0001428205false00014282052024-11-082024-11-080001428205us-gaap:SeriesCPreferredStockMember2024-11-082024-11-080001428205us-gaap:CommonStockMember2024-11-082024-11-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_____________

FORM 8-K

______________

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) November 8, 2024

ARMOUR Residential REIT, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | |

| Maryland | 001-34766 | 26-1908763 |

(State or Other Jurisdiction

of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | |

| 3001 Ocean Drive, Suite 201 | | |

| Vero Beach, | Florida | | 32963 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(772) 617-4340

(Registrant’s Telephone Number, Including Area Code)

n/a

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of Each Class | | Trading symbols | | Name of Exchange on which registered |

| Preferred Stock, 7.00% Series C Cumulative Redeemable | | ARR-PRC | | New York Stock Exchange |

| Common Stock, $0.001 par value | | ARR | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by a check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Item 7.01. Regulation FD Disclosure.

On November 8, 2024, ARMOUR Residential REIT, Inc. (“ARMOUR”) produced for distribution a presentation, which contains updates on ARMOUR's financial position, business and operations. Attached as Exhibit 99.1 to this report is the presentation produced by ARMOUR.

The presentation attached to this report as Exhibit 99.1 is furnished pursuant to this Item 7.01 and shall not be deemed filed in this or any other filing of ARMOUR under the Securities Exchange Act of 1934, as amended, unless expressly incorporated by specific reference in any such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| | |

| Exhibit No. | Description |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: November 8, 2024

ARMOUR RESIDENTIAL REIT, INC.

By: /s/ Gordon M. Harper

Name: Gordon M. Harper

Title: Chief Financial Officer

ARMOUR RESIDENTIAL REIT, INC.

| | | | | |

| Monthly Update | NOVEMBER 2024 |

ARMOUR Residential REIT, Inc. (“ARMOUR”; NYSE: ARR) brings private capital into the mortgage markets to support home ownership for a broad and diverse spectrum of Americans. We seek to create shareholder value through thoughtful investment and risk management of a leveraged and diversified portfolio of mortgage-backed securities issued or guaranteed by U.S Government-sponsored entities. We rely on the decades of experience of our management team for (i) MBS securities portfolio analysis and selection, (ii) access to equity capital and repurchase financing on potentially attractive rates and terms, and (iii) hedging and liquidity strategies to moderate interest rate and MBS price risk. We prioritize maintaining common share dividends appropriate for the intermediate term rather than focusing on short-term market fluctuations.

ARMOUR is externally managed by ARMOUR Capital Management LP, who is also the majority owner of BUCKLER Securities LLC, a FINRA registered broker-dealer that is the largest provider of ARMOUR’s repurchase financing.

| | | | | |

| ARMOUR Key Data as of 10/31/2024 |

| Common Stock Price | $ | 18.75 | |

Debt-Equity (1) | 8.5 |

Implied Leverage (2) | 8.5 |

Total Liquidity (3) (in millions) | $ | 541.7 | |

| |

| Dividend Information |

| November 2024 Common Dividend | $ | 0.24 | |

| Common Ex-Dividend Date/Record Date | 11/15/2024 |

| Pay Date | 11/27/2024 |

| | | | | | | | | | | |

| ARMOUR Portfolio | % of Portfolio | Current Value (millions) | Effective Duration Using Current Values |

| Agency CMBS | 4.3 | % | $512 | 4.05 |

| 30 Year Fixed Rate Pools | 95.7 | % | $11,464 | 4.68 |

| Conventionals | 89.4 | % | $10,712 | 4.81 |

| 30y 2.5s | 3.4 | % | $413 | 7.92 |

| 30y 3.0s | 8.0 | % | $957 | 7.41 |

| 30y 3.5s | 10.0 | % | $1,199 | 6.28 |

| 30y 4.0s | 8.2 | % | $977 | 5.80 |

| 30y 4.5s | 7.8 | % | $939 | 5.22 |

| 30y 5.0s | 14.5 | % | $1,734 | 4.79 |

| 30y 5.5s | 15.6 | % | $1,873 | 3.90 |

| 30y 6.0s | 17.0 | % | $2,041 | 3.07 |

| 30y 6.5s | 4.8 | % | $579 | 2.13 |

| Ginnie Mae | 6.3 | % | $752 | 2.75 |

| 30y 5.5s | 3.8 | % | $450 | 3.15 |

| 30y 6.0s | 2.5 | % | $301 | 2.15 |

| Agency Portfolio | 100.0 | % | $11,976 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Total Portfolio | 100.0 | % | $11,976 | |

| | | |

| | | |

Portfolio Data as of 10/31/24.

| | | | | | | | | | | | | | | | | |

| ARMOUR Repo | Principal Borrowed (millions) | % of Repo Positions with ARMOUR | Weighted Average Original Term (days) | Weighted Average Remaining Term (days) | Longest Maturity (days) |

BUCKLER Securities LLC (4) | $4,793 | 43.6 | % | 19 | | 11 | | 32 |

| All Other Counterparties | $6,196 | 56.4 | % | 38 | | 18 | | 82 |

Total (5) | $10,989 | 100.0 | % | 29 | | 15 | | |

| | | | | | | | | | | |

| ARMOUR Interest Rate Swaps Maturity (months) | Notional Amount (millions) | Weighted Average Remaining Term (months) | Weighted Average Rate |

| 0-12 | $73 | 6 | | 0.06 | |

| 13-24 | $53 | 17 | | 0.22 | |

| 25-36 | $1,129 | 28 | | 0.65 | |

| 37-48 | $0 | — | | — | |

| 49-60 | $525 | 59 | | 0.51 | |

| 61-72 | $927 | 67 | | 0.49 | |

| 73-84 | $1,800 | 76 | | 1.01 | |

| 85-96 | $700 | 91 | | 1.39 | |

| 97-108 | $325 | 105 | | 3.64 | |

| 109-120 | $1,450 | 116 | | 3.92 | |

| Total | $6,982 | 76 | | 1.59 | |

Certain statements made in this presentation regarding ARMOUR Residential REIT, Inc. (“ARMOUR” or the “Company”), and any other statements regarding ARMOUR’s future expectations, beliefs, goals or prospects constitute “forward-looking statements” made within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Any statements that are not statements of historical fact (including statements containing the words “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions) should also be considered forward-looking statements. Forward-looking statements include but are not limited to statements regarding the projections and future plans for ARMOUR’s business, growth and operational improvements. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of ARMOUR’s control. A number of important factors could cause actual results or events to differ materially from those indicated by such forward-looking statements. Additional information concerning these factors and risks are contained in the Company’s most recent annual and quarterly reports and other reports filed with the Securities and Exchange Commission. ARMOUR assumes no obligation to update the information in this communication, except as otherwise required by law. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof.

This material is for information purposes only and does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation for any securities or financial instruments. The statements, information and estimates contained herein are based on information that the Company believes to be reliable as of today's date unless otherwise indicated. ARMOUR cannot guarantee future results, levels of activity, performance or achievements.

Pricing and duration information are estimates provided by independent third-party providers based on models that require inputs and assumptions. Actual realized prices and durations will depend on a number of factors that cannot be predicted with certainty and may be materially different from estimates.

Estimates do not reflect any costs of operation of ARMOUR.

THE INFORMATION PRESENTED HEREIN IS UNAUDITED AND NOT REVIEWED BY OUR INDEPENDENT PUBLIC ACCOUNTANTS.

Footnotes

1.Total Repo divided by Shareholder’s Equity.

2.Total Repo plus TBA market value minus forward settling net sales and purchases divided by Shareholder’s Equity.

3.Total Liquidity is cash plus unencumbered Agency and US Government securities. Excludes any forward settling sales.

4.BUCKLER Securities LLC is a FINRA registered broker-dealer affiliated with ARMOUR REIT.

5.ARMOUR Repo breakdown does not include reverse repo for Treasury Short positions.

6.ARMOUR’s Treasury Shorts and Treasury Futures have a weighted average duration of 7.3 years and 5.1 years, respectively.

Portfolio Data as of 10/31/24.

Cover Document

|

Nov. 08, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 08, 2024

|

| Entity Registrant Name |

ARMOUR Residential REIT, Inc.

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

001-34766

|

| Entity Tax Identification Number |

26-1908763

|

| Entity Address, Address Line One |

3001 Ocean Drive, Suite 201

|

| Entity Address, City or Town |

Vero Beach,

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

32963

|

| City Area Code |

772

|

| Local Phone Number |

617-4340

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001428205

|

| Amendment Flag |

false

|

| Series C Preferred Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock, 7.00% Series C Cumulative Redeemable

|

| Trading Symbol |

ARR-PRC

|

| Security Exchange Name |

NYSE

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $0.001 par value

|

| Trading Symbol |

ARR

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesCPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

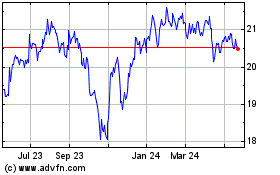

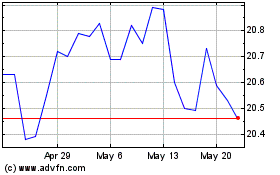

ARMOUR Residential REIT (NYSE:ARR-C)

Historical Stock Chart

From Jan 2025 to Feb 2025

ARMOUR Residential REIT (NYSE:ARR-C)

Historical Stock Chart

From Feb 2024 to Feb 2025