uniQure N.V. (NASDAQ: QURE), a leading gene therapy company

advancing transformative therapies for patients with severe medical

needs, today reported its financial results for the third quarter

of 2024 and highlighted recent progress across its business.

“uniQure has made significant strides during the

third quarter both clinically and operationally. We advanced our

pipeline of clinical gene therapy programs, including the

presentation of positive long-term follow-up data on AMT-130

supporting significant, dose-dependent slowing of Huntington’s

disease progression,” stated Matt Kapusta, chief executive officer

of uniQure. “We have scheduled a Type B meeting with the FDA for

late November and welcome the opportunity, as part of the

Regenerative Medicine Advanced Therapy (RMAT) designation, to

discuss the potential for an accelerated development pathway for

AMT-130. We believe the recently announced compelling clinical

data, combined with AMT-130’s manageable safety profile and the

lack of therapeutic options for patients in need, present a strong

case for accelerated development. In addition, dosing has begun

across two new Phase I/II studies in SOD1-ALS and Fabry disease,

and we are making substantial progress towards the initiation of a

third clinical trial in mesial temporal lobe epilepsy, with the

first patient recently enrolling into the observational phase of

the study.”

“We also delivered on one of our key corporate

goals, which was to take meaningful actions to streamline

operations and preserve capital. Following the sale of our

Lexington manufacturing facility, we announced a strategic

reorganization expected to further reduce our cash burn and

operating expenses,” he continued. “These decisions, which are

delivering an immediate favorable impact, have extended our cash

runway through the end of 2027 and multiple clinical and regulatory

milestones with the potential to generate shareholder value.”

Mr. Kapusta further commented, “Given the

positive interim data on AMT-130, the upcoming Type B meeting, the

sale of our manufacturing facility, commencement of three clinical

trials and the rightsizing of our organization, uniQure has

executed on its key short-term goals. Going forward we are turning

our near-term focus toward working with the FDA in an effort to

obtain an accelerated pathway for ATM-130 and further advancing our

clinical pipeline. We look forward to providing updates on all our

progress.”

Recent Company Updates

- Advancing AMT-130 for the treatment

of Huntington’s disease

- Based on the granting of the RMAT

designation, the Company has scheduled a Type B, multi-disciplinary

meeting with the U.S. Food and Drug Administration (FDA) in late

November at which the Company plans to present the most recent

clinical data and initiate discussions regarding the potential for

an expedited development pathway for AMT-130. The Company will also

discuss with the FDA a future communication plan that is expected

to include additional sub-disciplinary meetings to take place in

the first half of 2025. Once the Company and the FDA define the

registrational pathway for AMT-130, the Company expects to issue a

public announcement.

- In July 2024, uniQure announced

positive interim data from the ongoing U.S. and European Phase I/II

studies of AMT-130 for the treatment of early-stage Huntington’s

disease1. At 24 months, the data demonstrated a statistically

significant, dose-dependent slowing in disease progression measured

by the composite Unified Huntington’s Disease Rating Scale (cUHDRS)

in patients receiving the high dose of AMT-130 compared to a

propensity score-weighted external control (p=0.007), as well as a

statistically significant reduction of neurofilament light chain

(NfL) in cerebrospinal fluid (CSF) in patients dosed with AMT-130

compared to baseline (p=0.02). AMT-130 continued to be generally

well-tolerated with a manageable safety profile across both

doses.

- Patient dosing is ongoing in a

third cohort of up to 12 patients to further evaluate both doses of

AMT-130 together with an immunosuppression regimen, with a focus on

evaluating near-term safety and tolerability. Enrollment in this

third cohort is expected to be completed in the fourth quarter of

2024.

- The Company expects to provide an

additional interim update from its ongoing Phase I/II clinical

trials of AMT-130 in mid-2025. The update will include follow-up

data on all patients treated with AMT-130 in the first two cohorts,

including three years of follow-up on 21 treated patients.

- Initiating new Phase I/II clinical

studies

- AMT-191 for the treatment of Fabry

disease – In August 2024, the Company announced that the first

patient had been dosed in the Phase I/II clinical trial of AMT-191

for the treatment of Fabry disease. AMT-191 was granted Orphan Drug

and Fast Track designations in September and October 2024,

respectively. The U.S., multi-center, open-label trial is expected

to include up to 12 adult male patients across two dose

cohorts.

- AMT-162 for the treatment of SOD1

amyotrophic lateral sclerosis (ALS) – In October 2024, the Company

announced that the first patient had been dosed in the Phase I/II

clinical trial of AMT-162 for SOD1-ALS. The U.S., multi-center,

open-label trial is expected to include up to 12 patients across

three dose cohorts.

- AMT-260 for the treatment of

refractory mesial temporal lobe epilepsy (mTLE) – The first patient

has been enrolled into the observational phase of the Phase I/II

clinical trial of AMT-260 for the treatment of mTLE. The

FDA-approved study protocol provides that the first three patients

to be enrolled in the study are required to have MRI-confirmed

unilateral, hippocampal sclerosis. Due to the more restrictive

inclusion criteria for these sentinel patients, enrollment has

taken longer than expected. The Company is rapidly activating

recruitment sites with 10 centers currently open and an additional

two sites expected to be activated by the end of 2024.

- Capital preservation initiatives

- In July 2024, the Company announced

the closing of the sale of its Lexington, MA manufacturing facility

to Genezen.

- In August 2024, the Company

announced an organizational restructuring which, combined with the

Lexington manufacturing facility sale, is expected to eliminate

approximately 65% or 300 roles across the organization and reduce

recurring cash burn by $70 million per year.

- In the third quarter of 2024, the

Company made significant progress in reducing its operating

expenses, with immediate benefit realized as a decrease in fixed

costs from the sale of the Lexington facility and the reduction in

personnel. The Company expects its expenses to further decline upon

the completion of the restructuring, which is expected in the first

half of 2025.

- In July 2024, the Company retired

$50 million of its outstanding debt with Hercules Capital, which is

expected to reduce annual interest expense by approximately $5

million. As of September 30, 2024, the Company had $50 million of

debt outstanding.

Upcoming Investor Events

- Guggenheim Healthcare Talks –

Global Healthcare Conference, November 12th – Boston, MA

- Stifel 2024 Healthcare Conference,

November 18th – New York, NY

Financial Highlights

Cash position: As of September

30, 2024, the Company held cash and cash equivalents and investment

securities of $435.2 million, compared to $617.9 million as of

December 31, 2023. The reduction in cash was in part driven by

non-recurring payments made in the third quarter of 2024, including

$53 million related to the retirement of debt, $12M of one-time

payments related to the Lexington facility transaction, and $1M of

severance payments related to the Company’s corporate

restructuring. Based on the Company’s current operating plan, the

Company expects cash, cash equivalents and investment securities

will be sufficient to fund operations through the end of 2027.

Revenues: Revenue for the three

months ended September 30, 2024 was $2.3 million, compared to $1.4

million in the same period in 2023. The increase of $0.8 million in

revenue resulted from a $1.6 million increase in license revenue, a

decrease of $0.4 million from collaboration revenue, and a decrease

of $0.3 million from contract manufacturing of HEMGENIX® for CSL

Behring. Following the divestment of the Lexington facility in July

2024, revenue from contract manufacturing is recorded net of cost

within other expenses.

Cost of contract manufacturing

revenues: Cost of contract manufacturing revenues were

$0.8 million for the three months ended September 30, 2024,

compared to $1.0 million for the same period in 2023. The decrease

relates to the sale of the Lexington facility. Following the sale

of the Lexington facility in July 2024, cost of contract

manufacturing is recorded net of revenue within other expenses.

R&D expenses: Research and

development expenses were $30.6 million for the three months ended

September 30, 2024, compared to $65.4 million during the same

period in 2023. The $34.8 million decrease was related to a

decrease of $14.6 million related to changes in the fair value of

contingent consideration, a $13.7 million decrease in

employee-related expenses, partially offset by an increase of $3.4

million severance costs related to the reorganization announced in

August 2024, a net decrease of $4.9 million in external program

spend and a $3.7 million decrease in costs incurred related to

preclinical supplies.

SG&A expenses: Selling,

general and administrative expenses were $11.6 million for the

three months ended September 30, 2024, compared to $18.1 million

during the same period in 2023. The $6.5 million decrease was

primarily related to a $4.0 million decrease in employee-related

expenses, partially offset by an increase of $0.7 million severance

costs related to the reorganization announced in August 2024, and a

$1.3 million decrease in professional fees compared to the prior

year period.

Other income: Other income was

$2.6 million for the three months ended September 30, 2024,

compared to $1.4 million during the same period in 2023. The

increase was primarily related to the $1.2 million gain recorded on

divesting the Lexington manufacturing facility.

Other expense: Other expense

was $1.9 million for the three months ended September 30, 2024,

compared to $0.2 million during the same period in 2023. The

increase was primarily related to $1.5 million of non-cash expense

recognized to amortize the right to purchase HEMGENIX® from Genezen

on favorable terms.

Other non-operating items, net:

Other non-operating items, net was an expense of $4.2 million for

the three months ended September 30, 2024, compared to $7.8 million

for the same period in 2023. The $3.6 million decrease in other

non-operating items, net was primarily related to an increase in

net foreign currency gains of $7.4 million, which was partially

offset by a decrease of $2.6 million in interest income earned on

investment securities and an increase in non-cash interest expense

of $1.2 million related to the royalty agreement that the Company

entered into in May 2023.

Net loss: The net loss for the

three months ending September 30, 2024, was $44.4 million, or $0.91

basic and diluted loss per ordinary share, compared to $89.6

million net loss for the same period in 2023, or $1.88 basic and

diluted loss per ordinary share.

About uniQure

uniQure is delivering on the promise of gene

therapy – single treatments with potentially curative results. The

approvals of uniQure’s gene therapy for hemophilia B – an historic

achievement based on more than a decade of research and clinical

development – represent a major milestone in the field of genomic

medicine and ushers in a new treatment approach for patients living

with hemophilia. uniQure is now advancing a pipeline of proprietary

gene therapies for the treatment of patients with Huntington's

disease, refractory temporal lobe epilepsy, ALS, Fabry disease, and

other severe diseases. www.uniQure.com

uniQure Forward-Looking

Statements

This press release contains forward-looking

statements. All statements other than statements of historical fact

are forward-looking statements, which are often indicated by terms

such as "anticipate," "believe," "could," “establish,” "estimate,"

"expect," "goal," "intend," "look forward to", "may," "plan,"

"potential," "predict," "project," “seek,” "should," "will,"

"would" and similar expressions. Forward-looking statements are

based on management's beliefs and assumptions and on information

available to management only as of the date of this press release.

Examples of these forward-looking statements include, but are not

limited to, statements concerning the Company’s cash runway and its

ability to fund its operations through the end of 2027 and multiple

milestones with the potential to generate shareholder value; the

Company’s expectations regarding its organizational restructuring,

including reductions in headcount and reductions in annual cash

burn resulting the restructuring; the Company’s plans to announce

additional interim updates from its ongoing U.S. and European Phase

I/II clinical studies of AMT-130 in mid-2025 along with other

future program updates; the Company’s plans to meet the FDA

regarding potential expedited clinical development pathways for

AMT-130; the strength of the Company’s case for accelerated

development; the Company’s future communication plan and additional

meetings with FDA expected to take place in the first half of 2025;

the Company’s plans regarding the third cohort in its AMT-130

clinical trial and the timing of enrollment for such cohort; and

the Company’s site activation plans for its AMT-260 clinical trial

and the design of trials for its AMT-191, AMT-260 and AMT-162

programs. The Company’s actual results could differ materially from

those anticipated in these forward-looking statements for many

reasons. These risks and uncertainties include, among others: risks

associated with the clinical results and the development and timing

of the Company’s programs; the Company’s interactions with

regulatory authorities, which may affect the initiation, timing and

progress of clinical trials and pathways to approval; the Company’s

ability to continue to build and maintain the company

infrastructure and personnel needed to achieve its goals; the

Company’s effectiveness in managing current and future clinical

trials and regulatory processes; the continued development and

acceptance of gene therapies; the Company’s ability to demonstrate

the therapeutic benefits of its gene therapy candidates in clinical

trials; the Company’s ability to obtain, maintain and protect

intellectual property; and the Company’s ability to fund its

operations and to raise additional capital as needed. These risks

and uncertainties are more fully described under the heading "Risk

Factors" in the Company’s periodic filings with the U.S. Securities

& Exchange Commission (“SEC”), including its Annual Report on

Form 10-K filed February 28, 2024, its Quarterly Reports on Form

10-Q filed May 7, 2024, August 1, 2024 and November 5, 2024, and in

other filings that the Company makes with the SEC from time to

time. Given these risks, uncertainties and other factors, you

should not place undue reliance on these forward-looking

statements, and the Company assumes no obligation to update these

forward-looking statements, even if new information becomes

available in the future.

uniQure Contacts:

| FOR

INVESTORS: |

|

FOR

MEDIA: |

| |

|

|

| Chiara Russo |

|

Tom Malone |

| Direct: 617-306-9137 |

|

Direct: 339-970-7558 |

| Mobile: 617-306-9137 |

|

Mobile:339-223-8541 |

| c.russo@uniQure.com |

|

t.malone@uniQure.com |

| uniQure

N.V. |

| |

| UNAUDITED

CONSOLIDATED BALANCE SHEETS |

| |

| |

September

30 |

|

December 31, |

|

| |

2024 |

|

2023 |

|

| |

(in

thousands, except share and per share amounts) |

|

|

Current assets |

|

|

|

|

|

Cash and cash equivalents |

$ |

251,626 |

|

$ |

241,360 |

|

| Current

investment securities |

|

183,615 |

|

|

376,532 |

|

| Inventories,

net |

|

- |

|

|

12,024 |

|

| Accounts

receivable |

|

5,322 |

|

|

4,193 |

|

| Prepaid

expenses |

|

19,286 |

|

|

15,089 |

|

| Other

current assets and receivables |

|

4,289 |

|

|

2,655 |

|

|

Total current assets |

|

464,138 |

|

|

651,853 |

|

|

Non-current assets |

|

|

|

|

| Property,

plant and equipment, net |

$ |

25,566 |

|

$ |

46,548 |

|

| Other

investments |

|

28,260 |

|

$ |

2,179 |

|

| Operating

lease right-of-use assets |

|

14,833 |

|

|

28,789 |

|

| Intangible

assets, net |

|

76,609 |

|

|

60,481 |

|

|

Goodwill |

|

24,084 |

|

|

26,379 |

|

| Deferred tax

assets, net |

|

10,863 |

|

|

12,276 |

|

| Other

non-current assets |

|

1,453 |

|

|

3,184 |

|

|

Total non-current assets |

|

181,668 |

|

|

179,836 |

|

|

Total assets |

$ |

645,806 |

|

$ |

831,689 |

|

|

Current liabilities |

|

|

|

|

| Accounts

payable |

$ |

5,441 |

|

$ |

6,586 |

|

| Accrued

expenses and other current liabilities |

|

32,301 |

|

|

30,534 |

|

| Current

portion of contingent consideration |

|

29,233 |

|

|

28,211 |

|

| Current

portion of operating lease liabilities |

|

4,298 |

|

|

8,344 |

|

|

Total current liabilities |

|

71,273 |

|

|

73,675 |

|

|

Non-current liabilities |

|

|

|

|

| Long-term

debt |

|

51,113 |

|

|

101,749 |

|

| Liability

from royalty financing agreement |

|

426,687 |

|

|

394,241 |

|

| Operating

lease liabilities, net of current portion |

|

12,185 |

|

|

28,316 |

|

| Contingent

consideration, net of current portion |

|

12,181 |

|

|

14,795 |

|

| Deferred tax

liability, net |

|

7,627 |

|

|

7,543 |

|

| Other

non-current liabilities |

|

8,919 |

|

|

3,700 |

|

|

Total non-current liabilities |

|

518,712 |

|

|

550,344 |

|

|

Total liabilities |

|

589,985 |

|

|

624,019 |

|

|

Shareholders' equity |

|

|

|

|

|

Total shareholders' equity |

|

55,821 |

|

|

207,670 |

|

|

Total liabilities and shareholders' equity |

$ |

645,806 |

|

$ |

831,689 |

|

| |

|

|

|

|

| uniQure

N.V. |

| |

| UNAUDITED

CONSOLIDATED STATEMENTS OF OPERATIONS |

| |

| |

Three months ended September 30, |

| |

2024 |

|

2023 |

| |

(in

thousands, except share and per share amounts) |

|

Total revenues |

$ |

2,287 |

|

|

$ |

1,407 |

|

|

Operating expenses: |

|

|

|

| Cost of

license revenues |

|

(264 |

) |

|

|

— |

|

| Cost of

contract manufacturing revenues |

|

(757 |

) |

|

|

(1,006 |

) |

| Research and

development expenses |

|

(30,595 |

) |

|

|

(65,400 |

) |

| Selling,

general and administrative expenses |

|

(11,575 |

) |

|

|

(18,074 |

) |

|

Total operating expenses |

|

(43,191 |

) |

|

|

(84,480 |

) |

| Other

income |

|

2,591 |

|

|

|

1,424 |

|

| Other

expense |

|

(1,915 |

) |

|

|

(228 |

) |

| Loss

from operations |

|

(40,228 |

) |

|

|

(81,877 |

) |

|

Non-operating items, net |

|

(4,181 |

) |

|

|

(7,763 |

) |

| Loss

before income tax expense |

$ |

(44,409 |

) |

|

$ |

(89,640 |

) |

| Income tax

benefit |

|

31 |

|

|

|

69 |

|

| Net

loss |

$ |

(44,378 |

) |

|

$ |

(89,571 |

) |

| |

|

|

|

| Basic and

diluted net loss per ordinary share |

$ |

(0.91 |

) |

|

$ |

(1.88 |

) |

| Weighted

average shares used in computing basic and diluted net loss per

ordinary share |

|

48,718,533 |

|

|

|

44,770,101 |

|

| |

|

|

|

1 All p-values are nominal and unadjusted. Statistical

comparisons of patients treated with AMT-130 to the propensity

score-weighted external control were conducted on a post-hoc

basis.

This press release was published by a CLEAR® Verified

individual.

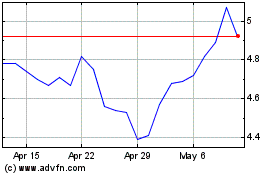

uniQure NV (NASDAQ:QURE)

Historical Stock Chart

From Nov 2024 to Dec 2024

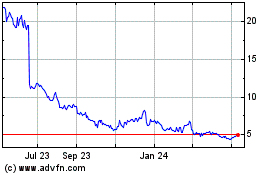

uniQure NV (NASDAQ:QURE)

Historical Stock Chart

From Dec 2023 to Dec 2024