Form 6-K/A - Report of foreign issuer [Rules 13a-16 and 15d-16]: [Amend]

April 17 2024 - 3:05PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K/A

Amendment No. 1

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE

13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2023

Commission File Number: 001- 40306

Utime Limited

7th Floor, Building 5A

Shenzhen Software Industry Base

Nanshan District, Shenzhen, 518061

People’s Republic of China

(Address of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☐

EXPLANATORY NOTE

This amendment to the Report on Form 6-K (“Form

6-K/A”) is being filed to amend the Report on Form 6-K initially filed by UTime Limited (the “Company”)

with the Securities and Exchange Commission on December 19, 2023 (the “Original Form 6-K”). The Company is filing

this Form 6-K/A solely to correct clerical errors in the number of votes which were submitted by the shareholders of the Company at the

Meeting (as defined below). Except as set forth in the foregoing, the Original Form 6-K is unchanged.

Submission of Matters to a Vote of Security Holders.

UTime Limited, a Cayman Islands exempted company (the

“Company”) held its 2023 extraordinary general meeting of shareholders at 10:00AM., Eastern Time, on December 16, 2023

(the “Meeting”) at the Company’s headquarters located at 7th Floor, Building 5A, Shenzhen Software Industry Base,

Nanshan District, Shenzhen, 518061, China. Holders of a total of 7,178,339 ordinary shares of the Company, par value $0.0001 each (the

“Ordinary Shares”), out of a total of 13,567,793 Ordinary Shares issued and outstanding and entitled to vote at the

Meeting, and that a quorum for the transaction of business is present at the Meeting. Each Ordinary Share is entitled to one vote. The

final voting results for each matter submitted to a vote of shareholders at the meeting are as follows:

1. Share Consolidation

To approve a share consolidation, of the Company’s

ordinary shares at a ratio of one-for-twenty five such that each twenty five ordinary shares of the Company shall be combined into one

ordinary share of the Company (the “Share Consolidation”). After the Share Consolidation, the Company’s authorized

share capital will be US$15,000 divided into (i) 560,000 Ordinary Shares of a par value of US$0.02678571 each, (ii) 10,000,000 Preference

Shares of a par value of US$0.0001 each.

The shareholders approved the proposal.

| For |

|

Against |

|

Abstain |

|

Total |

| 6,744,863 |

|

431,269 |

|

2,207 |

|

7,178,339 |

2. Increase of Authorized Shares

To approve to subdivide the Ordinary Shares of the

Company, by the increase in the Company’s authorized share capital from US$15,000 to US$100,000 and the creation of an additional

989,440,000 Ordinary Shares of a par value of US$0.0001 each, such that the authorized share capital shall be US$100,000 divided into

1,000,000,000 shares of a par value of US$0.0001 each, comprising of (i) 990,000,000 Ordinary Shares of a par value of US$0.0001 each

and (ii) 10,000,000 Preference Shares of a par value of US$0.0001 each (the “Increase of Authorized Shares”).

The shareholders approved the proposal.

| For |

|

Against |

|

Abstain |

|

Total |

| 6,721,065 |

|

454,995 |

|

2,279 |

|

7,178,339 |

3. Private Placement

Subject to shareholders’ approval of the Share

Consolidation and Increase of Authorized Shares, to ratify and approve as an ordinary resolution the issuance of 373,846,160 units, each

unit consisting of one ordinary share and a warrant to purchase three ordinary shares, pursuant to certain securities purchase agreement

dated November 15, 2023 in a private placement to certain “non-U.S. Persons” as defined in Regulation S (the “Private

Placement”).

The shareholders approved the proposal.

| For |

|

Against |

|

Abstain |

|

Total |

| 6,736,030 |

|

440,030 |

|

2,279 |

|

7,178,339 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Dated: April 17, 2024

| |

UTIME LIMITED |

| |

|

|

| |

By: |

/s/ Hengcong Qiu |

| |

Name: |

Hengcong Qiu |

| |

Title: |

Chief Executive Officer |

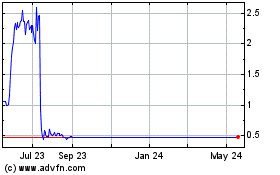

UTime (NASDAQ:UTME)

Historical Stock Chart

From Oct 2024 to Nov 2024

UTime (NASDAQ:UTME)

Historical Stock Chart

From Nov 2023 to Nov 2024