Riverview Bancorp Inc - Current report filing (8-K)

October 24 2007 - 1:36PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 23, 2007

RIVERVIEW BANCORP, INC.

(Exact name of registrant as specified in its charter)

|

Washington

|

000-22957

|

91-1838969

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(I.R.S. Employer

Identification No.)

|

|

900 Washington Street, Suite 900, Vancouver, Washington

|

98660

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant's telephone number, including area code:

(360) 693-6650

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions.

|

|

|

|

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

(17 CFR 240.14d-2(b))

|

|

|

|

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e-4(c))

|

<PAGE>

Item 2.02 Results of Operations and Financial Condition.

On October 23, 2007, Riverview Bancorp, Inc. issued its earnings release for the quarter ended September 30, 2007. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(c) Exhibits

99.1 News Release of Riverview Bancorp, Inc. dated October 23, 2007.

<PAGE>

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

RIVERVIEW BANCORP, INC.

|

|

|

|

|

|

|

|

|

/s/Patrick Sheaffer

|

|

Date: October 23, 2007

|

Patrick Sheaffer

|

|

|

Chairman and Chief Executive Officer

|

|

|

(Principal Executive Officer)

|

<PAGE>

Exhibit 99.1

News Release Dated October 23, 2007

<PAGE>

|

Contacts:

|

Pat Sheaffer or Ron Wysaske,

|

|

|

Riverview Bancorp, Inc. 360-693-6650

|

Riverview Bancorp, Inc. Earns $2.4 Million in Fiscal Second Quarter,

Core Deposits Increase 11% and Strong Credit Quality Continues

Vancouver, WA - October 23, 2007 - Riverview Bancorp, Inc. (NASDAQ GSM: RVSB) today reported that strong core deposit growth and continued excellent credit quality contributed to fiscal second quarter 2008 earnings. For the quarter ended September 30, 2007, net income was $2.4 million, or $0.22 per diluted share, compared to the record earnings of $3.0 million, or $0.26 per diluted share, posted in the second quarter of fiscal 2007. For the first six months of fiscal 2008, net income was $5.3 million, or $0.47 per diluted share, compared to $5.6 million, or $0.49 per diluted share, in the first six months of fiscal 2007. All per share data has been adjusted to reflect the August 2006 2-for-1 stock split.

"While our second quarter profits were below last year's record setting earnings, they reflect the very strong franchise we are building in the healthy Southwestern Washington and metropolitan Portland, Oregon markets," stated Pat Sheaffer, Chairman and CEO. "Leveraging our reputation as a provider of premier customer service has helped us gather low cost deposits and utilize them to fund our healthy and growing loan portfolio."

Second Quarter Fiscal 2008 Highlights

(at or for the period ended September 30, 2007, compared to September 30, 2006)

-

Net income was $2.4 million, or $0.22 per diluted share.

-

Asset quality remains excellent - Non-performing assets are just 0.03% of total assets.

-

Core deposits increased 11%.

-

Net interest margin was 4.72%.

-

Riverview Asset Management Corp. increased assets under management 9.6% to $302.9 million.

-

Asset management fees increased 12.7% to $513,000.

Operating Results

For the second quarter of fiscal 2008, the net interest margin was 4.72% compared to 4.83% in the previous linked quarter and 4.97% in the second fiscal quarter a year ago. For the first six months of fiscal 2008, the net interest margin was 4.78% compared to 5.10% in the first half of fiscal 2007. "The yield curve remained a challenge for us as well as the entire banking industry. We expect improved spreads in light of the recent Federal Reserve rate cut, and anticipate our margin will stabilize or improve as we see the effect of our interest bearing deposits re-price," said Ron Wysaske, President and COO.

Reflecting the impact of the increase in funding costs, net interest income in the second fiscal quarter of 2008 decreased to $8.7 million compared to $9.1 million in the second fiscal quarter a year ago. For the first six months of fiscal 2008, net interest income was $17.5 million, compared to $18.1 million in the first six months of fiscal 2007. Non-interest income was down slightly to $2.2 million for the quarter, compared to $2.3 million a year ago, primarily due to lower mortgage broker loan fees that are included in fees and service charges. However, for the first six months of fiscal 2008, non-interest income increased 3% to $4.5 million compared to $4.4 million for the first six months a year ago, largely due to fee income from Riverview Asset Management Corp., which increased 19% to $1.1 million during the first half of fiscal 2008.

Non-interest expenses were $6.8 million in the second quarter of fiscal 2008, unchanged from the previous linked quarter and an increase from $6.3 million in the second quarter of fiscal 2007. The efficiency ratio was 62.61% for the second quarter, compared to 54.93% in the second quarter a year ago and 61.76% for the first six months of fiscal 2008, compared to 57.84% for the same period a year ago. "We have increased our infrastructure to accommodate expanding our franchise in Southwest Washington and into Oregon in the last six months," said Wysaske. "We expect our efficiency ratio to return to more normalized levels in the second half of the year."

<PAGE>

Riverview Bancorp, Inc 2Q08 Earnings

October 23, 2007

Page 2

Riverview's return on average assets was 1.19% for the second quarter and 1.29% year-to-date, compared to 1.45% and 1.41% for the respective periods last year. Return on average equity was 9.98% for the quarter and 10.58% for the first six months of fiscal 2008, compared to 12.22% and 11.70%, respectively, for the same periods last year.

Balance Sheet Growth

"In spite of a very competitive market for deposits, we have been successful at growing core deposits to fund our loan growth," Wysaske said. "Non-interest checking balances represent 13% of total deposits and interest checking balances represent 20% of total deposits." Total deposits were $660 million at the end of September 2007 compared to $640 million at the end of September 2006. Core deposits, defined as all deposits excluding certificates of deposit, increased 11% over the past year to $480 million, and represent 73% of total deposits. The following table breaks out deposits by category:

|

|

|

|

|

|

At the year

|

|

|

At the six months ended September 30,

|

ended March 31,

|

|

|

2007

|

2006

|

2007

|

|

|

(Dollars in thousands)

|

|

|

|

DEPOSIT DATA

|

|

|

|

|

|

|

|

Interest checking

|

$ 132,340

|

20.06%

|

$ 153,631

|

23.99%

|

$ 144,451

|

21.71%

|

|

Regular savings

|

27,408

|

4.15%

|

32,896

|

5.14%

|

29,472

|

4.43%

|

|

Money market deposit accounts

|

235,091

|

35.63%

|

145,612

|

22.74%

|

205,007

|

30.81%

|

|

Non-interest checking

|

85,492

|

12.96%

|

101,852

|

15.90%

|

86,601

|

13.01%

|

|

Certificates of deposit

|

179,454

|

27.20%

|

206,413

|

32.23%

|

199,874

|

30.04%

|

|

Total deposits

|

$ 659,785

|

100.00%

|

$ 640,404

|

100.00%

|

$ 665,405

|

100.00%

|

|

|

|

|

|

|

|

|

Total assets were $821 million at the end of September 2007, compared to $844 million a year ago.

"During the current quarter we saw our loan growth improve," Wysaske said. "Growth in the loan portfolio will drive revenue growth." Net loans at September 30, 2007 grew 3.6% over the linked June 2007 quarter end. "As our loan portfolio grows, our goal is to keep it well-diversified and maintain our excellent credit quality. Loan growth and excellent credit quality should drive revenue growth going forward," stated Wysaske. Net loans were $687 million at September 30, 2007, compared to $691 million a year ago. Commercial and construction loans account for 89% of the total loan portfolio, similar to last year. The following table breaks out loans by category:

|

|

At the quarter

|

|

At the quarter

|

|

|

ended September 30,

|

|

ended September 30,

|

|

|

2007

|

|

2006

|

|

|

(Dollars in thousands)

|

|

LOAN DATA (1)

|

|

|

|

|

|

|

Commercial and construction

|

|

|

|

|

|

|

Commercial

|

$ 90,515

|

13.00%

|

|

$ 95,689

|

13.69%

|

|

Other real estate mortgage

|

367,380

|

52.75%

|

|

360,756

|

51.62%

|

|

Real estate construction

|

162,429

|

23.32%

|

|

166,233

|

23.78%

|

|

Total commercial and construction

|

620,324

|

89.07%

|

|

622,678

|

89.09%

|

|

Consumer

|

|

|

|

|

|

|

Real estate one-to-four family

|

71,725

|

10.30%

|

|

72,319

|

10.35%

|

|

Other installment

|

4,432

|

0.63%

|

|

3,916

|

0.56%

|

|

Total consumer

|

76,157

|

10.93%

|

|

76,235

|

10.91%

|

|

|

|

|

|

|

|

|

Total loans

|

$ 696,481

|

100.00%

|

|

$ 698,913

|

100.00%

|

|

|

|

|

|

|

|

|

(1) Certain prior period loan balances have been

reclassified to conform to management's current year presentation.

|

Shareholders' Equity

Shareholders' equity was

$92.6 million, compared to $95.8 million a year ago. Book value per share

improved to $8.42 at the end of September 2007, compared to $8.28 a year

earlier, and tangible book value per share improved to $6.01 at

<PAGE>

Riverview Bancorp, Inc 2Q08 Earnings

October 23, 2007

Page 3

quarter-end, compared to $5.97 a year ago. During fiscal

2008, 775,000 shares have been purchased on the open market under the announced

Repurchase Plans. Under the current Repurchase Plan announced June 21, 2007,

there are 225,000 shares remaining to be purchased. Riverview remains a

well-capitalized institution.

Credit Quality and Performance Measures

"Our lending team has done an excellent job at maintaining loan quality," noted Wysaske. "We continue to keep a watchful eye on industry and regional trends and closely monitor credit risk." Riverview has no sub-prime residential real estate loans in portfolio. Non-performing assets were $206,000, or 0.03% of total assets, at September 30, 2007, compared to $1.7 million, or 0.20% of total assets, at September 30, 2006. The allowance for loan losses, including unfunded loan commitments of $422,000, was $9.5 million, or 1.36% of net loans at quarter-end, compared to $8.6 million, or 1.24% of net loans, a year ago.

Conference Call

The management team of Riverview Bancorp, Inc. will host a conference call on Wednesday, October 24, at 8:00 a.m. PDT, to discuss the second quarter results. The conference call can be accessed live by telephone at 303-262-2211. To listen to the call online go the "About Riverview" page of Riverview's website at

www.riverviewbank.com

.

About the Company

Riverview Bancorp, Inc. (

www.riverviewbank.com

) is headquartered in Vancouver, Washington - just north of Portland, Oregon on the I-5 corridor. With assets of $821 million, it is the parent company of the 84 year-old Riverview Community Bank, as well as Riverview Mortgage and Riverview Asset Management Corp. There are 18 branches, including ten in fast growing Clark County, three in the Portland metropolitan area and three lending centers. The Bank offers true community banking services, focusing on providing the highest quality service and financial products to commercial and retail customers.

Statements concerning future performance, developments or events, concerning expectations for growth and market forecasts, and any other guidance on future periods, constitute forward-looking statements, which are subject to a number of risks and uncertainties that might cause actual results to differ materially from stated objectives. These factors include but are not limited to: RVSB's ability to acquire shares according to internal repurchase guidelines, regional economic conditions and the company's ability to efficiently manage expenses. Additional factors that could cause actual results to differ materially are disclosed in Riverview Bancorp's recent filings with the SEC, including but not limited to Annual Reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K.

<PAGE>

Riverview Bancorp, Inc 2Q08 Earnings

October 23, 2007

Page 4

|

RIVERVIEW BANCORP, INC. AND SUBSIDIARY

|

|

|

|

|

|

|

Consolidated Balance Sheets

|

|

|

|

|

|

|

September 30, 2007, March 31, 2007 and September 30, 2006

|

|

|

|

|

|

|

September 30,

|

|

March 31,

|

|

September 30,

|

|

(In thousands, except share data) (Unaudited)

|

2007

|

|

2007

|

|

2006

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash (including interest-earning accounts of $15,271,

$7,818

|

|

|

|

|

|

and $15,198)

|

$ 36,877

|

|

$ 31,423

|

|

$ 43,453

|

|

Loans held for sale

|

604

|

|

-

|

|

197

|

|

Investment securities available for sale, at fair value

|

|

|

|

|

|

|

(amortized cost of $8,735, $19,258 and $23,017)

|

8,761

|

|

19,267

|

|

22,963

|

|

Mortgage-backed securities held to maturity, at amortized

|

|

|

|

|

|

|

cost (fair value of $1,039, $1,243 and $1,495)

|

1,027

|

|

1,232

|

|

1,477

|

|

Mortgage-backed securities available for sale, at fair

value

|

|

|

|

|

|

|

(amortized cost of $6,043, $6,778 and $7,608)

|

5,943

|

|

6,640

|

|

7,404

|

|

Loans receivable (net of allowance for loan losses of

$9,062,

|

|

|

|

|

|

|

$8,653 and $8,263)

|

687,419

|

|

682,951

|

|

690,650

|

|

Real estate and other pers. property owned

|

74

|

|

-

|

|

-

|

|

Prepaid expenses and other assets

|

2,957

|

|

1,905

|

|

2,021

|

|

Accrued interest receivable

|

3,850

|

|

3,822

|

|

4,117

|

|

Federal Home Loan Bank stock, at cost

|

7,350

|

|

7,350

|

|

7,350

|

|

Premises and equipment, net

|

21,336

|

|

21,402

|

|

21,011

|

|

Deferred income taxes, net

|

4,089

|

|

4,108

|

|

3,716

|

|

Mortgage servicing rights, net

|

332

|

|

351

|

|

368

|

|

Goodwill

|

25,572

|

|

25,572

|

|

25,572

|

|

Core deposit intangible, net

|

630

|

|

711

|

|

799

|

|

Bank owned life insurance

|

13,893

|

|

13,614

|

|

13,349

|

|

TOTAL ASSETS

|

$ 820,714

|

|

$ 820,348

|

|

$ 844,447

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES:

|

|

|

|

|

|

|

Deposit accounts

|

$ 659,785

|

|

$ 665,405

|

|

$ 640,404

|

|

Accrued expenses and other liabilities

|

8,982

|

|

9,349

|

|

7,921

|

|

Advance payments by borrowers for taxes and insurance

|

376

|

|

397

|

|

377

|

|

Federal Home Loan Bank advances

|

33,600

|

|

35,050

|

|

90,000

|

|

Junior subordinated debentures

|

22,681

|

|

7,217

|

|

7,217

|

|

Capital lease obligation

|

2,704

|

|

2,721

|

|

2,737

|

|

Total liabilities

|

728,128

|

|

720,139

|

|

748,656

|

|

|

|

|

|

|

|

|

SHAREHOLDERS' EQUITY:

|

|

|

|

|

|

|

Serial preferred stock, $.01 par value; 250,000

authorized,

|

|

|

|

|

|

|

issued and outstanding, none

|

-

|

|

-

|

|

-

|

|

Common stock, $.01 par value; 50,000,000 authorized,

|

|

|

|

|

|

|

September 30, 2007- 10,996,650 issued, 10,996,650

outstanding;

|

110

|

|

117

|

|

116

|

|

March 31, 2007 - 11,707,980 issued, 11,707,980

outstanding;

|

|

|

|

|

|

|

September 30, 2006- 11,575,480 issued, 11,575,472

outstanding;

|

|

|

|

|

|

|

Additional paid-in capital

|

47,953

|

|

58,438

|

|

57,794

|

|

Retained earnings

|

45,629

|

|

42,848

|

|

39,134

|

|

Unearned shares issued to employee stock ownership trust

|

(1,057)

|

|

(1,108)

|

|

(1,083)

|

|

Accumulated other comprehensive loss

|

(49)

|

|

(86)

|

|

(170)

|

|

Total shareholders' equity

|

92,586

|

|

100,209

|

|

95,791

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY

|

$ 820,714

|

|

$ 820,348

|

|

$ 844,447

|

|

|

|

|

|

|

|

<PAGE>

Riverview Bancorp, Inc 2Q08 Earnings

October 23, 2007

Page 5

RIVERVIEW BANCORP, INC. AND SUBSIDIARY

FINANCIAL HIGHLIGHTS

(Unaudited)

|

RIVERVIEW BANCORP, INC. AND SUBSIDIARY

|

|

|

|

|

|

|

Consolidated Statements of Income for the Three and Six

Months

|

Three Months Ended

|

Six Months Ended

|

|

Ended September 30, 2007 and 2006

|

September 30,

|

|

September 30,

|

|

(In thousands, except share data) (Unaudited)

|

2007

|

2006

|

|

2007

|

2006

|

|

INTEREST INCOME:

|

|

|

|

|

|

|

Interest and fees on loans receivable

|

$ 14,631

|

$ 14,834

|

|

$ 29,511

|

$ 28,603

|

|

Interest on investment securities-taxable

|

140

|

221

|

|

312

|

442

|

|

Interest on investment securities-non taxable

|

38

|

42

|

|

76

|

84

|

|

Interest on mortgage-backed securities

|

85

|

109

|

|

176

|

223

|

|

Other interest and dividends

|

420

|

96

|

|

663

|

148

|

|

Total interest income

|

15,314

|

15,302

|

|

30,738

|

29,500

|

|

|

|

|

|

|

|

|

INTEREST EXPENSE:

|

|

|

|

|

|

|

Interest on deposits

|

6,033

|

4,908

|

|

12,223

|

9,130

|

|

Interest on borrowings

|

587

|

1,267

|

|

993

|

2,230

|

|

Total interest expense

|

6,620

|

6,175

|

|

13,216

|

11,360

|

|

Net interest income

|

8,694

|

9,127

|

|

17,522

|

18,140

|

|

Less provision for loan losses

|

400

|

600

|

|

450

|

950

|

|

|

|

|

|

|

|

|

Net interest income after provision for loan losses

|

8,294

|

8,527

|

|

17,072

|

17,190

|

|

|

|

|

|

|

|

|

NON-INTEREST INCOME:

|

|

|

|

|

|

|

Fees and service charges

|

1,382

|

1,449

|

|

2,809

|

2,780

|

|

Asset management fees

|

513

|

455

|

|

1,061

|

891

|

|

Gain on sale of loans held for sale

|

92

|

111

|

|

183

|

183

|

|

Loan servicing income

|

27

|

36

|

|

66

|

81

|

|

Gain on sale of credit card portfolio

|

-

|

66

|

|

-

|

133

|

|

Bank owned life insurance income

|

140

|

129

|

|

279

|

257

|

|

Other

|

62

|

45

|

|

120

|

81

|

|

Total non-interest income

|

2,216

|

2,291

|

|

4,518

|

4,406

|

|

|

|

|

|

|

|

|

NON-INTEREST EXPENSE:

|

|

|

|

|

|

|

Salaries and employee benefits

|

3,908

|

3,532

|

|

7,876

|

7,367

|

|

Occupancy and depreciation

|

1,244

|

1,135

|

|

2,546

|

2,209

|

|

Data processing

|

208

|

222

|

|

376

|

557

|

|

Amortization of core deposit intangible

|

38

|

46

|

|

80

|

96

|

|

Advertising and marketing expense

|

370

|

356

|

|

652

|

658

|

|

FDIC insurance premium

|

19

|

13

|

|

38

|

37

|

|

State and local taxes

|

178

|

133

|

|

349

|

288

|

|

Telecommunications

|

92

|

101

|

|

196

|

213

|

|

Professional fees

|

172

|

198

|

|

395

|

376

|

|

Other

|

602

|

536

|

|

1,104

|

1,240

|

|

Total non-interest expense

|

6,831

|

6,272

|

|

13,612

|

13,041

|

|

|

|

|

|

|

|

|

INCOME BEFORE INCOME TAXES

|

3,679

|

4,546

|

|

7,978

|

8,555

|

|

PROVISION FOR INCOME TAXES

|

1,249

|

1,573

|

|

2,709

|

2,951

|

|

NET INCOME

|

$ 2,430

|

$ 2,973

|

|

$ 5,269

|

$ 5,604

|

|

|

|

|

|

|

|

|

Earnings per common share:

|

|

|

|

|

|

|

Basic

|

$ 0.22

|

$ 0.26

|

|

$ 0.47

|

$ 0.50

|

|

Diluted

|

0.22

|

0.26

|

|

0.47

|

0.49

|

|

Weighted average number of shares outstanding:

|

|

|

|

|

|

|

Basic

|

10,904,464

|

11,302,927

|

|

11,146,813

|

11,289,143

|

|

Diluted

|

11,026,598

|

11,473,750

|

|

11,275,562

|

11,463,125

|

<PAGE>

Riverview Bancorp, Inc 2Q08 Earnings

October 23, 2007

Page 6

RIVERVIEW BANCORP, INC. AND SUBSIDIARY

FINANCIAL HIGHLIGHTS

|

|

|

At or for the six months ended September 30,

|

At or for the year

ended March 31,

|

|

|

|

2007

|

|

2006

|

|

2007

|

|

FINANCIAL CONDITION DATA

|

|

(Dollars in thousands)

|

|

|

|

Average interest-earning assets

|

|

$ 732,999

|

|

$ 711,372

|

|

$ 731,089

|

|

|

Average interest-bearing liabilities

|

|

621,295

|

|

592,679

|

|

614,546

|

|

|

Net average earning assets

|

|

111,704

|

|

118,693

|

|

116,543

|

|

|

Non-performing assets

|

|

206

|

|

1,704

|

|

226

|

|

|

Non-performing loans

|

|

132

|

|

1,704

|

|

226

|

|

|

Allowance for loan losses

|

|

9,062

|

|

8,263

|

|

8,653

|

|

|

Allowance for loan losses and unfunded loan

|

|

|

|

|

|

|

commitments

|

|

9,484

|

|

8,648

|

|

9,033

|

|

|

Average interest-earning assets to average

|

|

|

|

|

|

|

interest-bearing liabilities

|

|

117.98%

|

|

120.03%

|

|

118.96%

|

|

|

Allowance for loan losses to

|

|

|

|

|

|

|

|

|

non-performing loans

|

|

6,865.15%

|

|

484.92%

|

|

3,828.76%

|

|

|

Allowance for loan losses to net loans

|

1.30%

|

|

1.18%

|

|

1.25%

|

|

|

Allowance for loan losses and

|

|

|

|

|

|

|

|

|

unfunded loan commitments to net loans

|

1.36%

|

|

1.24%

|

|

1.31%

|

|

|

Non-performing loans to total net loans

|

0.02%

|

|

0.24%

|

|

0.03%

|

|

|

Non-performing assets to total assets

|

0.03%

|

|

0.20%

|

|

0.03%

|

|

|

Shareholders' equity to assets

|

|

11.28%

|

|

11.34%

|

|

12.22%

|

|

|

Number of banking facilities

|

|

19

|

|

18

|

|

19

|

|

|

|

|

|

|

|

|

|

|

|

LOAN DATA (1)

|

|

|

|

|

|

|

|

|

Commercial and construction

|

|

|

|

|

|

|

|

|

Commercial

|

|

$ 90,515

|

13.00%

|

$ 95,689

|

13.69%

|

$ 91,174

|

13.18%

|

|

Other real estate mortgage

|

|

367,380

|

52.75%

|

360,756

|

51.62%

|

360,930

|

52.19%

|

|

Real estate construction

|

|

162,429

|

23.32%

|

166,233

|

23.78%

|

166,073

|

24.01%

|

|

Total commercial and construction

|

620,324

|

89.07%

|

622,678

|

89.09%

|

618,177

|

89.38%

|

|

Consumer

|

|

|

|

|

|

|

|

|

Real estate one-to-four family

|

|

71,725

|

10.30%

|

72,319

|

10.35%

|

69,808

|

10.10%

|

|

Other installment

|

|

4,432

|

0.63%

|

3,916

|

0.56%

|

3,619

|

0.52%

|

|

Total consumer

|

|

76,157

|

10.93%

|

76,235

|

10.91%

|

73,427

|

10.62%

|

|

|

|

|

|

|

|

|

|

|

Total loans

|

|

696,481

|

100.00%

|

698,913

|

100.00%

|

691,604

|

100.00%

|

|

|

|

|

|

|

|

|

|

|

Less:

|

|

|

|

|

|

|

|

|

Allowance for loan losses

|

|

9,062

|

|

8,263

|

|

8,653

|

|

|

Loans receivable, net

|

|

$ 687,419

|

|

$ 690,650

|

|

$ 682,951

|

|

|

|

|

|

|

|

|

|

|

|

(1) Certain prior period loan balances have been reclassified to conform to management's current year presentation.

|

<PAGE>

Riverview Bancorp, Inc 2Q08 Earnings

October 23, 2007

Page 7

|

RIVERVIEW BANCORP, INC. AND SUBSIDIARY

|

|

|

|

|

|

FINANCIAL HIGHLIGHTS

|

|

|

|

|

|

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPOSITION OF COMMERCIAL AND CONSTRUCTION LOAN TYPES

BASED ON LOAN PURPOSE

|

|

|

|

|

Commercial

& Construction

Total

|

Commercial

|

Other

Real Estate

Mortgage

|

Real

Estate

Construction

|

|

September 30, 2007

|

(Dollars in thousands)

|

|

|

|

|

Commercial

|

$ 90,515

|

$ 90,515

|

$ -

|

$ -

|

|

|

|

Commercial construction

|

47,829

|

-

|

-

|

47,829

|

|

|

|

Office buildings

|

77,126

|

-

|

77,126

|

-

|

|

|

|

Warehouse/industrial

|

34,892

|

-

|

34,892

|

-

|

|

|

|

Retail/shopping centers/strip malls

|

66,890

|

-

|

66,890

|

-

|

|

|

|

Assisted living facilities

|

11,044

|

-

|

11,044

|

-

|

|

|

|

Single purpose facilities

|

46,248

|

-

|

46,248

|

-

|

|

|

|

Land

|

104,134

|

-

|

104,134

|

-

|

|

|

|

Multi-family

|

27,046

|

-

|

27,046

|

-

|

|

|

|

One-to-four family

|

114,600

|

-

|

-

|

114,600

|

|

|

|

Total

|

$ 620,324

|

$ 90,515

|

$ 367,380

|

$ 162,429

|

|

|

|

|

|

|

|

|

|

|

|

March 31, 2007

|

(Dollars in thousands)

|

|

|

|

Commercial

|

$ 91,174

|

$ 91,174

|

$ -

|

$ -

|

|

|

|

Commercial construction

|

56,226

|

-

|

-

|

56,226

|

|

|

|

Office buildings

|

62,310

|

-

|

62,310

|

-

|

|

|

|

Warehouse/industrial

|

40,238

|

-

|

40,238

|

-

|

|

|

|

Retail/shopping centers/strip malls

|

70,219

|

-

|

70,219

|

-

|

|

|

|

Assisted living facilities

|

11,381

|

-

|

11,381

|

-

|

|

|

|

Single purpose facilities

|

41,501

|

-

|

41,501

|

-

|

|

|

|

Land

|

103,240

|

-

|

103,240

|

-

|

|

|

|

Multi-family

|

32,041

|

-

|

32,041

|

-

|

|

|

|

One-to-four family

|

109,847

|

-

|

-

|

109,847

|

|

|

|

Total

|

$ 618,177

|

$ 91,174

|

$ 360,930

|

$ 166,073

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At the six months ended September 30,

|

At the year

ended March 31,

|

|

|

2007

|

2006

|

2007

|

|

|

(Dollars in thousands)

|

|

|

|

DEPOSIT DATA

|

|

|

|

|

|

|

|

Interest checking

|

$ 132,340

|

20.06%

|

$ 153,631

|

23.99%

|

$ 144,451

|

21.71%

|

|

Regular savings

|

27,408

|

4.15%

|

32,896

|

5.14%

|

29,472

|

4.43%

|

|

Money market deposit accounts

|

235,091

|

35.63%

|

145,612

|

22.74%

|

205,007

|

30.81%

|

|

Non-interest checking

|

85,492

|

12.96%

|

101,852

|

15.90%

|

86,601

|

13.01%

|

|

Certificates of deposit

|

179,454

|

27.20%

|

206,413

|

32.23%

|

199,874

|

30.04%

|

|

Total deposits

|

$ 659,785

|

100.00%

|

$ 640,404

|

100.00%

|

$ 665,405

|

100.00%

|

|

|

|

|

|

|

|

|

<PAGE>

Riverview Bancorp, Inc 2Q08 Earnings

October 23, 2007

Page 8

|

RIVERVIEW BANCORP, INC. AND SUBSIDIARY

|

|

|

|

|

FINANCIAL HIGHLIGHTS

|

|

|

|

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At or for the three

months ended September 30,

|

At or for the six

months ended September 30,

|

|

SELECTED OPERATING DATA

|

2007

|

2006

|

2007

|

2006

|

|

|

(Dollars in thousands, except share data)

|

|

|

Efficiency ratio (4)

|

62.61%

|

54.93%

|

61.76%

|

57.84%

|

|

Efficiency ratio net of intangible amortization

|

61.98%

|

54.31%

|

61.15%

|

57.21%

|

|

Coverage ratio (6)

|

127.27%

|

145.52%

|

128.72%

|

139.10%

|

|

Coverage ratio net of intangible amortization

|

127.98%

|

146.59%

|

129.49%

|

140.13%

|

|

Return on average assets (1)

|

1.19%

|

1.45%

|

1.29%

|

1.41%

|

|

Return on average equity (1)

|

9.98%

|

12.22%

|

10.58%

|

11.70%

|

|

Average rate earned on interest-earned assets

|

8.31%

|

8.32%

|

8.37%

|

8.28%

|

|

Average rate paid on interest-bearing liabilities

|

4.22%

|

4.01%

|

4.24%

|

3.82%

|

|

Spread (7)

|

4.09%

|

4.31%

|

4.13%

|

4.46%

|

|

Net interest margin

|

4.72%

|

4.97%

|

4.78%

|

5.10%

|

|

|

|

|

|

|

|

PER SHARE DATA

|

|

|

|

|

|

Basic earnings per share (2)

|

$ 0.22

|

$ 0.26

|

$ 0.47

|

$ 0.50

|

|

Diluted earnings per share (3)

|

0.22

|

0.26

|

0.47

|

0.49

|

|

Book value per share (5)

|

8.42

|

8.28

|

8.42

|

8.28

|

|

Tangible book value per share (5)

|

6.01

|

5.97

|

6.01

|

5.97

|

|

Market price per share:

|

|

|

|

|

|

High for the period

|

$ 15.73

|

$ 13.65

|

$ 16.28

|

$ 13.65

|

|

Low for the period

|

13.30

|

12.58

|

13.30

|

12.14

|

|

Close for period end

|

14.85

|

13.50

|

14.85

|

13.50

|

|

Cash dividends declared per share

|

0.110

|

0.100

|

0.220

|

0.195

|

|

|

|

|

|

|

|

Average number of shares outstanding:

|

|

|

|

|

|

Basic (2)

|

10,904,464

|

11,302,927

|

11,146,813

|

11,289,143

|

|

Diluted (3)

|

11,026,598

|

11,473,750

|

11,275,562

|

11,463,125

|

|

|

|

|

(1)

|

Amounts are annualized.

|

|

(2)

|

Amounts calculated exclude ESOP shares not committed to be released.

|

|

(3)

|

Amounts calculated exclude ESOP shares not committed to be released and include common stock equivalents.

|

|

(4)

|

Non-interest expense divided by net interest income and non-interest income.

|

|

(5)

|

Amounts calculated include ESOP shares not committed to be released.

|

|

(6)

|

Net interest income divided by non-interest expense.

|

|

(7)

|

Yield on interest-earning assets less cost of funds on interest bearing liabilities.

|

<PAGE>

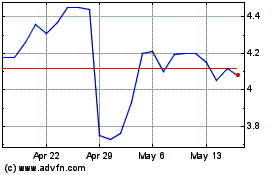

Riverview Bancorp (NASDAQ:RVSB)

Historical Stock Chart

From Jun 2024 to Jul 2024

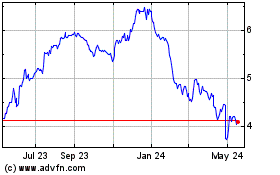

Riverview Bancorp (NASDAQ:RVSB)

Historical Stock Chart

From Jul 2023 to Jul 2024