Trending: Merck's Multiple Sclerosis Drug Misses Expectations in Late-Stage Trials

December 06 2023 - 7:20AM

Dow Jones News

1250 GMT - Merck is among the most mentioned companies across

news items over the past 12 hours, according to Factiva data, after

the German pharmaceutical-and-chemical group said its multiple

sclerosis drug didn't meet expectations in a late-stage trial. The

drug didn't show strong enough efficacy in reducing annualized

relapse rates and therefore missed the company's aim to match the

results of Aubagio, a drug for the disease owned by the French drug

giant Sanofi. The news is negative from a strategic point of view,

as it reduces the pipeline value, Equita analyst Gianmarco Bonacina

says in a research note. However, the analyst also points out that

expectations for sales of this drug had been significantly reduced

and were almost slashed to zero in April, after Merck flagged liver

problems shown by two patients in the sample under examination.

Sentiment towards the bruton tyrosine kinase inhibitors won't be

helped by Merck's failure of evobrutinib to demonstrate superiority

over Aubagio, given the class is already clouded by liver toxicity

concerns, Citi analysts write in a note to clients. Now the main

drug in the pipeline is xevinapant to treat cancer in the head and

neck region, with readout of the Phase 3 trial in the next six

months, Equita says. Dow Jones & Co. owns Factiva.

(andrea.figueras@wsj.com)

(END) Dow Jones Newswires

December 06, 2023 08:05 ET (13:05 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

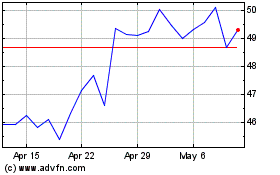

Sanofi (NASDAQ:SNY)

Historical Stock Chart

From Feb 2025 to Mar 2025

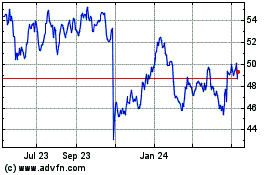

Sanofi (NASDAQ:SNY)

Historical Stock Chart

From Mar 2024 to Mar 2025