The Real Brokerage Inc. (NASDAQ: REAX) (“Real” or the

“Company”), a technology platform reshaping real estate for agents,

home buyers and sellers, announced today financial results for the

third quarter ended September 30, 2024.

“Real delivered another exceptional quarter underpinned by

industry-leading growth and innovation,” said Tamir Poleg, Real’s

Chairman and Chief Executive Officer. “Our technology leadership

was on full display at our recent RISE 2024 conference, with the

official launch of Real Wallet, our first fintech product, and the

announcement of Leo AI for clients. These innovations reflect our

ongoing commitment to creating a seamless, technology-first real

estate experience that empowers both agents and their clients.”

“Even with current market challenges, Real’s ability to attract

high-performing agents highlights the strength of our value

proposition,” said Sharran Srivatsaa, President of Real. “Our focus

on providing agents with world-class tools, support, and training —

evidenced by our preparation for the recent NAR practice changes —

ensures they can navigate shifts in the industry and grow their

businesses with confidence.”

“Our strong top- and bottom-line performance this quarter

reflects a balanced approach of disciplined cost control and

strategic investments in high-impact areas,” said Michelle Ressler,

Real’s Chief Financial Officer. “We remain focused on executing our

value-creation strategy and building on our recent momentum as we

prepare for an even stronger 2025.”

Q3 2024 Operational Highlights1

- The total value of completed real estate transactions reached

$14.4 billion in the third quarter of 2024, an increase of 78% from

$8.1 billion in the third quarter of 2023.

- The total number of transactions closed was 35,832 in the third

quarter of 2024, an increase of 76% from 20,397 in the third

quarter of 2023.

- The total number of agents on the platform increased to 21,770

at the end of the third quarter of 2024, an increase of 79% from

the third quarter of 2023. As of November 7, 2024, approximately

22,500 agents are now on the Real platform.

Q3 2024 Financial Highlights

- Revenue rose to $372.5 million in the third quarter of 2024, an

increase of 74% from $214.6 million in the third quarter of

2023.

- Gross profit reached $32.1 million in the third quarter of

2024, an increase of 71% from $18.8 million in the third quarter of

2023.

- Net loss attributable to owners of the Company was $(2.6)

million in the third quarter of 2024, compared to $(4.0) million in

the third quarter of 2023.

- Adjusted EBITDA2 was $13.3 million in the third quarter of

2024, compared to $3.5 million in the third quarter of 2023.

- Operating expenses, which include General & Administrative,

Marketing, and Research and Development expenses, totaled $34.6

million in the third quarter of 2024, a 52% increase from $22.7

million in the third quarter of 2023.

- Revenue share expense, which is included in Marketing expenses,

was $11.7 million in the third quarter of 2024, a 47% increase

compared to $7.9 million in the third quarter of 2023.

- Adjusted operating expenses, which reflect operating expenses

less revenue share expense, stock-based compensation, depreciation,

expenses related to the settlement of antitrust litigation, and

other unique or non-cash expenses, were $16.8 million in the third

quarter of 2024, an increase of 47% from $11.4 million in the third

quarter of 2023. Adjusted operating expense per transaction was

$468 in the third quarter of 2023, a decline of 16% from $558 in

the third quarter of 2023.

- Loss per share was $(0.01) in the third quarter of 2024,

compared to a loss per share of $(0.02) in the third quarter of

2023.

- The Company repurchased 2.7 million common shares for $15.1

million in the third quarter of 2024, pursuant to its normal course

issuer bid.

- As of September 30, 2024, Real held cash and cash equivalents

of $32.0 million, consisting of $21.6 million of unrestricted cash

and $10.4 million held in investments in financial assets.

- Real continues to have no debt.

Business Highlights and Recent Updates

Subsequent to the end of the quarter, in October, Real unveiled

an array of innovative products and features at its annual RISE

agent conference in Las Vegas. Highlights included:

- Real Wallet – Real announced the official launch of its

cutting-edge fintech product. Real Wallet was built specifically

for Real agents. Real Wallet allows U.S. agents to access their

earnings instantly, eliminating delays caused by legacy banking

systems, and provides financial insights that enable agents to

manage their business finances more effectively, while also

reinvesting in growth opportunities. Real Wallet is available to

select agents in the U.S. and Canada. U.S. agents can open a

business checking account with Thread Bank, Member FDIC, featuring

a Real-branded debit card, while Canadian agents will be offered a

credit line based on their earnings history with Real. Future

phases of Real Wallet aim to unify these offerings into a

comprehensive financial solution for all business banking needs.

Banking services in the U.S. are provided by Thread Bank, Member

FDIC, and the Canadian credit line will be offered directly by

Real.

- Leo CoPilot – The next evolution of Real’s AI-powered

assistant, Leo CoPilot acts as an agent's personal command center.

It anticipates individual agent needs, streamlines daily tasks, and

serves as the primary interface for reZEN, Real’s proprietary agent

software platform, enhancing productivity and simplifying business

operations.

- Leo for Clients – Designed to transform client-agent

interactions, Leo for Clients will enable direct communication

between agents and clients through SMS and iMessage. Building on

the same concept as Leo CoPilot, Leo for Clients will offer 24/7

access to property information and services through a dedicated

phone line for each agent. At launch, clients will be able to

interact with Leo for Clients enabling them to receive

recommendations for available properties based on their search

criteria, access open house information, schedule tours and

initiate mortgage applications. This tool streamlines

communication, enhances the client experience, and allows agents to

focus their time on strategic efforts and relationship building,

while maintaining seamless client engagement.

_________________________

1All dollar references are in U.S. dollars. 2There are references

to “Adjusted EBITDA” and “Adjusted Operating Expense” in this press

release, which are non-IFRS measures. See accompanying note under

the heading “Non-IFRS Measures” for an explanation of the

composition of these non-IFRS measures.

The Company will discuss the third quarter results on a

conference call and live webcast today at 8:30 a.m. ET.

Conference Call Details:

Date:

Thursday, November 7, 2024

Time:

8:30 am ET

Dial-in Number:

North American Toll Free:

888-506-0062

International: 973-528-0011

Access Code:

345905

Webcast:

https://www.webcaster4.com/Webcast/Page/2699/51300

Replay Information:

Replay Number:

North American Toll Free:

877-481-4010

International: 919-882-2331

Access Code:

51300

Replay Link:

https://www.webcaster4.com/Webcast/Page/2699/51300

Non-IFRS Measures

This news release includes references to “Adjusted EBITDA”, and

“Adjusted Operating Expense”, which are non-International Financial

Reporting Standards (“IFRS”) financial measures. Non-IFRS measures

are not recognized measures under IFRS, do not have a standardized

meaning prescribed by IFRS, and are therefore unlikely to be

comparable to similar measures presented by other companies.

Adjusted EBITDA is used as an alternative to net income by

removing major non-cash items, such as depreciation, amortization,

interest, stock-based compensation, current and deferred income tax

expenses and other items management considers unique and/or

non-operating in nature.

Adjusted Operating Expense is used as an alternative to

operating expenses by removing major non-cash items such as

stock-based compensation, depreciation, and other unique or

non-cash expenses, while retaining ongoing fixed operating expenses

and excluding variable cash expenses associated with revenue

share.

Adjusted EBITDA and Adjusted Operating Expense have no direct

comparable IFRS financial measures. The Company has used or

included these non-IFRS measures solely to provide investors with

added insight into Real’s financial performance. Readers are

cautioned that such non-IFRS measures may not be appropriate for

any other purpose. Non-IFRS measures should not be considered in

isolation or as a substitute for measures of performance prepared

in accordance with IFRS. Our Adjusted EBITDA is reconciled to the

most comparable IFRS measure for the three months and nine months

ended September 30, 2024 and 2023 and is presented in the table

below labeled Reconciliation of Total Comprehensive Loss

Attributable to Owners of the Company to Adjusted EBITDA. Our

Adjusted Operating Expense reconciled to the most comparable IFRS

measure is presented for the three months ended September 30, 2024

and on a quarterly basis for the prior two fiscal years in the

table below labeled Reconciliation of Operating Expense to Adjusted

Operating Expense.

THE REAL BROKERAGE

INC.

INTERIM CONDENSED CONSOLIDATED

STATEMENTS OF FINANCIAL POSITIONS

(Expressed in thousands of U.S.

dollars)

Unaudited

As of

September 30, 2024

December 31, 2023

ASSETS

CURRENT ASSETS

Cash and cash equivalents

$

21,580

$

14,707

Restricted cash

27,516

12,948

Funds held in restricted escrow

account

9,250

-

Investments in financial assets

10,398

14,222

Trade receivables

17,305

6,441

Other receivables

43

63

Prepaid expenses and deposits

2,391

2,132

TOTAL CURRENT ASSETS

88,483

50,513

NON-CURRENT ASSETS

Intangible assets

2,788

3,442

Goodwill

8,993

8,993

Property and equipment

2,209

1,600

TOTAL NON-CURRENT ASSETS

13,990

14,035

TOTAL ASSETS

102,473

64,548

LIABILITIES AND EQUITY

CURRENT LIABILITIES

Accounts payable

1,133

571

Accrued liabilities

30,991

13,374

Customer deposits

27,516

12,948

Other payables

12,843

302

Warrants outstanding

-

-

TOTAL CURRENT LIABILITIES

72,483

27,195

NON-CURRENT LIABILITIES

Warrants outstanding

-

269

TOTAL NON-CURRENT LIABILITIES

-

269

TOTAL LIABILITIES

72,483

27,464

EQUITY

EQUITY ATTRIBUTABLE TO OWNERS

Share premium

67,683

62,567

Stock-based compensation reserves

61,255

52,937

Deficit

(98,103

)

(78,205

)

Other reserves

195

(167

)

Treasury stock, at cost

(1,228

)

(257

)

EQUITY ATTRIBUTABLE TO OWNERS

29,802

36,875

Non-controlling interests

188

209

TOTAL EQUITY

29,990

37,084

TOTAL LIABILITIES AND EQUITY

102,473

64,548

THE REAL BROKERAGE

INC.

INTERIM CONDENSED CONSOLIDATED

STATEMENTS OF LOSS AND COMPREHENSIVE LOSS

(Expressed in thousands of U.S.

dollars, except for per share amounts)

Unaudited

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Revenues

$

372,488

$

214,640

$

914,009

$

507,817

Commissions and other agent-related

costs

340,359

195,865

829,253

460,475

Gross Profit

32,129

18,775

84,756

47,342

General and administrative expenses

16,301

9,234

42,452

27,526

Marketing expenses

15,261

11,577

43,779

29,527

Research and development expenses

3,045

1,931

8,115

5,034

Settlement of litigation

—

—

9,250

—

Operating Loss

(2,478

)

(3,967

)

(18,840

)

(14,745

)

Other income

151

38

381

106

Finance expenses, net

(214

)

(10

)

(1,289

)

(587

)

Net Loss

(2,541

)

(3,939

)

(19,748

)

(15,226

)

Net income attributable to noncontrolling

interests

45

85

150

311

Net Loss Attributable to the Owners of

the Company

(2,586

)

(4,024

)

(19,898

)

(15,537

)

Other comprehensive income/(loss):

Cumulative (gain)/loss on investments in

debt instruments classified as FVTOCI reclassified to profit or

loss

3

79

97

214

Foreign currency translation

adjustment

(230

)

(52

)

265

10

Total Comprehensive Loss Attributable

to Owners of the Company

(2,813

)

(3,997

)

(19,536

)

(15,313

)

Total Comprehensive Income Attributable

to NCI

45

85

150

311

Total Comprehensive Loss

(2,768

)

(3,912

)

(19,386

)

(15,002

)

Loss per share

Basic and diluted loss per share

(0.01

)

(0.02

)

(0.11

)

(0.09

)

Weighted-average shares, basic and

diluted

196,668

180,611

188,864

180,158

THE REAL BROKERAGE

INC.

INTERIM CONDENSED CONSOLIDATED

STATEMENT OF CASH FLOWS

(Expressed in thousands of U.S.

dollars)

Unaudited

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

OPERATING ACTIVITIES

Net Loss

$

(2,541

)

$

(3,939

)

$

(19,748

)

$

(15,226

)

Adjustments for:

Depreciation and amortization

358

277

1,024

830

Equity-settled share-based payment

15,417

7,144

37,797

18,980

Finance costs

(33

)

(143

)

638

156

Changes in operating asset and

liabilities:

Funds Held in Restricted Escrow

Account

-

-

(9,250

)

-

Trade receivables

1,326

(614

)

(10,864

)

(992

)

Other receivables

13

(23

)

20

(1

)

Prepaid expenses and deposits

(850

)

(266

)

(259

)

(796

)

Accounts payable

(63

)

(493

)

562

179

Accrued liabilities

(2,638

)

2,654

17,617

12,068

Customer deposits

(5,608

)

(13,247

)

14,568

8,852

Other payables

1,815

718

12,541

1,684

NET CASH PROVIDED BY OPERATING

ACTIVITIES

7,196

(7,932

)

44,646

25,734

INVESTING ACTIVITIES

Purchase of property and equipment

(367

)

(197

)

(964

)

(448

)

Investment Deposits in Debt Instruments

held at FVTOCI

(1,134

)

(3,037

)

(2,847

)

(6,766

)

Investment Withdrawals in Debt Instruments

held at FVTOCI

1,014

-

6,766

845

NET CASH PROVIDED BY (USED IN)

INVESTING ACTIVITIES

(487

)

(3,234

)

2,955

(6,369

)

FINANCING ACTIVITIES

Purchase of common shares for Restricted

Share Unit (RSU) Plan

(15,110

)

(350

)

(30,336

)

(1,761

)

Shares withheld for taxes

(736

)

-

(1,477

)

-

Proceeds from exercise of stock

options

1,994

380

5,617

592

Payment of lease liabilities

-

-

-

(96

)

Payment of contingent consideration

-

-

-

(800

)

Cash disbursements for non-controlling

interest

(119

)

(303

)

(171

)

(303

)

NET CASH USED IN FINANCING

ACTIVITIES

(13,971

)

(273

)

(26,367

)

(2,368

)

Net change in cash, cash equivalents and

restricted cash

(7,262

)

(11,439

)

21,234

16,997

Cash, cash equivalents and restricted

cash, beginning of period

56,440

46,745

27,655

18,327

Fluctuations in foreign currency

(82

)

33

207

15

CASH, CASH EQUIVALENTS AND RESTRICTED

CASH, ENDING BALANCE

$

49,096

$

35,339

$

49,096

$

35,339

THE REAL BROKERAGE

INC.

RECONCILIATION OF TOTAL

COMPREHENSIVE LOSS ATTRIBUTABLE TO OWNERS OF THE COMPANY TO

ADJUSTED EBITDA

(Expressed in thousands of U.S.

dollars)

Unaudited

For the Three Months Ended

For the Nine Months Ended

September 30, 2024

September 30, 2023

September 30, 2024

September 30, 2023

Total Comprehensive Loss Attributable to

Owners of the Company

(2,813

)

(3,997

)

(19,536

)

(15,313

)

Add/(Deduct):

Finance Expenses, net

214

10

1,289

587

Net Income Attributable to Noncontrolling

Interest

45

85

150

311

Cumulative (Gain)/Loss on Investments in

Debt Instruments Classified as at FVTOCI Reclassified to Profit or

Loss

(3

)

(79

)

(97

)

(214

)

Depreciation and Amortization

358

277

1,024

830

Stock-Based Compensation

15,417

7,144

37,797

18,980

Restructuring Expenses

-

80

-

165

Expenses related to Anti-Trust Litigation

Settlement

33

-

10,259

-

Adjusted EBITDA

13,251

3,520

30,886

5,346

THE REAL BROKERAGE

INC.

BREAKOUT OF REVENUE BY

SEGMENT

(Expressed in thousands of U.S.

dollars)

Unaudited

For the Three Months Ended

For the Nine Months Ended

September 30, 2024

September 30, 2023

September 30, 2024

September 30, 2023

Main revenue streams

Commissions

369,890

213,319

907,716

504,456

Title

1,400

964

3,450

2,510

Mortgage Income

1,198

357

2,843

851

Total Revenue

372,488

214,640

914,009

507,817

THE REAL BROKERAGE

INC.

RECONCILIATION OF OPERATING

EXPENSE TO ADJUSTED OPERATING EXPENSE BY QUARTER

(Expressed in thousands of U.S.

dollars)

Unaudited

2022

2023

2024

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Operating Expense

13,496

12,886

15,184

17,846

21,499

22,742

26,796

36,477

32,512

34,607

Less: Revenue Share Expense

4,376

3,876

4,020

5,434

7,684

7,946

6,840

9,064

12,475

11,651

Revenue Share Expense (% of revenue)

3.9

%

3.5

%

4.2

%

5.0

%

4.1

%

3.7

%

3.8

%

4.5

%

3.7

%

3.1

%

Less:

Stock-Based Compensation - Employees

897

281

608

1,019

1,214

285

6,543

1,493

2,265

3,139

Stock-Based Compensation - Agent

547

1,776

2,614

1,541

1,640

2,769

1,830

2,137

2,335

2,665

Depreciation Expense

135

87

108

269

284

277

298

326

340

358

Restructuring Expense

—

62

160

41

44

80

58

—

—

—

Expenses Related to Anti-Trust Litigation

Settlement

—

—

—

—

—

—

—

9,857

369

33

Subtotal

1,579

2,206

3,490

2,870

3,182

3,411

8,729

13,813

5,309

6,195

Adjusted Operating Expense1

7,541

6,804

7,674

9,542

10,633

11,385

11,227

13,600

14,728

16,761

Adjusted Operating Expense (% of

revenue)

6.7

%

6.1

%

8.0

%

8.8

%

5.7

%

5.3

%

6.2

%

6.8

%

4.3

%

4.5

%

1Adjusted operating expense excludes

revenue share, stock-based compensation, depreciation and other

non-recurring or non-cash expenses.

THE REAL BROKERAGE

INC.

KEY PERFORMANCE METRICS BY

QUARTER

(Dollar amounts expressed in U.S.

dollars)

Unaudited

2022

2023

2024

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Transaction

Data

Closed Transaction Sides

10,224

11,233

9,745

10,963

17,537

20,397

17,749

19,032

30,367

35,832

Total Value of Home Side Transactions ($,

billions)

4.2

4.2

3.5

4.0

7.0

8.1

6.8

7.5

12.6

14.4

Median Home Sales Price ($, thousands)

$

375

$

360

$

348

$

350

$

369

$

370

$

355

$

372

$

384

$

383

Agent

Metrics

Total Agents

5,600

6,700

8,200

10,000

11,500

12,175

13,650

16,680

19,540

21,770

Agent Churn Rate (%)

7.2

7.3

4.4

8.3

6.5

10.8

6.2

7.9

7.5

7.3

Revenue Churn Rate (%)

2.1

2.5

2.4

4.3

3.8

4.5

4.9

1.9

1.6

2.0

Headcount and

Efficiency Metrics

Full-Time Employees

121

122

118

127

145

162

159

151

231

240

Full-Time Employees, Excluding One Real

Title and One Real Mortgage

91

87

84

88

102

120

118

117

142

155

Headcount Efficiency Ratio

1:62

1:77

1:98

1:114

1:113

1:101

1:116

1:143

1:138

1:140

Revenue Per Full Time Employee ($,

thousands)

$

1,235

$

1,283

$

1,144

$

1,226

$

1,817

$

1,789

$

1,537

$

1,716

$

2,400

$

2,403

Operating Expense Excluding Revenue Share

($, thousands)

$

9,120

$

9,010

$

11,164

$

12,412

$

13,815

$

14,796

$

19,956

$

27,413

$

20,037

$

22,956

Operating Expense Per Transaction

Excluding Revenue Share ($)

$

892

$

802

$

1,146

$

1,132

$

788

$

725

$

1,124

$

1,440

$

660

$

641

Adjusted Operating Expense ($,

thousands)

$

7,541

$

6,804

$

7,674

$

9,542

$

10,633

$

11,385

$

11,226

$

13,600

$

14,728

$

16,761

Adjusted Operating Expense Per Transaction

($)

$

738

$

606

$

787

$

870

$

606

$

558

$

632

$

715

$

485

$

468

1Defined as the ratio of full-time

brokerage employees (excludes One Real Title and One Real Mortgage

employees) to the number of agents on our platform. 2Reflects total

company revenue divided by full-time brokerage employees (excludes

One Real Title and One Real Mortgage employees). 3Adjusted

operating expense excludes revenue share, stock-based compensation,

depreciation and other non-recurring or non-cash expenses.

Forward-Looking Information

This press release contains forward-looking information within

the meaning of applicable Canadian securities laws. Forward-looking

information is often, but not always, identified by the use of

words such as “seek”, “anticipate”, “believe”, “plan”, “estimate”,

“expect”, “likely” and “intend” and statements that an event or

result “may”, “will”, “should”, “could” or “might” occur or be

achieved and other similar expressions. These statements reflect

management’s current beliefs and are based on information currently

available to management as at the date hereof. Forward-looking

information in this press release includes, without limiting the

foregoing, information relating to Real’s expectation regarding

increasing the number of agents, revenue growth and profitability

and the business, strategic plans of Real and expectations

regarding Real Wallet, Leo CoPilot and Leo for Clients, including

their anticipated features.

Forward-looking information is based on assumptions that may

prove to be incorrect, including but not limited to Real’s business

objectives, expected growth, results of operations, performance,

business projects and opportunities and financial results. Real

considers these assumptions to be reasonable in the circumstances.

However, forward-looking information is subject to known and

unknown risks, uncertainties and other factors that could cause

actual results, performance or achievements to differ materially

from those expressed or implied in the forward-looking information.

Important factors that could cause such differences include, but

are not limited to, slowdowns in real estate markets, economic and

industry downturns, Real’s ability to attract new agents and retain

current agents, Real’s inability to successfully launch new

products and features, including Real Wallet, Leo CoPilot and Leo

for Clients and those risk factors discussed under the heading

“Risk Factors” in the Company’s Annual Information Form dated March

14, 2024, and “Risks and Uncertainties” in the Company’s Quarterly

Management’s Discussion and Analysis for the period ended September

30, 2024, copies of which are available under the Company’s SEDAR+

profile at www.sedarplus.ca.

These factors should be carefully considered and readers should

not place undue reliance on the forward-looking statements.

Although the forward-looking statements contained in this press

release are based upon what management believes to be reasonable

assumptions, Real cannot assure readers that actual results will be

consistent with these forward-looking statements. These

forward-looking statements are made as of the date of this press

release, and Real assumes no obligation to update or revise them to

reflect new events or circumstances, except as required by law.

About Real

Real (NASDAQ: REAX) is a real estate experience company working

to make life’s most complex transaction simple. The fast-growing

company combines essential real estate, mortgage and closing

services with powerful technology to deliver a single seamless

end-to-end consumer experience, guided by trusted agents. With a

presence in all 50 states throughout the U.S. and Canada, Real

supports over 22,000 agents who use its digital brokerage platform

and tight-knit professional community to power their own

forward-thinking businesses. Additional information can be found on

its website at www.onereal.com.

The Real Brokerage is a real estate technology company and is

not a bank. Banking services provided by Thread Bank, Member FDIC.

The Real Wallet Visa debit card is issued by Thread Bank, Member

FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used

anywhere Visa cards are accepted.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107115357/en/

For additional information, please contact: Ravi Jani Vice

President, Investor Relations and Financial Planning & Analysis

investors@therealbrokerage.com 908.280.2515

For media inquiries, please contact: Elisabeth Warrick Senior

Director, Marketing, Communications & Brand

elisabeth@therealbrokerage.com 201.564.4221

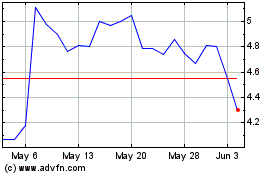

Real Brokerage (NASDAQ:REAX)

Historical Stock Chart

From Jan 2025 to Feb 2025

Real Brokerage (NASDAQ:REAX)

Historical Stock Chart

From Feb 2024 to Feb 2025