | the

terms and conditions upon which the Company may redeem the Debt Securities, in whole or in

part, at the Company’s option; |

| · | the

covenants applicable to the Debt Securities; |

| · | the

terms and conditions for any conversion or exchange of the Debt Securities for any other

securities; |

| · | the

extent and manner, if any, to which payment on or in respect of the Securities of the series

will be senior or will be subordinated to the prior payment of other liabilities and obligations

of the Company; |

| · | whether

the Securities will be secured or unsecured; |

| · | whether

the Debt Securities will be issuable in registered form or bearer form or both, and, if issuable

in bearer form, the restrictions as to the offer, sale and delivery of the Debt Securities

which are in bearer form and as to exchanges between registered form and bearer form; |

| · | whether

the Debt Securities will be issuable in the form of registered global securities (“Global

Securities”), and, if so, the identity of the depositary for such registered Global

Securities; |

| · | the

denominations in which registered Debt Securities will be issuable, if other than denominations

of $1,000 integral multiples of $1,000 and the denominations in which bearer Debt Securities

will be issuable, if other than $5,000; |

| · | each

office or agency where payments on the Debt Securities will be made and each office or agency

where the Debt Securities may be presented for registration of transfer or exchange; |

| · | if

other than Canadian dollars, the currency in which the Debt Securities are denominated or

the currency in which the Company will make payments on the Debt Securities; |

| · | material

Canadian federal income tax consequences of owning the Debt Securities; |

| · | any

index, formula or other method used to determine the amount of payments of principal of (and

premium, if any) or interest, if any, on the Debt Securities; and |

| · | any

other terms, conditions, rights or preferences of the Debt Securities which apply solely

to the Debt Securities. |

If the Company denominates the purchase price

of any of the Debt Securities in a currency or currencies other than Canadian dollars or a non-Canadian dollar unit or units, or if the

principal of and any premium and interest on any Debt Securities is payable in a currency or currencies other than Canadian dollars or

a non-Canadian dollar unit or units, the Company will provide investors with information on the restrictions, elections, general tax

considerations, specific terms and other information with respect to that issue of Debt Securities and such non-Canadian dollar currency

or currencies or non-Canadian dollar unit or units in the applicable Prospectus Supplement.

Each series of Debt Securities may be issued

at various times with different maturity dates, may bear interest at different rates and may otherwise vary.

The terms on which a series of Debt Securities

may be convertible into or exchangeable for Common Shares, Preferred Shares or other securities of the Company will be described in the

applicable Prospectus Supplement. These terms may include provisions as to whether conversion or exchange is mandatory, at the option

of the holder or at the option of the Company, and may include provisions pursuant to which the number of Common Shares, Preferred Shares

or other securities to be received by the holders of such series of Debt Securities would be subject to adjustment.

To the extent any Debt Securities are convertible

into Common Shares, Preferred Shares or other securities of the Company, prior to such conversion the holders of such Debt Securities

will not have any of the rights of holders of the securities into which the Debt Securities are convertible, including the right to receive

payments of dividends or the right to vote such underlying securities.

Warrants

The following is a brief summary of certain general

terms and provisions of the Warrants that may be offered pursuant to this Prospectus. This summary does not purport to be complete. The

particular terms and provisions of the Warrants as may be offered pursuant to this Prospectus will be set forth in the applicable Prospectus

Supplement pertaining to such offering of Warrants, and the extent to which the general terms and provisions described below may apply

to such Warrants will be described in the applicable Prospectus Supplement.

Warrants may be offered separately or together

with other Securities, as the case may be. Each series of Warrants may be issued under a separate warrant indenture or warrant agency

agreement to be entered into between the Company and one or more banks or trust companies acting as Warrant agent or may be issued as

stand-alone contracts. The applicable Prospectus Supplement will include details of the Warrant agreements, if any, governing the Warrants

being offered. The Warrant agent, if any, will be expected to act solely as the agent of the Company and will not assume a relationship

of agency with any holders of Warrant certificates or beneficial owners of Warrants. A copy of any warrant indenture or any warrant agency

agreement relating to an offering of Warrants will be filed by the Company with the relevant securities regulatory authorities in Canada

after it has been entered into by the Company.

Each applicable Prospectus Supplement will set

forth the terms and other information with respect to the Warrants being offered thereby, which may include, without limitation, the

following (where applicable):

| · | the

designation of the Warrants; |

| · | the

aggregate number of Warrants offered and the offering price; |

| · | the

designation, number and terms of the other Securities purchasable upon exercise of the Warrants,

and procedures that will result in the adjustment of those numbers; |

| · | the

exercise price of the Warrants; |

| · | the

dates or periods during which the Warrants are exercisable including any “early termination”

provisions; |

| · | the

designation, number and terms of any Securities with which the Warrants are issued; |

| · | if

the Warrants are issued as a unit with another Security, the date on and after which the

Warrants and the other Security will be separately transferable; |

| · | whether

such Warrants are to be issued in registered form, “book-entry only” form, bearer

form or in the form of temporary or permanent global securities and the basis of exchange,

transfer and ownership thereof; |

| · | any

minimum or maximum amount of Warrants that may be exercised at any one time; |

| · | whether

such Warrants will be listed on any securities exchange; |

| · | any

terms, procedures and limitations relating to the transferability, exchange or exercise of

the Warrants; |

| · | certain

material Canadian tax consequences of owning the Warrants; and |

| · | any

other material terms and conditions of the Warrants. |

Subscription Receipts

The following is a brief summary of certain general

terms and provisions of the Subscription Receipts that may be offered pursuant to this Prospectus. This summary does not purport to be

complete. The particular terms and provisions of the Subscription Receipts as may be offered pursuant to this Prospectus will be set

forth in the applicable Prospectus Supplement pertaining to such offering of Subscription Receipts, and the extent to which the general

terms and provisions described below may apply to such Subscription Receipts will be described in the applicable Prospectus Supplement.

Subscription Receipts may be offered separately or together with other Securities, as the case may be.

The Subscription Receipts may be issued under