0001747079false00017470792023-11-012023-11-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________

FORM 8-K

_______________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 1, 2023

________________________

BALLY'S CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware | 001-38850 | 20-0904604 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | | | | |

| 100 Westminster Street |

| Providence | RI | 02903 |

| (Address of Principal Executive Offices and Zip Code) |

________________________

(401) 475-8474

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12 (b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common stock, $0.01 par value | BALY | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 1, 2023, Bally's Corporation published a press release to report its financial results for the third quarter ended September 30, 2023. The press release is furnished as Exhibit 99.1 hereto and is incorporated herein by reference.

The information contained in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, is being furnished and will not be deemed “filed” for any purpose, including for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, and will not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or under the Exchange Act, except as otherwise expressly stated in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits | | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. | | | | | | | | |

| BALLY'S CORPORATION |

| By: | /s/ Marcus Glover |

| Name: | Marcus Glover |

| Title: | Chief Financial Officer |

Date: November 1, 2023

BALLY’S CORPORATION ANNOUNCES THIRD QUARTER 2023 RESULTS

PROVIDENCE, R.I., - November 1, 2023 - Bally’s Corporation (NYSE: BALY) today reported financial results for the third quarter ended September 30, 2023.

Third Quarter 2023 Financial Highlights

•Record company-wide revenue of $632.5 million, an increase of 9.4% year-over-year

•Record Casinos & Resorts revenue of $359.0 million, up 9.3% year-over-year

•International Interactive revenue of $243.9 million, up 7.2% year-over-year, driven by a 13.1% increase in the UK as market share gains continue

•Successfully opened the Chicago Temporary Casino in September

•Announced deal to operate the concession at Bally’s Golf Links, a golf course at Ferry Point in the Bronx, NY

Summary of Financial Results

| | | | | | | | | | | | | | | |

| Quarter Ended September 30, | | |

| (in thousands) | 2023 | | 2022 | | | | |

| Consolidated Revenue | $ | 632,477 | | | $ | 578,249 | | | | | |

| | | | | | | |

| | | | | | | |

| Casinos & Resorts Revenue | 359,026 | | | 328,540 | | | | | |

| International Interactive Revenue | 243,884 | | | 227,579 | | | | | |

| North America Interactive Revenue | 29,567 | | | 22,130 | | | | | |

| Net (loss) income | (61,802) | | | 593 | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Adjusted EBITDAR(1) | 173,217 | | | | | | | |

|

________________________________

(1) Refer to tables in this press release for a reconciliation of this non-GAAP financial measure to the most directly comparable measure calculated in accordance with GAAP.

Robeson Reeves, Bally’s Chief Executive Officer, said “Bally’s continued to generate very solid operating results across all three of our business segments as revenues rose to $632.5 million, a 9.4% year-over-year increase, while also achieving significant development and project milestones. These included the highly anticipated opening of our Chicago Temporary Casino as well as the completion of our reconceptualized Kansas City redevelopment. Additionally, we successfully rolled out our new Bally Bet OSB app, strengthening our solid foundation as we approach 2024.

Our core Casinos & Resorts segment produced record third-quarter revenues of $359.0 million, a 9.3% increase compared to the third quarter of 2022. Bally’s International Interactive continues its impressive performance, with revenues increasing 7.2% year-over-year, led by our robust UK business, where revenues rose by 13.1% year-over-year in USD. We continue to gain incremental share in the UK due to our timely adaptations in response to regulatory changes. Our formula of increasing Average Revenue Per User (ARPU) and First-Time Depositors (FTDs), while reducing Cost Per Acquisition (CPA), is yielding positive results. Our Bally Bet rollout will continue in the fourth quarter, and we are extremely pleased with the user engagement and the technology integration.”

Bally’s had a consolidated net loss in the quarter of $61.8 million and generated Adjusted EBITDAR of $173.2 million and Adjusted EBITDA of $141.6 million. For the nine-month period through September 2023, net income was $90.9 million with Adjusted EBITDAR of $492.2 million and Adjusted EBITDA of $398.0 million.

In terms of segment contribution highlights for the quarter, Casinos & Resorts generated Adjusted EBITDAR of $118.2 million, which included straight-line GAAP rent expense of $31.6 million. International Interactive generated Adjusted EBITDAR of $85.5 million this quarter, a 12.0% year-over-year increase compared with $76.3 million last year. North America Interactive reported an Adjusted EBITDAR loss of $(17.6) million this quarter compared with an Adjusted EBITDAR loss of $(19.7) million for the prior year period.

George Papanier, Bally’s President, added, “Bally’s portfolio of assets remains well-positioned, and has demonstrated significant year-over-year revenue growth. We continue to take share in our respective markets, which the monthly gaming data illustrates, as we outperformed peers in most states. While we are closely monitoring consumer spending, we haven’t seen major shifts in customer behavior, with the exception of very specific instances.

In addition, we are pleased with the September opening of our Chicago Temporary Casino. We have satisfied our critical operating criteria and execution milestones, and expect to receive the necessary regulatory support to expand and accelerate marketing initiatives beginning later this month, which will enable us to bolster revenue and EBITDAR. The completion of our property redevelopment in Kansas City was extremely well-received by our patrons as well, and we expect to ramp up our marketing efforts this holiday season to re-introduce yet another Bally’s flagship property. Our portfolio’s near-term capex cycle has come to its end, and we expect to benefit from our capital improvements over the last two years throughout 2024.”

2023 Guidance

Bally’s is adjusting the revenue guidance provided on May 9, 2023, for the remainder of the year to $2.4 billion to $2.5 billion. The guidance range for Adjusted EBITDAR is now $640 million to $655 million. This change reflects the later-than-expected opening of our Chicago Temporary Casino and our decision to pause reinvestment and operational changes at the Tropicana while awaiting MLB’s decision on the Oakland A’s relocation. The MLB’s vote on the Oakland A’s relocation plans is scheduled to take place in November. We are also updating recent foreign exchange headwinds at Bally’s International Interactive due to the strengthening of the U.S. dollar. Guidance for rent expense remains at $125 million (for straight-line GAAP rent while actual cash rent is $119 million) for the full year 2023.

Bally’s is maintaining its 2023 capital expenditure guidance of $160 million in aggregate as we complete our capex expansion cycle. This amount excludes the investment in the Chicago Temporary Casino development project, which is now complete.

Bally’s guidance is based on current plans and expectations and contains several assumptions. The guidance is subject to a number of known and unknown uncertainties and risks, including those discussed under “Cautionary Note Regarding Forward Looking Statements” set forth below.

Reconciliation of GAAP Measures to Non-GAAP Measures

To supplement the financial information presented on a generally accepted accounting principles (“GAAP”) basis, Bally’s has included in this earnings release non-GAAP financial measures for consolidated Adjusted EBITDA and segment Adjusted EBITDAR, which exclude certain items described below. The reconciliations of these non-GAAP financial measures to their comparable GAAP financial measures are presented in the tables appearing below.

“Adjusted EBITDA” is earnings, or loss, for Bally’s, or where noted Bally’s reportable segments, before, in each case, interest expense, net of interest income, provision (benefit) for income taxes, depreciation and amortization, non-operating (income) expense, acquisition and other transaction related costs, share-based compensation, and certain other gains or losses as well as, when presented for Bally’s reporting segments, an adjustment related to the allocation of corporate costs among segments.

“Segment Adjusted EBITDAR” is Adjusted EBITDA (as defined above) for Bally’s reportable segments, plus rent expense associated with triple net operating leases for the real estate assets used in the operation of the Bally’s casinos and the assumption of the lease for real estate and land underlying the operations of the Bally’s Lake Tahoe property. For the International Interactive, North America Interactive, and Other segments, Segment Adjusted EBITDAR and segment Adjusted EBITDA are equivalent due to a lack of triple net operating lease for real estate assets used in those segments.

Management has historically used consolidated Adjusted EBITDA and segment Adjusted EBITDAR when evaluating operating performance because Bally’s believes that these metrics are necessary to provide a full understanding of Bally’s core operating results and as a means to evaluate period-to-period performance. Management also believes that consolidated Adjusted EBITDA and segment Adjusted EBITDAR are measures that are widely used for evaluating operating performance of companies in Bally’s industry and a principal basis for valuing such companies as well. Consolidated Adjusted EBITDAR is used outside of our financial statements solely as a valuation metric. Management believes Consolidated Adjusted EBITDAR is an additional metric traditionally used by analysts in valuing gaming companies subject to triple net leases since it eliminates the effects of variability in leasing methods and capital structures. Consolidated Adjusted EBITDA and segment Adjusted EBITDAR should not be construed as alternatives to GAAP net income as an indicator of Bally’s performance. In addition, consolidated Adjusted EBITDA or segment Adjusted EBITDAR as used by Bally’s may not be defined in the same manner as other companies in Bally’s industry, and, as a result, may not be comparable to similarly titled non-GAAP financial measures of other companies.

Bally’s does not provide a reconciliation of Adjusted EBITDAR on a forward-looking basis to net income, its most comparable GAAP financial measure, because Bally’s is unable to forecast the amount or significance of certain items required to develop meaningful comparable GAAP financial measures without unreasonable efforts. These items include depreciation, impairment charges, gains or losses on retirement of debt, acquisition, integration and restructuring expenses, interest expense, share-based compensation expense, professional and advisory fees associated with Bally’s capital return program and variations in effective tax rate, which are difficult to predict and estimate and are primarily dependent on future events, but which are excluded from Bally’s calculation of Adjusted EBITDAR. Bally’s believes that the probable significance of providing this forward-looking valuation metric without a reconciliation to the most directly comparable GAAP metric, is that investors and analysts will have certain information that Bally’s believes is useful and meaningful in valuing its business. Investors are cautioned that Bally’s cannot predict the occurrence, timing or amount of all non-GAAP items that may be excluded from Adjusted EBITDAR in the future. Accordingly, the actual effect of these items, when determined, could potentially be significant to the calculation of Adjusted EBITDAR.

Third Quarter Conference Call

Bally’s third quarter 2023 earnings conference call and audio webcast will be held today, Wednesday, November 1, 2023, at 11:00 a.m. EDT. To access the conference call, please dial (800) 579-2543 (U.S. toll-free) and reference conference ID BALYQ323. The webcast of the call will be available to the public, on a listen-only basis, via the Internet at the Investors section of Bally’s website at www.ballys.com. An online archive of the webcast will be available on Bally’s website for 120 days. Supplemental materials have also been posted to the Investors section of the website under Events & Presentations.

About Bally’s Corporation

Bally's Corporation is a global casino-entertainment company with a growing omni-channel presence of Online Sports Betting and iGaming offerings. It currently owns and manages 16 casinos across 10 states, a golf course in New York, a horse racetrack in Colorado, and has access to OSB licenses in 18 states. It also owns Bally's Interactive International, formerly Gamesys Group, a leading, global, online gaming operator, Bally Bet, a first-in-class sports betting platform, and Bally Casino, a growing iCasino platform.

With 10,500 employees, the Company's casino operations include approximately 15,000 slot machines, 600 table games and 5,300 hotel rooms. Upon completing the construction of a permanent casino facility in Chicago, IL, and

a land-based casino near the Nittany Mall in State College, PA, Bally's will own and/or manage 17 casinos across 11 states. Its shares trade on the New York Stock Exchange under the ticker symbol "BALY".

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements may generally be identified by the use of words such as “anticipate,” “believe,” “expect,” “intend,” “plan” and “will” or, in each case, their negative, or other variations or comparable terminology. These forward-looking statements include all matters that are not historical facts. By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. As a result, these statements are not guarantees of future performance and actual events may differ materially from those expressed in or suggested by the forward-looking statements. Any forward-looking statement made by Bally’s in this press release, its reports filed with the Securities and Exchange Commission (“SEC”) and other public statements made from time-to-time speak only as of the date made. New risks and uncertainties come up from time to time, and it is impossible for Bally’s to predict or identify all such events or how they may affect it. Bally’s has no obligation, and does not intend, to update any forward-looking statements after the date hereof, except as required by federal securities laws. Factors that could cause these differences include those included in Bally’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other reports filed by Bally’s with the SEC. These statements constitute Bally’s cautionary statements under the Private Securities Litigation Reform Act of 1995.

| | | | | | | | |

| Investor Contact | | Media Contact |

| Marcus Glover | | Kekst CNC |

Chief Financial Officer | | 646-847-6102 |

| 401-475-8564 | | BallysMediaInquiries@kekstcnc.com |

| IR@ballys.com | | |

BALLY’S CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (unaudited)

(In thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenue: | | | | | | | |

| Gaming | $ | 508,895 | | | $ | 465,733 | | | $ | 1,489,086 | | | $ | 1,384,523 | |

| Non-gaming | 123,582 | | | 112,516 | | | 348,317 | | | 294,493 | |

| Total revenue | 632,477 | | | 578,249 | | | 1,837,403 | | | 1,679,016 | |

| | | | | | | |

| Operating (income) costs and expenses: | | | | | | | |

| Gaming | 229,131 | | | 197,196 | | | 665,731 | | | 620,459 | |

| Non-gaming | 58,041 | | | 53,494 | | | 162,661 | | | 140,515 | |

| General and administrative | 230,582 | | | 200,044 | | | 732,147 | | | 579,800 | |

| | | | | | | |

| Gain from sale-leaseback, net | — | | | — | | | (374,321) | | | (50,766) | |

| Depreciation and amortization | 77,487 | | | 73,853 | | | 231,235 | | | 227,507 | |

| Total operating costs and expenses | 595,241 | | | 524,587 | | | 1,417,453 | | | 1,517,515 | |

| Income from operations | 37,236 | | | 53,662 | | | 419,950 | | | 161,501 | |

| | | | | | | |

| Other income (expense): | | | | | | | |

| Interest expense, net | (70,630) | | | (53,572) | | | (200,987) | | | (145,085) | |

| | | | | | | |

| Other non-operating income, net | 15,528 | | | 1,640 | | | 24,949 | | | 46,563 | |

| Total other income (expense), net | (55,102) | | | (51,932) | | | (176,038) | | | (98,522) | |

| | | | | | | |

| (Loss) income before income taxes | (17,866) | | | 1,730 | | | 243,912 | | | 62,979 | |

| Provision for income taxes | 43,936 | | | 1,137 | | | 153,029 | | | 996 | |

| Net (loss) income | $ | (61,802) | | | $ | 593 | | | $ | 90,883 | | | $ | 61,983 | |

| | | | | | | |

| Basic (loss) earnings per share | $ | (1.15) | | | $ | 0.01 | | | $ | 1.68 | | | $ | 1.05 | |

| Weighted average common shares outstanding - basic | 53,580 | | | 57,020 | | | 53,961 | | | 59,170 | |

| Diluted (loss) earnings per share | $ | (1.15) | | | $ | 0.01 | | | $ | 1.67 | | | $ | 1.05 | |

| Weighted average common shares outstanding - diluted | 53,580 | | | 57,062 | | | 54,276 | | | 59,238 | |

Revenue and Reconciliation of Net (Loss) Income and Net (Loss) Income Margin to

Adjusted EBITDA and Adjusted EBITDA Margin (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

(In thousands, except percentages) | 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | $ | 632,477 | | | $ | 578,249 | | | $ | 1,837,403 | | | $ | 1,679,016 | |

| | | | | | | |

| Net (loss) income | $ | (61,802) | | | $ | 593 | | | $ | 90,883 | | | $ | 61,983 | |

| Interest expense, net of interest income | 70,630 | | | 53,572 | | | 200,987 | | | 145,085 | |

| Provision for income taxes | 43,936 | | | 1,137 | | | 153,029 | | | 996 | |

| Depreciation and amortization | 77,487 | | | 73,853 | | | 231,235 | | | 227,507 | |

Non-operating (income) expense (1) | (4,276) | | | (1,387) | | | (13,528) | | | (44,315) | |

| Foreign exchange (gain) loss | (8,459) | | | (253) | | | (2,512) | | | (2,248) | |

Transaction costs(2) | 20,953 | | | 18,052 | | | 59,405 | | | 39,595 | |

Restructuring charges(3) | 411 | | | — | | | 20,673 | | | — | |

Decommissioning costs(4) | — | | | — | | | 2,343 | | | — | |

| Share-based compensation | 6,257 | | | 6,715 | | | 18,587 | | | 18,132 | |

| Gain on sale-leaseback, net | — | | | — | | | (374,321) | | | (50,766) | |

Planned business divestiture(5) | 35 | | | — | | | 2,089 | | | — | |

| Impairment charges | — | | | — | | | 9,653 | | | — | |

Other, net(6) | (3,549) | | | (1,314) | | | (507) | | | 6,728 | |

| Adjusted EBITDA | $ | 141,623 | | | $ | 150,968 | | | $ | 398,016 | | | $ | 402,697 | |

Rent expense associated with triple net operating leases(7) | $ | 31,594 | | | | | $ | 94,152 | | | |

| Adjusted EBITDAR | $ | 173,217 | | | | | $ | 492,168 | | | |

| | | | | | | |

| Net (loss) income margin | (9.8) | % | | 0.1 | % | | 4.9 | % | | 3.7 | % |

| Adjusted EBITDA margin | 22.4 | % | | 26.1 | % | | 21.7 | % | | 24.0 | % |

________________________________

(1) Non-operating (income) expense includes: (i) change in value of naming rights liabilities, (ii) gain on extinguishment of debt, (iii) non-operating items of equity method investments including our share of net income or loss on an investment and depreciation expense related to our Rhode Island joint venture, and (iv) other (income) expense, net.

(2) Includes acquisition, integration and other transaction related costs, financing costs incurred in connection with the Hard Rock Biloxi and Tiverton sale lease-back transactions, the prior year tender offer process, and costs incurred to address the Standard General takeover bid.

(3) Restructuring costs related to the Interactive business workforce reduction.

(4) Costs related to the decommissioning of the Company's sports betting platform in favor of outsourcing the platform solution to third parties.

(5) Losses related to a North America Interactive business that Bally’s is marketing as held-for-sale as of September 30, 2023.

(6) Other includes the following items: (i) non-routine legal expenses and settlement charges for matters outside the normal course of business, (ii) demolition costs related to a failed parking garage structure at our Bally’s Atlantic City property and (iii) other individually de minimis expenses.

(7) Consists of the operating lease components contained within our triple net master lease dated June 4, 2021 with GLPI for the real estate assets used in the operation of Bally’s Evansville, Bally’s Dover, Bally’s Quad Cities, Bally’s Black Hawk, Hard Rock Biloxi and Bally’s Tiverton, the individual triple net lease with GLPI for the land underlying the operations of Tropicana Las Vegas, and the triple net lease assumed in connection with the acquisition of Bally’s Lake Tahoe for real estate and land underlying the operations of the Bally’s Lake Tahoe facility.

Revenue and Segment Adjusted EBITDAR (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

(In thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | | | | | | | |

| Casinos & Resorts | $ | 359,026 | | | $ | 328,540 | | | $ | 1,020,974 | | | $ | 908,385 | |

| International Interactive | 243,884 | | | 227,579 | | | 737,230 | | | 715,224 | |

| North America Interactive | 29,567 | | | 22,130 | | | 79,199 | | | 55,407 | |

| Total | $ | 632,477 | | | $ | 578,249 | | | $ | 1,837,403 | | | $ | 1,679,016 | |

| | | | | | | |

Adjusted EBITDAR(1) | | | | | | | |

| Casinos & Resorts | $ | 118,184 | | | $ | 118,740 | | | $ | 334,312 | | | $ | 303,413 | |

| International Interactive | 85,477 | | | 76,313 | | | 250,352 | | | 232,252 | |

| North America Interactive | (17,561) | | | (19,672) | | | (45,809) | | | (59,871) | |

| Other | (12,883) | | | (12,578) | | | (46,687) | | | (38,380) | |

| Total | $ | 173,217 | | | | | $ | 492,168 | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

________________________________

(1) Segment Adjusted EBITDAR is Bally’s reportable segment GAAP measure and its primary measure for profit or loss for its reportable segments. “Segment Adjusted EBITDAR” is Adjusted EBITDA (as defined above) for Bally’s reportable segments, plus rent expense associated with triple net operating leases for the real estate assets used in the operation of the Bally’s casinos and the assumption of the lease for real estate and land underlying the operations of the Bally’s Lake Tahoe property. For the International Interactive, North America Interactive, and Other segments, segment Adjusted EBITDAR and segment Adjusted EBITDA are equivalent due to a lack of triple net operating lease for real estate assets used in those segments.

Selected Financial Information (unaudited)

Balance Sheet Data

| | | | | | | | | | | |

| (in thousands) | September 30,

2023 | | December 31,

2022 |

| Cash and cash equivalents | $ | 178,526 | | | $ | 212,515 | |

| Restricted cash | 119,311 | | | 52,669 | |

| | | |

Term Loan Facility(1) | $ | 1,910,962 | | | $ | 1,925,550 | |

| Revolving Credit Facility | 115,000 | | | 137,000 | |

| | | |

| 5.625% Senior Notes due 2029 | 750,000 | | | 750,000 | |

| 5.875% Senior Notes due 2031 | 735,000 | | | 750,000 | |

| Less: Unamortized original issue discount | (24,719) | | | (27,729) | |

| Less: Unamortized deferred financing fees | (41,297) | | | (46,266) | |

| Long-term debt, including current portion | $ | 3,444,946 | | | $ | 3,488,555 | |

| Less: Current portion of Term Loan and Revolving Credit Facility | $ | (19,450) | | | $ | (19,450) | |

| Long-term debt, net of discount and deferred financing fees; excluding current portion | $ | 3,425,496 | | | $ | 3,469,105 | |

Cash Flow Data

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (in thousands) | 2023 | | 2022 | | 2021 | | 2023 | | 2022 | | 2021 |

| Capital expenditures | $ | 146,685 | | | $ | 51,282 | | | $ | 29,347 | | | $ | 266,231 | | | $ | 167,363 | | | $ | 65,132 | |

| Cash paid for internally developed software | 21,561 | | | 14,330 | | | 2,026 | | | 35,903 | | | 45,785 | | | 2,026 | |

| Acquisition of gaming licenses | — | | | 1,470 | | | 4,159 | | | 10,150 | | | 53,030 | | | 4,409 | |

Cash payments associated with triple net operating leases(2) | 29,871 | | | 13,338 | | | 11,353 | | | 88,481 | | | 36,338 | | | 15,367 | |

________________________________

(1) During the quarter ending September 30, 2023, the Company entered certain currency swaps to synthetically convert $400 million of its Term Loan Facility to an equivalent fixed-rate Euro-denominated instrument due October 2028 paying a fixed-rate coupon of approximately 6.74% per annum. Such currency swaps as of September 30, 2023, which had an original effective conversion rate of 1.082 and €369.7 million notional amount at inception, reflected a gain of $9.0 million when converted to US dollar as of September 30, 2023, or an equivalent in US dollars of $391.0 million.

(2) Consists of payments made in connection with Bally’s triple net operating leases, as defined above.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

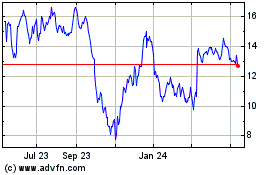

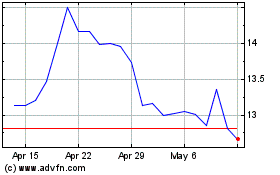

Ballys (NYSE:BALY)

Historical Stock Chart

From Apr 2024 to May 2024

Ballys (NYSE:BALY)

Historical Stock Chart

From May 2023 to May 2024