Surgery Partners, Inc. (NASDAQ:SGRY) ("Surgery Partners" or

the "Company"), a leading short-stay surgical facility owner and

operator, today announced results for the third quarter

ended September 30, 2024.

- Revenues increased 14.3% to $770.4

million compared to the prior year period

- Same-facility revenues increased

4.2%

- Same-facility cases

increased 3.7%

- Net loss attributable to Surgery

Partners, Inc. was $31.7 million

- Adjusted EBITDA was

$128.6 million, representing 21.9% growth compared to the prior

year period

- Adjusted EBITDA

margin was 16.7%, expanding 100 basis points from the prior year

period

- Full year 2024

revenue and Adjusted EBITDA guidance reaffirmed at greater than

$3.075 billion and greater than $508 million,

respectively

Wayne DeVeydt, Executive Chairman of the Board of

Surgery Partners, noted, "We are proud to report another quarter of

strong growth in Adjusted EBITDA and revenue, both of which were in

line with our expectations. This growth is derived from a

combination of core organic growth and inorganic growth strategies

in line with our long-term growth algorithm."

Eric Evans, Chief Executive Officer, stated,

"Surgical case volume, particularly in higher acuity and

strategically important growth areas, remained strong this quarter.

Together with recent acquisitions, we remain well positioned to

continue to benefit from the migration of surgical cases to the

optimal site of care and to deliver sustained mid-teens Adjusted

EBITDA growth.”

Dave Doherty, Chief Financial Officer, commented,

"We ended the quarter with $222 million of consolidated cash and

revolver capacity of $596 million. Combined with the actions we

took late last year and earlier this year to mitigate exposure to

refinancing and interest rates, our balance sheet can sustain our

future growth opportunities."

Third Quarter

2024 Results

Revenues for the third quarter of 2024 increased

14.3% to $770.4 million from $674.1 million for the third quarter

of 2023. Same-facility revenues for the third quarter of 2024

increased 4.2% from the same period last year, with a 0.5% increase

in revenue per case and a 3.7% increase in same-facility cases. For

the third quarter of 2024, the Company’s Adjusted EBITDA was $128.6

million, compared to $105.5 million for the same period last

year.

Year-to-Date 2024

Results

Revenues year-to-date 2024 increased 12.1% to

$2,249.9 million from $2,007.9 million for the 2023 period.

Same-facility revenues for year-to-date 2024 increased 8.7% from

the same period last year, with a 5.2% increase in revenue per case

and a 3.4% increase in same-facility cases. For year-to-date 2024,

the Company’s Adjusted EBITDA was $344.4 million, compared to

$295.8 million for the same period last year.

Liquidity

Surgery Partners had cash and cash equivalents of

$221.8 million and $595.8 million of borrowing capacity under its

revolving credit facility at September 30, 2024. Cash flows

from operating activities was $65.2 million for the third quarter

of 2024, compared to $104.6 million in the prior year quarter. The

year-over-year change is due to increased transaction-related

costs, the timing of routine transactions involving working capital

and the impact of Hurricane Helene on collections.

Year-to-date, operating cash flows were $188.7

million compared to $231.2 million in the prior year period.

The Company’s ratio of total net debt to EBITDA, as

calculated under the Company’s credit agreement, was approximately

3.8x at the end of the third quarter of 2024.

2024 Outlook

The Company reaffirmed its outlook for 2024

revenues and Adjusted EBITDA to be greater than $3.075 billion

and greater than $508 million, respectively.

Conference Call Information

Surgery Partners will hold a conference call today,

November 12, 2024 at 8:30 a.m. (Eastern Time). The conference

call can be accessed live over the phone by dialing 1-877-451-6152,

or for international callers, 1-201-389-0879. A replay will be

available three hours after the call and can be accessed by dialing

1-844-512-2921, or for international callers, 1-412-317-6671. The

passcode for the live call and the replay is 13749078. The replay

will be available until November 26, 2024.

Interested investors and other parties may also

listen to a simultaneous webcast of the conference call by logging

onto the Investor Relations section of the Company's website at

www.surgerypartners.com. The replay will also be available on this

same website for a limited time following the call.

To learn more about Surgery Partners, please visit

the Company's website at www.surgerypartners.com. Surgery Partners

uses its website as a channel of distribution for material Company

information. Financial and other material information regarding

Surgery Partners is routinely posted on the Company's website and

is readily accessible.

About Surgery Partners

Headquartered in Brentwood, Tennessee, Surgery

Partners is a leading healthcare services company with a

differentiated outpatient delivery model focused on providing high

quality, cost effective solutions for surgical and related

ancillary care in support of both patients and physicians. Founded

in 2004, Surgery Partners is one of the largest and fastest growing

surgical services businesses in the country, with more than 200

locations in 33 states, including ambulatory surgery centers,

surgical hospitals, multi-specialty physician practices and urgent

care facilities. For additional information, visit

www.surgerypartners.com.

Forward-Looking Statements

This press release contains forward-looking

statements, including those regarding growth, our anticipated

operating results for future periods and other similar statements.

These statements can be identified by the use of words such as

"believes," "anticipates," "expects," "intends," "plans,"

"continues," "estimates," "predicts," "projects," "forecasts,"

"may," "could," and similar expressions. All forward-looking

statements are based on current expectations and beliefs as of the

date of this release and are subject to risks, uncertainties and

other factors that may cause actual results to differ materially

from the expectations discussed in, or implied by, the

forward-looking statements. Many of these factors are beyond our

ability to control or predict including, without limitation,

reductions in payments from government health care programs and

private insurance payors, such as health maintenance organizations,

preferred provider organizations, and other managed care

organizations and employers; our ability to contract with private

insurance payors; changes in our payor mix or surgical case mix;

failure to maintain or develop relationships with physicians on

beneficial or favorable terms, or at all; the impact of payor

controls designed to reduce the number of surgical procedures; our

efforts to integrate operations of acquired or developed businesses

and surgical facilities, attract new physician partners, or acquire

additional surgical facilities; supply chain issues, including

shortages or quality control issues with surgery-related products,

equipment and medical supplies; competition for physicians, nurses,

strategic relationships, acquisitions and managed care contracts;

our ability to attract and retain qualified health care

professionals; our ability to enforce non-compete restrictions

against our physicians; our ability to manage material liabilities

whether known or unknown incurred as a result of acquiring or

operating surgical facilities; the impact of future legislation and

other health care regulatory reform actions, and the effect of that

legislation and other regulatory actions on our business; our

ability to comply with current health care laws and regulations;

the outcome of legal and regulatory proceedings that have been or

may be brought against us; the impact of cybersecurity attacks or

intrusions, changes in the regulatory, economic and other

conditions of the states where our surgical facilities are located;

our indebtedness; the social and economic impact of a pandemic,

epidemic or outbreak of a contagious disease on our business; and

the risks and uncertainties identified and discussed from time to

time in the Company’s reports filed with the SEC, including in Item

1A under the heading "Risk Factors" in the Company’s Annual Report

on Form 10-K for the year ended December 31, 2023 and other reports

filed with the SEC. Except as required by law, the Company

undertakes no obligation to revise or update publicly any

forward-looking statements to reflect events or circumstances after

the date of this report, or to reflect the occurrence of

unanticipated events or circumstances.

Use of Non-GAAP Financial

Measures

In addition to the results prepared in accordance

with generally accepted accounting principles in the United

States ("GAAP") provided throughout this press release,

Surgery Partners has presented the following non-GAAP financial

measures: Adjusted net income (loss) attributable to common

stockholders, Adjusted net income (loss) per share attributable to

common stockholders, Adjusted EBITDA, and Adjusted EBITDA related

to unconsolidated affiliates, which exclude various items detailed

in the "Reconciliation of Non-GAAP Financial Measures" below.

These non-GAAP financial measures are not intended

to replace financial performance measures determined in accordance

with GAAP. Rather, they are presented as supplemental measures of

the Company's performance that management believes may enhance the

evaluation of the Company's ongoing operating results. These

non-GAAP financial measures are not presented in accordance with

GAAP, and the Company’s computation of these non-GAAP financial

measures may vary from similar measures used by other companies.

These measures have limitations as an analytical tool and should

not be considered in isolation or as a substitute or alternative to

revenue, net income or loss, operating income or loss, cash flows

from operating activities, total indebtedness or any other measures

of operating performance, liquidity or indebtedness derived in

accordance with GAAP.

|

SURGERY PARTNERS, INC. Selected Consolidated

Financial Data(Dollars in millions, except per

share amounts, shares in

thousands)(Unaudited) |

| |

|

|

|

|

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| |

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

770.4 |

|

|

$ |

674.1 |

|

|

$ |

2,249.9 |

|

|

$ |

2,007.9 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

Salaries and benefits |

|

|

228.4 |

|

|

|

195.0 |

|

|

|

666.8 |

|

|

|

592.4 |

|

|

Supplies |

|

|

201.4 |

|

|

|

179.2 |

|

|

|

589.9 |

|

|

|

549.8 |

|

|

Professional and medical fees |

|

|

91.0 |

|

|

|

72.4 |

|

|

|

266.0 |

|

|

|

219.9 |

|

|

Lease expense |

|

|

23.9 |

|

|

|

21.1 |

|

|

|

67.5 |

|

|

|

64.3 |

|

|

Other operating expenses |

|

|

48.2 |

|

|

|

40.6 |

|

|

|

147.7 |

|

|

|

127.6 |

|

|

Cost of revenues |

|

|

592.9 |

|

|

|

508.3 |

|

|

|

1,737.9 |

|

|

|

1,554.0 |

|

|

General and administrative expenses |

|

|

29.2 |

|

|

|

36.8 |

|

|

|

102.7 |

|

|

|

100.0 |

|

|

Depreciation and amortization |

|

|

50.2 |

|

|

|

28.9 |

|

|

|

118.7 |

|

|

|

87.0 |

|

|

Transaction and integration costs |

|

|

29.4 |

|

|

|

12.8 |

|

|

|

66.1 |

|

|

|

37.3 |

|

|

Net loss on disposals, consolidations and deconsolidations |

|

|

14.7 |

|

|

|

5.8 |

|

|

|

21.5 |

|

|

|

7.5 |

|

|

Equity in earnings of unconsolidated affiliates |

|

|

(5.2 |

) |

|

|

(3.5 |

) |

|

|

(12.3 |

) |

|

|

(9.4 |

) |

|

Litigation settlement |

|

|

0.5 |

|

|

|

3.6 |

|

|

|

(0.8 |

) |

|

|

8.1 |

|

|

Loss on debt extinguishment |

|

|

— |

|

|

|

— |

|

|

|

5.1 |

|

|

|

— |

|

|

Other income, net |

|

|

(2.2 |

) |

|

|

(1.2 |

) |

|

|

(10.7 |

) |

|

|

(3.2 |

) |

| |

|

|

709.5 |

|

|

|

591.5 |

|

|

|

2,028.2 |

|

|

|

1,781.3 |

|

|

Operating income |

|

|

60.9 |

|

|

|

82.6 |

|

|

|

221.7 |

|

|

|

226.6 |

|

|

Interest expense, net |

|

|

(50.0 |

) |

|

|

(49.8 |

) |

|

|

(148.8 |

) |

|

|

(144.3 |

) |

|

Income before income taxes |

|

|

10.9 |

|

|

|

32.8 |

|

|

|

72.9 |

|

|

|

82.3 |

|

|

Income tax (expense) benefit |

|

|

(4.5 |

) |

|

|

(3.1 |

) |

|

|

(13.8 |

) |

|

|

6.3 |

|

|

Net income |

|

|

6.4 |

|

|

|

29.7 |

|

|

|

59.1 |

|

|

|

88.6 |

|

|

Less: Net income attributable to non-controlling interests |

|

|

(38.1 |

) |

|

|

(34.6 |

) |

|

|

(118.7 |

) |

|

|

(99.5 |

) |

|

Net loss attributable to Surgery Partners, Inc. |

|

$ |

(31.7 |

) |

|

$ |

(4.9 |

) |

|

$ |

(59.6 |

) |

|

$ |

(10.9 |

) |

| |

|

|

|

|

|

|

|

|

|

Net loss per share attributable to common stockholders |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.25 |

) |

|

$ |

(0.04 |

) |

|

$ |

(0.47 |

) |

|

$ |

(0.09 |

) |

|

Diluted (1) |

|

$ |

(0.25 |

) |

|

$ |

(0.04 |

) |

|

$ |

(0.47 |

) |

|

$ |

(0.09 |

) |

|

Weighted average common shares outstanding |

|

|

|

|

|

|

|

|

|

Basic |

|

|

126,172 |

|

|

|

125,747 |

|

|

|

126,093 |

|

|

|

125,559 |

|

|

Diluted (1) |

|

|

126,172 |

|

|

|

125,747 |

|

|

|

126,093 |

|

|

|

125,559 |

|

(1) The impact of potentially

dilutive securities for all periods was not considered because the

effect would be anti-dilutive.

|

SURGERY PARTNERS, INC. Selected Financial

and Operating Data(Dollars in millions, except per

case and per share

amounts)(Unaudited) |

| |

|

|

|

|

| |

|

September 30,2024 |

|

December 31,2023 |

| |

|

|

|

|

|

Balance Sheet Data (at period end): |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

221.8 |

|

|

$ |

195.9 |

|

|

Total current assets |

|

|

1,035.8 |

|

|

|

895.0 |

|

|

Total assets |

|

|

7,534.4 |

|

|

|

6,876.7 |

|

| |

|

|

|

|

|

Current maturities of long-term debt |

|

|

97.3 |

|

|

|

73.3 |

|

|

Total current liabilities |

|

|

575.2 |

|

|

|

523.0 |

|

|

Long-term debt, less current maturities |

|

|

3,094.2 |

|

|

|

2,701.8 |

|

|

Total liabilities |

|

|

3,986.1 |

|

|

|

3,514.8 |

|

| |

|

|

|

|

|

Non-controlling interests—redeemable |

|

|

436.4 |

|

|

|

327.4 |

|

| |

|

|

|

|

|

Total Surgery Partners, Inc. stockholders' equity |

|

|

1,896.5 |

|

|

|

1,987.2 |

|

|

Non-controlling interests—non-redeemable |

|

|

1,215.4 |

|

|

|

1,047.3 |

|

|

Total stockholders' equity |

|

|

3,111.9 |

|

|

|

3,034.5 |

|

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| |

|

|

|

|

|

|

|

|

|

Cash Flow Data: |

|

|

|

|

|

|

|

|

|

Net cash provided by (used in): |

|

|

|

|

|

|

|

|

|

Operating activities |

|

$ |

65.2 |

|

|

$ |

104.6 |

|

|

$ |

188.7 |

|

|

$ |

231.2 |

|

|

Investing activities |

|

|

(49.6 |

) |

|

|

(25.6 |

) |

|

|

(376.8 |

) |

|

|

(167.5 |

) |

|

Purchases of property and equipment |

|

|

(20.2 |

) |

|

|

(18.9 |

) |

|

|

(68.1 |

) |

|

|

(69.0 |

) |

|

Payments for acquisitions, net of cash acquired |

|

|

(26.6 |

) |

|

|

(5.3 |

) |

|

|

(291.2 |

) |

|

|

(48.8 |

) |

|

Purchases of equity investments |

|

|

— |

|

|

|

(1.8 |

) |

|

|

(1.7 |

) |

|

|

(50.2 |

) |

|

Financing activities |

|

|

(7.3 |

) |

|

|

(20.4 |

) |

|

|

214.0 |

|

|

|

(110.6 |

) |

|

Distributions to non-controlling interest holders |

|

|

(41.7 |

) |

|

|

(34.1 |

) |

|

|

(122.4 |

) |

|

|

(111.0 |

) |

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| |

|

|

|

|

|

|

|

|

|

Other Data: |

|

|

|

|

|

|

|

|

|

Number of surgical facilities as of the end of period |

|

|

166 |

|

|

|

152 |

|

|

|

166 |

|

|

|

152 |

|

|

Number of consolidated surgical facilities as of the end of

period |

|

|

123 |

|

|

|

119 |

|

|

|

123 |

|

|

|

119 |

|

| |

|

|

|

|

|

|

|

|

|

Cases |

|

|

162,635 |

|

|

|

146,514 |

|

|

|

482,547 |

|

|

|

452,653 |

|

|

Revenue per case |

|

$ |

4,737 |

|

|

$ |

4,601 |

|

|

$ |

4,663 |

|

|

$ |

4,436 |

|

|

Adjusted EBITDA (1) |

|

$ |

128.6 |

|

|

$ |

105.5 |

|

|

$ |

344.4 |

|

|

$ |

295.8 |

|

|

Adjusted EBITDA margin (2) |

|

|

16.7 |

% |

|

|

15.7 |

% |

|

|

15.3 |

% |

|

|

14.7 |

% |

|

Adjusted net income per share attributable to common stockholders -

Basic (1) |

|

$ |

0.19 |

|

|

$ |

0.19 |

|

|

$ |

0.50 |

|

|

$ |

0.56 |

|

|

Adjusted net income per share attributable to common stockholders -

Diluted (1) |

|

$ |

0.19 |

|

|

$ |

0.19 |

|

|

$ |

0.49 |

|

|

$ |

0.55 |

|

(1) A reconciliation of these non-GAAP

financial measures appears below.

(2) Defined as Adjusted EBITDA as a % of

Revenues.

|

SURGERY PARTNERS, INC. Supplemental

Information(Dollars in millions, except per case

amounts)(Unaudited) |

| |

|

|

|

|

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| |

|

|

|

|

|

|

|

|

|

Same-facility Information

(1): |

|

|

|

|

|

|

|

|

|

Cases |

|

|

176,650 |

|

|

|

167,646 |

|

|

|

515,642 |

|

|

|

496,135 |

|

|

Case growth |

|

|

5.4 |

% |

|

|

N/A |

|

|

|

3.9 |

% |

|

|

N/A |

|

|

Revenue per case |

|

$ |

4,717 |

|

|

$ |

4,695 |

|

|

$ |

4,463 |

|

|

$ |

4,244 |

|

|

Revenue per case growth |

|

|

0.5 |

% |

|

|

N/A |

|

|

|

5.2 |

% |

|

|

N/A |

|

|

Number of work days in the period |

|

|

64 |

|

|

|

63 |

|

|

|

192 |

|

|

|

191 |

|

|

Case growth (days adjusted) |

|

|

3.7 |

% |

|

|

N/A |

|

|

|

3.4 |

% |

|

|

N/A |

|

|

Revenue growth (days adjusted) |

|

|

4.2 |

% |

|

|

N/A |

|

|

|

8.7 |

% |

|

|

N/A |

|

(1) Same-facility information includes

cases and revenues from our consolidated and non-consolidated

surgical facilities (excluding facilities acquired in new markets

or divested during the current and prior periods).

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| |

|

|

|

|

|

|

|

|

|

Segment Revenues: |

|

|

|

|

|

|

|

|

|

Surgical Facility Services |

|

$ |

735.4 |

|

|

$ |

657.3 |

|

|

$ |

2,158.5 |

|

|

$ |

1,956.5 |

|

|

Ancillary Services |

|

|

35.0 |

|

|

|

16.8 |

|

|

|

91.4 |

|

|

|

51.4 |

|

|

Total revenues |

|

$ |

770.4 |

|

|

$ |

674.1 |

|

|

$ |

2,249.9 |

|

|

$ |

2,007.9 |

|

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| |

|

|

|

|

|

|

|

|

|

Adjusted EBITDA: |

|

|

|

|

|

|

|

|

|

Surgical Facility Services |

|

$ |

149.6 |

|

|

$ |

138.6 |

|

|

$ |

419.3 |

|

|

$ |

384.1 |

|

|

Ancillary Services |

|

|

0.7 |

|

|

|

(1.2 |

) |

|

|

(0.6 |

) |

|

|

(2.7 |

) |

|

All other |

|

|

(21.7 |

) |

|

|

(31.9 |

) |

|

|

(74.3 |

) |

|

|

(85.6 |

) |

|

Total Adjusted EBITDA |

|

$ |

128.6 |

|

|

$ |

105.5 |

|

|

$ |

344.4 |

|

|

$ |

295.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SURGERY PARTNERS,

INC.Reconciliation of Non-GAAP Financial

Measures(Dollars in millions, except per share

amounts, shares in

thousands)(Unaudited)

The following table reconciles Adjusted EBITDA to

income before income taxes in the reported consolidated financial

information, the most directly comparable GAAP financial

measure:

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| |

|

|

|

|

|

|

|

|

|

Income before income taxes |

|

$ |

10.9 |

|

|

$ |

32.8 |

|

|

$ |

72.9 |

|

|

$ |

82.3 |

|

| |

|

|

|

|

|

|

|

|

|

Net income attributable to non-controlling interests |

|

|

(38.1 |

) |

|

|

(34.6 |

) |

|

|

(118.7 |

) |

|

|

(99.5 |

) |

|

Interest expense, net |

|

|

50.0 |

|

|

|

49.8 |

|

|

|

148.8 |

|

|

|

144.3 |

|

|

Depreciation and amortization |

|

|

50.2 |

|

|

|

28.9 |

|

|

|

118.7 |

|

|

|

87.0 |

|

|

Equity-based compensation expense |

|

|

7.1 |

|

|

|

4.4 |

|

|

|

27.1 |

|

|

|

13.2 |

|

|

Transaction, integration and acquisition costs (1) |

|

|

31.5 |

|

|

|

13.0 |

|

|

|

71.2 |

|

|

|

38.8 |

|

|

Net loss on disposals, consolidations and deconsolidations |

|

|

14.7 |

|

|

|

5.8 |

|

|

|

21.5 |

|

|

|

7.5 |

|

|

Litigation settlements and regulatory change impact (2) |

|

|

1.6 |

|

|

|

4.2 |

|

|

|

1.5 |

|

|

|

13.9 |

|

|

Loss on debt extinguishment |

|

|

— |

|

|

|

— |

|

|

|

5.1 |

|

|

|

— |

|

|

Undesignated derivative activity |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.6 |

|

|

Other (3) |

|

|

0.7 |

|

|

|

1.2 |

|

|

|

(3.7 |

) |

|

|

7.7 |

|

|

Adjusted EBITDA (4) |

|

$ |

128.6 |

|

|

$ |

105.5 |

|

|

$ |

344.4 |

|

|

$ |

295.8 |

|

(1) This amount includes transaction and

integration costs of $29.4 million and $12.8 million for the three

months ended September 30, 2024 and 2023, respectively. This amount

further includes start-up costs related to de novo surgical

facilities of $2.1 million and $0.2 million for the three months

ended September 30, 2024 and 2023, respectively.

This amount includes transaction and integration

costs of $66.1 million and $37.3 million for the nine months ended

September 30, 2024 and 2023, respectively. This amount further

includes start-up costs related to de novo surgical facilities of

$5.1 million and $1.5 million for the nine months ended September

30, 2024 and 2023, respectively.

(2) This amount includes a litigation

settlement loss of $0.5 million and $3.6 million for the three

months ended September 30, 2024 and 2023, respectively. This amount

also includes other litigation costs of $1.1 million and $0.6

million for the three months ended September 30, 2024 and 2023,

respectively.

This amount includes a litigation settlements gain

of $0.8 million and a loss of $8.1 million for the nine months

ended September 30, 2024 and 2023, respectively. This amount also

includes other litigation costs of $2.3 million and $1.4 million

for the nine months ended September 30, 2024 and 2023,

respectively. Additionally, the nine months ended

September 30, 2023 includes $4.4 million related to the impact

of recent changes in Florida law regarding the use of letters of

protection.

(3) For the three months ended

September 30, 2024, this amount includes hurricane-related

impacts. For the three months ended September 30, 2023, this

amount includes estimates for the net impact of a cyber event.

For the nine months ended September 30, 2024,

this amount includes hurricane-related impacts in the third quarter

of 2024, net of insurance proceeds related to cyber event losses

predominantly incurred in 2023. For the nine months ended

September 30, 2023, this amount includes estimates for the net

impact of the same cyber event and losses from a divested

business.

(4) We use Adjusted EBITDA as a measure

of financial performance. Adjusted EBITDA is a key measure used by

management to assess operating performance, make business decisions

and allocate resources. Non-controlling interests represent the

interests of third parties, such as physicians, and in some cases,

healthcare systems that own an interest in surgical facilities that

we consolidate for financial reporting purposes. We believe that it

is helpful to investors to present Adjusted EBITDA as defined above

because it excludes the portion of net income attributable to these

third-party interests and clarifies for investors our portion of

Adjusted EBITDA generated by our surgical facilities and other

operations. Adjusted EBITDA is not a measurement of financial

performance under GAAP and should not be considered in isolation or

as a substitute for net income, operating income or any other

measure calculated in accordance with GAAP. The items excluded from

Adjusted EBITDA are significant components in understanding and

evaluating our financial performance. We believe such adjustments

are appropriate, as the magnitude and frequency of such items can

vary significantly and are not related to the assessment of normal

operating performance. Our calculation of Adjusted EBITDA may not

be comparable to similarly titled measures reported by other

companies.

The following table provides supplemental

information for Adjusted EBITDA related to unconsolidated

affiliates:

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Adjusted EBITDA related to unconsolidated

affiliates: |

|

|

|

|

|

|

|

|

Management fee revenues (1)(2) |

$ |

6.8 |

|

|

$ |

6.2 |

|

|

$ |

20.0 |

|

|

$ |

16.4 |

|

|

Equity in earnings of unconsolidated affiliates (2) |

|

5.2 |

|

|

|

3.5 |

|

|

|

12.3 |

|

|

|

9.4 |

|

|

Plus: |

|

|

|

|

|

|

|

|

Start-up costs related to unconsolidated de novo surgical

facilities (3) |

|

0.9 |

|

|

|

0.5 |

|

|

|

2.9 |

|

|

|

1.3 |

|

|

Adjusted EBITDA related to unconsolidated affiliates |

$ |

12.9 |

|

|

$ |

10.2 |

|

|

$ |

35.2 |

|

|

$ |

27.1 |

|

(1) Includes management and

administrative service fees derived from the non-consolidated

facilities that the Company accounts for under the equity method

and management of surgical facilities in which it does not own an

interest. Management fee revenues are included in Revenues on the

Consolidated Statements of Operations.

(2) Included as a component of income

before income taxes in the Adjusted EBITDA reconciliation table

above.

(3) Start-up costs related to de novo

surgical facilities are included in Transaction, integration and

acquisition costs in the Adjusted EBITDA reconciliation table

above.

From time to time, the Company incurs certain

non-recurring gains or losses that are normally non-operational in

nature and management does not consider relevant in assessing its

ongoing operating performance. When significant, Surgery Partners’

management and the Company's Board of Directors typically exclude

these gains or losses when evaluating the Company’s operating

performance and in certain instances when evaluating performance

for incentive compensation purposes. Additionally, management

believes that certain investors and equity analysts exclude these

or similar items when evaluating the Company’s current or future

operating performance and in making informed investment decisions

regarding the Company. Accordingly, the Company provides adjusted

net income attributable to common stockholders and adjusted net

income per share attributable to common stockholders as supplements

to the comparable GAAP financial measures. Adjusted net income

attributable to common stockholders and adjusted net income per

share attributable to common stockholders should not be considered

measures of financial performance under GAAP, and the items

excluded from such measures are significant components in

understanding and assessing financial performance. These measures

should not be considered in isolation or as an alternative to the

comparable GAAP measures as presented in the consolidated financial

statements.

The following table reconciles net income as

reflected in the consolidated statements of operations to adjusted

net income attributable to common stockholders used to calculate

adjusted net income per share attributable to common

stockholders:

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Consolidated Statements of Operations Data: |

|

|

|

|

|

|

|

|

Net income |

$ |

6.4 |

|

|

$ |

29.7 |

|

|

$ |

59.1 |

|

|

$ |

88.6 |

|

|

Plus (minus): |

|

|

|

|

|

|

|

|

Net income attributable to non-controlling interests |

|

(38.1 |

) |

|

|

(34.6 |

) |

|

|

(118.7 |

) |

|

|

(99.5 |

) |

|

Equity-based compensation expense |

|

7.1 |

|

|

|

4.4 |

|

|

|

27.1 |

|

|

|

13.2 |

|

|

Transaction, integration and acquisition costs |

|

31.5 |

|

|

|

13.0 |

|

|

|

71.2 |

|

|

|

38.8 |

|

|

Net loss on disposals, consolidations and deconsolidations |

|

14.7 |

|

|

|

5.8 |

|

|

|

21.5 |

|

|

|

7.5 |

|

|

Litigation settlements and regulatory change impact |

|

1.6 |

|

|

|

4.2 |

|

|

|

1.5 |

|

|

|

13.9 |

|

|

Loss on debt extinguishment |

|

— |

|

|

|

— |

|

|

|

5.1 |

|

|

|

— |

|

|

Other |

|

0.7 |

|

|

|

1.2 |

|

|

|

(3.7 |

) |

|

|

7.7 |

|

|

Adjusted net income attributable to common stockholders |

$ |

23.9 |

|

|

$ |

23.7 |

|

|

$ |

63.1 |

|

|

$ |

70.2 |

|

| |

|

|

|

|

|

|

|

|

Adjusted net income per share attributable to common

stockholders |

|

|

|

|

|

|

|

|

Basic |

$ |

0.19 |

|

|

$ |

0.19 |

|

|

$ |

0.50 |

|

|

$ |

0.56 |

|

|

Diluted |

$ |

0.19 |

|

|

$ |

0.19 |

|

|

$ |

0.49 |

|

|

$ |

0.55 |

|

|

Weighted average common shares outstanding |

|

|

|

|

|

|

|

|

Basic |

|

126,172 |

|

|

|

125,747 |

|

|

|

126,093 |

|

|

|

125,559 |

|

|

Diluted |

|

127,640 |

|

|

|

127,376 |

|

|

|

127,521 |

|

|

|

127,173 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contact

Surgery Partners Investor Relations (615)

234-8940 IR@surgerypartners.com

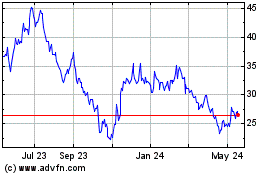

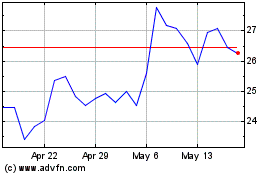

Surgery Partners (NASDAQ:SGRY)

Historical Stock Chart

From Jan 2025 to Feb 2025

Surgery Partners (NASDAQ:SGRY)

Historical Stock Chart

From Feb 2024 to Feb 2025