TransCode Therapeutics, Inc. Announces Pricing of Public Offering

July 22 2024 - 9:30PM

TransCode Therapeutics, Inc. (Nasdaq: RNAZ), (“TransCode” or the

“Company”), a clinical-stage RNA oncology company committed to more

effectively treating cancer using RNA therapeutics, today announced

the pricing of a public offering of 10,000,000 shares of its common

stock at a public offering price of $0.30 per share, for expected

gross proceeds of $3,000,000, before deducting placement agent

commissions and offering expenses. All of the shares of common

stock are being offered by the Company. The offering is expected to

close on July 24, 2024, subject to satisfaction of customary

closing conditions.

The Company intends to use the net proceeds from

the offering primarily for product development activities,

including one or more clinical trials with TTX-MC138, its lead

therapeutic candidate, and related investigational new drug (IND)

enabling studies, and for working capital and other general

corporate purposes.

ThinkEquity is acting as the sole placement

agent for the offering.

The securities are being offered and sold

pursuant to a shelf registration statement on Form S-3 (File No.

268764), including a base prospectus, filed with the U.S.

Securities and Exchange Commission (the “SEC”) on December 13,

2022, and declared effective on December 16, 2022. The offering is

being made only by means of a written prospectus forming part of

the effective shelf registration statement. A preliminary

prospectus supplement and accompanying prospectus describing the

terms of the offering were filed with the SEC and are available on

its website at www.sec.gov. A final prospectus supplement relating

to the offering will be filed with the SEC and will be available on

its website at www.sec.gov. Copies of the final prospectus

supplement and the accompanying prospectus relating to the offering

may also be obtained, when available, from the offices of

ThinkEquity, 17 State Street, 41st Floor, New York, New York

10004.

This press release shall not constitute an offer

to sell or a solicitation of an offer to buy any of the securities

described herein, nor shall there be any sale of these securities

in any state or jurisdiction in which such an offer, solicitation

or sale would be unlawful prior to registration or qualification

under the securities laws of any such state or jurisdiction.

About TransCode Therapeutics,

Inc.

TransCode is a clinical-stage oncology company

focused on treating metastatic disease. The company is committed to

defeating cancer through the intelligent design and effective

delivery of RNA therapeutics based on its proprietary TTX

nanoparticle platform. The Company’s lead therapeutic candidate,

TTX-MC138, is focused on treating metastatic tumors which

overexpress microRNA-10b, a unique, well-documented biomarker of

metastasis. In addition, TransCode is developing a portfolio of

first-in-class RNA therapeutic candidates designed to overcome the

challenges of RNA delivery and thus unlock therapeutic access to a

variety of novel genetic targets that could be relevant to treating

a variety of cancers.

Forward Looking StatementsThis

release contains “forward-looking statements” within the meaning of

the Private Securities Litigation Reform Act of 1995, that are

subject to substantial risks and uncertainties, including

statements related to the completion of the offering. All

statements, other than statements of historical fact, contained in

this press release are forward-looking statements. Forward-looking

statements contained in this press release may be identified by the

use of words such as “aim,” “anticipate,” “believe,” “contemplate,”

“could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,”

“potential,” “predict,” “project,” “seek,” “should,” “target,”

"will,” “would,” or the negative of these words or other similar

expressions, although not all forward-looking statements contain

these words. Forward-looking statements are based on the Company’s

current expectations and are subject to inherent uncertainties and

risks that are difficult to predict. Further, certain

forward-looking statements are based on assumptions as to future

events that may not prove to be accurate. These risks and

uncertainties include, but are not limited to: TransCode’s ability

to satisfy the closing conditions related to the offering and the

timing and completion of such closing, the use of the net proceeds

of the offering, various other factors, and the continued listing

of our common stock on the Nasdaq Capital Market. These and other

risks and uncertainties are described more fully in the sections

titled “Risk Factors” and “Cautionary Note Regarding

Forward-Looking Statements” in the registration statement and in

the preliminary prospectus supplement related to the offering

described herein, and the Company’s annual report on Form 10-K,

quarterly report on Form 10-Q and other reports filed with the

Securities and Exchange Commission. Forward-looking statements

contained in this announcement are made as of this date, and the

Company undertakes no duty to update such information except as

required under applicable law.

Investor Relations:

TransCode Therapeutics, Inc.Tania

Montgomery-HammonVP Business

DevelopmentTania.montgomery@transcodetherapeutics.com

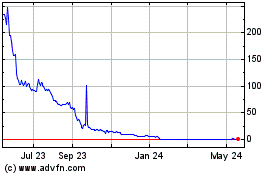

TransCode Therapeutics (NASDAQ:RNAZ)

Historical Stock Chart

From Oct 2024 to Nov 2024

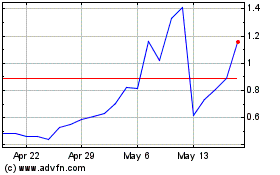

TransCode Therapeutics (NASDAQ:RNAZ)

Historical Stock Chart

From Nov 2023 to Nov 2024