Viracta Therapeutics, Inc. (Nasdaq: VIRX), a clinical-stage

precision oncology company focused on the treatment and prevention

of virus-associated cancers that impact patients worldwide, today

reported financial results for the third quarter of 2024 and

provided a business update.

“Last quarter, based on productive feedback from FDA, we

announced a sharpened focus on the second-line EBV-positive

PTCL subpopulation in the NAVAL-1 trial’s expansion phase, which is

ongoing,” said Mark Rothera, President and Chief Executive Officer

of Viracta. “To optimally support both the NAVAL-1 trial as well as

a randomized controlled trial that we are planning for the second

half of next year and reduce cash burn, we recently announced a

reprioritization of resources intended to right-size our

organization and further reduce our operating expenses. With a

clearly defined regulatory path forward for Nana-val, we believe

this will allow us to be efficient while we work toward the

possible submission of a New Drug Application in 2026 and seek to

introduce the first EBV-targeted therapy for lymphoma patients,

subject to obtaining requisite funding.”

“We are pleased to have determined a recommended Phase 2 dose

for Nana-val in patients with advanced EBV-positive solid tumors,”

said Darrel P. Cohen, M.D., Ph.D., Chief Medical Officer of

Viracta. “Although the EBV-positive solid tumor program has

been paused, clinical development in this patient population is

ready for Phase 2, with additional financing or with a partner,

using nanatinostat and valganciclovir doses that were well

tolerated with evidence of antitumor activity.”

Clinical Trial Updates and Anticipated

Milestones

Phase 1b/2 trial of Nana-val (nanatinostat in combination with

valganciclovir) in patients with recurrent/metastatic (R/M)

Epstein-Barr virus-positive (EBV+) nasopharyngeal carcinoma (NPC)

and other advanced EBV+ solid tumors (Study 301)

Clinical Trial Update:

- In October, determined the recommended Phase 2 dose in patients

with advanced EBV+ solid tumors.

Phase 2 NAVAL-1 trial of Nana-val (nanatinostat in combination

with valganciclovir) in patients with relapsed or refractory (R/R)

Epstein-Barr virus-positive (EBV+) lymphoma

Clinical Trial Updates:

- In August, announced positive combined Stage 1 and Stage 2 data

(n=21) in the R/R EBV+ PTCL cohort of patients treated with

nanatinostat (20 mg orally once daily, 4 days/week) in combination

with valganciclovir (900 mg orally once daily, 7 days/week) across

the first two stages of the study.

- Combined data from Stages 1 and 2 demonstrated Nana-val’s

substantial antitumor activity and generally well-tolerated safety

profile with a median duration of response (DOR) that has not yet

been reached.

- In August, announced that a productive FDA meeting was held to

align on a potential regulatory path forward for Nana-val in

patients with R/R EBV+ PTCL.

- Based on feedback from the FDA and the particularly robust

response rates observed in the second-line treatment setting, and

to target its resources, Viracta will focus the primary analysis on

the second-line EBV+ PTCL subpopulation in the ongoing NAVAL-1

trial’s expansion phase.

- The Company plans to begin a randomized controlled trial (RCT)

of Nana-val in the second-line treatment of EBV+ PTCL patients in

the second half of 2025, subject to obtaining financing.

Anticipated Milestones

Viracta plans to deliver on the following milestones, subject to

obtaining financing:

- Meet with the FDA to finalize the proposed RCT design in the

second-line treatment of patients with EBV+ PTCL in the first half

of 2025.

- Initiate the RCT in the second half of 2025.

- Report preliminary data from the expansion phase of the NAVAL-1

trial in second-line EBV+ PTCL patients in the first half of

2025.

- Report Stage 1 data from patients with R/R EBV+ diffuse large

B-cell lymphoma (DLBCL) in the first half of 2025.

- Present interim analysis outcomes from the NAVAL-1 trial’s

expansion phase in second-line EBV+ PTCL patients in 2026.

- File NDA for accelerated approval in 2026 based on interim

analysis of the NAVAL-1 trial’s expansion cohort.

Business Updates

- Announced on November 6th a reprioritization of resources

intended to enhance focus on the Company’s lead program, reduce

cash burn, and drive shareholder value:

- Included a reduction in force affecting approximately 42% of

the Company’s employees.

- Also reduced the size of its Board of Directors from 10 to 6

seats following voluntary resignations from 4 directors.

Third Quarter 2024 Financial Results

- Cash position – Cash, cash equivalents, and

short-term investments totaled approximately $21.1 million as of

September 30, 2024, which Viracta expects will be sufficient to

fund operations late into the first quarter of 2025.

- Research and development expenses – Research

and development expenses were approximately $7.2 million and $23.7

million for the three and nine months ended September 30, 2024,

respectively, compared to approximately $8.2 million and $24.0

million for the same periods in 2023. The decrease in research and

development expenses for the three months ended September 30, 2024

compared to the same period in 2023, was driven by decreases in

costs incurred to support the advancement and expansion of our

clinical development programs, including incremental costs to

support NAVAL-1, our Phase 2 trial of Nana-val in patients with R/R

EBV+ lymphomas and personnel-related costs. The decrease in

research and development expenses for the nine months ended

September 30, 2024 compared to the same period in 2023, was largely

due to decreases in costs incurred related to our clinical

development programs and personnel-related costs, partially offset

by a non-cash adjustment for insurance costs related to the

February 2021 reverse merger with Sunesis Pharmaceuticals of $1.8

million.

- General and administrative expenses – General

and administrative expenses were approximately $3.0 million and

$10.0 million for the three and nine months ended September 30,

2024, respectively, compared to $4.3 million and $13.2 million for

the same periods in 2023. The decrease in general and

administrative expenses was largely due to decreases in

personnel-related costs, corporate liability insurance premiums and

consulting and legal costs.

- Net loss – Net loss was approximately $10.6

million, or $0.27 per share (basic and diluted), for the quarter

ended September 30, 2024, compared to a net loss of $12.6 million,

or $0.33 per share (basic and diluted), for the same period in

2023. This change was primarily the result of decreases in research

and development expenses and personnel-related costs. Net loss was

approximately $29.5 million, or $0.75 per share, (basic and

diluted) for the nine months ended September 30, 2024, compared to

a net loss of $37.3 million, or $0.97 per share, (basic and

diluted) for the same period in 2023. This change was primarily the

result of $5.0 million of other income received related to the

monetization of a pre-commercialization, event-based milestone from

Day One Biopharmaceuticals, Inc. in March 2024, and decreases in

costs related to our clinical development programs and

personnel-related costs, partially offset by the non-cash

adjustment for insurance costs related to the February 2021 merger

of $1.8 million.

About the NAVAL-1 TrialNAVAL-1 (NCT05011058) is

a global, multicenter, clinical trial of Nana-val in patients with

relapsed or refractory (R/R) Epstein-Barr virus-positive (EBV+)

lymphoma. This trial employs a Simon two-stage design where, in

Stage 1, participants are enrolled into one of three indication

cohorts based on EBV+ lymphoma subtype. If two objective responses

are achieved within a lymphoma subtype in Stage 1 (n=10), then

additional patients will be enrolled in Stage 2 for a total of 21

patients. EBV+ lymphoma subtypes demonstrating promising antitumor

activity in Stage 2 may be further expanded following discussion

with regulators to potentially support registration.

About Nana-val (Nanatinostat and

Valganciclovir)Nanatinostat is an orally available histone

deacetylase (HDAC) inhibitor being developed by Viracta.

Nanatinostat is selective for specific isoforms of Class I HDACs,

which are key to inducing viral genes that are epigenetically

silenced in Epstein-Barr virus (EBV)-associated malignancies.

Nanatinostat is currently being investigated in combination with

the antiviral agent valganciclovir as an all-oral combination

therapy, Nana-val, in various subtypes of EBV-associated

malignancies. Ongoing trials include a potentially registrational,

global, multicenter, open-label Phase 2 basket trial in multiple

subtypes of relapsed or refractory (R/R) EBV+ lymphoma (NAVAL-1) as

well as a multinational Phase 1b/2 clinical trial in patients with

recurrent or metastatic (R/M) EBV+ NPC and other advanced EBV+

solid tumors.

About Peripheral T-Cell LymphomaT-cell

lymphomas comprise a heterogeneous group of rare and aggressive

malignancies, including peripheral T-cell lymphoma not otherwise

specified (PTCL-NOS) and angioimmunoblastic T-cell lymphoma (AITL).

There are approximately 5,600 newly diagnosed T-cell lymphoma

patients and approximately 2,600 newly diagnosed PTCL-NOS and AITL

patients in the U.S. annually. Approximately 70% of these patients

are either refractory to first-line therapy, or eventually

experience relapse of their disease. Clinical trials are currently

recommended for all lines of PTCL therapy, and most patients with

R/R PTCL have poor outcomes, with median progression-free survival

and median overall survival times reported to be 3.7 and 6.5

months, respectively. Approximately 40% to 65% of PTCL is

associated with EBV, the incidence of EBV+ PTCL varies by

geography, and reported outcomes for patients with EBV+ PTCL are

inferior to those whose disease is EBV-negative. There is no

approved targeted treatment specific for EBV+ PTCL, and therefore

this represents a high unmet medical need.

About EBV-Associated CancersApproximately 90%

of the world's adult population is infected with EBV. Infections

are commonly asymptomatic or associated with mononucleosis.

Following infection, the virus remains latent in a small subset of

cells for the duration of the patient's life. Cells containing

latent virus are increasingly susceptible to malignant

transformation. Patients who are immunocompromised are at an

increased risk of developing EBV-positive (EBV+) lymphomas. EBV is

estimated to be associated with approximately 2% of the global

cancer burden including lymphoma, nasopharyngeal carcinoma (NPC),

and gastric cancer.

About Viracta Therapeutics, Inc.Viracta is a

clinical-stage precision oncology company focused on the treatment

and prevention of virus-associated cancers that impact patients

worldwide. Viracta’s lead product candidate is an all-oral

combination therapy of its proprietary investigational drug,

nanatinostat, and the antiviral agent valganciclovir (collectively

referred to as Nana-val). Nana-val is currently being evaluated in

multiple ongoing clinical trials, including a potentially

registrational, global, multicenter, open-label Phase 2 basket

trial for the treatment of multiple subtypes of relapsed or

refractory (R/R) Epstein-Barr virus-positive (EBV+) lymphoma

(NAVAL-1), as well as a multinational, open-label Phase 1b/2

clinical trial for the treatment of patients with recurrent or

metastatic (R/M) EBV+ nasopharyngeal carcinoma (NPC) and other

advanced EBV+ solid tumors. Viracta is also pursuing the

application of its “Kick and Kill” approach in other virus-related

cancers.

For additional information, please visit www.viracta.com.

Forward-Looking StatementsThis communication

contains "forward-looking" statements within the meaning of the

Private Securities Litigation Reform Act of 1995, including,

without limitation, statements regarding: the details, timeline and

expected progress for Viracta's ongoing and anticipated clinical

trials and updates regarding the same, Viracta’s clinical focus and

strategy, the Company’s expectations related to the FDA submission

process and timelines, expectations regarding the Company’s target

patient populations, and expectations regarding the Company’s cash

runway and ability to fund continued operations and development.

Risks and uncertainties related to Viracta that may cause actual

results to differ materially from those expressed or implied in any

forward-looking statement include, but are not limited to:

Viracta’s ability to continue as a going concern; Viracta's ability

to successfully enroll patients in and complete its ongoing and

planned clinical trials; Viracta's plans to develop and

commercialize its product candidates, including all oral

combinations of nanatinostat and valganciclovir; the timing of

initiation of Viracta's planned clinical trials; the timing of the

availability of data from Viracta's clinical trials; previous

preclinical and clinical results may not be predictive of future

clinical results; the timing of any planned investigational new

drug application or new drug application; Viracta's plans to

research, develop, and commercialize its current and future product

candidates; the clinical utility, potential benefits, and market

acceptance of Viracta's product candidates; Viracta's ability to

manufacture or supply nanatinostat, valganciclovir, and

pembrolizumab for clinical testing; and Viracta's estimates

regarding its ability to fund ongoing operations into 2025, future

expenses, capital requirements, and need for additional financing

in the future.

If any of these risks materialize or underlying assumptions

prove incorrect, actual results could differ materially from the

results implied by these forward-looking statements. Additional

risks and uncertainties that could cause actual outcomes and

results to differ materially from those contemplated by the

forward-looking statements are included under the caption "Risk

Factors" and elsewhere in Viracta's reports and other documents

that Viracta has filed, or will file, with the SEC from time to

time and available at www.sec.gov.

The forward-looking statements included in this communication

are made only as of the date hereof. Viracta assumes no obligation

and does not intend to update these forward-looking statements,

except as required by law or applicable regulation.

Investor Relations Contact:Michael FaermChief

Financial OfficerViracta Therapeutics, Inc.ir@viracta.com

SOURCE Viracta Therapeutics, Inc.

-- Financial tables attached –

|

|

|

Viracta Therapeutics, Inc. |

|

Selected Balance Sheet Highlights |

|

|

(in thousands) |

|

| |

|

|

|

|

|

|

|

|

|

September 30, |

|

|

|

December 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

(Unaudited) |

|

|

|

|

|

|

Cash, cash equivalents and short-term investments |

$ |

21,132 |

|

|

$ |

53,691 |

|

|

Total assets |

$ |

21,958 |

|

|

$ |

56,692 |

|

|

Total liabilities |

$ |

28,575 |

|

|

$ |

38,373 |

|

|

Stockholders' equity (deficit) |

$ |

(6,617) |

|

|

$ |

18,319 |

|

| |

|

|

|

|

|

|

|

|

|

|

Viracta Therapeutics, Inc. |

|

Condensed Consolidated Statement of Operations and

Comprehensive Loss |

|

(in thousands except share and per share

data) |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

$ |

7,181 |

|

|

$ |

8,158 |

|

|

$ |

23,685 |

|

|

$ |

23,962 |

|

|

General and administrative |

|

3,004 |

|

|

|

4,317 |

|

|

|

9,966 |

|

|

|

13,170 |

|

|

Total operating expenses |

|

10,185 |

|

|

|

12,475 |

|

|

|

33,651 |

|

|

|

37,132 |

|

|

Loss from operations |

|

(10,185) |

|

|

|

(12,475) |

|

|

|

(33,651) |

|

|

|

(37,132) |

|

|

Total other income (expense) |

|

(368) |

|

|

|

(125) |

|

|

|

4,127 |

|

|

|

(161) |

|

|

Net loss |

|

(10,553) |

|

|

|

(12,600) |

|

|

|

(29,524) |

|

|

|

(37,293) |

|

|

Unrealized gain on short-term investments |

|

14 |

|

|

|

50 |

|

|

|

- |

|

|

|

113 |

|

|

Comprehensive loss |

|

(10,539) |

|

|

|

(12,550) |

|

|

|

(29,524) |

|

|

|

(37,180) |

|

|

Net loss per share, basic and diluted |

$ |

(0.27) |

|

|

$ |

(0.33) |

|

|

$ |

(0.75) |

|

|

$ |

(0.97) |

|

|

Weighted-average common shares outstanding, basic and diluted |

|

39,574,070 |

|

|

|

38,683,858 |

|

|

|

39,434,846 |

|

|

|

38,568,515 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

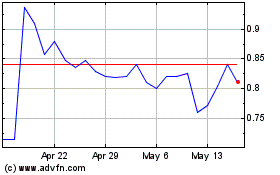

Viracta Therapeutics (NASDAQ:VIRX)

Historical Stock Chart

From Dec 2024 to Jan 2025

Viracta Therapeutics (NASDAQ:VIRX)

Historical Stock Chart

From Jan 2024 to Jan 2025