Cleveland-Cliffs Successfully Amends Asset-Based Lending Facility

September 13 2024 - 7:31AM

Business Wire

Cleveland-Cliffs Inc. (NYSE: CLF) (“Cliffs”) today

announced that it successfully amended its $4.75 billion

Asset-Based Lending (ABL) facility as part of the financing for the

pending acquisition of Stelco Holdings Inc. (“Stelco”). Cliffs has

completely replaced Goldman Sachs’ participation with increased

commitments from Bank of America, Wells Fargo, J.P. Morgan, Fifth

Third, Truist, Capital One, BMO, Huntington, and U.S. Bank.

Additionally, PNC, Flagstar, UBS, MUFG, Regions, Barclays, ING,

RBC, and First Citizens have also maintained their existing

commitments to the ABL.

Cliffs’ Chairman, President and CEO, Lourenco Goncalves said:

“In this latest ABL amendment, our capital request was three times

over-subscribed, showing continued strong support from our banking

partners. We thank our entire bank group for their participation as

we focus on partners who share our strategic priorities. As we

position Cliffs for further growth in the United States and Canada,

this amendment reinforces our strong financial position and ability

to close the Stelco transaction quickly and efficiently in the

fourth quarter of 2024.”

As of the finalization of the amendment, Cliffs had no net

borrowings on its ABL facility. The amended ABL matures in

2028.

About Cleveland-Cliffs Inc.

Cleveland-Cliffs is a leading North America-based steel producer

with focus on value-added sheet products, particularly for the

automotive industry. The Company is vertically integrated from the

mining of iron ore, production of pellets and direct reduced iron,

and processing of ferrous scrap through primary steelmaking and

downstream finishing, stamping, tooling, and tubing. Headquartered

in Cleveland, Ohio, Cleveland-Cliffs employs approximately 28,000

people across its operations in the United States and Canada.

Forward-Looking Statements

This release contains statements that constitute

"forward-looking statements" within the meaning of the federal

securities laws. All statements other than historical facts,

including, without limitation, statements regarding our current

expectations, estimates and projections about our industry, our

businesses, our financial position or a transaction with Stelco,

are forward-looking statements. We caution investors that any

forward-looking statements are subject to risks and uncertainties

that may cause actual results and future trends to differ

materially from those matters expressed in or implied by such

forward-looking statements. Investors are cautioned not to place

undue reliance on forward-looking statements. Among the risks and

uncertainties that could cause actual results to differ from those

described in forward-looking statements are the following: our

ability to maintain adequate liquidity, our level of indebtedness

and the availability of capital could limit our financial

flexibility and cash flow necessary to fund working capital,

planned capital expenditures, acquisitions, and other general

corporate purposes or ongoing needs of our business, or to

repurchase our common shares; adverse changes in credit ratings,

interest rates, foreign currency rates and tax laws; our ability to

consummate any public or private acquisition transactions and to

realize any or all of the anticipated benefits or estimated future

synergies, as well as to successfully integrate any acquired

businesses into our existing businesses; the risk that the proposed

transaction with Stelco may not be consummated; the risk that a

transaction with Stelco may be less accretive than expected, or may

be dilutive, to Cliffs’ earnings per share, which may negatively

affect the market price of Cliffs’ common shares; the risk that

adverse reactions or changes to business or regulatory

relationships may result from the announcement or completion of the

proposed Stelco transaction; the possibility of the occurrence of

any event, change or other circumstance that could give rise to the

right of one or both of Cliffs or Stelco to terminate the

transaction agreement between the two companies, including, but not

limited to, the companies’ inability to obtain necessary regulatory

approvals; the risk of shareholder litigation relating to the

proposed transaction that could be instituted against Stelco,

Cliffs or their respective directors and officers; the possibility

that Cliffs and Stelco will incur significant transaction and other

costs in connection with the proposed transaction, which may be in

excess of those anticipated by Cliffs; the risk that the financing

transactions to be undertaken in connection with the proposed

Stelco transaction may have a negative impact on the combined

company’s credit profile, financial condition or financial

flexibility; the possibility that the anticipated benefits of the

proposed acquisition of Stelco are not realized to the same extent

as projected and that the integration of the acquired business into

Cliffs’ existing business, including uncertainties associated with

maintaining relationships with customers, vendors and employees, is

not as successful as expected; the risk that future synergies from

the Stelco acquisition may not be realized or may take longer than

expected to achieve; the risk that any announcements relating to,

or the completion of, the proposed Stelco transaction could have

adverse effects on the market price of Cliffs' common shares; and

the risk of any unforeseen liabilities and future capital

expenditures related to the proposed Stelco transaction.

For additional factors affecting the business of Cliffs, refer

to Part I – Item 1A. Risk Factors of Cliffs’ Annual Report on Form

10-K for the year ended December 31, 2023, and other filings with

the U.S. Securities and Exchange Commission.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240912372016/en/

MEDIA CONTACT: Patricia Persico Senior Director,

Corporate Communications (216) 694-5316

INVESTOR CONTACT: James Kerr Director, Investor Relations

(216) 694-7719

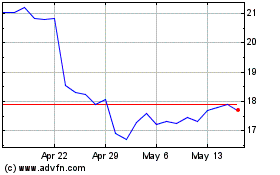

Cleveland Cliffs (NYSE:CLF)

Historical Stock Chart

From Nov 2024 to Dec 2024

Cleveland Cliffs (NYSE:CLF)

Historical Stock Chart

From Dec 2023 to Dec 2024