As filed with the Securities and Exchange Commission

on November 8, 2023.

Registration

No. 333-[*]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Treasure Global Inc

(Exact name of registrant as specified in its charter)

| Delaware |

|

7389 |

|

36-4965082 |

(State

or Other Jurisdiction of

Incorporation or Organization) |

|

(Primary

Standard Industrial

Classification Code Number) |

|

(I.R.S.

Employer

Identification No.) |

276 5th Avenue, Suite 704 #739

New York, New York 10001

+6012

643 7688

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Chong Chan “Sam” Teo

Chief Executive Officer

Treasure Global Inc

276 5th Avenue, Suite 704 #739

New York, New York 10001

+6012

643 7688

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

| Ross D. Carmel, Esq. |

|

Joseph M. Lucosky, Esq. |

| Jeffrey P. Wofford, Esq. |

|

Scott E. Linsky, Esq. |

| Sichenzia Ross Ference Carmel LLP |

|

Lucosky Brookman LLP |

| 1185 Avenue of the Americas, 31st Floor |

|

101 Wood Avenue South, 5th Floor |

| New York, NY 10036 |

|

Woodbridge, NJ 08830 |

| Telephone: (212) 658-0458 |

|

(732) 395-4400 |

Approximate

date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933 check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company”

in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

Accelerated

filer ☐ |

| Non-accelerated

filer ☒ |

Smaller

reporting company ☒ |

| |

Emerging

growth company ☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

The

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the

Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date

as the Commission acting pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting

an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS |

SUBJECT TO COMPLETION |

DATED November 8, 2023 |

Up to 12,909,888 Shares of Common Stock

Pre-funded Warrants to Purchase up to 12,909,888

Shares of Common Stock

Treasure

Global Inc

Treasure Global Inc is offering 12,909,888 shares

of its common stock, par value, $0.00001 per share, at an assumed offering price of $0.3873 per share, based upon the last reported sale

price of our common stock on The Nasdaq Capital Market on November 6, 2023.

We are also offering to those purchasers, if any,

whose purchase of common stock in this offering would otherwise result in the purchaser, together with its affiliates and certain related

parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock immediately

following the consummation of this offering, the opportunity to purchase, if the purchaser so chooses, pre-funded warrants (each a “Pre-funded

Warrant”) at an exercise price of $0.001 per share. The purchase price of each Pre-funded Warrant is equal to the price per share

of common stock being sold to the public in this offering, minus $0.001. The Pre-funded Warrants will be immediately exercisable and may

be exercised at any time until all of the Pre-funded Warrants are exercised in full.

For

each Pre-funded Warrant we sell, the number of shares of common stock we are offering will be decreased on a one-for-one basis. The offering

also includes the shares of common stock issuable from time to time upon exercise of the Pre-Funded Warrants.

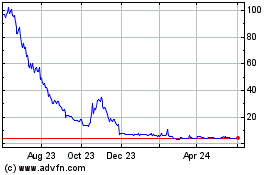

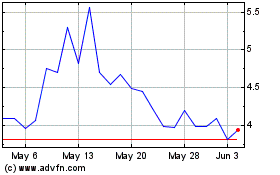

Our common stock is listed on The Nasdaq Capital

Market under the symbol “TGL.” The closing price of our common stock on November 6, 2023, as reported by The Nasdaq Capital

Market, was $0.3873. There is no established trading market for the Pre-funded Warrants and we do not intend to list the Pre-funded Warrants

on any securities exchange or nationally recognized trading system.

We have agreed pursuant to the terms in an underwriting

agreement dated the date of this prospectus, to grant EF Hutton, division of Benchmark Investments, LLC, the underwriter, a 45-day over-allotment

option exercisable from the date of this prospectus, to purchase up to an additional 1,936,483 shares of common stock and/or Pre-funded

Warrants (15% of the shares of common stock and the Pre-funded Warrants sold in this offering).

We

intend to use the proceeds from this offering for general corporate purposes, including investments. See “Use of Proceeds.”

Investing

in our securities involves a high degree of risk. See “Risk Factors” beginning on page 14 of this prospectus for

a discussion of information that should be considered in connection with an investment in our securities.

Neither

the Securities and Exchange Commission (“SEC”) nor any state securities commission has approved or disapproved of these securities

or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

We

are an “emerging growth company” as that term is used in the Jumpstart Our Business Start-ups Act of 2012 (the “Jobs

Act”), and we have elected to comply with certain reduced public company reporting requirements.

| | |

Per Share | | |

Total(1) | |

| Assumed Public offering price | |

$ | 0.3873 | | |

$ | 4,999,999.62 | |

| Underwriting discounts and commissions (7%)(2) | |

$ | 0.0271 | | |

$ | 349,857.96 | |

| Proceeds to us (before expenses), to us | |

$ | 0.3602 | | |

$ | 4,650,141.66 | |

| (1) | The

amount of offering proceeds to us presented in this table does not give effect to any exercise of the underwriter’s over-allotment option

(if any) we have granted to the underwriter as described above. |

| (2) | Assumes 100% of the gross proceed

were obtained from investors introduced to us by the underwriter. |

For additional information regarding our arrangement

with the underwriter, please see “Underwriting” beginning on page 81.

The

underwriter expects to deliver the shares against payment on ________________, 2023.

EF Hutton

division of Benchmark Investments, LLC

Prospectus

dated ________________, 2023

Table

of Contents

You

should rely only on the information contained in this prospectus or any prospectus supplement or amendment. Neither we, nor the underwriters,

have authorized any other person to provide you with information that is different from, or adds to, that contained in this prospectus.

If anyone provides you with different or inconsistent information, you should not rely on it. Neither we nor the underwriters take responsibility

for, and can provide no assurance as to the reliability of, any other information that others may give you. You should assume that the

information contained in this prospectus or any free writing prospectus is accurate only as of the date of this prospectus, regardless

of the time of delivery of this prospectus or of any sale of our securities. Our business, financial condition, results of operations

and prospects may have changed since that date. We are not making an offer of any securities in any jurisdiction in which such offer

is unlawful.

No

action is being taken in any jurisdiction outside the United States to permit a public offering of our securities or possession or distribution

of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States

are required to inform themselves about and to observe any restrictions as to this public offering and the distribution of this prospectus

applicable to that jurisdiction.

ABOUT

THIS PROSPECTUS

Throughout

this prospectus, unless otherwise designated or the context suggests otherwise,

| ● | all

references to the “Company,” “TGL,” the “registrant,” “we,” “our” or “us”

in this prospectus mean Treasure Global Inc and its subsidiaries; |

| ● | “year”

or “fiscal year” means the year ending June 30th; |

| ● | all

dollar or $ references, when used in this prospectus, refer to United States dollars; and |

| ● | all

RM or MYR references, when used in this prospectus, refer to Malaysian Ringgit. |

MARKET

DATA

Market

data and certain industry data and forecasts used throughout this prospectus were obtained from internal company surveys, market research,

consultant surveys, publicly available information, reports of governmental agencies and industry publications and surveys. Industry

surveys, publications, consultant surveys and forecasts generally state that the information contained therein has been obtained from

sources believed to be reliable, but the accuracy and completeness of such information is not guaranteed. To our knowledge, certain third-party

industry data that includes projections for future periods does not take into account the effects of the worldwide coronavirus pandemic.

Accordingly, those third-party projections may be overstated and should not be given undue weight. Forecasts are particularly likely

to be inaccurate, especially over long periods of time. In addition, we do not necessarily know what assumptions regarding general economic

growth were used in preparing the forecasts we cite. Statements as to our market position are based on the most currently available data.

While we are not aware of any misstatements regarding the industry data presented in this prospectus, our estimates involve risks and

uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors”

in this prospectus.

PROSPECTUS

SUMMARY

This

summary provides a brief overview of the key aspects of our business and our securities. The reader should read the entire prospectus

carefully, especially the risks of investing in our common stock discussed under “Risk Factors.” Some of the statements contained

in this prospectus, including statements under “Summary” and “Risk Factors” as well as those noted in the documents

incorporated herein by reference, are forward-looking statements and may involve a number of risks and uncertainties. Our actual results

and future events may differ significantly based upon a number of factors. The reader should not put undue reliance on the forward-looking

statements in this document, which speak only as of the date on the cover of this prospectus.

Solely

for convenience, our trademarks and tradenames referred to in this registration statement, may appear without the ® or ™ symbols,

but such references are not intended to indicate in any way that we will not assert, to the fullest extent under applicable law, our

rights to these trademarks and tradenames. All other trademarks, service marks and trade names included in this prospectus are the property

of their respective owners.

Our

Mission

Our

mission is to bring together the worlds of online e-commerce and offline physical retailers; widening consumer choice and rewarding loyalty,

while sustaining and enhancing our earning potential.

Our

Company

We

have created an innovative online-to-offline (“O2O”) e-commerce platform business model offering consumers and merchants

instant rebates and affiliate cashback programs, while providing a seamless e-payment solution with rebates in both e-commerce (i.e.,

online) and physical retailers/merchant (i.e., offline) settings.

Our proprietary product is an internet application

(or “App”) branded “ZCITY App,” which was developed through our wholly owned subsidiary, ZCity Sdn. Bhd. (formerly

known as Gem Reward Sdn. Bhd, name change effected on July 20, 2023) (“ZCITY”). The ZCITY App was successfully launched in

Malaysia in June 2020. ZCITY is equipped with the know-how and expertise to develop additional/add-on technology-based products and services

to complement the ZCITY App, thereby growing its reach and user base.

Through

simplifying a user’s e-payment gateway experience, as well as by providing great deals, rewards and promotions with every use,

we aim to make the ZCITY App Malaysia’s top reward and payment gateway platform. Our longer-term goal is for the ZCITY App and

its ever-developing technology to become one of the most well-known commercialized applications more broadly in Southeast Asia and Japan.

As of November 6, 2023, we had 2,663,165 registered

users and 2,026 registered merchants.

Our

Consumer Business

Consumers in Southeast Asia (“SEA”)

have access to a plethora of smart ordering, delivery and “loyalty” websites and apps, but in our experience, SEA consumers

very rarely receive personalized deals based on their purchases and behavior.

The ZCITY App targets consumers through the provision

of personalized deals based on consumers’ purchase history, location and preferences. Our technology platform allows us to identify

the spending trends of our customers (the when, where, why, and how much). We are able to offer these personalized deals through the application

of our proprietary artificial intelligence (“AI”) technology that scours the available database to identify and create opportunities

to extrapolate the greatest value from the data, analyze consumer behavior and roll out attractive rewards-based campaigns for targeted

audiences. We believe this AI technology is currently a unique market differentiator for the ZCITY App.

We

operate our ZCITY App on the hashtag: “#RewardsOnRewards.” We believe this branding demonstrates to users the ability to

spend ZCITY App-based Reward Points (or “RP”) and “ZCITY Cash Vouchers” with discount benefits at checkout. Additionally,

users can use RP while they earn rewards from selected e-Wallet or other payment methods.

ZCITY App users do not require any on-going credit

top-up or need to provide bank card number with their binding obligations. We have partnered with Malaysia’s leading payment gateway,

iPay88, for secure and convenient transactions. Users can use our secure platform and enjoy cashless shopping experiences with rebates

when they shop with e-commerce and retail merchants through trusted and leading e-wallet providers such as Touch’n Go eWallet, Boost

eWallet, GrabPay eWallet and credit card/online banking like the “FPX” (the Malaysian Financial Process Exchange) as well

as more traditional providers such as Visa and Mastercard.

Our

ZCITY App also provides the following functions:

| 1. | Registration

and Account verification |

Users may register as a ZCITY App user

simply, using their mobile device. They can then verify their ZCITY App account by submitting a valid email address to receive new user

“ZCITY Newbie Rewards.”

| 2. | Geo-location-based

Homepage |

Based on the users’ location,

nearby merchants and exclusive offers are selected and directed to them on their homepage for a smooth, user-friendly interaction.

Our ZCITY App is affiliated with more

than five local services providers such as Shopee and Lazada. The ZCITY App allows users to enjoy more rewards when they navigate from

the ZCITY App to a partner’s website.

| 4. | Bill

Payment & Prepaid service |

Users

can access and pay utility bills, such as water, phone, internet and TV bills, while generating instant discounts and rewards points

with each payment.

Users

can purchase their preferred e-Vouchers with instant discounts and rewards points with each checkout.

| 6. | User

Engagement through Gamification |

Users

can earn daily rewards by playing our ZCITY App minigame “Spin & Win” where they can earn further ZCITY RP, ZCITY e-Vouchers

as well as monthly grand prizes.

ZCITY has collaborated with the Ministry

of Domestic Trade and Cost of Living (KPDN) for the launch of the ‘Payung Rahmah’ program (“ZCITY RAHMAH Package”).

This program offers a comprehensive package of living essential e-vouchers on the ZCITY app for items such as petrol, food, and bills.

ZCITY users will be able to purchase vouchers for these items at reduced prices, thereby assisting low-income Malaysians and helping

to address this societal challenge.

ZCITY App offers a “Smart F&B”

system that provides a one stop solution and digitalization transformation for all registered Food and Beverage (“F&B”)

outlets located in Malaysia. It also allows merchants to easily record transactions with QR Digital Payment technology, set discounts

and execute RP redemptions and rewards online on the ZCITY App.

By utilizing our CRM analytics software

to attract and retain consumers through personalized promotions, we believe that data-driven engagement can be more efficiently harnessed

to generate greater profitability.

Zstore is ZCITY App’s e-mall

service that offers group-buys and instant rebate to users with embedded AI and big data analytics to provide an express shopping experience.

The functionality and benefit of users to use the Zstore can be summarized within the chart below:

Reward Points. Operating under the hashtag

#RewardsOnRewards, we believe the ZCITY App reward points program encourages users to sign

up on the App, as well as increasing user engagement and spending on purchases/repeat purchases and engenders user loyalty.

Furthermore, we believe the simplicity of the

steps to obtaining Reward Points (or “RP”) is an attractive incentive to user participation in that participants receive:

| |

● |

200 RP for registration as a new user; |

| |

|

|

| |

● |

100 RP for referral of a new user; |

| |

|

|

| |

● |

Conversion of Malaysian ringgit spent into RP; |

| |

|

|

| |

● |

50% RP of every user paid amount; and |

| |

|

|

| |

● |

25% RP of every referred user paid amount as a result of the referral. |

The key objectives of our RP are:

| |

○ |

RP are offered to users for increased social engagement. |

| |

○ |

RP incentivizes users with every MYR spent in order to increase the spending potential and to build users loyalty. |

| |

○ |

Drives loyalty and greater customer engagement. Every new user onboarded will get 200 RP as welcoming gift. |

| |

○ |

Rewards users with RP when they refer a new user. |

Offline Merchant

When using our ZCITY App to make payment to a

registered physical merchant, the system will automatically calculate the amount of RP to deduct. The deducted RP amount is based on the

percentage of profit sharing as with the merchant and the available RP of the user.

Online Merchant

When using our ZCITY App to pay utility bills

or purchase any e-vouchers, our system shows the maximum RP deduction allowed and the user determines the amount of discount deducted

subject to maximum deductions described below and the number of RP owned by such user.

Different features have different maximum deduction amounts. For example,

for bill payments, the maximum deduction is up to 3% of the bill amount. For e-vouchers, the maximum deduction is up to 5% of the voucher

amount.

In order to increase the spending power of the

user, our ZCITY App RP program will credit RP to the user for all MYR paid.

Merchant Facing Business

At present, our ZCITY merchants are concentrated

in the F&B and lifestyle sectors. Moving forward, we plan to expand our product/service offering to include grocery stores, convenience

stores, “micro-SME” (“small to medium size enterprises”) loan programs, affiliate programs

and advertising agencies.

We believe that ZCITY’s TAZTE Smart F&B

System, launched in the fourth quarter of 2022, provides merchants with a one-stop automated solution to digitalize their business. It

offers an innovative and integrated technology ecosystem that addresses and personalizes each merchant’s technological needs and

aims to be at the forefront of creating a smart consumer experience, thereby eliminating conventional and outdated standalone point of

sale (or “POS”) systems.

TAZTE

allows merchants to effortlessly record transactions with online payment or QR digital payment technology, set discounts and execute

RP redemptions and rewards online, all via our ZCITY App. It utilizes ZCITY App’s CRM analytics software to attract and retain

consumers through personalized, data-driven engagement to generate greater profitability.

TAZTE Smart F&B System also features a ‘Deviceless

Queue System’ that reduces staff headcount and a private domain delivery service that will allow merchants access to multiple dedicated

delivery partners to ensure outstanding delivery service to consumers.

Foodlink

As

we became closer to the F&B industry and increased our understanding, we saw a significant opportunity that would not only support

the distribution of TAZTE, but establish several new revenue streams for us. Our strategic plan is to establish synergies with our technology

solutions by becoming a master licensor of F&B companies in Southeast Asia. We will adopt TAZTE into new restaurants, while also

receiving revenue from monthly licensing fees and start-up fees with little barrier to entry.

Under

the subsidiary named “Foodlink” that TGL has established to house F&B master franchisor activity, the subsidiary will

manage all brand royalties and related IP through lease, ownership or JV agreements; and provide F&B consulting including market

& product optimization as well as supply chain monetization. TAZTE Smart F&B System shall be adopted in Morgan Global and

AY Food Venture licensee holder.

Revenue

Model

ZCITY’s

revenues are generated from a diversified mix of:

| |

● |

e-commerce activities for users; |

| |

|

|

| |

● |

services to merchants to help them grow their businesses; and |

| |

|

|

| |

● |

membership subscription fees. |

The

revenue streams consist of “Consumer Facing” revenues and “Merchant Facing” revenues.

The

revenue streams can be further categorized as following: (1) product and loyalty program revenue, (2) transaction revenue, and (3) agent

subscription revenue. Please see “Management’s Discussion and Analysis ̶ Revenue Recognition.”

Corporate

Information

Our

principal executive offices are located at 276 5th Avenue, Suite 704 #739, New York, New York 10001 and No.29, Jalan PPU 2A,

Taman Perindustrian Pusat Bandar Puchong, 47100 Puchong, Selangor, Malaysia. Our corporate website address is https://treasureglobal.co.

Our ZCITY website address is https://zcity.io. The information included on our websites is not part of this prospectus.

Going

Concern

As of June 30, 2023, management has determined

there is substantial doubt about the Company’s ability to continue as a going concern. The Company may need to obtain funds to support

its working capital, the methods of which include, without limitation, the following:

| ● | Other

available sources of financing (including debt) from Malaysian banks and other financial institutions; and |

| ● | Financial

support and credit guarantee commitments from the Company’s related parties. |

There

can be no assurance that the Company will be successful in securing sufficient funds to sustain its operations.

Recent

Developments

Issuance of Common Stock in Repayment of Debt

On October 30, 2023 we issued 1,057,519 shares

of our common stock to our Chief Executive Officer, Chong Chan “Sam” Teo and 759,216 shares of our common stock to our former

chief executive officer, Kok Pin “Darren” Tan in repayment of $187,180and $134,381of debt, respectively.

AI Software License Agreement

On October 12, 2023, our wholly owned subsidiary,

ZCity Sdn Bhd and AI Lab Martech Sdn. Bhd. (the “Licensor”), a company that provides application, services and turnkey solutions

on artificial intelligence (“AI”) in various aspects, including customization, video production, brand engagement, marketing

and content creation, entered into a 12 month License and Service Agreement (the “AI License Agreement”), in which the Licensor

shall provide a non-exclusive, non-transferable, royalty-free license to use and operate an AI software solutions in exchange for the

issuance of 2,943,021 shares of our common stock. The AI License Agreement is renewable for an additional 12 month term. The AI License

Agreement may be terminated by any party thereto if the other party materially breaches any of its terms or if the other party is subject

to any form of insolvency administration, ceases to conduct its business or has a liquidator appointed over any part of its assets.

Nasdaq Notice of Failure to Comply with Continued

Listing Standards

Minimum Stockholders’ Equity Requirement

On October 9, 2023, we received a letter from

the Nasdaq Listing Qualifications Staff of The Nasdaq Stock Market LLC (“Nasdaq”), notifying that we were no longer in compliance

with the minimum stockholders’ equity requirement for continued listing on The Nasdaq Capital Market. Nasdaq Listing Rule 5550(b)(1)

requires listed companies to maintain stockholders’ equity of at least $2,500,000. In our Annual Report on Form 10-K for the fiscal

year ended June 30, 2023, we reported stockholders’ equity of $(130,332), which is below the minimum stockholders’ equity

required for continued listing pursuant to Nasdaq Listing Rule 5550(b)(1). In addition, as of October 6, 2023, we do not currently meet

the alternative compliance standards relating to the market value of listed securities or net income from continuing operations.

Under Nasdaq rules, we have 45 calendar days from

October 9, 2023 to submit a plan or regain compliance. The letter provides us until November 23, 2023 to submit a plan or regain compliance

with the minimum stockholders’ equity standard. If our plan to regain compliance is accepted, Nasdaq may grant an extension of up

to 180 calendar days from the date of the letter (until April 6, 2024) for us to regain compliance.

We are presently evaluating various courses of

action, including consummating this offering, to regain compliance and we intend to timely submit a plan to Nasdaq to regain compliance

with the Nasdaq Listing Rule 5550(b)(1). However, there can be no assurance that our plan will be accepted or that if it is, we will be

able to regain compliance and maintain our listing on The Nasdaq Capital Market. If we fail to submit a plan to regain compliance with

the minimum stockholders’ equity standard, or our plan is not accepted, or if Nasdaq grants an extension but we do not regain compliance

within the extension period, Nasdaq will provide notice that our securities will become subject to delisting. In such event, Nasdaq rules

permit us to request a hearing before an independent Nasdaq Hearings Panel which has the authority to grant us an additional extension

of time of up to 180 calendar days to regain compliance.

Bid Price Rule

On August 17, 2023, we received a letter from

the Nasdaq Listing Qualifications Staff of Nasdaq therein stating that for the 30 consecutive business day period between July 6, 2023

through August 16, 2023, our common stock had not maintained a minimum closing bid price of $1.00 per share required for continued listing

on The Nasdaq Capital Market pursuant to Nasdaq Listing Rule 5550(a)(2) (the “Bid Price Rule”). Pursuant to Nasdaq Listing

Rule 5810(c)(3)(A), we were provided an initial period of 180 calendar days, or until February 13, 2024, to regain compliance with the

Bid Price Rule.

To regain compliance, the closing bid price of

our common stock must meet or exceed $1.00 per share for a minimum of 10 consecutive trading days, unless extended by Nasdaq under Nasdaq

Rule 5810(c)(3)(H), prior to February 13, 2024. If we do not regain compliance with the Bid Price Rule by February 13, 2024, we may be

eligible for an additional 180-day period to regain compliance.

The notices from Nasdaq have no immediate effect

on the listing of our common stock and our common stock will continue to be listed on The Nasdaq Capital Market under the symbol “TGL.”

We are currently evaluating our options for regaining compliance. While, we do believe our receipt of the net proceeds from this offering

will result in us regaining compliance with Nasdaq’s minimum stockholders’ equity requirement, there can be no assurance that

we will regain compliance with the minimum stockholders’ equity requirement or the Bid Price Rule or maintain compliance with any

of the other Nasdaq continued listing requirements.

Tourism

AI Application

On

July 19, 2023, we entered into a Collaboration Agreement (the “Collaboration Agreement”) with VCI Global Limited (NASDAQ:

VCIG) (“VCI Global”), a multi-disciplinary consulting group focused on business and technology, in which VCI Global and us

shall collaborate to develop an AI-powered travel platform (“Travel Platform”) which utilizes advanced technology, including

high-tech and predictive technology, to assist its users in discovering the best places to visit, explore, dine and engage in various

activities during their travel in Malaysia. Furthermore, the Travel Platform aims to facilitate the seamless booking of flights, hotels,

car rentals, theme park tickets and concert show tickets. Pursuant to the Collaboration Agreement, VCI Global and us shall share ownership

and profits generated from this collaboration on a 50:50 basis.

On

July 20, 2023, ZCITY entered into a Software Development Agreement (the “Software Agreement”) with VCI Global, in which ZCITY

shall create, design, produce, develop, finalize, commission and deliver to VCI Global the Travel Platform. Pursuant to the Software

Agreement, VCI Global shall pay ZCITY in either cash or VCI Global shares of common stock equal to USD $1 million as service consideration.

Licensing

Agreements

Abe

Yus

On

June 6, 2023, AY Food Ventures Sdn Bhd (“AYFV”), one of our wholly owned subsidiaries entered into a licensing agreement

with Sigma Muhibah Sdn Bhd (“Abe Yus”), a food & beverage company, in which Abe Yus granted AYFV the exclusive worldwide

right to grant sub-licensees to any third parties to use Abe Yus’ trademarks for its food & beverage business chain (the “Abe

Yus Licensing Agreement”). As the master franchisor, AYFV will manage brand loyalty and raw material supply. Under the Abe Yus

Licensing Agreement, all the Abe Yus F&B outlets will be obligated to adopt TAZTE, our digital F&B management system, across

all our businesses.

Morganfield’s

On

May 1, 2023, through our subsidiary, Morgan Global Sdn. Bhd. and Morganfield’s Holdings Sdn. Bhd. (“Morganfield’s”),

a restaurant chain specializing in comfort food and American-style barbecue, entered into a Worldwide Master License Agreement (the “Morganfield’s

License Agreement”), in which Morganfield’s granted us an exclusive worldwide license to grant sub-licensees to third parties

to use Morganfield’s trademarks for the restaurant business. Pursuant to the Morganfield’s License Agreement, Morganfield’s

will also adopt our digital food & beverage management system, TAZTE, in its nine franchisees in Malaysia, China and Singapore, accelerating

the rollout of TAZTE in the region.

The

term of the Morganfield’s License Agreement is for a period of five years, from May 1, 2023 to May 1, 2028, and will automatically

renew for another five years upon expiration of the initial term unless the Morganfield’s License Agreement is terminated by either

party. We will be entitled the right to collect payment of the total monthly collections from our sub-licensees, namely current licensees

and the newly-appointed sub-licensees provided that we pay to Morganfield’s the monthly management fees, the amount of which will

range depending on our total monthly collection from our sublicensees in any given period, with a minimum monthly payment of RM 90,000

in year 1, RM 100,000 in year 2, RM 110,000 in year 3, RM 120,000 in year 4 and RM 130,000 in year 5.

Private

Placement of Convertible Debentures

Terms

of the Convertible Debentures

On February 28, 2023, we entered into the Securities

Purchase Agreement (the “Securities Purchase Agreement”) with the Purchaser, pursuant to which the Purchaser agreed to purchase

the Convertible Debentures, in the aggregate principal amount of up to $5,500,000 in a private placement (the “Private Placement”)

for a purchase price with respect to each Convertible Debenture of 92% of the initial principal amount of such Convertible Debenture.

The purchase by the Purchaser of the First Convertible Debenture which has an initial issuance principal amount of $2,000,000 occurred

on February 28, 2023 for a purchase price of $1,840,000 and the closing of the purchase of the Second Convertible Debenture which has

an initial issuance a principal amount of $3,500,000 occurred shortly after the registration statement related to the prospectus for the

shares of common stock issuable upon the conversion of the Convertible Debentures was declared effective by the SEC for a purchase price

of $3,220,000. The total purchase price paid to us by the Purchaser for the Convertible Debentures in the Private Placement was $5,060,000.

Prior to the execution of the Securities Purchase Agreement and the issuance of the First Convertible Debenture, we paid the Purchaser

a one-time $20,000 due diligence and structuring fee.

Each

Convertible Debenture accrues or will accrue interest on its full outstanding principal amount at 4% per annum and has a 12-month term.

Assuming no conversions, prepayments or events of default have been made on or occurred with respect to the First Convertible Debenture,

on the maturity date thereof, interest of $80,000 shall have accrued and be payable on the First Convertible Debenture. Upon the occurrence

and continuance of an Event of Default (as defined below) with respect to any Convertible Debenture, its per annum interest rate will

increase to 15%. As of July 31, 2023, no Event of Default has occurred under the First Convertible Debenture. Upon the occurrence and

continuance of an Event of Default under the Second Convertible Debenture, its per annum interest rate will increase to 15%.

“Event

of Default” means with respect to any Convertible Debenture: (i) the Company’s failure to pay to amounts due under such

Convertible Debenture; (ii) the Company or any subsidiary of the Company is subject to bankruptcy or insolvency proceeding or similar

proceeding and such proceedings remain undismissed for a period of sixty one (61) days; (iii) the Company or any subsidiary of the

Company shall default in any of its payment obligations under any debenture, mortgage, credit agreement or other facility, indenture

agreement, factoring agreement or other instrument under which there may be issued, or by which there may be secured or evidenced any

indebtedness for borrowed money or money due under any long term leasing or factoring arrangement of the Company in an amount exceeding

$100,000 and such default shall result in the full amount of such indebtedness becoming or being declared due and payable and such default

is not thereafter cured within five (5) Business Days; (iv) the Company’s common stock shall cease to be quoted or listed

for trading, as applicable, on any national exchange for a period of ten (10) consecutive trading days; (v) the Company shall be a party

to certain change of control transactions (unless in connection with such change of control transaction such Convertible Debenture is

retired; (vi) the Company’s (A) failure to deliver required number of shares of common stock as required under such Convertible

Debenture or (B) notice, written or oral, to any holder of such Convertible Debenture of the Company’s intention not to comply

with a request for conversion of such Convertible Debenture; (vii) the Company shall fail for any reason to deliver the payment

in cash pursuant to a Buy-In (as defined in the Convertible Debenture) within five (5) Business Days after such payment is due; (viii) the

Company’s failure to timely file with the SEC any of its periodic reports and such default is not thereafter cured within five

(5) business days; (ix) any representation or warranty made or deemed to be made by or on behalf of the Company in or in connection

with such Convertible Debenture or any of the other documents related to the Private Placement, or any waiver hereunder or thereunder,

shall prove to have been incorrect in any material respect (or, in the case of any such representation or warranty already qualified

by materiality, such representation or warranty shall prove to have been incorrect) when made or deemed made; (x) any material provision

of any Transaction Document, at any time after its execution and delivery and for any reason other than as expressly permitted hereunder

or thereunder, ceases to be in full force and effect; or the Company or any other person or entity contests in writing the validity or

enforceability of any provision of any Convertible Debenture or any of the other documents related to the Private Placement; or the Company

denies in writing that it has any or further liability or obligation under any Convertible Debenture or any of the other documents related

to the Private Placement, or purports in writing to revoke, terminate (other than in line with the relevant termination provisions) or

rescind any Convertible Debenture or any of the other documents related to the Private Placement; (xi) the Company uses the proceeds

of the issuance of such Convertible Debenture, whether directly or indirectly, and whether immediately, incidentally or ultimately, to

purchase or carry margin stock (within the meaning of Regulations T, U and X of the Federal Reserve Board, as in effect

from time to time and all official rulings and interpretations thereunder or thereof), or to extend credit to others for the purpose

of purchasing or carrying margin stock or to refund indebtedness originally incurred for such purpose; or (xii) any Event of Default

(as defined in the other Convertible Denture or in any other documents related to the Private Placement) occurs with respect to any other

Convertible Debenture, or any breach of any material term of any other debenture, note, or instrument held by the holder of such Convertible

Debenture in the Company or any agreement between or among the Company and such holder; or (xiii) the Company shall fail to observe or

perform any material covenant, agreement or warranty contained in, or otherwise commit any material breach or default of any provision

of such Convertible Debenture (except as may be covered by another Event of Default) or any other any other document related to the Private

Placement) which is not cured or remedied within the time prescribed or if no time is prescribed within ten (10) business days of notification

thereof.

If any Event of Default occurs under a Convertible

Debenture (other than an event with respect to a bankruptcy or insolvency), at the Purchaser election, all amounts owing in respect thereof,

to the date of acceleration shall become immediately due and payable in cash; provided that, in the case of a bankruptcy or insolvency

of the Company, all amounts owing in respect thereof, to the date of acceleration shall automatically become immediately due and payable

in cash, in each case without presentment, demand, protest or other notice of any kind, all of which are hereby waived by the Company.

The Purchaser will also have the right to convert such Convertible Debenture at the applicable conversion price.

The

Convertible Debentures provide a conversion right, in which any portion of the principal amount of the Convertible Debentures, together

with any accrued but unpaid interest, may be converted into our common stock at a conversion price equal to the lower of (i) $1.6204

(the “Fixed Price”) or (ii) 93% of the lowest daily volume weighted average price (the “VWAP”) of the common

stock during the ten (10) trading days immediately preceding the date of conversion (but not lower than a floor price of $0.25).

If a Trigger Event occurs, then the Company

shall make monthly payments beginning on the 10th calendar day after the date on which a Trigger Event occurs and then on the

same day of each successive calendar month. Each monthly payment shall be in an amount equal to the sum of (i) the lesser of (x) $1,000,000

and (y) the outstanding principal of the Convertible Debentures (the “Triggered Principal Amount”), plus (ii) a redemption

premium of 7% of such Triggered Principal Amount, plus (iii) accrued and unpaid interest hereunder as of each payment date. The obligation

of the Company to make monthly payments shall cease if any time after the Trigger Date the daily VWAP is greater than the Floor Price

for a period of 5 of 7 consecutive Trading Days, unless a new Trigger Event occurs.

“Trigger Event” means the daily VWAP

is less than the $0.25 for five Trading Days during a period of any 5 of 7 consecutive trading days.

Under the Convertible Debentures, the Company

has the right, but not the obligation, to redeem (“Optional Redemption”) early a portion or all amounts outstanding under

the Convertible Debentures; provided that (i) the closing price of the Company’s common stock on the date of such Optional

Redemption is less than $1.6204 and (ii) the Company provides the Holder with at least 5 business days’ prior written notice (each,

a “Redemption Notice”) of its desire to exercise an Optional Redemption. The “Redemption Amount” shall be equal

to the outstanding Principal balance being redeemed by the Company, plus a 10% premium on the principal amount being redeemed, plus all

accrued and unpaid interest. If we elect to redeem the full $5,500,0000 principal amount of the Convertible Debentures, such premium

payable will equal to $550,000.

As of November 8, 2023, we have issued

5,091,723 shares of common stock to the Purchaser.

Occurrence of a Trigger Event

On September 28, 2023, a Trigger Event occurred.

In response to the Trigger Event occurrence, we entered into an agreement effective October 5, 2023 with the Purchaser in which we agreed

to pay the Purchaser on October 6, 20023 an amount that exceeded the amount required to be paid as the first monthly Trigger Event payment,

which consisted of (i) $1,092,071 and (ii) an additional payment in the amount of $500,000 (of which $467,289.72 was applied towards principal

and $32,710.28 towards the Redemption Premium of 7%). In return the Purchaser agreed (i) unless an Event of Default has occurred or we

consent, beginning on October 5, 2023 and ending on November 18, 2023, it shall not sell any of our shares of common stock at a price

per share less than $1.00 and (ii) that any subsequent monthly Trigger Event payments that may become due shall be deferred until November

28, 2023, and continuing on the same day of each successive calendar month thereafter.

On October 20 2023, the Trigger Event was

cured and no further Trigger Event payments are required with respect to the Trigger Event that occurred on September 28, 2023.

Summary Risk Factors

This offering and the ownership of our common

stock is subject to a number of risks. You should be aware of these risks before making an investment decision. These risks are discussed

more fully in the “Risk Factor section of this Prospectus. These risks include, among others, that:

| |

● |

There is substantial doubt about our ability to continue as a going concern; |

| |

● |

We have a limited operating history in an evolving industry, which makes it difficult to evaluate our future prospects and may increase the risk that we will not be successful; |

| |

● |

If we fail to raise capital when needed it will have a material adverse effect on our business, financial condition and results of operations; |

| |

● |

None of our material contracts are long term and if not renewed could have a material adverse effect on our business; |

| |

● |

We rely on email, internet search engines and application marketplaces to drive traffic to our ZCITY App, certain providers of which offer products and services that compete directly with our products. If links to our applications and website are not displayed prominently, traffic to our ZCITY App could decline and our business would be adversely affected; |

| |

● |

The ecommerce market is highly competitive and if we do not have sufficient resources to maintain research and development, marketing, sales and client support efforts on a competitive basis our business could be adversely affected; |

| |

● |

The market for our ZCITY App is new and unproven; |

| |

● |

If we are unable to expand our systems or develop or acquire technologies to accommodate increased volume or an increased variety of operating systems, networks and devices broadly used in the marketplace our ZCITY App could be impaired; |

| |

● |

As we increase our reliance on cloud-based applications and platforms to operate and deliver our products and services, any disruption or interference with these platforms could adversely affect our financial condition and results of operations; |

| |

● |

Our failure to successfully market our ZCITY App could result in adverse financial consequences; |

| |

● |

We may not be able to successfully develop and promote new products or services which could result in adverse financial consequences; |

| |

● |

A decline in the demand for goods and services of the merchants included in the ZCITY App could result in adverse financial consequences; |

| |

● |

The effective operation of our platform is dependent on technical infrastructure and certain third-party service providers; |

| ● | There

is no assurance that we will be profitable; |

| |

● |

We could lose the right to the use of our domain names; |

| |

● |

We may be required to expend resources to protect ZCITY App information or we may be unable to launch our services; |

| ● | Breaches

of our online commerce security could occur and could have an adverse effect on our reputation; |

| ● | We

rely on the performance of highly skilled personnel, and if we are unable to attract, retain and motivate well-qualified employees, our

business could be harmed; |

| ● | We

face the risk that changes in the policies of the Malaysian government could have a significant impact upon the business we may be able

to conduct in Malaysia and the profitability of such business; |

| ● | Any

potential disruption in and other risks relating to our merchants’ supply chain could increase the costs of their products or services

to consumers, potentially causing consumers to limit their spending or seek products or services from alternative businesses that may

not be registered as a merchant with us, which may ultimately affect the total number of users using our platform and harm our business,

financial condition and results of operations; |

| ● | Geopolitical

conditions, including acts of war or terrorism or unrest in the regions in which we operate could adversely affect our business; |

| ● | Because

our principal assets are located outside of the United States and all of our directors and officers reside outside of the United

States, it may be difficult for you to enforce your rights based on U.S. Federal Securities Laws against us and our officers and directors

or to enforce a judgment of a United States court against us or our officers and directors; |

| ● | Our

failure to maintain effective internal controls over financial reporting could have an adverse impact on us; |

| ● | We

have not paid dividends in the past and do not expect to pay dividends in the future, and any return on investment may be limited to

the value of our stock; |

| ● | Failure

to comply with laws and regulations applicable to our business could subject us to fines and penalties and could also cause us to lose

customers or otherwise harm our business; |

| ● | If

we are unable to protect the confidentiality of our trade secrets, our business and competitive position could be harmed; |

| ● | Our

management will have broad discretion over the use of any net proceeds from this offering and you may not agree with how we use the proceeds,

and the proceeds may not be invested successfully; |

| |

● |

There is no established public trading market for the Pre-funded Warrants being offered in this offering, and we do not expect a market to develop for the Pre-funded Warrants; |

| |

● |

The Pre-funded Warrants are speculative in nature; |

| ● | A

large number of shares of our common stock issuable upon conversion of the Convertible Debentures may be sold in the market, which may

depress the market price of our common stock and substantially dilute stockholders’ voting power; |

| |

● |

The occurrence of an Event of Default under a Convertible Debenture could lead to increased amounts payable under the Convertible Debentures and could cause an acceleration of the Convertible Debentures and materially and adversely affect our operations; |

| ● | If

securities or industry analysts do not publish research or publish inaccurate or unfavorable research about our business, our stock price

and trading volume could decline; |

| ● | We

may not be able to continue to satisfy listing requirements of Nasdaq to maintain a listing of our common stock; and |

| ● | If

there is no viable public market for our common stock, you may be unable to sell your shares at or above your purchase price. |

Implications

of Being an Emerging Growth Company

We

are an “emerging growth company,” as defined in the Jobs Act. We will remain an emerging growth company until the earlier

of (i) the last day of the fiscal year following the fifth anniversary of the date of the first sale of our common stock pursuant to

an effective registration statement under the Securities Act; (ii) the last day of the fiscal year in which we have total annual gross

revenues of $1.235 billion or more; (iii) the date on which we have issued more than $1 billion in nonconvertible debt during the previous

three years; or (iv) the date on which we are deemed to be a large accelerated filer under applicable SEC rules. We expect that we will

remain an emerging growth company for the foreseeable future, but cannot retain our emerging growth company status indefinitely and will

no longer qualify as an emerging growth company on or before the last day of the fiscal year following the fifth anniversary of the date

of the first sale of our common stock pursuant to an effective registration statement under the Securities Act. For so long as we remain

an emerging growth company, we are permitted and intend to rely on exemptions from specified disclosure requirements that are applicable

to other public companies that are not emerging growth companies.

These

exemptions include:

| ● | being

permitted to provide only two years of audited financial statements, in addition to any required

unaudited interim financial statements, with correspondingly reduced “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” disclosure; |

| ● | not

being required to comply with the requirement of auditor attestation of our internal controls over financial reporting; |

| ● | not

being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory

audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial

statements; |

| ● | reduced

disclosure obligations regarding executive compensation; and |

| ● | not

being required to hold a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments

not previously approved. |

We

have taken advantage of certain reduced reporting requirements in this prospectus. Accordingly, the information contained herein may

be different than the information you receive from other public companies in which you hold stock.

An

emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for

complying with new or revised accounting standards. This allows an emerging growth company to delay the adoption of certain accounting

standards until those standards would otherwise apply to private companies. We have irrevocably elected to avail ourselves of this extended

transition period and, as a result, we will not be required to adopt new or revised accounting standards on the dates on which adoption

of such standards is required for other public reporting companies.

We

are also a “smaller reporting company” as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), and have elected to take advantage of certain of the scaled disclosure available for smaller reporting companies.

SUMMARY

OF THE OFFERING

| Securities offered |

12,909,888 shares of common stock (at an assumed offering

price of $0.3873 per share, based upon the last reported sale price of our common stock on The Nasdaq Capital Market on November 6,

2023) and Pre-funded Warrants to purchase shares of common stock in lieu of shares of common stock that would otherwise result in

the purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common

stock. The Pre-funded Warrants have an exercise price of $0.001 per share, will be exercisable immediately and may be exercised at

any time until all of the Pre-funded Warrants are exercised in full. We are also offering the shares of common stock issuable upon

exercise of the Pre-funded Warrants. |

| |

|

| Common stock outstanding prior to the offering(1)(2) |

27,425,309 shares. |

| |

|

| Common stock to be outstanding after the offering(2) |

40,335,197, assuming no exercise of the over-allotment option and no sale of any Pre-funded Warrants. |

| |

|

| Use of proceeds |

We currently intend to use the net proceeds to us from this offering for general corporate purposes, including working capital. See “Use of Proceeds” beginning on page 33. |

| |

|

| Assumed Offering price |

$0.3873 per share (minus $0.001 per Pre-funded Warrants), based upon the last reported sale price of our common stock on The Nasdaq Capital Market on November 6, 2023. |

| |

|

| Over-allotment option |

The underwriter has a 45-day option to purchase up to an additional 1,936,483 shares of common stock and/or Pre-funded Warrants (15% of the shares of common stock and Pre-funded Warrants sold in this offering). |

| |

|

| Transfer agent |

Vstock Transfer, LLC. |

| |

|

| Risk factors |

You should carefully consider the information set forth in this prospectus and, in particular, the specific factors set forth in the “Risk Factors” section beginning on page 14 of this prospectus before deciding whether or not to invest in shares of our common stock. |

| Lock-up agreements |

You should carefully consider the information set forth in this prospectus and, in particular, the specific factors set forth in the “Risk Factors” section beginning on page 14 of this prospectus before deciding whether or not to invest in shares of our common stock.We have agreed that, without the prior written consent of EF Hutton, we will not, during the period commencing November 1, 2023 and ending on January 24, 2024 (including any extensions of such period) and additionally for a period of ninety (90) days after the closing of this public offering (i) offer, pledge, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase, lend, or otherwise transfer or dispose of, directly or indirectly, any shares of capital stock of the Company or any securities convertible into or exercisable or exchangeable for shares of our capital stock; (ii) file or caused to be filed any registration statement (excluding a S-8 registration statement) with the SEC relating to the offering of any shares of our capital stock or any securities convertible into or exercisable or exchangeable for shares of our capital stock; (iii) complete any offering of our debt securities, other than entering into a line of credit with a traditional bank, or (iv) enter into any swap or other arrangement that transfers to another, in whole or in part, any of the economic consequences of ownership of our capital stock, whether any such transaction described in clause (i), (ii), (iii) or (iv) above is to be settled by delivery of shares of our capital stock or such other securities, in cash or otherwise. Additionally, our directors and officers are required to enter into customary “lock-up” agreements in favor of EH Hutton pursuant to which such persons and entities shall agree, for a period of ninety (90) days after the closing of this public offering, that they shall not offer, pledge, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase, lend, or otherwise transfer or dispose of, directly or indirectly, any shares of our capital stock or any securities convertible into or exercisable or exchangeable for shares of our capital stock, subject to customary exceptions. |

| (1) | As of November 8, 2023. |

| | |

| (2) | Excludes (i) 100,000 shares of our common stock issuable upon the

exercise of warrants at an exercise price of $5.00 per share issued to the underwriter in our initial public offering that closed on

August 15, 2022 and (ii) 5,547,445 shares of our common stock underlying the Convertible Debentures as of November 8,

2023. |

RISK

FACTORS

Our

business is subject to many risks and uncertainties, which may affect our future financial performance. If any of the events or circumstances

described below occur, our business and financial performance could be adversely affected, our actual results could differ materially

from our expectations, and the price of our stock could decline. The risks and uncertainties discussed below are not the only ones we

face. There may be additional risks and uncertainties not currently known to us or that we currently do not believe are material that

may adversely affect our business and financial performance. You should carefully consider the risks described below, together with all

other information included in this prospectus including our financial statements and related notes, before making an investment decision.

The statements contained in this prospectus that are not historic facts are forward-looking statements that are subject to risks and

uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements.

If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case,

the trading price of our common stock could decline, and investors in our securities may lose all or part of their investment.

Risks

Related to Our Business

There

is substantial doubt about our ability to continue as a going concern.

We have incurred substantial operating losses

since our inception. For the year ended June 30, 2023, we had approximately $4.6 million cash on hand, an accumulated deficit of approximately

$31.4 million at June 30, 2023, a net loss of approximately $11.7 million for the year ended June 30, 2023, and approximately $9.6 million

net cash used by operating activities for the year ended June 30, 2023. The accompanying consolidated financial statements have been prepared

on a going concern basis, which contemplates the realization of assets and satisfaction of liabilities in the normal course of business.

We anticipate incurring additional losses until such time, if ever, that we will be able to effectively market our products.

The

net proceeds from our sale of shares of our common stock and Pre-funded Warrants, if any, in this offering will be approximately

$4.3 million, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by

us. We believe that the net proceeds from this offering will meet our capital needs for the next 5 months

under our current business plan.

If

we have insufficient capital to operate our business under our current business plan, we have contingency plans for our business that

include, among other things, the delay of the introduction of new products and a reduction in headcount which is expected to substantially

reduce revenue growth and delay our profitability. There can be no assurance that our implementation of these contingency plans will

not have a material adverse effect on our business.

Following

this offering, we will seek to obtain additional capital through the sale of debt or equity financings or other arrangements to fund

operations; however, there can be no assurance that we will be able to raise needed capital under acceptable terms, if at all. The sale

of additional equity may dilute investors and newly issued shares may contain senior rights and preferences compared to currently outstanding

shares of common stock. Issued debt securities may contain covenants and limit our ability to pay dividends or make other distributions

to stockholders. If we are unable to obtain such additional financing, future operations would need to be scaled back or discontinued.

We

have a limited operating history in an evolving industry, which makes it difficult to evaluate our future prospects and may increase

the risk that we will not be successful.

We have a limited operating history on which to

base an evaluation of our business and prospects. We are subject to all the risks inherent in a small company seeking to develop, market

and distribute new services, particularly companies in evolving markets such as the internet, technology and payment systems. The likelihood

of our success must be considered, in light of the problems, expenses, difficulties, complications and delays frequently encountered in

connection with the development, introduction, marketing and distribution of new products and services in a competitive environment.

Such

risks for us include, but are not limited to, dependence on the success and acceptance of our services, the ability to attract and retain

a suitable client base and the management of growth. To address these risks, we must, among other things, generate increased demand,

attract a sufficient clientele base, respond to competitive developments, increase the “ZCITY” brand names’ visibility,

successfully introduce new services, attract, retain and motivate qualified personnel and upgrade and enhance our technologies to accommodate

expanded service offerings. In view of the rapidly evolving nature of our business and our limited operating history, we believe that

period-to-period comparisons of our operating results are not necessarily meaningful and should not be relied upon as an indication of

future performance.

We

are therefore subject to many of the risks common to early-stage enterprises, including under-capitalization, cash shortages, limitations

with respect to personnel, financial and other resources and lack of revenues.

If

we fail to raise capital when needed it will have a material adverse effect on our business, financial condition and results of operations.

We have limited revenue-producing operations and

will require the proceeds from our recently concluded offering to execute our full business plan. We believe the proceeds from our previous

offering will be sufficient to cover our funding needs until part way through the first calendar quarter of 2024. Further, no assurance

can be given if additional capital is needed as to how much additional capital will be required or that additional financing can be obtained,

or if obtainable, that the terms will be satisfactory to us, or that such financing would not result in a substantial dilution of shareholder

interest. A failure to raise capital when needed would have a material adverse effect on our business, financial condition and results

of operations. In addition, debt and other equity financing may involve a pledge of assets and may be senior to interests of equity holders.

Any debt financing secured in the future could involve restrictive covenants relating to capital raising activities and other financial

and operational matters, which may make it more difficult for us to obtain additional capital or to pursue business opportunities, including

potential acquisitions. If adequate funds are not obtained, we may be required to reduce, curtail or discontinue operations.

None

of our material contracts are long term and if not renewed could have a material adverse effect on our business.

We

have entered into material contracts with a number of companies that directly or indirectly provide the goods and services that appear

on our ZCITY App. The majority of these contracts can be terminated by any party with 30 days’ notice. The contract with iPay88

(the “iPay88 Agreement”), which provides the payment gateway for many of the brands that can be accessed through the ZCITY

App, has no termination clause which means that iPay88 could terminate the iPay88 Agreement without any notice. If one

or more of these contracts were not renewed or were terminated and we were not able to enter into agreements with others that could replace

these services, the ZCITY App could lose material features and in turn we could find it harder to maintain and grow our user base, which

would have a material adverse effect on our business. For a description of these material contracts See “Business—About

ZCITY App.”

We

rely on email, internet search engines and application marketplaces to drive traffic to our ZCITY App, certain providers of which offer

products and services that compete directly with our products. If links to our applications and website are not displayed prominently,

traffic to our ZCITY App could decline and our business would be adversely affected.

Email

continues to be a verification source of organic traffic for us. If email providers or internet service providers implement new or more

restrictive email or content delivery or accessibility policies, including with respect to net neutrality, it may become more difficult

to deliver emails to our users or for user verification process. For example, certain email providers, including Google, categorize our

emails as “promotional,” and these emails are directed to an alternate, and less readily accessible, section of a users’

inbox. If email providers materially limit or halt the delivery of our emails, or if we fail to deliver emails to users in a manner compatible

with email providers’ email handling or authentication technologies, our ability to contact users through email could be significantly

restricted. In addition, if we are placed on “spam” lists or lists of entities that have been involved in sending unwanted,

unsolicited emails, marketing campaigns and business updates could be substantially harmed.

We

rely heavily on Internet search engines, such as Google, to drive traffic to our ZCITY App through their unpaid search results and on

application marketplaces to drive downloads of our applications. Although search results and application marketplaces have allowed us

to attract a large audience with low organic traffic acquisition costs to date, if they fail to drive sufficient traffic to our ZCITY

App, we may need to increase our marketing spend to acquire additional traffic. We cannot assure you that the value we ultimately derive

from any such additional traffic would exceed the cost of acquisition, and any increase in marketing expense may in turn harm our operating

results.

The

amount of traffic we attract from search engines is due in large part to how and where information from and links to our website are

displayed on search engine result pages. The display, including rankings, of unpaid search results can be affected by a number of factors,

many of which are not in our direct control, and may change frequently. Search engines have made changes in the past to their ranking

algorithms, methodologies and design layouts that may have reduced the prominence of links to our ZCITY App and negatively impacted our

traffic, and we expect they will continue to make such changes from time to time in the future. Similarly, marketplace operators may

make changes to their marketplaces that make access to our products more difficult. For example, our applications may receive unfavorable

treatment compared to the promotion and placement of competing applications, such as the order in which they appear within marketplaces.

We

may not know how or otherwise be in a position to influence search results or our treatment in application marketplaces. With respect

to search results in particular, even when search engines announce the details of their methodologies, their parameters may change from

time to time, be poorly defined or be inconsistently interpreted. For example, Google previously announced that the rankings of sites

showing certain types of app install interstitials could be penalized on its mobile search results pages. While we believe the type of

interstitial we currently use is not being penalized, we cannot guarantee that Google will not unexpectedly penalize our app install

interstitials, causing links to our mobile website to be featured less prominently in Google’s mobile search results and harming

traffic to our ZCITY App as a result.

In

some instances, search engine companies and application marketplaces may change their displays or rankings in order to promote their

own competing products or services or the products or services of one or more of our competitors. For example, Google has integrated

its local product offering with certain of its products, including search and maps. The resulting promotion of Google’s own competing

products in its web search results has negatively impacted the search ranking of our website. Because Google in particular is the most

significant source of traffic to our website, accounting for a substantial portion of the visits to our website, our success depends

on our ability to maintain a prominent presence in search results for queries regarding local businesses on Google. As a result, Google’s

promotion of its own competing products, or similar actions by Google in the future that have the effect of reducing our prominence or

ranking on its search results, could have a substantial negative effect on our business and results of operations.

The

ecommerce market is highly competitive and if we do not have sufficient resources to maintain research and development, marketing, sales

and client support efforts on a competitive basis our business could be adversely affected.

The

internet-based ecommerce business is highly competitive and we compete with several different types of companies that offer some form

of user-vendor connection experience, as well as marketing data companies. Certain of these competitors may have greater industry experience

or financial and other resources than us.

To

become and remain competitive, we will require research and development, marketing, sales and client support. We may not have sufficient

resources to maintain research and development, marketing, sales and client support efforts on a competitive basis which could materially

and adversely affect our business, financial condition and results of operations. We intend to differentiate ourselves from competitors

by developing a payments platform that allows consumers and merchants to accept and use bonus points.

The

market for consumer’s lifestyle is rapidly evolving and intensely competitive, and we expect competition to intensify further in

the future. There is no guarantee that any factors that differentiate us from our competitors will give us a market advantage or continue

to be a differentiating factor for us in the foreseeable future. Competitive pressures created by our direct or indirect competitors

could have a material adverse effect on our business, results of operations and financial condition.

The

market for our ZCITY App is new and unproven.

We

were founded in 2020 and ZCITY was founded in 2017 and since our inception have been creating products for the developing and rapidly

evolving market for API-based software platforms, a market that is largely unproven and is subject to a number of inherent risks and

uncertainties. We believe that our future success will depend in large part on the growth, if any, in the market for software platforms

that provide features and functionality to create the entire lifestyle ecosystem. It is difficult to predict customer adoption and renewal

rates, customer demand for our solutions, the size and growth rate of the overall market that our ZCITY App addresses, the entry of competitive