Revenue of $276 Million, up 5% Year-Over-Year,

up 6% in Constant Currency

Remaining Performance Obligations of $1.3

Billion, up 13% Year-Over-Year, up 14% in Constant Currency

Record GAAP Operating Margin of 8.5% and Record

Non-GAAP Operating Margin of 29.1%

GAAP Net Income Per Share of $0.05 and Record

Non-GAAP Net Income Per Share of $0.45

Box, Inc. (NYSE:BOX), the leading Intelligent Content Management

(ICM) platform, today announced preliminary financial results for

the third quarter of fiscal year 2025, which ended October 31,

2024.

“We delivered strong Q3 financial results and unveiled the most

transformational product line-up in Box history,” said Aaron Levie,

co-founder and CEO of Box. “Now businesses of all sizes will be

able to realize the full value of their content and leverage the

data inside their files to drive innovation, automate processes,

and secure their most important information as we drive a new era

of Intelligent Content Management.”

“Third quarter revenue growth of 5% year-over-year, or 6% in

constant currency, came in at the high-end of our guidance,” said

Dylan Smith, co-founder and CFO of Box. “With operational

discipline built into the core of our company, we drove record

gross and operating margins in the quarter. Our efficient cost

structure enables us to continue to make meaningful investments in

our sales and marketing programs and product roadmap as we deliver

the leading Intelligent Content Cloud for the enterprise.”

Fiscal Third Quarter Financial Highlights

- Revenue for the third quarter of fiscal 2025 was $275.9

million, a 5% increase from revenue for the third quarter of fiscal

2024 of $261.5 million, or 6% growth on a constant currency

basis.

- Remaining performance obligations (“RPO”) as of October 31,

2024 were $1.282 billion, a 13% increase from RPO as of October 31,

2023 of $1.131 billion, or 14% growth on a constant currency

basis.

- Billings for the third quarter of fiscal 2025 were $264.7

million, a 4% increase from billings for the third quarter of

fiscal 2024 of $253.7 million, or 3% growth on a constant currency

basis. Third quarter billings were impacted by a roughly 100 basis

point tailwind from FX versus our prior expectations of 210 basis

point tailwind.

- GAAP gross profit for the third quarter of fiscal 2025 was a

record $220.4 million, or 79.9% of revenue. This compares to a GAAP

gross profit of $192.3 million, or 73.5% of revenue, in the third

quarter of fiscal 2024.

- Non-GAAP gross profit for the third quarter of fiscal 2025 was

a record $226.1 million, or 81.9% of revenue. This compares to a

non-GAAP gross profit of $199.6 million, or 76.3% of revenue, in

the third quarter of fiscal 2024.

- GAAP operating income in the third quarter of fiscal 2025 was a

record $23.4 million, or 8.5% of revenue. This compares to a GAAP

operating income of $11.4 million, or 4.4% of revenue, in the third

quarter of fiscal 2024.

- Non-GAAP operating income in the third quarter of fiscal 2025

was a record $80.2 million, or 29.1% of revenue. This compares to a

non-GAAP operating income of $64.6 million, or 24.7% of revenue, in

the third quarter of fiscal 2024.

- GAAP diluted net income per share attributable to common

stockholders in the third quarter of fiscal 2025 was $0.05 on 149.1

million weighted-average shares outstanding. This compares to GAAP

diluted net income per share attributable to common stockholders of

$0.04 in the third quarter of fiscal 2024 on 147.6 million

weighted-average shares outstanding. GAAP diluted net income per

share attributable to common stockholders in the third quarter of

fiscal 2025 includes a negative impact of $0.02 year-over-year from

unfavorable foreign exchange rates.

- Non-GAAP diluted net income per share attributable to common

stockholders in the third quarter of fiscal 2025 was a record $0.45

on 149.5 million weighted-average shares outstanding. This compares

to non-GAAP diluted net income per share attributable to common

stockholders of $0.36 in the third quarter of fiscal 2024 on 147.6

million weighted-average shares outstanding. Non-GAAP diluted net

income per share attributable to common stockholders in the third

quarter of fiscal 2025 includes a negative impact of $0.02

year-over-year from unfavorable foreign exchange rates.

- Net cash provided by operating activities in the third quarter

of fiscal 2025 was $62.6 million, a 13% decrease from net cash

provided by operating activities of $71.8 million in the third

quarter of fiscal 2024.

- Non-GAAP free cash flow in the third quarter of fiscal 2025 was

$57.4 million, a 2% decrease from non-GAAP free cash flow of $58.3

million in the third quarter of fiscal 2024.

- Raised $460 million through a convertible debt offering, with

convertible notes due September 15, 2029.

Growth on a constant currency basis and impact from foreign

exchange is determined by comparing current period reported results

with the current results calculated using the equivalent rates in

the prior period.

For more information on the non-GAAP financial measures and key

metrics discussed in this press release, please see the section

titled, “About Non-GAAP Financial Measures and Other Key Metrics,”

and the reconciliations of non-GAAP financial measures and certain

key metrics to their nearest comparable GAAP financial measures at

the end of this press release.

Recent Business Highlights

- Delivered wins or expansions with leading organizations across

a variety of industries, including Aerospace (Blue Origin),

Financial Services (Citadel Enterprise Americas and Moelis &

Company), Legal (Gibson Dunn and Morgan Lewis), Life Sciences

(Biogen and Catalent Pharma Solutions), Public Sector (Food &

Drug Administration and Naval Air Systems Command), Manufacturing

(Veeco Instruments and Vulcan Materials), and Media and

Entertainment (Lionsgate, San Antonio Spurs and Serviceplan).

- Introduced a new Suites plan, Enterprise Advanced, to allow

customers to access the full power of the Intelligent Content

Management platform, which includes:

- Box Forms, allowing users to easily design and publish engaging

web and mobile forms; and Doc Gen, which automatically creates

custom documents within Box by pulling data from Box Forms,

third-party apps, custom apps, and metadata.

- Box AI Studio, allowing admins to select their preferred AI

model from Box’s list of trusted providers to create tailored Box

AI agents, with no coding required.

- Box Apps beta, a no-code solution that makes it easier to

create intelligent applications that manage content-centric

business processes throughout the enterprise.

- A new suite of advanced data security and compliance features

including Box Archive and Content Recovery.

- Enhanced developer tools including the Doc Gen API, Box AI API

Metadata Extract and Box AI API and higher API allocations.

- Announced the general availability of Box Hubs, revolutionizing

content publishing in the enterprise and allowing users to extract

insights from their enterprise content with Box AI.

- Announced that Box received its “In Process” designation for

FedRAMP High from the Federal Risk and Authorization Management

Program Management Office.

- Expanded its strategic partnership with Amazon Web Services

(AWS), allowing customers to access foundation models directly in

Box AI using Amazon Bedrock, starting with Anthropic’s Claude and

Amazon Titan.

- Announced a new AI partnership with Slalom to help customers

leverage advanced AI and machine learning to unlock valuable

insights from their content.

- Hosted BoxWorks 2024, attracting thousands of attendees and

customer speakers from leading organizations in-person in San

Francisco and virtually.

- Recognized as a Leader in the IDC MarketScape: Worldwide

Intelligent Content Services 2024 Vendor Assessment.

- Announced the fourth-annual Box Impact Fund, which awards a

total of $150K to six nonprofits pursuing digital transformation

projects. Each organization will receive a $25K grant to help fuel

critical missions and digitally transform the nonprofit

workplace.

Outlook

As a reminder, approximately one third of Box’s revenue is

generated outside of the U.S., of which approximately 65% is in

Japanese Yen. The following guidance includes the expected impact

of FX headwinds, assuming present foreign currency exchange

rates.

Additionally, as we have become consistently profitable in our

international business, in the fourth quarter of fiscal year 2024

we released the valuation allowance against our deferred tax assets

in the United Kingdom. Accordingly, in fiscal year 2025 we are

recognizing deferred tax expense in the United Kingdom. This

non-cash expense is reflected in our GAAP and non-GAAP diluted net

income per share guidance for the fourth quarter of fiscal year

2025 and full fiscal year 2025.

Q4 FY25 Guidance

- Revenue is expected to be approximately $279 million, up 6%

year-over-year, or 7% growth on a constant currency basis.

- GAAP operating margin is expected to be approximately 7.5%, and

non-GAAP operating margin is expected to be approximately

27.5%.

- GAAP net income per share attributable to common stockholders

is expected to be approximately $0.07. GAAP EPS guidance includes

an expected negative impact of $0.02 from unfavorable exchange

rates and $0.01 from the recognition of deferred tax expenses in

international countries.

- Non-GAAP diluted net income per share attributable to common

stockholders is expected to be approximately $0.41. Non-GAAP EPS

guidance includes an expected negative impact of $0.02 from

unfavorable exchange rates and $0.01 from the recognition of

deferred tax expenses in international countries.

- Weighted-average diluted shares outstanding are expected to be

approximately 151 million.

Full Year FY25 Guidance

- Revenue is expected to be approximately $1.090 billion, up 5%

year-over-year, or 7% growth on a constant currency basis. We now

expect FX to be a 190 basis point headwind to full fiscal year 2025

revenue growth, 20 basis points higher than our previous

expectations. On a constant currency basis, our new guidance

represents a $3 million increase from our previous guidance.

- GAAP operating margin is expected to be approximately 7.5%, and

non-GAAP operating margin is expected to be approximately 28%. For

full fiscal year 2025 GAAP and non-GAAP operating margin, we now

expect FX to be a headwind of 140 basis points, 10 basis points

higher than our previous expectations.

- GAAP net income per share attributable to common stockholders

is expected to be approximately $0.30. FY25 GAAP EPS guidance

includes an expected negative impact of $0.13 from unfavorable

exchange rates and $0.05 from the recognition of deferred tax

expenses in international countries.

- Non-GAAP diluted net income per share attributable to common

stockholders is expected to be approximately $1.70. FY25 non-GAAP

EPS guidance includes an expected negative impact of $0.13 from

unfavorable exchange rates and $0.05 from the recognition of

deferred tax expenses in international countries.

- Weighted-average diluted shares outstanding are expected to be

approximately 149 million.

All forward-looking non-GAAP financial measures contained in

this section titled “Outlook” exclude estimates for stock-based

compensation expense, intangible assets amortization, and as

applicable, other special items. Box has provided a reconciliation

of GAAP to non-GAAP net income per share and operating margin

guidance at the end of this press release.

Webcast and Conference Call Information

Box’s management team will host a conference call today

beginning at 2:00 p.m. (PT) / 5:00 p.m. (ET) to discuss Box’s

financial results, business highlights and future outlook. A live

audio webcast of this call will be available through Box’s Investor

Relations website at https://www.boxinvestorrelations.com for a

period of 90 days after the date of the call. Prepared remarks will

be available on the Box Investor Relations website after the call

ends.

The conference call can be accessed by registering online at

https://events.q4inc.com/attendee/640324096 at which time

registrants will receive dial-in information as well as a

conference ID.

A live webcast will be accessible from the Box investor

relations website at www.boxinvestorrelations.com. A replay will be

available at the same webcast link until 11:59 p.m. on December 2,

2025.

Box has used, and intends to continue to use, its Investor

Relations website (www.box.com/investors), as well as certain X

accounts (@box, @levie and @boxincir), as a means of disclosing

material non-public information and for complying with its

disclosure obligations under Regulation FD. Information on or that

can be accessed through Box’s Investor Relations website, these X

accounts, or that is contained in any website to which a hyperlink

is provided herein is not part of this press release, and the

inclusion of Box’s Investor Relations website address, these X

accounts, and any hyperlinks are only inactive textual

references.

This press release, the financial tables, as well as other

supplemental information including the reconciliations of non-GAAP

financial measures and certain key metrics to their nearest

comparable GAAP financial measures, are also available on Box’s

Investor Relations website. Box also provides investor information,

including news and commentary about Box’s business and financial

performance, Box’s filings with the Securities and Exchange

Commission, notices of investor events and Box’s press and earnings

releases, on Box’s Investor Relations website.

Forward-Looking Statements

This press release contains forward-looking statements that

involve risks, uncertainties, and assumptions, including statements

regarding Box’s expectations regarding its growth and

profitability, the size of its market opportunity, its investments

in go-to-market programs, the demand for its products, the

potential of AI and its impact on Box, the timing of recent and

planned product introductions, enhancements and integrations, the

short- and long-term success, market adoption and retention,

capabilities, and benefits of such product introductions and

enhancements, the success of strategic partnerships and

acquisitions, the impact of macroeconomic conditions on its

business, its ability to grow and scale its business and drive

operating efficiencies, the impact of fluctuations in foreign

currency exchange rates on its future results, its net retention

rate, its ability to achieve revenue targets and billings

expectations, its revenue and billings growth rates, its ability to

expand operating margins, its revenue growth rate plus free cash

flow margin in fiscal year 2025 and beyond, its long-term financial

targets, its ability to maintain profitability on a quarterly or

ongoing basis, its free cash flow, its ability to continue to grow

unrecognized revenue and remaining performance obligations, its

revenue, billings, GAAP and non-GAAP gross margins, GAAP and

non-GAAP net income per share, GAAP and non-GAAP operating margins,

the related components of GAAP and non-GAAP net income per share,

weighted-average outstanding share count expectations for Box’s

fiscal fourth quarter and full fiscal year 2025 in the section

titled “Outlook” above, equity burn rate, any potential repurchase

of its common stock, whether, when, in what amount and by what

method any such repurchase would be consummated, and the share

price of any such repurchase. There are a significant number of

factors that could cause actual results to differ materially from

statements made in this press release, including: (1) adverse

changes in general economic or market conditions, including those

caused by the Russia-Ukraine conflict and the conflict in the

Middle East, inflation, and fluctuations in foreign currency

exchange rates; (2) delays or reductions in information technology

spending; (3) factors related to Box’s highly competitive market,

including but not limited to pricing pressures, industry

consolidation, entry of new competitors and new applications and

marketing initiatives by Box’s current or future competitors; (4)

the development of the cloud content management market; (5) the

risk that Box’s customers do not renew their subscriptions, expand

their use of Box’s services, or adopt new products offered by Box

on a timely basis, or at all; (6) Box’s ability to provide timely

and successful enhancements, integrations, new features and

modifications to its platform and services; (7) actual or perceived

security vulnerabilities in Box’s services or any breaches of Box’s

security controls; (8) Box’s ability to realize the expected

benefits of its third-party partnerships; and (9) Box’s ability to

successfully integrate acquired businesses and achieve the expected

benefits from those acquisitions. In addition, the preliminary

financial results set forth in this release are estimates based on

information currently available to Box. While Box believes these

estimates are meaningful, they could differ from the actual amounts

that Box ultimately reports in its Quarterly Report on Form 10-Q

for the fiscal quarter ended October 31, 2024. Box assumes no

obligations and does not intend to update these estimates prior to

filing its Form 10-Q for the fiscal quarter ended October 31,

2024.

Additional information on potential factors that could affect

Box’s financial results is included in the reports on Forms 10-K,

10-Q and 8-K and in other filings Box makes with the Securities and

Exchange Commission from time to time, including the Quarterly

Report on Form 10-Q filed for the fiscal quarter ended July 31,

2024. These documents are available on the SEC Filings section of

Box’s Investor Relations website located at

www.boxinvestorrelations.com. Box does not assume any obligation to

update the forward-looking statements contained in this press

release to reflect events that occur or circumstances that exist

after the date on which they were made.

About Non-GAAP Financial Measures and Other Key

Metrics

To supplement Box’s consolidated financial statements, which are

prepared and presented in accordance with GAAP, Box provides

investors with certain non-GAAP financial measures and other key

metrics, including non-GAAP gross profit, non-GAAP gross margin,

non-GAAP operating income, non-GAAP operating margin, non-GAAP net

income attributable to common stockholders, non-GAAP net income per

share attributable to common stockholders, billings, remaining

performance obligations, non-GAAP free cash flow and free cash flow

margin. The presentation of these non-GAAP financial measures and

key metrics is not intended to be considered in isolation or as a

substitute for, or superior to, the financial information prepared

and presented in accordance with GAAP. For more information on

these non-GAAP financial measures and key metrics, please see the

reconciliation of these non-GAAP financial measures and certain key

metrics to their nearest comparable GAAP financial measures at the

end of this press release.

Box uses these non-GAAP financial measures and key metrics for

financial and operational decision-making (including for purposes

of determining variable compensation of members of management and

other employees) and as a means to evaluate period-to-period

comparisons. Box’s management believes that these non-GAAP

financial measures and key metrics provide meaningful supplemental

information regarding Box’s performance by excluding certain

expenses that may not be indicative of Box’s recurring core

business operating results. Box believes that both management and

investors benefit from referring to these non-GAAP financial

measures and key metrics in assessing Box’s performance and when

planning, forecasting, and analyzing future periods. These non-GAAP

financial measures and key metrics also facilitate management's

internal comparisons to Box’s historical performance as well as

comparisons to Box’s competitors' operating results. Box believes

these non-GAAP financial measures and key metrics are useful to

investors both because they (1) allow for greater transparency with

respect to key metrics used by management in its financial and

operational decision-making and (2) are used by Box’s institutional

investors and the analyst community to help them analyze the health

of Box’s business.

A limitation of non-GAAP financial measures and key metrics is

that they do not have uniform definitions. Further, Box’s

definitions will likely differ from the definitions used by other

companies, including peer companies, and therefore comparability

may be limited. Thus, Box’s non-GAAP financial measures and key

metrics should be considered in addition to, and not as a

substitute for, or in isolation from, measures prepared in

accordance with GAAP. Additionally, in the case of stock-based

compensation expense, if Box did not pay a portion of compensation

in the form of stock-based compensation expense, the cash salary

expense included in cost of revenue and operating expenses would be

higher, which would affect Box’s cash position. The accompanying

tables have more details on the reconciliations of non-GAAP

financial measures and certain key metrics to their nearest

comparable GAAP financial measures.

Non-GAAP gross profit and non-GAAP gross margin. Box defines

non-GAAP gross profit as GAAP gross profit excluding expenses

related to stock-based compensation (“SBC”) included in cost of

revenue, intangible assets amortization, and as applicable, other

special items. Non-GAAP gross margin is defined as non-GAAP gross

profit divided by revenue. Although SBC is an important aspect of

the compensation of Box’s employees and executives, determining the

fair value of certain of the stock-based instruments Box utilizes

estimation and the expense recorded may bear little resemblance to

the actual value realized upon the vesting or future exercise of

the related stock-based awards. Management believes it is useful to

exclude SBC in order to better understand the long-term performance

of Box’s core business and to facilitate comparison of Box’s

results to those of peer companies. Management also views

amortization of acquired intangible assets, such as the

amortization of the cost associated with an acquired company’s

developed technology and trade names, as items arising from

pre-acquisition activities determined at the time of an

acquisition. While these intangible assets are continually

evaluated for impairment, amortization of the cost of purchased

intangibles is a static expense that is not typically affected by

operations during any particular period. Box also excludes expenses

associated with a non-recurring workforce reorganization from

non-GAAP gross profit as they are considered by management to be

special items outside of Box’s core operating results.

Non-GAAP operating income and non-GAAP operating margin. Box

defines non-GAAP operating income as operating income excluding

expenses related to SBC, intangible assets amortization, and as

applicable, other special items. Non-GAAP operating margin is

defined as non-GAAP operating income divided by revenue. Box

excludes the following expenses as they are considered by

management to be special items outside of Box’s core operating

results: (1) fees related to shareholder activism (2) expenses

related to certain litigation, (3) expenses associated with a

non-recurring workforce reorganization, consisting primarily of

severance and other personnel-related costs, and (4) expenses

related to acquisitions.

Non-GAAP net income attributable to common stockholders and

non-GAAP net income per share attributable to common stockholders.

Box defines non-GAAP net income attributable to common stockholders

as GAAP net income attributable to common stockholders excluding

expenses related to SBC, intangible assets amortization,

amortization of debt issuance costs, the income tax benefit from

the release of a valuation allowance on deferred tax assets,

induced conversion of convertible notes, undistributed earnings

attributable to preferred stockholders, and as applicable, other

special items as described in the preceding paragraph. Box defines

non-GAAP net income per share attributable to common stockholders

as non-GAAP net income attributable to common stockholders divided

by the weighted-average outstanding shares.

Billings. Billings reflect, in any particular period, (1) sales

to new customers, plus (2) subscription renewals and (3) expansion

within existing customers, and represent amounts invoiced for all

products and professional services. Box calculates billings for a

period by adding changes in deferred revenue and contract assets in

that period to revenue. Box believes that billings help investors

better understand sales activity for a particular period, which is

not necessarily reflected in revenue as a result of the fact that

Box recognizes subscription revenue ratably over the subscription

term. Box considers billings a significant performance measure. Box

monitors billings to manage the business, make planning decisions,

evaluate performance and allocate resources. Box believes that

billings offers valuable supplemental information regarding the

performance of the business and helps investors better understand

the sales volumes and performance of the business. Although Box

considers billings to be a significant performance measure, Box

does not consider it to be a non-GAAP financial measure because it

is calculated using exclusively revenue, deferred revenue, and

contract assets, all of which are financial measures calculated in

accordance with GAAP.

Remaining performance obligations. Remaining performance

obligations (“RPO”) represent, at a point in time, contracted

revenue that has not yet been recognized. RPO consists of deferred

revenue and backlog. Backlog is defined as non-cancellable

contracts deemed certain to be invoiced and recognized as revenue

in future periods. Future invoicing is determined to be certain

when we have an executed non-cancellable contract or a significant

penalty that is due upon cancellation. While Box believes RPO is a

leading indicator of revenue as it represents sales activity not

yet recognized in revenue, it is not necessarily indicative of

future revenue growth as it is influenced by several factors,

including seasonality, contract renewal timing, average contract

terms and foreign currency exchange rates. Box monitors RPO to

manage the business and evaluate performance. Box considers RPO to

be a significant performance measure. Box does not consider RPO to

be a non-GAAP financial measure because it is calculated in

accordance with GAAP, specifically under ASC Topic 606.

Non-GAAP free cash flow and free cash flow margin. Box defines

non-GAAP free cash flow as cash flows from operating activities

less purchases of property and equipment, principal payments of

finance lease liabilities, capitalized internal-use software costs,

and other items that did not or are not expected to require cash

settlement and that management considers to be outside of Box’s

core business. Free cash flow margin is calculated as non-GAAP free

cash flow divided by revenue. Box specifically identifies adjusting

items in the reconciliation of GAAP to non-GAAP financial measures.

Box considers non-GAAP free cash flow to be a profitability and

liquidity measure that provides useful information to management

and investors about the amount of cash generated by the business

that can possibly be used for investing in Box's business and

strengthening its balance sheet, but it is not intended to

represent the residual cash flow available for discretionary

expenditures. The presentation of non-GAAP free cash flow is also

not meant to be considered in isolation or as an alternative to

cash flows from operating activities as a measure of liquidity.

About Box

Box (NYSE:BOX) is the leading Intelligent Content Management

provider, a single platform that enables organizations to fuel

collaboration, manage the entire content lifecycle, secure critical

content, and transform business workflows with enterprise AI.

Founded in 2005, Box simplifies work for leading global

organizations, including AstraZeneca, JLL, Morgan Stanley, and

Nationwide. Box is headquartered in Redwood City, CA, with offices

across the United States, Europe, and Asia. Visit box.com to learn

more. And visit box.org to learn more about how Box empowers

nonprofits to fulfill their missions.

BOX, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In Thousands)

(Unaudited)

October 31,

January 31,

2024

2024

ASSETS

Current assets:

Cash and cash equivalents

$

608,765

$

383,742

Short-term investments

89,150

96,948

Accounts receivable, net

188,495

281,487

Deferred commissions

43,192

45,817

Other current assets

32,988

34,186

Total current assets

962,590

842,180

Operating lease right-of-use assets,

net

83,283

99,354

Goodwill

78,733

76,750

Deferred commissions, non-current

57,470

63,541

Deferred tax assets

72,352

75,665

Other long-term assets

99,892

83,673

Total assets

$

1,354,320

$

1,241,163

LIABILITIES, CONVERTIBLE PREFERRED

STOCK AND STOCKHOLDERS’ DEFICIT

Current liabilities:

Accounts payable, accrued expenses and

other current liabilities

$

53,416

$

52,737

Accrued compensation and benefits

32,629

36,872

Operating lease liabilities

25,590

26,812

Deferred revenue

475,469

562,859

Total current liabilities

587,104

679,280

Debt, net, non-current

651,675

370,822

Operating lease liabilities,

non-current

75,992

94,165

Other liabilities, non-current

25,754

35,863

Total liabilities

1,340,525

1,180,130

Series A convertible preferred stock

493,677

492,095

Stockholders’ deficit:

Common stock

14

14

Additional paid-in capital

686,216

785,374

Accumulated other comprehensive loss

(9,959

)

(9,686

)

Accumulated deficit

(1,156,153

)

(1,206,764

)

Total stockholders’ deficit

(479,882

)

(431,062

)

Total liabilities, convertible preferred

stock and stockholders’ deficit

$

1,354,320

$

1,241,163

BOX, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(In Thousands, Except Per

Share Data)

(Unaudited)

Three Months Ended

Nine Months Ended

October 31,

October 31,

2024

2023

2024

2023

Revenue

$

275,913

$

261,537

$

810,610

$

774,863

Cost of revenue (1)

55,556

69,227

169,321

197,891

Gross profit

220,357

192,310

641,289

576,972

Operating expenses:

Research and development (1)

67,865

61,026

195,983

186,860

Sales and marketing (1)

95,407

87,930

283,315

262,745

General and administrative (1)

33,674

31,975

100,293

97,778

Total operating expenses

196,946

180,931

579,591

547,383

Income from operations

23,411

11,379

61,698

29,589

Interest and other (expense) income,

net

(6,119

)

1,801

2,438

7,412

Income before provision for income

taxes

17,292

13,180

64,136

37,001

Provision for income taxes

4,399

2,524

13,525

7,204

Net income

$

12,893

$

10,656

$

50,611

$

29,797

Accretion and dividend on series A

convertible preferred stock

(4,282

)

(4,280

)

(12,832

)

(12,811

)

Undistributed earnings attributable to

preferred stockholders

(985

)

(729

)

(4,302

)

(1,938

)

Net income attributable to common

stockholders

$

7,626

$

5,647

$

33,477

$

15,048

Net income per share attributable to

common stockholders

Basic

$

0.05

$

0.04

$

0.23

$

0.10

Diluted

$

0.05

$

0.04

$

0.23

$

0.10

Weighted-average shares used to compute

net income per share attributable to common stockholders

Basic

143,479

143,915

144,275

144,296

Diluted

149,071

147,625

148,002

149,351

(1) Includes stock-based compensation

expense as follows:

Three Months Ended

Nine Months Ended

October 31,

October 31,

2024

2023

2024

2023

Cost of revenue

$

4,640

$

4,973

$

13,992

$

14,688

Research and development

19,925

17,731

57,420

53,455

Sales and marketing

19,635

16,810

56,591

49,674

General and administrative

11,384

11,380

33,854

33,700

Total stock-based compensation

$

55,584

$

50,894

$

161,857

$

151,517

BOX, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In Thousands)

(Unaudited)

Three Months Ended

Nine Months Ended

October 31,

October 31,

2024

2023

2024

2023

CASH FLOWS FROM OPERATING

ACTIVITIES:

Net income

$

12,893

$

10,656

$

50,611

$

29,797

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

5,926

14,513

15,910

38,996

Stock-based compensation expense

55,584

50,894

161,857

151,517

Amortization of deferred commissions

12,839

13,434

39,377

40,803

Induced conversion expense

10,139

—

10,139

—

Other

(4,898

)

1,024

(2,496

)

2,729

Changes in operating assets and

liabilities:

Accounts receivable, net

(12,537

)

(3,029

)

90,764

93,280

Deferred commissions

(11,572

)

(11,042

)

(30,860

)

(28,361

)

Operating lease right-of-use assets,

net

4,821

10,452

18,171

26,302

Other assets

569

1,934

(26

)

707

Accounts payable, accrued expenses and

other liabilities

3,880

(3,002

)

(10,519

)

(9,138

)

Operating lease liabilities

(6,332

)

(11,545

)

(21,658

)

(35,731

)

Deferred revenue

(8,730

)

(2,507

)

(91,186

)

(81,513

)

Net cash provided by operating

activities

62,582

71,782

230,084

229,388

CASH FLOWS FROM INVESTING

ACTIVITIES:

Purchases of short-term investments

(34,221

)

(40,644

)

(90,676

)

(106,389

)

Maturities of short-term investments

21,500

29,000

97,396

79,000

Sales of short-term investments

—

—

3,567

—

Purchases of property and equipment

(271

)

(2,461

)

(1,945

)

(4,461

)

Proceeds from sales of property and

equipment

2,404

418

8,395

1,671

Capitalized internal-use software

costs

(7,354

)

(3,985

)

(19,031

)

(12,362

)

Other

(3,525

)

—

(3,525

)

(190

)

Net cash used in investing activities

(21,467

)

(17,672

)

(5,819

)

(42,731

)

CASH FLOWS FROM FINANCING

ACTIVITIES:

Proceeds from issuance of convertible

notes, net of issuance costs

448,953

—

448,953

—

Partial repurchase of convertible

notes

(191,713

)

—

(191,713

)

—

Purchase of capped calls related to

convertible notes

(52,486

)

—

(52,486

)

—

Settlement of capped calls related to

convertible notes

30,313

—

30,313

—

Repurchases of common stock

(29,965

)

(51,016

)

(168,651

)

(155,922

)

Principal payments on borrowings

(30,000

)

—

(30,000

)

—

Payments of dividends to preferred

stockholders

(3,750

)

(3,750

)

(11,250

)

(11,193

)

Proceeds from exercise of stock

options

817

362

16,170

1,157

Proceeds from issuances of common stock

under employee stock purchase plan

10,233

10,815

25,910

26,860

Employee payroll taxes paid for net

settlement of stock awards

(20,306

)

(16,272

)

(58,089

)

(58,298

)

Principal payments of finance lease

liabilities

—

(7,179

)

(2,141

)

(26,131

)

Other

—

(419

)

(2,022

)

(3,989

)

Net cash provided by (used in) financing

activities

162,096

(67,459

)

4,994

(227,516

)

Effect of exchange rate changes on

cash, cash equivalents, and restricted cash

(881

)

(4,874

)

(3,470

)

(9,710

)

Net increase (decrease) in cash, cash

equivalents, and restricted cash

202,330

(18,223

)

225,789

(50,569

)

Cash, cash equivalents, and restricted

cash, beginning of period

407,716

396,694

384,257

429,040

Cash, cash equivalents, and restricted

cash, end of period

$

610,046

$

378,471

$

610,046

$

378,471

BOX, INC.

RECONCILIATION OF GAAP TO

NON-GAAP DATA

(In Thousands, Except Per

Share Data and Percentages)

(Unaudited)

Three Months Ended

Nine Months Ended

October 31,

October 31,

2024

2023

2024

2023

GAAP gross profit

$

220,357

$

192,310

$

641,289

$

576,972

Stock-based compensation

4,640

4,973

13,992

14,688

Acquired intangible assets

amortization

1,073

1,452

3,206

4,356

Workforce reorganization

—

912

—

912

Non-GAAP gross profit

$

226,070

$

199,647

$

658,487

$

596,928

GAAP gross margin

79.9

%

73.5

%

79.1

%

74.5

%

Stock-based compensation

1.6

1.9

1.7

1.9

Acquired intangible assets

amortization

0.4

0.6

0.4

0.5

Workforce reorganization

—

0.3

—

0.1

Non-GAAP gross margin

81.9

%

76.3

%

81.2

%

77.0

%

GAAP operating income

$

23,411

$

11,379

$

61,698

$

29,589

Stock-based compensation

55,584

50,894

161,857

151,517

Acquired intangible assets

amortization

1,073

1,452

3,206

4,356

Acquisition-related expenses

50

—

343

14

Expenses related to litigation

72

(10

)

176

309

Workforce reorganization

—

912

—

912

Non-GAAP operating income

$

80,190

$

64,627

$

227,280

$

186,697

GAAP operating margin

8.5

%

4.4

%

7.6

%

3.8

%

Stock-based compensation

20.2

19.4

20.0

19.6

Acquired intangible assets

amortization

0.4

0.6

0.4

0.6

Acquisition-related expenses

—

—

—

—

Expenses related to litigation

—

—

—

—

Workforce reorganization

—

0.3

—

0.1

Non-GAAP operating margin

29.1

%

24.7

%

28.0

%

24.1

%

GAAP net income attributable to common

stockholders

$

7,626

$

5,647

$

33,477

$

15,048

Stock-based compensation

55,584

50,894

161,857

151,517

Acquired intangible assets

amortization

1,073

1,452

3,206

4,356

Acquisition-related expenses

50

—

343

14

Expenses related to litigation

72

(10

)

176

309

Workforce reorganization

—

912

—

912

Amortization of debt issuance costs

651

475

1,604

1,423

Induced conversion expense

10,139

—

10,139

—

Undistributed earnings attributable to

preferred stockholders

(7,733

)

(6,145

)

(20,192

)

(18,090

)

Non-GAAP net income attributable to common

stockholders

$

67,462

$

53,225

$

190,610

$

155,489

GAAP net income per share attributable to

common stockholders, diluted

$

0.05

$

0.04

$

0.23

$

0.10

Stock-based compensation

0.37

0.34

1.09

1.01

Acquired intangible assets

amortization

0.01

0.01

0.02

0.03

Acquisition-related expenses

—

—

—

—

Expenses related to litigation

—

—

—

—

Workforce reorganization

—

0.01

—

0.01

Amortization of debt issuance costs

—

—

0.01

0.01

Induced conversion expense

0.07

—

0.07

—

Undistributed earnings attributable to

preferred stockholders

(0.05

)

(0.04

)

(0.13

)

(0.12

)

Non-GAAP net income per share attributable

to common stockholders, diluted

$

0.45

$

0.36

$

1.29

$

1.04

Weighted-average shares used to compute

GAAP net income per share attributable to common stockholders,

diluted

149,071

147,625

148,002

149,351

Weighted-average shares used to compute

non-GAAP net income per share attributable to common stockholders,

diluted

149,499

147,625

148,311

149,351

GAAP net cash provided by operating

activities

$

62,582

$

71,782

$

230,084

$

229,388

Proceeds from sales of property and

equipment, net of purchases

2,133

(2,043

)

6,450

(2,790

)

Principal payments of finance lease

liabilities

—

(7,179

)

(2,141

)

(26,131

)

Capitalized internal-use software

costs

(7,354

)

(4,243

)

(21,053

)

(13,334

)

Non-GAAP free cash flow

$

57,361

$

58,317

$

213,340

$

187,133

GAAP net cash used in investing

activities

$

(21,467

)

$

(17,672

)

$

(5,819

)

$

(42,731

)

GAAP net cash provided by (used in)

financing activities

$

162,096

$

(67,459

)

$

4,994

$

(227,516

)

BOX, INC.

RECONCILIATION OF GAAP REVENUE

TO BILLINGS

(In Thousands)

(Unaudited)

Three Months Ended

Nine Months Ended

October 31,

October 31,

2024

2023

2024

2023

GAAP revenue

$

275,913

$

261,537

$

810,610

$

774,863

Deferred revenue, end of period

491,304

471,963

491,304

471,963

Less: deferred revenue, beginning of

period

(502,104

)

(479,293

)

(586,871

)

(566,630

)

Contract assets, beginning of period

5,481

3,477

2,452

1,900

Less: contract assets, end of period

(5,909

)

(3,944

)

(5,909

)

(3,944

)

Billings

$

264,685

$

253,740

$

711,586

$

678,152

BOX, INC.

RECONCILIATION OF GAAP TO

NON-GAAP NET INCOME PER SHARE GUIDANCE

(In Thousands, Except Per

Share Data)

(Unaudited)

Three Months Ended

Fiscal Year Ended

January 31, 2025

January 31, 2025

GAAP net income per share attributable to

common stockholders, diluted

$

0.07

$

0.30

Stock-based compensation

0.36

1.46

Acquired intangible asset amortization

0.01

0.03

Amortization of debt issuance costs

0.01

0.02

Other (1)

—

0.07

Undistributed earnings attributable to

preferred stockholders

(0.04

)

(0.18

)

Non-GAAP net income per share attributable

to common stockholders, diluted

$

0.41

$

1.70

Weighted-average shares, diluted

151,500

149,000

(1)

Other includes induced conversion expense,

acquisition-related expenses, and expenses related to

litigation.

BOX, INC.

RECONCILIATION OF GAAP TO

NON-GAAP OPERATING MARGIN GUIDANCE

(Unaudited)

Three Months Ended

Fiscal Year Ended

January 31, 2025

January 31, 2025

GAAP operating margin

7.5

%

7.5

%

Stock-based compensation

19.5

20.0

Acquired intangible assets

amortization

0.5

0.5

Non-GAAP operating margin

27.5

%

28.0

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241202375629/en/

Investors: Cynthia Hiponia and Elaine Gaudioso +1 650-209-3463

ir@box.com

Media: Kait Conetta and Sheridan Hoover press@box.com

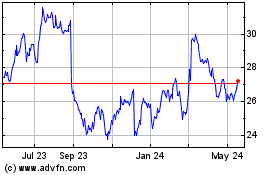

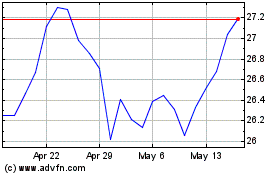

Box (NYSE:BOX)

Historical Stock Chart

From Feb 2025 to Mar 2025

Box (NYSE:BOX)

Historical Stock Chart

From Mar 2024 to Mar 2025