Filed Pursuant to Rule 424(b)(3)

Registration No. 333-275311

PROSPECTUS SUPPLEMENT

(to Prospectus dated November 22, 2023)

Up to $785,679

SONOMA PHARMACEUTICALS, INC.

COMMON STOCK

We have entered into an Equity Distribution Agreement,

dated December 15, 2023, as amended on March 8, 2024 (collectively, the “Equity Distribution Agreement”), with Maxim Group

LLC (“Maxim, or the “Sales Agent”), relating to the sale of shares of our common stock offered by this prospectus supplement

and the accompanying prospectus. In accordance with the terms of the Equity Distribution Agreement, under this prospectus supplement and

the accompanying prospectus, we may offer and sell shares of our common stock, $0.0001 par value per share, having an aggregate offering

price of up to $785,679 from time to time through the Sales Agent.

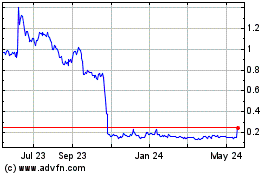

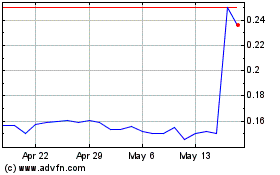

Our common stock is quoted on The Nasdaq Capital

Market under the symbol “SNOA.” On March 7, 2024, the last reported sale price for our common stock was $0.15 per share. The

aggregate market value of our outstanding voting common equity held by non-affiliates on March 7, 2024 was $3,533,248 based on 15,607,433

outstanding shares of common stock, 15,361,946 of which are held by non-affiliates, and the closing price of our common stock of $0.23

on January 11, 2024. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell the shelf securities in

a public primary offering with a value exceeding more than one-third of the aggregate market value of our voting and non-voting ordinary

shares held by non-affiliates in any 12-month period as long as the aggregate market value of our outstanding ordinary

shares held by non-affiliates is less than $75 million. During the twelve calendar months prior to and including the date

hereof, we sold $392,070 of securities pursuant to General Instruction I.B.6. of Form S-3.

Sales of our common stock, if any, under this

prospectus supplement and the accompanying prospectus may be made by any method permitted that is deemed to be an “at the market

offering” as defined in Rule 415 promulgated under the Securities Act of 1933, as amended, or the Securities Act.

The Sales Agent is not required to sell any specific

number or dollar amount of securities, but will act as our sales agent using commercially reasonable efforts consistent with its normal

trading and sales practices, on mutually agreed terms between the Sales Agent and us. There is no arrangement for funds to be received

in any escrow, trust or similar arrangement.

The compensation to the Sales Agent for sales

of common stock sold pursuant to the Equity Distribution Agreement will be an amount equal to 3.0% of the aggregate gross proceeds of

any shares of common stock sold under the Equity Distribution Agreement. In connection with the sale of the common stock on our behalf,

the Sales Agent will be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of the

Sales Agent will be deemed to be underwriting commissions or discounts. We have also agreed to provide indemnification and contribution

to the Sales Agent with respect to certain civil liabilities, including liabilities under the Securities Act.

Investing in our securities involves a high

degree of risk. Before buying any of our securities, you should carefully consider the risk factors described in “Risk Factors”

on page S-3 of this prospectus supplement, and under similar headings in other documents filed after the date hereof and incorporated

by reference into this prospectus supplement and the accompanying prospectus.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the

accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

MAXIM GROUP LLC

The date of this prospectus supplement is March

8, 2024.

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

We are offering to sell, and are seeking offers

to buy, the securities only in jurisdictions where such offers and sales are permitted. The distribution of this prospectus supplement

and the accompanying prospectus and the offering of the securities in certain jurisdictions may be restricted by law. Persons outside

the United States who come into possession of this prospectus supplement and the accompanying prospectus must inform themselves about

and observe any restrictions relating to the offering of the securities and the distribution of this prospectus supplement and the accompanying

prospectus outside the United States. This prospectus supplement and the accompanying prospectus do not constitute, and may not be used

in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus supplement and the

accompanying prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying

prospectus are part of a “shelf” registration statement on Form S-3 that we filed with the Securities and Exchange Commission,

or the SEC, on November 3, 2023, and which was declared effective by the SEC on November 20, 2023.

This document is in two parts. The first part

is this prospectus supplement, which describes the terms of this offering and also adds to and updates information contained in the accompanying

prospectus and the documents incorporated by reference into this prospectus and the accompanying prospectus. The second part is the accompanying

prospectus, which gives more general information about the shares of our common stock and other securities we may offer from time to time

under our shelf registration statement, some of which does not apply to the securities offered by this prospectus supplement. To the extent

there is a conflict between the information contained in this prospectus supplement, on the one hand, and the information contained in

the accompanying prospectus or any document incorporated by reference therein, on the other hand, you should rely on the information in

this prospectus supplement.

You should read this prospectus supplement, the

accompanying prospectus, the documents incorporated by reference in this prospectus supplement and the accompanying prospectus before

making an investment decision. You should also read and consider the information in the documents referred to in the sections of this

prospectus supplement entitled “Where You Can Find More Information” and “Incorporation

of Certain Documents by Reference.”

In this prospectus supplement and the accompanying

prospectus, unless otherwise indicated, the terms “Sonoma,” “we,” “us,” “our,” and similar

terms refer to Sonoma Pharmaceuticals, Inc. and its subsidiaries on a consolidated basis.

PROSPECTUS SUPPLEMENT SUMMARY

This summary contains basic information about

us and this offering. Because it is a summary, it does not contain all of the information that you should consider before investing. Before

you decide to invest in our common stock, you should read this entire prospectus supplement and the accompanying prospectus carefully,

including the section entitled “Risk Factors,” and our consolidated financial statements and the related

notes and other documents incorporated by reference in the accompanying prospectus.

COMPANY OVERVIEW

We are a global healthcare leader for developing

and producing stabilized hypochlorous acid, or HOCl, products for a wide range of applications, including wound care, animal health care,

eye care, oral care and dermatological conditions. Our products reduce infections, itch, pain, scarring and harmful inflammatory responses

in a safe and effective manner. In-vitro and clinical studies of HOCl show it to have impressive antipruritic, antimicrobial, antiviral

and anti-inflammatory properties. Our stabilized HOCl immediately relieves itch and pain, kills pathogens and breaks down biofilm, does

not sting or irritate skin and oxygenates the cells in the area treated, assisting the body in its natural healing process.

THE OFFERING

| Common stock offered by us |

Shares of our common stock having an aggregate offering price of up to $785,679. |

| |

|

| Manner of offering |

“At the market offering” that may be made from time to time through our Sales Agent, Maxim Group LLC See “Plan of Distribution” on page S-12 of this prospectus supplement. |

| |

|

| Common stock outstanding prior to this offering |

15,607,433 shares |

| |

|

| Common stock to be outstanding after this offering |

Up to 20,845,293 shares (as more fully described in the notes following

this table), assuming sales of 5,237,860 shares of our common stock in this offering at an offering price of $0.15 per share, which was

the last reported sale price of our common stock on the Nasdaq Capital Market on March 7, 2024. The actual number of shares issued will

vary depending on the sales price under this offering. |

| |

|

| Use of proceeds |

We intend to use the net proceeds from this offering for working capital and general corporate purposes. See “Use of Proceeds” on page S-9 of this prospectus supplement. |

| |

|

| Risk factors |

Investment in our common stock involves a high degree of risk. See “Risk Factors” on page S-3 of this prospectus supplement, as well as the other information included in or incorporated by reference in this prospectus, for factors to consider before deciding to purchase our securities. |

| |

|

| Nasdaq Capital Market stock symbol |

SNOA |

RISK FACTORS

Investing in our securities involves a high

degree of risk. Before investing in our securities, you should carefully consider the risks described below, together with all of the

other information contained in this prospectus supplement and the accompanying prospectus and incorporated by reference herein and therein,

including from our most recent Annual Report on Form 10-K and subsequent filings. Some of these factors relate principally to our business

and the industry in which we operate. Other factors relate principally to your investment in our securities. The risks and uncertainties

described therein and below are not the only risks we face, but those that we consider to be material. Additional risks and uncertainties

not presently known to us or that we currently deem immaterial may also materially and adversely affect our business and operations. Our

business, financial condition, results of operations, cash flows or prospects could be materially and adversely affected as a result of

these risks. In such case, you may lose all or part of your investment. Please also read carefully the section below entitled “Cautionary

Note Regarding Forward-Looking Statements.”

Additional Risks Related to This Offering

The common stock offered hereby will be

sold in “at-the-market” offerings, and investors who buy shares at different times will likely pay different prices.

Investors who purchase shares in this offering

at different times will likely pay different prices. As a result, investors may experience different outcomes in their investment results.

We will have discretion, subject to market demand, to vary the timing, prices and numbers of shares sold, and there is no minimum or maximum

sales price. Investors may experience a decline in the value of their shares as a result of share sales made at prices lower than the

prices they paid.

The actual number of shares of common stock

we will issue under the Equity Distribution Agreement, at any one time or in total, is uncertain.

Subject to certain limitations in the Equity Distribution

Agreement and compliance with applicable law, we have the discretion to deliver a sales notice to the Sales Agent as our sales agent at

any time throughout the term of the Equity Distribution Agreement. The number of shares that are sold by the Sales Agent after delivering

a sales notice will fluctuate based on the market price of our common stock during the sales period and limits we set with the Sales Agent.

Because the price per share of each share sold will fluctuate based on the market price of our common stock during the sales period, it

is not possible at this stage to predict the number of shares that will be ultimately issued.

We will have broad discretion in how we

use the proceeds, and we may use the proceeds in ways in which you and other stockholders may disagree.

We intend to use the net proceeds from this offering

for working capital and general corporate purposes. Our management will have broad discretion in the application of the net proceeds from

this offering and could spend the proceeds in ways that do not improve our results of operations or enhance the value of our common stock.

The failure by management to apply these funds effectively could result in financial losses that could have a material adverse effect

on our business or cause the price of our common stock to decline.

You may experience future dilution as a

result of future equity offerings.

In order to raise additional capital, we may in

the future offer additional shares of our common stock or other securities convertible into or exchangeable for our common stock at prices

that may be less than the price per share paid by investors in this offering, and investors purchasing shares or other securities in the

future could have rights superior to existing stockholders.

OUR BUSINESS

We are a global healthcare leader for developing

and producing stabilized hypochlorous acid, or HOCl, products for a wide range of applications, including wound care, eye, oral and nasal

care, dermatological conditions, podiatry, animal health care and non-toxic disinfectants. Our products reduce infections, scarring and

harmful inflammatory responses in a safe and effective manner. In-vitro and clinical studies of HOCl show it to have impressive antipruritic,

antimicrobial, antiviral and anti-inflammatory properties. Our stabilized HOCl immediately relieves itch and pain, kills pathogens and

breaks down biofilm, does not sting or irritate skin and oxygenates the cells in the area treated, assisting the body in its natural healing

process. We sell our products either directly or via partners in 55 countries worldwide.

Business Channels

Our core market differentiation is based on being

the leading developer and producer of stabilized hypochlorous acid, or HOCl, solutions. We have been in business for over 20 years, and

in that time, we have developed significant scientific knowledge of how best to develop and manufacture HOCl products, backed by decades

of studies and data collection. HOCl is known to be among the safest and most-effective ways to relieve itch, inflammation and burns while

stimulating natural healing through increased oxygenation and eliminating persistent microorganisms and biofilms.

We sell our products based on our HOCl technology

into many markets both in the U.S. and internationally. Our core strategy is to work with partners to market and distribute our products.

In some cases, we market and sell our own products.

Dermatology

We have developed unique, differentiated, prescription-strength

and safe dermatologic products that support paths to healing among various key dermatologic conditions. Our products are primarily targeted

at the treatment of redness and irritation, the management of scars, and symptoms of eczema/atopic dermatitis. We are strategically focused

on introducing innovative new products that are supported by human clinical data with applications that address specific dermatological

procedures currently in demand. In addition, we look for markets where we can provide effective product line extensions and pricing to

new product families.

In the United States, we partner with EMC Pharma,

LLC to sell our prescription dermatology products. Pursuant to our March 2021 agreement with EMC Pharma, we manufacture products for EMC

Pharma and EMC Pharma has the right to market, sell and distribute them to patients and customers for an initial term of five years, subject

to meeting minimum purchase and other requirements.

In September 2021, we launched a new over-the-counter

product, Regenacyn® Advanced Scar Gel, which is clinically proven to improve the overall appearance of scars while reducing

pain, itch, redness, and inflammation. On the same day, we launched Regenacyn® Plus, a prescription-strength scar gel which

is available as an office dispense product through physician offices.

In October 2022, we launched two new over-the-counter

dermatology products in the United States, Reliefacyn® Advanced Itch-Burn-Rash-Pain Relief Hydrogel for the alleviation

of red bumps, rashes, shallow skin fissures, peeling, and symptoms of eczema/atopic dermatitis, and Rejuvacyn® Advanced

Skin Repair Cooling Mist for management of minor skin irritations following cosmetic procedures as well as daily skin health and hydration.

In June 2022, the Natural Products Association

certified Rejuvacyn Advanced as a Natural Personal Care Product. Reliefacyn Advanced received the National Eczema Association Seal of

AcceptanceTM in 2023.

In January 2023, we launched a line of office

dispense products exclusively for skin care professionals, including two new prescription strength dermatology products, Reliefacyn® Plus

Advanced Itch-Burn-Rash-Pain Relief Hydrogel and Rejuvacyn® Plus Skin Repair Cooling Mist. These products, along with

Regenacyn® Plus Scar Gel, are marketed and sold directly to dermatology practices and medical spas.

In April 2023, we introduced a new pediatric dermatology

and wound care product for over-the-counter use, Pediacyn™ All Natural Skin Care & First Aid For Children.

In January 2024, we launched LumacynTM

Clarifying Mist, a direct-to-consumer skin care product in the United States. Lumacyn is an all-natural daily toner to soothe skin, reduce

redness and irritation, and manage blemishes by reducing infection.

Our consumer products are available through Amazon.com,

our online store, and third-party distributors.

We sell dermatology products in Europe and Asia

through distributors. In these international markets, we have a network of partners, ranging from country specific distributors to large

pharmaceutical companies to full-service sales and marketing companies. We work with our international partners to create products they

can market in their home country. Some products we develop and manufacture are custom label while others use branding we have already

developed. We have created or co-developed a wide range of products for international markets using our core HOCl technology.

First Aid and Wound Care

Our HOCl-based wound care products are intended

for the treatment of acute and chronic wounds as well as first- and second-degree burns, and as an intraoperative irrigation treatment.

They work by first removing foreign material and debris from the skin surface and moistening the skin, thereby improving wound healing.

Secondly, our HOCl products assist in the wound healing process by removing microorganisms. HOCl is an important constituent of our innate

immune system, formed and released by the macrophages during phagocytosis. Highly organized cell structures such as human tissue can tolerate

the action of our wound care solution while single-celled microorganisms cannot, making our products advantageous to other wound-irrigation

and antiseptic solutions. Due to its unique chemistry, our wound treatment solution is also much more stable than similar products on

the market and therefore maintains much higher levels of hypochlorous acid over its shelf life.

In the United States, we sell our wound care products

directly to hospitals, physicians, nurses, and other healthcare practitioners and indirectly through non-exclusive distribution arrangements.

In Europe, the Middle East and Asia, we sell our wound care products through a diverse network of distributors.

To respond to market demand for our HOCl technology-based

products, we launched our first direct to consumer over-the-counter product in the United States in February 2021. Microcyn®

OTC Wound and Skin Cleanser is formulated for home use without prescription to help manage and cleanse wounds, minor cuts, and burns,

including sunburns and other skin irritations. Microcyn OTC is available without prescription through Amazon.com, our online store, and

third-party distributors.

In March 2021, we received approval to market

and use our HOCl products as biocides under Article 95 of the European Biocidal Products Regulation in France, Germany and Portugal. The

approval applies to our products MucoClyns™ for human hygiene to be marketed and commercialized by us, MicrocynAH®

for animal heath marketed and commercialized through our partner, Petagon Limited, and MicroSafe for disinfectant use to be marketed and

commercialized through our partner, MicroSafe Group DMCC.

In June 2022, the Natural Products Association

certified Microcyn OTC as a Natural Personal Care Product in the United States.

In June 2023, we announced a new application of

our HOCl technology for intraoperative pulse lavage irrigation treatment, which can replace commonly used IV bags in a variety of surgical

procedures. The intraoperative pulse lavage container is designed to be used in combination with a pulse lavage irrigation device, or

flush gun, for abdominal, laparoscopic, orthopedic, and periprosthetic procedures. It is in trial use by hospitals in Europe, and launched

in the U.S. in November 2023.

Eye Care

Our prescription product Acuicyn™ is an

antimicrobial prescription solution for the treatment of blepharitis and the daily hygiene of eyelids and lashes and helps manage red,

itchy, crusty and inflamed eyes. It is strong enough to kill the bacteria that causes discomfort, fast enough to provide near instant

relief, and gentle enough to use as often as needed. In the United States, our partner EMC Pharma sells Acuicyn through its distribution

network.

In September 2021, we launched Ocucyn®

Eyelid & Eyelash Cleanser, which is sold directly to consumers on Amazon.com, through our online store, and through third party distributors.

Ocucyn® Eyelid & Eyelash Cleanser, designed for everyday use, is a safe, gentle, and effective solution for good eyelid

and eyelash hygiene.

In international markets we rely on distribution

partners to sell our eye products. On May 19, 2020, we entered into an expanded license and distribution agreement with our existing partner,

Brill International S.L., for our Microdacyn60® Eye Care HOCl-based product. Under the license and distribution agreement,

Brill has the right to market and distribute our eye care product under the private label Ocudox™ in Italy, Germany, Spain, Portugal,

France, and the United Kingdom for a period of 10 years, subject to meeting annual minimum sales quantities. In return, Brill paid us

a one-time fee and the agreed upon supply prices. In parts of Asia, Dyamed Biotech markets our eye product under the private label Ocucyn.

In January 2024, we entered into a license

agreement with NovaBay Pharmaceuticals, Inc. for the sale and marketing of Avenova®-branded Ocudox products in the European Union

through our European distribution network.

Oral, Dental and Nasal Care

We sell a variety of oral, dental, and nasal products

around the world.

In late 2020, we launched a HOCl-based product

in the dental, head and neck markets called Endocyn®, a biocompatible root canal irrigant. In the U.S., we sell Endocyn

through U.S.-based distributors.

In international markets, our product Microdacyn60®

Oral Care treats mouth and throat infections and thrush. Microdacyn60 assists in reducing inflammation and pain, provides soothing cough

relief and does not contain any harmful chemicals. It does not stain teeth, is non-irritating, non-sensitizing, has no contraindications

and is ready for use with no mixing or dilution.

Our international nasal care product Sinudox™

based on our HOCl technology is an electrolyzed solution intended for nasal irrigation. Sinudox clears and cleans stuffy, runny noses

and blocked or inflamed sinuses by ancillary ingredients that may have a local antimicrobial effect. Sinudox is currently sold through

Amazon in Europe. In other parts of the world, we partner with distributors to sell Sinudox.

Podiatry

Our HOCl-based wound care products are also indicated

for the treatment of diabetic foot ulcers. In the United States, we sell our wound care products directly to podiatrists, as well as hospitals,

nurses, and other healthcare practitioners, and indirectly through non-exclusive distribution arrangements. In Europe, we sell our wound

care products for podiatric use through a diverse network of distributors.

On April 11, 2023, we launched Podiacyn™

Advanced Everyday Foot Care direct to consumers for over-the-counter use in the United States, intended for management of foot odors,

infections, and irritations, as well as daily foot health and hygiene. Podiacyn is available through Amazon.com, our online store, and

third-party distributors.

Animal Health Care

MicrocynAH® is an HOCl-based topical

product that cleans, debrides and treats a wide spectrum of animal wounds and infections. It is intended for the safe and rapid treatment

of a variety of animal afflictions including cuts, burns, lacerations, rashes, hot spots, rain rot, post-surgical sites, pink eye symptoms

and wounds to the outer ear.

For our animal health products sold in the U.S.

and Canada, we partner with Manna Pro Products, LLC. Manna Pro distributes non-prescription products to national pet-store retail chains

and farm animal specialty stores such as Chewy.com, PetSmart, Tractor Supply, Cabela’s, PetExpress, and Bass Pro Shops. In August

2022, we announced the launch of a MicrocynVS® line of products exclusively for veterinarians for the management of wound,

skin, ear and eye afflictions in all animal species.

For the Asian and European markets, on May 20,

2019, we partnered with Petagon, Limited, an international importer and distributor of quality pet food and products for an initial term

of five years. We supply Petagon with all MicrocynAH products sold by Petagon. On August 3, 2020, Petagon received a license from the

People’s Republic of China for the import of veterinary drug products manufactured by us. This is the highest classification Petagon

and Sonoma can receive for animal health products in China.

Surface Disinfectants

Our HOCl technology has been formulated as a disinfectant

and sanitizer solution for our partner MicroSafe and is sold in numerous countries. It is designed to be used to spray in aerosol format

in areas and environments likely to serve as a breeding ground for the spread of infectious disease, which could result in epidemics or

pandemics. The medical-grade surface disinfectant solution is used in hospitals worldwide to protect doctors and patients. In May 2020,

Nanocyn® Disinfectant & Sanitizer received approval to be entered into the Australian Register of Therapeutic Goods,

or ARTG for use against the coronavirus SARS-CoV-2, or COVID-19, and was also authorized in Canada for use against COVID-19. Nanocyn has

also met the stringent environmental health and social/ethical criteria of Good Environmental Choice Australia, or GECA, becoming one

of the very few eco-certified, all-natural disinfectant solutions in Australia.

Through our partner MicroSafe, we sell hard surface

disinfectant products into Europe, the Middle East and Australia.

On July 31, 2021, we granted MicroSafe the non-exclusive

right to sell and distribute Nanocyn in the United States provided that MicroSafe secure U.S. EPA approval. In April of 2022, MicroSafe

secured the EPA approval for Nanocyn® Disinfectant & Sanitizer, meaning that it can now be sold in the United States

as a surface disinfectant. Nanocynwas subsequently added to the EPA’s list N for use against COVID-19. In June 2022, the EPA added

Nanocyn to List Q as a disinfectant for Emerging Viral Pathogens, including Ebola virus, Mpox, and SARS-CoV-2, and in March 2023 the EPA

added Nanocyn to Lists G and H, for use against Methicillin Resistant Staphylococcus Aureus (MRSA), Salmonella, Norovirus, Poliovirus,

and as a fungicide. Nanocyn also received the Green Seal® Certification after surpassing a series of rigorous standards

that measure environmental health, sustainability and product performance. Nanocyn is currently sold by MicroSafe in Europe, the Middle

East and Australia.

Corporate Information

We incorporated under the laws of the State of

California in April 1999 as Micromed Laboratories, Inc. In August 2001, we changed our name to Oculus Innovative Sciences, Inc. In December

2006, we reincorporated under the laws of the State of Delaware. On December 6, 2016, we changed our name from Oculus Innovative Sciences,

Inc. to Sonoma Pharmaceuticals, Inc. Our principal executive offices are located at 5445 Conestoga Court, Suite 150, Boulder, Colorado

80301, and our telephone number is (800) 759-9305. We have two active wholly-owned subsidiaries: Oculus Technologies of Mexico, S.A. de

C.V., organized in Mexico; and Sonoma Pharmaceuticals Netherlands, B.V., organized in the Netherlands.

Corporate Information

We were initially incorporated as Micromed Laboratories,

Inc. in 1999 under the laws of the State of California. We changed our name to Oculus Innovative Sciences, Inc. in 2001. In December 2006

we reincorporated under the laws of the State of Delaware, and in December 2016 we changed our name to Sonoma Pharmaceuticals, Inc. Our

principal executive offices are located at 5445 Conestoga Court, Suite 150, Boulder, Colorado 80301. We have two active wholly owned subsidiaries:

Oculus Technologies of Mexico, S.A. de C.V., and Sonoma Pharmaceuticals Netherlands, B.V. Our fiscal year end is March 31. Our corporate

telephone number is (800) 759-9305.

Additional Information

Investors and others should note that we announce

material financial information using our company website (www.sonomapharma.com), our investor relations website (ir.sonomapharma.com),

SEC filings, press releases, public conference calls and webcasts. The information on, or accessible through, our websites is not incorporated

by reference in this prospectus supplement.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus

and the documents incorporated by reference in this prospectus supplement contain forward looking statements. When used in this prospectus

supplement, the words “anticipate,” “intend,” “estimate,” “plan,” “project,”

“continue,” “ongoing,” “potential,” “expect,” “predict,” “believe,”

“intend,” “may,” “can,” “will,” “should,” “could,” “would,”

“proposal,” and similar expressions are intended to identify forward-looking statements.

You should not place undue reliance on these forward-looking

statements. Our actual results could differ materially from those anticipated in the forward-looking statements for many reasons, including

the reasons described in our “Risk Factors” section. Although we believe the expectations reflected

in the forward-looking statements are reasonable, they relate only to events as of the date on which the statements are made. These forward-looking

statements speak only as of the date of this prospectus supplement. We expressly disclaim any obligation or undertaking to update or revise

any forward-looking statements contained herein to reflect any change in our expectations with regard thereto or any change in events,

conditions or circumstances on which any such statement is based, except as required by law.

USE OF PROCEEDS

We may issue and sell shares of our common stock

having aggregate sales proceeds of up to $785,679 from time to time. Because there is no minimum offering amount required as a condition

to close this offering, the actual total public offering amount, commissions and proceeds to us, if any, are not determinable at this

time. We estimate that the net proceeds from the sale of the shares of common stock that we are offering may be up to approximately $692,109,

at an assumed offering price of $0.15 per share, the last reported sale price of our common stock on The Nasdaq Capital Market on March

7, 2024, and after deducting the Sales Agent’s commission and estimated offering expenses payable by us.

We intend to use the net proceeds of this offering

for working capital and general corporate purposes. As of the date of this prospectus supplement, we cannot specify with certainty all

of the particular uses for the net proceeds to us from this offering. Accordingly, our management will have broad discretion in the application

of these proceeds.

DILUTION

Purchasers of common stock offered by this prospectus

supplement and the accompanying prospectus will suffer immediate and substantial dilution in the net tangible book value per share of

common stock. Our net tangible book value on December 31, 2023 was approximately $6,692,000, or approximately $0.49 per share of common

stock based upon 13,684,333 shares outstanding as of December 31, 2023. Following the issuance of 1,923,100 shares of our common stock

on January 11, 2024, our as adjusted net tangible book value was approximately $7,000,822, or approximately $0.45 per share of common

stock. Net tangible book value per share is determined by dividing our net tangible book value, which consists of tangible assets less

total liabilities, by the number of shares of common stock outstanding on that date.

The shares in this offering will be sold at market

prices which may fluctuate substantially. For purposes of calculating dilution, we have assumed a sale price of $0.15 per share, which

was the closing price of our stock on March 7, 2024.

After giving effect to the pro forma adjustment

set forth above and the sale of our common stock in the aggregate amount of $785,679, or 5,237,860 shares, at an assumed offering price

of $0.15 per share, and after deducting estimated commissions and offering expenses payable by us, our pro forma as adjusted net tangible

book value as of December 31, 2023 would have been approximately $7,726,930 or $0.37 per share of common stock. This represents an immediate

decrease in net tangible book value of $0.08 per share to existing stockholders and a dilution of $0.22 per share to new investors purchasing

our common stock in this offering at the public offering price. The following table illustrates this calculation on a per share basis:

| Assumed public offering price per share | |

$ | 0.15 | |

| Net tangible book value per share as of December 31, 2023 | |

$ | 0.49 | |

| Pro Forma net tangible book value per share as adjusted for issuance of 1,923,000 shares on January 11, 2024 | |

| 0.45 | |

| Decrease in net tangible book value per share attributable to this offering | |

$ | (0.08 | ) |

| | |

| | |

| Pro Forma as adjusted net tangible book value per share as of December 31, 2023, after giving effect to this offering | |

$ | 0.37 | |

| | |

| | |

| Dilution | |

$ | (0.22 | ) |

The shares subject to the Equity Distribution

Agreement are being sold from time to time at various prices. An increase of $0.10 per share in the price at which the shares are sold

from the assumed public offering price of $0.15 per share shown in the table above, assuming all of our common stock in the aggregate

amount of $785,679 during the term of the Equity Distribution Agreement are sold at that price, would increase our as adjusted net tangible

book value per share after the offering to $0.41 per share and result in an increase in net tangible book value per share to new investors

in this offering of $0.16 per share, after deducting estimated offering commissions and estimated aggregate offering expenses payable

by us. A decrease of $0.10 per share in the price at which the shares are sold from the assumed public offering price of $0.15 per share

shown in the table above, assuming all of our common stock in the aggregate amount of $785,679 during the term of the Equity Distribution

Agreement is sold at that price, would decrease our adjusted net tangible book value per share after the offering to $0.25 per share and

result in an increase in net tangible book value per share to new investors in this offering of $0.20 per share, after deducting estimated

commissions and estimated aggregate offering expenses payable by us. This information is supplied for illustrative purposes only and may

differ based on the actual offering price and the actual number of shares offered.

The above discussion is based on 13,684,333 shares

of our common stock outstanding as of December 31, 2023, and excludes:

| |

· |

1,011,000 shares of common stock issuable

upon exercise of outstanding stock options, at a weighted average exercise price of $3.24 per share, under our equity incentive plans;

and |

| |

|

|

| |

· |

127,000 additional shares of common stock reserved for future issuance under our equity incentive plans. |

To the extent that outstanding options as of December

31, 2023 have been or may be exercised or we issue other shares investors purchasing our Common Stock in this offering may experience

further dilution. In addition, we may choose to raise additional capital due to market conditions or strategic considerations even if

we believe we have sufficient funds for our current or future operating plans. To the extent that we raise additional capital through

the sale of equity or convertible debt securities, the issuance of these securities could result in further dilution to our stockholders.

DESCRIPTION OF SECURITIES

We have 24,000,000 shares of authorized common

stock, par value $0.0001 per share. As of March 7, 2024, there were 15,607,433 shares of common stock issued and outstanding. All outstanding

shares of common stock are fully paid and nonassessable, and the shares of common stock offered, when issued, will be fully paid and nonassessable.

See “Description of Common Stock” on page 6 of the accompanying prospectus for a description of the material terms

of our common stock.

Our common stock is traded on the Nasdaq Capital

Market under the symbol “SNOA.”

The transfer agent for our common stock and our

warrants is Computershare, Inc. located at 462 South 4th Street, Suite 1600, Louisville, KY 40202. Its telephone number is 1-888-647-8901.

PLAN OF DISTRIBUTION

We have entered into an amendment to the Equity

Distribution Agreement with Maxim Group LLC as Sales Agent, under which we may issue and sell shares of our common stock from time to

time through the Sales Agent acting as a sales agent, including sales having an aggregate gross sales price of up to $785,679 pursuant

to this prospectus supplement.

The Sales Agent may sell the shares of common

stock by any method that is deemed to be an “at the market offering” as defined in Rule 415 promulgated under the Securities

Act. Subject to the terms of the placement notice Maxim may also sell the shares of common stock by any other method permitted by law,

including in privately negotiated transactions. If we and Maxim agree on a method of distribution other than sales of shares of our common

stock on or through Nasdaq or another existing trading market at market prices, we will file a further prospectus supplement providing

all information about such offering as required by Rule 424(b) under the Securities Act.

The Sales Agent will offer the shares of our common

stock subject to the terms and conditions of the Equity Distribution Agreement on a daily basis or as otherwise agreed upon by us and

the Sales Agent. We will designate the maximum number of shares of common stock to be sold through the Sales Agent on a daily basis or

otherwise determine such maximum number together with the Sales Agent. Subject to the terms and conditions of the Equity Distribution

Agreement, the Sales Agent will use its commercially reasonable efforts to sell on our behalf all of the shares of common stock so designated

or determined. We may instruct the Sales Agent not to sell shares of common stock if the sales cannot be effected at or above the price

designated by us in any such instruction. We or the Manger may suspend the offering of shares of common stock being made through the Sales

Agent under the Equity Distribution Agreement upon proper notice to the other party.

We will pay the Sales Agent commissions, in cash,

for its services in acting as agent in the sale of our common stock. The Sales Agent will be entitled to compensation at a fixed commission

rate of 3.0% of the aggregate gross proceeds from each sale of our common stock. Because there is no minimum offering amount required

as a condition to close this offering, the actual total public offering amount, commissions and proceeds to us, if any, are not determinable

at this time. We have also agreed to reimburse the Sales Agent for certain specified fees and documented expenses, including the fees

and documented expenses of its legal counsel in an amount not to exceed $20,000, as provided in the Equity Distribution Agreement. We

estimate that the total expenses for the offering, excluding compensation and reimbursements payable to the Sales Agent under the terms

of the Equity Distribution Agreement, will be approximately $70,000.

Settlement for sales of common stock will occur

on the second business day following the date on which any sales are made, or on some other date that is agreed upon by us and the Sales

Agent in connection with a particular transaction, in return for payment of the net proceeds to us. Sales of our common stock as contemplated

in this prospectus will be settled through the facilities of The Depository Trust Company or by such other means as we and the Sales Agent

may agree upon. There is no arrangement for funds to be received in an escrow, trust or similar arrangement.

The Sales Agent is not required to sell any certain

number of shares or dollar amount of our common stock, but the Sales Agent will use its commercially reasonable efforts consistent with

its normal trading and sales practices to sell on our behalf all of the shares of common stock requested to be sold by us, subject to

the conditions set forth in the Equity Distribution Agreement. In connection with the sale of the common stock on our behalf, the Sales

Agent will be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of the Sales Agent

will be deemed to be underwriting commissions or discounts. We have agreed to provide indemnification and contribution to the Sales Agent

against certain civil liabilities, including liabilities under the Securities Act.

The offering of our common stock pursuant to the

Equity Distribution Agreement will terminate as permitted therein.

This summary of the material provisions of the

Equity Distribution Agreement does not purport to be a complete statement of its terms and conditions. We will file a copy of the Equity

Distribution Agreement as an exhibit to a report under the Securities Exchange Act of 1934, as amended, or the Exchange Act with the Securities

and Exchange Commission, which will, upon filing, be incorporated by reference into this prospectus supplement. See the section below

entitled “Where You Can Find More Information.”

LEGAL MATTERS

The validity of the issuance of the common stock

offered by this prospectus will be passed upon for us by Burns & Levinson, LLP. Blank Rome LLP, New York, New York, is counsel

for the Sales Agent in connection with this offering.

EXPERTS

The consolidated financial statements of Sonoma

Pharmaceuticals, Inc. appearing in Sonoma Pharmaceuticals, Inc.’s annual report on Form 10-K for the year ended March 31,

2023, filed on June 21, 2023, have been audited by Frazier & Deeter, LLC, an independent registered public accounting firm, as set

forth in their report included therein, and incorporated herein by reference. Such consolidated financial statements are incorporated

herein by reference in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports,

proxy statements and other information with the SEC. The SEC maintains a website that contains reports, proxy and information statements

and other information regarding companies, such as ours, that file documents electronically with the SEC. The address of the SEC’s

website is http://www.sec.gov. The information on the SEC’s website is not part of this prospectus, and any references to this website

or any other website are inactive textual references only.

This prospectus is part of a registration statement

on Form S-3 that we filed with the SEC to register the securities to be offered hereby. This prospectus does not contain all of the information

included in the registration statement, including certain exhibits and schedules. You may obtain the registration statement and exhibits

to the registration statement from the SEC at the address listed above or from the SEC’s website listed above.

In addition to the foregoing, we maintain a website

at www.sonomapharma.com. Our website content is made available for informational purposes only. It should neither be relied upon for investment

purposes nor is it incorporated by reference into this prospectus. We make available at www.sonomapharma.com copies of our Annual Reports

on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K and any amendments to such document as soon as practicable

after we electronically file such material with or furnish such documents to the SEC.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The SEC permits us to “incorporate by reference”

the information contained in documents we file with the SEC, which means that we can disclose important information to you by referring

you to those documents rather than by including them in this prospectus. Information that is incorporated by reference is considered to

be part of this prospectus and you should read it with the same care that you read this prospectus. Later information that we file with

the SEC will automatically update and supersede the information that is either contained, or incorporated by reference, in this prospectus,

and will be considered to be a part of this prospectus from the date those documents are filed. We have filed with the SEC, and incorporate

by reference the following in this prospectus:

| |

· |

our Annual Report on Form 10-K for the year ended March 31, 2023, filed on June 21, 2023; |

| |

|

|

| |

· |

our Quarterly Report on Form 10-Q for the quarter ended June 30, 2023, filed on August 10, 2023; |

| |

|

|

| |

· |

our Quarterly Report on Form 10-Q for the quarter ended September 30, 2023, filed on November 13, 2023; |

| |

|

|

| |

· |

our Quarterly Report on Form 10-Q for

the quarter ended December 30, 2023, filed on February 8, 2024; |

| |

|

|

| |

· |

our Current Reports on Form 8-K filed on April

13, 2023, July

14, 2023, September

28, 2023, December 18, 2023, December 29, 2023, and January 9, 2024; |

| |

|

|

| |

· |

our Current Report on Form 8-K/A filed on October 11, 2023; |

| |

|

|

| |

· |

our Definitive Proxy Statement on Schedule 14A, as filed with the SEC on July 27, 2023; and |

| |

|

|

| |

· |

our Registration Statement on Form 8-A as filed with the SEC on December 15, 2006. |

In addition, all documents that we file with the

SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, after the date of the initial registration statement of which

this prospectus is a part and prior to the effectiveness of the registration statement as well as all such documents that we file with

the SEC after the date of this prospectus and before the termination of the offering of our securities shall be deemed incorporated by

reference into this prospectus and to be a part of this prospectus from the respective dates of filing such documents. Unless specifically

stated to the contrary, none of the information that we disclose under Items 2.02 or 7.01 of any Current Report on Form 8-K that we may

from time to time furnish to the SEC will be incorporated by reference into, or otherwise included in, this prospectus.

You may request a copy of any or all of the documents

incorporated by reference but not delivered with this prospectus, at no cost, by writing or telephoning us at the following address and

number: Investor Relations, Sonoma Pharmaceuticals, Inc., 5445 Conestoga Court, Suite 150, Boulder, Colorado 80301, telephone (800) 759-9305.

We will not, however, send exhibits to those documents, unless the exhibits are specifically incorporated by reference in those documents.

DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION

Insofar as indemnification for liabilities arising

under the Securities Act, as amended, may be permitted to directors, officers, and controlling persons of the registrant pursuant to the

Company’s constituent documents, or otherwise, the registrant has been advised that in the opinion of the SEC such indemnification

is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification

against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer, or controlling

person in the successful defense of any action, suit, or proceeding) is asserted by such director, officer, or controlling person connected

with the securities being registered, we will, unless in the opinion of our counsel the matter has been settled by controlling precedent,

submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in

the Securities Act and will be governed by the final adjudication of such issue.

PROSPECTUS

$51,300,000

SONOMA PHARMACEUTICALS, INC.

Common Stock

Preferred Stock

Debt Securities

Warrants

Units

We may, from time to time, offer and sell common

stock, preferred stock, debt securities or warrants, either separately or in units, in one or more offerings. The preferred stock and

warrants may be convertible into or exercisable or exchangeable for common or preferred stock. We will specify in the accompanying prospectus

supplement more specific information about any such offering. The aggregate initial offering price of all securities sold under this prospectus

will not exceed $51,300,000, including the U.S. dollar equivalent if the public offering of any such securities is denominated in

one or more foreign currencies, foreign currency units or composite currencies.

We may offer these securities independently or

together in any combination for sale directly to investors or through underwriters, dealers or agents. We will set forth the names of

any underwriters, dealers or agents and their compensation in the accompanying prospectus supplement.

This prospectus may not be used to sell any of

these securities unless accompanied by a prospectus supplement.

Our common stock is traded on the Nasdaq Capital

Market under the symbol “SNOA.” On November 21, 2023, the last reported sale price for our common stock was $0.18 per share.

The aggregate market value of our outstanding voting and non-voting equity held by non-affiliates on November 21, 2023 was $2,418,092

based on a share price of $0.18. As of the date hereof, during the prior 12 calendar month period, we have offered $3,051,726 of securities

pursuant to a previously filed Form S-3 pursuant to General Instruction I.B.6. Pursuant to General Instruction I.B.6 of Form S-3, in no

event will we sell securities registered on this registration statement in a public primary offering with a value exceeding more than

one-third of the aggregate market value of the voting and non-voting common equity in any 12 month period so long as our public float

remains below $75 million.

Investing in our securities involves a high

degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors”

contained in this prospectus beginning on page 4 and any applicable prospectus supplement, and under similar headings in the other documents

that are incorporated by reference into this prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon

the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Subject to completion, the date of this prospectus

is November 22, 2023.

TABLE OF CONTENTS

You should rely only on the information incorporated

by reference or provided in this prospectus, any prospectus supplement and the registration statement. We have not authorized anyone else

to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it.

We are not making an offer to sell these securities in any state where the offer or sale is not permitted. You should assume that the

information in this prospectus and any prospectus supplement, or incorporated by reference, is accurate only as of the dates of those

documents. Our business, financial condition, results of operations and prospects may have changed since those dates.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement

that we filed with the Securities and Exchange Commission, or SEC, using a “shelf” registration, or continuous offering, process.

Under this shelf registration process, we may, from time to time, issue and sell any combination of preferred stock, common stock or warrants,

either separately or in units, in one or more offerings with a maximum aggregate offering price of $51,300,000, including the U.S. dollar

equivalent if the public offering of any such securities is denominated in one or more foreign currencies, foreign currency units or composite

currencies.

This prospectus provides you with a general description

of the securities we may offer. Each time we sell securities, we will provide a prospectus supplement that will contain specific information

about the terms of that offering and the offered securities. Any prospectus supplement may also add, update or change information contained

in this prospectus. Any statement that we make in this prospectus will be modified or superseded by any inconsistent statement made by

us in a prospectus supplement. The registration statement we filed with the SEC includes exhibits that provide more detail of the matters

discussed in this prospectus. You should read this prospectus and the related exhibits filed with the SEC and any prospectus supplement,

together with additional information described under the heading “Where You Can Find More Information,” before making

your investment decision.

THIS PROSPECTUS MAY NOT BE USED TO CONSUMMATE

A SALE OF SECURITIES UNLESS IT IS ACCOMPANIED BY A PROSPECTUS SUPPLEMENT.

Neither we, nor any agent, underwriter or dealer

has authorized any person to give any information or to make any representation other than those contained or incorporated by reference

in this prospectus, any applicable prospectus supplement prepared by or on behalf of us or to which we have referred you. This prospectus

or any applicable supplement to this prospectus do not constitute an offer to sell or the solicitation of an offer to buy any securities

other than the registered securities to which they relate, nor do this prospectus or any applicable supplement to this prospectus constitute

an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such

offer or solicitation in such jurisdiction.

You should not assume that the information contained

in this prospectus or any applicable prospectus supplement is accurate on any date subsequent to the date set forth on the front of the

document or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated

by reference, even though this prospectus or any applicable prospectus supplement is delivered, or securities are sold, on a later date.

We may sell the securities directly to or through underwriters, dealers

or agents. We, and our underwriters or agents, reserve the right to accept or reject all or part of any proposed purchase of securities.

If we do offer securities through underwriters, dealers or agents, we will include in any applicable prospectus supplement:

| |

· |

the names of those underwriters, dealers or agents; |

| |

|

|

| |

· |

applicable fees, discounts, and commissions to be paid to them; |

| |

|

|

| |

· |

details regarding over-allotment options, if any; and |

| |

|

|

| |

· |

the net proceeds to us. |

PROSPECTUS SUMMARY

This summary highlights information contained

elsewhere in this prospectus or incorporated by reference. This summary does not contain all of the information you should consider before

buying shares of our common stock, preferred stock, warrants, or units or any combination of these securities. You should read the entire

prospectus carefully, especially the risks of investing in our securities that we describe under “Risk Factors” and our consolidated

financial statements appearing in our annual and periodic reports incorporated in this prospectus by reference, before deciding to invest

in our securities. Unless the context requires otherwise, references to “Sonoma,” “the Company,” “the Registrant,”

“we,” “our” and “us” refer to Sonoma Pharmaceuticals, Inc.

Company Overview

We are a global healthcare leader for developing

and producing stabilized hypochlorous acid, or HOCl, products for a wide range of applications, including wound care, eye care, oral care,

dermatological conditions, podiatry, animal health care and non-toxic disinfectants. Our products reduce infections, itch, pain, scarring

and harmful inflammatory responses in a safe and effective manner. In-vitro and clinical studies of HOCl show it to have impressive antipruritic,

antimicrobial, antiviral and anti-inflammatory properties. Our stabilized HOCl immediately relieves itch and pain, kills pathogens and

breaks down biofilm, does not sting or irritate skin and oxygenates the cells in the area treated assisting the body in its natural healing

process. We sell our products either directly or via partners in 55 countries worldwide.

We originally incorporated as Micromed Laboratories,

Inc. in 1999 under the laws of the State of California. We changed our name to Oculus Innovative Sciences, Inc. in 2001. In December 2006

we reincorporated under the laws of the State of Delaware, and in December 2016 we changed our name to Sonoma Pharmaceuticals, Inc. In

2022, we relocated our principal executive offices from 645 Molly Lane, Suite 150, Woodstock, Georgia, 30189 to 5445 Conestoga Court,

Suite 150, Boulder, Colorado 80301. We have two active wholly-owned subsidiaries: Oculus Technologies of Mexico, S.A. de C.V., and Sonoma

Pharmaceuticals Netherlands, B.V. Our fiscal year end is March 31. Our corporate telephone number is (800) 759-9305. Our websites are

www.sonomapharma.com and www.sonomapharma.eu. The websites and any information contained therein or connected thereto is not intended

to be incorporated into this report.

The Securities We May Offer

We may offer and sell, from time to time, in one

or more offerings, any combination of shares of our common stock, preferred stock, debt securities and warrants to purchase any of such

securities, up to a total aggregate offering price of $51,300,000 under this prospectus, together with any applicable prospectus supplement,

at prices and on terms to be determined by market conditions at the time of the relevant offering. This prospectus provides you with a

general description of the securities we may offer. Each time we offer a type or series of securities under this prospectus, we will provide

a prospectus supplement that will describe the specific amounts, prices and other important terms of the securities, including, to the

extent applicable:

| |

· |

designation or classification; |

| |

|

|

| |

· |

aggregate offering price; |

| |

|

|

| |

· |

rates and times of payment of dividends, if any; |

| |

|

|

| |

· |

redemption, conversion, exchange or sinking fund terms, if any; |

| |

· |

conversion or exchange prices or rates, if any, and, if applicable, any provisions for changes to or adjustments in the conversion or exchange prices or rates and in the securities or other property receivable upon conversion or exchange; |

| |

|

|

| |

· |

ranking, if applicable; |

| |

|

|

| |

· |

restrictive covenants, if any; |

| |

|

|

| |

· |

voting or other rights, if any; and |

| |

|

|

| |

· |

important United States federal income tax considerations. |

The prospectus supplement may also add, update

or change information contained in this prospectus or in documents we have incorporated by reference. However, no prospectus supplement

will offer a security that is not registered and described in this prospectus at the time of the effectiveness of the registration statement

of which this prospectus is a part.

This prospectus may not be used to consummate

a sale of securities unless it is accompanied by a prospectus supplement.

We may sell the securities directly to investors

or through underwriters, dealers or agents. We, and our underwriters or agents, reserve the right to accept or reject all or part of any

proposed purchase of securities. If we do offer securities through underwriters or agents, we will include in the applicable prospectus

supplement:

| |

· |

the names of those underwriters or agents; |

| |

|

|

| |

· |

applicable fees, discounts and commissions to be paid to them; |

| |

|

|

| |

· |

details regarding over-allotment options, if any; and |

| |

|

|

| |

· |

the estimated net proceeds to us. |

RISK FACTORS

Investing in our securities involves a high degree

of risk. You should carefully review the risks and uncertainties described herein and under the heading “Risk Factors” contained

in the applicable prospectus supplement, and under similar headings in our Annual Report on Form 10-K for the fiscal year ended March

31, 2023, as updated by our quarterly and other reports and documents that are incorporated by reference into this prospectus, before

deciding whether to purchase any of the securities being registered pursuant to the registration statement of which this prospectus is

a part. Each of the risk factors could adversely affect our business, operating results and financial condition, as well as adversely

affect the value of an investment in our securities, and the occurrence of any of these risks might cause you to lose all or part of your

investment. Additional risks not presently known to us or that we currently believe are immaterial may also significantly impair our business

operations.

Our failure to maintain compliance with

Nasdaq’s continued listing requirements could result in the delisting of our common stock.

On September 22, 2023, we received a letter from

The Nasdaq Stock Market LLC (“Nasdaq”) indicating that we are not in compliance with Nasdaq Listing Rule 5550(a)(2), which

requires companies listed on The Nasdaq Stock Market to maintain a minimum bid price of $1 per share for continued listing. Nasdaq’s

letter has no immediate impact on the listing of our common stock, which will continue to be listed and traded on Nasdaq, subject to our

compliance with the other continued listing requirements. Nasdaq has granted us a period of 180 calendar days, or until March 20, 2024,

to regain compliance with the rule. We may regain compliance at any time during this compliance period if the minimum bid price for our

common stock is at least $1 for a minimum of ten consecutive business days.

Until Nasdaq has reached a final determination

that we have regained compliance with all of the applicable continued listing requirements, there can be no assurances regarding the continued

listing of our common stock or warrants on Nasdaq. The delisting of our common stock and warrants from Nasdaq would have a material adverse

effect on our access to capital markets, and any limitation on market liquidity or reduction in the price of its common stock as a result

of that delisting would adversely affect our ability to raise capital on terms acceptable to the Company, if at all.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

When used in this prospectus, the words “expect,”

“believe,” “anticipate,” “estimate,” “may,” “could,” “intend,”

and similar expressions are intended to identify forward-looking statements. These statements are subject to known and unknown risks and

uncertainties that could cause actual results to differ materially from those projected or otherwise implied by the forward-looking statements.

These forward-looking statements speak only as of the date of this prospectus. Given these risks and uncertainties, you should not place

undue reliance on these forward-looking statements. We have discussed many of these risks and uncertainties in greater detail in this

prospectus under the heading “Risk Factors.” Additional cautionary statements or discussions of risks and uncertainties that

could affect our results or the achievement of the expectations described in forward-looking statements may also be contained in the documents

we incorporate by reference into this prospectus.

These forward-looking statements speak only as

of the date of this prospectus. We expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any

forward-looking statements contained herein to reflect any change in our expectations with regard thereto or any change in events, conditions

or circumstances on which any such statement is based. You should, however, review additional disclosures we make in our Annual Report

on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K filed with the SEC.

USE OF PROCEEDS

Unless we state otherwise in the accompanying

prospectus supplement, we intend to use the net proceeds from the sale of the securities offered by this prospectus for general corporate

purposes. General corporate purposes may include additions to working capital, research and development, financing of capital expenditures,

and future acquisitions and strategic investment opportunities. Pending the application of net proceeds, we expect to invest the net proceeds

in interest-bearing securities.

DILUTION

We will set forth in a prospectus supplement the

following information regarding any material dilution of the equity interests of investors purchasing securities in an offering under

this prospectus:

| |

· |

the net tangible book value per share of our equity securities before and after the offering; |

| |

|

|

| |

· |

the amount of the increase in such net tangible book value per share attributable to the cash payments made by purchasers in the offering; and |

| |

|

|

| |

· |

the amount of the immediate dilution from the public offering price

which will be absorbed by such purchasers.

|

DIVIDEND POLICY

We have not declared or paid dividends to stockholders since inception

and do not plan to pay cash dividends in the foreseeable future. We currently intend to retain earnings, if any, to finance our growth.

PLAN OF DISTRIBUTION

We may sell the securities offered by this prospectus

to one or more underwriters or dealers for public offering and sale by them or to investors directly or through agents. The accompanying

prospectus supplement will set forth the terms of the offering and the method of distribution and will identify any firms acting as underwriters,

dealers or agents in connection with the offering, including:

| |

· |

the name or names of any underwriters, dealers or agents; |

| |

|

|

| |

· |

the purchase price of the securities and the proceeds to us from the sale; |

| |

|

|

| |

· |

any underwriting discounts and other items constituting compensation to underwriters, dealers or agents; |

| |

|

|

| |

· |

any public offering price; |

| |

|

|

| |

· |

any discounts or concessions allowed or re-allowed or paid to dealers; and |

| |

|

|

| |

· |

any securities exchange or market on which the securities offered in the prospectus supplement may be listed. |

Only those underwriters identified in such

prospectus supplement are deemed to be underwriters in connection with the securities offered in the prospectus supplement.

The distribution of the securities may be effected

from time to time in one or more transactions at a fixed price or prices, which may be changed, or at prices determined as the applicable

prospectus supplement specifies. The securities may be sold through a rights offering, forward contracts or similar arrangements. In connection

with the sale of the securities, underwriters, dealers or agents may be deemed to have received compensation from us in the form of underwriting

discounts or commissions and also may receive commissions from securities purchasers for whom they may act as agent. Underwriters may

sell the securities to or through dealers, and the dealers may receive compensation in the form of discounts, concessions or commissions

from the underwriters or commissions from the purchasers for whom they may act as agent. Some of the underwriters, dealers or agents who

participate in the securities distribution may engage in other transactions with, and perform other services for, us or our subsidiaries

in the ordinary course of business.

We will provide in the applicable prospectus supplement

information regarding any underwriting discounts or other compensation that we pay to underwriters or agents in connection with the securities

offering, and any discounts, concessions or commissions which underwriters allow to dealers. Underwriters, dealers and agents participating

in the securities distribution may be deemed to be underwriters, and any discounts and commissions they receive and any profit they realize

on the resale of the securities may be deemed to be underwriting discounts and commissions under the Securities Act of 1933. Underwriters

and their controlling persons, dealers and agents may be entitled, under agreements entered into with us, to indemnification against and

contribution toward specific civil liabilities, including liabilities under the Securities Act.

The securities may or may not be listed on a national

securities exchange. In connection with an offering, the underwriters may purchase and sell securities in the open market. These transactions

may include short sales, stabilizing transactions and purchases to cover positions created by short sales. Short sales involve the sale

by the underwriters of a greater number of securities than they are required to purchase in an offering. Stabilizing transactions consist

of bids or purchases made for the purpose of preventing or retarding a decline in the market price of the securities while an offering

is in progress. The underwriters also may impose a penalty bid. This occurs when a particular underwriter repays to the underwriters a

portion of the underwriting discount received by it because the underwriters have repurchased securities sold by or for the account of

that underwriter in stabilizing or short-covering transactions. These activities by the underwriters may stabilize, maintain or otherwise

affect the market price of the securities. As a result, the price of the securities may be higher than the price that otherwise might

exist in the open market. If these activities are commenced, they may be discontinued by the underwriters at any time.

DESCRIPTION OF COMMON STOCK

This section describes the general terms and provisions

of the shares of our common stock. This description is only a summary and is qualified in its entirety by reference to the description

of our common stock incorporated by reference in this prospectus. A copy of our restated certificate of incorporation, as amended, and

our amended and restated bylaws, as amended, has been incorporated by reference from our filings with the SEC as exhibits to the registration

statement of which this prospectus forms a part. Our common stock and the rights of the holders of our common stock are subject to the

applicable provisions of the Delaware General Corporation Law, which we refer to as “Delaware law,” our restated certificate

of incorporation, as amended, our amended and restated bylaws, as amended, the rights of the holders of our preferred stock, if any, as

well as some of the terms of our outstanding indebtedness. See “Where You Can Find More Information.”

We have 24,000,000 shares of authorized common

stock, par value $0.0001 per share. As of November 21, 2023, there were 13,679,333 shares of common stock issued and outstanding. All

outstanding shares of common stock are fully paid and nonassessable, and the shares of common stock offered, when issued, will be fully

paid and nonassessable.

The following description of our common stock,

and any description of our common stock in a prospectus supplement, may not be complete and is subject to, and qualified in its entirety

by reference to, Delaware law and the actual terms and provisions contained in our restated certificate of incorporation and our amended

and restated bylaws, each as amended from time to time.

Voting Rights: Unless otherwise

provided by law or provided in our restated certificate of incorporation, as amended, each holder of common stock is entitled to one vote

for each share of common stock held on all matters submitted to a vote of stockholders. At a meeting of stockholders at which a quorum

is present, an affirmative vote of the majority of the shares entitled to vote on a matter and that are represented either in person or

by proxy decides all questions, unless the question is one upon which by express provision of law or our restated certificate of incorporation

or of our amended and restated bylaws, a different vote is required.

Dividends: Dividends upon the

capital stock of the corporation may be declared by our board of directors at any regular or special meeting or by unanimous written consent,