false

0001367083

0001367083

2024-03-08

2024-03-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of

earliest event reported) March 8,

2024

SONOMA

PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-33216 |

|

68-0423298 |

| (State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

| of incorporation) |

|

File Number) |

|

Identification No.) |

5445

Conestoga Court, Suite

150

Boulder, CO 80301

(Address of principal executive offices)

(Zip Code)

(800) 759-9305

(Registrant’s telephone number, including

area code)

Not applicable.

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ |

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading symbol(s) |

Name of each exchange on which registered |

| Common

Stock |

SNOA |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or

Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive

Agreement.

As previously disclosed, on December 15, 2023,

Sonoma Pharmaceuticals, Inc. (the “Company”) entered into an Equity Distribution Agreement (the “Agreement”),

with Maxim Group LLC (“Maxim”), pursuant to which the Company may offer and sell, from time to time, through Maxim, as sales

agent or principal, shares of its common stock, $0.0001 par value per share. On March 8, 2024, the Company entered into an amendment to

the Agreement (“Amendment No. 1”) to provide for the sale of up to $785,679 of additional shares under the Agreement.

Sales of shares of common stock under the Agreement,

as amended by Amendment No. 1, will be made pursuant to the registration statement on Form S-3 (File No. 333-275311), which was declared

effective by the U.S. Securities and Exchange Commission (the “SEC”) on November 20, 2023, and a related prospectus supplement

filed with the SEC on March 8, 2024, for an aggregate offering price of up to $785,679.

The foregoing summary of Amendment No. 1 and the

original Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of Amendment No. 1,

which is filed herewith as Exhibit 1.1 to this Current Report on Form 8-K, and the original Agreement, which was filed as Exhibit 1.1

to the Company’s Current Report on Form 8-K on December 18, 2023.

A copy of the opinion of Burns & Levinson,

LLP relating to the legality of the issuance and sale of shares under the Agreement, as amended by Amendment No. 1, is attached hereto

as Exhibit 5.1 to this Current Report on Form 8-K.

This Current Report on Form 8-K shall not constitute

an offer to sell or the solicitation of an offer to buy any shares under the Agreement, nor shall there be any sale of such shares in

any state in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws

of any such state.

This report contains forward-looking statements.

Forward-looking statements include, but are not limited to, statements that express the Company’s intentions, beliefs, expectations,

strategies, predictions or any other statements related to the Company’s future activities, or future events or conditions. These

statements are based on current expectations, estimates and projections about the Company’s business based, in part, on assumptions

made by management. These statements are not guarantees of future performances and involve risks, uncertainties and assumptions that are

difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in the forward-looking

statements due to numerous factors, including those risks discussed in the Company’s Annual Report on Form 10-K and in other documents

that the Company files from time to time with the SEC. Any forward-looking statements speak only as of the date on which they are made,

and the Company does not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the

date of this report, except as required by law.

|

Item 9.01 |

Financial Statements and Exhibits. |

| Exhibit Number |

|

Description |

| 1.1* |

|

Amendment No. 1 to Equity Distribution Agreement, by and between Sonoma Pharmaceuticals, Inc. and Maxim Group LLC., dated March 8, 2024. |

| 1.2 |

|

Equity Distribution Agreement, by and between Sonoma Pharmaceuticals, Inc. and Maxim Group LLC., dated December 15, 2023 (included as Exhibit 1.1 to the Company’s Current Report on Form 8-K filed on December 18, 2023, and incorporated herein by reference). |

| 5.1* |

|

Opinion of Burns & Levinson, LLP |

| 23.1 |

|

Consent of Burns & Levinson, LLP (included in Exhibit 5.1). |

| 104 |

|

Cover Page Interactive Data File (formatted in Inline XBRL in Exhibit 101). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

SONOMA PHARMACEUTICALS, INC. |

| |

|

| |

|

| Date: March 8,

2024 |

By: |

/s/ Amy Trombly |

| |

Name:

Title: |

Amy Trombly

Chief Executive Officer |

Exhibit 1.1

AMENDMENT

NO. 1

TO

EQUITY

DISTRIBUTION AGREEMENT

March 8, 2024

Maxim Group LLC

300 Park Avenue, 16th Floor

New York, New York 10022

Ladies and Gentlemen:

Sonoma Pharmaceuticals, Inc.,

a Delaware corporation (the “Company”), and Maxim Group LLC, as sales agent (the “Agent”),

are parties to that certain Equity Distribution Agreement dated as of December 15, 2023 (the “Original Agreement”).

The Company and the Agent desire to amend the Original Agreement as set forth in this agreement (this “Amendment No. 1”).

All capitalized terms not defined herein shall have the meanings ascribed to them in the Original Agreement. The parties, intending to

be legally bound, hereby amend the Original Agreement as follows:

| 1. | Section 2(d) is hereby deleted and replaced in its entirety with the following: |

“(d) The Company and the Agent

agree that beginning as of the date of the Original Agreement, the Agent was not, and shall not be, required to sell any certain number

of shares or dollar amount of Common Stock, whether based on the daily trading volume of the Common Stock or otherwise, and that the Agent

will use its commercially reasonable efforts consistent with its normal trading and sales practices to sell any such Shares on the Company’s

behalf as requested to be sold by the Company, subject to the conditions set forth in the Original Agreement and applicable law.”

| 2. | Section 3(dd) is hereby deleted and replaced in its entirety with the following: |

“(dd) The parties hereto

are also party to that certain Placement Agency Agreement, dated October 30, 2023 (the “2023 Placement Agency Agreement”).

The Company and the Agent agree that the Agent hereby provides a one-time waiver of Section 4(q) of the 2023 Placement Agency Agreement

for any Shares sold under this Agreement pursuant to the prospectus, dated March 8, 2024, with respect to up to $785,679 of shares of

Common Stock. Except as specifically set forth herein, the terms set forth in the 2023 Placement Agency Agreement shall continue to apply

as set forth therein.”

| 3. | No Other Changes. Except as specifically set forth herein, all other provisions of the Original

Agreement shall remain in full force and effect. |

| | | |

| 4. | Entire Agreement; Amendment; Severability; Headings. This Amendment No. 1 together with

the Original Agreement (including all schedules and exhibits attached hereto and transaction notices issued pursuant hereto) constitutes

the entire agreement and supersedes all other prior and contemporaneous agreements and undertakings, both written and oral, among the

parties hereto with regard to the subject matter hereof. Neither this Amendment No. 1 together with the Original Agreement nor any term

hereof or thereof may be amended except pursuant to a written instrument executed by the Company and the Agent. In the event that any

one or more of the provisions contained herein or therein, or the application thereof in any circumstance, is held invalid, illegal or

unenforceable as written by a court of competent jurisdiction, then such provision shall be given full force and effect to the fullest

possible extent that it is valid, legal and enforceable, and the remainder of the terms and provisions herein shall be construed as if

such invalid, illegal or unenforceable term or provision was not contained herein, but only to the extent that giving effect to such provision

and the remainder of the terms and provisions hereof shall be in accordance with the intent of the parties as reflected in this Amendment

No. 1 together with the Original Agreement. All references in the Original Agreement to the “Agreement” shall mean the Original

Agreement as amended by this Amendment No. 1; provided, however, that all references to “date of this Agreement”

in the Original Agreement shall continue to refer to the date of the Original Agreement. |

| 5. | Governing Law. This Amendment No. 1 shall be governed by and construed in accordance with

the laws of the State of New York, including Section 5-1401 of the General Obligations Law of the State of New York, but otherwise without

regard to conflict of laws rules that would apply the laws of any other jurisdiction. |

| | | |

| 6. | Counterparts. This Amendment No. 1 may be executed in one or more counterparts and, if executed

in more than one counterpart, the executed counterparts shall each be deemed to be an original and all such counterparts shall together

constitute one and the same instrument. In the event that any signature is delivered by facsimile transmission or a .pdf or other electronic

format file, such signature shall create a valid and binding obligation of the party executing (or on whose behalf such signature is executed)

with the same force and effect as if such facsimile or .pdf or other electronic signature page were an original thereof. |

| | | |

| 7. | Waiver of Jury Trial. Each of the Company and the Agent hereby waives any right it may have

to a trial by jury in respect of any claim based upon or arising out of this Amendment No. 1 or the transactions contemplated hereby. |

| | | |

| 8. | Submission to Jurisdiction. The Company irrevocably submits to the non-exclusive jurisdiction

of any New York State or United States federal court sitting in The City of New York, Borough of Manhattan, over any suit, action or proceeding

arising out of or relating to this Agreement, the Prospectus, the Registration Statement, or the offering of the Shares. The Company irrevocably

waives, to the fullest extent permitted by law, any objection which it may now or hereafter have to the laying of venue of any such suit,

action or proceeding brought in such a court and any claim that any such suit, action or proceeding brought in such a court has been brought

in an inconvenient forum. To the extent that the Company has or hereafter may acquire any immunity (on the grounds of sovereignty or otherwise)

from the jurisdiction of any court or from any legal process with respect to itself or its property, the Company irrevocably waives, to

the fullest extent permitted by law, such immunity in respect of any such suit, action or proceeding including without limitation, any

immunity pursuant to the U.S. Foreign Sovereign Immunities Act of 1976, as amended. Each of the Agent and the Company further agrees to

accept and acknowledge service of any and all process which may be served in any such suit, action or proceeding in the Supreme Court

of the State of New York, New York County, or in the United States District Court for the Southern District of New York and agrees that

service of process upon the Company mailed by certified mail or delivered by Federal Express via overnight delivery to the Company’s

address shall be deemed in every respect effective service of process upon the Company in any such suit, action or proceeding, and service

of process upon the Agent mailed by certified mail or delivered by Federal Express via overnight delivery to the Agent’s address

shall be deemed in every respect effective service of process upon such Agent in any such suit, action or proceeding. |

[Signature Page Follows]

If the foregoing is in accordance

with your understanding of our agreement, please sign and return to the Company the enclosed duplicate of this Amendment No. 1 to Original

Agreement, whereupon this letter and your acceptance shall represent a binding agreement between the Company and the Agent in accordance

with its terms.

| |

Very truly yours, |

| |

|

|

| |

|

|

| |

SONOMA PHARMACEUTICALS, INC. |

| |

|

|

| |

|

|

| |

By: |

/s/ Amy Trombly |

| |

|

Name: |

Amy Trombly |

| |

|

Title: |

President and Chief Executive Officer |

Confirmed

as of the date first above mentioned.

| MAXIM GROUP LLC, as Agent |

|

| |

|

|

| By: |

/s/ Clifford A. Teller |

|

| |

Name: |

Clifford A. Teller |

|

| |

Title: |

Co-President |

|

[Signature Page to Amendment

No. 1 to the Equity Distribution Agreement]

Exhibit 5.1

March 8, 2024

Sonoma Pharmaceuticals, Inc.

5445 Conestoga Court

Suite 150

Boulder, CO 80301

Dear Ladies and Gentlemen:

We have acted as legal counsel to Sonoma Pharmaceuticals, Inc., a Delaware

corporation (the “Company”), in connection with the offering and sale by the Company of shares (the “Shares”)

of the Company’s common stock, par value $0.0001 per share (“Common Stock”), having an aggregate offering price

of up to $785,679 to be offered and sold from time to time pursuant to a prospectus supplement dated March 8, 2024 (the “Prospectus

Supplement”) and the accompanying prospectus dated November 22, 2023 (together with the Prospectus Supplement, the “Prospectus”)

that form part of the Company’s registration statement on Form S-3 (File No. 333-275311) (together with the Prospectus, the “Registration

Statement”) filed by the Company with the Securities and Exchange Commission (the “Commission”) under the

Securities Act of 1933, as amended (the “Securities Act”). The Shares are to be sold by the Company through or to Maxim

Group LLC (the “Sales Agent”), as sales agent and/or principal, in accordance with that certain Equity Distribution

Agreement, dated December 15, 2023 and as amended on March 8, 2024 by and between the Company and the Sales Agent (the “Equity

Distribution Agreement”), as described in the Prospectus Supplement.

In connection with this opinion, we have examined originals or copies,

certified or otherwise identified to our satisfaction, of (i) the Registration Statement, including the Prospectus Supplement, (ii) a

specimen certificate representing the Common Stock, (iii) the Equity Distribution Agreement, (iv) the Company’s Restated Certificate

of Incorporation, as currently in effect, (v) the Company’s Bylaws, as currently in effect, and (vi) certain resolutions adopted

by the Board of Directors of the Company and committees thereof with respect to the Equity Distribution Agreement and the issuance of

the Shares. We have also examined originals or copies, certified or otherwise identified to our satisfaction, of such records of the Company

and such agreements, certificates of public officials, certificates of officers or other representatives of the Company and others, and

such other documents, certificates and records, as we have deemed necessary or appropriate as a basis for the opinion set forth herein.

In our examination, we have assumed and have not verified (i) the legal

capacity of all natural persons, (ii) the genuineness of all signatures, (iii) the authenticity of all documents submitted to us as originals,

(iv) the conformity with the originals of all documents supplied to us as copies, (v) the accuracy and completeness of all corporate records

and documents made available to us by the Company, (vi) the truth, accuracy and completeness of the information, representations and warranties

contained in the records, documents, instruments and certificates we have reviewed; and (vii) that the foregoing documents, in the form

submitted to us for our review, have not been altered or amended in any respect material to our opinion stated herein. We have relied

as to factual matters upon certificates from officers of the Company and certificates and other documents from public officials and government

agencies and departments and we have assumed the accuracy and authenticity of such certificates and documents. We have further assumed

that the Shares will be issued and delivered in accordance with the terms of the Equity Distribution Agreement.

For purposes of the opinion set forth below, we refer to the following

as “Future Approval and Issuance”: (a) the approval by the Company’s board of directors (or a duly authorized committee

of the board of directors) of the issuance of the Shares (the “Approval”) and (b) the issuance of the Shares in accordance

with the Approval and the receipt by the Company of the consideration (which shall not be less than the par value of such Shares) to be

paid therefor in accordance with the Approval.

Based on the foregoing, and subject to the assumptions, qualifications

and limitations set forth herein, as of the date hereof, we are of the opinion that the Shares have been duly authorized for issuance,

and upon Future Approval and Issuance, will be validly issued, fully paid and non-assessable.

For purposes of our opinion above, we express no opinion as to the

law of any jurisdiction other than the General Corporation Law of the State of Delaware (including the statutory provisions, all applicable

provisions of the Delaware Constitution and reported judicial decisions interpreting the foregoing). No opinion is expressed herein with

respect to the qualification of the Shares under the securities or blue sky laws of any state or foreign jurisdiction. The opinion expressed

herein is given as of this date, and we do not undertake to supplement this opinion with respect to any events or changes occurring subsequent

to the date hereof.

We hereby consent to the filing of this opinion as an exhibit to the

Current Report on Form 8-K to be filed with the Commission in connection with the offering and to the use of our name under the caption

“Legal Matters” in the Prospectus Supplement. In giving this consent, we do not thereby admit that we are included in the

category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Commission promulgated

thereunder.

| |

Very

truly yours, |

| |

|

| |

/s/ Burns & Levinson LLP |

| |

|

| |

Burns

& Levinson LLP |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

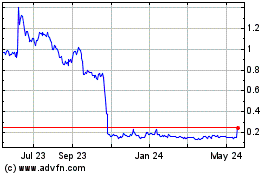

Sonoma Pharmaceuticals (NASDAQ:SNOA)

Historical Stock Chart

From Oct 2024 to Nov 2024

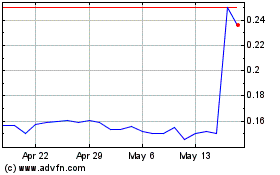

Sonoma Pharmaceuticals (NASDAQ:SNOA)

Historical Stock Chart

From Nov 2023 to Nov 2024