Brookfield Asset Management Shareholder Meeting

December 02 2024 - 4:30PM

Brookfield Asset Management Ltd. (NYSE: BAM, TSX: BAM) (“BAM”)

today announced that due to a postal strike in Canada, it will not

be able to mail its meeting materials to meet regulatory

requirements for its upcoming special meeting of shareholders (the

“Meeting”) originally to be held on December 20, 2024. Brookfield

is working with regulators to ensure these requirements are met in

the most expeditious manner possible and continues to believe that

it will be able to meet its timeline of closing the transaction in

the first quarter of 2025.

BAM will file an amended notice of meeting and

record date on SEDAR+ at www.sedarplus.ca and on EDGAR at

www.sec.gov with the new date for the Meeting once it has been

determined. The record date for determining shareholders eligible

to vote at the postponed Meeting will remain November 12, 2024.

The Meeting has been called to consider the

previously announced arrangement (the “Arrangement”), which is

still expected to close in early 2025, subject to court approval

and other customary closing conditions. Additional information

regarding the Arrangement and the details of the Meeting will be

provided in the information circular for the Meeting, which will

also be filed by BAM on SEDAR+ at www.sedarplus.ca and on

EDGAR at www.sec.gov.

About Brookfield Asset

Management

BAM is a leading global alternative asset

manager with over $1 trillion of assets under management across

renewable power and transition, infrastructure, private equity,

real estate, and credit. BAM invests client capital for the

long-term with a focus on real assets and essential service

businesses that form the backbone of the global economy. BAM offers

a range of alternative investment products to investors around the

world — including public and private pension plans, endowments and

foundations, sovereign wealth funds, financial institutions,

insurance companies and private wealth investors. BAM draws on

Brookfield’s heritage as an owner and operator to invest for value

and generate strong returns for its clients, across economic

cycles.

For more information, please visit BAM’s website

at www.bam.brookfield.com or contact:

| Media:Simon

MaineTel: +44 739 890 9278Email:

simon.maine@brookfield.com |

Investor

Relations:Jason FooksTel: (212) 417-2442Email:

jason.fooks@brookfield.com |

| |

|

Forward Looking Statements

This press release contains “forward-looking

information” within the meaning of Canadian provincial securities

laws and “forward-looking statements” within the meaning of

the U.S. Securities Act of 1933,

the U.S. Securities Exchange Act of 1934, “safe harbor”

provisions of the United States Private Securities Litigation

Reform Act of 1995 and in any applicable Canadian securities

regulations (collectively, “forward-looking statements”).

Forward-looking statements include statements that are predictive

in nature, depend upon or refer to future results, events or

conditions, and include, but are not limited to, statements which

reflect management’s current estimates, beliefs and assumptions and

which are in turn based on our experience and perception of

historical trends, current conditions and expected future

developments, as well as other factors management believes are

appropriate in the circumstances. The estimates, beliefs and

assumptions of BAM and BN are inherently subject to

significant business, economic, competitive and other uncertainties

and contingencies regarding future events and as such, are subject

to change. Forward-looking statements are typically identified by

words such as “expect”, “anticipate”, “believe”, “foresee”,

“could”, “estimate”, “goal”, “intend”, “plan”, “seek”, “strive”,

“will”, “may” and “should” and similar expressions. In particular,

the forward-looking statements contained in this press release

include statements referring to the expected timing of the Meeting

and expected closing of the Arrangement. Factors that could cause

actual results, performance, achievements or events to differ from

current expectations include, among others, risks and uncertainties

related to: obtaining approvals, rulings, court orders and

consents, or satisfying other requirements, necessary or desirable

to permit or facilitate completion of the Arrangement (including

regulatory and shareholder approvals); future factors that may

arise making it inadvisable to proceed with, or advisable to delay,

all or part of the Arrangement; and business cycles, including

general economic conditions.

Certain risks and uncertainties specific to the

proposed Arrangement will be further described in the management

information circular to be mailed to BAM shareholders in advance of

the Meeting. Other factors, risks and uncertainties not presently

known to BAM or BN or that BAM and BN currently believe are not

material could also cause actual results or events to differ

materially from those expressed or implied by statements containing

forward-looking statements. Readers are cautioned not to place

undue reliance on statements containing forward-looking statements

that are included in this press release, which are made as of the

date of this press release, and not to use such information for

anything other than their intended purpose. BAM and BN disclaim any

obligation or intention to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, except as required by applicable law.

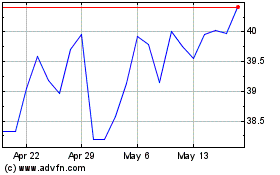

Brookfield Asset Managem... (NYSE:BAM)

Historical Stock Chart

From Nov 2024 to Dec 2024

Brookfield Asset Managem... (NYSE:BAM)

Historical Stock Chart

From Dec 2023 to Dec 2024