As filed with the Securities and Exchange Commission on December 13, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-11

FOR REGISTRATION

UNDER

THE SECURITIES ACT OF 1933

OF SECURITIES OF CERTAIN REAL ESTATE COMPANIES

ASHFORD HOSPITALITY TRUST, INC.

(Exact name of registrant as specified in governing instruments)

14185 Dallas Parkway, Suite 1200

Dallas, Texas 75254

(972) 490-9600

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Alex Rose

Executive Vice President, General Counsel and Secretary

14185 Dallas Parkway, Suite 1200

Dallas, Texas 75254

(972) 490-9600

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Robert H. Bergdolt

Laura K. Sirianni

DLA Piper LLP (US)

4141 Parklake Avenue, Suite 300

Raleigh, North Carolina 27612-2350

(919) 786-2000

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box: ☒

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ☐

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| |

Large Accelerated filer

☐

|

|

|

Accelerated filer

☒

|

|

| |

Non-accelerated filer

☐

|

|

|

Smaller reporting company

☒

|

|

| |

|

|

|

Emerging growth company

☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION — PRELIMINARY PROSPECTUS, DATED DECEMBER 13, 2024

PROSPECTUS

Series L Redeemable Preferred Stock

Series M Redeemable Preferred Stock

(Liquidation Preference $25.00 per share)

Maximum of 12,000,000 Shares in Primary Offering

Maximum of 4,000,000 Shares Pursuant to Dividend Reinvestment Plan

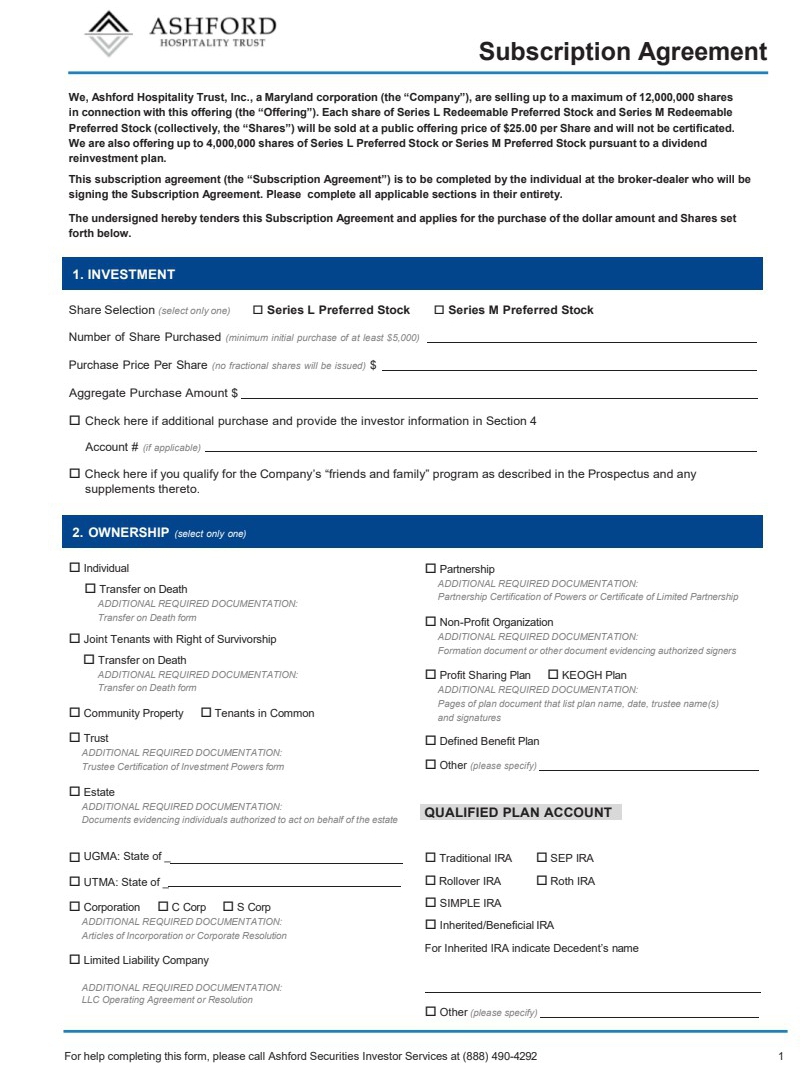

We are offering a maximum of 12,000,000 shares of our Series L Redeemable Preferred Stock, par value $0.01 per share (the “Series L Preferred Stock”), or our Series M Redeemable Preferred Stock, par value $0.01 per share (the “Series M Preferred Stock” and, together with the Series L Preferred Stock, the “Preferred Stock”), in our primary offering at a public offering price of $25.00 per share. We are also offering up to 4,000,000 shares of the Series L Preferred Stock or the Series M Preferred Stock pursuant to a dividend reinvestment plan (the “DRP”) at $25.00 per share. We reserve the right to reallocate the shares of Series L Preferred Stock or Series M Preferred Stock we are offering between our primary offering and the DRP. This prospectus also covers the shares of our common stock that may be issuable upon redemption of the Preferred Stock sold pursuant to our primary offering and issued pursuant to the DRP.

The Preferred Stock ranks senior to our common stock with respect to payment of dividends and distribution of amounts upon liquidation, dissolution or winding up of our affairs. Holders of the Preferred Stock will generally have no voting rights, but will have limited voting rights if we fail to pay dividends on the Preferred Stock for 18 or more monthly periods (whether or not consecutive) and under certain other circumstances.

Our primary offering is scheduled to terminate on the date (the “Termination Date”) that is the earlier of (i) [•], 2027 (which is the third anniversary of the effective date of the registration statement of which this prospectus forms a part), unless earlier terminated or extended by our board of directors, and (ii) the date on which all of the shares of Preferred Stock offered in our primary offering are sold. We may terminate our primary offering at any time or may offer shares of the Preferred Stock pursuant to a new registration statement, including a follow-on registration statement. With the filing of a registration statement for a subsequent offering, we may also be able to extend this offering beyond three years until the follow-on registration statement is declared effective. Should the offering continue beyond [•], 2027, we will supplement this prospectus accordingly. The offering period for the DRP may extend beyond the Termination Date and will terminate upon the issuance of all of the shares of Preferred Stock under the DRP, unless earlier terminated by our board of directors.

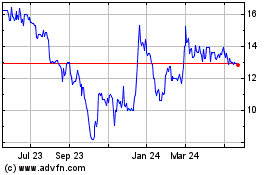

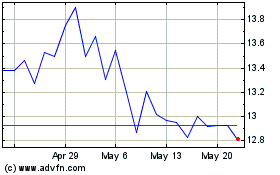

Our common stock trades on the New York Stock Exchange (the “NYSE”) under the symbol “AHT.” On December 12, 2024, the last reported sale price of our common stock on the NYSE was $8.56 per share. There is no public trading market for the Preferred Stock, and we do not expect one to develop. Redemption by us will likely be the only way to dispose of your shares. We have no plans to list the Preferred Stock on the NYSE or another national securities exchange.

We impose certain restrictions on the ownership and transfer of our capital stock. You should read the information under the section entitled “Description of Our Capital Stock — Restrictions on Ownership and Transfer” in this prospectus for a description of these restrictions.

Investing in our securities involves risks. The Preferred Stock has no public trading market and has limited liquidity and may at times be illiquid. The Preferred Stock has not been rated and investors will be subject to the risks associated with investing in non-rated securities. See “Risk Factors” on page 19 for information regarding risks associated with an investment in our securities.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| |

|

|

Public

Offering Price

|

|

|

Selling

Commissions(3)(4)(5)

|

|

|

Dealer

Manager Fee(3)(4)

|

|

|

Proceeds,

Before Expenses, to Us

|

|

|

Maximum Primary Offering(1)(2)

|

|

|

|

$ |

300,000,000.00 |

|

|

|

|

$ |

21,000,000.00 |

|

|

|

|

$ |

9,000,000.00 |

|

|

|

|

$ |

270,000,000.00 |

|

|

|

Series L Preferred Stock, per share

|

|

|

|

$ |

25.00 |

|

|

|

|

$ |

1.75 |

|

|

|

|

$ |

0.75 |

|

|

|

|

$ |

22.50 |

|

|

|

Series M Preferred Stock, per share

|

|

|

|

$ |

25.00 |

|

|

|

|

|

— |

|

|

|

|

$ |

0.75 |

|

|

|

|

$ |

24.25 |

|

|

|

Maximum DRP(1)

|

|

|

|

$ |

100,000,000.00 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

|

$ |

100,000,000.00 |

|

|

(1)

We reserve the right to reallocate shares of the Preferred Stock between our primary offering and the DRP.

(2)

Assumes the maximum of $300,000,000 is sold in our primary offering and is composed solely of shares of Series L Preferred Stock.

(3)

Selling commissions and the dealer manager fee in respect of the Series L Preferred Stock will equal up to 7.0% and 3.0%, respectively, of the aggregate gross proceeds from the sale of the Series L Preferred Stock in our primary offering ($25.00 per share). No selling commissions are paid in respect of the sale of Series M Preferred Stock. The dealer manager fee in respect of the Series M Preferred Stock will equal up to 3.0% of the aggregate gross proceeds from the sale of the Series M Preferred Stock in our primary offering ($25.00 per share). We or our affiliates also may provide permissible forms of non-cash compensation to registered representatives of our dealer manager and to broker-dealers that are members of the Financial Industry Regulatory Authority, Inc. (“FINRA”) and authorized by our dealer manager to sell the Preferred Stock (“participating broker-dealers”). The value of such items will be considered underwriting compensation in connection with this offering. Pursuant to FINRA Rule 2310(b)(4)(B)(ii), the combined selling commissions, dealer manager fee, permissible forms of non-cash compensation, and all other forms of underwriting compensation for this offering will not exceed 10.0% of the aggregate gross offering proceeds (excluding proceeds from shares to be sold through the DRP) (“FINRA’s 10% cap”). No selling commissions or dealer manager fee will be paid with respect to shares of Preferred Stock sold pursuant to the DRP.

(4)

Our dealer manager may reallow all or a portion of its selling commissions attributable to a participating broker-dealer. In addition, our dealer manager also may reallow all or a portion of its dealer manager fee earned on the proceeds raised by a participating broker-dealer to such participating broker-dealer as a marketing fee. The amount of the reallowance to any participating broker-dealer will be determined by the dealer manager. If applicable, any reduction in the dealer manager fee will also reduce the purchase price per share. See “Plan of Distribution.”

(5)

To the extent a participating broker-dealer reduces its selling commissions below 7.0%, the purchase price per share of Series L Preferred Stock will be decreased by an amount equal to such reduction. See “Plan of Distribution.”

The dealer manager of this offering, Ashford Securities LLC (“Ashford Securities”), is an affiliate of Ashford Inc. The dealer manager is not required to sell any specific number of shares or dollar amount of the Preferred Stock, but will use its “reasonable best efforts” to sell the shares of Preferred Stock offered. The minimum permitted purchase is generally $5,000, but purchases of less than $5,000 may be made in the discretion of the dealer manager.

We will sell the Preferred Stock through Depository Trust Company (“DTC”) settlement (“DTC Settlement”) or, under special circumstances, through Direct Registration System settlement (“DRS Settlement”). See the section entitled “Plan of Distribution” in this prospectus for a description of these settlement methods.

Ashford Securities LLC,

as Dealer Manager

The date of this prospectus is , 2024

TABLE OF CONTENTS

| |

|

|

Page

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

19 |

|

|

|

|

|

|

|

|

25 |

|

|

|

|

|

|

|

|

27 |

|

|

|

|

|

|

|

|

28 |

|

|

|

|

|

|

|

|

30 |

|

|

|

|

|

|

|

|

33 |

|

|

|

|

|

|

|

|

41 |

|

|

|

|

|

|

|

|

49 |

|

|

|

|

|

|

|

|

57 |

|

|

|

|

|

|

|

|

72 |

|

|

|

|

|

|

|

|

76 |

|

|

|

|

|

|

|

|

80 |

|

|

|

|

|

|

|

|

109 |

|

|

|

|

|

|

|

|

113 |

|

|

|

|

|

|

|

|

120 |

|

|

|

|

|

|

|

|

130 |

|

|

|

|

|

|

|

|

130 |

|

|

|

|

|

|

|

|

130 |

|

|

|

|

|

|

|

|

130

|

|

|

We have not authorized any dealer, salesperson or other person to give any information or to make any representation other than those contained or incorporated by reference in this prospectus. You must not rely upon any information or representation not contained or incorporated by reference in this prospectus. This prospectus does not constitute an offer to sell or the solicitation of an offer to buy any securities other than the registered securities to which it relates, nor does this prospectus constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. You should not assume that the information contained in this prospectus is accurate on any date subsequent to the date set forth on its front cover or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus is delivered or securities are sold on a later date.

PROSPECTUS SUMMARY

The following summary highlights information contained elsewhere or incorporated by reference in this prospectus. It may not contain all of the information that is important to you. Before making a decision to invest in the Preferred Stock, you should read carefully this entire prospectus and the documents incorporated by reference herein, including the sections entitled “Risk Factors” in this prospectus and our most recent Annual Report on Form 10-K, as well as our subsequent filings under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which are incorporated by reference in this prospectus. This summary is qualified in its entirety by the more detailed information and financial statements, including the notes thereto, appearing elsewhere or incorporated by reference in this prospectus.

When used in this prospectus, the terms “our company,” “we,” “us,” or “our” refer to Ashford Hospitality Trust, Inc., a Maryland corporation, and, as the context may require, its consolidated subsidiaries, including Ashford Hospitality Limited Partnership, a Delaware limited partnership.

OUR COMPANY

We are an externally-advised real estate investment trust (“REIT”) formed as a Maryland corporation in May 2003. While our portfolio currently consists of upscale hotels and upper upscale full-service hotels, our investment strategy is predominantly focused on investing in upper upscale full-service hotels in the United States that have revenue per available room (“RevPAR”) generally less than twice the U.S. national average, and in all methods including direct real estate, equity, and debt. We currently anticipate future investments will predominantly be in upper upscale hotels. We own our lodging investments and conduct our business through Ashford Hospitality Limited Partnership (“Ashford Trust OP”), our operating partnership. Ashford OP General Partner LLC, a wholly-owned subsidiary of our company, serves as the sole general partner of Ashford Trust OP.

Our hotel properties are all located in the United States and are primarily branded under the widely recognized upscale and upper upscale brands of Hilton, Hyatt, Marriott and Intercontinental Hotel Group. As of September 30, 2024, we owned interests in the following:

•

68 consolidated operating hotel properties, which represent 17,051 total rooms;

•

one consolidated operating hotel property, which represents 188 total rooms through a 29.3% owned investment in a consolidated entity;

•

four consolidated operating hotel properties, which represent 405 total rooms owned through a 99.0% ownership interest in Stirling REIT OP, LP (“Stirling OP”), which was formed by Stirling Hotels & Resorts, Inc. (“Stirling Inc.”) to acquire and own a diverse portfolio of stabilized income-producing hotels and resorts;

•

15.1% ownership in OpenKey, Inc. with a carrying value of approximately $1.1 million; and

•

an investment in an entity that owns the Meritage Resort and Spa and the Grand Reserve at the Meritage in Napa, California, with a carrying value of approximately $8.0 million.

For U.S. federal income tax purposes, we have elected to be treated as a REIT, which imposes limitations related to our operations. As of September 30, 2024, our 69 operating hotel properties and four Stirling OP hotel properties were leased or owned by our wholly-owned or majority-owned subsidiaries that are treated as taxable REIT subsidiaries for U.S. federal income tax purposes (collectively, these subsidiaries are referred to as “Ashford TRS”). Ashford TRS then engages third-party or affiliated hotel management companies to operate the hotels under management contracts.

Based on our primary business objectives and forecasted operating conditions, our current key priorities and financial strategies include, among other things:

•

preserving capital and maintaining significant cash and cash equivalents liquidity;

•

disposition of non-core hotel properties;

•

acquisition of hotel properties, in whole or in part, that we expect will be accretive to our portfolio;

•

pursuing capital market activities and implementing strategies to enhance long-term stockholder value;

•

accessing cost effective capital, including through the issuance of non-traded preferred securities;

•

opportunistically exchanging preferred stock into common stock;

•

implementing selective capital improvements designed to increase profitability and maintain the quality of our assets;

•

implementing effective asset management strategies to minimize operating costs and increase revenues;

•

financing or refinancing hotels on competitive terms;

•

modifying or extending property-level indebtedness;

•

utilizing hedges, derivatives and other strategies to mitigate risks;

•

pursuing opportunistic value-add additions to our hotel portfolio; and

•

making other investments or divestitures that our board of directors deems appropriate.

Our current investment strategy is to focus on owning predominantly full-service hotels in the upper upscale segment in domestic markets that have RevPAR generally less than twice the national average. We believe that as supply, demand, and capital market cycles change, we will be able to shift our investment strategy to take advantage of new lodging-related investment opportunities as they may develop. Our board of directors may change our investment strategy at any time without stockholder approval or notice. We will continue to seek ways to benefit from the cyclical nature of the hotel industry.

We are advised by Ashford Hospitality Advisors LLC (“Ashford LLC”), a subsidiary of Ashford Inc., through an advisory agreement. Our 69 operating hotel properties and four Stirling OP hotel properties in our consolidated portfolio are currently asset-managed by Ashford LLC. We do not have any employees. All of the services that might be provided by employees are provided to us by Ashford LLC.

We do not operate any of our hotel properties directly; instead we contractually engage hotel management companies to operate them for us under management contracts. Remington Lodging & Hospitality, LLC (“Remington Hospitality”), a subsidiary of Ashford Inc., manages 50 of our 69 operating hotel properties and three of the four Stirling OP hotel properties. Third-party management companies manage the remaining hotel properties.

Ashford Inc. also provides other products and services to us or our hotel properties through certain entities in which Ashford Inc. has an ownership interest. These products and services include, but are not limited to, design and construction services, debt placement and related services, audiovisual services, real estate advisory and brokerage services, insurance policies covering general liability, workers’ compensation and business automobile claims and insurance claims services, hypoallergenic premium rooms, watersport activities, broker-dealer and distribution services, mobile key technology and cash management services.

On September 27, 2024, our board of directors approved a reverse stock split of our issued and outstanding common stock at a ratio of 1-for-10. This reverse stock split converted every ten issued and outstanding shares of common stock into one share of common stock. The reverse stock split was effective as of the close of business on October 25, 2024. As a result of the reverse stock split, the number of outstanding shares of common stock was reduced from approximately 55.2 million shares to approximately 5.5 million shares on that date. Additionally, the number of outstanding common units, Long-Term Incentive Plan (“LTIP”) units and Performance LTIP units was reduced from approximately 2.1 million units to approximately 208,000 units on that date.

Mr. Monty J. Bennett, chairman and chief executive officer of Ashford Inc. and, together with his father Mr. Archie Bennett, Jr., (the “Bennetts”), as of September 30, 2024, hold a controlling interest in Ashford Inc. The Bennetts owned approximately 809,937 shares of Ashford Inc. common stock, which represented an approximate 38.4% ownership interest in Ashford Inc., and owned 18,758,600 shares of Ashford Inc. Series D Cumulative Preferred Stock, which, along with all unpaid accrued and accumulated

dividends thereon, was convertible (at a conversion price of $117.50 per share) into an additional approximate 4,316,632 shares of Ashford Inc. common stock, which if converted as of September 30, 2024, would have increased the Bennetts’ ownership interest in Ashford Inc. to 79.8%. The 18,758,600 shares of Series D Cumulative Preferred Stock owned by Mr. Monty J. Bennett and Mr. Archie Bennett, Jr. include 360,000 shares owned by trusts.

Pursuant to a contribution agreement with Ashford Securities, we, Ashford LLC and other entities advised by Ashford LLC contributed capital to Ashford Securities to fund a portion of its operations. Ashford Securities acts as the dealer manager with respect to the distribution of the Preferred Stock in this offering. In addition, Ashford Securities currently distributes our Series J Redeemable Preferred Stock, par value $0.01 per share (the “Series J Preferred Stock”) and our Series K Redeemable Preferred Stock, par value $0.01 per share (the “Series K Preferred Stock”), Stirling, Inc.’s private offering of its common stock, and interests in private funds sponsored by Ashford LLC. We currently own 98.8% of the equity interests in Stirling REIT OP, LP, Stirling Inc.’s operating partnership. Through our contributions to Ashford Securities, we may pay or be deemed to have paid sales-based compensation to Ashford Securities personnel of up to 1.25% of the gross amount of Stirling Inc. common stock sold by them.

Our principal executive offices are located at 14185 Dallas Parkway, Suite 1200, Dallas, Texas 75254. Our telephone number is (972) 490-9600. Our website is www.ahtreit.com. The contents of our website are not a part of this prospectus. Shares of our common stock are traded on the NYSE under the symbol “AHT.”

ABOUT THIS PROSPECTUS

You should rely only on the information contained in or incorporated by reference into this prospectus and any supplement hereto. We have not authorized anyone to provide you with information different from that which is contained in this prospectus or to make representations as to matters not stated in this prospectus or any supplement hereto. If anyone provides you with different or inconsistent language, you should not rely on it. We are not making an offer to sell, or soliciting an offer to buy, any securities in any jurisdiction in which it is unlawful to do so. The information contained in this prospectus is accurate only as of the date of this prospectus, and any information incorporated by reference is accurate only as of the date of the document incorporated by reference, in each case, regardless of the time of delivery of this prospectus or any purchase of our securities. Our business, financial condition, results of operations, and prospects may have changed since those dates. To understand this offering fully, you should read this entire document carefully, as well as the “Risk Factors” included in our most recent Annual Report on Form 10-K, as updated by our subsequent filings under the Exchange Act incorporated herein by reference.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. To the extent there is any inconsistency between the summaries contained herein and the actual terms of these documents, the actual terms will govern. The registration statement and the exhibits and other documents can be obtained from the SEC as indicated under the sections entitled “Where You Can Find More Information” and “Incorporation of Certain Information By Reference.”

MARKET AND INDUSTRY DATA AND FORECASTS

Market data and industry forecasts and projections used in this prospectus and documents incorporated by reference have been obtained from third-party sources, which data and forecasts are publicly available for free or upon payment as part of a subscription service. None of such data and forecasts was prepared specifically for us. No third-party source that has prepared such information has reviewed or passed upon our use of the information in this prospectus or documents incorporated by reference, and no third-party source is quoted or summarized in this prospectus as an expert. Furthermore, these sources generally state that the information they provide has been obtained from sources believed to be reliable but that the accuracy and completeness of the information are not guaranteed. The forecasts and projections are based on industry surveys and the preparers’ experience in the industry, and there can be no assurance that any of the forecasts or projections will be achieved. The quantitative information may be derived from estimates and subjective judgments and may be subject to limited audit and validation procedures. We believe that the surveys and market research others have performed are reliable, but we have not independently investigated or verified this information.

THE OFFERING

Ashford Hospitality Trust, Inc.

Preferred Stock offered by us

A maximum of 12,000,000 shares of Series L Preferred Stock or Series M Preferred Stock will be offered through our dealer manager in our primary offering on a reasonable-best-efforts basis at $25.00 per share, unless discounted prices are available as described in the “Plan of Distribution” section of this prospectus. We are also offering up to 4,000,000 shares of Series L Preferred Stock or Series M Preferred Stock pursuant to the DRP at $25.00 per share.

The Series L Preferred Stock and the Series M Preferred Stock offered hereby have similar characteristics, including, but not limited to, rank, stated value, liquidation preferences and voting rights; however, differences include, but are not limited to, dividend rates and redemption options, all as summarized below.

See the sections entitled “Description of the Series L Preferred Stock” and “Description of the Series M Preferred Stock” in this prospectus for further discussion of this topic. We reserve the right to reallocate the shares of Preferred Stock we are offering between our primary offering and the DRP.

With respect to our preferred stockholders, our principal business objectives are to (i) provide investors a sustainable and attractive level of income through the payment of preferential monthly dividends, and (ii) to provide greater assurance of the preservation and return of investor capital through the offering of securities senior to our common stock.

The Termination Date of our primary offering is the earlier of (i) [•], 2027, unless earlier terminated or extended by our board of directors, and (ii) the date on which all of the shares of Preferred Stock offered in our primary offering are sold. The offering period for the DRP may extend beyond the Termination Date and will terminate upon the issuance of all of the shares of Preferred Stock under the DRP, unless earlier terminated by our board of directors.

Series L Preferred Stock offered by us

Ranking. The Series L Preferred Stock ranks (i) senior to all classes or series of our common stock and future junior securities, (ii) on a parity with each series of our outstanding preferred stock, including the 8.45% Series D Cumulative Preferred Stock, par value $0.01 per share (the “Series D Preferred Stock”), the 7.375% Series F Cumulative Preferred Stock, par value $0.01 per share (the “Series F Preferred Stock”), the 7.375% Series G Cumulative Preferred Stock, par value $0.01 per share (the “Series G Preferred Stock”), the 7.50% Series H Cumulative Preferred Stock, par value $0.01 per share (the “Series H Preferred Stock”), the 7.50% Series I Cumulative Preferred Stock, par value $0.01 per share (the “Series I Preferred Stock”), the Series J Redeemable Preferred Stock, par value $0.01 per share (the “Series J Preferred Stock”), the Series K Redeemable Preferred Stock, par value $0.01 per share (the “Series K Preferred Stock”), the Series M Preferred Stock and with any future parity securities and (iii) junior to any future senior securities (none of which are currently outstanding) and to all our existing and future indebtedness, with respect to the payment of

dividends and rights upon our liquidation, dissolution or winding up of our affairs.

Stated Value. Each share of Series L Preferred Stock will have a “Stated Value” of $25.00, as set forth in the articles supplementary setting forth the rights, preferences and limitations of the Series L Preferred Stock (the “Series L Articles Supplementary”).

Dividends. Holders of Series L Preferred Stock are entitled to receive, when and as authorized by our board of directors and declared by us out of legally available funds, cumulative cash dividends on each share of Series L Preferred Stock at an annual rate of [ ]% of the Stated Value (equivalent to an annual dividend rate of $[ ] per share). We expect to authorize and declare dividends on the shares of Series L Preferred Stock on a monthly basis, payable on the 15th day of each month (or if such payment date is not a business day, on the next succeeding business day), unless our financial condition, operating performance, general economic conditions, applicable provisions of Maryland law, applicable provisions of our credit agreements or other factors make it imprudent to do so or prevent us from doing so. Dividends will be payable in arrears to holders of record as they appear on our records at the close of business on the last business day of each month immediately preceding the applicable dividend payment date. The timing and amount of such dividends will be determined by our board of directors, in its sole discretion, and may vary from time to time. Declaration of dividends on the Preferred Stock will for the foreseeable future require a determination by our board of directors, at the time of any such determination, that we would continue to have positive equity on a fair value basis, among other considerations.

Redemption at the Option of Holders. Except as noted below, a holder will have the right to require us to redeem any or all of such holder’s shares of Series L Preferred Stock at a redemption price equal to 100% of the Stated Value, less a redemption fee, plus an amount equal to any accrued but unpaid dividends (whether or not authorized or declared) to, but not including, the date fixed for redemption.

The redemption fee shall be equal to:

•

beginning on the “date of original issuance” of the shares to be redeemed: [ ]%;

•

beginning on the second anniversary from the “date of original issuance” of the shares to be redeemed: [ ]%;

•

beginning on the third anniversary from the “date of original issuance” of the shares to be redeemed: [ ]%;

•

beginning on the fourth anniversary from the “date of original issuance” of the shares to be redeemed: [ ]%; and

•

beginning on the fifth anniversary from the “date of original issuance” of the shares to be redeemed: [ ]%.

Subject to the following sentence, for so long as our common stock is listed on a national securities exchange, if a holder of shares of Series L Preferred Stock causes us to redeem such shares of Series L Preferred Stock, we have the right, in our sole discretion, to

pay the redemption price in cash or in equal value of shares of our common stock or any combination thereof, based on the closing price per share of our common stock for the single trading day prior to the date of redemption. Pursuant to the Series L Articles Supplementary, our board of directors may, without stockholder approval, permanently revoke this right to pay the redemption price (or a portion thereof) in shares of our common stock and pay the redemption price solely in cash.

For purposes of this “Redemption at the Option of Holders” provision, the “date of original issuance” of the shares to be redeemed will mean the earliest date that any shares of Series L Preferred Stock were issued to any investor during the calendar quarter in which the shares to be redeemed were issued.

For purposes of this “Redemption at the Option of Holders” provision, where the shares of Preferred Stock to be redeemed were acquired by the holder pursuant to the DRP (such shares, “DRP Shares”), the “date of original issuance” of such DRP Shares shall be deemed to be the same as the “date of original issuance” of the underlying shares of Preferred Stock pursuant to which such DRP Shares are directly or indirectly attributable (such shares, “Underlying Shares”), and such DRP Shares shall be subject to the same redemption terms to which the Underlying Shares would be subject if submitted for redemption hereunder.

Our ability to redeem shares of Series L Preferred Stock may be limited to the extent that we do not have sufficient funds lawfully available, taking into account such reserves and other considerations as our board of directors may determine in its sole discretion, to fund such cash redemption. In addition, aggregate redemptions by holders of Preferred Stock pursuant to this “Redemption at the Option of Holders” provision, will be subject to the following redemption limits: (i) no more than 2% of the outstanding Preferred Stock will be redeemed per calendar month; (ii) no more than 5% of the outstanding Preferred Stock will be redeemed per fiscal quarter; and (iii) no more than 20% of the outstanding Preferred Stock will be redeemed per fiscal year. See “Description of the Series L Preferred Stock — Redemption at the Option of Holders.”

Optional Redemption Following Death or Disability of a Holder. Subject to the requirements and considerations below, we will redeem shares of Series L Preferred Stock held by a natural person upon his or her death or upon suffering a qualifying disability at a redemption price equal to 100% of the Stated Value, plus an amount equal to any accrued but unpaid dividends (whether or not authorized or declared) to, but not including, the date fixed for redemption. No redemption fees shall apply to such redemptions.

In order to redeem shares on the terms described above upon the death or qualifying disability of a holder, the following conditions must be met:

•

the deceased or disabled holder must be the sole holder or the beneficiary of a trust or an individual retirement account (“IRA”) or other retirement or profit-sharing plan that is a holder or, in the case of shares owned by spouses who are joint

registered holders (or holders by tenants in the entirety), the deceased or disabled may be one of the spouses;

•

in the case of the disability of a holder:

•

such disability must meet the requirements of Section 72(m)(7) of the Internal Revenue Code of 1986, as amended (the “Code”) (i.e., the individual must be unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment that can be expected to result in death or to be of a long continued and indefinite duration);

•

such determination of disability must be made by the U.S. governmental agency responsible for reviewing the disability retirement benefits that the holder could be eligible to receive;

•

the condition causing the disability shall have occurred after the date that the holder became a holder of Series L Preferred Stock; and

•

the condition causing the disability shall have occurred before the holder reached full retirement age, which is the age at which such worker can claim full Social Security retired-worker benefits;

•

the redemption request must be received by the company within 12 months after the death or disability of the holder; and

•

in the case of the death of a holder, the redemption request must be made by a recipient of the shares through bequest or inheritance or, in the case of the death of a beneficiary of a trust, by the trustee of the trust or, in the case of shares owned by spouses who are joint registered holders (or holders by tenants in the entirety), the request may be made by the surviving spouse.

Subject to the following sentence, for so long as our common stock is listed on a national securities exchange, we have the right, in our sole discretion, to pay the redemption price in cash or in equal value of shares of our common stock or any combination thereof, based on the closing price per share of our common stock for the single trading day prior to the date of redemption. Pursuant to the Series L Articles Supplementary, our board of directors may, without stockholder approval, permanently revoke this right to pay the redemption price (or a portion thereof) in shares of our common stock and pay the redemption price solely in cash.

Our ability to redeem shares of Series L Preferred Stock may be limited to the extent that we do not have sufficient funds lawfully available, taking into account such reserves and other considerations as our board of directors may determine in its sole discretion, to fund such cash redemption. Although death and disability redemptions will not be subject to the 2%/5%/20% limits described above, death and disability redemptions will count toward such limits when applied to other redemptions at the option of the holder. See

“Description of the Series L Preferred Stock — Optional Redemption Following Death or Disability of a Holder.”

Optional Redemption by the Company. After two years from the “date of original issuance” of the shares of Series L Preferred Stock to be redeemed, we will have the right (but not the obligation) to redeem such shares of Series L Preferred Stock, in whole or in part, at a redemption price equal to 100% of the Stated Value, plus an amount equal to any accrued but unpaid dividends (whether or not authorized or declared) to, but not including, the date fixed for redemption.

Subject to the following sentence, for so long as our common stock is listed on a national securities exchange, if we choose to redeem any shares of Series L Preferred Stock, we have the right, in our sole discretion, to pay the redemption price in cash or in equal value of shares of our common stock or any combination thereof, based on the closing price per share of our common stock for the single trading day prior to the date of redemption. Pursuant to the Series L Articles Supplementary, our board of directors may, without stockholder approval, permanently revoke this right to pay the redemption price (or a portion thereof) in shares of our common stock and pay the redemption price solely in cash.

For purposes of this “Optional Redemption by the Company” provision, the “date of original issuance” of the shares to be redeemed will mean the earliest date that any shares of Series L Preferred Stock were issued to any investor during the calendar quarter in which the shares to be redeemed were issued. As a result, depending upon how late in a calendar quarter you purchased your shares, we may have the ability to redeem your shares even if they have been outstanding for slightly less than two years.

For purposes of this “Optional Redemption by the Company” provision, where the shares of Preferred Stock to be redeemed are DRP Shares, the “date of original issuance” of such DRP Shares shall be deemed to be the same as the “date of original issuance” of the Underlying Shares, and such DRP Shares shall become subject to optional redemption by us hereunder on the same date and terms as the Underlying Shares.

Special Optional Redemption by the Company. Upon the occurrence of a Change of Control (as defined below), we will have the right (but not the obligation) to redeem the outstanding shares of Series L Preferred Stock, in whole or in part, within 120 days after the first date on which such Change of Control occurred, in cash at a redemption price equal to 100% of the Stated Value, plus an amount equal to any accrued but unpaid dividends (whether or not authorized or declared) to, but not including, the date fixed for redemption.

A “Change of Control” is when the following have occurred and are continuing:

•

the acquisition by any person, including any syndicate or group deemed to be a “person” under Section 13(d)(3) of the Exchange Act, of beneficial ownership, directly or indirectly, through a purchase, merger or other acquisition transaction or

series of purchases, mergers or other acquisition transactions of shares of our company entitling that person to exercise more than 50% of the total voting power of all shares of our company entitled to vote generally in elections of directors (except that such person will be deemed to have beneficial ownership of all securities that such person has the right to acquire, whether such right is currently exercisable or is exercisable only upon the occurrence of a subsequent condition); and

•

following the closing of any transaction referred to in the bullet point above, neither we nor the acquiring or surviving entity has a class of common securities (or American Depositary Receipts (“ADRs”) representing such securities) listed on the NYSE, the NYSE American LLC (the “NYSE American”) or The Nasdaq Stock Market LLC (“Nasdaq”) or listed or quoted on an exchange or quotation system that is a successor to the NYSE, the NYSE American or Nasdaq.

Liquidation. Upon any voluntary or involuntary liquidation, dissolution or winding up of our affairs, the holders of the Series L Preferred Stock will have the right to receive the Stated Value, plus an amount equal to any accrued but unpaid dividends (whether or not declared) to, but not including, the date of payment, before any distribution or payment is made to the holders of our common stock or any other class or series of capital stock ranking junior to the Series L Preferred Stock. The rights of the holders of the Series L Preferred Stock to receive the Stated Value will be subject to the rights of holders of our debt, holders of any equity securities ranking senior in liquidation preference to the Series L Preferred Stock (none of which are currently outstanding) and the proportionate rights of holders of each other series or class of our equity securities ranked on a parity with the Series L Preferred Stock, including the Series D Preferred Stock, the Series F Preferred Stock, the Series G Preferred Stock, the Series H Preferred Stock, the Series I Preferred Stock the Series J Preferred Stock, the Series K Preferred Stock and the Series M Preferred Stock.

Voting Rights. Holders of the Series L Preferred Stock generally have no voting rights except as required by law. However, whenever dividends on the Series L Preferred Stock are in arrears for 18 or more monthly periods (whether or not consecutive), the holders of such shares (voting together as a single class with all other shares of any class or series of shares ranking on a parity with the Series L Preferred Stock which are entitled to similar voting rights, if any) will be entitled to vote for the election of two additional directors to serve on our board of directors until all dividends in arrears on the outstanding shares of the Series L Preferred Stock have been paid and dividends for the current monthly dividend period have been paid in full. In addition, the issuance of future senior stock or certain charter amendments, whether by merger, consolidation or other business combination or otherwise materially adversely affecting the rights of holders of Series L Preferred Stock cannot be made without the affirmative vote or consent of holders of at least 662∕3% of the outstanding shares of Series L Preferred Stock and shares of any class or series of preferred stock entitled to vote on such matters, if any, voting as a single class. However, any

amendments that only affect the contract rights of the Series L Preferred Stock, as expressly set forth in our charter, are subject only to the approval by the affirmative vote or consent of holders of at least a majority of the outstanding shares of Series L Preferred Stock, and no other class of our capital stock will have any voting rights in that instance.

Eligibility to Purchase. Shares of the Series L Preferred Stock are suitable only as a long-term investment for persons of adequate financial means who do not need near-term liquidity from their investment. We do not expect there to be a public market for the shares of Series L Preferred Stock and thus it may be difficult for you to sell your shares. On a limited basis, you may be able to have your shares redeemed by us.

An investment in the Series L Preferred Stock requires a minimum initial investment of $5,000, which minimum may be waived in the sole discretion of our dealer manager. Except as noted elsewhere in this prospectus, shares of Series L Preferred Stock are available for purchase in this offering only through participating broker-dealers and are not suitable for wrap accounts. See “Plan of Distribution — Compensation of Dealer Manager and Participating Broker-Dealers.”

Series M Preferred Stock offered by us

Ranking. The Series M Preferred Stock ranks (i) senior to all classes or series of our common stock and future junior securities, (ii) on a parity with each series of our outstanding preferred stock, including the Series D Preferred Stock, the Series F Preferred Stock, the Series G Preferred Stock, the Series H Preferred Stock, the Series I Preferred Stock, the Series J Preferred Stock, the Series K Preferred Stock, the Series L Preferred Stock and with any future parity securities, and (iii) junior to any future senior securities (none of which are currently outstanding) and to all our existing and future indebtedness, with respect to the payment of dividends and rights upon our liquidation, dissolution or winding up of our affairs.

Stated Value. Each share of Series M Preferred Stock will have a “Stated Value” of $25.00, as set forth in the articles supplementary setting forth the rights, preferences and limitations of the Series M Preferred Stock (the “Series M Articles Supplementary”).

Dividends. Holders of Series M Preferred Stock are entitled to receive, when and as authorized by our board of directors and declared by us out of legally available funds, cumulative cash dividends on each share of Series M Preferred Stock at an annual rate of [ ]% of the Stated Value (equivalent to an annual dividend rate of $[ ] per share). Beginning one year from the “date of original issuance” of each share of Series M Preferred Stock, and on each one-year anniversary thereafter for such Series M Preferred Stock, the dividend rate will increase by 0.10% per annum for such share; provided, however, that the dividend rate for any share of Series M Preferred Stock shall not exceed [ ]% per annum. We expect to authorize and declare dividends on the shares of Series M Preferred Stock on a monthly basis, payable on the 15th day of each month (or if such payment date is not a business day, on the next succeeding business day), unless our financial condition, operating performance, general economic conditions, applicable

provisions of Maryland law, applicable provisions of our credit agreements or other factors make it imprudent to do so or prevent us from doing so. Dividends will be payable in arrears to holders of record as they appear on our records at the close of business on the last business day of each month immediately preceding the applicable dividend payment date. The timing and amount of such dividends will be determined by our board of directors, in its sole discretion, and may vary from time to time. Declaration of dividends on the Preferred Stock will for the foreseeable future require a determination by our board of directors, at the time of any such determination, that we would continue to have positive equity on a fair value basis, among other considerations.

For purposes of the 0.10% per annum dividend rate increase in this “Dividends” provision, the “date of original issuance” of the shares of Series M Preferred Stock will mean the earliest date that any shares of Series M Preferred Stock were issued to any investor during the calendar quarter in which the shares were issued.

Redemption at the Option of Holders. Except as noted below, a holder will have the right to require us to redeem any or all of such holder’s shares of Series M Preferred Stock at a redemption price equal to 100% of the Stated Value, less a redemption fee, plus an amount equal to any accrued but unpaid dividends (whether or not authorized or declared) to, but not including, the date fixed for redemption.

The redemption fee shall be equal to:

•

beginning on the “date of original issuance” of the shares to be redeemed: [ ]%; and

•

beginning on the first anniversary from the “date of original issuance” of the shares to be redeemed: [ ]%.

Subject to the following sentence, for so long as our common stock is listed on a national securities exchange, if a holder of shares of Series M Preferred Stock causes us to redeem such shares of Series M Preferred Stock, we have the right, in our sole discretion, to pay the redemption price in cash or in equal value of shares of our common stock or any combination thereof, based on the closing price per share of our common stock for the single trading day prior to the date of redemption. Pursuant to the Series M Articles Supplementary, our board of directors may, without stockholder approval, permanently revoke this right to pay the redemption price (or a portion thereof) in shares of our common stock and pay the redemption price solely in cash.

For purposes of this “Redemption at the Option of Holders” provision, the “date of original issuance” of the shares to be redeemed will mean the earliest date that any shares of Series M Preferred Stock were issued to any investor during the calendar quarter in which the shares to be redeemed were issued.

For purposes of this “Redemption at the Option of Holders” provision, where the shares of Preferred Stock to be redeemed are DRP Shares, the “date of original issuance” of such DRP Shares shall be deemed to be the same as the “date of original issuance” of the Underlying Shares, and such DRP Shares shall be subject to

the same redemption terms to which the Underlying Shares would be subject if submitted for redemption hereunder.

Our ability to redeem shares of Series M Preferred Stock may be limited to the extent that we do not have sufficient funds lawfully available, taking into account such reserves and other considerations as our board of directors may determine in its sole discretion, to fund such cash redemption. In addition, aggregate redemptions by holders of Preferred Stock pursuant to this “Redemption at the Option of Holders” provision, will be subject to the following redemption limits: (i) no more than 2% of the outstanding Preferred Stock will be redeemed per calendar month; (ii) no more than 5% of the outstanding Preferred Stock will be redeemed per fiscal quarter; and (iii) no more than 20% of the outstanding Preferred Stock will be redeemed per fiscal year. See “Description of the Series M Preferred Stock — Redemption at the Option of Holders.”

Optional Redemption Following Death or Disability of a Holder. Subject to the requirements and considerations below, we will redeem shares of Series M Preferred Stock held by a natural person upon his or her death or upon suffering a qualifying disability at a redemption price equal to 100% of the Stated Value, plus an amount equal to any accrued but unpaid dividends (whether or not authorized or declared) to, but not including, the date fixed for redemption. No redemption fees shall apply to such redemptions.

In order to redeem shares on the terms described above upon the death or qualifying disability of a holder, the following conditions must be met:

•

the deceased or disabled must be the sole holder or the beneficiary of a trust or an IRA or other retirement or profit-sharing plan that is a holder or, in the case of shares owned by spouses who are joint registered holders (or holders by tenants in the entirety), the deceased or disabled may be one of the spouses;

•

in the case of the disability of a holder:

•

such disability must meet the requirements of Section 72(m)(7) of the Code (i.e., the individual must be unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment that can be expected to result in death or to be of a long continued and indefinite duration);

•

such determination of disability must be made by the U.S. governmental agency responsible for reviewing the disability retirement benefits that the holder could be eligible to receive;

•

the condition causing the disability shall have occurred after the date that the holder became a holder of Series M Preferred Stock; and

•

the condition causing the disability shall have occurred before the holder reached full retirement age, which is the age at which such worker can claim full Social Security retired-worker benefits;

•

the redemption request must be received by the company within 12 months after the death or disability of the holder; and

•

in the case of the death of a holder, the redemption request must be made by a recipient of the shares through bequest or inheritance or, in the case of the death of a beneficiary of a trust, by the trustee of the trust or, in the case of shares owned by spouses who are joint registered holders (or holders by tenants in the entirety), the request may be made by the surviving spouse.

Subject to the following sentence, for so long as our common stock is listed on a national securities exchange, we have the right, in our sole discretion, to pay the redemption price in cash or in equal value of shares of our common stock or any combination thereof, based on the closing price per share of our common stock for the single trading day prior to the date of redemption. Pursuant to the Series M Articles Supplementary, our board of directors may, without stockholder approval, permanently revoke this right to pay the redemption price (or a portion thereof) in shares of our common stock and pay the redemption price solely in cash.

Our ability to redeem shares of Series M Preferred Stock may be limited to the extent that we do not have sufficient funds lawfully available, taking into account such reserves and other considerations as our board of directors may determine in its sole discretion, to fund such cash redemption. Although death and disability redemptions will not be subject to the 2%/5%/20% limits described above, death and disability redemptions will count toward such limits when applied to other redemptions at the option of the holder. See “Description of the Series M Preferred Stock — Optional Redemption Following Death or Disability of a Holder.”

Optional Redemption by the Company. After two years from the “date of original issuance” of the shares of Series M Preferred Stock to be redeemed, we will have the right (but not the obligation) to redeem such shares of Series M Preferred Stock, in whole or in part, at a redemption price equal to 100% of the Stated Value, plus an amount equal to any accrued but unpaid dividends (whether or not authorized or declared) to, but not including, the date fixed for redemption.

Subject to the following sentence, for so long as our common stock is listed on a national securities exchange, if we choose to redeem any shares of Series M Preferred Stock, we have the right, in our sole discretion, to pay the redemption price in cash or in equal value of shares of our common stock or any combination thereof, based on the closing price per share of our common stock for the single trading day prior to the date of redemption. Pursuant to the Series M Articles Supplementary, our board of directors may, without stockholder approval, permanently revoke this right to pay the redemption price (or a portion thereof) in shares of our common stock and pay the redemption price solely in cash.

For purposes of this “Optional Redemption by the Company” provision, the “date of original issuance” of the shares to be redeemed

will mean the earliest date that any shares of Series M Preferred Stock were issued to any investor during the calendar quarter in which the shares to be redeemed were issued. As a result, depending upon how late in a calendar quarter you purchased your shares, we may have the ability to redeem your shares even if they have been outstanding for slightly less than two years.

For purposes of this “Optional Redemption by the Company” provision, where the shares of Series M Preferred Stock to be redeemed are DRP Shares, the “date of original issuance” of such DRP Shares shall be deemed to be the same as the “date of original issuance” of the Underlying Shares, and such DRP Shares shall become subject to optional redemption by us hereunder on the same date and terms as the Underlying Shares.

Special Optional Redemption by the Company. Upon the occurrence of a Change of Control, we will have the right (but not the obligation) to redeem the outstanding shares of Series M Preferred Stock, in whole or in part, within 120 days after the first date on which such Change of Control occurred, in cash at a redemption price equal to 100% of the Stated Value, plus an amount equal to any accrued but unpaid dividends (whether or not authorized or declared) to, but not including, the date fixed for redemption.

Liquidation. Upon any voluntary or involuntary liquidation, dissolution or winding up of our affairs, the holders of the Series M Preferred Stock will have the right to receive the Stated Value, plus an amount equal to any accrued but unpaid dividends (whether or not declared) to, but not including, the date of payment, before any distribution or payment is made to the holders of our common stock or any other class or series of capital stock ranking junior to the Series M Preferred Stock. The rights of the holders of the Series M Preferred Stock to receive the Stated Value will be subject to the rights of holders of our debt, holders of any equity securities ranking senior in liquidation preference to the Series M Preferred Stock (none of which are currently outstanding) and the proportionate rights of holders of each other series or class of our equity securities ranked on a parity with the Series M Preferred Stock, including the Series D Preferred Stock, the Series F Preferred Stock, the Series G Preferred Stock, the Series H Preferred Stock, the Series I Preferred Stock, the Series J Preferred Stock, the Series K Preferred Stock and the Series L Preferred Stock.

Voting Rights. Holders of the Series M Preferred Stock generally have no voting rights except as required by law. However, whenever dividends on the Series M Preferred Stock are in arrears for 18 or more monthly periods (whether or not consecutive), the holders of such shares (voting together as a single class with all other shares of any class or series of shares ranking on a parity with the Series M Preferred Stock which are entitled to similar voting rights, if any) will be entitled to vote for the election of two additional directors to serve on our board of directors until all dividends in arrears on the outstanding shares of the Series M Preferred Stock have been paid and dividends for the current monthly dividend period have been paid in full. In addition, the issuance of future senior stock or certain charter amendments, whether by merger, consolidation or other business combination or otherwise, materially adversely affecting the

rights of holders of Series M Preferred Stock cannot be made without the affirmative vote or consent of holders of at least 662∕3% of the outstanding shares of Series M Preferred Stock and shares of any class or series of preferred stock entitled to vote on such matters, if any, voting as a single class. However, any amendments that only affect the contract rights of the Series M Preferred Stock, as expressly set forth in our charter, are subject only to the approval by the affirmative vote or consent of holders of at least a majority of the outstanding shares of Series M Preferred Stock, and no other class of our capital stock will have any voting rights in that instance.

Eligibility to Purchase. Shares of the Series M Preferred Stock are suitable only as a long-term investment for persons of adequate financial means who do not need near-term liquidity from their investment. We do not expect there to be a public market for the shares of Series M Preferred Stock and thus it may be difficult for you to sell your shares. On a limited basis, you may be able to have your shares redeemed by us.

An investment in the Series M Preferred Stock requires a minimum initial investment of $5,000, which minimum may be waived in the sole discretion of our dealer manager. Except as noted elsewhere in this prospectus, shares of Series M Preferred Stock are available for purchase in this offering only through certain registered investment advisors and through participating broker-dealers who have agreed to make Series M Preferred Stock available to clients who pay the broker-dealer a fee based on assets under management. See “Plan of Distribution — Compensation of Dealer Manager and Participating Broker-Dealers.”

Dividend Reinvestment Plan

Our transfer agent, Computershare Trust Company, N.A., will administer the DRP for holders of the Preferred Stock, pursuant to which holders may elect to have all, but not less than all, of their dividends automatically reinvested in additional shares of the Series L Preferred Stock or the Series M Preferred Stock, as applicable, at a price of $25.00 per share. Holders of each of the Series L Preferred Stock and the Series M Preferred Stock will receive the Series L DRP Shares and the Series M DRP Shares, respectively. Holders who do not so elect will receive their dividends in cash. See “Dividend Reinvestment Plan” in this prospectus for additional information regarding the DRP.

Capital stock to be outstanding after this offering(1)

5,591,642 shares of common stock

1,111,127 shares of Series D Preferred Stock

1,037,044 shares of Series F Preferred Stock

1,470,948 shares of Series G Preferred Stock

1,037,956 shares of Series H Preferred Stock

1,034,303 shares of Series I Preferred Stock

6,699,327 shares of Series J Preferred Stock

596,656 shares of Series K Preferred Stock

16,000,000 shares of Series L Preferred Stock and/or Series M Preferred Stock (assuming the maximum offering of 12,000,000 shares of Preferred Stock in our primary offering and 4,000,000 shares of Preferred Stock in the DRP)

Estimated use of proceeds

Assuming we issue only shares of Series L Preferred Stock and in an amount equal to the maximum offering amount in our primary offering and no sales pursuant to the DRP, we estimate that we will receive net proceeds from our primary offering of approximately $265.5 million after deducting estimated offering expenses, including selling commissions and the dealer manager fee, of approximately $34.5 million. Assuming we issue only shares of the Series M Preferred Stock and in an amount equal to the maximum offering amount in our primary offering and no sales pursuant to the DRP, we estimate that we will receive net proceeds from our primary offering of approximately $286.5 million after deducting estimated offering expenses, including the dealer manager fee, of approximately $13.5 million. Assuming the sale of the maximum offering amount in our primary offering consisting of 80% of shares of Series L Preferred Stock and 20% of shares of the Series M Preferred Stock and assuming no sales pursuant to the DRP, we estimate that we will receive net proceeds from our primary offering of approximately $269.7 million after deducting estimated offering expenses, including selling commissions and the dealer manager fee, of approximately $30.3 million. We are not making any representations as to the actual outcome of this offering. As of the date of this prospectus, we have issued no shares of Series L Preferred Stock or Series M Preferred Stock in this offering.

We intend to use the net proceeds from this offering for general corporate purposes, including, without limitation, payment of dividends on our outstanding capital stock, repayment of debt or other maturing obligations, financing future hotel-related investments, redemption of outstanding shares of our preferred stock, capital expenditures and working capital. See the section entitled “Estimated Use of Proceeds” in this prospectus.

Our common stock is listed on the NYSE under the trading symbol “AHT,” the Series D Preferred Stock is listed on the NYSE under the symbol “AHTpD,” the Series F Preferred Stock is listed on the NYSE under the symbol “AHTpF,” the Series G Preferred Stock is listed on the NYSE under the symbol “AHTpG,” the Series H Preferred Stock is listed on the NYSE under the symbol “AHTpH,” and the Series I Preferred Stock is listed on the NYSE under the symbol “AHTpI.”

There is no public trading market for the Preferred Stock, and we do not expect one to develop. We have no plans to list the Preferred Stock on the NYSE or another national securities exchange.

(1)

Shares outstanding as of December 11, 2024. This number excludes (i) shares of common stock that may be issued upon redemption of the Preferred Stock offered hereby, (ii) shares of common stock that may be issued upon redemption of the Series J Preferred Stock and Series K Preferred Stock sold in the primary and dividend reinvestment plan offering pursuant to our Registration Statement on Form S-3 (Registration No. 333-263323), (iii) shares of common stock reserved for issuance to our directors, executive officers and other Ashford LLC employees under our Amended and Restated 2021 Stock Incentive Plan, (iv) shares of common stock reserved for issuance upon redemption of common units

of Ashford Trust OP, and (v) any shares of common stock we may issue to Ashford LLC in payment of any portion of the incentive fee.

Common Stock Issuable

This prospectus also covers the shares of our common stock that may be issuable upon (i) redemption of the Preferred Stock sold pursuant to this offering and (ii) redemption of the Series J Preferred Stock and the Series K Preferred Stock sold pursuant to our continuous primary and dividend reinvestment plan offering under our registration statement on Form S-3 (Registration Statement No. 333-263323), the primary portion of which is scheduled to terminate on March 31, 2025.

Capital Structure

The Preferred Stock ranks senior to our common stock and on a parity with the Series D Preferred Stock, the Series F Preferred Stock, the Series G Preferred Stock, the Series H Preferred Stock, the Series I Preferred Stock, the Series J Preferred Stock and the Series K Preferred Stock with respect to both the payment of dividends and distribution of amounts upon liquidation, dissolution or winding up of our affairs. Our board of directors may authorize the issuance and sale of additional shares of preferred stock from time to time, including additional shares of Preferred Stock.

Determination of Offering Price

The offering price of the Preferred Stock and the related selling commissions and dealer manager fees have been determined pursuant to discussions between us and our dealer manager, which is an affiliate of Ashford LLC, based upon our financial condition and the conditions of the securities markets at the time of this offering. Because the offering price is not based upon any independent valuation, the offering price may not be indicative of the price that you would receive upon the sale of the Preferred Stock in a hypothetical liquid market.

However, for the purpose of allowing the dealer manager and the participating broker-dealers to comply with FINRA Rule 2310(b)(5) and to participate in the distribution of this offering of Preferred Stock, we have agreed that annually we will provide a per share estimate of the value of the Preferred Stock in the annual report to stockholders filed pursuant to Section 13(a) of the Exchange Act.

Covered Security

The term “covered security” applies to securities exempt from state registration because of their oversight by federal authorities and national-level regulatory bodies pursuant to Section 18 of the Securities Act of 1933, as amended (the “Securities Act”). Generally, securities listed on national exchanges are the most common type of covered security exempt from state registration. A non-traded security also can be a covered security if it has a seniority greater than or equal to other securities from the same issuer that are listed on a national exchange, such as the NYSE. The Preferred Stock is a covered security because it is senior to our common stock and therefore is exempt from state registration. See “Risk Factors — Risks Related To This Offering — Investors in the Preferred Stock will not enjoy the protections afforded by registration of this offering under state securities laws.”

RISK FACTORS

An investment in our securities involves significant risks. Prior to making a decision about investing in our securities, and in consultation with your own financial, tax and legal advisors, you should carefully consider, among other matters, the following risk factors related to this offering, as well as the other risk factors incorporated by reference in this prospectus, from our most recent Annual Report on Form 10-K, subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” as applicable.

Risks Related to This Offering

There is no public market for the Preferred Stock, and we do not expect one to develop; therefore, your ability to dispose of your shares will likely be limited to redemption by us. If you do sell your shares to us, you may receive less than the Stated Value.

There is no public trading market for the Preferred Stock offered in this offering, and we do not intend to list these securities on the NYSE or any other securities exchange or to include these shares for quotation on any national securities market. Therefore, the redemption of shares by us will likely be the only way for you to dispose of your shares. Subject to limited exceptions, shares redeemed within [ ] years of the date of issuance will be subject to a redemption fee. As a result, you may receive less than the Stated Value of your shares when you sell them to us. Additionally, our charter contains restrictions on the ownership and transfer of our securities, and these restrictions may inhibit your ability to sell the Preferred Stock promptly or at all. If you are able to sell the Preferred Stock, you may only be able to sell them at a substantial discount from the price you paid. Therefore, you should purchase the Preferred Stock only as a long-term investment.

The Preferred Stock is subordinated in right of payment to our existing and future debt, and your interests could be diluted by the issuance of additional preferred stock, including additional shares of Preferred Stock, and by other transactions.

The Preferred Stock is subordinated in right of payment to all of our existing and future debt. Our existing secured revolving credit facility restricts, and our future debt may include restrictions on, our ability to pay dividends to preferred stockholders in the event of a default under the debt facilities. As of September 30, 2024, our total indebtedness was approximately $2.7 billion including approximately $2.5 billion of variable interest rate debt, and we may incur significant additional debt to finance future acquisition activities. In addition, on January 15, 2021, we entered into a senior secured term loan facility (the “Oaktree Credit Agreement”) with Oaktree Capital Management L.P. (“Oaktree”) comprised of (i) initial term loans in an aggregate principal amount of $200 million, (ii) initial delayed draw term loans (the “Initial DDTLs”) in an aggregate principal amount of up to $150 million and (iii) additional delayed draw term loans in an aggregate principal amount of up to $100 million. The terms of the Oaktree Credit Agreement, as amended, require us to (i) pay an unused fee in an amount of 9% per annum multiplied by the actual daily amount by which $100,000,000 exceeds the aggregate outstanding principal amount of Initial DDTLs that were requested, after the initial term loan, and funded after the key draw is funded following a duly submitted request for credit extension; (ii) pay a cash exit fee equal to the product of (A) 12.5% multiplied by (B) the aggregate amount of initial loans advanced to us plus the then-outstanding balance of paid-in-kind principal. A substantial level of indebtedness could have adverse consequences for our business, results of operations and financial position because it could, among other things: (i) require us to dedicate a substantial portion of our cash flow from operations to make principal and interest payments on our indebtedness, thereby reducing our cash flow available to fund working capital, capital expenditures and other general corporate purposes, including to pay dividends on our common stock and our preferred stock, including the Series L Preferred Stock and the Series M Preferred Stock, as currently contemplated or necessary to satisfy the requirements for qualification as a REIT; (ii) increase our vulnerability to general adverse economic and industry conditions and limit our flexibility in planning for, or reacting to, changes in our business and our industry; (iii) limit our ability to borrow additional funds or refinance indebtedness on favorable terms or at all to expand our business or ease liquidity constraints; and (iv) place us at a competitive disadvantage relative to competitors that have less indebtedness.