Broadstone Net Lease, Inc. (NYSE: BNL) (“Broadstone,” “BNL,” the

“Company,” “we,” “our,” or “us”), today announced the closing of a

$1.5 billion Amended and Restated Credit Agreement, inclusive of a

$1.0 billion revolving credit facility and $500 million term loan

(together, the “Credit Facilities”). The Company also entered into

conforming amendments to its 2027 and 2029 term loans.

The amended revolving credit facility has an initial term of

four years, maturing in March 2029, and includes two six-month

extension options that can be exercised at the Company’s election.

The new term loan replaces the Company’s existing $400 million term

loan due February 2026, has an initial term of three years,

maturing in March 2028, and includes two 12-month extension options

that can be exercised at the Company’s election. The term loan also

includes a three-month delayed-draw feature for the incremental

$100 million of commitments. Together, the terms of the Credit

Facilities enhance the Company’s financial flexibility, providing

increased liquidity, improved borrowing rates, and favorable

adjustments to financial covenants that align with our investment

strategy.

Kevin Fennell, Chief Financial Officer of Broadstone, commented,

“We are grateful for the strong support of our banking partners,

demonstrating their continued confidence in BNL. This successful

transaction significantly enhances our financial flexibility and

increases our weighted average debt maturity profile. With ample

liquidity, no near-term debt maturities until April 2027, and a

robust pipeline of investment opportunities, we are well positioned

to execute on our growth objectives through our core building

blocks.”

J.P. Morgan Chase Bank, N.A., Capital One, National Association,

Bank of Montreal, Manufacturers and Traders Trust Company, and

Truist Bank acted as Joint Bookrunners and Joint Lead Arrangers.

Other Joint Lead Arrangers included Keybanc Capital Markets, Inc.,

Regions Capital Markets, TD Securities (USA) LLC, U.S. Bank

National Association, and Huntington National Bank.

About Broadstone Net Lease, Inc.

BNL is an industrial-focused, diversified net lease REIT that

invests in primarily single-tenant commercial real estate

properties that are net leased on a long-term basis to a

diversified group of tenants. Utilizing an investment strategy

underpinned by strong fundamental credit analysis and prudent real

estate underwriting, as of December 31, 2024, BNL’s diversified

portfolio consisted of 765 individual net leased commercial

properties with 758 properties located in 44 U.S. states and seven

properties located in four Canadian provinces across the

industrial, retail, and other property types.

Forward-Looking Statements

This press release contains “forward-looking” statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, regarding, among other things, our plans, strategies, and

prospects, both business and financial. Such forward-looking

statements can generally be identified by our use of

forward-looking terminology such as “outlook,” “potential,” “may,”

“will,” “should,” “could,” “seeks,” “approximately,” “projects,”

“predicts,” “expect,” “intends,” “anticipates,” “estimates,”

“plans,” “would be,” “believes,” “continues,” or the negative

version of these words or other comparable words. Forward-looking

statements, including our 2025 guidance and assumptions, involve

known and unknown risks and uncertainties, which may cause BNL’s

actual future results to differ materially from expected results,

including, without limitation, risks and uncertainties related to

general economic conditions, including but not limited to increases

in the rate of inflation and/or interest rates, local real estate

conditions, tenant financial health, property investments and

acquisitions, and the timing and uncertainty of completing these

property investments and acquisitions, and uncertainties regarding

future distributions to our stockholders. These and other risks,

assumptions, and uncertainties are described in Item 1A “Risk

Factors” of the Company's Annual Report on Form 10-K for the fiscal

year ended December 31, 2024, which was filed with the SEC on

February 20, 2025, which you are encouraged to read, and will be

available on the SEC’s website at www.sec.gov. Should one or more

of these risks or uncertainties materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those indicated or anticipated by such forward-looking

statements. Accordingly, you are cautioned not to place undue

reliance on these forward-looking statements, which speak only as

of the date they are made. The Company assumes no obligation to,

and does not currently intend to, update any forward-looking

statements after the date of this press release, whether as a

result of new information, future events, changes in assumptions,

or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250303992381/en/

Company:

Brent Maedl Director, Corporate Finance & Investor Relations

brent.maedl@broadstone.com 585.382.8507

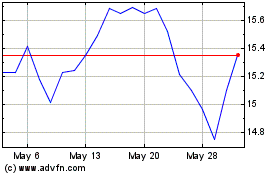

Broadstone Net Lease (NYSE:BNL)

Historical Stock Chart

From Feb 2025 to Mar 2025

Broadstone Net Lease (NYSE:BNL)

Historical Stock Chart

From Mar 2024 to Mar 2025