PlayAGS, Incorporated (NYSE: AGS) (“AGS” or the “Company”), a

global gaming supplier of high-performing slot, table, and

interactive products, today announced that it has signed a

definitive agreement to be acquired by affiliates of Brightstar

Capital Partners (“Brightstar”), a middle market private equity

firm focused on investing in industrial, manufacturing, and

services businesses.

The Company’s Board of Directors has unanimously approved, and

recommended that the Company's stockholders approve, the agreement.

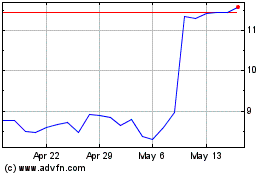

AGS shareholders will receive $12.50 per share in cash. The per

share purchase price represents a 41% premium to the Company’s

volume-weighted average share price over the last 90 days and a 40%

premium to AGS’ closing price on May 8, 2024.

AGS is a global company focused on creating a diverse mix of

entertaining gaming experiences for every kind of player. Powered

by high-performing slot products, an expansive table products

portfolio, and highly rated online casino content, the Company

believes it offers an unmatched value proposition for its casino

partners.

“We are very pleased to reach this agreement, which we believe

provides our stockholders with compelling, certain cash value.

Joining forces with Brightstar represents an exciting new chapter

for AGS and our mission to provide exceptional gaming solutions for

our operator partners,” said David Lopez, CEO & President of

AGS. “With Brightstar’s resources and strategic guidance, we

believe AGS will be well-positioned to make targeted investments in

R&D, top talent, operations, and industry-leading innovation,

which should accelerate our global footprint.”

“We look forward to working with David and the AGS team to

capitalize on opportunities by taking a long-term approach to

creating value," said Andrew Weinberg, Founder & CEO of

Brightstar. "AGS has a strong pipeline of new products, and we

believe the Company’s innovative approach to game development

provides significant potential for continued growth.”

“We have been impressed by AGS’ award-winning products,

differentiated culture, and outstanding reputation in this

expanding industry,” said Roger Bulloch, Partner at Brightstar. “We

trust that partnering with AGS and executing on our shared vision

can accelerate the Company’s ability to create even greater value

for its customers and players around the world.”

Macquarie Capital is serving as financial advisor and Cooley LLP

is serving as legal counsel to AGS. Jefferies LLC is serving as

lead financial advisor to Brightstar. Barclays and Citizens JMP

Securities are also serving as financial advisors to Brightstar.

Kirkland & Ellis LLP is serving as legal counsel to

Brightstar.

First Quarter 2024 Financial Results

In light of the proposed transaction, AGS has canceled its

previously announced conference call to discuss its first quarter

2024 financial results, which had been scheduled for Thursday, May

9, 2024, at 5:00 p.m. EDT. Additionally, AGS will not be issuing a

quarterly earnings release. The Company expects to file its 10-Q

for the quarter ended March 31, 2024 with the SEC later today.

Timing and Approvals

The proposed transaction, which is expected to close in the

second half of 2025 is subject to customary closing conditions,

including the receipt of regulatory approvals and approval by a

majority of AGS stockholders. Upon completion of the transaction,

AGS will become a privately held company and shares of AGS common

stock will no longer be listed on any public market.

About AGS

AGS is a global company focused on creating a diverse mix of

entertaining gaming experiences for every kind of player. Its

customer-centric culture and remarkable growth have helped it

become one of the most all-inclusive commercial gaming suppliers in

the world. Powered by high-performing slot products, an expansive

table products portfolio, highly rated online casino content for

players and operators, and differentiated service, the Company

believes it offers an unmatched value proposition for its casino

partners. Learn more at www.playags.com.

About Brightstar Capital Partners

Brightstar Capital Partners is a middle market private equity

firm focused on investing in industrial, manufacturing, and

services businesses where Brightstar believes it can drive

significant value with respect to the management, operations, and

strategic direction of the business. Brightstar employs an

operationally intensive “Us & Us” approach that leverages its

extensive experience and relationship network to help companies

reach their full potential. For more information, please

visit www.brightstarcp.com.

Additional Information and Where to Find

It

In connection with the proposed transaction, the Company intends

to file with the SEC preliminary and definitive proxy statements

relating to the proposed transaction and other relevant

documents. Promptly after filing the definitive proxy

statement with the SEC, the definitive proxy statement and a proxy

card will be mailed to the Company’s stockholders entitled to vote

as of the record date to be established for voting on the proposed

transaction and any other matters to be voted on at the special

meeting. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SECURITY

HOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENTS, ANY

AMENDMENTS OR SUPPLEMENTS THERETO, ANY OTHER SOLICITING MATERIALS

AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH

THE PROPOSED TRANSACTION OR INCORPORATED BY REFERENCE IN THE PROXY

STATEMENTS WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION ABOUT THE COMPANY, THE ACQUIRING ENTITY AND

THE PROPOSED TRANSACTION. When the documents are available,

investors and security holders may obtain free copies of the proxy

statement, any amendments or supplements thereto, and any other

relevant documents filed by the Company with the SEC in connection

with the proposed transaction on the SEC’s web site at www.sec.gov,

on the Company’s website at

https://investors.playags.com/financial-information/sec-filings or

by contacting the Company’s Investor Relations via email at

https://investors.playags.com/investor-resources/contact-investor-relations/.

Participants in the Solicitation

The Company and its directors and executive officers may be

deemed participants in the solicitation of proxies from the

Company’s stockholders in connection with the proposed transaction.

Information regarding the Company’s directors and executive

officers, including a description of their direct or indirect

interests, by security holdings or otherwise, in the Company can be

found under the captions “The Board of Directors,” “Executive

Officers,” and “Section 16(a) Beneficial Ownership Reporting

Compliance” contained in the Company’s 2024 annual proxy

statement filed with the SEC on April 29, 2024 (the “2024

Proxy Statement”). To the extent that the Company’s directors and

executive officers and their respective affiliates have acquired or

disposed of security holdings since the applicable “as of” date

disclosed in the 2024 Proxy Statement, such transactions have been

or will be reflected on Statements of Change in Ownership on

Form 4 filed with the SEC. Other information regarding the

participants in the proxy solicitation and a description of their

interests will be contained in the proxy statement for the

Company’s special meeting of stockholders and other relevant

materials to be filed with the SEC in respect of the proposed

transaction when they become available. These documents can be

obtained free of charge from the sources indicated above.

Forward-Looking and Cautionary Language

This press release contains, and oral statements made from time

to time by our representatives may contain, forward-looking

statements which include, but are not limited to, all statements

that do not relate solely to historical or current facts, such as

statements regarding the Company’s expectations, intentions or

strategies regarding the timing, completion and effects of the

proposed transaction. In some cases, these statements include words

like: “may,” “might,” “will,” “could,” “would,” “should,” “expect,”

“intend,” “plan,” “objective,” “anticipate,” “believe,” “estimate,”

“predict,” “project,” “potential,” “continue,” and “ongoing,” or

the negatives of these terms, or other comparable terminology

intended to identify statements about the future. These

forward-looking statements are subject to the safe harbor

provisions under the Private Securities Litigation Reform Act of

1995. The Company’s expectations and beliefs regarding these

matters may not materialize. Actual outcomes and results may differ

materially from those contemplated by these forward-looking

statements as a result of uncertainties, risks, and changes in

circumstances, including, but not limited to, risks and

uncertainties related to: the ability of the parties to consummate

the proposed transaction in a timely manner or at all; the

satisfaction (or waiver) of closing conditions to the consummation

of the proposed transaction, including with respect to the approval

of the Company’s stockholders; potential delays in consummating the

proposed transaction; the ability of the Company to timely and

successfully achieve the anticipated benefits of the proposed

transaction; the occurrence of any event, change or other

circumstance or condition that could give rise to the termination

of the definitive agreement; the effect of the announcement or

pendency of the proposed transaction on the Company’s business

relationships, operating results and business generally; costs

related to the proposed transaction; the outcome of any legal

proceedings that may be instituted against the Company, Brightstar

or any of their respective directors or officers related to the

definitive agreement or the proposed transaction; and the impact of

these costs and other liabilities on the cash, property, and other

assets available for distribution to the Company’s stockholders.

Additional risks and uncertainties that could cause actual outcomes

and results to differ materially from those contemplated by the

forward-looking statements are included under the caption “Risk

Factors” and elsewhere in the Company’s most annual and quarterly

reports filed with the SEC, including its Quarterly Report on

Form 10-Q for the quarter ended March 31, 2024 and any

subsequent reports on Form 10-K, Form 10-Q or

Form 8-K filed with the SEC from time to time and

available at www.sec.gov. These documents can be accessed on the

Company’s web page at

https://investors.playags.com/financial-information/sec-filings.

The forward-looking statements included in this press release,

and in any oral statements made from time to time by our

representatives, are made only as of the date hereof or thereof.

The Company assumes no obligation and does not intend to update

these forward-looking statements, except as required by law.

AGS ContactJulia Boguslawski, Chief Marketing

Officerjboguslawski@PlayAGS.com

Brad Boyer, Senior Vice President of Investor Relations &

Corporate OperationsInvestors@PlayAGS.com

Brightstar ContactCraig Thomas, Chief Marketing

Officercthomas@brightstarcp.com

PlayAGS (NYSE:AGS)

Historical Stock Chart

From Nov 2024 to Dec 2024

PlayAGS (NYSE:AGS)

Historical Stock Chart

From Dec 2023 to Dec 2024