SonoSite, Inc. (Nasdaq:SONO), the world leader and

specialist in hand-carried and point-of-care ultrasound, today

announced financial results for the fourth quarter and full year

ended December 31, 2008.

Fourth quarter 2008 worldwide revenue grew to $70.2 million, an

increase of 8% over the fourth quarter of 2007. Full year 2008

revenue grew to $243.5 million, up 19% over 2007. Changes in

foreign currency rates decreased worldwide revenue in the fourth

quarter by 4.2% and had a favorable impact of 0.6% on the year.

The company reported a net income increase of 184% for the

fourth quarter of 2008 to $12.1 million or $0.69 per diluted share,

compared to $4.3 million or $0.25 per diluted share in 2007. For

the full year net income grew 199% to $20.6 million, or $1.18 per

diluted share, compared to $6.9 million, or $0.40 per diluted share

in 2007.

Net income in the fourth quarter and full year 2008 included a

non-recurring, pre-tax charge of $3.0 million from terminated

acquisition talks and severance payments, as well as a $15.7

million pre-tax gain from the repurchase of $80.3 million of senior

convertible notes.

During the fourth quarter of 2008, US revenue grew 3% to $33.7

million and was impacted by a slowdown in capital spending at US

hospitals. International business grew 14% to $36.5 million in the

fourth quarter and continued to deliver broad-based double digit

growth, but was negatively impacted by 8.5% from foreign exchange

rate changes. For the full year, US revenue grew approximately 12%

to $116.7 million and international revenue grew 26% to $126.8

million.

Total operating expenses in the fourth quarter increased 8% to

$42.7 million, and increased 7% for the full year to $147.4

million. Including the previously mentioned $3.0 million non-

recurring charge, SG&A expenses grew 4% in the fourth quarter

and 6% for the full year. R&D expenses increased 30% in the

fourth quarter and 11% for the full year. Stock-based compensation

increased by $1.9 million in the fourth quarter, primarily as the

result of a change in the future forfeiture rate assumptions.

As of December 31, 2008, the company held $279.7 million in cash

and investments and long-term debt of $144.7 million, for net

liquidity of $135.0 million.

�2008 marked a year of excellent progress for the company. We

exceeded our original full year guided targets of 15% revenue

growth with 7-8% operating margins,� said Kevin M. Goodwin,

SonoSite President and CEO. �The drivers of our performance

included the new M-Turbo� and S Series� product lines alongside

excellent execution throughout the company. We delivered a 5-fold

increase in operating income with more than a quadrupling of

operating margins. We began to demonstrate operating leverage from

our business model that we have always believed possible. Further,

our net liquidity improved by $50 million during the year.�

�Our international business delivered another strong quarter and

year with double digit gains across all major geographic regions,�

Mr. Goodwin said. �Our US business performed well throughout the

year, although it was significantly hampered by customers deferring

orders which had an estimated negative impact of 10% on worldwide

revenue for the quarter. During the year, we delivered several new

products and upgrades to our S Series and M-Turbo product lines

which extended their footprint into new clinical markets. In 2009,

we plan to continue entering new clinical markets while delivering

more new products that will continue our tradition of innovation

that helps make healthcare faster and less expensive while

improving patient safety.�

Company Updates Outlook for 2009

�We expect that the worldwide economy will continue to be

challenging and difficult to predict and now do not expect there to

be any meaningful recovery until 2010,� Mr. Goodwin said. �Our

primary financial objective in 2009 is to maintain and build upon

our long-term earnings power and growth capacity. Our goal is to

increase operating income at least 10% in 2009. To position

ourselves for improved profitability in this difficult economic

environment we are targeting a 5% reduction in our operating

expenses from 2008 levels to approximately $140 million. Assuming

current exchange rates, foreign currency will have a negative

impact of 3-4% on revenue growth. Given the continued deterioration

of the global economic markets and the slowdown in US hospital

capital spending, we are not providing revenue or other financial

guidance at this time.�

�While the current economic environment is uncertain, we are in

the strongest position in our history as a company in terms of

market share, innovation and growth opportunities,� Mr. Goodwin

said. �Our products are becoming essential tools for patient safety

and clinical productivity. We expect to continue building our

financial strength, growth and earnings power going forward.�

Conference Call Information

SonoSite will hold a conference call on February 12th at 1:30

p.m. PT/4:30 p.m. ET. The call will be broadcast live and can be

accessed via the �Investors� Section of SonoSite�s website at

www.sonosite.com. A replay of the audio webcast will be available

beginning February 12, 2009, at 4:30 p.m. (PT) until�February 26,

2009, at 10:00 p.m. (PT) by dialing (719) 457-0820 or toll-free

(888) 203-1112. The confirmation code 7024347 is required to access

the replay.

About SonoSite

SonoSite, Inc. (www.sonosite.com) is the innovator and world

leader in hand-carried ultrasound. Headquartered near Seattle, the

company is represented by ten subsidiaries and a global

distribution network in over 100 countries. SonoSite�s small,

lightweight systems are expanding the use of ultrasound across the

clinical spectrum by cost-effectively bringing high performance

ultrasound to the point of patient care. The company employs over

600 people worldwide.

Forward-looking Information

and the Private Litigation Reform Act of 1995

Certain statements in this press release relating to the market

acceptance of our products, possible future sales relating to

expected orders, and our future financial position and operating

results are �forward-looking statements� for the purposes of the

safe harbor provisions of the Private Securities Litigation Reform

Act of 1995. These forward-looking statements are based on the

opinions and estimates of our management at the time the statements

are made and are subject to risks and uncertainties that could

cause actual results to differ materially from those expected or

implied by the forward-looking statements. These statements are not

guaranties of future performance and are subject to known and

unknown risks and uncertainties and are based on potentially

inaccurate assumptions. Factors that could affect the rate and

extent of market acceptance of our products, the receipt of

expected orders, and our financial performance include our ability

to successfully manufacture, market and sell our ultrasound

systems, our ability to accurately forecast customer demand for our

products, our customers� ability to finance the purchase of our

systems, including the effect of reduced spending by hospitals, our

ability to manufacture and ship our systems in a timely manner to

meet customer demand, variability in quarterly results caused by

the timing of large project orders from governmental or

international entities and the seasonality of hospital purchasing

patterns, timely receipts of regulatory approvals to market and

sell our products, regulatory and reimbursement changes in various

national health care markets, constraints in government and public

health spending, the ability of our distribution partners and other

sales channels to market and sell our products and any changes to

such channels, the impact of patent litigation, our ability to

execute our acquisition strategy, the effect of transactions and

activities associated with our issuance of senior convertible debt

in July 2007, including a repurchase of a portion of the debt, on

the market price of our common stock, and as well as other factors

contained in the Item 1A. �Risk Factors� section of our most recent

Annual Report on Form 10-K filed with the Securities and Exchange

Commission. We caution readers not to place undue reliance upon

these forward-looking statements that speak only as to the date of

this release. We undertake no obligation to publicly revise any

forward-looking statements to reflect new information, events or

circumstances after the date of this release or to reflect the

occurrence of unanticipated events.

�

SonoSite, Inc.

Selected Financial

Information

�

Condensed Consolidated Statements of Income (in thousands

except per share data) (unaudited) � � Three Months Ended � Twelve

Months Ended December 31, December 31,

2008

�

2007

2008

�

2007

� � � � Revenue $ � 70,162 $ � 64,835 $ � 243,524 $ � 205,068 Cost

of revenue � � 22,753 � � � 19,687 � � � 73,715 � � � 62,505 � �

Gross margin 47,409 45,148 169,809 142,563 Gross margin percentage

67.6 % 69.6 % 69.7 % 69.5 % � Operating expenses: Research and

development 8,124 6,234 28,698 25,872 Sales, general and

administrative � � 34,610 � � � 33,345 � � � 118,679 � � � 112,240

� � Total operating expenses 42,734 39,579 147,377 138,112 �

Operating income 4,675 5,569 22,432 4,451 � Other income, net � �

14,460 � � � 1,522 � � � � 11,651 � � � 6,565 � � Income before

income taxes 19,135 7,091 34,083 11,016 � Income tax provision � �

7,044 � � � 2,838 � � � 13,497 � � � 4,132 � � � Net income $ �

12,091 � $ � 4,253 � $ � 20,586 � $ � 6,884 � � Net income per

share: Basic $ � 0.71 � $ � 0.25 � $ � 1.22 � $ � 0.41 � � Diluted

$ � 0.69 � $ � 0.25 � $ � 1.18 � $ � 0.40 � � Weighted average

common and potential common shares outstanding: Basic � � 17,028 �

� �

16,723

� � � 16,892 � � � 16,621 � � Diluted � � 17,511 � � � 17,350 � � �

17,486 � � � 17,168 � � � � � �

Condensed Consolidated Balance

Sheets (in thousands) (unaudited)

�

�

December 31,

December 31,

� �

2008

� � �

2007

� � Cash and cash equivalents $ 209,258 $ 188,701 Short-term

investment securities 69,882 119,873 Accounts receivable, net

66,094 60,954 Inventories 29,115 29,740 Deferred income taxes,

current 9,355 13,023 Prepaid expenses and other current assets � �

6,623 � � � 7,759 � � Total current assets 390,327 420,050 �

Property and equipment, net 8,955 10,133 Investment securities 578

1,257 Deferred income taxes 6,134 8,431 Intangible assets, net

16,829 16,346 Other assets � � 6,464 � � � 9,521 � � Total assets $

� 429,287 � $ � 465,738 � � � Accounts payable $ 6,189 $ 8,868

Accrued expenses 31,921 24,431 Deferred revenue � � 2,755 � � �

3,502 � � Total current liabilities 40,865 36,801 � Long-term debt

144,745 225,000 Other non-current liabilities � � 13,750 � � �

11,075 � � Total liabilities 199,360 272,876 � Shareholders'

equity: Common stock and additional paid-in capital 253,066 236,325

Accumulated deficit (24,307 ) (44,893 ) Accumulated other

comprehensive income � � 1,168 � � � 1,430 � � Total shareholders'

equity � � 229,927 � � � 192,862 � � Total liabilities and

shareholders' equity $ � 429,287 � $ � 465,738 � � � � � �

Condensed Consolidated Statements of Cash Flow (in

thousands) (unaudited) Twelve Months Ended December 31,

2008

2007

� � Operating activities: Net income $ 20,586 $ 6,884 Adjustments

to reconcile net income to net cash provided by operating

activities: Depreciation and amortization 4,125 4,290 Stock-based

compensation 8,709 6,809 Deferred income tax provision 8,929 1,933

Gain on convertible debt repurchase (15,684 ) - Other adjustments

831 (653 ) Changes in working capital � � 1,675 � � � (3,037 ) �

Net cash provided by operating activities 29,171 16,226 � Investing

activities: Investment securities, net 50,390 (78,611 ) Purchases

of property and equipment (2,841 ) (3,341 ) Acquisition of LumenVu

- (3,498 ) Earn-out consideration associated with SonoMetric

acquisition � � (921 ) � � (654 ) � Net cash provided by (used in)

investing activities 46,628 (86,104 ) � Financing activities:

Excess tax benefit from exercise of stock based compensation 1,025

630 Purchase of treasury stock - (133 ) Proceeds from (repurchase

of) convertible debt and related hedge transactions (61,923 )

208,540 Proceeds from exercise of stock options & employee

stock purchase plan � � 4,551 � � � 5,597 � � Net cash (used in)

provided by financing activities (56,347 ) 214,634 � Effect of

exchange rate changes on cash and cash equivalents � � 1,105 � � �

(1,728 ) � Net change in cash and cash equivalents 20,557 143,028

Cash and cash equivalents at beginning of period � � 188,701 � � �

45,673 � � Cash and cash equivalents at end of period $ � 209,258 �

$ � 188,701 �

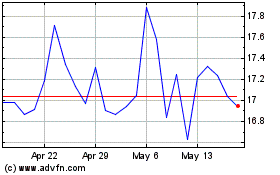

Sonos (NASDAQ:SONO)

Historical Stock Chart

From Jun 2024 to Jul 2024

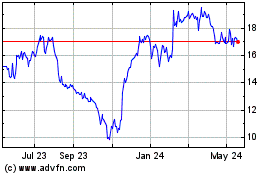

Sonos (NASDAQ:SONO)

Historical Stock Chart

From Jul 2023 to Jul 2024