OHA is Lead Lender and Lead Left Arranger for Alkegen Debt Refinancing

October 01 2024 - 11:23AM

Oak Hill Advisors (“OHA”) served as lead lender and Lead Left

Arranger of a comprehensive debt refinancing solution for Alkegen,

a global specialty materials platform providing high performance

materials used in advanced applications. OHA is the largest lender

across the new senior facility, which consists of new $1,925

million first lien term loan and notes facilities and a new $200

million first-out revolving credit facility. Proceeds will be used

primarily to refinance in full Alkegen’s existing first lien term

loans, pay down outstanding borrowings under its revolver, extend

maturities and provide liquidity runway for the company to execute

on its growth and operational plans. In addition, a majority of

existing holders of Alkegen’s secured and unsecured notes due 2028

and 2029 exchanged their notes for new second lien notes due 2029.

Alkegen is separately commencing an offer to exchange all of the

remaining secured and unsecured notes for new second lien notes.

“We are very pleased with the successful

completion of this transaction, which further strengthens our

financial position and provides additional flexibility to continue

to execute on our long-term growth priorities,” said John Dandolph,

President and CEO of Alkegen. “We appreciate the continued strong

support from our investors and lenders, which highlights their

confidence in our strategic direction.”

Trevor Winstead, Managing Director at Oak

Hill Advisors, added, “We are delighted to partner with Alkegen and

have the opportunity to help strengthen its balance sheet by

refinancing near-dated maturities. We appreciate the opportunity to

work with John and his team to lead a capital structure solution

that positions Alkegen to further its status as a global leader in

specialty materials.”

OHA was a lender to Alkegen’s predecessor

business and has followed the company over the years throughout

various stages of growth. This transaction is reflective of OHA’s

capabilities as a full-service capital solutions provider adept at

partnering with companies to address complex and varied financing

needs.

###

About OHA: Oak Hill Advisors (OHA) is a

leading global credit-focused alternative asset manager with over

30 years of investment experience. OHA works with institutions and

individuals and seeks to deliver a consistent track record of

attractive risk-adjusted returns. The firm manages approximately

$65 billion of capital across credit strategies, including private

credit, high yield bonds, leveraged loans, stressed and distressed

debt and collateralized loan obligations as of June 30, 2024. OHA’s

emphasis on long-term partnerships with companies, sponsors and

other partners provides access to a proprietary opportunity set,

allowing for customized credit solutions across market cycles.

With over 400 experienced professionals across

six global offices, OHA brings a collaborative approach to offering

investors a single platform to meet their diverse credit needs. OHA

is the private markets platform of T. Rowe Price Group, Inc.

(NASDAQ – GS: TROW). For more information, please visit

oakhilladvisors.com.

About Alkegen: Alkegen creates high

performance specialty materials used in advanced applications

including electric vehicles, energy storage, filtration, fire

protection and high-temperature insulation, among many others.

Employing a vertically integrated approach across our broad array

of technology platforms, Alkegen is committed to achieving energy

efficiency, pollution reduction, and enhanced safety for

individuals, structures, and equipment. Our overarching mission is

to help the world breathe easier, live greener and go further than

ever before. Alkegen has 60+ manufacturing facilities operating in

12 countries and employs 7,500+ employees globally.

Natalie Harvard, Head of Investor Relations & Partner

Oak Hill Advisors, L.P.

212-326-1505

nharvard@oakhilladvisors.com

Kristin Celestino, Public Relations

Oak Hill Advisors, L.P.

817-215-2934

kcelestino@oakhilladvisors.com

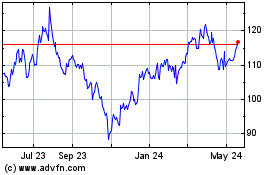

T Rowe Price (NASDAQ:TROW)

Historical Stock Chart

From Oct 2024 to Nov 2024

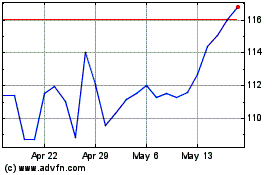

T Rowe Price (NASDAQ:TROW)

Historical Stock Chart

From Nov 2023 to Nov 2024