Important Information for Zynerba Pharmaceuticals Stockholders to Tender Shares for the Harmony Transaction: Process and Instructions

October 04 2023 - 3:05PM

Zynerba Pharmaceuticals, Inc. (Nasdaq: ZYNE), the leader in

innovative pharmaceutically-produced transdermal cannabinoid

therapies for orphan neuropsychiatric disorders, today reminds all

stockholders, including individual stockholders, to promptly tender

their shares into the tender offer (the “Offer”) by Harmony

Biosciences Holdings, Inc. (“Harmony”) and its wholly owned

subsidiary, Xylophone Acquisition Corp. (“Purchaser”), to purchase

all outstanding shares of Zynerba common stock.

The Zynerba

Board of Directors unanimously recommends that Zynerba stockholders

tender their shares pursuant to the Offer.

Key Information to Know

Tender Deadline:

- Zynerba

stockholders must tender their shares by 5:00 p.m., New

York City time, on Tuesday, October 10, 2023. Please note

that if you hold shares of Zynerba common stock through a broker or

other nominee, they may have a processing cutoff that is prior to

the tender deadline (e.g., October 5th or 6th), so it is important

that you act now if you want to tender your

shares.

How to Tender Your Shares:

- If you hold shares

of Zynerba common stock through a broker, dealer, commercial bank,

trust company or other nominee, you must instruct such broker or

other nominee to tender your shares. Please contact your

broker or other nominee promptly to allow sufficient time to

tender. Do not wait until the tender deadline to tender your

shares as they may not be counted. Please note that, in

some cases, your broker's or other nominee’s processing cutoff date

may have changed since the Offer deadline was first announced, so

take prompt action today to ensure your shares are properly

tendered prior to any applicable processing cutoff.

- Contact

Information for Commonly Used Brokers:

- Call TD Ameritrade

at 888-723-8504, option 1

- Call Fidelity at

800-343-3548

- Call E-Trade at

1-800-387-2331

- Contact Robinhood

at https://robinhood.com/contact

- Please include the

stock symbol for the offer (ZYNE) and the number

of shares you would like to tender.

- Call Charles Schwab

at 1-800-435-4000

- Call Morgan Stanley

at 1-888-454-3965

- Call JP Morgan at

1-800-935-9935

- Call Merrill, a

Bank of America Company at 1-800-637-7455

- If your broker is

not listed above, please contact your broker’s customer service

department and ask to speak with Corporate Actions. From there, you

should be directed to someone who can help you.

- Zynerba

stockholders should contact MacKenzie Partners, Inc., toll free by

phone at 800-322-2885 or by email to

tenderoffer@mackenziepartners.com with any questions or to request

assistance with tendering shares.

Why You Should Tender Your Shares:

- Every share

tendered by stockholders is important.

- If less than a

majority of the outstanding shares of Zynerba common stock are

tendered, the Offer will not be completed and Zynerba will not be

acquired by Harmony.

- If Zynerba is not

acquired by Harmony, there are significant risks associated with

Zynerba’s ability to raise the required capital to continue as a

standalone company and remain listed on the Nasdaq stock

market.

If the Offer is completed, stockholders will receive an up-front

purchase price of $1.1059 per share

plus one non-tradeable contingent value right

(“CVR”) per share representing the right to receive up to

an additional approximately $2.5444 per share in cash,

without interest and less any applicable tax withholding, upon the

achievement of certain clinical and commercial milestones related

to Zygel. If all such milestones are achieved, the total

consideration payable to stockholders is up to

$3.6503 per share in cash when

combined with the up-front purchase price. Additional transaction

details and the Company’s previous Offer reminder can be found

HERE.

Questions About How to Tender Shares:

- Please contact

MacKenzie Partners, Inc., toll free by phone at 800-322-2885 or by

email to tenderoffer@mackenziepartners.com. They will be able to

walk you through the tender process and assist with any

questions.

- If you hold

shares of Zynerba common stock through a broker or nominee, you

should contact your broker or nominee as soon as possible to answer

your questions and to allow sufficient time to

tender.

Cautionary Note on Forward-Looking

Statements

This press release contains forward-looking statements within

the meaning of The Private Securities Litigation Reform Act of

1995. We may, in some cases, use terms such as “predicts,”

“believes,” “potential,” “proposed,” “continue,” “estimates,”

“anticipates,” “expects,” “plans,” “intends,” “may,” “could,”

“might,” “will,” “should” or other words that convey uncertainty of

future events or outcomes to identify these forward-looking

statements. Such statements are subject to numerous important

factors, risks and uncertainties that may cause actual events or

results to differ materially from Zynerba’s current expectations.

Management’s expectations and, therefore, any forward-looking

statements in this press release could also be affected by risks

and uncertainties relating to a number of other factors, including

the following: Zynerba’s cash and cash equivalents may not be

sufficient to support its operating plan for as long as

anticipated; Zynerba’s expectations, projections and estimates

regarding expenses, future revenue, capital requirements, incentive

and other tax credit eligibility, collectability and timing, and

availability of and the need for additional financing; Zynerba’s

ability to obtain additional funding to support its clinical

development programs; the results, cost and timing of Zynerba’s

clinical development programs, including any delays to such

clinical trials relating to enrollment or site initiation; clinical

results for Zynerba’s product candidates may not be replicated or

continue to occur in additional trials and may not otherwise

support further development in a specified indication or at all;

actions or advice of the U.S. Food and Drug Administration, the

European Medicines Agency and other foreign regulatory agencies may

affect the design, initiation, timing, continuation and/or progress

of clinical trials or result in the need for additional clinical

trials; Zynerba’s ability to obtain and maintain regulatory

approval for its product candidates, and the labeling under any

such approval; Zynerba’s reliance on third parties to assist in

conducting pre-clinical and clinical trials for its product

candidates; delays, interruptions or failures in the manufacture

and supply of Zynerba’s product candidates and Zynerba’s ability to

commercialize its product candidates; the size and growth potential

of the markets for Zynerba’s product candidates, and Zynerba’s

ability to service those markets; Zynerba’s ability to develop

sales and marketing capabilities, whether alone or with potential

future collaborators; the rate and degree of market acceptance of

Zynerba’s product candidates; Zynerba’s expectations regarding its

ability to obtain and adequately maintain sufficient intellectual

property protection for its product candidates; the extent to which

health epidemics and other outbreaks of communicable diseases,

including COVID-19, could disrupt our operations or adversely

affect our business and financial condition; and the extent to

which inflation, banking stability or global instability, including

political instability, may disrupt our business operations or our

financial condition. This list is not exhaustive and these and

other risks are described in Zynerba’s periodic reports, including

the annual report on Form 10-K, quarterly reports on Form 10-Q and

current reports on Form 8-K, filed with or furnished to the

Securities and Exchange Commission (the “SEC”) and available at

www.sec.gov. Any forward-looking statements that Zynerba makes in

this press release speak only as of the date of this press release.

Zynerba assumes no obligation to update forward-looking statements

whether as a result of new information, future events or otherwise,

after the date of this press release.

Additional Information about the Acquisition and Where

to Find It

This document is for informational purposes only and is neither

an offer to purchase nor a solicitation of an offer to sell shares

of Zynerba, nor is it a substitute for the tender offer materials

that Harmony and Purchaser filed with the SEC upon commencement of

the tender offer. Harmony and Purchaser initially filed tender

offer materials on Schedule TO on August 28, 2023, and Zynerba

initially filed a Solicitation/Recommendation Statement on Schedule

14D-9 with the SEC with respect to the tender offer on August 28,

2023. Holders of shares of Zynerba common stock are urged to read

the tender offer materials (including an Offer to Purchase, a

related Letter of Transmittal and certain other tender offer

documents) and the Solicitation/Recommendation Statement (as each

may be amended or supplemented from time to time) because they

contain important information that holders of shares of Zynerba

common stock should consider before making any decision regarding

tendering their shares. The Offer to Purchase, the related Letter

of Transmittal and certain other tender offer documents, as well as

the Solicitation/Recommendation Statement, have been available to

all holders of shares of Zynerba at no expense to them. The tender

offer materials and the Solicitation/Recommendation Statement are

available for free at the SEC’s website at www.sec.gov. In

addition, these materials are available at no charge on the

Enhanced SEC Filings section of the Investor Relations page of

Zynerba’s website at https://www.zynerba.com/ and by directing a

request to the information agent for the tender offer, MacKenzie

Partners, Inc., who can be reached toll free by phone at

800-322-2885 or by email to tenderoffer@mackenziepartners.com.

Zynerba Contacts

Peter VozzoICR WestwickeOffice: 443.213.0505Cell:

443.377.4767Peter.Vozzo@Westwicke.com

Zynerba Pharmaceuticals (NASDAQ:ZYNE)

Historical Stock Chart

From Apr 2024 to May 2024

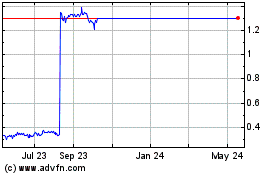

Zynerba Pharmaceuticals (NASDAQ:ZYNE)

Historical Stock Chart

From May 2023 to May 2024