Exhibit 99.1

Annex

A

Manager

and Executive Officers of Orbic North America, LLC.

The

following sets forth the name and principal occupation of each of the directors and executive officers of Orbic North America, LLC.

(“Orbic”), whose address (unless otherwise specified in the Schedule 13D) is c/o Orbic North America, LLC., 555 Wireless

Blvd., Hauppauge, NY 11788. Each of such persons is a citizen of the United States. During the last five years, none of the persons

listed below has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors), or been a party to

a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is

subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities

subject to, federal or state securities laws or finding any violation with respect to such laws.

| Name |

|

Position

with Orbic |

| Ashima Narula |

|

Sole member and manager of Orbic North America, LLC. |

| Parveen Narula |

|

President and Chief Executive Officer of Orbic North

America, LLC. |

| Gina Wetzel |

|

Chief Financial Officer and Chief Operating Officer

of Orbic North America, LLC. |

| Eileen Lever |

|

Director of Human Resources of Orbic North America,

LLC. |

Exhibit 99.2

Sale

of Shares of Sonim Technologies, Inc.

Preliminary

Summary of Terms and Conditions

January

10, 2025

The

following is a summary of the preliminary terms and conditions (“Term Sheet”) for a proposed sale of shares of common stock

of Sonim Technologies, Inc. (“Sonim”) owned by AJP Holding Company, LLC. to Orbic North America LLC, or an affiliated entity

(the “Transaction”). This Term Sheet is not intended to be a definitive agreement on all the terms of the Transaction,

and such terms and any obligation of the parties with respect to the Transaction are subject to the completion of business, financial

and legal due diligence and the negotiation and execution of the definitive documents for the Transaction. Notwithstanding anything to

the contrary herein, the parties acknowledge and agree that their respective agreements set forth below under the headings “Expiration”,

“Exclusivity” and “Governing Law” are intended to be, and are, binding and enforceable agreements of the parties

with respect to the matters set forth therein and shall survive the termination or expiration of this Term Sheet.

| Company: | Sonim

Technologies, Inc. (NASDAQ:SONM) (the “Company”). |

| Seller:: | AJP

Holding Company LLC, a limited liability company with an office at 829 Peach Avenue, Sunnyvale,

CA 94087 (the “Seller”). |

| Purchaser: | Orbic

North America LLC, or an entity to be designated by it (the “Purchaser”) with an address at 555 Wireless Blvd., Hauppauge,

NY 11788 |

| Closing

Date: | Targeted

to occur within two weeks after execution of this Term Sheet. |

| Terms: | Seller

will sell and Purchaser will purchase an aggregate of 973,173 shares of common stock of the

Company (the “Shares”) owned by Seller at an aggregate purchase price of $4.21

which is equal to the Market Price of the shares of common stock of the Company, plus a 30%

premium (the “Purchase Price”). The Market Price is defined as the average closing

price of the Company’s Common Stock on the Nasdaq Stock Market (“Nasdaq”)

for the five (5) trading days preceding the date hereof. The Shares represent 50% of the

shares of common stock of the Company that are owned by the Seller. The 973,172 balance of

the shares of common stock of the Company owned by the Seller are referred to as the “Remaining

Shares”. The Purchase Price shall be paid as follows: (i) $200,000 on the date of signing

of the definitive purchase agreement as a non-refundable deposit to the Purchase Price; and

(ii) the balance to be paid within six months of the closing of the Transaction (the “Closing”).

The Purchaser will pledge the Shares to the Seller as security for the payment of the Purchase

Price pursuant to a stock pledge agreement. |

| Arrangements

with respect To Remaining Shares: | (i)

The Seller agrees to sign a voting agreement with the Purchaser whereby the Seller agrees to vote the Remaining Shares as directed by

the Purchaser in any meeting of the Company’s shareholders whereby a vote of all shareholders entitled to vote is held or in connection

with actions to be taken by written consent. |

| | |

| | (ii)

The Purchaser shall have the right to purchase (the “Option”) 50% of the Remaining Shares (the “Option Shares”)

at any time during the three year period following the Closing (the “Option Period”). The Exercise Price of the Option shall

be equal to the greater of (i) a 40% premium to the Market Price, or (ii) the then Market Price, if exercised in Year one of the Option

Period. The Exercise Price shall be equal to the greater of (i) a 35% premium to the Market Price, or (ii) the then Market Price, if

exercised in Year two of the Option Period. The Exercise Price shall be equal to the greater of (i) a 30% premium to the Market Price,

or (ii) the then Market Price, if exercised in Year 3 of the Option Period. The Exercise Price shall be payable 60 days following the

closing of such exercise. |

| (iii)

During the Option Period, the Seller shall not have the right to sell any of the Option Shares. From the Closing until six months following

the expiration of the Option Period, in the event the Seller desires to sell or otherwise dispose of any of the Remaining Shares that

are not the Option Shares (the “Retained Shares”), the Purchaser shall have a right of first refusal to purchase the Retained

Shares at a price equal to the lesser of the price agreed to with the third party or a 30% premium to the then Market Price. |

| | |

| | (iv)

The Purchaser agrees to pay to the Seller in cash an amount of money representing the difference between the price per share paid in

the Transaction and the market price of the Company’s common stock three years from the date of the definitive agreement (the “Guarantee

Date”) multiplied by 1.3 multiplied by the number of Remaining Shares (the “Guarantee Price”) not being purchased by

Purchaser pursuant to (ii) above. For illustration purposes,

if the Company’s common stock has a Market Price of $3.00 per share on the date of the Transaction (which would result in a Purchase

Price of $3.90 per share) and has a Market Price of $2.90 per share on the Guarantee Date, the Buyer shall be obligated to pay to the

Seller an aggregate of {$973,172} which is equal to $1.00 multiplied by the number of Remaining Shares. This obligation which shall be

referred to as the Guarantee Payment shall be a personal obligation of Mike Narula and shall be paid within five (5) business days of

the Guarantee Date. Even in the event that the Seller does not pay for the Shares in six months from the date of the Transaction and

the Shares are returned to the Seller, the Purchaser’s obligation to pay the Guarantee Payment shall remain as a binding obligation.

The payment of the Guarantee Payment shall not give any ownership of the Remaining Shares to Purchaser that are not acquired pursuant

to an exercise of the Option.

|

| Board

Seat: |

At the request of Purchaser,

Jeffrey Wang shall resign as a member of the Board of Directors of the Company (the “Board”) and he shall recommend to

the Board that it fill the vacancy created thereby with a nominee designated by Purchaser. |

| |

|

| Mutually

Exclusive Sourcing Agreement |

Purchaser will recommend

to the Board that the Company enter into a Sourcing Agreement with Seller’s designated company which shall provide that Sonim

will source all of its products from Seller’s designated company at agreed upon prices and Seller’s designated company

will be the exclusive designer of Sonim’s products to Sonim (i.e., the Company will only utilize such designated company for

such design services and such designated company shall not provide design services for any entity other than the Company) until January

21, 2028. |

| |

|

| Certain Documentation |

The definitive documents

shall include a stock purchase agreement, a voting agreement and an option agreement which shall contain usual and customary provisions

for transactions of this type, including, but without limitation, representations and warranties, affirmative covenants, negative

covenants and events of default. |

| |

|

| Governing Law: |

This Term Sheet shall be

governed by, and construed in accordance with, the internal laws of the State of New York (without regard to conflicts of law principles).

The parties hereby irrevocably consent to the exclusive jurisdiction of any New York state or United States federal court sitting

in New York County, New York over any action or proceeding arising out of or relating to this Term Sheet. The Seller and the Purchaser

each irrevocably agree to waive all rights to trial by jury in any such action or proceeding. The parties agree to the exclusive

venue in the State of New York. |

| Exclusivity: | For

the time period ending 60 days following the date this Term Sheet is executed and delivered

by the parties hereto, the Seller agrees not to, directly or indirectly, offer to sell, negotiate

to sell, sell, purchase or lend any of the Shares or the Remaining Shares to any third party

or otherwise engage in any discussions with any third party with regard to a Transaction.

Promptly upon the execution and delivery of this Term Sheet, the Seller will cease any ongoing

negotiations with any persons other than the Purchaser with respect to the Shares and the

Remaining Shares. The Parties will not disclose the terms of this Term Sheet to any person

other than their own affiliates and affiliated persons without the written consent of the

other Party except as required by law or requested by a governmental authority or self-regulatory

organization and except that, promptly following the execution of this Term Sheet, the parties

will make a press release with regard to the Transaction, which press release shall be subject

to the approval of both parties. |

| Expiration: | This

Term Sheet shall expire 5 days following the date first listed above unless first executed

and delivered by the parties. |

(Signature

page follows)

IN

WITNESS WHEREOF, the Parties hereto have executed this Term Sheet as of the 10th day of January 2025.

| |

SELLER: |

| |

|

| |

AJP HOLDING COMPANY, LLC |

| |

|

| |

By: |

/s/

Jeffrey Wang |

| |

Name: |

Jeffrey Wang |

| |

Title: |

Manager |

| |

|

| |

BUYER: |

| |

|

| |

ORBIC NORTH AMERICA LLC |

| |

|

| |

By: |

/s/ Ashima

Narula |

| |

Name: |

Ashima Narula |

| |

Title: |

Manager |

4

Exhibit 99.3

AGREEMENT

AND IRREVOCABLE PROXY

THIS

AGREEMENT AND IRREVOCABLE PROXY (this “Agreement”) is entered into and made effective as of March 10, 2025 by and

between AJP Holding Company, LLC (“AJP”) and Orbic North America LLC (“Orbic”).

RECITALS

WHEREAS,

AJP and Orbic have executed but not yet delivered an agreement (the “Contemplated Purchase Agreement”) with respect

to, among other things, the sale by AJP to Orbic of 973,173 shares of common stock, $0.001 par value (“Common Stock”),

of Sonim Technologies, Inc., a Delaware corporation (the “Company”) (the “Contemplated Purchase Shares”);

WHEREAS,

the Company has resisted the efforts of AJP to transfer the Contemplated Purchase Shares to Orbic;

WHEREAS,

the Contemplated Purchase Agreement also provides that AJP will grant an irrevocable proxy to Orbic with regard to its 973,172 remaining

shares of Common Stock of the Company (together with the Contemplated Purchase Shares, the “Shares”);

WHEREAS,

Orbic intends to engage a proxy solicitation firm (the “Proxy Solicitor”) and legal counsel and other professionals

(collectively, “Professionals”) in connection with the dispute with the Company with regard to the transfer of the

Contemplated Purchase Shares, a contemplated proxy contest to be undertaken by Orbic and other matters related to the Company; and

WHEREAS,

AJP will benefit from Orbic’s efforts in connection with the transfer of the Contemplated Purchase Shares to Orbic, the contemplated

proxy contest and other matters related to the Company.

AGREEMENT

NOW,

THEREFORE, in consideration of the premises and the mutual covenants of the parties hereinafter expressed and other good and valuable

consideration, the receipt and sufficiency of which is hereby acknowledged, the parties hereto, each intending to be legally bound, agree

as follows:

1. Irrevocable

Proxy and Power of Attorney. AJP hereby irrevocably grants to, and appoints, Orbic as AJP’s

exclusive proxy and attorney-in-fact (with full power of substitution and re-substitution), for and in the name, place and stead of AJP,

to attend any meeting of the shareholders of the Company on behalf of AJP or otherwise cause all of the Shares to be counted as present

thereat for purposes of establishing a quorum, to vote the Shares, and/or grant a consent or approval in respect of the Shares. AJP hereby

affirms that the irrevocable proxy set forth in this Section 1 is given in consideration of Orbic’s engagement of the Proxy

Solicitor and Counsel. AJP hereby further affirms that the irrevocable proxy is coupled with an interest sufficient at law to support

an irrevocable proxy and may under no circumstances be revoked except upon the termination of this Agreement in accordance with its terms.

For purposes of this Section this Agreement shall terminate three (3) years from the date of this Agreement. AJP hereby ratifies and confirms

all actions that such proxyholder may lawfully take or cause to be taken by virtue hereof. Such irrevocable proxy is executed and intended

to be irrevocable, and the exercise of the voting rights of the Shares is intended to be enforceable, in accordance with the provisions

of all applicable law, including Sections 212 and 218 of the Delaware General Corporation Law. The irrevocable proxy granted hereunder

shall remain in full force and effect until the Contemplated Purchase Shares are sold by AJP to Orbic, except that it shall thereafter

continue in full force and effect pursuant to the terms of the Voting Agreement and Irrevocable Proxy contemplated to be entered into

concurrently with the Contemplated Purchase Agreement. AJP shall take all further action and execute such other instruments as may be

reasonably necessary to effectuate the intent of this irrevocable proxy. AJP hereby represents that any proxies heretofore given in respect

the Shares, if any, with respect to the matters set forth in Section 1 are revocable and hereby revokes any and all such proxies.

2. Certain

Covenants. AJP hereby covenants and agrees that AJP shall not, and shall not offer or agree to, sell, transfer, tender, assign, hypothecate

or otherwise dispose of, any of the Shares, or create or permit to exist any lien, security interest or other encumbrance on any of the

Shares without the prior written approval of Orbic, at any time prior to the date on which the Contemplated Purchase Shares are sold

to Orbic pursuant to the Contemplated Purchase Agreement, except that the covenants herein shall continue in full force and effect pursuant

to the terms of the Call Option Agreement contemplated to be entered into concurrently with the Contemplated Purchase Agreement.

3. Expenses.

AJP agrees to reimburse Orbic for, or, at Orbic’s request, pay directly fifty percent (50%) of the fees and expenses incurred by

Orbic in connection with its engagement of the Proxy Solicitor and Professionals. Notwithstanding the above sentence, Orbic shall be

solely responsible for the fees of Certilman Balin Adler & Hyman, LLP and AJP shall be solely responsible for the fees of Sichenzia

Ross Ference Carmel LLP.

4. Miscellaneous.

4.1 Entire

Agreement. This Agreement sets forth the entire understanding between the parties hereto with respect to the subject matter hereof.

4.2 Successors

and Assigns. This Agreement shall inure to the benefit of, and be binding upon, the successors and assigns of the parties hereto.

4.3 Amendment.

No provision of this Agreement may be amended other than by an instrument in writing signed by AJP and Orbic.

4.4 Execution.

This Agreement may be executed in one or more counterparts, all of which taken together shall be deemed and considered one and the same

agreement, and same shall become effective when counterparts have been signed by each party and each party has delivered its signed counterpart

to the other party. A digital reproduction, portable document format (“.pdf”), or other reproduction of this Agreement may

be executed by one or more parties hereto and delivered by such party by electronic signature (including signature via DocuSign or similar

services), electronic mail, or any similar electronic transmission device pursuant to which the signature of or on behalf of such party

can be seen. Such execution and delivery shall be considered valid, binding, and effective for all purposes.

4.5 Headings.

The article and section headings contained in this Agreement are inserted for convenience only and shall not affect in any way the meaning

or interpretation of this Agreement.

4.6 Governing

Law. This Agreement shall be governed by and construed and enforced in accordance with, and all questions concerning the construction,

validity, interpretation, and performance of this Agreement shall be governed by, the internal laws of the State of New York, without

giving effect to any choice of law or conflict of law provision or rule (whether of the State of New York or any other jurisdictions)

that would cause the application of the laws of any jurisdictions other than the State of New York. The parties hereto hereby irrevocably

waive personal service of process and consent to process being served in any such suit, action, or proceeding by mailing a copy thereof

to the applicable party at the address set forth in Section 4.10 and agree that such service shall constitute good and sufficient

service of process and notice thereof. The parties hereto hereby irrevocably submit to the exclusive jurisdiction of the state and federal

courts sitting in Counties of Nassau or Suffolk in the State of New York, for the adjudication of any dispute hereunder or in connection

herewith or with any transaction contemplated hereby or discussed herein, and hereby irrevocably waive, and agree not to assert in any

suit, action, or proceeding, any claim that it is not personally subject to the jurisdiction of any such court, that such suit, action,

or proceeding is brought in an inconvenient forum or that the venue of such suit, action, or proceeding is improper. THE PARTIES HERETO

HEREBY IRREVOCABLY WAIVE ANY RIGHT THEY MAY HAVE TO, AND AGREE NOT TO REQUEST, A JURY TRIAL FOR THE ADJUDICATION OF ANY DISPUTE HEREUNDER

OR IN CONNECTION WITH OR ARISING OUT OF THIS AGREEMENT OR ANY TRANSACTION CONTEMPLATED HEREBY.

4.7 Further

Assurances. The parties hereto will execute and deliver such further instruments and do such further acts and things as may be reasonably

required to carry out the intent and purposes of this Agreement.

4.8 Severability.

If any one of the provisions contained in this Agreement, for any reason, shall be held invalid, illegal, or unenforceable in any respect,

such invalidity, illegality, or unenforceability shall not affect any other provision of this Agreement, and this Agreement shall remain

in full force and effect and be construed as if the invalid, illegal or unenforceable provision had never been contained herein.

4.9 No

Third Party Beneficiaries. This Agreement is intended for the benefit of the parties hereto and their respective successors and assigns,

and is not for the benefit of, nor may any provision hereof be enforced by, any other person.

4.10 Notices.

Any and all notices or other communications or deliveries required or permitted to be given or made pursuant to any of the provisions

of this Agreement shall be deemed to have been duly given or made for all purposes when hand delivered or sent by the party or its counsel

by certified or registered mail, return receipt requested and postage prepaid, or overnight mail or courier as follows:

If

to Orbic, at:

555

Wireless Blvd.

Hauppauge,

New York 11788

Attention:

CEO

With

a copy to:

Certilman

Balin Adler & Hyman, LLP

90

Merrick Avenue

East

Meadow, New York 11554

Attention:

Jaspreet Mayall, Esq.

If

to AJP, at:

AJP

HOLDING COMPANY LLC

829

Peach Avenue

Sunnyvale,

CA 94087

Attention:

Jeff Wang

With

a copy to:

Sichenzia

Ross Ference Carmel LLP

1185

Avenue of the Americas, 31st Floor

New

York, New York 10036

Attention:

Arthur Marcus, Esq.

or

at such other address as either party may specify by notice given to the other party in accordance with this Section 4.10.

4.11 No

Strict Construction. The parties to this Agreement have participated jointly in the negotiation and drafting of this Agreement. In

the event an ambiguity or question of intent or interpretation arises, this Agreement will be construed as if drafted jointly by the

parties, and no presumption or burden of proof will arise favoring or disfavoring any party by virtue of the authorship of any of the

provisions of this Agreement.

[SIGNATURES

ON THE FOLLOWING PAGE]

IN

WITNESS WHEREOF, the parties hereto have caused this Agreement and Irrevocable Proxy to be executed as of the date hereof.

| |

AJP Holding Company, LLC |

| |

|

|

| |

Signature: |

By: |

/s/ Jeffry Wang |

| |

Name: |

|

Jeffrey Wang |

| |

Title: |

|

Manager |

| |

|

|

| |

Orbic North America LLC |

| |

|

|

| |

Signature: |

By: |

/s/ Ashima Narula |

| |

Name: |

|

Ashima Narula |

| |

Title: |

|

Member |

Exhibit 99.4

Joint

Filing Agreement

In

accordance with Rule 13d-1(k) promulgated under the Securities Exchange Act of 1934, as amended, each of the persons and entities named

below agrees to the joint filing of this Schedule 13D Amendment with respect to the shares of common stock, par value $0.001, of SONIM

Technologies Inc., a corporation incorporated under the laws of Delaware, and further agrees that this Joint Filing Agreement be filed

with the Securities and Exchange Commission as an exhibit to such filing; provided no such person or entity shall be responsible for

the completeness of any other person or entity making the filing unless such person or entity knows or has reason to believe such information

is inaccurate (as provided in Rule 13d-1(k)(1)(ii)). This Joint Filing Agreement may be executed in one or more counterparts, all of

which together shall constitute one and the same instrument.

[Remainder

of page intentionally left blank; signature page follows]

IN

WITNESS WHEREOF, the persons and entities named below have executed, in counterparts, this Joint Filing Agreement as of the date

set forth below.

Dated

as of March 18, 2025

| |

AJP Holding Company, LLC |

| |

|

|

| |

By: |

/s/ Jeffrey Wang |

| |

Name: |

Jeffrey Wang |

| |

Title: |

Manager |

| |

|

|

| |

Jeffrey Wang |

| |

|

|

| |

By: |

/s/ Jeffrey Wang |

| |

Name: |

Jeffrey Wang |

| |

|

|

| |

Orbic North America, LLC. |

| |

|

|

| |

By: |

/s/ Parveen Narula |

| |

Name: |

Parveen Narula |

| |

Title: |

Chief Executive Officer |

| |

|

|

| |

Ashima Narula |

| |

|

|

| |

By: |

/s/ Ashima Narula |

| |

Name: |

Ashima Narula |

| |

|

|

| |

Parveen Narula |

| |

|

|

| |

By: |

/s/ Parveen Narula |

| |

Name: |

Parveen Narula |

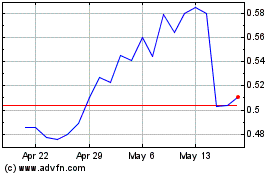

Sonim Technologies (NASDAQ:SONM)

Historical Stock Chart

From Feb 2025 to Mar 2025

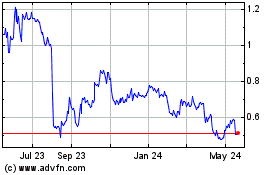

Sonim Technologies (NASDAQ:SONM)

Historical Stock Chart

From Mar 2024 to Mar 2025