BellRing Brands, Inc. (NYSE:BRBR) (“BellRing”), a holding

company operating in the global convenient nutrition category,

today reported results for the second fiscal quarter ended March

31, 2024.

Highlights:

- Second quarter net sales of

$494.6 million

- Operating profit of $91.0

million, net earnings of $57.2

million and Adjusted EBITDA* of

$103.7 million

- Raised fiscal year 2024 net sales outlook to

$1.93-$1.99 billion and Adjusted EBITDA* outlook to $400-$420

million

*Adjusted EBITDA is a non-GAAP measure. For additional

information regarding non-GAAP measures, see the related

explanations presented under “Use of Non-GAAP Measures” later in

this release. BellRing provides Adjusted EBITDA guidance only on a

non-GAAP basis and does not provide a reconciliation of its

forward-looking Adjusted EBITDA non-GAAP guidance measure to the

most directly comparable GAAP measure due to the inherent

difficulty in forecasting and quantifying certain amounts that are

necessary for such reconciliation, including the adjustments

described under “Outlook” later in this release.

“Our momentum continued this quarter as we restarted meaningful

shake promotions and experienced greater than forecasted shake

demand. Premier Protein shake consumption growth was strong,

boosted by strong velocities, new products and significant gains in

household penetration. Our powder products success in mainstream

channels continued this quarter, behind brand building investments

and distribution gains,” said Darcy H. Davenport, President and

Chief Executive Officer of BellRing. “Our greenfield facilities

continue to scale up and overall shake capacity expansion is on

track. Our first half performance gives us greater confidence to

deliver our second half expectations and drives our decision to

raise our full year outlook.”

Dollar consumption of Premier Protein ready-to-drink

(“RTD”) shakes and Premier Protein powder products increased 28.8%

and 52.2%, respectively, and Dymatize powder products

decreased 8.3% in the 13-week period ended March 31, 2024, as

compared to the same period in 2023 (inclusive of Circana United

States (“U.S.”) Multi Outlet including Convenience and management

estimates of untracked channels).

Second Quarter Operating

Results

Net sales were $494.6 million, an increase of 28.3%, or $109.0

million, compared to the prior year period, driven by 42.7%

increase in volume and 14.4% decrease in price/mix.

Premier Protein net sales increased 33.8%, driven by 44.9%

increase in volume and 11.1% decrease in price/mix. Premier Protein

RTD shake net sales increased 33.7%, driven by 46.2% increase in

volume and 12.5% decrease in price/mix. Volume growth was driven by

incremental promotional activity (which resulted in a decline in

price/mix), distribution gains and organic growth.

Dymatize net sales increased 4.6%, driven by 1.4% increase in

volume and 3.2% increase in price/mix. Volume growth was driven by

distribution gains and organic growth. The increase in price/mix

was driven by favorable mix changes.

Gross profit was $164.3 million, or 33.2% of net sales, an

increase of 40.3%, or $47.2 million, compared to $117.1 million, or

30.4% of net sales, in the prior year period. The higher gross

profit margin was driven by net input cost deflation, which was

partially offset by incremental promotional activity.

Selling, general and administrative (“SG&A”) expenses were

$69.1 million, or 14.0% of net sales, an increase of $14.8 million

compared to $54.3 million, or 14.1% of net sales, in the prior year

period. SG&A expenses in the second quarter of 2024 included

higher employee expenses and distribution and warehousing expenses

on higher volumes, as well as higher marketing and consumer

advertising expenses of $3.3 million.

Operating profit was $91.0 million, an increase of 56.9%, or

$33.0 million, compared to $58.0 million in the prior year

period.

Interest expense, net was $14.5 million and $16.8 million in the

second quarter of 2024 and 2023, respectively, with the decline

primarily driven by lower borrowings outstanding under the

revolving credit facility. Income tax expense was $19.3 million in

the second quarter of 2024, an effective income tax rate of 25.2%,

compared to $10.3 million in the second quarter of 2023, an

effective income tax rate of 25.0%.

Net earnings were $57.2 million, an increase of 85.1%, or $26.3

million, compared to $30.9 million in the prior year period. Net

earnings per diluted common share were $0.43, an increase of 87.0%,

compared to $0.23 in the prior year period. Adjusted net earnings*

were $59.2 million, an increase of 85.6%, compared to $31.9 million

in the prior year period. Adjusted net earnings per common share*

were $0.45, an increase of 87.5%, compared to $0.24 in the prior

year period.

Adjusted EBITDA* was $103.7 million, an increase of 52.5%, or

$35.7 million, compared to $68.0 million in the prior year

period.

*Adjusted net earnings, Adjusted diluted earnings per common

share and Adjusted EBITDA are non-GAAP measures. For additional

information regarding non-GAAP measures, see the related

explanations presented under “Use of Non-GAAP Measures” later in

this release.

Six Month Operating Results

Net sales were $925.0 million, an increase of 23.6%, or $176.7

million, compared to the prior year period, driven by 31.0%

increase in volume and 7.4% decrease in price/mix. Premier Protein

net sales increased 26.5%, driven by 32.3% increase in volume and

5.8% decrease in price/mix. Dymatize net sales increased 11.6%,

driven by 14.4% increase in volume and 2.8% decrease in

price/mix.

Gross profit was $312.3 million, or 33.8% of net sales, an

increase of 30.7%, or $73.4 million, compared to $238.9 million, or

31.9% of net sales, in the prior year period. The higher gross

profit margin was driven by net input cost deflation, which was

partially offset by incremental promotional activity.

SG&A expenses were $121.9 million, or 13.2% of net sales, an

increase of $25.9 million compared to $96.0 million, or 12.8% of

net sales, in the prior year period. SG&A expenses in the six

months ended March 31, 2024 included higher employee expenses and

distribution and warehousing expenses on higher volumes, as well as

increased marketing and consumer advertising expenses of $4.3

million.

Operating profit was $164.0 million, an increase of 23.1%, or

$30.8 million, compared to $133.2 million in the prior year period,

and was negatively impacted by $17.4 million of accelerated

amortization incurred in connection with the discontinuance of the

North American PowerBar business, which was treated as an

adjustment for non-GAAP measures.

Interest expense, net was $29.4 million and $33.5 million in the

six months ended March 31, 2024 and 2023, respectively, with the

decline primarily driven by lower borrowings outstanding under the

revolving credit facility. Income tax expense was $33.5 million in

the six months ended March 31, 2024, an effective income tax rate

of 24.9%, compared to $24.6 million in the six months ended March

31, 2023, an effective income tax rate of 24.7%.

Net earnings were $101.1 million, an increase of 34.6%, or $26.0

million, compared to $75.1 million in the prior year period. Net

earnings per diluted common share were $0.76, an increase of 35.7%,

compared to $0.56 in the prior year period. Adjusted net earnings*

were $116.5 million, an increase of 51.7%, compared to $76.8

million in the prior year period. Adjusted diluted earnings per

common share* were $0.88, an increase of 54.4%, compared to $0.57

in the prior year period.

Adjusted EBITDA* was $204.2 million, an increase of 33.6%, or

$51.3 million, compared to $152.9 million in the prior year

period.

*Adjusted net earnings, Adjusted diluted earnings per common

share and Adjusted EBITDA are non-GAAP measures. For additional

information regarding non-GAAP measures, see the related

explanations presented under “Use of Non-GAAP Measures” later in

this release.

Share Repurchases

During the second quarter of 2024, BellRing repurchased 0.4

million shares for $22.9 million at an average price of $56.46 per

share. During the six months ended March 31, 2024, BellRing

repurchased 0.6 million shares for $32.3 million at an average

price of $52.28 per share. As of March 31, 2024, BellRing had

$289.4 million remaining under its share repurchase

authorization.

Outlook

For fiscal year 2024, BellRing management has raised its

guidance range for net sales to $1.93-$1.99 billion (from

$1.87-$1.95 billion) and Adjusted EBITDA to $400-$420 million (from

$375-$400 million) (resulting in net sales and Adjusted EBITDA

growth of 16%-19% and 18%-24%, respectively, over fiscal year

2023). BellRing management expects fiscal year 2024 capital

expenditures of approximately $4 million.

BellRing provides Adjusted EBITDA guidance only on a non-GAAP

basis and does not provide a reconciliation of its forward-looking

Adjusted EBITDA non-GAAP guidance measure to the most directly

comparable GAAP measure due to the inherent difficulty in

forecasting and quantifying certain amounts that are necessary for

such reconciliation, including adjustments that could be made for

mark-to-market adjustments on commodity hedges and other charges

reflected in BellRing’s reconciliation of historical numbers, the

amounts of which, based on historical experience, could be

significant. For additional information regarding BellRing’s

non-GAAP measures, see the related explanations presented under

“Use of Non-GAAP Measures.”

Use of Non-GAAP Measures

BellRing uses certain non-GAAP measures in this release to

supplement the financial measures prepared in accordance with U.S.

generally accepted accounting principles (“GAAP”). These non-GAAP

measures include Adjusted net earnings, Adjusted diluted earnings

per common share, Adjusted EBITDA and Adjusted EBITDA as a

percentage of net sales. The reconciliation of each of these

non-GAAP measures to the most directly comparable GAAP measure is

provided later in this release under “Explanation and

Reconciliation of Non-GAAP Measures.”

Management uses certain of these non-GAAP measures, including

Adjusted EBITDA and Adjusted EBITDA as a percentage of net sales,

as key metrics in the evaluation of underlying company performance,

in making financial, operating and planning decisions and, in part,

in the determination of bonuses for its executive officers and

employees. Additionally, BellRing is required to comply with

certain covenants and limitations that are based on variations of

EBITDA in its financing documents. Management believes the use of

these non-GAAP measures provides increased transparency and assists

investors in understanding the underlying operating performance of

BellRing and in the analysis of ongoing operating

trends. Non-GAAP measures are not prepared in accordance with

GAAP, as they exclude certain items as described later in this

release. These non-GAAP measures may not be comparable to similarly

titled measures of other companies. For additional information

regarding BellRing’s non-GAAP measures, see the related

explanations provided under “Explanation and Reconciliation of

Non-GAAP Measures” later in this release.

Conference Call to Discuss Earnings Results and

Outlook

BellRing will host a conference call on Tuesday, May 7, 2024 at

9:00 a.m. EDT to discuss financial results for the second quarter

of fiscal year 2024 and fiscal year 2024 outlook and to respond to

questions. Darcy H. Davenport, President and Chief Executive

Officer, and Paul A. Rode, Chief Financial Officer, will

participate in the call.

Interested parties may join the conference call by registering

in advance at the following link: BellRing Q2 2024 Earnings

Conference Call. Upon registration, participants will receive a

dial-in number and a unique passcode to access the conference call.

Interested parties are invited to listen to the webcast of the

conference call, which can be accessed by visiting the Investor

Relations section of BellRing’s website at www.bellring.com. A

slide presentation containing supplemental material will also be

available at the same location on BellRing’s website. A webcast

replay also will be available for a limited period on BellRing’s

website in the Investor Relations section.

Prospective Financial Information

Prospective financial information is necessarily speculative in

nature, and it can be expected that some or all of the assumptions

underlying the prospective financial information described above

will not materialize or will vary significantly from actual

results. For further discussion of some of the factors that may

cause actual results to vary materially from the information

provided above, see “Forward-Looking Statements” below.

Accordingly, the prospective financial information provided above

is only an estimate of what BellRing’s management believes is

realizable as of the date of this release. It also should be

recognized that the reliability of any forecasted financial data

diminishes the farther in the future that the data is forecasted.

In light of the foregoing, the information should be viewed in

context and undue reliance should not be placed upon it.

Forward-Looking Statements

Certain matters discussed in this release and on BellRing’s

conference call are forward-looking statements, including

BellRing’s net sales, Adjusted EBITDA and capital expenditures

outlook for fiscal year 2024. These forward-looking statements

are sometimes identified from the use of forward-looking words such

as “believe,” “should,” “could,” “potential,” “continue,” “expect,”

“project,” “estimate,” “predict,” “anticipate,” “aim,” “intend,”

“plan,” “forecast,” “target,” “is likely,” “will,” “can,” “may” or

“would” or the negative of these terms or similar expressions, and

include all statements regarding future performance, earnings

projections, events or developments. There are a number of risks

and uncertainties that could cause actual results to differ

materially from the forward-looking statements made herein. These

risks and uncertainties include, but are not limited to, the

following:

- BellRing’s dependence on sales from its RTD protein

shakes;

- BellRing’s ability to continue to compete in its product

categories and its ability to retain its market position and

favorable perceptions of its brands;

- disruptions or inefficiencies in BellRing’s supply chain,

including as a result of BellRing’s reliance on third-party

suppliers or manufacturers for the manufacturing of many of its

products, pandemics and other outbreaks of contagious diseases,

labor shortages, fires and evacuations related thereto, changes in

weather conditions, natural disasters, agricultural diseases and

pests and other events beyond BellRing’s control;

- BellRing’s dependence on a limited number of third-party

contract manufacturers for the manufacturing of most of its

products, including one manufacturer for the majority of its RTD

protein shakes;

- the ability of BellRing’s third-party contract manufacturers to

produce an amount of BellRing’s products that enables BellRing to

meet customer and consumer demand for the products;

- BellRing’s reliance on a limited number of third-party

suppliers to provide certain ingredients and packaging;

- significant volatility in the cost or availability of inputs to

BellRing’s business (including freight, raw materials, packaging,

energy, labor and other supplies);

- BellRing’s ability to anticipate and respond to changes in

consumer and customer preferences and behaviors and introduce new

products;

- consolidation in BellRing’s distribution channels;

- BellRing’s ability to expand existing market penetration and

enter into new markets;

- the loss of, a significant reduction of purchases by or the

bankruptcy of a major customer;

- legal and regulatory factors, such as compliance with existing

laws and regulations, as well as new laws and regulations and

changes to existing laws and regulations and interpretations

thereof, affecting BellRing’s business, including current and

future laws and regulations regarding food safety, advertising,

labeling, tax matters and environmental matters;

- fluctuations in BellRing’s business due to changes in its

promotional activities and seasonality;

- BellRing’s ability to maintain the net selling prices of its

products and manage promotional activities with respect to its

products;

- BellRing’s ability to obtain additional financing (including

both secured and unsecured debt) and its ability to service its

outstanding debt (including covenants that restrict the operation

of its business);

- the accuracy of BellRing’s market data and attributes and

related information;

- changes in critical accounting estimates;

- uncertain or unfavorable economic conditions that limit

customer and consumer demand for BellRing’s products or increase

its costs;

- risks related to BellRing’s ongoing relationship with Post

Holdings, Inc. (“Post”) following BellRing’s separation from Post

and Post’s distribution of BellRing stock to Post’s shareholders

(the “Spin-off”), including BellRing’s obligations under various

agreements with Post;

- conflicting interests or the appearance of conflicting

interests resulting from certain of BellRing’s directors also

serving as officers or directors of Post;

- risks related to the previously completed Spin-off;

- the ultimate impact litigation or other regulatory matters may

have on BellRing;

- risks associated with BellRing’s international business;

- BellRing’s ability to protect its intellectual property and

other assets and to continue to use third-party intellectual

property subject to intellectual property licenses;

- costs, business disruptions and reputational damage associated

with technology failures, cybersecurity incidents and corruption of

BellRing’s data privacy protections;

- impairment in the carrying value of goodwill or other

intangible assets;

- BellRing’s ability to identify, complete and integrate or

otherwise effectively execute acquisitions or other strategic

transactions and effectively manage its growth;

- BellRing’s ability to hire and retain talented personnel,

employee absenteeism, labor strikes, work stoppages or unionization

efforts;

- BellRing’s ability to satisfy the requirements of Section 404

of the Sarbanes-Oxley Act of 2002;

- significant differences in BellRing’s actual operating results

from any guidance BellRing may give regarding its performance;

and

- other risks and uncertainties described in BellRing’s filings

with the Securities and Exchange Commission.

These forward-looking statements represent BellRing’s judgment

as of the date of this release. BellRing disclaims, however, any

intent or obligation to update these forward-looking

statements.

About BellRing Brands, Inc.

BellRing Brands, Inc. is a rapidly growing leader in the global

convenient nutrition category offering ready-to-drink shake and

powder protein products. Its primary brands, Premier Protein® and

Dymatize®, appeal to a broad range of consumers and are distributed

across a diverse network of channels including club, food, drug,

mass, eCommerce, specialty and convenience. BellRing’s commitment

to consumers is to strive to make highly effective products that

deliver best-in-class nutritionals and superior taste. For more

information, visit www.bellring.com.

Contact:Investor RelationsJennifer

Meyerjennifer.meyer@bellringbrands.com(415) 814-9388

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS (Unaudited)(in

millions, except for per share data) |

| |

Three Months Ended March 31, |

|

Six Months Ended March 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

| Net

Sales |

$ |

494.6 |

|

$ |

385.6 |

|

$ |

925.0 |

|

$ |

748.3 |

| Cost of goods sold |

|

330.3 |

|

|

268.5 |

|

|

612.7 |

|

|

509.4 |

| Gross

Profit |

|

164.3 |

|

|

117.1 |

|

|

312.3 |

|

|

238.9 |

| Selling, general and

administrative expenses |

|

69.1 |

|

|

54.3 |

|

|

121.9 |

|

|

96.0 |

| Amortization of intangible

assets |

|

4.2 |

|

|

4.8 |

|

|

26.4 |

|

|

9.7 |

| Operating

Profit |

|

91.0 |

|

|

58.0 |

|

|

164.0 |

|

|

133.2 |

| Interest expense, net |

|

14.5 |

|

|

16.8 |

|

|

29.4 |

|

|

33.5 |

| Earnings before Income

Taxes |

|

76.5 |

|

|

41.2 |

|

|

134.6 |

|

|

99.7 |

| Income tax expense |

|

19.3 |

|

|

10.3 |

|

|

33.5 |

|

|

24.6 |

| Net

Earnings |

$ |

57.2 |

|

$ |

30.9 |

|

$ |

101.1 |

|

$ |

75.1 |

| |

|

|

|

|

|

|

|

| Earnings per Common

Share: |

|

|

|

|

|

|

|

| Basic |

$ |

0.44 |

|

$ |

0.23 |

|

$ |

0.77 |

|

$ |

0.56 |

| Diluted |

$ |

0.43 |

|

$ |

0.23 |

|

$ |

0.76 |

|

$ |

0.56 |

| |

|

|

|

|

|

|

|

|

Weighted-Average Common Shares Outstanding: |

|

|

|

|

|

|

| Basic |

|

131.0 |

|

|

133.4 |

|

|

131.1 |

|

|

134.1 |

| Diluted |

|

133.0 |

|

|

134.5 |

|

|

133.0 |

|

|

134.8 |

|

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)(in millions) |

| |

March 31, 2024 |

|

September 30, 2023 |

| |

|

|

|

|

ASSETS |

| Current

Assets |

|

|

|

|

Cash and cash equivalents |

$ |

79.3 |

|

|

$ |

48.4 |

|

|

Receivables, net |

|

229.4 |

|

|

|

168.2 |

|

|

Inventories |

|

194.1 |

|

|

|

194.3 |

|

|

Prepaid expenses and other current assets |

|

10.4 |

|

|

|

13.3 |

|

|

Total Current Assets |

|

513.2 |

|

|

|

424.2 |

|

| |

|

|

|

| Property, net |

|

8.5 |

|

|

|

8.5 |

|

| Goodwill |

|

65.9 |

|

|

|

65.9 |

|

| Intangible assets, net |

|

150.4 |

|

|

|

176.8 |

|

| Deferred income taxes |

|

12.2 |

|

|

|

4.2 |

|

| Other assets |

|

14.8 |

|

|

|

12.0 |

|

|

Total Assets |

$ |

765.0 |

|

|

$ |

691.6 |

|

| |

|

|

|

| |

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ DEFICIT |

| Current

Liabilities |

|

|

|

|

Accounts payable |

$ |

101.9 |

|

|

$ |

89.0 |

|

|

Other current liabilities |

|

71.1 |

|

|

|

61.2 |

|

|

Total Current Liabilities |

|

173.0 |

|

|

|

150.2 |

|

| |

|

|

|

| Long-term debt |

|

832.4 |

|

|

|

856.8 |

|

| Deferred income taxes |

|

0.4 |

|

|

|

0.4 |

|

| Other liabilities |

|

6.9 |

|

|

|

7.7 |

|

|

Total Liabilities |

|

1,012.7 |

|

|

|

1,015.1 |

|

| |

|

|

|

| Stockholders’

Deficit |

|

|

|

|

Common stock |

|

1.4 |

|

|

|

1.4 |

|

|

Additional paid-in capital |

|

26.1 |

|

|

|

19.3 |

|

|

Accumulated deficit |

|

(89.0 |

) |

|

|

(190.1 |

) |

|

Accumulated other comprehensive loss |

|

(2.7 |

) |

|

|

(3.1 |

) |

|

Treasury stock, at cost |

|

(183.5 |

) |

|

|

(151.0 |

) |

|

Total Stockholders’ Deficit |

|

(247.7 |

) |

|

|

(323.5 |

) |

|

Total Liabilities and Stockholders’ Deficit |

$ |

765.0 |

|

|

$ |

691.6 |

|

|

SELECTED CONDENSED CONSOLIDATED CASH FLOWS

INFORMATION (Unaudited)(in

millions) |

| |

Six Months Ended March 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| Cash provided by (used

in): |

|

|

|

|

Operating activities |

$ |

90.5 |

|

|

$ |

20.3 |

|

|

Investing activities |

|

(0.5 |

) |

|

|

(0.5 |

) |

|

Financing activities |

|

(59.2 |

) |

|

|

(30.7 |

) |

|

Effect of exchange rate changes on cash and cash equivalents |

|

0.1 |

|

|

|

0.6 |

|

| Net increase

(decrease) in cash and cash equivalents |

$ |

30.9 |

|

|

$ |

(10.3 |

) |

EXPLANATION AND RECONCILIATION OF

NON-GAAP MEASURES

BellRing uses certain non-GAAP measures in this release to

supplement the financial measures prepared in accordance with U.S.

generally accepted accounting principles (“GAAP”). These non-GAAP

measures include Adjusted net earnings, Adjusted diluted earnings

per common share, Adjusted EBITDA and Adjusted EBITDA as a

percentage of net sales. The reconciliation of each of these

non-GAAP measures to the most directly comparable GAAP measure is

provided in the tables following this section. Non-GAAP measures

are not prepared in accordance with GAAP, as they exclude certain

items as described below. These non-GAAP measures may not be

comparable to similarly titled measures of other companies.

Adjusted net earnings and Adjusted diluted earnings per common

shareBellRing believes Adjusted net earnings and Adjusted diluted

earnings per common share are useful to investors in evaluating

BellRing’s operating performance because they exclude items that

affect the comparability of BellRing’s financial results and could

potentially distort an understanding of the trends in business

performance.

Adjusted net earnings and Adjusted diluted earnings per common

share are adjusted for the following items:

- Accelerated amortization: BellRing has excluded non-cash

accelerated amortization charges recorded in connection with the

discontinuation of certain brands or the discontinuation of the use

of certain brands in certain regions as the amount and frequency of

such charges are not consistent. Additionally, BellRing believes

that these charges do not reflect expected ongoing future operating

expenses and do not contribute to a meaningful evaluation of

BellRing’s current operating performance or comparisons of

BellRing’s operating performance to other periods.

- Mark-to-market adjustments on commodity hedges: BellRing has

excluded the impact of mark-to-market adjustments on commodity

hedges due to the inherent uncertainty and volatility associated

with such amounts based on changes in assumptions with respect to

fair value estimates. Additionally, these adjustments are primarily

non-cash items and the amount and frequency of such adjustments are

not consistent.

- Foreign currency gain/loss on intercompany loans: BellRing has

excluded the impact of foreign currency fluctuations related to

intercompany loans denominated in currencies other than the

functional currency of the respective legal entity in evaluating

BellRing’s performance to allow for more meaningful comparisons of

performance to other periods.

- Separation costs: BellRing has excluded certain expenses

incurred in connection with secondary offerings of shares of

BellRing common stock previously held by Post, as the amount and

frequency of such expenses are not consistent. Additionally,

BellRing believes that these costs do not reflect expected ongoing

future operating expenses and do not contribute to a meaningful

evaluation of BellRing’s current operating performance or

comparisons of BellRing’s operating performance to other

periods.

- Income tax effect on adjustments:

BellRing has included the income tax impact of the non-GAAP

adjustments using a rate described in the applicable footnote of

the reconciliation tables, as BellRing believes that its GAAP

effective income tax rate as reported is not representative of the

income tax expense impact of the adjustments.Adjusted EBITDA and

Adjusted EBITDA as a percentage of net salesBellRing believes that

Adjusted EBITDA is useful to investors in evaluating BellRing’s

operating performance and liquidity because (i) BellRing believes

it is widely used to measure a company’s operating performance

without regard to items such as depreciation and amortization,

which can vary depending upon accounting methods and the book value

of assets, (ii) it presents a measure of corporate performance

exclusive of BellRing’s capital structure and the method by which

the assets were acquired and (iii) it is a financial indicator of a

company’s ability to service its debt, as BellRing is required to

comply with certain covenants and limitations that are based on

variations of EBITDA in its financing documents. Management uses

Adjusted EBITDA to provide forward-looking guidance and to forecast

future results. BellRing believes that Adjusted EBITDA as a

percentage of net sales is useful to investors in evaluating

BellRing’s operating performance because it allows for more

meaningful comparison of operating performance across periods.

Adjusted EBITDA reflects adjustments for income tax expense,

interest expense, net and depreciation and amortization including

accelerated amortization, and the following adjustments discussed

above: mark-to-market adjustments on commodity hedges, foreign

currency gain/loss on intercompany loans and separation costs.

Additionally, Adjusted EBITDA reflects an adjustment for the

following item:

- Stock-based compensation: BellRing’s

compensation strategy includes the use of BellRing stock-based

compensation to attract and retain executives and employees by

aligning their long-term compensation interests with BellRing’s

stockholders’ investment interests. BellRing’s director

compensation strategy includes an election by any director who

earns retainers in which the director may elect to defer

compensation granted as a director to BellRing common stock,

earning a match on the deferral, both of which are stock-settled

upon the director’s retirement from the BellRing board of

directors. BellRing has excluded stock-based compensation as

stock-based compensation can vary significantly based on reasons

such as the timing, size and nature of the awards granted and

subjective assumptions which are unrelated to operational decisions

and performance in any particular period and does not contribute to

meaningful comparisons of BellRing’s operating performance to other

periods.

| |

RECONCILIATION OF NET EARNINGS TO ADJUSTED NET

EARNINGS (Unaudited)(in

millions) |

| |

|

Three Months Ended March 31, |

|

Six Months Ended March 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net

Earnings |

$ |

57.2 |

|

|

$ |

30.9 |

|

|

$ |

101.1 |

|

|

$ |

75.1 |

|

| |

|

|

|

|

|

|

|

|

Adjustments: |

|

|

|

|

|

|

|

| |

Accelerated amortization |

|

— |

|

|

|

— |

|

|

|

17.4 |

|

|

|

— |

|

| |

Mark-to-market adjustments on

commodity hedges |

|

2.5 |

|

|

|

0.8 |

|

|

|

2.7 |

|

|

|

2.0 |

|

| |

Foreign currency loss (gain)

on intercompany loans |

|

0.1 |

|

|

|

— |

|

|

|

0.1 |

|

|

|

(0.6 |

) |

| |

Separation costs |

|

— |

|

|

|

0.4 |

|

|

|

— |

|

|

|

0.7 |

|

| |

Total Net

Adjustments |

|

2.6 |

|

|

|

1.2 |

|

|

|

20.2 |

|

|

|

2.1 |

|

| Income tax effect

on adjustments (1) |

|

(0.6 |

) |

|

|

(0.2 |

) |

|

|

(4.8 |

) |

|

|

(0.4 |

) |

| Adjusted

Net Earnings |

$ |

59.2 |

|

|

$ |

31.9 |

|

|

$ |

116.5 |

|

|

$ |

76.8 |

|

| |

|

|

|

|

|

|

|

|

| (1) Income tax

effect on adjustments was calculated on all items, except for

separation costs, using a rate of 24.0%. For the three and six

months ended March 31, 2023, income tax effect for separation costs

was calculated using a rate of 8.0%. |

| |

RECONCILIATION OF DILUTED EARNINGS PER COMMON

SHARE TO ADJUSTED DILUTED EARNINGS PER COMMON

SHARE (Unaudited) |

| |

|

Three Months Ended March 31, |

|

Six Months Ended March 31, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

|

2023 |

| Diluted

Earnings per share of Common Stock |

$ |

0.43 |

|

$ |

0.23 |

|

$ |

0.76 |

|

|

$ |

0.56 |

| |

|

|

|

|

|

|

|

|

Adjustments: |

|

|

|

|

|

|

|

| |

Accelerated amortization |

|

— |

|

|

— |

|

|

0.13 |

|

|

|

— |

| |

Mark-to-market adjustments on

commodity hedges |

|

0.02 |

|

|

0.01 |

|

|

0.02 |

|

|

|

0.01 |

| |

Total Net

Adjustments |

|

0.02 |

|

|

0.01 |

|

|

0.15 |

|

|

|

0.01 |

| Income tax effect

on adjustments (1) |

|

— |

|

|

— |

|

|

(0.03 |

) |

|

|

— |

| Adjusted

Diluted Earnings per share of Common Stock |

$ |

0.45 |

|

$ |

0.24 |

|

$ |

0.88 |

|

|

$ |

0.57 |

| |

|

|

|

|

|

|

|

|

| (1) Income tax

effect on adjustments was calculated on all items using a rate of

24.0%. |

|

RECONCILIATION OF NET EARNINGS TO

ADJUSTED EBITDA (Unaudited)(in

millions) |

| |

Three Months Ended March 31, |

|

Six Months Ended March 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net

Earnings |

$ |

57.2 |

|

|

$ |

30.9 |

|

|

$ |

101.1 |

|

|

$ |

75.1 |

|

| Income tax expense |

|

19.3 |

|

|

|

10.3 |

|

|

|

33.5 |

|

|

|

24.6 |

|

| Interest expense, net |

|

14.5 |

|

|

|

16.8 |

|

|

|

29.4 |

|

|

|

33.5 |

|

| Depreciation and amortization,

including accelerated amortization |

|

4.6 |

|

|

|

5.2 |

|

|

|

27.2 |

|

|

|

10.5 |

|

| Stock-based compensation |

|

5.5 |

|

|

|

3.6 |

|

|

|

10.2 |

|

|

|

7.1 |

|

| Mark-to-market adjustments on

commodity hedges |

|

2.5 |

|

|

|

0.8 |

|

|

|

2.7 |

|

|

|

2.0 |

|

| Foreign currency loss (gain)

on intercompany loans |

|

0.1 |

|

|

|

— |

|

|

|

0.1 |

|

|

|

(0.6 |

) |

| Separation costs |

|

— |

|

|

|

0.4 |

|

|

|

— |

|

|

|

0.7 |

|

| Adjusted

EBITDA |

$ |

103.7 |

|

|

$ |

68.0 |

|

|

$ |

204.2 |

|

|

$ |

152.9 |

|

| Net Earnings as a

percentage of Net Sales |

|

11.6 |

% |

|

|

8.0 |

% |

|

|

10.9 |

% |

|

|

10.0 |

% |

| Adjusted EBITDA as a

percentage of Net Sales |

|

21.0 |

% |

|

|

17.6 |

% |

|

|

22.1 |

% |

|

|

20.4 |

% |

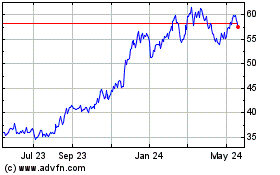

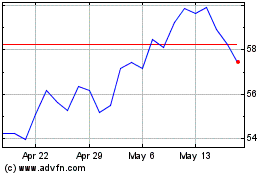

BellRing Brands (NYSE:BRBR)

Historical Stock Chart

From Nov 2024 to Dec 2024

BellRing Brands (NYSE:BRBR)

Historical Stock Chart

From Dec 2023 to Dec 2024