UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed

by the Registrant ¨ Filed by a Party other than the Registrant x

Check the appropriate box:

| ¨ |

Preliminary Proxy Statement |

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ |

Definitive Proxy Statement |

| x |

Definitive Additional Materials |

| ¨ |

Soliciting material Pursuant to §240.14a-12 |

Air Products and Chemicals, Inc.

(Name of Registrant as Specified In Its Charter)

MANTLE RIDGE LP

EAGLE FUND A1 LTD

EAGLE ADVISOR LLC

PAUL HILAL

ANDREW EVANS

TRACY MCKIBBEN

DENNIS REILLEY

(Name of Person(s) Filing Proxy Statement, if

other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x |

No fee required. |

| ¨ |

Fee paid previously with preliminary materials. |

| ¨ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

On

January 9, 2025, Mantle Ridge LP, which, together with its affiliates (collectively, “Mantle Ridge”), beneficially owns approximately

$1.3 billion of the outstanding common shares of Air Products and Chemicals, Inc. (NYSE: APD) (“Air Products” or the “Company”),

issued and uploaded to its website, www.RefreshingAirProducts.com, the following press release:

LEADING PROXY ADVISORY FIRM GLASS LEWIS

RECOMMENDS AIR PRODUCTS AND CHEMICALS, INC. SHAREHOLDERS VOTE “FOR” ALL FOUR MANTLE RIDGE DIRECTOR NOMINEES ANDREW EVANS,

PAUL HILAL, TRACY MCKIBBEN, AND DENNIS REILLEY

Glass Lewis Finds a “Compelling”

Case for Change at Air Products Following “Years of Poor Performance Fueled by a Spate of High-Cost, Low-Visibility Strategic Expeditions

Pointedly Departing from APD’s Core Risk Profile”

Report Notes Board Has Overseen a “Faulty

Succession Effort” and that Certain of the Company's “Quantitative Rebuttals Heavily Tax Analytical Veracity”

Glass Lewis Recognizes “Mantle Ridge's

Copious Dissection of APD's Track Record” is “Much More Decisive” than Air Products’ Perspective on Company’s

Strategic Pivot

States that Mantle Ridge Has “Provided

Shareholders with a Clear, Credible and Proportionate Alternative Backed by Suitably Experienced, Independent Candidates” While

Air Products Has a “Functionally Vacant Succession Framework Slated to Leave CEO Seifi Ghasemi in an Indefinite Position of Influence”

Recommends Shareholders Vote “WITHHOLD”

On Seifi Ghasemi and Three Other Company Nominees Opposed by Mantle Ridge – Charles Cogut, Lisa A. Davis, and Edward L. Monser

Glass Lewis’ Recommendation Reinforces

the Clear Case for Change at Air Products and Validates Mantle Ridge’s Strategy to Restore Performance, Fix Capital Allocation Missteps,

and Ensure Long-Term Leadership Stability at Air Products for the Benefit of All Shareholders

Mantle Ridge Urges Shareholders to Vote the

BLUE Proxy Card "FOR" All Four of its Superbly Qualified Director Nominees – Andrew Evans, Paul Hilal,

Tracy McKibben, and Dennis Reilley – and "WITHHOLD" on the Company Nominees Charles Cogut, Lisa A. Davis, Seifollah

"Seifi" Ghasemi, and Edward L. Monser

New

York – January 9, 2025 – Mantle Ridge LP, which, together with its affiliates (collectively, “Mantle Ridge”),

beneficially owns approximately $1.3 billion of the outstanding common shares of Air Products and Chemicals, Inc. (NYSE: APD) (“Air

Products” or the “Company”), today announced that Glass Lewis & Co. (“Glass Lewis”), a leading independent

proxy advisory firm, has recommended that Air Products shareholders vote “FOR” the election of all four of Mantle Ridge’s

highly qualified director nominees – Andrew Evans, Paul Hilal, Tracy McKibben, and Dennis Reilley – to the Company’s

Board of Directors (the “Board”) at the Company’s 2025 Annual Meeting of Shareholders, scheduled for January 23, 2025.

Glass Lewis also recommended shareholders vote

“WITHHOLD” on the Company nominees Charles Cogut, Lisa A. Davis, Seifollah “Seifi” Ghasemi, and Edward L. Monser.

With respect to Air Products’ recent

underperformance for shareholders and the case for change at the Board and management level, Glass Lewis stated*:

| · | “All factors considered, we believe the

case for change here is compelling. Indeed, following years of poor performance fueled by a spate of high-cost, low-visibility strategic

expeditions pointedly departing from APD's core risk profile — and in view of a functionally vacant succession framework slated

to leave CEO Seifi Ghasemi in an indefinite position of influence — we consider Mantle Ridge has provided shareholders with a clear,

credible and proportionate alternative backed by suitably experienced, independent candidates.” |

| · | “We believe the assortment of modestly

reasoned metrics advanced by APD swiftly falters under withering critique from Mantle Ridge, which goes on to offer investors a substantially

more comprehensive and transparent dissection of the Company's operating performance and financial condition.” |

| · | “Since launching its non-core capital allocation

initiative in earnest, APD has generated decidedly subpar value for investors[.]” |

| · | “Put simply, we believe there is a strong

case to suggest APD investors have ceded significant value as a direct extension of management's capital-intensive non-core strategy,

and should, in our view, have very little confidence in the idea that long-serving members of the board actively committed to the further

pursuit of that strategy are likely to serve as effective change agents here[.]” |

| · | “[W]e see little persuasive cause for investors

to afford the incumbent board meaningful credit for finding religion amidst a long-speculated run-up to definitive activist intervention

at APD, and further see no reasonable cause for investors to conclude those parties most culpable for overseeing APD's fumbled strategic

execution should be trusted to address associated consequences.” |

| · | “The circumstances at APD thus strongly

reinforce our belief that investors would be best served supporting significant alterations to the APD board at this time.” |

With respect to Mantle Ridge’s case for

change, director nominees, and proposed leadership “Dream Team”, Glass Lewis stated, in support of all four of Mantle Ridge’s

director nominees:

| · | “We believe Mantle Ridge has — APD's

manifold and occasionally specious protestations to the contrary — advanced a highly credible slate of candidates who appear well

suited to the challenge at hand. Given these considerations, we believe there is ample space to conclude investors would, at this time,

be best served supporting Mantle Ridge's short slate in place of APD nominees Cogut, Davis, Ghasemi and Monser.” |

| · | “Mr. Hilal is, in our view, appropriately

positioned to serve as a much-needed shareholder advocate. Furthermore, we believe Mr. Hilal, who was a key figure in Pershing Square's

campaign at the Company more than a decade ago, has comparatively strong familiarity with APD and the industrial gas sector.” |

| · | “As the former chair and CEO of Praxair

(now Linde) and a recognized thought leader in the industrial gases industry, we consider Mr. Reilley clearly has substantial, relevant

industry expertise. We see little credible cause to conclude his addition to the APD board would represent a negative outcome, particularly

given Mr. Reilley's operational bona fides, Linde's current best-in-class positioning and the litany of unforced errors at APD over the

last several years.” |

| · | “Mr. Evans would bring potentially high-value

public company CEO/CFO experience to the APD board, as well as additional capital allocation expertise in industries with high capital

intensity. We believe his insight may prove particularly valuable here, given APD's bloated capex, diminished focus on ROC and muddled

project-related disclosures[.]” |

| · | “Ms. McKibben would offer what appears

to be relevant domestic and international experience in renewable energy, energy transition and energy policy. Given the Company's extant

commitment to a range of domestic and international projects centered on green energy and decarbonization, we consider Ms. McKibben's

background is reasonably aligned with APD's current operational exposure.” |

| · | “Given the factors noted above, we consider

the analytical case for change fairly clear… having reviewed Mantle Ridge's slate, we believe the Dissident has — notwithstanding

extended commentary by the APD board — advanced experienced, capable nominees well-suited to addressing certain of the challenges

faced by the Company at this time.” |

With respect to Air Products’ distortions

about Mantle Ridge’s nominees and track record, Glass Lewis stated:

| · | “APD's effort to return fire on Mantle

Ridge's track record by utilizing overtly dubious measurement dates and eschewing relevant industry benchmarks ultimately carves a fairly

wide berth around credibility. We note Mantle Ridge has firmly addressed this issue with much more widely accepted analytical methodologies.” |

| · | “APD's effort to discredit Mr. Reilley's

candidacy (and the entire Mantle Ridge campaign) by loosely pointing to a dated insider trading investigation which resulted in no accusations

or charges against Mr. Reilley is, in short, unpersuasive.” |

| · | “With respect to Mr. Menezes, though APD

has sought to make much of the fact that Mantle Ridge's preferred CEO candidate has not been nominated as a candidate on the Dissident

slate, it is worth noting Mantle Ridge has simply sought for his consideration as part of a legitimate succession effort. We do not believe

this methodology — which would appropriately vest succession responsibilities with a reconstituted board — represents cause

for concern… and believe the substantive issue of concern is whether credible CEO candidates, prospectively including Mr. Menezes,

have received a fair shake in what we currently believe is a faulty succession effort.” |

With respect to Air Products’ director

nominees, poor board governance, succession planning failures, and entrenched Chairman & CEO Seifi Ghasemi, Glass Lewis stated:

| · | “In an effort to cultivate credibility,

the board presently points to the August 2024 disclosure of a succession process that has purportedly been ongoing since January 2023

and is currently slated to conclude by March 31, 2025. Thus, by APD's own accounting, the board is slated to take more than two years

to identify and appoint a single executive, a rather lengthy window which, in our view, underscores APD's inability to develop internal

talent or attract strong external candidates[.]” |

| · | “Investors seeking to understand the connective

tissue underpinning management's functionally unchecked pursuit of costly, value-crimping strategic initiatives arguably need look no

further than the board's relationship with Mr. Ghasemi. In particular, where shareholders might otherwise expect to find a board critically

focused on communicating credible and thoughtful succession objectives for a long-serving CEO who has missed the mark at considerable

expense to APD's perceived value, investors are instead presented with a muddled, slipshod framework which strongly implies APD's highest

oversight body functionally operates at the direction of the Company's senior executive.” |

| · | “Further still, APD has not clarified what

role Mr. Ghasemi may or may not hold on a continuing basis, a disconcerting ambiguity given his prodigious predilection for communicating

his intent to interminably helm APD. We expect the implied landscape for any incoming president (i.e. indeterminate bench-warming period,

potentially direct oversight by Mr. Ghasemi as chair or executive chair for an unknown period, strongly implied obligation to support

the pursuit of Mr. Ghasemi's to-date failed strategic agenda) renders the opening still more unattractive to many otherwise capable and

credible candidates[.]” |

| · | “It should be stated that the foregoing

factors heavily undermine APD's current assertion that the succession process is ‘led by [APD] Lead Independent Director [Monser]

with the support of the full Board and an independent search firm’. Decidedly contrary to this framework, we are concerned that

available information strongly suggests that the incumbent board, if left to its own devices and not held accountable at the forthcoming

AGM, may simply surface something of a figurehead candidate previously selected or endorsed by Mr. Ghasemi, while concurrently permitting

Mr. Ghasemi to retain substantial influence for an unspecified period, without a substantive acknowledgment of the poor capital allocation

performance of his strategy. In these regards, while we recognize basic elements of APD's core corporate governance architecture could

be considered suitable, we believe there exists ample cause to conclude that critical board functions, including senior executive oversight

and succession planning, are deeply flawed.” |

| · | “[T]he firm previously helmed by Mr. Ghasemi

(Rockwood Holdings) was sued by Huntsman Corporation for fraud in relation to an asset sale undertaken during Mr. Ghasemi's tenure (and

for which he was provided a deal-contingent bonus), which ultimately resulted in a $665 million arbitration ruling in favor of Huntsman[.]”

|

With respect to the current Board’s poor

track record of capital allocation, strategy, and execution across multiple challenged projects, Glass Lewis stated:

| · | “All told, we believe a fair read of the

current landscape suggests the APD board has missed the brief. Indeed, we are inclined to agree that several of the Company's quantitative

rebuttals heavily tax analytical veracity, and further find APD's recent reformation on matters of capital allocation seems to reflect

an eleventh-hour dash for the pews in an effort to burnish optics around investor engagement and strategic sobriety.” |

| · | “[T]he current dispute primarily hinges

on representations of APD's capital-intensive junket into large scale non-core projects over the last several years. The underlying structural

pivot — undertaken as part of what APD presently frames as its "‘two-pillar growth strategy’" — has

come under increasing scrutiny as the Company has disclosed multiple delays and scale revisions, while demonstrating an indeterminate

ability to de-risk its projects in a manner consistent with its core industrial gases business… we believe Mantle Ridge's copious

dissection of APD's track record proves much more decisive here.” |

| · | “Presumably seeking some fundamental, value-driven traction with investors,

we note the board again reverts to analytically dubious methodologies, in this case by indicating that ‘several recent key actions

changed [APD's TSR] trajectory’. Here, the board looks to argue that previously noted commitments to more circumspect capital allocation

procedures have directly contributed to attractive trailing one-year and YTD returns.” |

| · | “While we have already established our

belief that the board's recent undertakings appear problematically reactive and disconcertingly indicative of lax legacy oversight, it

is worth stressing that the performance periods highlighted by the board disingenuously claim credit for long-public speculation around

possible activist intervention and, most notably, the substantial single-day impact of Mantle Ridge's reported involvement at APD (+9.5%).

That the board not only sidesteps basic acknowledgment of this patently evident connection, but actually goes on to blithely take credit

for the underlying gain, should be very troubling to investors, in our view.” |

| · | “[W]e consider there is very little about

the foregoing procession which comports with the board's assertion that it has been an efficient, disciplined capital allocator. Much

to the contrary, we are concerned APD's relatively maladroit pursuit of large-scale projects suggests management and the board have been

worryingly ineffective at executing against non-core, capital-intensive initiatives, leaving the Company in a relatively poor position

to convincingly articulate an attractive value proposition or a clear ‘first-mover’ advantage.” |

*Mantle Ridge has neither sought nor obtained

consent from Glass Lewis to use previously published information in this press release.

To Enhance Air Products' Performance and Create

the Long-Term Value that Shareholders Deserve, Mantle Ridge Urges Shareholders to Vote the BLUE Proxy Card “FOR” Mantle

Ridge's Four Highly Qualified Director Nominees – Andrew Evans, Paul Hilal, Tracy McKibben, and Dennis Reilley – and “WITHHOLD”

on the Company Nominees Charles Cogut, Lisa A. Davis, Seifollah “Seifi” Ghasemi and Edward L. Monser.

Additional information regarding Mantle Ridge’s highly qualified

nominees, as well as voting instructions, may be found at www.RefreshingAirProducts.com.

***

About Mantle Ridge

Founded in 2016, Mantle Ridge LP is an engaged,

long-term owner-steward that works closely and constructively with company boards to create durable long-term value for all stakeholders.

None of Mantle Ridge’s affiliated entities is a hedge fund or other investment vehicle with a structurally short-term incentive.

Mantle Ridge engages with the expectation of maintaining an ownership position over the very long-term. Mantle Ridge has raised separate,

single-investment, five-year special purpose vehicles to support its previous engagements with companies including CSX Corporation, Aramark,

and Dollar Tree. For more information, visit https://www.mantleridge.com/.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

The information herein contains “forward-looking

statements.” Specific forward-looking statements can be identified by the fact that they do not relate strictly to historical or

current facts and include, without limitation, words such as “may,” “will,” “expects,” “believes,”

“anticipates,” “plans,” “estimates,” “projects,” “potential,” “targets,”

“forecasts,” “seeks,” “could,” “should” or the negative of such terms or other variations

on such terms or comparable terminology. Similarly, statements that describe our objectives, plans or goals are forward-looking. Forward-looking

statements are subject to various risks and uncertainties and assumptions. There can be no assurance that any idea or assumption herein

is, or will be proven, correct. If one or more of the risks or uncertainties materialize, or if any of the underlying assumptions of Mantle

Ridge LP and its affiliates (collectively, “Mantle Ridge”) or any of the other participants in the proxy solicitation described

herein prove to be incorrect, the actual results may vary materially from outcomes indicated by these statements. Accordingly, forward-looking

statements should not be regarded as a representation by Mantle Ridge that the future plans, estimates or expectations contemplated will

ever be achieved.

Certain statements and information included herein

may have been sourced from third parties. Mantle Ridge does not make any representations regarding the accuracy, completeness or timeliness

of such third party statements or information. Except as may be expressly set forth herein, permission to cite such statements or information

has neither been sought nor obtained from such third parties, nor has Mantle Ridge paid for any such statements or information. Any such

statements or information should not be viewed as an indication of support from such third parties for the views expressed herein.

Mantle Ridge disclaims any obligation to update

the information herein or to disclose the results of any revisions that may be made to any projected results or forward-looking statements

herein to reflect events or circumstances after the date of such information, projected results or statements or to reflect the occurrence

of anticipated or unanticipated events.

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Mantle Ridge LP and the other Participants (as

defined below) have filed a definitive proxy statement (the “Definitive Proxy Statement”) and accompanying BLUE universal

proxy card or voting instruction form with the SEC to be used to solicit proxies for, among other matters, the election of its slate of

director nominees at the 2025 annual meeting of stockholders of the Company (the “2025 Annual Meeting”). Shortly after filing

the Definitive Proxy Statement with the SEC, Mantle Ridge LP furnished the Definitive Proxy Statement and accompanying BLUE universal

proxy card or voting instruction form to some or all of the stockholders entitled to vote at the 2025 Annual Meeting.

The participants in the proxy solicitation are

Mantle Ridge LP, Eagle Fund A1 Ltd, Eagle Advisor LLC, Paul Hilal (all of the foregoing persons, collectively, the “Mantle Ridge

Parties”), Andrew Evans, Tracy McKibben and Dennis Reilley (such individuals, collectively with the Mantle Ridge Parties, the “Participants”).

IMPORTANT INFORMATION AND WHERE TO FIND IT

MANTLE RIDGE LP STRONGLY ADVISES ALL STOCKHOLDERS

OF THE COMPANY TO READ ITS DEFINITIVE PROXY STATEMENT, ANY AMENDMENTS OR SUPPLEMENTS TO SUCH PROXY STATEMENT AND OTHER PROXY MATERIALS

FILED BY MANTLE RIDGE LP WITH THE SEC AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL

BE AVAILABLE AT NO CHARGE ON THE SEC’S WEBSITE AT WWW.SEC.GOV. THE DEFINITIVE PROXY STATEMENT AND OTHER RELEVANT DOCUMENTS ARE ALSO

AVAILABLE ON THE SEC’S WEBSITE, FREE OF CHARGE, OR BY DIRECTING A REQUEST TO THE PARTICIPANTS’ PROXY SOLICITOR, D.F. KING

& CO., INC., 48 WALL STREET, 22ND FLOOR, NEW YORK, NEW YORK 10005. STOCKHOLDERS CAN CALL TOLL-FREE: (888) 628-8208.

Information about the Participants and a description

of their direct or indirect interests by security holdings or otherwise can be found in the Definitive Proxy Statement.

Investor Contact

D.F. King & Co., Inc.

Edward McCarthy

Tel: (212) 493-6952

Media Contacts

Jonathan Gasthalter / Nathaniel Garnick

Gasthalter & Co.

Tel: (212) 257-4170

Email: RefreshingAPD@gasthalter.com

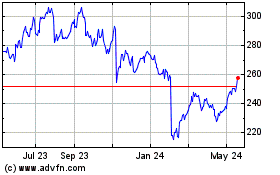

Air Products and Chemicals (NYSE:APD)

Historical Stock Chart

From Dec 2024 to Jan 2025

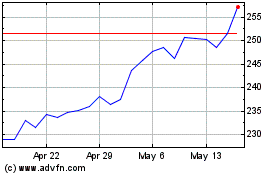

Air Products and Chemicals (NYSE:APD)

Historical Stock Chart

From Jan 2024 to Jan 2025