AMTD IDEA Group (“AMTD IDEA” or the “Company”, NYSE: AMTD;SGX:

HKB), a NYSE and SGX-ST dual listed company and a controlling

shareholder of AMTD Digital, today announced its unaudited

financial results for the six months ended June 30, 2023.

Coinciding with the announcement, AMTD IDEA also announced the

migration of its headquarters and principal executive office to

Paris, France.

AMTD Group is a conglomerate focusing on the “IDEA” strategy to

develop and operate its four pillars of core businesses, namely

“I”: international business connectors with financial services as

the back bones, “D”: digital media, entertainment and cultural

connectors, “E”: private education and professional training, and

“A”: premium assets and hospitality.

AMTD IDEA, a subsidiary of AMTD Group, includes the “I”, “D” and

“A”pillars of businesses in a listed holding platform to fuse

synergies, create value and empower ecosystem of resources and

network to develop and enable ongoing opportunities and sustainable

developments.

Highlights of 2023 Half Year Financial Results

- During the six months ended June 30, 2023, despite the global

economic slowdown and rising geopolitical uncertainties, leading to

volatile world markets overall, the Company demonstrated strong

resilience and achieved solid financial performance. Our total

revenue for the six months ended June 30, 2023 increased by 8.6% as

compared to the same period in the previous year, from US$117.8

million to US$128.0 million.

- The revenue generated from digital media, entertainment and

cultural connector services surged to US$23.5 million, which

represented 2.9 times the comparative figure year on year, as a

result of the successful operations and expansions of L’Officiel

since the Company’s acquisition in the first half of 2022. This

reaffirms the strategic decision of the management to diversify our

income sources since last year by identifying various merger and

acquisition opportunities.

- The finance costs for the six months ended June 30, 2023

increased by 1,024.5% as compared to the same period in prior year,

reaching US$3.6 million. The increase was mainly attributable to

the global interest rate hike and the rise in the average balance

of bank borrowings, which were successfully secured during the

pandemic times to optimise the Company's earning capabilities and

support the continuous growth of the Company.

- The profit for the six months ended June 30, 2023 has

maintained a steady growth of 3.3% as compared to the same period

in the prior year, increasing from US$102.3 million to US$105.7

million.

- The net assets as of June 30, 2023 increased by 47.4% to US$1.5

billion when compared with December 31, 2022, following the

successful completion of the acquisition of AMTD Assets Group

(“AMTD Assets”), who holds a global portfolio of premium real

estate assets during the period. After the acquisition, the hotel

operations, hospitality and VIP services income of US$4.3 million,

reflective of only partial year of contributions, was recorded

during the period.

Recent Developments during the Six Months Ended June 30,

2023, together with Events subsequent to June 30, 2023

- In January 2023, the Company acquired AMTD Assets, a subsidiary

of AMTD Group, with a total consideration of approximately US$268

million, by issuing 30,875,576 Class B treasury shares, priced at

US$8.68 per share. The transaction was completed on February 6,

2023 and AMTD Assets became a subsidiary of the Company. AMTD

Assets holds a global portfolio of premium properties.

- In March 2023, the Company’s subsidiaries, L’Officiel Singapore

Pte. Ltd. and L'Officiel Malaysia Sdn. Bhd., have been granted the

publication permits in Singapore and Malaysia by the Singapore

Registrar of Newspapers and Ministry of Home Affairs, to publish

magazines under the direct owner’s model. In October 2023,

L'Officiel Hong Kong successfully registered with the HKSAR

Government's Office for Film, Newspaper and Article Administration.

We reinforce our direct position in Asia, while continuing to

foster our relationships with franchisees for the rest of the

world, promoting greater values for the overall ecosystem under our

one world's global approach and service quality's consistency.

- In April 2023, the Company secured US$93.6 million of new share

subscription of 90,000,000 newly issued Class A ordinary share at

21.1% premium above the prevailing traded price, further

solidifying the Company's financial and capital strengths.

- In August 2023, the Company, AMTD Group and its subsidiary AMTD

Digital Inc. officially established AMTD World Media and

Entertainment Group (“AMTD WME”). AMTD WME will embark and focus on

global strategies and developments of a multi-media, entertainment

and cultures worldwide platform.

- Subsequent to June 30, 2023, the Company entered into a

definitive agreement with an independent third party to dispose

certain real estate assets. The consideration for the disposal was

determined with reference to the assets' latest valuation, with

potential adjustments based on the final valuation performed by the

independent valuer. The disposal was carried out with an aim to

reallocate the proceeds into other premium assets at more preferred

locations or more favourable pricing.

- Subsequent to June 30, 2023, the Company reached an agreement

with the counterparty of certain derivative financial assets held

by the Company to conclude and settle.

- Subsequent to June 30, 2023, the Company entered into a

termsheet with an independent third party. Pursuant to the

termsheet, there is a restructuring exercise for certain

subsidiaries of L'Officiel Inc. SAS to take advantage of certain

opportunities, including disposal of non-core components, in view

of reverse inquiries from market.

Statement from the Board Members and Senior

Management:

Dr. Feridun Hamdullahpur, Chairman of the board and audit

committee, “Long term vision and planning, resiliency, innovative

thinking, and solid leadership were altogether behind the

remarkably exciting financial performance. The current volatile

market conditions coupled with the on-going global geopolitical

uncertainties have created a challenging environment for the entire

investment world. Despite these unfavourable winds, the AMTD IDEA

Group has achieved an overall 8.6% increase in revenues compared

the same period last year. I am delighted with these results and,

on behalf of the Board of Directors convey my heartfelt thanks to

the entire leadership team. I look forward to seeing even stronger

results for the next half of the year.”

Mr. William Fung, CEO of the Company, “Maintaining growth

sustainability and achieving business diversification have been the

key strategic objectives of the management team as we continued to

navigate through global political uncertainties and economic

challenges in the first half of 2023. We were able to achieve an

encouraging 8.6% y/y increase in total revenue, expand in

identified growth areas and strengthen the Group’s liquidity and

asset base via share placements and banking facilities, and

acquisition of premium global properties, whereby net assets

increased by 47.4% to US$1.5 billion. On behalf of the management

team, I would like to thank the board of directors for their

continued support and guidance, as well as our shareholders and

business partners for their trust and partnership. We remain

confident and committed towards the financial and strategic goals

of the Group.”

Mr. Xavier Zee, CFO of the Company, “I am glad to see that the

Group stayed resilient and delivered solid results despite the

global economic slowdown. Successful acquisitions of businesses of

hotel operations, media and entertainment bring in more stable

income streams to the Group. More synergies would be anticipated

from these businesses through collaborating with our ecosystem

partners.”

Financial Results for the Six Months Ended June 30,

2023

Revenue

Our revenue for the six months ended June 30, 2023 amounted to

US$128.0 million, increasing from US$117.8 million recorded for the

six months ended June 30, 2022. The 8.6% increase compared to prior

year was primarily attributable to (i) the net increase in

dividends, fair value changes and disposal gains of our investment

portfolio, and (ii) diversification of our revenue sources which

results from the acquisition of L'Officiel and AMTD Assets.

- Digital solutions and other services income was US$16.2 million

for six months ended June 30, 2023, 126.9% higher than the same

period of 2022. The increase was primarily driven by the

introduction of new clients in the second half of 2022 and the

expansion of digital marketing services.

- Fashion and luxury media advertising and marketing services

income was US$7.2 million, representing 7.4 times the comparative

figure in the same period of last year. The increase was mainly

attributable to the successful operations and expansions of

L’Officiel into Asia.

- Hotel operations, hospitality and VIP services income was

US$4.3 million and becomes a new revenue driver after the

successful acquisition of AMTD Assets, the real estate arm of AMTD

Group, focusing and specialising in hospitality and lifestyle

concepts globally during the period.

- Dividends and disposal gains of investments was US$93.5million,

representing 14.6 times the comparative figure in the same period

of last year. It was in turn attributable to the increase of the

gain from the successful divestment of certain investments in our

portfolio and an increase in dividend income.

Other Income And Gains

Other income and gains increased by 54.0% as compared to the

same period in prior year to US$11.3 million, primarily due to (i)

increase in bank interest income as the Company had generated

additional interest income from deposits with banks, and (ii)

increase in the net average outstanding balance due from our

immediate holding company, which was interest bearing.

Other Operating Expenses

Other operating expenses for the six months ended June 30, 2023

increased by 60.4% as compared to the same period in prior year to

US$12.4 million, primarily attributable to (i) an addition of hotel

operation expenses in AMTD Assets of US$2.8 million, and (ii) full

period effect for the increase in operation expenses of L’Officiel

of US$1.2 million.

Staff Costs

Staff costs for the six months ended June 30, 2023 increased by

36.9% as compared to the same period in prior year to US$10.3

million. This was due to the incremental costs in connection to the

post-acquisition operations of AMTD Digital Inc., L’Officiel and

AMTD Assets.

Finance Costs

Finance costs for the six months ended June 30, 2023 increased

by 1,024.5% as compared to the same period in prior year to US$3.6

million, primarily due to the increase in the market interest rate

and outstanding bank borrowings during the period.

Income Tax Expense

Income tax expense for the six months ended June 30, 2023

decreased by 18.9% as compared to the same period in prior year to

US$7.2 million, primarily due to a decrease in tax assessable

income.

Profit For The Period

Profit for the six months ended June 30, 2023 slightly increased

by 3.3% as compared to the same period in the prior year to

US$105.7 million.

Accounts Receivable

Accounts receivable increased by 9.6% from US$24.1 million as of

December 31, 2022 to US$26.4 million as of June 30, 2023, primarily

due to increase in dividend receivable and receivables from hotel

and hospitality services of US$1.7 million.

Financial Assets At Fair Value Through

Profit or Loss, Including Derivative Financial

Assets

Financial assets at fair value through profit or loss decreased

by 4.9% from US$380.4 million as of December 31, 2022 to US$361.7

million as of June 30, 2023, primarily due to decrease in fair

value of the financial assets and net disposal of investments

during the period.

Accounts Payable

Accounts payable decreased by 9.6% from US$10.6 million as of

December 31, 2022 to US$9.5 million as of June 30, 2023, largely

attributable to a decrease of US$1.2 million in payables to

suppliers of fashion and luxury media advertising and marketing

services, which was in turn resulting from the optimization of our

payment cycle during the period.

Bank Borrowings

Total bank borrowings were US$ 96.4 million as of June 30, 2023,

representing 4.7 times of the comparative figure. The increase was

mainly attributable to the increase in bank borrowings, which were

successfully secured during the pandemic times and through the

acquisition of AMTD Assets.

Net Assets

The net assets increased by 47.4% from US$1.0 billion as of

December 31, 2022 to US$1.5 billion as of June 30, 2023,

reflecting

(i) the successful completion of acquisition

of AMTD Assets, of which certain line items, including property,

plant and equipment (hotel properties within the property

portfolio), interest in joint ventures (the Company’s stake in a

hotel venture project), and amount due from / to non-controlling

shareholders (the outstanding balances with our business partners),

recorded a significant change when compared with December 31, 2022,

and

(ii) the contribution of our results and

comprehensive income from our operations.

There were other fluctuations in various financial line items,

and it was due to the reclassification of certain assets and

liabilities (e.g. goodwill) associated with assets classified as

held for sale as a result of Company’s plan to streamline certain

operations.

Accounting Changes - Change in

presentation currency

The directors have elected to change the Company’s presentation

currency in the financial information from Hong Kong dollar to

United States dollar to better reflect the economic footprint of

our businesses. The directors of the Company believe that the

presentation currency change will give investors and other

stakeholders a clearer understanding of the AMTD IDEA’s performance

over time. The change in presentation currency is a voluntary

change which is accounted for retrospectively in the interim

condensed consolidated statement of profit or loss and statements

of financial position and all comparative financial information has

been restated accordingly.

AMTD IDEA GROUP

UNAUDITED INTERIM CONDENSED

CONSOLIDATED STATEMENTS OF PROFIT OR LOSS

FOR THE SIX MONTHS ENDED JUNE 30,

2022 AND 2023

Six months ended June

30,

2022

2023

US$’000

US$’000

REVENUE

Capital market solutions services

income

60,636

14,263

Digital solutions and other services

income

7,154

16,235

Fashion and luxury media advertising and

marketing services income

979

7,245

Hotel operations, hospitality and VIP

services income

—

4,268

Dividends and gains related to disposed

financial assets at fair value through profit or loss

6,413

93,493

75,182

135,504

Net fair value changes on financial assets

at fair value through profit or loss (except derivative financial

assets and gains related to disposed financial assets at fair value

through profit or loss)

(18,072)

(41,376)

Net fair value changes on derivative

financial assets

60,715

33,868

117,825

127,996

Other income and gains

7,356

11,325

Other operating expenses

(7,753)

(12,435)

Staff costs

(7,541)

(10,325)

Finance costs

(319)

(3,587)

Net fair value changes on derivative

financial liability

1,705

—

PROFIT BEFORE TAX

111,273

112,974

Income tax expense

(8,929)

(7,240)

PROFIT FOR THE PERIOD

102,344

105,734

Profit (Loss) attributable to:

Owners of the parent

Ordinary shareholders

94,710

96,586

Holders of perpetual securities

7,817

6,396

Non-controlling interests

(183)

2,752

102,344

105,734

EARNINGS PER SHARE ATTRIBUTABLE TO

ORDINARY

EQUITY HOLDERS OF THE PARENT

Class A ordinary shares:

Basic (US$ cents per share)

32.60

32.62

Diluted (US$ cents per share)

32.60

32.62

Class B ordinary shares:

Basic (US$ cents per share)

32.60

32.62

Diluted (US$ cents per share)

32.60

32.62

AMTD IDEA GROUP

UNAUDITED INTERIM CONDENSED

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

AS AT DECEMBER 31, 2022 AND JUNE

30, 2023

December 31, 2022

June 30, 2023

US$’000

US$’000

ASSETS

Current assets

Accounts receivable

24,068

26,372

Prepayments, deposits and other

receivables

124,223

169,354

Amount due from immediate holding

company

287,178

519,648

Amount due from a non-controlling

shareholder

—

759

Derivative financial assets

185,069

217,612

Tax recoverable

398

—

Other assets

1,234

613

Restricted cash

415

168

Cash and bank balances

138,297

161,455

Assets classified as held for sale

—

11,818

Total current assets

760,882

1,107,799

Non-current assets

Property, plant and equipment

12

242,721

Goodwill

7,525

—

Intangible assets

96,967

92,713

Interests in joint ventures

—

99,594

Financial assets at fair value through

profit or loss

195,337

144,132

Total non-current assets

299,841

579,160

Total assets

1,060,723

1,686,959

LIABILITIES AND EQUITY

Current liabilities

Accounts payable

10,556

9,542

Other payables and accruals

16,904

34,004

Bank borrowings

20,122

66,049

Amount due to a non-controlling

shareholder

—

54,256

Provisions

4,079

3,962

Income tax payable

2,883

8,219

Liabilities associated with assets

classified as held for sale

—

691

Total current liabilities

54,544

176,723

Non-current liabilities

Bank borrowings

458

30,398

Deferred tax liabilities

3,307

2,648

Total non-current liabilities

3,765

33,046

Total liabilities

58,309

209,769

AMTD IDEA GROUP

UNAUDITED INTERIM CONDENSED

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

(CONTINUED)

AS AT DECEMBER 31, 2022 AND JUNE

30, 2023

December 31, 2022

June 30, 2023

US$’000

US$’000

Equity

Class A ordinary shares (par value of

US$0.0001 as of December 31, 2022 and June 30, 2023; 8,000,000,000

shares authorized as of December 31, 2022 and June 30, 2023;

144,077,210 and 234,077,210 shares as of December 31, 2022 and June

30, 2023, respectively)

12

21

Class B ordinary shares (par value of

US$0.0001 as of December 31, 2022 and June 30, 2023; 2,000,000,000

shares authorized as of December 31, 2022 and June 30, 2023;

233,526,979 shares as of December 31, 2022 and June 30, 2023)

26

26

Treasury shares

(962,658)

(694,658)

Capital reserve

988,965

995,099

Exchange reserve

2,991

(3,055)

Revaluation reserve

—

2,237

Retained profits

712,862

809,447

Total equity attributable to ordinary

shareholders of the Company

742,198

1,109,117

Non-controlling interests

31,740

133,851

Perpetual securities

228,476

234,222

Total equity

1,002,414

1,477,190

Total liabilities and equity

1,060,723

1,686,959

About AMTD IDEA Group

AMTD IDEA Group, formerly known as AMTD International Inc.

(NYSE: AMTD; SGX: HKB) represents a diversified institution and

digital solutions group connecting companies and investors with

global capital markets. Its comprehensive one-stop business

services plus digital solutions platform addresses different

clients’ diverse and inter-connected business needs and digital

requirements across all phases of their life cycles as well as

hospitality and VIP services. Through our unique eco-system - the

"AMTD SpiderNet" - AMTD IDEA Group is uniquely positioned as an

active superconnector between clients, business partners, investee

companies, and investors, connecting the East and the West. For

more information, please visit www.amtdinc.com or follow us on X

(formerly known as Twitter) at @AMTDGroup.

Safe Harbor Statement

This press release contains statements that may constitute

“forward-looking” statements pursuant to the “safe harbor”

provisions of the U.S. Private Securities Litigation Reform Act of

1995. These forward-looking statements can be identified by

terminology such as “will,” “expects,” “anticipates,” “aims,”

“future,” “intends,” “plans,” “believes,” “estimates,” “likely to,”

and similar statements. Statements that are not historical facts,

including statements about the beliefs, plans, and expectations of

AMTD IDEA Group are forward-looking statements. Forward-looking

statements involve inherent risks and uncertainties. Further

information regarding these and other risks is included in the

filings of AMTD IDEA Group with the SEC. All information provided

in this press release is as of the date of this press release, and

AMTD IDEA Group does not undertake any obligation to update any

forward-looking statement, except as required under applicable

law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231222379710/en/

IR Office AMTD IDEA Group ir@amtdinc.com

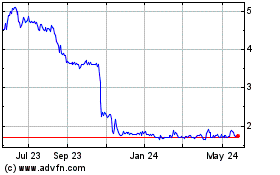

AMTD IDEA (NYSE:AMTD)

Historical Stock Chart

From Jan 2025 to Feb 2025

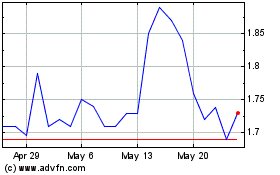

AMTD IDEA (NYSE:AMTD)

Historical Stock Chart

From Feb 2024 to Feb 2025