Tesla Charges Up on Model S Sales - Analyst Blog

April 03 2013 - 5:00AM

Zacks

Tesla Motors Inc. (TSLA) is so pleased with its

better-than-expected sales of the Model S electric sedan that the

company now expects to be fully profitable in the first quarter of

the year, rather than the prior guidance of modestly profitable,

excluding non-cash option and warrant expenses. The news sent the

stock to 52-week high of $46.68 on Apr 1.

Sales of Model S in the first quarter were more than 4,750 units,

exceeding the guidance of 4,500 units. The same Model S was the

center of controversy in February following an article published in

the New York Times. The article detailed the result of a

test drive that raised many questions about the viability of

electric cars such as Model S, but the report's validity was

aggressively challenged by Tesla.

Initially, Tesla launched two all-electric models, Roadster and the

Model S, with a price tag of $109,000 and $49,900, respectively.

However, the company has phased out Roadster later due to its

higher price tag and weak demand, and started relying solely on

Model S to rejuvenate its market share. According to Environmental

Protection Agency (EPA), Model S can travel up to 265 miles on a

single charge of its 85-kilowatt-hour (kWh) battery pack.

In 2012, Tesla lost $396.2 million or $3.69 per share compared with

$254.4 million or $2.53 per share in 2011. Due to a good start in

2013, the company now plans to repay its $465 million U.S.

Department of Energy (DOE) loan much earlier and boost vehicle

production to lower costs.

Tesla made its first DOE loan repayment of nearly $13 million in

December last year while the second payment is due this month. The

company expects the deliveries of Model S to go up to 20,000 this

year.

Tesla also denied plans of producing Model S with a smaller battery

pack (40 kWh) due to lack of demand, It will not be a viable option

as well because consumers would not have the liberty to travel long

distances. Instead, the company would provide a 60 kWh batter pack

vehicle to the customers, which will have the improved acceleration

and top speed of the bigger pack.

Tesla currently retains a Zacks Rank #3 (Hold). While we remain

on the sidelines about Tesla, stocks from the same industry that

warrant a look include Visteon Corp. (VC),

Gentherm Incorporated (THRM) and Denso

Corp. (DNZOY). All of them carry a Zacks Rank #1 (Strong

Buy).

DENSO CORP (DNZOY): Get Free Report

GENTHERM INC (THRM): Free Stock Analysis Report

TESLA MOTORS (TSLA): Free Stock Analysis Report

VISTEON CORP (VC): Free Stock Analysis Report

To read this article on Zacks.com click here.

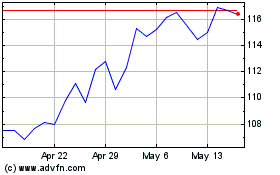

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jun 2024 to Jul 2024

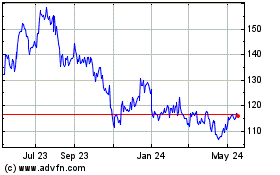

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jul 2023 to Jul 2024