Fourth Quarter 2024 Financial Highlights

- GAAP net income of $120.0 million, or $2.44 per diluted

share.

- Net operating income(i) of $122.6 million, or $2.49 per diluted

share.

- Average loans increased 14.8% on a linked-quarter, annualized

basis, to $25.3 billion.

- Average loans increased $2.2 billion, or 9.4%, as compared to

the fourth quarter of 2023.

- Average deposits increased 30.9% on a linked-quarter,

annualized basis, to $38.0 billion.

- Credit quality remained strong, with net charge-offs of just

0.10% of average loans for the year ended December 31, 2024.

UMB Financial Corporation (Nasdaq: UMBF), a financial services

company, announced net income for the fourth quarter of 2024 of

$120.0 million, or $2.44 per diluted share, compared to $109.6

million, or $2.23 per diluted share, in the third quarter (linked

quarter) and $70.9 million, or $1.45 per diluted share, in the

fourth quarter of 2023.

Net operating income, a non-GAAP financial measure reconciled

later in this release to net income, the nearest comparable GAAP

measure, was $122.6 million, or $2.49 per diluted share, for the

fourth quarter of 2024, compared to $110.4 million, or $2.25 per

diluted share, for the linked quarter and $112.0 million, or $2.29

per diluted share, for the fourth quarter of 2023. Operating

pre-tax, pre-provision income (operating PTPP), a non-GAAP measure

reconciled later in this release to the components of net income

before taxes, the nearest comparable GAAP measure, was $166.9

million, or $3.39 per diluted share, for the fourth quarter of

2024, compared to $154.6 million, or $3.15 per diluted share, for

the linked quarter, and $134.9 million, or $2.76 per diluted share,

for the fourth quarter of 2023. These operating PTPP results

represent increases of 8.0% on a linked-quarter basis and 23.7%

compared to the fourth quarter of 2023.

“Our fourth quarter financial results punctuated a successful

year for UMB Financial, driven by strong operating fundamentals

that are the core of our investment thesis for shareholders,” said

Mariner Kemper, UMB Financial Corporation chairman and chief

executive officer. “Our 2024 results reflect strong growth on both

sides of the balance sheet, continued momentum and new client

acquisitions in many of our fee income businesses, excellent credit

quality metrics and disciplined expense management. We set new

company records with annual net income of $441.2 million, net

operating income of $461.7 million, net interest income that

surpassed $1.0 billion, and noninterest income of $628.1

million.

“For the fourth quarter, net interest income increased 8.7%

sequentially driven by both an 11-basis-point increase in net

interest margin and a 15.6% linked-quarter annualized increase in

average earning assets. Additionally, the strength of our fee

income businesses propelled a 4.1% increase in noninterest income

compared to the third quarter of 2024. Average loan balances

increased 14.8% on a linked-quarter annualized basis, driven by top

line loan production of $1.6 billion, another record for us.

“With the previously announced receipt of necessary approvals,

we are excited to close our merger with Heartland Financial, slated

for January 31, 2025. Teams at both companies have been diligently

working to prepare for the closing and integration of our two

franchises.”

(i) A non-GAAP financial measure reconciled later in this

release to net income, the nearest comparable GAAP measure.

Fourth Quarter 2024 earnings discussion

Summary of quarterly financial

results

UMB Financial

Corporation

(unaudited, dollars in thousands, except

per share data)

Q4

Q3

Q4

2024

2024

2023

Net income (GAAP)

$

119,997

$

109,643

$

70,923

Earnings per share - diluted (GAAP)

2.44

2.23

1.45

Operating pre-tax, pre-provision income

(Non-GAAP)(i)

166,901

154,594

134,901

Operating pre-tax, pre-provision earnings

per share - diluted (Non-GAAP)(i)

3.39

3.15

2.76

Operating pre-tax, pre-provision income -

FTE (Non-GAAP)(i)

173,270

161,195

141,571

Operating pre-tax, pre-provision earnings

per share - FTE - diluted (Non-GAAP)(i)

3.52

3.28

2.90

Net operating income (Non-GAAP)(i)

122,577

110,358

112,038

Operating earnings per share - diluted

(Non-GAAP)(i)

2.49

2.25

2.29

GAAP

Return on average assets

1.06

%

1.01

%

0.69

%

Return on average equity

13.53

12.63

9.52

Efficiency ratio

61.83

61.69

77.65

Non-GAAP(i)

Operating return on average assets

1.08

%

1.01

%

1.10

%

Operating return on average equity

13.82

12.71

15.04

Operating efficiency ratio

61.12

61.46

63.06

(i) See reconciliation of Non-GAAP

measures to their nearest comparable GAAP measures later in this

release.

Summary of revenue

UMB Financial

Corporation

(unaudited, dollars in thousands)

Q4

Q3

Q4

CQ vs.

CQ vs.

2024

2024

2023

LQ

PY

Net interest income

$

268,974

$

247,376

$

230,522

$

21,598

$

38,452

Noninterest income:

Trust and securities processing

76,861

74,222

66,584

2,639

10,277

Trading and investment banking

6,185

7,118

5,751

(933

)

434

Service charges on deposit accounts

21,405

20,089

21,330

1,316

75

Insurance fees and commissions

425

282

238

143

187

Brokerage fees

18,635

15,749

13,439

2,886

5,196

Bankcard fees

21,089

22,394

18,672

(1,305

)

2,417

Investment securities gains, net

593

2,623

1,014

(2,030

)

(421

)

Other

20,018

16,266

13,226

3,752

6,792

Total noninterest income

$

165,211

$

158,743

$

140,254

$

6,468

$

24,957

Total revenue

$

434,185

$

406,119

$

370,776

$

28,066

$

63,409

Net interest income (FTE)

$

275,343

$

253,977

$

237,192

Net interest margin (FTE)

2.57

%

2.46

%

2.46

%

Total noninterest income as a % of total

revenue

38.1

39.1

37.8

Net interest income

- Fourth quarter 2024 net interest income totaled $269.0 million,

an increase of $21.6 million, or 8.7%, from the linked quarter,

driven primarily by balance sheet growth, favorable reinvestment

yields, as well as decreased interest expense due to the mix shift

in the funding composition and repricing of deposits following the

reduction in short-term interest rates. These benefits were

partially offset by repricing of variable rate loans in response to

reductions in the Secured Overnight Financing Rate (SOFR) and Prime

rates.

- Average earning assets increased $1.6 billion, or 3.9%, from

the linked quarter, largely driven by increases of $902.6 million

in average loans, $585.6 million in average securities, and $101.7

million in federal funds sold and resell agreements.

- Average interest-bearing liabilities increased $487.1 million,

or 1.6%, from the linked quarter, primarily driven by an increase

of $1.6 billion in interest-bearing deposits, partially offset by a

decrease of $1.1 billion in borrowed funds driven by the repayment

of borrowings under the Bank Term Funding Program (BTFP) and

Federal Home Loan Bank (FHLB) advances. Average noninterest-bearing

demand deposits increased $1.1 billion, or 12.0%, as compared to

the linked quarter.

- Net interest margin for the fourth quarter was 2.57%, an

increase of 11 basis points from the linked quarter, driven by the

decreased cost of interest-bearing liabilities due to lower

short-term interest rates and a favorable mix shift in the funding

composition, partially offset by decreased loan yields and earning

asset mix changes. The cost of interest-bearing liabilities

decreased 39 basis points sequentially to 3.79%. Total cost of

funds decreased 36 basis points from the linked quarter to 2.80%.

Average loan yields decreased 33 basis points while earning asset

yields decreased 23 basis points from the linked quarter.

- On a year-over-year basis, net interest income increased $38.5

million, or 16.7%, driven by a $4.3 billion, or 11.3%, increase in

average earning assets, partially offset by higher interest costs

due to higher short-term interest rates and unfavorable mix shift

in the composition of liabilities.

- Compared to the fourth quarter of 2023, average earning assets

increased $4.3 billion, or 11.3%, largely driven by the increase in

average loans noted above, an increase of $1.2 billion in

interest-bearing due from banks, and an increase of $743.3 million

in average securities.

- Average deposits increased 16.3% compared to the fourth quarter

of 2023. Average interest-bearing deposits increased 21.4% and

noninterest-bearing demand deposit balances increased 5.1% compared

to the fourth quarter of 2023. Average demand deposit balances

comprised 28.0% of total deposits, compared to 26.9% in the linked

quarter and 31.0% in the fourth quarter of 2023.

- Average borrowed funds decreased $1.1 billion as compared to

the linked quarter and $1.9 billion as compared to the fourth

quarter of 2023, driven by the repayment of borrowings under the

BTFP and FHLB advances.

Noninterest income

- Fourth quarter 2024 noninterest income increased $6.5 million,

or 4.1%, on a linked-quarter basis, largely due to:

- A gain of $4.1 million related to the previously announced sale

of UMB Distribution Services during the fourth quarter of 2024

recorded in other income.

- An increase of $2.9 million in brokerage income primarily

driven by higher 12b-1 fees and money market income.

- An increase of $2.6 million in trust and securities processing

driven by strong activity in the corporate trust, private wealth,

funds services and investor solutions lines of business.

- An increase of $1.7 million in derivative income, recorded in

other income.

- These increases were partially offset by the following

decreases:

- A decrease of $2.0 million in investment securities gains,

primarily driven by decreased valuations in the company's

non-marketable securities.

- A decrease of $2.0 million in company-owned life insurance

income, recorded in other income. The decrease in company-owned

life insurance was offset by a proportionate decrease in deferred

compensation expense as noted below.

- Compared to the prior year, noninterest income in the fourth

quarter of 2024 increased $25.0 million, or 17.8%, primarily driven

by:

- An increase of $5.2 million in brokerage income primarily

driven by higher 12b-1 fees and money market income.

- Increases of $4.8 million in fund services income, $3.5 million

in corporate trust income, and $2.0 million in trust income, all

recorded in trust and securities processing.

- A gain of $4.1 million related to the sale of UMB Distribution

Services and a gain of $1.0 million on the sale of art during the

fourth quarter of 2024, both recorded in other income.

- An increase of $2.4 million in bankcard income, primarily due

to increased card purchase volume and related interchange

income.

- An increase of $1.2 million in derivative income, recorded in

other income.

Noninterest expense

Summary of noninterest expense

UMB Financial

Corporation

(unaudited, dollars in thousands)

Q4

Q3

Q4

CQ vs.

CQ vs.

2024

2024

2023

LQ

PY

Salaries and employee benefits

$

161,062

$

146,984

$

134,231

$

14,078

$

26,831

Occupancy, net

11,272

12,274

12,296

(1,002

)

(1,024

)

Equipment

15,312

15,988

16,579

(676

)

(1,267

)

Supplies and services

3,173

4,967

5,546

(1,794

)

(2,373

)

Marketing and business development

8,999

6,817

6,659

2,182

2,340

Processing fees

30,565

29,697

27,271

868

3,294

Legal and consulting

12,229

9,518

8,424

2,711

3,805

Bankcard

9,398

12,482

8,677

(3,084

)

721

Amortization of other intangible

assets

1,917

1,917

2,048

—

(131

)

Regulatory fees

5,255

4,686

59,183

569

(53,928

)

Other

11,179

7,124

9,060

4,055

2,119

Total noninterest expense

$

270,361

$

252,454

$

289,974

$

17,907

$

(19,613

)

- GAAP noninterest expense for the fourth quarter of 2024 was

$270.4 million, an increase of $17.9 million, or 7.1%, from the

linked quarter and a decrease of $19.6 million, or 6.8% from the

fourth quarter of 2023. Operating noninterest expense, a non-GAAP

financial measure reconciled later in this release to noninterest

expense, the nearest comparable GAAP measure, was $267.3 million

for the fourth quarter of 2024, an increase of $15.8 million, or

6.3%, from the linked quarter and an increase of $31.4 million, or

13.3%, from the fourth quarter of 2023.

- The linked-quarter increase in GAAP noninterest expense was

driven by:

- An increase of $15.4 million in salaries and bonus expense,

recorded in salaries and employee benefits, primarily driven by

increased bonuses due to improved company performance.

- An increase of $4.5 million in operational losses, recorded in

other expense.

- An increase of $2.7 million in legal and consulting expense

driven by expense related to the announced acquisition of Heartland

Financial USA, Inc. and an increase of $2.2 million in marketing

and business development due to the timing of multiple advertising

campaigns and increased travel and entertainment expense.

- These increases were partially offset by the following

decreases:

- A decrease of $3.1 million in bankcard expense driven by lower

administrative expense.

- A decrease of $1.8 million in deferred compensation expense,

recorded in salaries and employee benefits. The decrease in

deferred compensation expense was offset by the decrease in

company-owned life insurance income noted above.

- A decrease of $1.8 million in supplies driven by purchases of

computers during the third quarter of 2024.

- The year-over-year decrease in GAAP noninterest expense was

driven by:

- A decrease of $53.9 million in regulatory fees expense driven

by the $52.8 million expense recorded in the fourth quarter of 2023

related to the industry-wide FDIC special assessment levied as a

result of the 2023 bank failures.

- A decrease of $2.4 million in supplies driven by purchases of

computers during the fourth quarter of 2023.

- These decreases were partially offset by the following

increases:

- An increase of $26.8 million in salaries and employee benefits,

primarily driven by increased bonuses due to improved company

performance.

- An increase of $3.8 million in legal and consulting driven by

expense related to the announced acquisition of Heartland Financial

USA, Inc.

- Increases of $3.3 million in processing fees expense due to

increased software subscription costs and $2.3 million in marketing

and business development due to the timing of multiple campaigns

and increased travel and entertainment expense.

Full Year 2024 earnings discussion

Net income for the year ended December 31, 2024, was $441.2

million, or $8.99 per diluted share, compared to $350.0 million, or

$7.18 per diluted share in 2023. The results for 2024 include $6.6

million in pre-tax expense for the FDIC special assessment,

compared to $52.8 million in pre-tax expense in 2023. Net operating

income, a non-GAAP financial measure reconciled to net income, the

nearest comparable GAAP measure, later in this release, was $461.7

million, or $9.41 per diluted share, compared to $397.1 million, or

$8.14 per diluted share in 2023. These results represent an

increase of $64.6 million, or 16.3% as compared to 2023. Operating

PTPP, a non-GAAP financial measure reconciled later in this release

to the components of net income before taxes, the nearest

comparable GAAP measure, was $625.8 million, or $12.75 per diluted

share, compared to $524.8 million, or $10.76 per diluted share in

2023. These results represent an increase of 19.2% as compared to

2023.

Summary of year-to-date financial

results

UMB Financial

Corporation

(unaudited, dollars in thousands, except

per share data)

December

December

YTD

YTD

2024

2023

Net income (GAAP)

$

441,243

$

350,024

Earnings per share - diluted (GAAP)

8.99

7.18

Operating pre-tax, pre-provision income

(Non-GAAP)(i)

625,786

524,791

Operating pre-tax, pre-provision earnings

per share - diluted (Non-GAAP)(i)

12.75

10.76

Operating pre-tax, pre-provision income -

FTE (Non-GAAP)(i)

651,679

551,150

Operating pre-tax, pre-provision earnings

per share - FTE - diluted (Non-GAAP)(i)

13.28

11.30

Net operating income (Non-GAAP)(i)

461,745

397,115

Operating earnings per share - diluted

(Non-GAAP)(i)

9.41

8.14

GAAP

Return on average assets

1.02

%

0.88

%

Return on average equity

13.24

12.23

Efficiency ratio

62.56

67.76

Non-GAAP(i)

Operating return on average assets

1.07

%

1.00

%

Operating return on average equity

13.85

13.87

Operating efficiency ratio

61.12

63.52

- Net interest income increased $80.8 million, or 8.8%

year-over-year due to a $3.3 billion, or 8.9%, increase in average

earning assets, coupled with the impacts from increased short-term

and long-term interest rates in 2024 as compared to 2023. The

increase in earning assets was driven by an increase of $1.9

billion, or 8.4%, in average loans, and an increase of $1.4

billion, or 70.2%, in average interest-bearing due from banks as

compared to 2023. Average interest-bearing liabilities increased

$3.4 billion, or 13.3%, while noninterest-bearing demand deposits

decreased $563.1 million, or 5.3%, as expected in a higher interest

rate environment. The yield on earning assets increased 41 basis

points, while the cost of interest-bearing liabilities increased 44

basis points. Net interest margin for 2024 was 2.51%, compared to

2.52% in 2023.

- Full-year noninterest income increased $86.3 million, or 15.9%,

due to:

- Increases of $20.5 million in fund services income, $7.7

million in corporate trust income, and $5.1 million in trust

income, all recorded in trust and securities processing.

- An increase of $14.1 million in other income, primarily driven

by gains on the sale of UMB Distribution Services, art, and land,

as well as the recognition of $4.0 million from a legal settlement,

all recorded during 2024.

- An increase of $13.9 million in investment securities gains,

primarily driven by increased valuations in the company's

non-marketable securities in 2024, coupled with the $4.9 million

impairment loss on an available-for-sale subordinated debt security

recorded in the prior year.

- Increases of $13.1 million in bankcard income due to higher

interchange revenue, $7.4 million in brokerage income, due to

higher 12b-1 fees and money market income, and $4.6 million in

investment banking due to increased trade volume.

- Full-year GAAP noninterest expense increased $27.5 million, or

2.8% due to:

- An increase of $40.5 million in salaries and employee benefits,

driven by increases of $36.4 million in salaries and bonus expense

and $4.1 million in employee benefits expense.

- An increase of $16.2 million in legal and consulting expense

driven by expense related to the announced acquisition of Heartland

Financial USA, Inc.

- Increases of $14.8 million in processing fees, driven by

increased software subscription costs, and $11.3 million in

bankcard expense driven by higher administrative expense.

- These increases were partially offset by the following

decreases:

- A decrease of $45.1 million in regulatory fees driven by the

reduced FDIC special assessment expense during 2024 as compared to

2023. The results for 2024 and 2023 include expense of $6.6 million

and $52.8 million, respectively, for the industry-wide FDIC special

assessment.

- Decreases of $5.3 million in equipment expense, driven by

reduced software expense, and $3.7 million in other expense,

primarily due to fewer operational losses and decreased charitable

contributions in 2024 as compared to 2023.

Income taxes

- The company’s effective tax rate was 18.5% for the year ended

December 31, 2024, compared to 17.0% for the same period in 2023.

The increase in the effective tax rate in 2024 is primarily

attributable to a smaller portion of income being earned from

tax-exempt municipal securities and higher non-deductible

acquisition costs in 2024. These increases were partially offset by

an increase in federal tax credits, net of related

amortization.

Balance sheet

- Average total assets for the fourth quarter of 2024 were $45.0

billion compared to $43.3 billion for the linked quarter and $40.5

billion for the same period in 2023.

Summary of average loans and leases -

QTD Average

UMB Financial

Corporation

(unaudited, dollars in thousands)

Q4

Q3

Q4

CQ vs.

CQ vs.

2024

2024

2023

LQ

PY

Commercial and industrial

$

10,637,952

$

10,176,502

$

9,825,043

$

461,450

$

812,909

Specialty lending

491,546

508,957

496,816

(17,411

)

(5,270

)

Commercial real estate

10,007,361

9,669,076

8,890,057

338,285

1,117,304

Consumer real estate

3,143,613

3,045,229

2,945,114

98,384

198,499

Consumer

177,341

164,105

153,791

13,236

23,550

Credit cards

630,373

613,663

495,502

16,710

134,871

Leases and other

201,602

209,631

302,740

(8,029

)

(101,138

)

Total loans

$

25,289,788

$

24,387,163

$

23,109,063

$

902,625

$

2,180,725

- Average loans for the fourth quarter of 2024 increased $902.6

million, or 3.7%, on a linked-quarter basis and $2.2 billion, or

9.4%, compared to the fourth quarter of 2023.

Summary of average securities - QTD

Average

UMB Financial

Corporation

(unaudited, dollars in thousands)

Q4

Q3

Q4

CQ vs.

CQ vs.

2024

2024

2023

LQ

PY

Securities available for sale:

U.S. Treasury

$

1,131,295

$

821,308

$

859,114

$

309,987

$

272,181

U.S. Agencies

159,808

166,250

169,723

(6,442

)

(9,915

)

Mortgage-backed

4,200,465

3,888,879

3,466,152

311,586

734,313

State and political subdivisions

1,241,033

1,240,199

1,218,176

834

22,857

Corporates

321,939

320,570

345,634

1,369

(23,695

)

Collateralized loan obligations

359,053

340,604

349,149

18,449

9,904

Total securities available for sale

$

7,413,593

$

6,777,810

$

6,407,948

$

635,783

$

1,005,645

Securities held to maturity:

U.S. Agencies

$

116,316

$

116,286

$

123,195

$

30

$

(6,879

)

Mortgage-backed

2,542,385

2,597,430

2,756,528

(55,045

)

(214,143

)

State and political subdivisions

2,765,663

2,785,138

2,825,138

(19,475

)

(59,475

)

Total securities held to maturity

$

5,424,364

$

5,498,854

$

5,704,861

$

(74,490

)

$

(280,497

)

Trading securities

$

25,224

$

19,743

$

16,880

$

5,481

$

8,344

Other securities

466,545

447,698

456,758

18,847

9,787

Total securities

$

13,329,726

$

12,744,105

$

12,586,447

$

585,621

$

743,279

- Average total securities increased 4.6% on a linked-quarter

basis and increased 5.9% compared to the fourth quarter of

2023.

- At December 31, 2024, the unrealized pre-tax net loss on the

available-for-sale securities portfolio was $633.3 million, or 7.5%

of the $8.4 billion amortized cost balance. At December 31, 2024,

the unrealized pre-tax net loss on the securities designated as

held to maturity was $630.0 million, or 11.7% of the $5.4 billion

amortized cost value.

Summary of average deposits - QTD

Average

UMB Financial

Corporation

(unaudited, dollars in thousands)

Q4

Q3

Q4

CQ vs.

CQ vs.

2024

2024

2023

LQ

PY

Deposits:

Noninterest-bearing demand

$

10,637,616

$

9,502,106

$

10,118,748

$

1,135,510

$

518,868

Interest-bearing demand and savings

25,367,316

23,779,651

19,457,878

1,587,665

5,909,438

Time deposits

2,012,287

2,010,199

3,098,636

2,088

(1,086,349

)

Total deposits

$

38,017,219

$

35,291,956

$

32,675,262

$

2,725,263

$

5,341,957

Noninterest bearing deposits as % of

total

28.0

%

26.9

%

31.0

%

- Average deposits increased 7.7% on a linked-quarter basis and

16.3% compared to the fourth quarter of 2023.

Capital

Capital information

UMB Financial

Corporation

(unaudited, dollars in thousands, except

per share data)

December 31, 2024

September 30, 2024

December 31, 2023

Total equity

$

3,466,541

$

3,535,489

$

3,100,419

Accumulated other comprehensive loss,

net

(573,050

)

(395,856

)

(556,935

)

Book value per common share

71.02

72.45

63.85

Tangible book value per common share

(Non-GAAP)(i)

65.46

66.86

58.12

Regulatory capital:

Common equity Tier 1 capital

$

3,802,257

$

3,691,874

$

3,418,676

Tier 1 capital

3,802,257

3,691,874

3,418,676

Total capital

4,445,872

4,324,890

4,014,910

Regulatory capital ratios:

Common equity Tier 1 capital ratio

11.29

%

11.22

%

10.94

%

Tier 1 risk-based capital ratio

11.29

11.22

10.94

Total risk-based capital ratio

13.21

13.14

12.85

Tier 1 leverage ratio

8.50

8.58

8.49

(i) See reconciliation of Non-GAAP

measures to their nearest comparable GAAP measures later in this

release.

- At December 31, 2024, the regulatory capital ratios presented

in the foregoing table exceeded all “well-capitalized” regulatory

thresholds.

Asset Quality

Credit quality

UMB Financial

Corporation

(unaudited, dollars in thousands)

Q4

Q3

Q2

Q1

Q4

2024

2024

2024

2024

2023

Net charge-offs - total loans

$

8,935

$

8,454

$

2,856

$

3,017

$

1,352

Net loan charge-offs as a % of total

average loans

0.14

%

0.14

%

0.05

%

0.05

%

0.02

%

Loans over 90 days past due

$

7,602

$

7,133

$

5,644

$

3,076

$

3,111

Loans over 90 days past due as a % of

total loans

0.03

%

0.03

%

0.02

%

0.01

%

0.01

%

Nonaccrual and restructured loans

$

19,282

$

19,291

$

13,743

$

17,756

$

13,212

Nonaccrual and restructured loans as a %

of total loans

0.08

%

0.08

%

0.06

%

0.08

%

0.06

%

Provision for credit losses

$

19,000

$

18,000

$

14,050

$

10,000

$

—

- Provision for credit losses for the fourth quarter increased

$1.0 million from the linked quarter and $19.0 million from the

fourth quarter of 2023. These changes are driven largely by

provision tied to the $651.5 million and $2.5 billion increases,

respectively, in period-end loans from the prior periods, as well

as general portfolio trends in the current period as compared to

the prior periods.

- Net charge-offs for the fourth quarter totaled $8.9 million, or

0.14% of average loans, compared to $8.5 million, or 0.14% of

average loans in the linked quarter, and $1.4 million, or 0.02% of

average loans for the fourth quarter of 2023.

Dividend Declaration

At the company’s quarterly board meeting, the Board of Directors

declared a $0.40 per share quarterly cash dividend, payable on

April 1, 2025, to stockholders of record of the company's common

stock at the close of business on March 10, 2025.

Conference Call

The company will host a conference call to discuss its fourth

quarter 2024 earnings results on Wednesday, January 29, 2025, at

8:30 a.m. (CT).

Interested parties may access the call by dialing (toll-free)

833-470-1428 or (international) 404-975-4839 and requesting to join

the UMB Financial call with access code 099512. The live call may

also be accessed by visiting investorrelations.umb.com or by using

the following link:

UMB Financial 4Q 2024 Conference Call

A replay of the conference call may be heard through February

12, 2025, by calling (toll-free) 866-813-9403 or (international)

929-458-6194. The replay access code required for playback is

612758. The call replay may also be accessed at

investorrelations.umb.com.

Non-GAAP Financial

Information

In this release, we provide information about net operating

income, operating earnings per share – diluted (operating EPS),

operating return on average equity (operating ROE), operating

return on average assets (operating ROA), operating noninterest

expense, operating efficiency ratio, operating pre-tax,

pre-provision income (operating PTPP), operating pre-tax,

pre-provision earnings per share – diluted (operating PTPP EPS),

operating pre-tax, pre-provision income on a fully tax equivalent

basis (operating PTPP-FTE), operating pre-tax, pre-provision FTE

earnings per share – diluted (operating PTPP-FTE EPS), tangible

shareholders’ equity, and tangible book value per share, all of

which are non-GAAP financial measures. This information supplements

the results that are reported according to generally accepted

accounting principles in the United States (GAAP) and should not be

viewed in isolation from, or as a substitute for, GAAP results. The

differences between the non-GAAP financial measures – net operating

income, operating EPS, operating ROE, operating ROA, operating

noninterest expense, operating efficiency ratio, operating PTPP,

operating PTPP EPS, operating PTPP-FTE, operating PTPP-FTE EPS,

tangible shareholders’ equity, and tangible book value per share –

and the nearest comparable GAAP financial measures are reconciled

later in this release. The company believes that these non-GAAP

financial measures and the reconciliations may be useful to

investors because they adjust for acquisition- and

severance-related items, and the FDIC special assessment that

management does not believe reflect the company’s fundamental

operating performance.

Net operating income for the relevant period is defined as GAAP

net income, adjusted to reflect the impact of excluding expenses

related to acquisitions, severance expense, the FDIC special

assessment, and the cumulative tax impact of these adjustments.

Operating EPS (diluted) is calculated as earnings per share as

reported, adjusted to reflect, on a per share basis, the impact of

excluding the non-GAAP adjustments described above for the relevant

period. Operating ROE is calculated as net operating income,

divided by the company’s average total shareholders’ equity for the

relevant period. Operating ROA is calculated as net operating

income, divided by the company’s average assets for the relevant

period. Operating noninterest expense for the relevant period is

defined as GAAP noninterest expense, adjusted to reflect the

pre-tax impact of non-GAAP adjustments described above. Operating

efficiency ratio is calculated as the company’s operating

noninterest expense, net of amortization of other intangibles,

divided by the company’s total non-GAAP revenue (calculated as net

interest income plus noninterest income, less gains on sales of

securities available for sale, net).

Operating PTPP income for the relevant period is defined as GAAP

net interest income plus GAAP noninterest income, less noninterest

expense, adjusted to reflect the impact of excluding expenses

related to acquisitions and severance, and the FDIC special

assessment.

Operating PTPP-FTE for the relevant period is defined as GAAP

net interest income on a fully tax equivalent basis plus GAAP

noninterest income, less noninterest expense, adjusted to reflect

the impact of excluding expenses related to acquisitions and

severance, and the FDIC special assessment.

Tangible shareholders’ equity for the relevant period is defined

as GAAP shareholders’ equity, net of intangible assets. Tangible

book value per share is defined as tangible shareholders’ equity

divided by the Company’s total shares outstanding.

Forward-Looking

Statements:

This press release contains, and our other communications may

contain, forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. These statements

can be identified by the fact that they do not relate strictly to

historical or current facts. Forward-looking statements often use

words such as “believe,” “expect,” “anticipate,” “intend,”

“estimate,” “project,” “outlook,” “forecast,” “target,” “trend,”

“plan,” “goal,” or other words of comparable meaning or

future-tense or conditional verbs such as “may,” “will,” “should,”

“would,” or “could.” Forward-looking statements convey our

expectations, intentions, or forecasts about future events,

circumstances, results, or aspirations. All forward-looking

statements are subject to assumptions, risks, and uncertainties,

which may change over time and many of which are beyond our

control. You should not rely on any forward-looking statement as a

prediction or guarantee about the future. Our actual future

objectives, strategies, plans, prospects, performance, condition,

or results may differ materially from those set forth in any

forward-looking statement. Some of the factors that may cause

actual results or other future events, circumstances, or

aspirations to differ from those in forward-looking statements are

described in our Annual Report on Form 10-K for the year ended

December 31, 2023, our subsequent Quarterly Reports on Form 10-Q or

Current Reports on Form 8-K, or other applicable documents that are

filed or furnished with the U.S. Securities and Exchange Commission

(SEC). In addition to such factors that have been disclosed

previously: macroeconomic and adverse developments and

uncertainties related to the collateral effects of the collapse of,

and challenges for, domestic and international banks, including the

impacts to the U.S. and global economies; sustained levels of high

inflation and the potential for an economic recession on the heels

of aggressive quantitative tightening by the Federal Reserve; and

impacts related to or resulting from instability in the Middle East

and Russia’s military action in Ukraine, such as the broader

impacts to financial markets and the global macroeconomic and

geopolitical environments, may also cause actual results or other

future events, circumstances, or aspirations to differ from our

forward-looking statements. Any forward-looking statement made by

us or on our behalf speaks only as of the date that it was made. We

do not undertake to update any forward-looking statement to reflect

the impact of events, circumstances, or results that arise after

the date that the statement was made, except to the extent required

by applicable securities laws. You, however, should consult further

disclosures (including disclosures of a forward-looking nature)

that we may make in any subsequent Annual Report on Form 10-K,

Quarterly Report on Form 10-Q, Current Report on Form 8-K, or other

applicable document that is filed or furnished with the SEC.

About UMB:

UMB Financial Corporation (Nasdaq: UMBF) is a financial services

company headquartered in Kansas City, Missouri. UMB offers

commercial banking, which includes comprehensive deposit, lending

and investment services, personal banking, which includes wealth

management and financial planning services, and institutional

banking, which includes asset servicing, corporate trust solutions,

investment banking, and healthcare services. UMB operates branches

throughout Missouri, Illinois, Colorado, Kansas, Oklahoma,

Nebraska, Arizona and Texas. As the company’s reach continues to

grow, it also serves business clients nationwide and institutional

clients in several countries. For more information, visit UMB.com,

UMB Blog, UMB Facebook and UMB LinkedIn.

Consolidated Balance Sheets

UMB Financial

Corporation

(unaudited, dollars in thousands)

December 31,

2024

2023

ASSETS

Loans

$

25,642,301

$

23,172,484

Allowance for credit losses on loans

(259,089

)

(219,738

)

Net loans

25,383,212

22,952,746

Loans held for sale

2,756

4,420

Securities:

Available for sale

7,774,334

7,068,613

Held to maturity, net of allowance for

credit losses

5,376,267

5,688,610

Trading securities

28,533

18,093

Other securities

471,018

492,935

Total securities

13,650,152

13,268,251

Federal funds sold and resell

agreements

545,000

245,344

Interest-bearing due from banks

7,986,270

5,159,802

Cash and due from banks

573,175

447,201

Premises and equipment, net

221,773

241,700

Accrued income

246,095

220,306

Goodwill

207,385

207,385

Other intangibles, net

63,647

71,012

Other assets

1,530,199

1,193,507

Total assets

$

50,409,664

$

44,011,674

LIABILITIES

Deposits:

Noninterest-bearing demand

$

13,617,167

$

12,130,662

Interest-bearing demand and savings

27,397,195

20,588,606

Time deposits under $250,000

969,132

2,292,899

Time deposits of $250,000 or more

1,158,535

780,692

Total deposits

43,142,029

35,792,859

Federal funds purchased and repurchase

agreements

2,609,715

2,119,644

Short-term debt

—

1,800,000

Long-term debt

385,292

383,247

Accrued expenses and taxes

368,457

389,860

Other liabilities

437,630

425,645

Total liabilities

46,943,123

40,911,255

SHAREHOLDERS' EQUITY

Common stock

55,057

55,057

Capital surplus

1,145,638

1,134,363

Retained earnings

3,174,948

2,810,824

Accumulated other comprehensive loss,

net

(573,050

)

(556,935

)

Treasury stock

(336,052

)

(342,890

)

Total shareholders' equity

3,466,541

3,100,419

Total liabilities and shareholders'

equity

$

50,409,664

$

44,011,674

Consolidated Statements of

Income

UMB Financial

Corporation

(unaudited, dollars in thousands except

share and per share data)

Three Months Ended

Year Ended

December 31,

December 31,

2024

2023

2024

2023

INTEREST INCOME

Loans

$

410,631

$

381,041

$

1,612,948

$

1,399,961

Securities:

Taxable interest

71,403

53,890

257,562

214,981

Tax-exempt interest

24,387

25,637

99,375

102,197

Total securities income

95,790

79,527

356,937

317,178

Federal funds and resell agreements

5,902

3,540

17,628

17,647

Interest-bearing due from banks

42,314

32,267

182,145

103,190

Trading securities

331

227

1,351

729

Total interest income

554,968

496,602

2,171,009

1,838,705

INTEREST EXPENSE

Deposits

255,303

213,842

982,302

704,210

Federal funds and repurchase

agreements

23,745

21,903

106,558

93,026

Other

6,946

30,335

81,257

121,353

Total interest expense

285,994

266,080

1,170,117

918,589

Net interest income

268,974

230,522

1,000,892

920,116

Provision for credit losses

19,000

—

61,050

41,227

Net interest income after provision for

credit losses

249,974

230,522

939,842

878,889

NONINTEREST INCOME

Trust and securities processing

76,861

66,584

290,571

257,200

Trading and investment banking

6,185

5,751

24,226

19,630

Service charges on deposit accounts

21,405

21,330

84,512

84,950

Insurance fees and commissions

425

238

1,257

1,009

Brokerage fees

18,635

13,439

61,564

54,119

Bankcard fees

21,089

18,672

87,797

74,719

Investment securities gains (losses),

net

593

1,014

10,720

(3,139

)

Other

20,018

13,226

67,470

53,365

Total noninterest income

165,211

140,254

628,117

541,853

NONINTEREST EXPENSE

Salaries and employee benefits

161,062

134,231

593,913

553,421

Occupancy, net

11,272

12,296

47,539

48,502

Equipment

15,312

16,579

63,406

68,718

Supplies and services

3,173

5,546

14,845

16,829

Marketing and business development

8,999

6,659

28,439

25,749

Processing fees

30,565

27,271

117,899

103,099

Legal and consulting

12,229

8,424

46,207

29,998

Bankcard

9,398

8,677

44,265

32,969

Amortization of other intangible

assets

1,917

2,048

7,705

8,587

Regulatory fees

5,255

59,183

31,904

77,010

Other

11,179

9,060

30,564

34,258

Total noninterest expense

270,361

289,974

1,026,686

999,140

Income before income taxes

144,824

80,802

541,273

421,602

Income tax expense

24,827

9,879

100,030

71,578

NET INCOME

$

119,997

$

70,923

$

441,243

$

350,024

PER SHARE DATA

Net income – basic

$

2.46

$

1.46

$

9.05

$

7.22

Net income – diluted

2.44

1.45

8.99

7.18

Dividends

0.40

0.39

1.57

1.53

Weighted average shares outstanding –

basic

48,807,081

48,538,127

48,747,814

48,503,643

Weighted average shares outstanding –

diluted

49,178,891

48,860,020

49,056,956

48,763,820

Consolidated Statements of

Comprehensive Income

UMB Financial

Corporation

(unaudited, dollars in thousands)

Three Months Ended

Year Ended

December 31,

December 31,

2024

2023

2024

2023

Net income

$

119,997

$

70,923

$

441,243

$

350,024

Other comprehensive (loss) income, before

tax:

Unrealized gains and losses on debt

securities:

Change in unrealized holding gains and

losses, net

(183,961

)

293,578

(8,956

)

147,977

Less: Reclassification adjustment for net

(gains) losses included in net income

—

—

(139

)

279

Amortization of net unrealized loss on

securities transferred from available-for-sale to

held-to-maturity

8,560

9,288

35,905

39,851

Change in unrealized gains and losses on

debt securities

(175,401

)

302,866

26,810

188,107

Unrealized gains and losses on derivative

hedges:

Change in unrealized gains and losses on

derivative hedges, net

(58,542

)

10,767

(40,530

)

15,015

Less: Reclassification adjustment for net

gains included in net income

(677

)

(2,589

)

(8,069

)

(10,654

)

Change in unrealized gains and losses on

derivative hedges

(59,219

)

8,178

(48,599

)

4,361

Other comprehensive (loss) income, before

tax

(234,620

)

311,044

(21,789

)

192,468

Income tax benefit (expense)

57,426

(75,608

)

5,674

(46,668

)

Other comprehensive (loss) income

(177,194

)

235,436

(16,115

)

145,800

Comprehensive (loss) income

$

(57,197

)

$

306,359

$

425,128

$

495,824

Consolidated Statements of

Shareholders' Equity

UMB Financial

Corporation

(unaudited, dollars in thousands except

per share data)

Common Stock

Capital Surplus

Retained Earnings

Accumulated Other

Comprehensive (Loss) Income

Treasury Stock

Total

Balance - January 1, 2023

$

55,057

$

1,125,949

$

2,536,086

$

(702,735

)

$

(347,264

)

$

2,667,093

Total comprehensive income

—

—

350,024

145,800

—

495,824

Dividends ($1.53 per share)

—

—

(75,286

)

—

—

(75,286

)

Purchase of treasury stock

—

—

—

—

(8,367

)

(8,367

)

Issuances of equity awards, net of

forfeitures

—

(10,385

)

—

—

11,104

719

Recognition of equity-based

compensation

—

17,975

—

—

—

17,975

Sale of treasury stock

—

220

—

—

296

516

Exercise of stock options

—

604

—

—

1,341

1,945

Balance - December 31, 2023

$

55,057

$

1,134,363

$

2,810,824

$

(556,935

)

$

(342,890

)

$

3,100,419

Balance - January 1, 2024

$

55,057

$

1,134,363

$

2,810,824

$

(556,935

)

$

(342,890

)

$

3,100,419

Total comprehensive income (loss)

—

—

441,243

(16,115

)

—

425,128

Dividends ($1.57 per share)

—

—

(77,119

)

—

—

(77,119

)

Purchase of treasury stock

—

—

—

—

(7,738

)

(7,738

)

Issuances of equity awards, net of

forfeitures

—

(11,220

)

—

—

11,923

703

Recognition of equity-based

compensation

—

21,876

—

—

—

21,876

Sale of treasury stock

—

342

—

—

240

582

Exercise of stock options

—

1,690

—

—

2,413

4,103

Common stock issuance costs

—

(1,413

)

—

—

—

(1,413

)

Balance - December 31, 2024

$

55,057

$

1,145,638

$

3,174,948

$

(573,050

)

$

(336,052

)

$

3,466,541

Average Balances / Yields and

Rates

UMB Financial

Corporation

(tax - equivalent basis)

(unaudited, dollars in thousands)

Three Months Ended December

31,

2024

2023

Average

Average

Average

Average

Balance

Yield/Rate

Balance

Yield/Rate

Assets

Loans, net of unearned interest

$

25,289,788

6.46

%

$

23,109,063

6.54

%

Securities:

Taxable

9,739,156

2.92

8,853,426

2.41

Tax-exempt

3,565,346

3.42

3,716,141

3.44

Total securities

13,304,502

3.05

12,569,567

2.72

Federal funds and resell agreements

429,898

5.46

235,284

5.97

Interest bearing due from banks

3,573,884

4.71

2,372,767

5.40

Trading securities

25,224

5.68

16,880

5.83

Total earning assets

42,623,296

5.24

38,303,561

5.21

Allowance for credit losses

(250,824

)

(223,668

)

Other assets

2,608,524

2,435,687

Total assets

$

44,980,996

$

40,515,580

Liabilities and Shareholders'

Equity

Interest-bearing deposits

$

27,379,603

3.71

%

$

22,556,514

3.76

%

Federal funds and repurchase

agreements

2,250,507

4.20

1,883,392

4.61

Borrowed funds

409,474

6.75

2,286,271

5.26

Total interest-bearing liabilities

30,039,584

3.79

26,726,177

3.95

Noninterest-bearing demand deposits

10,637,616

10,118,748

Other liabilities

776,031

715,688

Shareholders' equity

3,527,765

2,954,967

Total liabilities and shareholders'

equity

$

44,980,996

$

40,515,580

Net interest spread

1.45

%

1.26

%

Net interest margin

2.57

2.46

Average Balances / Yields and

Rates

UMB Financial

Corporation

(tax - equivalent basis)

(unaudited, dollars in thousands)

Year Ended December

31,

2024

2023

Average

Average

Average

Average

Balance

Yield/Rate

Balance

Yield/Rate

Assets

Loans, net of unearned interest

$

24,212,645

6.66

%

$

22,337,119

6.27

%

Securities:

Taxable

9,290,809

2.77

9,097,110

2.36

Tax-exempt

3,634,588

3.44

3,790,921

3.38

Total securities

12,925,397

2.96

12,888,031

2.66

Federal funds and resell agreements

303,096

5.82

316,072

5.58

Interest bearing due from banks

3,482,402

5.23

2,046,349

5.04

Trading securities

22,311

6.53

14,030

5.65

Total earning assets

40,945,851

5.37

37,601,601

4.96

Allowance for credit losses

(235,370

)

(216,245

)

Other assets

2,479,363

2,344,911

Total assets

$

43,189,844

$

39,730,267

Liabilities and Shareholders'

Equity

Interest-bearing deposits

$

25,224,201

3.89

%

$

21,122,305

3.33

%

Federal funds and repurchase

agreements

2,338,455

4.56

2,175,415

4.28

Borrowed funds

1,447,646

5.61

2,311,238

5.25

Total interest-bearing liabilities

29,010,302

4.03

25,608,958

3.59

Noninterest-bearing demand deposits

10,077,251

10,640,344

Other liabilities

769,479

618,230

Shareholders' equity

3,332,812

2,862,735

Total liabilities and shareholders'

equity

$

43,189,844

$

39,730,267

Net interest spread

1.34

%

1.37

%

Net interest margin

2.51

2.52

Business Segment Information

UMB Financial

Corporation

(unaudited, dollars in thousands)

Three Months Ended December

31, 2024

Commercial Banking

Institutional Banking

Personal Banking

Total

Net interest income

$

180,085

$

53,118

$

35,771

$

268,974

Provision for credit losses

15,392

1,021

2,587

19,000

Noninterest income

29,278

109,812

26,121

165,211

Noninterest expense

92,740

109,850

67,771

270,361

Income (loss) before taxes

101,231

52,059

(8,466

)

144,824

Income tax expense (benefit)

17,764

8,246

(1,183

)

24,827

Net income (loss)

$

83,467

$

43,813

$

(7,283

)

$

119,997

Three Months Ended December

31, 2023

Commercial Banking

Institutional Banking

Personal Banking

Total

Net interest income

$

154,289

$

44,150

$

32,083

$

230,522

Provision for credit losses

(1,926

)

653

1,273

—

Noninterest income

25,956

90,361

23,937

140,254

Noninterest expense

114,190

114,306

61,478

289,974

Income (loss) before taxes

67,981

19,552

(6,731

)

80,802

Income tax expense (benefit)

5,198

2,867

1,814

9,879

Net income (loss)

$

62,783

$

16,685

$

(8,545

)

$

70,923

Year Ended December 31,

2024

Commercial Banking

Institutional Banking

Personal Banking

Total

Net interest income

$

665,587

$

199,821

$

135,484

$

1,000,892

Provision for credit losses

50,155

2,781

8,114

61,050

Noninterest income

130,187

398,306

99,624

628,117

Noninterest expense

356,136

408,323

262,227

1,026,686

Income (loss) before taxes

389,483

187,023

(35,233

)

541,273

Income tax expense (benefit)

71,248

33,126

(4,344

)

100,030

Net income (loss)

$

318,235

$

153,897

$

(30,889

)

$

441,243

Year Ended December 31,

2023

Commercial Banking

Institutional Banking

Personal Banking

Total

Net interest income

$

598,371

$

192,765

$

128,980

$

920,116

Provision for credit losses

33,184

1,406

6,637

41,227

Noninterest income

97,614

347,933

96,306

541,853

Noninterest expense

365,856

382,770

250,514

999,140

Income (loss) before taxes

296,945

156,522

(31,865

)

421,602

Income tax expense (benefit)

47,874

26,664

(2,960

)

71,578

Net income (loss)

$

249,071

$

129,858

$

(28,905

)

$

350,024

The company has strategically aligned its operations into the

following three reportable segments: Commercial Banking,

Institutional Banking, and Personal Banking. Senior executive

officers regularly evaluate business segment financial results

produced by the company’s internal reporting system in deciding how

to allocate resources and assess performance for individual

business segments. The company’s reportable segments include

certain corporate overhead, technology and service costs that are

allocated based on methodologies that are applied consistently

between periods. For comparability purposes, amounts in all periods

are based on methodologies in effect at December 31, 2024.

Non-GAAP Financial Measures

Net operating income Non-GAAP

reconciliations:

UMB Financial

Corporation

(unaudited, dollars in thousands except

per share data)

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

Net income (GAAP)

$

119,997

$

70,923

$

441,243

$

350,024

Adjustments:

Acquisition expense

3,658

52

16,250

179

Severance expense

245

1,207

569

8,943

FDIC special assessment

(826

)

52,840

6,644

52,840

Tax-impact of adjustments (i)

(497

)

(12,984

)

(2,961

)

(14,871

)

Total Non-GAAP adjustments (net of

tax)

2,580

41,115

20,502

47,091

Net operating income (Non-GAAP)

$

122,577

$

112,038

$

461,745

$

397,115

Earnings per share - diluted (GAAP)

$

2.44

$

1.45

$

8.99

$

7.18

Acquisition expense

0.07

—

0.33

—

Severance expense

—

0.02

0.01

0.18

FDIC special assessment

(0.01

)

1.08

0.14

1.08

Tax-impact of adjustments (i)

(0.01

)

(0.26

)

(0.06

)

(0.30

)

Operating earnings per share - diluted

(Non-GAAP)

$

2.49

$

2.29

$

9.41

$

8.14

GAAP

Return on average assets

1.06

%

0.69

%

1.02

%

0.88

%

Return on average equity

13.53

9.52

13.24

12.23

Non-GAAP

Operating return on average assets

1.08

%

1.10

%

1.07

%

1.00

%

Operating return on average equity

13.82

15.04

13.85

13.87

(i) Calculated using the company’s

marginal tax rate of 23.0% for 2024 and 24.0% for 2023. Certain

merger-related expenses are non-deductible.

Operating noninterest expense and

operating efficiency ratio Non-GAAP reconciliations:

UMB Financial

Corporation

(unaudited, dollars in thousands)

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

Noninterest expense

$

270,361

$

289,974

$

1,026,686

$

999,140

Adjustments to arrive at operating

noninterest expense (pre-tax):

Acquisition expense

3,658

52

16,250

179

Severance expense

245

1,207

569

8,943

FDIC special assessment

(826

)

52,840

6,644

52,840

Total Non-GAAP adjustments (pre-tax)

3,077

54,099

23,463

61,962

Operating noninterest expense

(Non-GAAP)

$

267,284

$

235,875

$

1,003,223

$

937,178

Noninterest expense

$

270,361

$

289,974

$

1,026,686

$

999,140

Less: Amortization of other

intangibles

1,917

2,048

7,705

8,587

Noninterest expense, net of amortization

of other intangibles (Non-GAAP) (numerator A)

$

268,444

$

287,926

$

1,018,981

$

990,553

Operating noninterest expense

$

267,284

$

235,875

$

1,003,223

$

937,178

Less: Amortization of other

intangibles

1,917

2,048

7,705

8,587

Operating expense, net of amortization of

other intangibles (Non-GAAP) (numerator B)

$

265,367

$

233,827

$

995,518

$

928,591

Net interest income

$

268,974

$

230,522

$

1,000,892

$

920,116

Noninterest income

165,211

140,254

628,117

541,853

Less: Gains on sales of securities

available for sale, net

—

—

139

152

Total Non-GAAP Revenue (denominator A)

$

434,185

$

370,776

$

1,628,870

$

1,461,817

Efficiency ratio (numerator A/denominator

A)

61.83

%

77.65

%

62.56

%

67.76

%

Operating efficiency ratio (Non-GAAP)

(numerator B/denominator A)

61.12

63.06

61.12

63.52

Operating pre-tax, pre-provision income

non-GAAP reconciliations:

UMB Financial

Corporation

(unaudited, dollars in thousands except

per share data)

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

Net interest income (GAAP)

$

268,974

$

230,522

$

1,000,892

$

920,116

Noninterest income (GAAP)

165,211

140,254

628,117

541,853

Noninterest expense (GAAP)

270,361

289,974

1,026,686

999,140

Adjustments to arrive at operating

noninterest expense:

Acquisition expense

3,658

52

16,250

179

Severance expense

245

1,207

569

8,943

FDIC special assessment

(826

)

52,840

6,644

52,840

Total Non-GAAP adjustments

3,077

54,099

23,463

61,962

Operating noninterest expense

(Non-GAAP)

267,284

235,875

1,003,223

937,178

Operating pre-tax, pre-provision income

(Non-GAAP)

$

166,901

$

134,901

$

625,786

$

524,791

Net interest income earnings per share -

diluted (GAAP)

$

5.47

$

4.72

$

20.40

$

18.87

Noninterest income (GAAP)

3.36

2.87

12.80

11.11

Noninterest expense (GAAP)

5.50

5.93

20.93

20.48

Acquisition expense

0.07

—

0.33

—

Severance expense

—

0.02

0.01

0.18

FDIC special assessment

(0.01

)

1.08

0.14

1.08

Operating pre-tax, pre-provision earnings

per share - diluted (Non-GAAP)

$

3.39

$

2.76

$

12.75

$

10.76

Operating pre-tax, pre-provision income

- FTE Non-GAAP reconciliations:

UMB Financial

Corporation

(unaudited, dollars in thousands except

per share data)

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

Net interest income (GAAP)

$

268,974

$

230,522

$

1,000,892

$

920,116

Adjustments to arrive at net interest

income - FTE:

Tax equivalent interest

6,369

6,670

25,893

26,359

Net interest income - FTE (Non-GAAP)

275,343

237,192

1,026,785

946,475

Noninterest income (GAAP)

165,211

140,254

628,117

541,853

Noninterest expense (GAAP)

270,361

289,974

1,026,686

999,140

Adjustments to arrive at operating

noninterest expense:

Acquisition expense

3,658

52

16,250

179

Severance expense

245

1,207

569

8,943

FDIC special assessment

(826

)

52,840

6,644

52,840

Total Non-GAAP adjustments

3,077

54,099

23,463

61,962

Operating noninterest expense

(Non-GAAP)

267,284

235,875

1,003,223

937,178

Operating pre-tax, pre-provision income -

FTE (Non-GAAP)

$

173,270

$

141,571

$

651,679

$

551,150

Net interest income earnings per share -

diluted (GAAP)

$

5.47

$

4.72

$

20.40

$

18.87

Tax equivalent interest

0.13

0.14

0.53

0.54

Net interest income - FTE (Non-GAAP)

5.60

4.86

20.93

19.41

Noninterest income (GAAP)

3.36

2.87

12.80

11.11

Noninterest expense (GAAP)

5.50

5.93

20.93

20.48

Acquisition expense

0.07

—

0.33

—

Severance expense

—

0.02

0.01

0.18

FDIC special assessment

(0.01

)

1.08

0.14

1.08

Operating pre-tax, pre-provision income -

FTE earnings per share - diluted (Non-GAAP)

$

3.52

$

2.90

$

13.28

$

11.30

Tangible book value non-GAAP

reconciliations:

UMB Financial

Corporation

(unaudited, dollars in thousands except

share and per share data)

As of December 31,

2024

2023

Total shareholders' equity (GAAP)

$

3,466,541

$

3,100,419

Less: Intangible assets

Goodwill

207,385

207,385

Other intangibles, net

63,647

71,012

Total intangibles, net

271,032

278,397

Total tangible shareholders' equity

(Non-GAAP)

$

3,195,509

$

2,822,022

Total shares outstanding

48,814,177

48,554,127

Ratio of total shareholders' equity (book

value) per share

$

71.02

$

63.85

Ratio of total tangible shareholders'

equity (tangible book value) per share (Non-GAAP)

65.46

58.12

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250124294797/en/

Media Contact: Stephanie Hague: 816.729.1027 Investor Relations

Contact: Kay Gregory: 816.860.7106

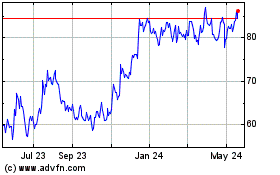

UMB Financial (NASDAQ:UMBF)

Historical Stock Chart

From Dec 2024 to Jan 2025

UMB Financial (NASDAQ:UMBF)

Historical Stock Chart

From Jan 2024 to Jan 2025